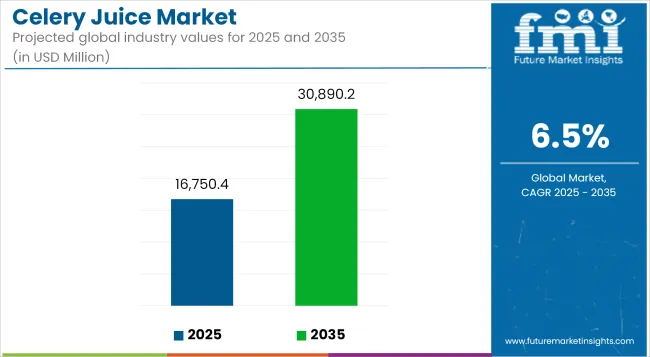

As of 2025, the global celery juice industry is valued at approximately USD 16,750.4 million and is likely to register a CAGR of 6.5% to surpass USD 30,890.2 million by the end of 2035. Celery juice has gained prominence as a detox-centric beverage, with claims around anti-inflammatory and digestive benefits shaping its rapid ascent.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 16,750.4 million |

| Projected Market Value (2035F) | USD 30,890.2 million |

| Value-based CAGR (2025 to 2035) | 6.5% |

A rising inclination toward plant-based wellness regimens and morning ritual beverages has catalyzed the adoption of cold-pressed celery juice products, especially in developed markets. Brands have increasingly prioritized functional label claims, with organic and clean-label formulations capturing widespread consumer trust.

Momentum in the celery juice market has been primarily driven by the wellness narrative, as detox culture and gut health optimization influence consumer preferences. However, growth has also been shaped by broader trends such as sugar-reduction, minimal processing, and preservative-free positioning.

Innovation in packaging formats, from ready-to-drink bottles to frozen concentrates, has allowed brands to meet various consumption moments. Nevertheless, shelf-life limitations of fresh celery juice and its naturally bitter flavor profile have emerged as mild deterrents to mass-market penetration.

The absence of standardized functional benefit validation remains a restraint for clinical-positioning across therapeutic channels. Players have been observed enhancing appeal through blends with apple, lemon, or ginger juice to widen sensory acceptance and functional appeal.

Over the next decade, the celery juice market is expected to consolidate its foothold within the global wellness beverage landscape. By 2035, sustained demand from health-focused millennials and clean-label seekers is projected to drive both online and retail sales of premium celery juice offerings.

Functional innovation and advancements in HPP (High Pressure Processing) are anticipated to address perishability issues, expanding geographic reach. Additionally, personalized nutrition and microbiome-supporting claims could further elevate celery juice into adjacent nutraceutical or fortified beverage categories.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global Celery Juice market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.1% |

| H2 (2024 to 2034) | 6.4% |

| H1 (2025 to 2035) | 6.5% |

| H2 (2025 to 2035) | 6.8% |

The above table presents the expected CAGR for the global Celery Juice demand space over a semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 6.1%, followed by a slightly higher growth rate of 6.4% in the second half (H2) of the same year.

Moving into 2025, the CAGR is projected to increase slightly to 6.5% in the first half and remain relatively moderate at 6.8% in the second half. In the first half (H1 2025), the market witnessed a decrease of 16 BPS, while in the second half (H2 2025), the market experienced an increase of 34 BPS.

Blended celery juice formulations account for an estimated 31.6% market share in 2025, supported by consumer preference for balanced flavor and multipurpose functionality. This segment plays a strategic role in expanding celery juice’s appeal beyond detox regimens. Combinations with ingredients such as apple, lemon, cucumber, and ginger are designed to enhance palatability and nutrient profile while masking bitterness.

The European Food Information Council (EUFIC) and regulatory trends on sugar intake reduction have favored such blends due to their lower natural sugar content compared to standalone fruit juices. Brands like Raw Generation and Pressed Juicery have commercialized these hybrids in refrigerated and frozen formats, optimizing shelf life and taste acceptance.

In North America and Western Europe, blended celery juice SKUs have gained traction within the premium refrigerated juice aisle and direct-to-consumer subscriptions. With consumers increasingly associating blends with functional benefits-such as gut support, immunity, and hydration-this segment is projected to grow at a CAGR above the overall market. Continued advancement in HPP technology is enabling more complex formulations with preserved nutrient integrity, ensuring blended celery juice retains premium status across both health retail and e-commerce platforms.

Institutional and foodservice sales of celery juice currently represent just 11.4% of the market in 2025, reflecting underutilization in cafes, hotels, wellness retreats, and meal program services. However, this segment is emerging as a strategic avenue for expanding celery juice consumption beyond at-home use. As per the European Vending & Coffee Service Association (EVA) and the National Restaurant Association (U.S.), demand for functional beverages in wellness-themed menus has increased substantially post-2022.

Juice bars, spa chains, and hotel breakfast programs have begun incorporating cold-pressed celery blends as part of detox and anti-inflammatory drink selections. Companies like Suja Life and Evolution Fresh have piloted B2B packaging innovations in foodservice-grade PET and aseptic formats. Moreover, wellness-oriented catering and diet-focused meal kits are integrating celery juice into bundled offerings, contributing to brand visibility in premium hospitality channels.

The segment is constrained by refrigeration logistics and short shelf life, but solutions such as frozen purées and pasteurized juice bases are enabling broader penetration. Over the next decade, foodservice is expected to see double-digit growth, especially in urban wellness hubs across North America, East Asia, and Western Europe.

Growing Consumer Shift toward Natural and Functional Beverages

Consumer priorities have shifted and they are more inclined toward natural and functional beverages which have health benefits beyond basic nutrition. The rising concerns pertaining to side effects of artificial ingredients, excessive sugar consumption, and synthetic preservatives have evolved into a need for cleaner plant-based drinks like celery juice.

Celery juice, which is abundant in antioxidants, vitamins, and minerals, is usually advertised for having detoxifying and anti-inflammatory properties, thus it becomes the choice of the health worried people. Besides, the prevailing trend of wellness in a holistic way, consumers have been showing interest in the kind of drink that helps in digestion, hydration, and immunity.

As a consequence, natural juice brands are surfacing across both retail and online platforms, focusing on cold-pressed, organic, and preservative-free options based on the consumer demand. To make the point even clearer, doctors and alternative medicine professionals are now associating celery juice with healing benefits like inflammation reduction, gut health promotion, and weight loss support. Thus, the market has got the chance to increase far more than expected.

Expansion of E-Commerce and Direct-to-Consumer Sales Channels

The e-commerce and direct-to-consumer (DTC) sales sectors have been a major driver for the spike in celery juice demand. Nowadays, people are more prone to buying health and wellness products online due to receiving benefits like time-saving, wider product range, and a no-fuss access to the organic and premium assortments.

Besides that, the availability of subscription services, Customized Meal plans, and Also direct deliveries have últimately helped the clients to start taking celery juice without having to depend on common stores only. The e-commerce portals bring about more info on products such as transparency of the ingredients, and customer reviews, which let them make wise purchases.

In addition, brands' social media marketing campaigns focus on collaboration with community members and influencers to make the digital footprint more substantial which ultimately leads to more consumer involvement. Accordingly, the anticipated further rise of the demand for celery juice through the Internet stems from both the quick uptake of the e-grocery model and the consumer's inclination toward practical and health-oriented choices.

Rising Adoption of Plant-Based and Organic Lifestyles

The celery juice market is largely influenced by the global tendency of people switching to plant-based and organic stores. As a result, celery juice is extremely beneficial not only because it is plant-based, but also it does not contain any artificial additives or allergens typically present in processed beverages.

Furthermore, the organic movement is a true success story, with-with buyers of chemicals and sustainably sourced products at the forefront of the process. Many celery juice labels are joining the bandwagon by having certified organic choices, which will provide clear guidance regarding the origin and the method of production applied.

Also, the rise of organic juice bars, health food stores, and premium beverage brands that produce celery juice as part of their product lines adds another factor bolstering its demand. Furthermore, government intervention and regulatory approvals for organic farming and clean-label goods are encouraging new companies to invest in celery juice production. Plant-based diets are still the top preference of consumers, and that is why celery juice is projected to grow steadily in the future.

Tier-1 companies that can be classified as industry leaders and they exceed the annual sales of more than USD 50 million, holding about 40% to 50% of the market segment. These companies maintain their leadership by utilizing a combination of high production capacities, a wide range of product portfolios, and strong distribution networks.

Their regional spread is wide, they benefit from the presence of the brand name and customer loyalty. Furthermore, these pioneers in the market heavily fund research and development, which in turn allows them to create new products like celery juice with organic ingredients, cold pressed and superfood functional blends.

Some of these are Suja Life, Evolution Fresh, Pressed Juicery, the well-known Coca-Cola Company (through Simply Beverages). They are the main actors in the celery juice industry because of their capacity to scale production effectively, optimize the supply chain, and participate in dynamic marketing campaigns.

Tier 2 class are the ones that make profits of USD 10 to 50 million in a year and make up about 25-35% of the market. These companies are concentrated on certain strong regional markets and have roots in geo regions that are specific to them.

They mainly deal with organic and premium celery juice products tailored to the wishes of their specific consumer groups, for instance, sugar-free, preservative-free, and locally sourced offerings. Despite lacking the extensive geographical coverage that Tier 1 companies boast, they frequently sign strategic deals with health food stores, juice bars, and online retail platforms to promote their products. The prominent Tier 2 companies that one can think of are Blueprint Organic, Tio Gazpacho, Lakewood Organic, and Sol-ti.

These companies build their brand image through the introduction of new products, the use of biodegradable packaging, and the organization of events aimed at health-oriented consumer groups, and thus they excel and gain market share in the celery juice segment which is on the upward trend.

Tier 3 are small-sized and handicraft businesses with annual revenues less than USD 10 million that hold 15-25% market shares. These companies, which prioritize operations in local neighborhoods, offer exclusively organic, locally sourced, and handcrafted celery juice.

Their primary customers are farm-to-table food lovers and residents who are loyal to the community-based businesses they depend on farmers' markets, local health food shops, and their online store to reach their customers directly.

Even though these companies are not as big as Tier 1 and Tier 2 manufacturers, they manage to stay in the market and even compete with their focus on the quality of the raw materials and their commitment to sustainability. Pure Green, The Juicery, Juice Press, and other local cold-pressed juice brands are the best examples of Tier 3 companies. Emerging trends in customers' demand for fresh and natural beverages strongly push these small companies to enter and remain in celery juice production.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 1,102.5 million |

| Germany | USD 734.8 million |

| China | USD 589.4 million |

| India | USD 368.2 million |

| Japan | USD 147.2 million |

Celery juice consumption is primarily by the United States that leads the consumption volume of this product. The health awareness factor and the rise in preference for organic liquids are some of the factors that are fueling the growth of this market.

The sector is accelerated by the influx of individuals who take detox diets, eat a plant-based diet, and drink functional beverages that are believed to aid in gut health and overall wellness. The signing of top juice brands, the robustness of retail distribution networks, and the presence of widespread availability of cold-pressed juice choices in supermarkets and online platforms are other supporting aspects to the growth of the sector.

Fantastically, the trend of celebrity endorsements and social media wellness trends have brilliantly ceaselessly increased the popularity of celery juice in the USA The organic agriculture practice is on the rise; hence, there is an increase in the number of juice brands that offer organic and premium products, thus, the market is benefiting from wider geographic coverage.

Celery juice in Germany is among the foremost European markets and is primarily driven by the heightened consumer interest in health functional beverages and organic products. Evolving consumer mentality about fruit and vegetable drinks has made cold-pressed and preservative-free juices a coveted item in the market.

Due to the EU's stringent food and drink safety guidelines, manufacturers have set higher standards resulting in more high-quality, organic-certified celery juice. To add to that, the consumption of detoxifying and digestion-enhancing drinks made with only natural ingredients is on the rise among consumers in Germany, hence unwillingness in the case to look for anything other than celery juice.

This has given rise to supermarkets, health food stores, and e-commerce sites in making available celery juice; both of them are the leaders in such trade along with biodegradable packaging and sustainable production schemes which resonate with the environmental consciousness.

The popularity of celery juice in Australia has increased significantly as people become more conscious of the use of natural health remedies and the trends of holistic nutrition. Juicing is one of the ways that consumers incorporate cold-pressed, chemical-free, and healthful juices in their drink routine.

The use of locally talks about the availability of fresh celery sourced and the country’s focus on sustainable farming is a factor in the growth of the market. Fresh and organic beverages are the choices that the Australian consumers are fond of, which is why there is an increase in demand for high-end celery juice.

Additionally, juice bars, cafes, as well as organic grocery chains are the main distribution channels through which celery juice can be obtained easily in major cities like Sydney and Melbourne. The fast-growing health drink market in Australia is boosted by not only the online shops but also the direct-to-consumer channels. This has allowed small and medium-sized brands to be successful in the health drink market which is ever-changing in Australia.

The celery juice market is becoming increasingly competitive as key players focus on product innovation, organic certifications, and direct-to-consumer sales strategies to strengthen their market presence. Leading brands are emphasizing cold-pressed, organic, and functional juice formulations to cater to the growing demand for health-conscious beverages.

Prominent companies in the market are expanding their distribution networks across online and offline channels, leveraging e-commerce growth and subscription-based delivery models to enhance accessibility. Many brands are also investing in sustainable packaging solutions to appeal to environmentally conscious consumers.

For instance

The global Celery Juice industry is estimated to be worth USD 16,750.4 million in 2025 and is projected to reach a value of USD 30,890.2 million by 2035, expanding at a CAGR of 6.5% over the assessment period of 2025 to 2035.

Sales of Celery Juice increased at 6.8% CAGR between 2020 and 2024.

Some of the leading players in this industry include JuicePress, Suja Life, Evolution Fresh, BluePrint Organic, Pressed Juicery, Daily Greens, Lakewood Organic, Urban Remedy, Greenhouse Juice Co., and Raw Generation.

The Asia-Pacific region is projected to hold a revenue share of 32% over the forecast period.

North America holds 35% share of the global demand space for Celery Juice in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.