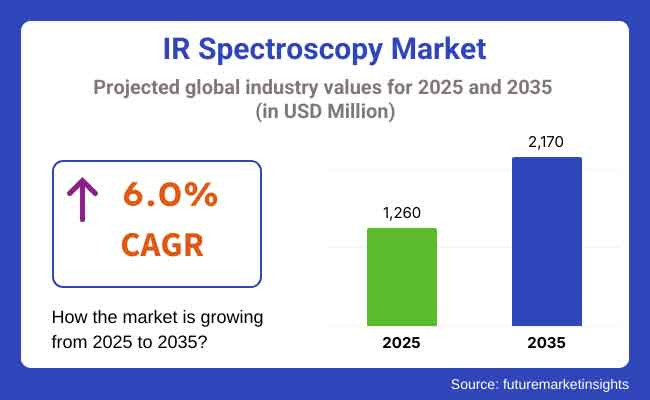

The IR spectroscopy market is anticipated to grow steadily between 2025 and 2035, driven by its widespread adoption in pharmaceutical, chemical, environmental, and food testing applications. The market was valued at USD 1,260 million in 2025 and is projected to reach USD 2,170 million by 2035, expanding at a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The increasing need for non-destructive and highly precise analytical techniques is a key factor fueling demand for IR spectroscopy across industries. The pharmaceutical sector, in particular, relies on infrared spectroscopy for drug formulation, quality control, and regulatory compliance, making it one of the most significant contributors to market growth. Additionally, advancements in miniaturization, portable IR spectrometers, and Fourier-transform infrared (FTIR) technology have made these devices more accessible and efficient, expanding their use in diverse applications such as material identification, forensic investigations, and polymer analysis.

Moreover, the increasing integration of artificial intelligence (AI) and machine learning (ML) algorithms in spectroscopy systems is revolutionizing data analysis, enhancing detection accuracy, and enabling real-time monitoring. These technological advancements, coupled with the rising investment in spectroscopy research and development, are expected to further drive market growth. The expansion of automation in laboratories, cost reduction in spectroscopic instruments, and increasing funding for scientific research are additional factors contributing to the market’s expansion.

The IR spectroscopy market holds great potential and is expected to grow significantly, given the focus on high-precision analytical techniques across the industries, regulatory compliance, and environmental sustainability. IR spectroscopy is complex and was out of reach for many leading to limited applications, there have been continued advancements in technology, adoption addressing use in other applications and reduced cost that is expected to propel the domain in the next decade.

Advancements in IR spectroscopy applications and an increase in healthcare and pharmaceutical developments in North America are some of the key drivers for IR spectroscopy market growth in the region. The United States and Canada are at the forefront of the region, with strong academic institutions, industrial laboratory facilities, and regulations that require accurate chemical analysis.

Rising use of IR spectroscopy in forensic analysis, food safety testing, and biotechnology will drive the market. Moreover, AI and machine learning techniques are also being assimilated in spectroscopic analysis leading to increased accuracy and efficiency in data generation. Nevertheless, the rise in equipment pricing and necessity for trained professionals could restrict market expansion.

The presence and adherence to strict environmental regulations, the well-established pharmaceutical and chemical industries, and the advancement of analytical technologies have created a sizeable marketplace for IR spectroscopy in the region. Germany, the UK, France, and Italy are key players in boosting market demand, their robust industrial base and legislative focus on product safety and quality assurance.

The region's efforts on green energy, food quality assessment, and innovation in material science are further driving the growth of the IR spectroscopy adoption in the region. Moreover, the presence of leading players/ spectrometer manufacturers and continuous technology-associated research activities further boosts the market. But, as flexible supply chains and costs set high barriers for smaller enterprises, adoption may be hampered by economic uncertainties.

Asia-Pacific is predicted to play a key role in the growth of IR spectroscopy market due to the rapid expansion of industrialization, rise in pharmaceutical and biotechnology research and the demand for environmental monitoring solutions usability. China and India work hand-in-hand with Japan and South Korea, leading the charge à la route with government-backed scientific development and quality control.

The growing number of academic research institutions in the region, with increased foreign investments in analytical technologies, and a rapid adoption of spectroscopy for food safety and medical diagnostics. More affordability and availability are attributed to the cost-effective production and presence of market key players. Nonetheless, obstacles like a shortage of skilled personnel and inconsistent regulatory standards could affect market growth.

Challenges - High Cost of Equipment and Maintenance

IR spectrometers are costly and this has been a major drawback for the initial investment on advanced spectrometers. The price of Fourier-transform infrared (FTIR) spectrometers, near-infrared (NIR) analysers and portable IR devices can be high, hindering uptake from small and medium-sized enterprises (SMEs). Furthermore, operational expenses are challenging for overall deployment due to maintenance costs, professionals required for operation, and the requirement of calibration.

Opportunities - Advancements in Miniaturized and Portable Spectroscopy Devices

This is fuelling innovation in miniaturized, cost-effective devices, with the increasing prevalence of IR spectrometers for real-time, on-site solutions. AI-assisted spectral examination, cloud-based data accessibility, and integration of IoT sensors are all helping to make IR spectroscopy in industries ranging from pharmaceuticals and food safety to forensics and environmental sensing more accurate and accessible than ever before. IR affording return management AI IR companies willing to invest in less costly, portable such IR, in hand will registering profiting in future.

In pharmaceutical quality control, food authenticity testing, environmental pollution monitoring, IR spectroscopy found its place between 2020 to 2024. The advancement of FTIR and NIR spectroscopy in drug analysis, quickly characterizing pathogens, and forensic investigation has propelled market growth. Yet high costs, technical complexities and the need for skilled personnel were major constraints, they added.

For 2025 to 2035, will likely see spectroscopic analysis driven by AI, cloud-based spectral data cleaning/analysis, and non-invasive infrared imaging transform the market. The proliferation of low-cost, handheld spectrometers along with automation and real-time spectral interpretation will enable the wider application of IR spectroscopy in many industries. Increasing integration of spectroscopy in point-of-care diagnostics, counterfeit detection, and personalized medicine will unlock new opportunities.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stringent compliance in pharmaceuticals and food safety |

| Technological Advancements | Growth in FTIR and NIR technologies |

| Industry Adoption | Widespread use in pharmaceuticals and forensics |

| Supply Chain and Sourcing | Reliance on expensive spectrometers |

| Market Competition | Dominance of high-end spectrometer manufacturers |

| Market Growth Drivers | Increasing demand for food safety and drug quality analysis |

| Sustainability and Energy Efficiency | Growing demand for eco-friendly analytical techniques |

| Consumer Preferences | Preference for high-accuracy lab-based spectroscopy |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Automated AI-driven regulatory compliance in spectroscopy |

| Technological Advancements | AI-powered spectroscopy with cloud-based data interpretation |

| Industry Adoption | Expansion into wearable IR devices for health monitoring |

| Supply Chain and Sourcing | Affordable, portable spectroscopy devices for widespread adoption |

| Market Competition | Entry of AI-driven spectroscopy start-ups and cost-effective alternatives |

| Market Growth Drivers | Integration of spectroscopy in IoT and AI-driven diagnostics |

| Sustainability and Energy Efficiency | Development of low-power, portable spectrometers |

| Consumer Preferences | Demand for real-time, mobile, and user-friendly spectroscopy solutions |

The IR spectroscopy market is growing in the United States as it is widely applied in pharmaceuticals, chemicals and environmental testing. Geographically, the growth of the market is propelling with the presence of key spectroscopy manufacturers and research organizations, and with the advancing technology. Moreover, demand for IR spectroscopy solutions is being propelled by strict regulatory frameworks surrounding quality control in different sectors like food safety and healthcare.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

As there is an upsurge in investment in life sciences and material sciences research, steady growth continues in the IR spectroscopy market in the UK. Rising government initiatives to support advanced analytical techniques and stringent quality control regulations in pharmaceuticals and food industries are the key factors propelling the technology. Market growth is also driven by the increasing demand for innovative spectroscopy solutions from academic and industrial research institutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

In Europe, increasing regulations on pharmaceutical compliance, environmental monitoring and food safety drive demand for IR spectroscopy market. Leading contributors include Germany, France and Italy, owing to their robust industrial and research base. Technological advancements, such as the development of sophisticated spectroscopy techniques for accurate analysis and use of portable IR spectrometers are aiding in the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.5% |

The installation of IR spectroscopy in Japan is primarily driven by the rising semiconductor manufacturing, pharmaceuticals, and chemical industries. Growing focus on high-precision analytical techniques along with automation in laboratory testing is driving market growth in the country. Moreover, the demand for IR spectroscopy solutions is also increasing due to their rising research and development in material sciences and nanotechnology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

In South Korea, demand for IR spectroscopy is rising, driven by increasing investments being made in biotechnology, pharmaceutical, and environmental monitoring sectors. The country’s strong emphasis on research and innovation in chemical analysis and quality assurance processes is driving market growth. Another factor fueling demand is the increasing by manufacturers and academic researchers for advanced spectroscopy techniques.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The IR spectroscopy market is witnessing steady growth due to the advancements in analytical techniques and increasing adoption of spectroscopic methods in various industries. Benchtop and portable IR spectroscopy devices hold the highest market share of the product types as these devices are widely used in laboratories and in fields owing to their high efficiency and provide superior accuracy.

Benchtop IR spectroscopy devices are the most common ones available as they are precise and reproducible for complex molecular analyses. These tools are crucial for pharmaceutical research, environmental testing, and material characterization in industries, including chemicals and food safety. Because they can perform high-throughput analysis, they're a necessity for labs carrying out quality control and forensic investigations. On top of that, the ongoing development of software integration and automation has greatly enhanced the user experience of benchtop systems, making them more accessible to a wider scope of end users.

Portable IR spectroscopy devices have been witnessing significant adoption owing to the compact and portable nature of devices and real time analysis capabilities. Such devices are commonly used in forensic science, field-based chemical analysis and agricultural testing.

The non-destructive nature of X-ray analysis along with the speed of the process has made it a requirement for on-field analysis and testing. Advancements in pharmaceuticals and law enforcement agencies are likely to boost adoption of portable IR spectrometers, owing to the potential of field-deployable analytical instruments, during the assessment period.

The hyphenated category is trending and combines the IR with another analytical technique such as gas chromatography or mass spectroscopy, making it more accurate in complex samples. These multi technological systems can be particularly powerful in applications of biomedical research and advanced material science, where such approaches increase data reliability and insight.

Growth of the IR spectroscopy market is primarily driven by the increasing need for precise analytical techniques in the health-care and pharmaceutical industries.

The healthcare & pharmaceuticals industry is related to the highest market, utilizing IR spectroscopy for drug quality inspection, raw material confirmation, and sickness diagnostics. It is, in fact, crucial to pharmaceutical research, where this technology does a lot for identifying active pharmaceutical ingredients (APIs) and formulation analysis, and detects contamination.

And regulatory compliance has been a big player as demanding guidelines laid down by agencies like the USA Food and Drug Administration and European Medicines Agency have been fuelling the adoption of IR spectroscopy in pharmaceutical manufacturers.

Additionally, the chemicals industry stands out as the largest end-user for IR spectroscopy, primarily employed for structural elucidation, polymer characterization, and hazardous material detection. IR spectrometers are capable of delivering real-time analyses of chemical compositions without any destruction of the sample, making them an invaluable resource for industrial quality assurance and safety assessments.

In addition some biological research institutes are using IR spectroscopy in bimolecular research, protein analysis, metabolic profiling, and other areas. The increase in applications of spectroscopy in personalized medicine and biopharmaceutical has also led to major investments in more advanced IR spectroscopy technologies that provide superior sensitivity and rapid detection capabilities.

Continuous innovations in spectroscopy techniques, software automation, and miniaturization have led the IR spectroscopy market to witness significant growth, which is expected to continue for the foreseeable future. Increasingly demanding industries that require accurate, non-destructive, and high-throughput analytical methods will continue to create a strong demand for IR spectrometers, and these products will play an important role in the future of science and industry.

The rising demand for IR spectroscopy across pharmaceutical, chemical, food & beverage and environmental testing applications is anticipated to drive the market growth segment positively. Market growth is being driven by the growing requirement for accurate molecular analysis, process monitoring, and regulatory compliance. Market opportunities are further expanding due to the proliferation of IR spectrometers that can be handheld, miniaturized, and even AI-driven on spectral analysis.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific | 20-24% |

| Agilent Technologies | 15-19% |

| PerkinElmer | 12-16% |

| Bruker Corporation | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific | Provides high-precision IR spectrometers, including FTIR and near-IR solutions for pharmaceuticals and research applications. |

| Agilent Technologies | Specializes in molecular spectroscopy solutions, offering FTIR and ATR spectroscopy for chemical analysis and material identification. |

| PerkinElmer | Develops advanced IR spectrometers for food safety, forensic, and environmental testing applications. |

| Bruker Corporation | Focuses on high-resolution IR spectroscopy solutions, including hyphenated techniques for life sciences and polymer analysis. |

Key Company Insights

Thermo Fisher Scientific (20-24%)

It is the leading player in the IR spectroscopy market with a wide portfolio of spectroscopy systems, including FTIR, Raman and NIR systems. Its emphasis on AI-driven spectral analysis and automation bolsters its competitive stance.

Agilent Technologies (15-19%)

Developer of FTIR, UV-Vis & Raman spectroscopy solutions for molecular & vibrational spectroscopy. This bodes well for its position in the pecking order, aided by a robust R&D spend and cloud-based spectral analysis software.

PerkinElmer (12-16%)

PerkinElmer focuses on IR spectrometers high performance biotech-no pharmacy for environmental applications. Their growth in market is driven by expansion into real-time monitoring and process control solutions.

Bruker Corporation (10-14%)

Bruker Corporation has a leading presence in FTIR and mid-IR spectroscopy, serving a diverse range of applications from academic research to industrial quality control and materials science. Its emphasis on high-resolution and portable IR spectrometry fortifies its standing.

Other Players (combined 30-40%)

The IR spectroscopy market is very competitive, with multiple companies investing in portable IR spectrometers, AI-based spectral databases, and improved analytical prowess. Key players include:

The overall market size for the IR spectroscopy market was USD 1,260 million in 2025.

The IR spectroscopy market is expected to reach USD 2,170 million in 2035.

The demand for IR spectroscopy is expected to rise due to its widespread adoption in pharmaceutical, chemical, environmental, and food testing applications, along with advancements in portable and handheld IR spectroscopy devices.

The top five countries driving the development of the IR spectroscopy market are the USA, Germany, China, Japan, and the UK.

Fourier-transform infrared (FTIR) spectroscopy is expected to command a significant share over the forecast period due to its high-resolution capabilities, speed, and extensive use in pharmaceutical and chemical industries.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: North America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: Latin America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 37: East Asia Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ billion) Forecast by End Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ billion) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ billion) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ billion) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ billion) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ billion) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ billion) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ billion) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ billion) by End Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ billion) by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ billion) by End Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ billion) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ billion) by End Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ billion) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ billion) by End Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ billion) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ billion) Analysis by End Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Iris Recognition Market Size and Share Forecast Outlook 2025 to 2035

Irrigation Syringe Market Size and Share Forecast Outlook 2025 to 2035

IR Corrected Lenses Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Iridium Spark Plug Market Size and Share Forecast Outlook 2025 to 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

IR Emitters and Receivers Market Analysis by Type, End-use, and Region Through 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Irradiation Apparatus Market Trends – Growth & Industry Outlook 2024-2034

Irrigation testing kit Market

Irrigation Liners Market

Direct Fast Dyes Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Printing Film Market Size and Share Forecast Outlook 2025 to 2035

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Directional Drilling Service Market Forecast Outlook 2025 to 2035

Direct Methanol Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA