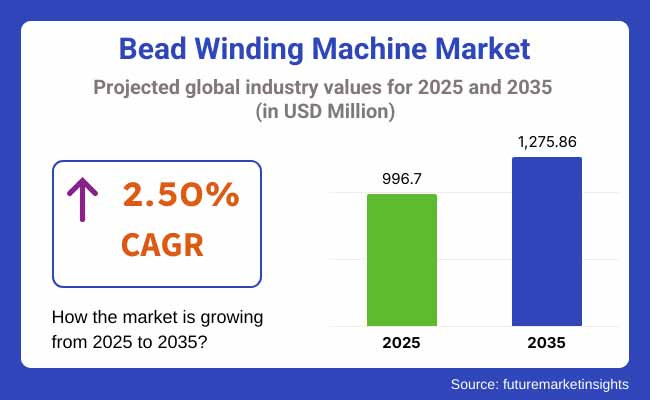

The industry for bead winding machines is expected to grow to USD 996.7 million by 2025 and USD 1,275.86 million by 2035 at a CAGR of 2.50%. Rising demand boosted by advancements in precision engineering and automation is promoting manufacturers to opt for efficiency, sustainability, and high-performance tire production. Increasing adoption driven by the transition toward premium and fuel-efficient automotive tires is further expanding the industry, and cost-efficient solution innovations help grow the market further.

In 2024, the bead winding machine industry progressed with increased automation and precision-based production. Manufacturers focused on efficiency, adopting advanced technology to simplify processes while minimizing labor dependency. Sustainability was the focus, with energy-efficient mechanisms optimizing material use without compromising quality.

By 2025, the sector is poised for additional growth, spurred by increasing demand for high-end automotive tires and eco-friendly production processes. Automation and process optimization through AI will streamline manufacturing efficiency, providing improved consistency and cost savings.

Higher R&D expenditure will drive innovation, improving machine capabilities to support changing industry requirements. With the drive for fuel-efficient cars on the rise, bead winding machines will continue to play a crucial role in the manufacture of high-performance tires, supporting long-term growth and technological development.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Shift from Traditional to Precision Manufacturing: The sector transitioned from using traditional bead winding solutions, to incorporating precision control systems as these systems maximize consistency and reduce material waste. | Next-Generation Smart Manufacturing: AI-powered real-time tracking and adaptive control systems will optimize accuracy, limiting errors, and improving operational efficiency. |

| Rise of Electric and Hybrid Vehicle Influence: The demand for EV and hybrid vehicle-specific tires encouraged developments in bead winding technologies to meet the structural demands. | Growth of EV-Specific Tire Technologies: New bead winding machines will be designed for ultra-lightweight and low-resistance tires for next-generation EVs, fueling a new era of machine customizations. |

| Automation with Limited Interconnectivity: As automation grew, the majority of machines ran in stand-alone production environments with restricted seamless data transfer and predictive analytics. | Fully Integrated Digital Ecosystems: Bead winding machines enables with IoT-technology will work on integrated production channels, capitalizing cloud-based analytics for predictive maintenance and real-time process optimization. |

| Sustainability being a Competitive Strategy: Energy-efficient motors and better material use was incorporated heavily by leading industrialists as sustainability emerged as a leading differentiator. | Regulation-Driven Sustainability Requirements: Stringent regulations enforced on global sustainability trend will encourage producers to produce ultra-low emission equipment that will limit the material waste production. |

| Regional Manufacturing Hubs Enhanced: Growth was majorly accelerated by leading automotive regions like China, Germany, and the USA, where manufacturers optimized cpacity. | Diversified Production Footprint: Southeast Asian and Latin American emerging economies will experience greater investment, building decentralized production clusters for more resilient supply chains. |

The bead winding machines industry is an integral part of the industrial machinery and automation sector, particularly tire and rubber production equipment. The sector is closely related to the automotive sector, which is observing a high demand of good-quality tires.

Furthermore, the bead winding machine industry is extensively influenced by the evolving geopolitical environment and changing nature of global supply chains. The growth of sovereign industrial policy in large economies such as the USA, China, and the EU is fueling massive subsidies for automation and sustainable production

Financially, the sector is experiencing a boom in private equity investment as companies want long-term profitability of EV-centric tire technologies, consolidating the sector's shift toward high-precision, intelligent manufacturing ecosystems.

Single wire machines will remain relevant to small-scale tire producers and old systems. Their cost-effectiveness and easier operation render them suitable in emerging sectors and low-volume tire production. The segment will decline over time, though, and by 2035 will capture only 22% of the entire industry.

On the other hand, multi wire machines will be the future of tire production. As the world is moving towards automation, energy efficiency, and shorter production cycles, tire manufacturers will turn to multi wire systems in greater numbers to improve throughput. By 2035, this segment will grow at a strong 7.6% CAGR, and will account for almost 78% of the world market. These machines enable the production of stronger, tougher beads needed in high-performance, electric, and commercial vehicle tires.

On the application front, passenger car tires will continue to be the largest user of bead winding machines, increasing at a 6.8% CAGR. This is driven by increasing vehicle ownership around the globe, Asian urbanization, and the increasing adoption of electric vehicles, which require reinforced and precision bead construction.

Commercial truck tires will see the most rapid expansion among all types of tires. The expansion comes on the back of last-mile delivery fleet growth, heavy-duty logistics, and infrastructure development, particularly in emerging economies.

The two-wheeler tire segment will expand more conservatively, at a 2.6% CAGR. Although two-wheeler electrification in Southeast Asia and Africa will generate some demand, the relatively uncomplicated nature of these tires will restrict the requirement for high-end bead winding machines.

On the other hand, off-the-road (OTR) tires employed in mining, agriculture, and construction will increase at a 7.2% CAGR. Greater investment in autonomous mining trucks and precision farming machinery will support this movement.

The USA bead winding machine industry is on the verge of steady growth due to the incorporation of enhanced automation in tire production. As electric vehicle manufacturing and high-performance tire demand continue to grow, manufacturers are adopting AI-based defect detection and real-time monitoring.

Tighter environmental regulations are compelling businesses to implement energy-efficient bead winding technologies with less material waste. Also, state-sponsored programs assisting local manufacturing are fortifying the supply chain, lessening dependence on imports. Increased R&D spending on advanced machinery is also transforming the business, allowing tire manufacturers to engineer highly customized tire solutions.

FMI analysis found that the CAGR for the USA industry is projected at approximately 2.6% from 2025 to 2035.

India's bead winding machine sector is witnessing a growth wave, spurred by the very rapid growth in domestic and export-based tire production. The growing trend toward performance-focused and EV-compatible tires is compelling producers to invest in sophisticated automation to ensure precision and longevity. With global players setting up bases in India, high-speed, cost-effective bead winding machines are being sought after to meet international quality levels by local players.

With tire makers focusing on customization and material use, CNC and automatic bead winding technology are becoming increasingly dominant. With a strengthening supply chain through mounting foreign investment, India will become a major hub for next-generation tire manufacturing.

FMI opines that the CAGR for India is expected to be around 2.8% between 2025 and 2035.

China's bead winding machine industry is transforming at a fast pace with top tire players focusing on digitalization and sustainability in manufacturing. The nation's initiative for low-emission and high-performance tires is fueling demand for energy-efficient, automated bead winding technology that maximizes material usage. With increasing labor costs, makers are using robot-based automation increasingly to improve precision and minimize dependence on manual actions.

The dominance of the country in raw material supply chains places it in a strategic position to enable tire producers to use low-cost and high-volume production and still meet quality standards. As producers embrace predictive maintenance and smart monitoring, the efficiency of production is reaching new levels.

FMI analysis found that the CAGR for China is projected to be approximately 2.7% during 2025 to 2035.

The UK bead winding machine industry is developing with emphasis on high-precision manufacturing for top-tier auto brands. As the nation shifts toward a more environmentally friendly automobile industry, investments in eco-friendly tire technology are powering innovation in sophisticated manufacturing processes. The demand for high-speed and CNC bead winding machines that provide utmost tire quality is being fueled by the presence of major luxury and performance automobile brands.

Furthermore, Brexit-influenced trade policies are redesigning supply chain dynamics, and this is causing manufacturers to design localized production strategies. With growing investment in R&D in automated tire production, companies are focusing on smart production lines that maximize efficiency.

FMI opines that the CAGR for the UK is anticipated to be around 2.4% from 2025 to 2035.

Germany, renowned for its engineering prowess, is at the forefront of bead winding technology innovation with a heavy emphasis on Industry 4.0 integration. Top tire companies are implementing AI-driven predictive maintenance and data-informed process optimization to maximize machine efficiency.

The nation's booming automotive industry, especially in performance and electric vehicles, is driving demand for niche bead winding solutions. Sustainability is a top priority, with producers making investments in low-energy, high-output equipment to meet the EU's strict environmental regulations. Moreover, partnerships between industrial automation companies and tire makers are driving innovative cutting-edge technology.

FMI analysis found that the CAGR for Germany is projected to be approximately 2.5% for the 2025 to 2035 period.

South Korea's bead winding machine industry is changing at a fast pace as tire makers invest in high-speed automation to achieve global quality standards. With top automobile companies demanding fuel-efficient and performance-oriented tires, the need for precision-driven bead winding solutions is increasing.

The nation's focus on digital manufacturing transformation is fueling the use of IoT-enabled machines that allow real-time process control. Further, South Korea's leadership in battery technology for electric vehicles is driving tire production trends, requiring lighter and tougher tires. Manufacturers are improving manufacturing capability through the use of robots and AI-based defect detection.

FMI opines that the CAGR for South Korea is expected to be around 2.6% from 2025 to 2035.

Japan's bead winding machine manufacturing industry is pushed by technological development, with suppliers highlighting high-precision automation and the integration of robotics. Japan's extensive know-how in the advanced materials segment is driving innovations to create bead winding solutions especially suited for ultra-high-durability tires.

As Japan's automobile industry changes course toward electric and hybrid cars, suppliers are placing their sights on lightweight and high-strength tire manufacturing. The presence of major tire companies is also inducing substantial investment in next-generation production equipment, optimizing efficiency and accuracy. Also, government initiatives on smart manufacturing are driving the development of AI-powered bead winding technology.

FMI analysis found that the CAGR for Japan is projected to be approximately 2.5% from 2025 to 2035.

France's bead winding machinery sector is evolving with the nation concentrating on high-efficiency and sustainable tire production. The demand for more environmental-friendly auto solutions is forcing tire makers to embrace energy-efficient bead winding machinery. The nation's firm regulatory environment for lowering emissions is forcing firms to update production lines with low-waste, automated equipment.

Also contributing to the country's innovation commitment is the growth of research collaborations between the academic and industrial communities that have encouraged the creation of next-gen bead winding machines. Growth in the use of digital twin technology is also further streamlining manufacturing operations, minimizing downtime, and enhancing product consistency.

FMI opines that the CAGR for France is expected to be around 2.4% during 2025 to 2035.

Italy's bead winding machine industry is flourishing based on its robust base in high-performance tire production. Italy's luxury and motorsport car industry fuels demand for precision-crafted tires, which require sophisticated bead winding solutions. As the demand for EV and hybrid vehicles increases, producers are investing in intelligent automation to enhance efficiency and minimize material loss.

Italy's technological mastery in the field of mechatronics is having an impact on the construction of high-speed, fully automatic bead winding machines using AI-aided defect avoidance. In addition, international cooperation with top car manufacturers globally is pushing innovations in tire technology and making Italy a leader in specialized production. FMI analysis found that the CAGR for Italy is projected to be approximately 2.5% from 2025 to 2035.

Australia and New Zealand's bead winding machine industry is growing as domestic tire makers invest in automation to cope with growing local demand. Rising use of off-road and agricultural tires, influenced by the strong mining and agriculture industries in the region, is driving demand for specialized bead winding solutions. Manufacturers are increasing capacity with next-generation automated machines amid global supply chain disruptions that are encouraging regional self-sufficiency.

Sustainability continues to be a priority, with firms integrating renewable energy sources into manufacturing plants. Moreover, collaborations with international tire companies are driving technology transfer, enhancing manufacturing efficiency. FMI opines that the CAGR for Australia and New Zealand is expected to be around 2.3% between 2025 and 2035.

Surveyed Q4 2024, n=450 stakeholder participants, including machine manufacturers, tire OEMs, automotive suppliers, industrial automation specialists, and raw material providers across North America, Europe, and Asia-Pacific

Industry stakeholders pointed to automation, precision, and sustainability as the top drivers of bead winding machine uptake.

Regional Variance:

The industry is moving toward intelligent manufacturing, digital twin solutions, and real-time production tracking to improve efficiency.

High Variance:

Material developments are transforming the world of bead winding machines with a growing inclination towards light weight and high-strength bead wires.

Consensus:

Carbon steel and high-tensile alloys are still the most sought-after materials, with 67% of the respondents highlighting their durability.

Regional Variance:

Raw material price fluctuations and increasing labor costs are affecting pricing strategies and technology adoption.

Shared Challenges:

Regional Differences:

Every region has specific challenges, from regulatory policies to infrastructure constraints.

Manufacturers:

End Users:

Consensus:

Cost reduction, material efficiency, and automation are high-priority concern areas across the world.

Regional Differences:

Industry Insight:

Each company needs to adapt strategies by region-efficiency and precision in North America, compliance solutions in Europe, and economical scalability in Asia-Pacific.

| Countries | Government Regulations & Policy Impact |

|---|---|

| United States | Rigid EPA and Department of Transportation (DOT) regulations compel tire companies to embrace energy-efficient bead winding machines. OSHA compliance demands safer technologies in machine design. The Buy American Act is inducing local manufacturing. |

| India | Automotive Industry Standards (AIS-142) imposes strict quality control on tire manufacturing. BIS certification for imported bead winding machines is compulsory. Emerging policies prefer PLI schemes for tire machinery automation. |

| China | The government implements GB standards for tire manufacturing, with a focus on automated defect detection. The Dual-Carbon Policy demands energy-efficient equipment, encouraging manufacturers to adopt AI-based bead winding solutions. |

| United Kingdom | Post-Brexit trade regulations demand manufacturers comply with UKCA certification rather than EU standards. The Net Zero Strategy is creating a demand for low-energy-consuming industrial machinery. |

| Germany | EU Machinery Regulation (2027/745) enhances safety and environmental regulation for bead winding machines. DIN certifications for production quality are essential for exports. Carbon tax policies encourage energy-efficient machine uptake. |

| South Korea | Korea Occupational Safety & Health Agency (KOSHA) enforces stringent safety compliance in industrial automation. Government policies promote smart factories with subsidies for automated bead winding technology. |

| Japan | JIS tire manufacturing standards drive greater precision and material usage efficiency in bead winding. Green Manufacturing Subsidies encourage low-emission production line investments. |

| France | ADEME laws require lower energy use in tire manufacturing. The Extended Producer Responsibility (EPR) policy encourages producers to make materials more recyclable. |

| Italy | CE marking and UNI standards ensure EU safety standards compliance. Industry 4.0 incentives provide tax relief on digitalized and AI-based bead winding machines. |

| Australia-New Zealand | Australian Industrial Standards (AIS) have stringent safety and efficiency standards for imported machinery. NZ's Low-Emission Vehicle Program is stimulating demand for environmentally friendly tire production processes. |

The bead winding machine sector is on the edge of change, with AI-based defect detection and automation being high-impact investment opportunities. Investors can leverage predictive maintenance systems to minimize downtime and maximize efficiency. Bead winding machine customization for future-generation tire designs, such as EV and high-performance tires, is a profitable opportunity. Firms need to incorporate digital twin technology to maximize production in real time, minimizing waste and maximizing precision.

Producers need to take advantage of local cost benefits by establishing localized manufacturing centers in high-demand sectors such as India and China, making supply chains more resilient. Strategic alliances with OEMs and tire innovators can propel co-development of customized bead winding solutions. Investment in sustainable material processing to keep pace with changing regulatory environments will enhance market positioning.

The bead winding machine sector is fragmented, with numerous players competing globally. Market leaders in the bead winding machine sector are adopting a number of overarching strategies to improve their positions. The manufacturers are investing in research and development to bring in advanced, automated, and power-efficient machines.

In January 2024, Victor Capital Partners, a private equity company in the United States, purchased The Coats Company, a UK-based bead winding machines manufacturer. The purchase is intended to enhance Coats' prospects through increased national service and product offerings.

New environmental policies of the European Union, coming into force mid to 2024, have led manufacturers to invest in green bead winding machines with less carbon footprint. There are declarations by manufacturers regarding the establishment of new manufacturing units in countries like India, serving the increasing requirement for tire-making machinery.

Market Share Analysis

Herbert Maschinen: ~15%

L&T Technologies: ~12%

Roland Electronics: ~10%

Bartell Machinery Systems: ~8%

VMI Group: ~6%

Zeppelin Systems: ~4%

Single Wire Machine, Multi Wire Machine

Passenger Vehicle Tires, Commercial Vehicle Tires, Two- Wheeler Tires, Off the Road Tires

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa

Rising demand for advanced tire manufacturing, automation, and energy-efficient production processes are key factors shaping industry growth.

Manufacturers are integrating AI, automation, and high-speed precision control to enhance efficiency and reduce production downtime.

Asia-Pacific, particularly China and India, is experiencing rapid expansion due to increasing industrialization and tire production demands.

Stringent environmental policies, especially in the EU and North America, are pushing companies to develop eco-friendly and energy-efficient machines.

Strategic acquisitions and partnerships are helping companies expand product portfolios, enter new regions, and enhance technological capabilities.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Tire Type, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Tire Type, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Tire Type, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Tire Type, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Tire Type, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Tire Type, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Tire Type, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Tire Type, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Tire Type, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Tire Type, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Tire Type, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Tire Type, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Tire Type, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Tire Type, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Tire Type, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Tire Type, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Tire Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Tire Type, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Tire Type, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Tire Type, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Tire Type, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Tire Type, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Tire Type, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Tire Type, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Tire Type, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Tire Type, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Tire Type, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Tire Type, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Tire Type, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Tire Type, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Tire Type, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Tire Type, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Tire Type, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Tire Type, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Tire Type, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Tire Type, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Tire Type, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Tire Type, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Tire Type, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Tire Type, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Tire Type, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Tire Type, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Tire Type, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Tire Type, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Tire Type, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Tire Type, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Tire Type, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Tire Type, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Tire Type, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tire Type, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tire Type, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Tire Type, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Tire Type, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Tire Type, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Tire Type, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Tire Type, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Tire Type, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Tire Type, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Tire Type, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Tire Type, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Tire Type, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Tire Type, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tire Type, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Tire Type, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnetic Beads Market

Pellistor Bead Chemical Sensors Industry Analysis by Component, End-Use Industry, and Region through 2035

Cell Separation Beads Market

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Two Winding Air Insulated Transformer Market Size and Share Forecast Outlook 2025 to 2035

Two Winding Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Two Winding Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Coil Winding Machine Market Growth – Trends & Forecast 2024 to 2034

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Tissue Paper Unwinding Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Tissue Paper Unwinding Machine Manufacturers

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA