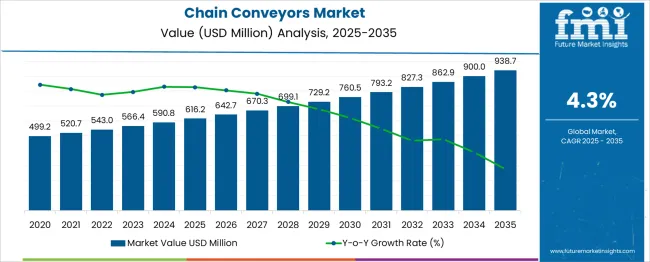

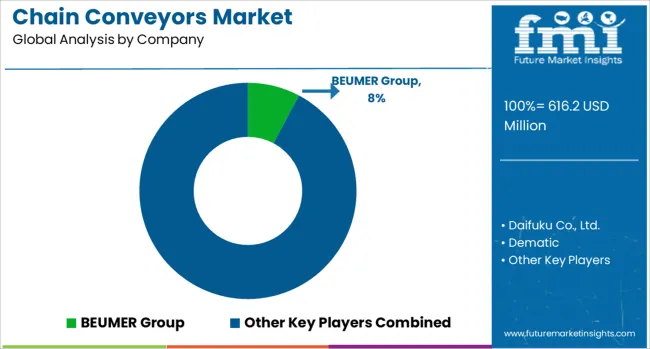

The Chain Conveyors Market is estimated to be valued at USD 616.2 million in 2025 and is projected to reach USD 938.7 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Chain Conveyors Market Estimated Value in (2025 E) | USD 616.2 million |

| Chain Conveyors Market Forecast Value in (2035 F) | USD 938.7 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The chain conveyors market is driven by the increasing need for efficient material handling solutions across industries such as automotive, mining, food processing, and logistics. These systems are widely valued for their durability, high load-carrying capacity, and ability to transport goods across long distances and complex layouts.

As manufacturing and industrial sectors continue to adopt automation and lean production practices, the integration of chain conveyors has become essential for enhancing workflow efficiency and minimizing downtime. The market outlook remains favorable, with ongoing infrastructure development and the expansion of warehousing and distribution facilities further supporting demand.

Future growth is likely to be reinforced by advancements in chain materials, corrosion-resistant components, and smart monitoring systems that improve reliability and safety. The versatility of chain conveyors in handling both light and heavy-duty operations positions them as a vital component in modern industrial environments.

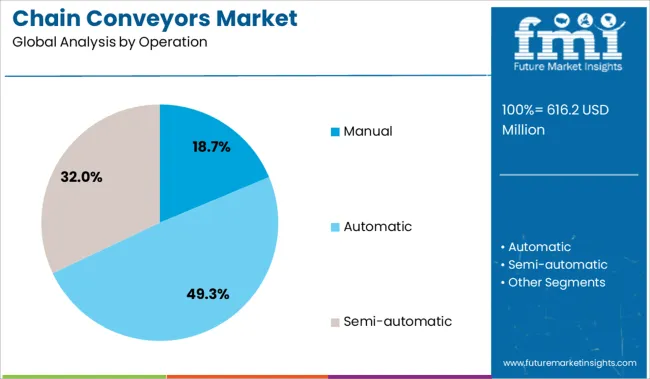

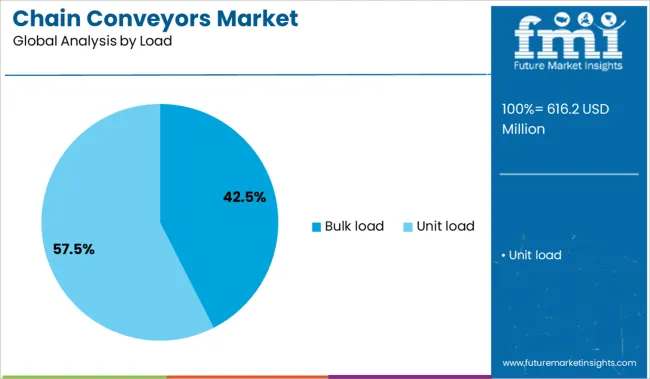

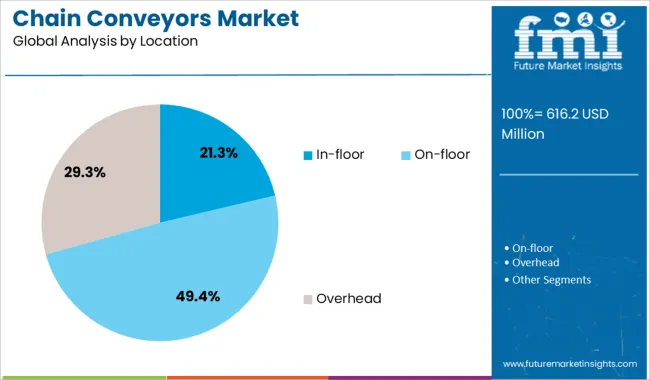

The chain conveyor market is segmented by operation, load, location, end use, and distribution channel and geographic regions. By operation of the chain conveyors, the market is divided into Manual, Automatic, and Semi-automatic. In terms of load, the chain conveyor market is classified into Bulk load and Unit load. Based on the location of the chain conveyors, the market is segmented into In-floor, On-floor, and Overhead. By end use, the chain conveyor market is segmented into Food & beverages, Pharmaceuticals, Automotive & transport, Mining, Manufacturing, Airport, Warehouses & Logistic Centers, and Others (Marine, oil & gas, etc.). The distribution channel of the chain conveyor market is segmented into Direct Sales and Indirect Sales. Regionally, the chain conveyor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual operation segment accounted for 18.7% of the chain conveyor market, maintaining a steady presence due to its cost-effectiveness and suitability for low-speed, controlled environments. Despite increasing automation, manual chain conveyors continue to be preferred in facilities where precise human oversight is required or where budget constraints limit the adoption of powered systems.

These conveyors are particularly effective in short-run production setups or in situations involving custom and non-repetitive tasks. The segment is also bolstered by applications in workshops and assembly lines where flexibility and simplicity are prioritized over throughput speed.

While the share of automated systems is growing, manual operations retain relevance due to their ease of maintenance, low energy consumption, and minimal infrastructure requirements. This segment is expected to remain stable, serving niche and low-volume applications where user control and adaptability are key considerations.

With a commanding 42.5% share, the bulk load segment leads the chain conveyors market, driven by its critical role in transporting heavy and high-volume materials efficiently. Chain conveyors are especially effective in handling abrasive, irregular, or loose materials, making them ideal for industries such as mining, cement, and agriculture.

The demand for robust and reliable systems that can operate in harsh environments has fueled growth in this segment, supported by ongoing investments in large-scale processing and extraction facilities. Technological enhancements such as reinforced chains, wear-resistant linings, and modular designs have improved system durability and reduced maintenance needs.

The emphasis on improving operational safety and minimizing material loss during transit has further reinforced the adoption of chain conveyors for bulk load applications. This segment is expected to continue dominating due to its ability to handle demanding loads with consistency and efficiency.

The in-floor segment represents 21.3% of the chain conveyors market, with its share attributed to the need for unobtrusive, space-saving conveyor solutions in high-traffic or assembly-intensive environments. In-floor chain conveyors are widely implemented in automotive manufacturing, appliance assembly lines, and heavy-equipment production facilities where material flow must be integrated seamlessly with operator movement.

This setup minimizes surface obstruction while allowing for ergonomic access to products and components during the assembly process. Demand for in-floor systems is also growing due to facility layout optimization trends, where floor-level automation is preferred for enhancing safety and operational efficiency.

The segment benefits from design innovations such as embedded sensors and precision tracking systems that improve performance monitoring and process control. With continued emphasis on plant productivity and worker safety, the in-floor segment is expected to maintain a strong position in applications requiring clean, integrated, and efficient material transport.

Chain conveyors are being employed in manufacturing, distribution and processing environments where heavy loads, continuous operation and rough surface handling are required. Robust chain systems with modular attachments, hardened links and integrated sensors are being integrated into automotive lines, beverage bottling, and agricultural grain movement. Conveyor layouts with incline, incline-cleat, and scraper features are being implemented where bulk or packed items must be moved reliably. Demand has been observed in high throughput settings such as food processing, mining logistics and warehouse operations.

Chain conveyors have been selected for applications requiring reliable transport of high weight volumes or abrasive materials. Hardened steel chains equipped with attachments such as flights or cleats have enabled movement of pallets, drums, and bulk solids without slippage or wear. Continuous duty design has allowed 24/7 operation in automotive assembly lines and packaging plants, reducing downtime for maintenance. Sensors monitoring chain tension and alignment have been employed to detect wear and prevent failure in real time. Modular conveyor sections have been used to enable quick configuration changes and support workflow flexibility. Integration with upstream and downstream equipment has enabled synchronized operation for stamping presses, filling lines, and robotic pick cells, improving overall system efficiency.

Chain conveyor adoption has been hindered by the wear and lubrication requirements inherent in high-load environments. Chain elongation and link fatigue require routine inspection and precise tension adjustments, which increase maintenance costs. Heavy chains and attachments can generate noise and vibration in lighter facility structures. Conveyor alignment must be monitored frequently to prevent premature wear on sprockets, bearings, and support rails. Integration of sensors and predictive maintenance software has added control complexity and installation cost. Replacement lead times for specialized attachments may result in extended downtime during breakdown events. As facility managers balance reliability with operational cost targets, chain conveyor deployments have required careful asset management planning and service infrastructure.

chain-conveyors-market-cagr-analysis-by-country

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

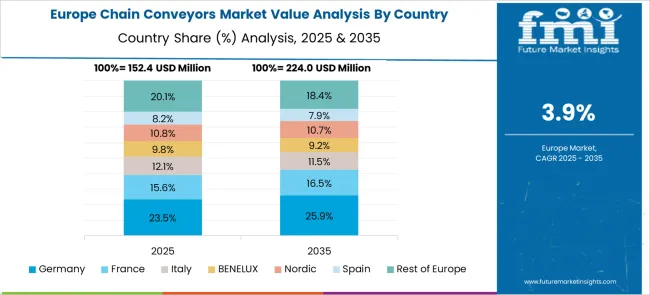

The global chain conveyors market is projected to grow at a 4.3% CAGR from 2025 to 2035, supported by automation in manufacturing and material handling operations. Among the 40 countries analyzed, China leads with 5.8%, followed by India at 5.4% and Germany at 4.9%, while France records 4.5% and the United Kingdom posts 4.1%. Growth is driven by investments in industrial modernization, automated logistics, and demand for energy-efficient conveying systems. Asia dominates due to rising production volumes, whereas European nations prioritize precision-engineered conveyors integrated with advanced monitoring tools. The report includes analysis of over 40 countries, with five profiled below for reference.

China is expected to grow at a 5.8% CAGR, driven by large-scale deployment in automotive assembly lines, food processing units, and mining operations. Manufacturers focus on modular chain conveyors for flexible layouts in multi-product facilities. Automation adoption in warehousing and e-commerce distribution centers further boosts demand. Domestic players invest in wear-resistant chain materials and energy-saving motors to enhance operational efficiency. Rising exports of heavy-duty conveyors for cement and power plants also contribute to market expansion..

India is forecast to grow at a 5.4% CAGR, supported by investments in manufacturing and bulk material handling across steel, cement, and agriculture sectors. Chain conveyors with high-load capacity are being integrated into continuous production facilities. Local manufacturers emphasize cost-optimized solutions with improved corrosion resistance for outdoor installations. Government-driven infrastructure development and food processing projects strengthen adoption. E-commerce growth encourages automation in warehouses, increasing demand for conveyors integrated with control systems for precise product movement.

Germany is projected to grow at a 4.9% CAGR, driven by advanced material handling systems in automotive and machinery manufacturing. Chain conveyors integrated with IoT-enabled sensors for predictive maintenance are becoming common in high-output facilities. Leading OEMs focus on precision-engineered conveyor chains for heavy-duty applications in steel plants and chemical units. Energy optimization initiatives push adoption of low-friction chain systems to reduce power consumption. The aftermarket service segment gains traction as companies prioritize equipment lifecycle management and uptime.

France is forecast to grow at a 4.5% CAGR, supported by automated solutions for automotive, aerospace, and food industries. Manufacturers develop stainless steel and plastic chain conveyors for hygiene-critical environments. Demand for compact, customizable systems rises in small-scale plants focusing on production flexibility. Investments in packaging automation and logistics facilities fuel further adoption. Integration of electronic control systems for speed variation and load optimization is becoming standard in conveyor design, ensuring process efficiency in high-precision industries.

The United Kingdom is projected to grow at a 4.1% CAGR, driven by the modernization of material handling operations in food processing and distribution networks. Compact and modular conveyors are increasingly preferred for space-constrained production facilities. Manufacturers emphasize energy-saving chain designs to meet rising efficiency requirements. Aftermarket customization services and quick replacement parts supply enhance adoption among mid-sized enterprises. The focus on improving productivity in e-commerce fulfillment centers further accelerates demand for conveyors integrated with automated sorting systems.

The chain conveyors market is shaped by leading material handling and automation companies offering innovative solutions for manufacturing, warehousing, and distribution. BEUMER Group and Daifuku Co., Ltd. dominate with integrated conveyor systems for large-scale industrial applications. Dematic, Honeywell International, and Siemens focus on automation-driven conveyor technologies to improve efficiency in logistics and assembly lines. FlexLink and Interroll deliver modular, flexible conveyor designs tailored for packaging and FMCG sectors. Hytrol and Regal Rexnord provide robust conveyor components optimized for heavy-duty applications, while WAMGROUP specializes in bulk material handling solutions. Kardex and Shuttleworth enhance intralogistics with smart conveyor solutions, and Ultimation Industries caters to customized chain conveyor systems for diverse industrial needs. Competition centers on automation, durability, and energy efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 616.2 Million |

| Operation | Manual, Automatic, and Semi-automatic |

| Load | Bulk load and Unit load |

| Location | In-floor, On-floor, and Overhead |

| End Use | Food & beverages, Pharmaceuticals, Automotive & transport, Mining, Manufacturing, Airport, Warehouses & Logistic Centers, and Others (Marine, oil & gas, etc.) |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BEUMER Group, Daifuku Co., Ltd., Dematic, Fives, FlexLink, Honeywell International Inc, Hytrol Conveyor Company, Inc., Interroll Group, Kardex, Regal Rexnord Corporation, Shuttleworth, Siemens, Taikisha Ltd., Ultimation Industries, LLC., and WAMGROUP S.p.A. |

| Additional Attributes | Dollar sales in the chain conveyors market are driven by rising demand for efficient material handling in automotive, food processing, and e-commerce sectors. Growth is supported by automation integration, modular conveyor designs, and energy-efficient systems. Asia-Pacific leads adoption due to expanding manufacturing facilities, while key players focus on smart controls, durability, and customized solutions for high-load industrial applications. |

The global chain conveyors market is estimated to be valued at USD 616.2 million in 2025.

The market size for the chain conveyors market is projected to reach USD 938.7 million by 2035.

The chain conveyors market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in chain conveyors market are manual, automatic and semi-automatic.

In terms of load, bulk load segment to command 42.5% share in the chain conveyors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Chain Logistics Transport Insulated Truck Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Interoperability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Blockchain AI Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Messaging Apps Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Energy Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Identity Management Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Agriculture and Food Supply Chain Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Technology Market Analysis & Forecast 2025 to 2035, By Solution, Use Case, Enterprise Size, Industry, and Region

Market Share Breakdown for Cold Chain Packaging Market

Blockchain in Banking Market

Blockchain in Agriculture Market Analysis – Size, Share & Forecast 2024-2034

Cross-chain NFT Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA