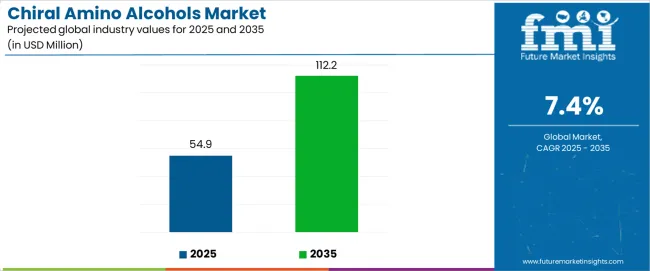

The chiral amino alcohols market is projected to grow from USD 54.9 million in 2025 to USD 112.2 million in 2035 at a CAGR of 7.4%. Pricing and profitability analysis point to historical cost trends, segment-specific margins, and raw material dynamics shaping long-term growth potential. Chiral amino alcohols are specialty intermediates in pharmaceuticals, agrochemicals, and fine chemicals, where demand is driven by enantioselective synthesis and active pharmaceutical ingredient (API) formulation. Prices have historically remained higher compared with commodity amino alcohols due to complexity in synthesis, need for high enantiomeric purity, and limited availability of production technologies.

Forecast pricing trends suggest continued stability with modest upward movement through 2035. Expansion of pharmaceutical pipelines with a stronger focus on chiral drug development supports consistent pricing power for manufacturers. Specialty grades with high optical purity are likely to command premium pricing, while bulk commodity variants for lower-value applications in coatings or industrial intermediates are expected to maintain stable but narrower margins. Innovation in catalytic synthesis and biocatalytic methods may gradually reduce production costs, but premium product segments are unlikely to see significant price compression due to performance differentiation.

Margins across segments demonstrate notable variation. Commodity chiral amino alcohols used in industrial synthesis or basic agrochemical intermediates generate thinner margins because of competition from low-cost producers and limited differentiation. Specialty segments catering to pharmaceutical and biotech applications deliver significantly higher margins, reflecting stringent quality standards, regulatory compliance, and intellectual property barriers. Manufacturers with the capability to scale production while meeting good manufacturing practice (GMP) requirements gain higher profitability in these segments. The ability to offer customized enantiomer-specific solutions further enhances margin potential.

Profitability is influenced strongly by raw material costs. Feedstock availability for amino acid precursors, petrochemical derivatives, and catalytic agents impacts cost structure. Price fluctuations in petrochemicals, solvents, and reagents used in asymmetric synthesis directly affect margins. Companies with backward integration into key intermediates gain insulation from volatility, while others dependent on external sourcing face higher margin risks. Increasing reliance on biocatalytic methods and fermentation-based routes is expected to mitigate raw material volatility by reducing dependence on petrochemical feedstocks.

The overall pricing and profitability outlook indicates a favorable trajectory supported by consistent demand in high-value pharmaceutical applications. Profit pools are concentrated in specialty segments, while commodity products maintain volume-driven revenues. Manufacturers that can optimize production efficiency, integrate into feedstock supply, and expand custom synthesis capabilities are expected to secure stronger profitability. At a CAGR of 7.4%, the chiral amino alcohols market reflects a structurally attractive growth profile with balanced price stability and differentiated margin opportunities across commodity and specialty categories through 2035.

Between 2025 and 2030, the chiral amino alcohols market is projected to expand from USD 54.9 million to USD 78.5 million, resulting in a value increase of USD 23.6 million, which represents 41.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing pharmaceutical R&D investments requiring chiral intermediates, rising adoption of enantioselective catalysis processes, and growing demand for optically active amino alcohols with enhanced stereochemical purity characteristics. Pharmaceutical manufacturers are expanding their chiral amino alcohol sourcing capabilities to address the growing demand for complex drug synthesis, API production, and specialty pharmaceutical development requirements.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (USD) | 54.9 million |

| Forecast Value in 2035 (USD) | 112.2 million |

| Forecast CAGR (2025–2035) | 7.4% |

From 2030 to 2035, the chiral amino alcohols market is forecast to grow from USD 78.5 million to USD 112.2 million, adding another USD 33.7 million, which constitutes 58.8% of the ten-year expansion. This period is expected to be characterized by the expansion of asymmetric synthesis technologies, the integration of green chemistry methodologies, and the development of novel chiral amino alcohol derivatives with improved pharmaceutical properties. The growing adoption of automated synthesis systems will drive demand for chiral amino alcohols with superior optical purity capabilities and compatibility with high-throughput pharmaceutical manufacturing across research facilities.

Between 2020 and 2025, the chiral amino alcohols market experienced robust growth, driven by increasing demand for pharmaceutical intermediates and growing recognition of chiral amino alcohols as essential building blocks for enantiopure drug synthesis across pharmaceutical research, biotechnology applications, and fine chemical manufacturing. The chiral amino alcohols market developed as manufacturers recognized the potential for chiral amino alcohols to enable stereoselective transformations while maintaining high enantiomeric excess and enabling cost-effective chiral synthesis pathways. Technological advancement in asymmetric catalysis and chiral resolution methods began emphasizing the critical importance of maintaining optical purity and stereochemical integrity in pharmaceutical intermediate production environments.

Market expansion is being supported by the increasing global demand for pharmaceutical intermediates and the corresponding need for chiral building blocks that can provide superior stereoselectivity and enantiomeric purity while enabling efficient drug synthesis and API manufacturing across various pharmaceutical and biotechnology research applications. Modern pharmaceutical companies and research institutions are increasingly focused on implementing chiral synthesis strategies that can produce optically pure compounds, prevent racemic mixture formation, and provide consistent stereochemical outcomes throughout complex multi-step synthesis pathways. Chiral amino alcohols' proven ability to deliver exceptional stereochemical control, enable efficient chiral pool synthesis, and support cost-effective pharmaceutical manufacturing make them essential chemical intermediates for contemporary drug development and API production operations.

The growing emphasis on enantiopure drug development and synthesis efficiency is driving demand for chiral amino alcohols that can support high-throughput pharmaceutical research requirements, improve drug candidate properties, and enable automated synthesis formats. Manufacturers' preference for intermediates that combine effective stereochemical control with processing compatibility and material efficiency is creating opportunities for innovative chiral amino alcohol implementations. The rising influence of personalized medicine and specialty pharmaceuticals is also contributing to increased demand for chiral amino alcohols that can provide stereochemical precision, optical purity, and reliable performance across extended synthesis sequences.

The chiral amino alcohols market is poised for rapid growth and transformation. As industries across pharmaceuticals, biotechnology, fine chemicals, agrochemicals, and specialty materials seek intermediates that deliver exceptional stereochemical control, enantiomeric purity, and synthesis efficiency, chiral amino alcohols are gaining prominence not just as commodity chemicals but as strategic enablers of pharmaceutical innovation and drug discovery.

Rising pharmaceutical R&D investments in Asia-Pacific and expanding biotechnology sectors globally amplify demand, while manufacturers are leveraging innovations in asymmetric catalysis, chiral resolution techniques, and automated synthesis systems.

Pathways like specialized L-alaninol derivatives, automated chiral synthesis platforms, and application-specific customization promise strong margin uplift, especially in high-value pharmaceutical segments. Geographic expansion and vertical integration will capture volume, particularly where local manufacturing capabilities and pharmaceutical industry proximity are critical. Regulatory pressures around drug purity requirements, enantiomeric excess standards, pharmaceutical quality control, and API manufacturing compliance give structural support.

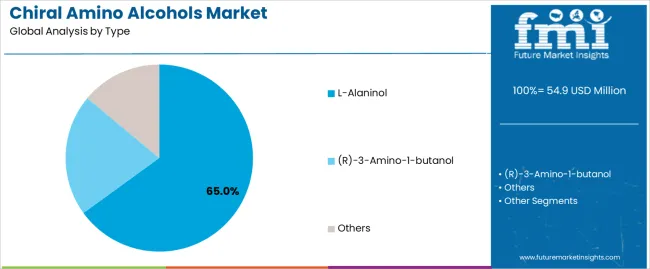

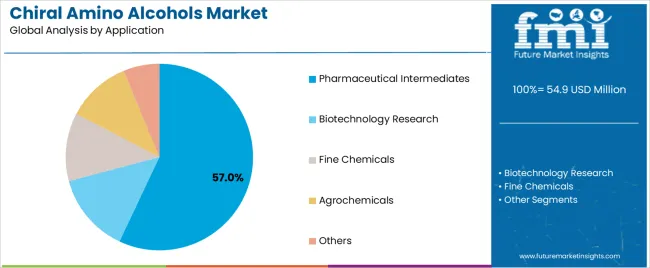

The chiral amino alcohols market is segmented by type, application, purity grade, end-use industry, and region. By type, the chiral amino alcohols market is divided into L-alaninol, (R)-3-amino-1-butanol, and others. By application, it covers pharmaceutical intermediates, biotechnology research, fine chemicals, agrochemicals, and others. By purity grade, the chiral amino alcohols market is segmented into analytical grade (>99%), pharmaceutical grade (>98%), and standard grade (<98%). The end-use industry includes pharmaceutical manufacturing, biotechnology, academic research, contract manufacturing, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The L-alaninol segment is projected to account for 65% of the chiral amino alcohols market in 2025, reaffirming its position as the leading product category. Pharmaceutical companies and research institutions increasingly utilize L-alaninol for its superior stereochemical properties when processed through asymmetric synthesis methodologies, excellent chiral pool characteristics, and cost-effectiveness in applications ranging from API synthesis to pharmaceutical intermediate production. L-alaninol technology's advanced optical purity capabilities and consistent enantiomeric excess directly address the industrial requirements for reliable stereochemical control in pharmaceutical manufacturing environments.

This product segment forms the foundation of modern pharmaceutical synthesis operations, as it represents the chiral amino alcohol type with the greatest versatility and established market demand across multiple pharmaceutical categories and research sectors. Manufacturer investments in enhanced purification technologies and automated synthesis compatibility continue to strengthen adoption among pharmaceutical companies and research institutions. With companies prioritizing drug purity and stereochemical precision, L-alaninol aligns with both pharmaceutical performance requirements and economic efficiency objectives, making them the central component of comprehensive chiral synthesis strategies.

Pharmaceutical intermediates applications are projected to represent 57% of chiral amino alcohols demand in 2025, underscoring their critical role as the primary industrial consumers of optically active amino alcohols for drug synthesis, API production, and pharmaceutical research applications. Pharmaceutical manufacturers prefer chiral amino alcohols for their exceptional stereochemical control capabilities, high enantiomeric purity characteristics, and ability to enable complex synthesis while ensuring drug quality with precise optical activity. Positioned as essential intermediates for modern pharmaceutical operations, chiral amino alcohols offer both synthesis advantages and quality assurance benefits.

The segment is supported by continuous innovation in asymmetric synthesis technologies and the growing availability of specialized chiral amino alcohol derivatives that enable pharmaceutical applications with enhanced stereochemical performance and rapid synthesis throughput. Pharmaceutical companies are investing in chiral synthesis capabilities to support large-volume chiral amino alcohol utilization and manufacturing efficiency. As personalized medicine demand becomes more prevalent and pharmaceutical complexity increases, pharmaceutical intermediates applications will continue to dominate the end-use market while supporting advanced chiral synthesis utilization and pharmaceutical manufacturing strategies.

The chiral amino alcohols market is advancing rapidly due to increasing demand for pharmaceutical intermediates and growing adoption of chiral synthesis solutions that provide superior stereochemical control and enantiomeric purity while enabling efficient drug development across diverse pharmaceutical and biotechnology research applications. The chiral amino alcohols market faces challenges, including raw material cost fluctuations, complex synthesis technology requirements, and the need for specialized optical purity analysis investments. Innovation in asymmetric catalysis methodologies and green synthesis development continues to influence product development and market expansion patterns.

The growing adoption of asymmetric hydrogenation, enzymatic resolution, and chiral auxiliary methodologies is enabling manufacturers to produce chiral amino alcohols with superior optical purity, enhanced enantiomeric excess, and improved synthetic efficiency functionalities. Advanced catalytic systems provide improved stereochemical control while allowing more efficient pharmaceutical synthesis and consistent performance across various drug development conditions and applications. Manufacturers are increasingly recognizing the competitive advantages of advanced synthesis capabilities for product differentiation and premium pharmaceutical market positioning.

Modern chiral amino alcohol producers are incorporating automated synthesis reactors, integrated purification systems, and real-time optical purity monitoring to enhance manufacturing efficiency, enable quality assurance, and deliver value-added solutions to pharmaceutical and biotechnology customers. These technologies improve synthesis throughput while enabling new operational capabilities, including high-purity production, consistent enantiomeric excess, and reduced manufacturing variability. Advanced automation integration also allows manufacturers to support pharmaceutical-scale production operations and research facility modernization beyond traditional batch synthesis approaches.

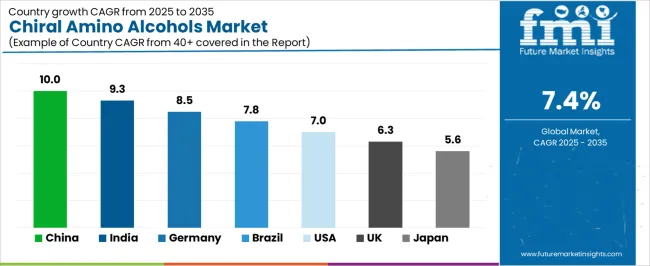

| Country | CAGR (2025–2035) |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| Brazil | 7.8% |

| USA | 7.0% |

| UK | 6.3% |

| Japan | 5.6% |

The chiral amino alcohols market is experiencing strong growth globally, with China leading at a 10.0% CAGR through 2035, driven by the expanding pharmaceutical manufacturing sector, growing API production capabilities, and significant investment in fine chemical manufacturing development. India follows at 9.3%, supported by rapid pharmaceutical industry growth, increasing contract manufacturing demand, and growing domestic research capabilities. Germany shows growth at 8.5%, emphasizing pharmaceutical innovation and advanced chemical synthesis development. Brazil records 7.8%, focusing on pharmaceutical market expansion and biotechnology research growth. The USA demonstrates 7.0% growth, prioritizing drug discovery innovation and pharmaceutical R&D development. The UK exhibits 6.3% growth, emphasizing precision pharmaceutical manufacturing and biotechnology research excellence. Japan shows 5.6% growth, supported by pharmaceutical quality standards and advanced synthesis technology production.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from chiral amino alcohols in China is projected to exhibit exceptional growth with a CAGR of 10.0% through 2035, driven by expanding pharmaceutical manufacturing capabilities and rapidly growing API production supported by government initiatives promoting chemical industry development. The country's strong position in fine chemical manufacturing and increasing investment in pharmaceutical infrastructure are creating substantial demand for chiral amino alcohol solutions. Major pharmaceutical companies and chemical manufacturers are establishing comprehensive chiral amino alcohol production capabilities to serve both domestic pharmaceutical demand and export markets.

Demand for chiral amino alcohols in India is expanding at a CAGR of 9.3%, supported by the country's massive pharmaceutical industry, expanding contract manufacturing activities, and increasing adoption of advanced synthesis technologies. The country's government initiatives promoting pharmaceutical manufacturing and growing pharmaceutical research capabilities are driving requirements for sophisticated chiral intermediate capabilities. International pharmaceutical companies and domestic manufacturers are establishing extensive production and research capabilities to address the growing demand for chiral amino alcohol products.

Revenue from chiral amino alcohols in Germany is growing at a CAGR of 8.5%, supported by the country's advanced pharmaceutical industry, strong emphasis on chemical innovation technologies, and robust demand for high-performance chiral intermediates in pharmaceutical and biotechnology applications. The nation's mature chemical sector and research-focused operations are driving sophisticated chiral amino alcohol systems throughout the pharmaceutical supply chain. Leading manufacturers and research institutions are investing extensively in synthesis technology and green chemistry approaches to serve both domestic and international markets.

Demand for chiral amino alcohols in Brazil is projected to expand at a CAGR of 7.8%, driven by the country's expanding pharmaceutical sector, growing biotechnology market, and increasing investment in research infrastructure development. Brazil's large pharmaceutical industry and commitment to healthcare innovation are supporting demand for chiral amino alcohol solutions across multiple pharmaceutical segments. Manufacturers are establishing comprehensive production capabilities to serve the growing domestic market and regional pharmaceutical opportunities.

Revenue from chiral amino alcohols in the USA is expected to grow at a CAGR of 7.0%, supported by the country's pharmaceutical industry leadership, advanced research capabilities, and strategic focus on drug discovery and development. The USA's innovation excellence and pharmaceutical research concentration are driving demand for chiral amino alcohols in pharmaceutical R&D, biotechnology applications, and contract manufacturing. Manufacturers are investing in comprehensive research capabilities to serve both domestic pharmaceutical companies and international specialty markets.

Demand for chiral amino alcohols in the UK is growing at a CAGR of 6.3%, driven by the country's expertise in pharmaceutical manufacturing, emphasis on research quality, and strong position in biotechnology and pharmaceutical development. The UK's established pharmaceutical technology capabilities and commitment to innovation are supporting investment in advanced synthesis technologies throughout major pharmaceutical centers. Industry leaders are establishing comprehensive quality systems to serve domestic pharmaceutical manufacturers and biotechnology researchers.

Revenue from chiral amino alcohols in Japan is expanding at a CAGR of 5.6%, supported by the country's pharmaceutical manufacturing concentration, advanced chemical technology, and strategic position in precision synthesis applications. Japan's pharmaceutical expertise and integrated research infrastructure are driving demand for high-quality chiral amino alcohols in pharmaceutical manufacturing, specialty chemical production, and advanced research applications. Leading manufacturers are investing in specialized capabilities to serve the stringent requirements of pharmaceutical and research industries.

The chiral amino alcohols market in Europe is projected to grow from USD 14.8 million in 2025 to USD 31.2 million by 2035, registering a CAGR of 7.7% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, slightly increasing to 29.0% by 2035, supported by its strong pharmaceutical industry, advanced chemical manufacturing capabilities, and comprehensive research sector serving diverse chiral amino alcohol applications across Europe.

The United Kingdom follows with a 22.0% share in 2025, projected to reach 22.5% by 2035, driven by robust demand for chiral amino alcohols in pharmaceutical research, biotechnology applications, and contract manufacturing, combined with established pharmaceutical infrastructure and research excellence. France holds a 19.5% share in 2025, expected to reach 20.0% by 2035, supported by strong pharmaceutical market and growing pharmaceutical research activities. Italy commands a 12.5% share in 2025, projected to reach 12.8% by 2035, while Spain accounts for 8.0% in 2025, expected to reach 8.2% by 2035. Switzerland maintains a 4.5% share in 2025, growing to 4.7% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Netherlands, and other nations, is anticipated to maintain momentum, with its collective share moving from 5.0% to 2.8% by 2035, attributed to increasing pharmaceutical manufacturing in Eastern Europe and growing biotechnology research in Nordic countries implementing advanced chiral synthesis programs.

The chiral amino alcohols market is characterized by competition among established pharmaceutical intermediate manufacturers, specialized chiral chemical producers, and integrated fine chemical companies. Companies are investing in asymmetric synthesis research, optical purity optimization, automated production system development, and comprehensive product portfolios to deliver consistent, high-performance, and application-specific chiral amino alcohol solutions. Innovation in green synthesis methods, enzymatic resolution techniques, and quality assurance systems is central to strengthening market position and competitive advantage.

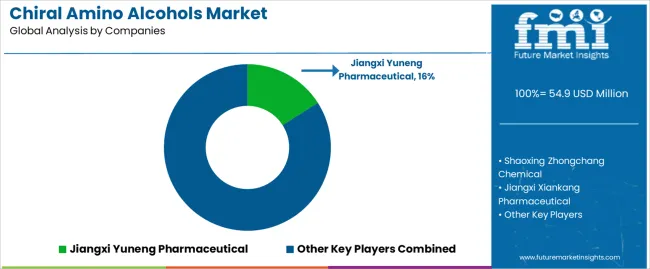

Jiangxi Yuneng Pharmaceutical leads the chiral amino alcohols market with a strong market share, offering comprehensive chiral amino alcohol solutions with a focus on pharmaceutical intermediates and API synthesis applications. Shaoxing Zhongchang Chemical provides specialized chiral synthesis capabilities with an emphasis on L-alaninol production and pharmaceutical-grade quality standards. Jiangxi Xiankang Pharmaceutical delivers innovative chiral intermediates with a focus on pharmaceutical manufacturing and custom synthesis services. Hangzhou Aolishen Chemical specializes in chiral amino alcohol derivatives and pharmaceutical intermediate production for research applications. Yancheng Huahong Chemical focuses on high-purity chiral amino alcohols and integrated pharmaceutical intermediate solutions. Porton Pharma Solutions offers specialized pharmaceutical intermediates and contract manufacturing services with emphasis on chiral synthesis applications.

| Item | Values |

|---|---|

| Quantitative Units (2025) | USD 54.9 million |

| Type | L-Alaninol, (R)-3-Amino-1-butanol, Others |

| Application | Pharmaceutical Intermediates, Biotechnology Research, Fine Chemicals, Agrochemicals, Others |

| Purity Grade | Analytical Grade (>99%), Pharmaceutical Grade (>98%), Standard Grade (<98%) |

| End-Use | Pharmaceutical Manufacturing, Biotechnology, Academic Research, Contract Manufacturing, Others |

| Regions | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies | Jiangxi Yuneng Pharmaceutical, Shaoxing Zhongchang Chemical, Jiangxi Xiankang Pharmaceutical, Hangzhou Aolishen Chemical, Yancheng Huahong Chemical, Porton Pharma Solutions |

| Additional Attributes | Dollar sales by type and application category, regional demand trends, competitive landscape, technological advancements in asymmetric synthesis, optical purity analysis, automated production systems, and pharmaceutical supply chain integration |

The global chiral amino alcohols market is estimated to be valued at USD 54.9 million in 2025.

The market size for the chiral amino alcohols market is projected to reach USD 112.2 million by 2035.

The chiral amino alcohols market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in chiral amino alcohols market are l-alaninol , (r)-3-amino-1-butanol and others.

In terms of application, pharmaceutical intermediates segment to command 57.0% share in the chiral amino alcohols market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Amino Resin Market Growth - Trends & Forecast 2025 to 2035

Amino Acids Market Growth - Trends & Forecast 2025 to 2035

Amino Acids Premixes Market

Amino Acid Metabolism Disorders Treatment Market Growth – Trends & Forecast 2024-2034

Acetaminophen API Market Report – Demand, Trends & Industry Forecast 2025–2035

Acetaminophen Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Acetaminophen-Opioid Combination Market Analysis – Size, Share & Forecast 2024-2034

Food Amino Acids Market Size, Growth, and Forecast for 2025 to 2035

Feed Amino Acids Market Analysis by Product, Application, and Region through 2035

Serine Amino Acid Market - Size, Share, and Forecast Outlook 2025 to 2035

Liquid Amino Ingredients Market Analysis by Source,Type and Application Through 2035

Alanine Aminotransferase Reagent Market

(S)-(+)-2-Amino-1-Propanol Market Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Branched Chain Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Theophylline And Aminophylline Market Size and Share Forecast Outlook 2025 to 2035

Bioalcohols Market Size and Share Forecast Outlook 2025 to 2035

Oxo Alcohols Market

Plasticizer Alcohols Market Growth & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA