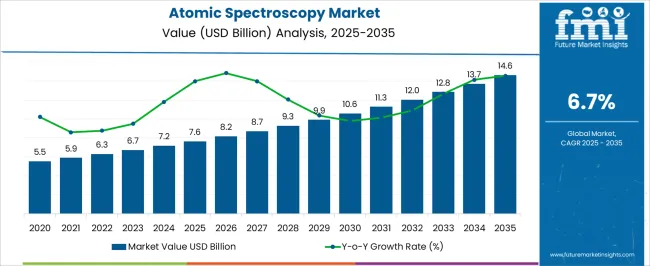

The Atomic Spectroscopy Market is estimated to be valued at USD 7.6 billion in 2025 and is projected to reach USD 14.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Atomic Spectroscopy Market Estimated Value in (2025 E) | USD 7.6 billion |

| Atomic Spectroscopy Market Forecast Value in (2035 F) | USD 14.6 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The atomic spectroscopy market is experiencing steady growth due to its critical role in providing precise and reliable elemental analysis across a wide range of industries. Increasing regulatory requirements for environmental monitoring, food safety, pharmaceuticals, and chemical manufacturing are driving the adoption of advanced atomic spectroscopy technologies. Continuous advancements in instrumentation, including enhanced sensitivity, lower detection limits, and faster analysis capabilities, are further enhancing market growth.

Investments in laboratory modernization and automated analytical systems are enabling higher throughput and better reproducibility of results. The increasing demand for accurate trace element detection in research, quality control, and compliance testing is influencing market expansion, particularly in developed and emerging economies. As industries increasingly emphasize safety, regulatory compliance, and process optimization, the adoption of atomic spectroscopy techniques is being reinforced.

The integration of software-driven automation, coupled with improved detection capabilities, is creating new opportunities for real-time and high-precision elemental analysis As a result, the market is projected to witness sustained growth over the next decade, with ongoing technological innovations and regulatory pressures serving as key drivers.

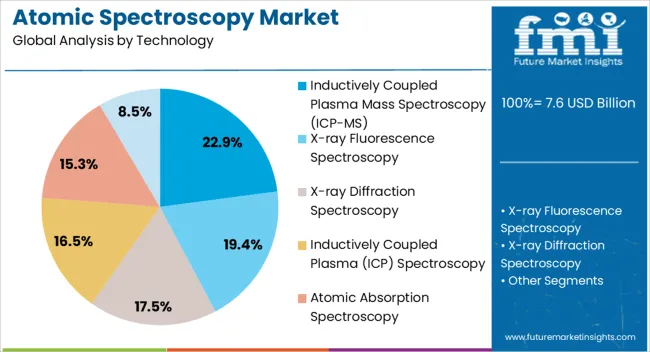

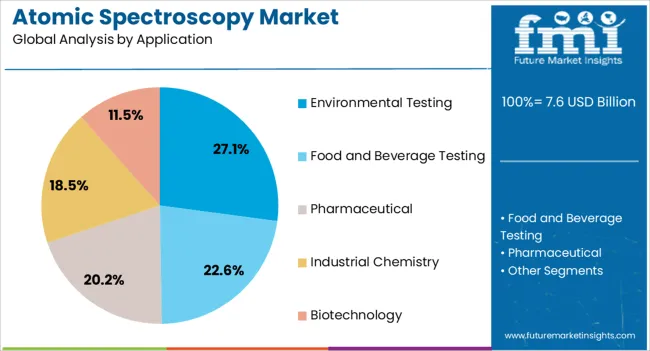

The atomic spectroscopy market is segmented by technology, application, and geographic regions. By technology, atomic spectroscopy market is divided into Inductively Coupled Plasma Mass Spectroscopy (ICP-MS), X-ray Fluorescence Spectroscopy, X-ray Diffraction Spectroscopy, Inductively Coupled Plasma (ICP) Spectroscopy, Atomic Absorption Spectroscopy, and Elemental Analyzers. In terms of application, atomic spectroscopy market is classified into Environmental Testing, Food and Beverage Testing, Pharmaceutical, Industrial Chemistry, and Biotechnology. Regionally, the atomic spectroscopy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The inductively coupled plasma mass spectroscopy segment is projected to hold 22.9% of the atomic spectroscopy market revenue share in 2025, making it a leading technology segment. Its prominence is driven by high sensitivity and accuracy, which allows for precise detection of trace elements at extremely low concentrations. ICP-MS technology is particularly favored for multi-element analysis across complex matrices due to its wide dynamic range and ability to provide rapid, reproducible results.

The segment is supported by increasing adoption in research laboratories, environmental monitoring, and industrial quality control applications where accurate elemental quantification is critical. Advancements in plasma generation, interface design, and detector technology have further enhanced instrument performance and lowered detection limits. The technology’s compatibility with automated sample introduction systems improves throughput and reduces human error, making it a preferred choice for high-demand applications.

Growing focus on environmental compliance, food safety, and pharmaceutical quality assurance is reinforcing adoption Consequently, the ICP-MS technology segment is expected to maintain strong growth momentum, supported by ongoing innovations and increasing demand for precise elemental analysis.

The environmental testing application segment is anticipated to account for 27.1% of the atomic spectroscopy market revenue share in 2025, establishing it as a leading application area. Its dominance is being reinforced by stringent environmental regulations that require accurate monitoring of air, water, and soil contaminants. Atomic spectroscopy techniques are highly valued for their ability to detect trace metals, pollutants, and toxins with high precision, ensuring compliance with environmental quality standards.

Increasing awareness regarding pollution control and sustainability is accelerating demand from regulatory agencies, industrial monitoring, and research institutions. Continuous improvements in instrumentation, including enhanced sensitivity, faster analysis, and automation, are enabling laboratories to handle larger sample volumes efficiently.

The segment is also being supported by initiatives to monitor industrial effluents, urban water quality, and environmental remediation programs, which rely on precise elemental analysis As environmental safety becomes a top priority globally, the adoption of atomic spectroscopy solutions in this segment is expected to grow steadily, reinforced by the need for accurate, reliable, and high-throughput testing methods.

The major factor responsible for the growth of the atomic spectroscopy market is the rising number of funds that are received by research laboratories from the government for research and development. Moreover, the growing concerns on food and beverage safety and security will also propel the overall market growth.

Furthermore, the increasing use and awareness of atomic spectroscopy in the pharmaceutical and biopharmaceutical sector is predicted to increase the market demand in the forecasted years. Besides this, the enforcement of several safety regulations in the biotech and pharma companies will help out organizations to understand the significance of atomic spectroscopy in environmental testing, food and beverage testing, and biotechnology, eventually encouraging the growth of the market in the upcoming years.

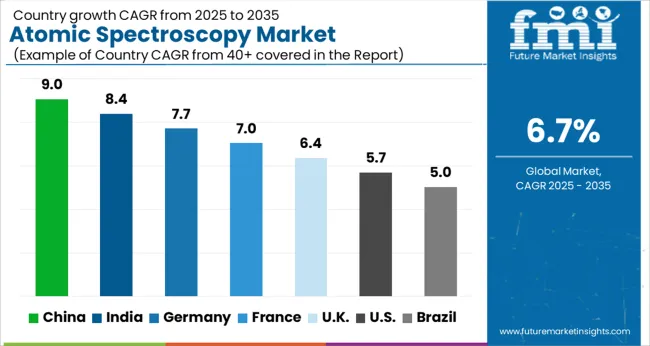

Geographically, the atomic spectroscopy market is broadly divided into seven major regions, North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

Among all these regions, North America holds the largest share in the atomic spectroscopy market owing to the rising concerns about food safety. Besides this, the increasing presence of manufacturers is expected to propel the market in North America.

On the other hand, the Asian region is expected to emerge as the rapidly growing region in the global atomic spectroscopy market. The market growth is attributed to the growing number of biotech and pharmaceutical firms in developing economies like China and India.

Some of the key manufacturers operating in the atomic spectroscopy market are Agilent Technologies, Aurora Biomed Inc., Bruker Corporation, Hitachi High-Tech Corporation, Shimadzu Corporation, GBC Scientific Equipment Pty Ltd., Thermo Fisher Scientific Inc, PerkinElmer Inc., Analytik Jena GmbH, and Rigaku Corporation.

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The Atomic Spectroscopy Market is expected to register a CAGR of 6.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.0%, followed by India at 8.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.0%, yet still underscores a broadly positive trajectory for the global Atomic Spectroscopy Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.7%. The USA Atomic Spectroscopy Market is estimated to be valued at USD 2.8 billion in 2025 and is anticipated to reach a valuation of USD 4.9 billion by 2035. Sales are projected to rise at a CAGR of 5.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 352.3 million and USD 216.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.6 Billion |

| Technology | Inductively Coupled Plasma Mass Spectroscopy (ICP-MS), X-ray Fluorescence Spectroscopy, X-ray Diffraction Spectroscopy, Inductively Coupled Plasma (ICP) Spectroscopy, Atomic Absorption Spectroscopy, and Elemental Analyzers |

| Application | Environmental Testing, Food and Beverage Testing, Pharmaceutical, Industrial Chemistry, and Biotechnology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Agilent Technologies, Thermo Fisher Scientific Inc, PerkinElmer Inc., Bruker Corporation, Shimadzu Corporation, Hitachi High-Tech Corporation, Analytik Jena GmbH, Rigaku Corporation, Aurora Biomed Inc., and GBC Scientific Equipment Pty Ltd. |

The global atomic spectroscopy market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the atomic spectroscopy market is projected to reach USD 14.6 billion by 2035.

The atomic spectroscopy market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in atomic spectroscopy market are inductively coupled plasma mass spectroscopy (icp-ms), x-ray fluorescence spectroscopy, x-ray diffraction spectroscopy, inductively coupled plasma (icp) spectroscopy, atomic absorption spectroscopy and elemental analyzers.

In terms of application, environmental testing segment to command 27.1% share in the atomic spectroscopy market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Atomic Absorption Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Atomic Clock Oscillators Market Forecast and Outlook 2025 to 2035

Atomic System Clocks Market Forecast and Outlook 2025 to 2035

Atomic Clock Market Size and Share Forecast Outlook 2025 to 2035

Atomic Layer Deposition (ALD) Equipment Market Growth - Trends & Forecast 2025 to 2035

Atomic Absorption Spectrometer Market Growth - Trends & Forecast 2025 to 2035

Anatomic Pathology Track and Trace Solution Market Size and Share Forecast Outlook 2025 to 2035

Anatomic Pathology Market Size and Share Forecast Outlook 2025 to 2035

Human Anatomical Models Market

Spectroscopy Equipment and Supplies Market Growth – Trends & Forecast 2018-2027

Spectroscopy Intravascular Imaging System Market

IR Spectroscopy Market Analysis - Growth & Forecast 2025 to 2035

THz Spectroscopy Kit Market Size and Share Forecast Outlook 2025 to 2035

Process Spectroscopy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Molecular Spectroscopy Market Insights - Growth & Forecast 2025 to 2035

Fluorescence Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Bioimpedance Spectroscopy Market – Trends & Forecast 2025 to 2035

Optical Emission Spectroscopy Market Report – Trends 2019-2027

X-ray Photoelectron Spectroscopy Market Insights - Growth & Forecast 2024 to 2034

Microfluidic Modulation Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA