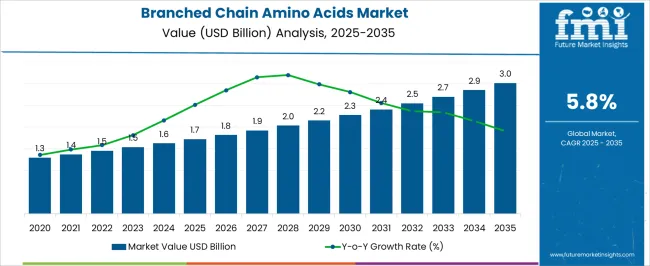

The branched chain amino acids market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The branched-chain amino acids (BCAAs) market is projected to rise from USD 1.7 billion in 2025 to USD 3 billion by 2035, with a CAGR of 5.8%. The long-term value accumulation curve shows a steady increase, moving from 1.8 billion in 2026 to 2.0 billion in 2028 and 2.3 billion by 2030. This gradual rise reflects the growing demand for BCAAs in sports nutrition, dietary supplements, and functional foods. The steady growth pattern signals a stable and dependable adoption driven by consumer interest in muscle recovery, endurance, and protein synthesis. In my view, this curve highlights long-term resilience in the sector, underpinned by consistent product usage.

From 2031 onward, the market continues its ascent, reaching 2.7 billion in 2032, 2.9 billion in 2034, and ultimately 3.0 billion in 2035. This sustained growth suggests the increasing role of BCAAs in both health and wellness markets as well as the pharmaceutical and medical industries for therapeutic uses. Market observers argue that the demand for premium, high-quality amino acid formulations will further reinforce growth. In an opinionated reading, the curve indicates strong potential for suppliers, with future opportunities arising from the growing focus on wellness, fitness, and performance-driven nutrition.

| Metric | Value |

|---|---|

| Branched Chain Amino Acids Market Estimated Value in (2025 E) | USD 1.7 billion |

| Branched Chain Amino Acids Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The branched-chain amino acids (BCAAs) market holds a key position within several larger markets, particularly in the nutraceuticals and sports nutrition sectors. Within the nutraceuticals market, the BCAA market accounts for around 4-5%, as amino acids are widely used for their health benefits, including muscle recovery and metabolic support. In the sports nutrition market, BCAAs represent a larger share of approximately 15-18%, driven by their essential role in muscle growth, recovery, and endurance, which makes them highly sought after by athletes and fitness enthusiasts. The functional foods market sees a smaller contribution from BCAAs, around 5-7%, as they are often incorporated into protein-rich foods and beverages aimed at enhancing health.

In the dietary supplements market, the BCAA market commands a substantial 10-12% share, as amino acid supplements are increasingly popular among individuals seeking improved performance, weight management, and overall wellness. Within the animal feed additives market, BCAAs contribute about 3-4%, as they are used to improve the health, growth, and productivity of livestock. The growing awareness of health, fitness, and wellness trends, alongside the increasing prevalence of fitness centers and sports participation, fuels the demand for BCAA-based products. These figures highlight the significant role of BCAAs across diverse sectors, where their application extends beyond human nutrition to animal health and performance, thus underlining their widespread relevance in the global health and wellness landscape.

The branched chain amino acids market is witnessing consistent expansion due to rising consumer awareness about muscle health, recovery, and endurance enhancement. Increased participation in sports, fitness activities, and bodybuilding has driven demand for nutritional supplements enriched with BCAAs.

Advancements in formulation technologies have improved solubility, taste, and absorption rates, making products more appealing to a wider audience. Additionally, the growing popularity of preventive healthcare and functional nutrition has accelerated the integration of BCAAs into daily dietary routines.

Regulatory support for safe supplementation and the increasing influence of digital fitness communities are further boosting adoption. The market outlook remains favorable, supported by product diversification, targeted marketing strategies, and a sustained emphasis on performance nutrition across global markets.

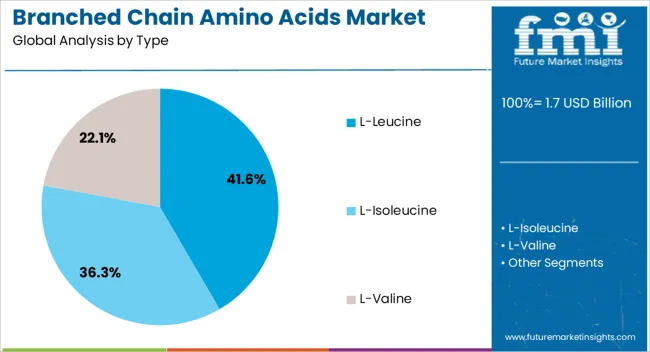

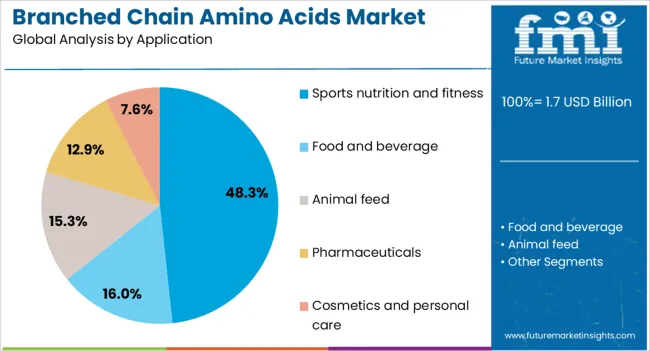

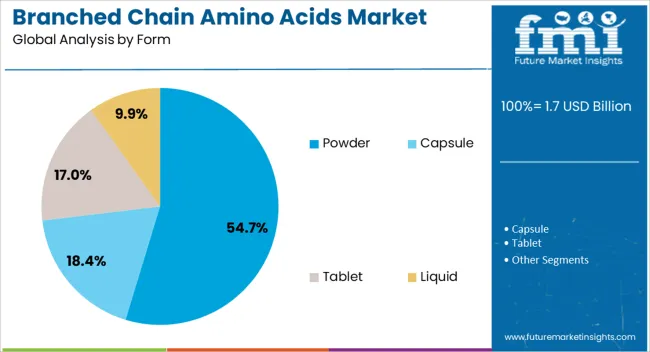

The branched chain amino acids market is segmented by type, application, form, and geographic regions. By type, branched chain amino acids market is divided into L-leucine, L-isoleucine, and L-valine. In terms of application, branched chain amino acids market is classified into sports nutrition and fitness, food and beverage, animal feed, pharmaceuticals, and cosmetics and personal care. Based on form, branched chain amino acids market is segmented into powder, capsule, tablet, and liquid. Regionally, the branched chain amino acids industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The L-Leucine segment is projected to account for 41.6% of total market revenue by 2025 within the type category, making it the leading segment. Its dominance is attributed to its critical role in muscle protein synthesis and recovery, particularly valued among athletes and active individuals.

L-Leucine’s ability to stimulate anabolic pathways and preserve lean muscle mass during intense training has elevated its demand in sports and clinical nutrition.

Continuous research highlighting its metabolic benefits and superior efficacy compared to other amino acids has reinforced its market leadership.

The sports nutrition and fitness application segment is expected to hold 48.3% of total market revenue by 2025, establishing it as the largest application category. This growth is driven by the global surge in gym memberships, participation in competitive sports, and adoption of structured workout regimens.

BCAAs are widely used in this segment for improving endurance, reducing muscle soreness, and supporting faster recovery, leading to higher repeat purchase rates.

Increasing product availability through online retail channels and endorsements by fitness influencers have also supported its prominence.

The powder form segment is projected to contribute 54.7% of total market revenue by 2025 within the form category, making it the most preferred format. Its popularity stems from ease of mixing, customizable dosages, and rapid absorption compared to tablets or capsules.

Powder formulations often feature flavored options, enhancing consumer acceptance.

The format’s compatibility with pre-workout and post-workout blends has further cemented its dominance, especially among professional athletes and fitness enthusiasts seeking flexible supplementation solutions.

The branched-chain amino acids (BCAA) market is expected to grow due to increasing demand for fitness supplements, muscle recovery products, and functional foods. Demand is reinforced by their benefits in muscle protein synthesis, reducing muscle soreness, and improving endurance. Opportunities are emerging in the growing wellness and sports nutrition segments, particularly in the form of powders, tablets, and beverages. Trends point to increasing adoption in vegan and plant-based formulations. Challenges include high production costs, regulatory scrutiny, and competition from alternative protein sources.

The demand for branched-chain amino acids is being driven by their use in sports nutrition and fitness supplements. BCAAs are widely recognized for their role in muscle protein synthesis and reducing muscle breakdown during intense exercise, making them highly sought after by athletes, bodybuilders, and fitness enthusiasts. These amino acids, especially leucine, isoleucine, and valine, have been shown to support endurance and improve recovery time, which enhances performance. In our opinion, as health-conscious consumers continue to prioritize physical fitness and muscle health, BCAA products will remain a staple in sports supplements and wellness regimes.

Opportunities are expanding in the growing vegan and plant-based markets, where the demand for BCAA products derived from non-animal sources is increasing. As more consumers adopt plant-based diets, the need for plant-derived amino acids that can provide the same benefits as animal-based BCAAs is rising. Vegan-friendly BCAA formulations using fermented sources are gaining popularity, as they cater to the needs of this specific demographic. In our view, the most promising opportunities lie in creating BCAA products that cater to both fitness enthusiasts and plant-based consumers who are seeking high-quality, sustainable supplementation.

Trends in the BCAA market point to the increasing inclusion of BCAAs in functional foods and beverages, such as protein bars, energy drinks, and ready-to-drink shakes. These products are being favored for their convenience and effectiveness, especially for those looking to improve their fitness performance or recovery without consuming traditional supplements. As consumer preferences shift toward functional, easy-to-consume products, BCAA-fortified beverages and snacks are becoming more mainstream. In our opinion, the most significant trend is the integration of BCAAs into everyday food products, as it makes muscle support more accessible and aligns with the growing wellness movement.

Challenges in the BCAA market stem from high production costs, particularly the fermentation process used to produce high-quality BCAAs. The high expense of raw materials, such as plant-based proteins, and the complexity of ensuring product purity contribute to the overall cost. Furthermore, competition from alternative protein sources, such as whey and soy protein, may limit growth for BCAAs, especially in markets with price-sensitive consumers. In our view, addressing these challenges will require innovations in cost-efficient production methods and effective marketing strategies to differentiate BCAAs from other protein sources, focusing on their specific performance and recovery benefits.

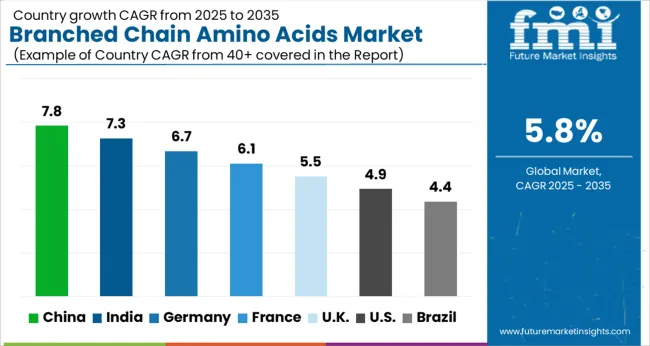

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

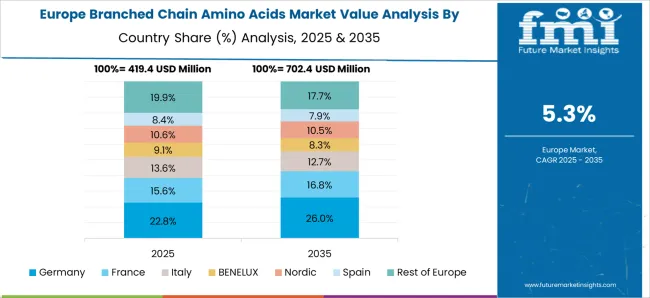

The global branched-chain amino acids (BCAAs) market is projected to grow at 5.8% from 2025 to 2035. China leads at 7.8%, followed by India 7.3% and Germany 6.7%; the United Kingdom 5.5% and United States 4.9% follow. BCAAs are increasingly in demand for their benefits in muscle recovery, energy production, and appetite regulation, particularly in the fitness, sports nutrition, and healthcare sectors. The rise of fitness culture and growing awareness of the benefits of BCAAs, coupled with their use in dietary supplements, pharmaceuticals, and animal feed, is driving market growth. Asia is expected to lead in production volume, while Europe and North America will focus on product innovation, quality, and regulatory compliance. In our view, companies that emphasize R&D, sustainable production, and transparent labeling will capture significant market share. This report includes insights on 40+ countries; the top markets are shown here for reference.

The branched-chain amino acids (BCAAs) market in China is expected to expand at 7.8%. The market is being driven by the growing awareness of BCAAs' role in muscle recovery, energy production, and overall health. With an increasing focus on fitness and wellness, particularly among young adults and athletes, the demand for BCAAs in dietary supplements and sports nutrition products is rising. China’s expanding e-commerce platforms are also contributing to the market’s growth, as consumers increasingly seek health-related supplements online. The growing sports industry and the increasing popularity of bodybuilding, along with increasing disposable incomes, are expected to further boost demand for BCAAs in the country.

The branched-chain amino acids (BCAAs) market in India is projected to grow at 7.3%. The demand for BCAAs is being driven by a growing middle class, an increasing focus on fitness, and a shift towards healthier lifestyles. As awareness about sports nutrition and the benefits of BCAAs for muscle recovery and endurance grows, more consumers in India are incorporating them into their daily routines. The rise in demand for protein-rich supplements and their growing popularity in the athletic, bodybuilding, and health-conscious segments are key factors in the market’s expansion. With an increasing number of fitness enthusiasts and athletes, India is poised to become one of the fastest-growing markets for BCAAs.

The branched-chain amino acids (BCAAs) market in Germany is forecast to grow at 6.7%. Germany’s growing emphasis on fitness, wellness, and healthy living is driving demand for BCAAs in the sports nutrition and dietary supplements sectors. With a robust health-conscious consumer base, the demand for BCAAs in bodybuilding, endurance sports, and recovery products is on the rise. Germany’s mature pharmaceutical and nutraceutical markets also contribute to the demand for BCAAs in various medical applications, particularly in hospitals and clinics where they are used for patients recovering from surgeries or illnesses. Germany’s focus on clean and sustainable nutrition products is likely to further boost the market for high-quality, ethically sourced BCAAs.

The branched-chain amino acids (BCAAs) market in the UK is expected to expand at 5.5%. The UK market is driven by the increasing focus on fitness and wellness, where BCAAs are widely used for their benefits in muscle recovery, performance, and fat burning. As fitness and health awareness grow, particularly among the millennial and Gen Z populations, demand for BCAAs in dietary supplements is on the rise. In addition, the UK’s growing demand for protein supplements, especially from the vegan and vegetarian sectors, is contributing to the market’s expansion. As consumers continue to seek healthier lifestyle choices, BCAAs are gaining popularity as a part of sports nutrition and general wellness regimes.

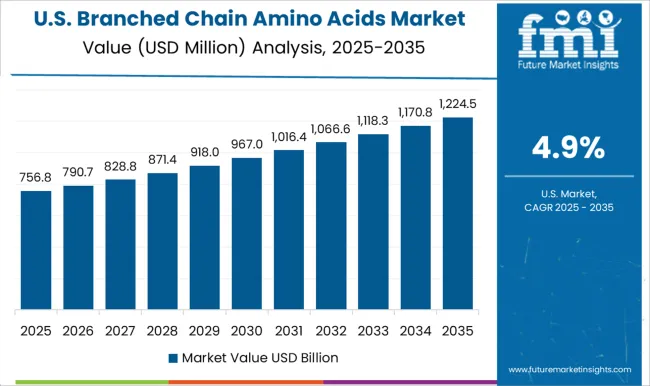

The branched-chain amino acids (BCAAs) market in the United States is projected to grow at 4.9%. The USA market is experiencing strong growth, driven by the increasing demand for fitness supplements and sports nutrition products. BCAAs are becoming a staple in the diets of athletes, bodybuilders, and fitness enthusiasts due to their proven benefits in muscle recovery, endurance, and weight management. The growing awareness of BCAAs in general wellness and as part of a balanced diet is also pushing demand. The market is further supported by the growing focus on plant-based protein sources and the increasing popularity of vegan and vegetarian diets.

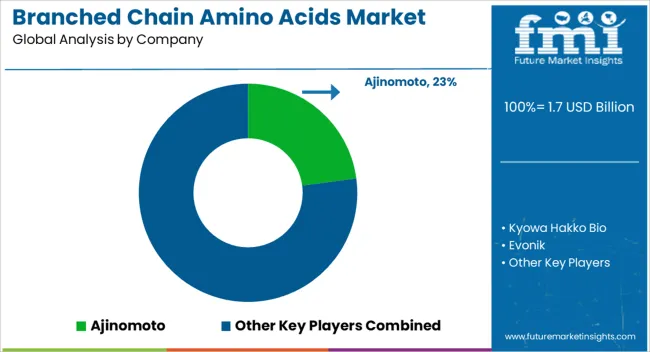

Competition in the branched-chain amino acids (BCAAs) market has been driven by how companies present purity, efficacy, and application versatility in their brochures. Ajinomoto and Kyowa Hakko Bio lead with brochures highlighting their high-quality, pharmaceutical-grade BCAAs, emphasizing their use in dietary supplements, sports nutrition, and medical nutrition, with detailed information on amino acid profiles, bioavailability, and absorption rates. Evonik and BASF focus on the production of optimized BCAA formulations, promoting their amino acids' impact on muscle recovery, protein synthesis, and overall performance.

Toray Industries and DSM emphasize their sustainable sourcing and advanced fermentation processes, presenting brochures that highlight natural, plant-based BCAAs, while ensuring consistency and regulatory compliance. Kerry Group, Glanbia, and Cargill position themselves with flexible offerings, showcasing the diverse forms of BCAAs available, including powders, capsules, and liquid formulations, aimed at both professional athletes and general consumers seeking health benefits. Archer Daniels Midland (ADM) promotes its BCAA range with a focus on its broad application in functional foods and beverages, offering customized solutions for different market segments.

Strategy has been executed through brochures that focus on quality control, product efficacy, and application flexibility. Detailed technical specifications, such as amino acid purity, processing methods, and batch-to-batch consistency, are emphasized to reassure buyers about product reliability. Many brochures also highlight BCAAs’ role in enhancing exercise performance, promoting muscle mass, and reducing fatigue, with clinical studies or real-world data presented to validate these claims.

Companies gain a competitive edge when brochures clearly communicate the potential health benefits of BCAAs, including their support for weight management, energy production, and muscle recovery. Sustainability initiatives, such as the use of renewable energy in production and efforts to reduce environmental impact, are increasingly highlighted to appeal to environmentally-conscious consumers. In this market, brochures serve as critical tools for decision-making, helping customers select BCAA suppliers based on technical expertise, product quality, and alignment with consumer health trends.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 billion |

| Type | L-Leucine, L-Isoleucine, and L-Valine |

| Application | Sports nutrition and fitness, Food and beverage, Animal feed, Pharmaceuticals, and Cosmetics and personal care |

| Form | Powder, Capsule, Tablet, and Liquid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ajinomoto, Kyowa Hakko Bio, Evonik, BASF, Toray Industries, DSM, Kerry Group, Glanbia, Archer Daniels Midland (ADM), and Cargill |

| Additional Attributes | Dollar sales by type (leucine, isoleucine, valine), Dollar sales by application (sports nutrition, dietary supplements, functional foods, pharmaceuticals), Trends in plant-based BCAAs and flavor innovation, Role in muscle recovery, energy production, and exercise performance, Growth driven by health trends and fitness culture, Regional demand across North America, Europe, Asia Pacific. |

The global branched chain amino acids market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the branched chain amino acids market is projected to reach USD 3.0 billion by 2035.

The branched chain amino acids market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in branched chain amino acids market are l-leucine, l-isoleucine and l-valine.

In terms of application, sports nutrition and fitness segment to command 48.3% share in the branched chain amino acids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Branched Stent Graft Market Size and Share Forecast Outlook 2025 to 2035

Chain Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Interoperability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Blockchain AI Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Messaging Apps Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Energy Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Technology Market Analysis & Forecast 2025 to 2035, By Solution, Use Case, Enterprise Size, Industry, and Region

Market Share Breakdown for Cold Chain Packaging Market

Blockchain in Banking Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA