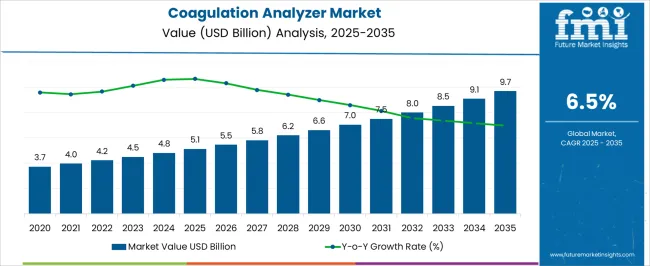

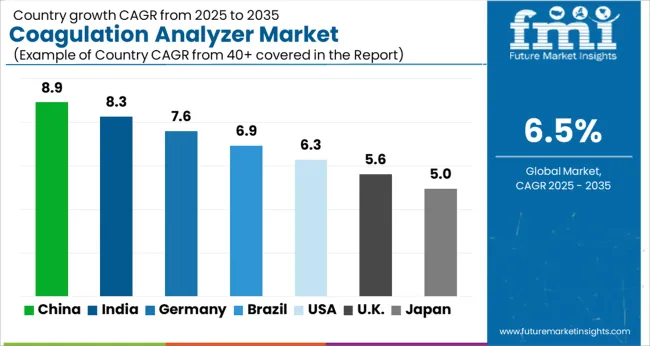

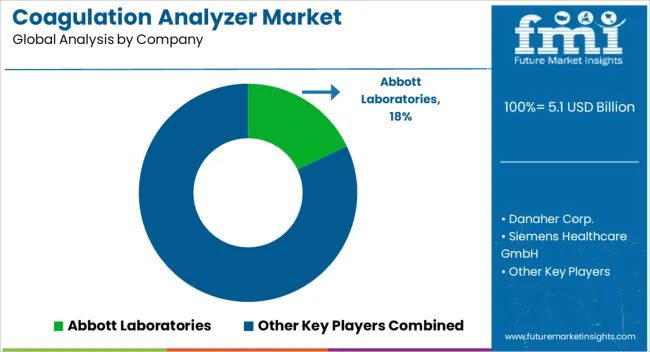

The Coagulation Analyzer Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Coagulation Analyzer Market Estimated Value in (2025 E) | USD 5.1 billion |

| Coagulation Analyzer Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The coagulation analyzer market is advancing steadily, driven by the increasing prevalence of cardiovascular diseases, rising surgical procedures, and heightened demand for point-of-care testing. Growing awareness regarding early diagnosis of coagulation disorders and advancements in diagnostic technologies are further contributing to market growth. Hospitals, diagnostic centers, and research institutions are increasingly relying on coagulation analyzers for accurate, efficient, and rapid test results.

The market is also benefiting from the integration of automation, connectivity, and advanced data analytics, which enhance workflow efficiency and clinical decision-making. The current landscape reflects a shift toward more compact and user-friendly analyzers, expanding their applicability in decentralized settings.

With healthcare systems emphasizing early detection and treatment optimization, demand for coagulation analyzers is expected to rise further. The outlook remains positive, underpinned by innovation, growing healthcare expenditure, and rising adoption of automated diagnostic solutions worldwide.

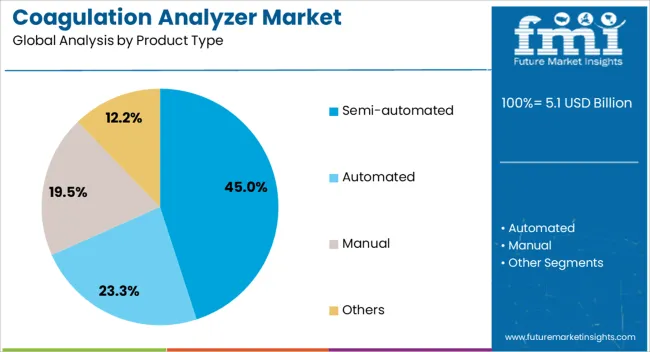

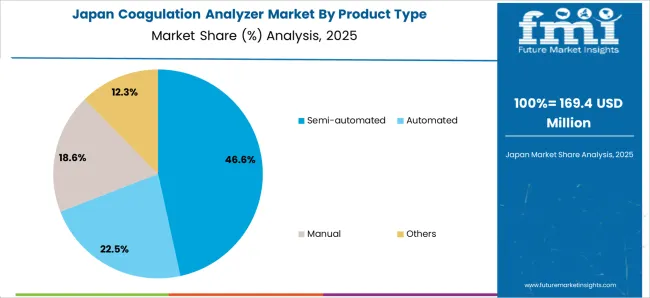

The semi-automated segment holds approximately 45% share in the product type category of the coagulation analyzer market. This segment’s prominence is supported by its balance between cost-effectiveness and functionality, making it suitable for mid-sized laboratories and diagnostic centers.

Semi-automated analyzers provide flexibility in conducting multiple test types with reliable accuracy while maintaining lower operational costs compared to fully automated systems. Their adoption is reinforced by ease of use, minimal training requirements, and suitability for regions with moderate testing volumes.

The segment continues to benefit from consistent demand in emerging markets, where affordability and accessibility remain key drivers. With technological enhancements improving efficiency and user interfaces, the semi-automated segment is expected to sustain its market share.

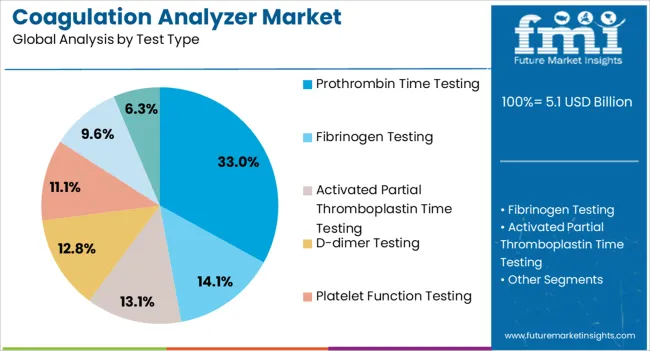

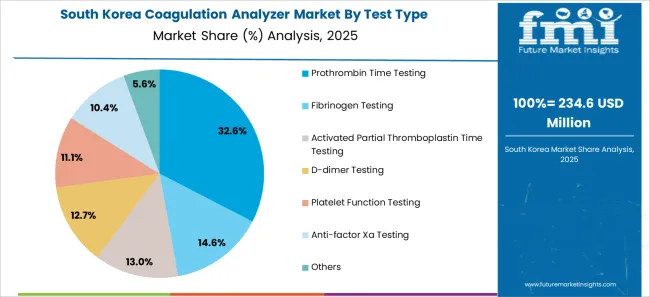

The prothrombin time testing segment accounts for approximately 33% share of the test type category, reflecting its crucial role in monitoring patients on anticoagulant therapy. The test is widely used to assess clotting function, evaluate liver performance, and guide clinical decisions in surgical and critical care settings.

Rising prevalence of thromboembolic disorders and the growing elderly population requiring regular anticoagulation monitoring have reinforced demand for this segment. Prothrombin time testing is particularly valued for its reliability, simplicity, and established role in routine diagnostics.

Increasing adoption in point-of-care settings has further expanded accessibility. With the global burden of cardiovascular and blood-related disorders continuing to rise, the segment is expected to retain its strong position in the market.

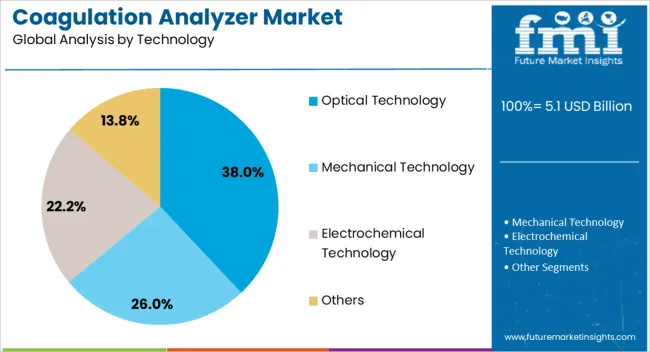

The optical technology segment leads the technology category with approximately 38% share, supported by its accuracy, reliability, and suitability for a wide range of coagulation assays. Optical detection methods enable precise measurement of clot formation by monitoring light transmission changes, enhancing reproducibility and reducing error rates.

The segment benefits from continuous innovation in sensor technologies and integration with automated analyzers, improving throughput and efficiency. Adoption has been further supported by its compatibility with modern laboratory workflows and reduced reliance on manual interpretation.

With increasing demand for standardized, accurate results in clinical diagnostics, the optical technology segment is anticipated to remain the leading technology in the coagulation analyzer market.

Chronic Blood Disorders Steer Market Growth to New Heights! The primary factors driving the market expansion are the expanding elderly population and the increasing frequency of chronic blood disorders.

Increased Awareness Sparks a Surge in Coagulation Disorder Diagnosis and Testing! People are becoming increasingly aware of the consequences of coagulation disorder.

Government Backing Fuels Demand for Coagulation Disorder Solutions! The quality of healthcare services has improved due to government initiatives and increased healthcare spending. This has surged the demand for coagulation hemostasis tests and treatments, driving the market growth.

Innovative Coagulation Analyzers Spark a Technological Renaissance! Technological developments have resulted in the creation of progressively intricate coagulation analyzers.

The financial barriers hinder the growth of this market. In many developing and underdeveloped economies, the market faces challenges due to the high cost of fully automated analyzers. Limited resources in these economies make it difficult for healthcare facilities to invest in expensive automated coagulation analyzers. Moreover, the sluggish adoption of advanced hemostasis instruments like coagulation analyzers further hinders progress.

From 2020 to 2025, the coagulation analyzer industry showed promising growth, boasting a 9.8% CAGR. During this period, there has been a sharp increase in the number of coagulation screening tests conducted. Because of this, automated coagulation analyzers have become more efficient and effective. This has made it possible to create precise, high-throughput analyzers with little human measurement error.

| Historical CAGR (2020 to 2025) | 9.8% |

|---|---|

| Forecasted CAGR (2025 to 2035) | 6.6% |

The market for coagulation analyzers is expected to exhibit a lower CAGR compared to the historical period. The use of modern technology has increased dramatically, such as polymerase chain reaction (PCR), flow cytometers, automated platelet function analyzers, and microarrays. When all of these technologies are combined, there is less pre- and post-analytical handling, which increases productivity and accuracy. Therefore, throughout the foreseeable period, manufacturers are likely to have more development prospects due to improvements in coagulation analyzers. This is also expected to have a highly positive impact on the global demand for coagulation analyzers.

The North America coagulation analyzer market stands out as a dominant force. The rising incidence of chronic blood diseases, the growing automation of labs, and the market participants' execution of strategic initiatives are the primary catalysts of the industry's growth. Europe is witnessing steady growth in demand for coagulation analyzers. This expansion is reinforced by sufficient clinics, hospitals, and health centers with medical professionals on hand who are qualified to offer efficient treatment. There is likely to be a historic progression in the Asia Pacific coagulation analyzer industry. Increasing investment in advanced healthcare technologies and growing demand for unconventional therapies support this growth.

Demand for coagulation analyzers in the United States is set to rise with an anticipated CAGR of 6.7% through 2035. Key factors influencing the demand include:

The United Kingdom coagulation analyzer market is expected to surge at a CAGR of 7.7% through 2035. Top factors supporting the hemostasis analyzer market expansion in the country include:

The China coagulation analyzer market is forecasted to inflate at a CAGR of 6.9% through 2035. The main factors supporting the hemostasis/coagulation market growth are:

Sales of coagulation analyzers in Japan are estimated to record a CAGR of 7.8% through 2035. The primary factors bolstering the blood coagulation analyzer market size are:

The market in South Korea is likely to exhibit a CAGR of 8.8% through 2035. Reasons supporting the growth of the hemostasis-coagulation analysis market in the country include:

The semi-automated coagulation analyzer segment is likely to dominate the revenue share of coagulation analyzers through 2035, registering a CAGR of 6.5%. Similarly, the prothrombin time testing segment is expected to dominate by test type, with a projected CAGR of 6.3% through 2035.

| Segment | Forecasted CAGR (2025 to 2035) |

|---|---|

| Semi-automated Coagulation Analyzer | 6.5% |

| Prothrombin Time Testing | 6.3% |

The semi-automated coagulation analyzer segment is anticipated to lead the way, holding an impressive coagulation analyzer market share. The following factors contribute to its sales:

Prothrombin time testing takes the top spot in the market when it comes to blood testing for coagulation disorder, a trend substantiated by factors such as:

Coagulation analyzer market players employ diverse strategies to gain a competitive edge. Some concentrate on technology innovation, always bringing in cutting-edge innovations to satisfy changing demands in healthcare. Others place more emphasis on strategic alliances, working with significant stakeholders to improve market presence. Some place an intense focus on cost leadership by providing effective solutions at affordable prices.

Recent Developments

The global coagulation analyzer market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the coagulation analyzer market is projected to reach USD 9.7 billion by 2035.

The coagulation analyzer market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in coagulation analyzer market are semi-automated, automated, manual and others.

In terms of test type, prothrombin time testing segment to command 33.0% share in the coagulation analyzer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Coagulation Analyzers Market Growth – Trends & Forecast 2025 to 2035

Coagulation Markers Market Trends - Growth, Demand & Forecast 2025 to 2035

Coagulation Disorders Market

Rapid Coagulation Testing Market

Special Coagulation Tests Market Size and Share Forecast Outlook 2025 to 2035

Retinal Laser Photocoagulation Market Size and Share Forecast Outlook 2025 to 2035

Disseminated Intravascular Coagulation (DIC) Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

TOC Analyzer Market Size and Share Forecast Outlook 2025 to 2035

ESR Analyzer Market Analysis - Size, Share, and Forecast 2025 to 2035

XRF Analyzer Market Growth – Trends & Forecast 2019-2027

Fuel Analyzer Market

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Boron Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Power Analyzers Market

Logic Analyzer Market

Urine Analyzers Market

Ozone Analyzer Market

Breath Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Signal Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA