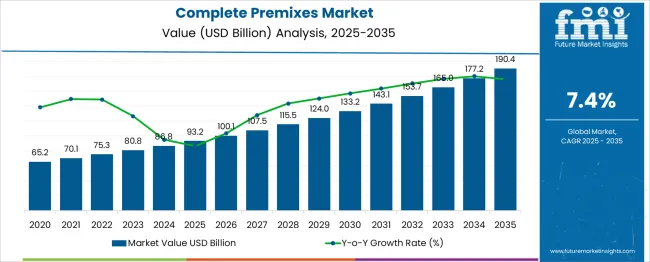

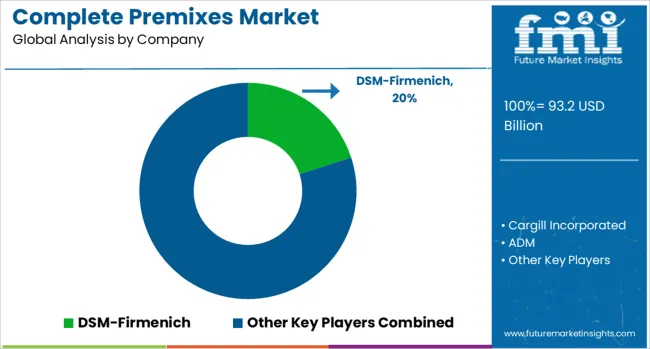

The Complete Premixes Market is estimated to be valued at USD 93.2 billion in 2025 and is projected to reach USD 190.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. This impressive growth indicates increasing demand for premixed products that enhance nutrition and food fortification across various sectors, including food and beverages, animal feed, and pharmaceuticals.

The absolute dollar opportunity, representing the incremental market value over the 15 years, amounts to USD 125.2 billion. This substantial increase reflects rising awareness about nutritional deficiencies and the growing need for efficient supplementation solutions globally. Between 2020 and 2025, the market expands from USD 65.2 billion to USD 93.2 billion, marking an early growth phase driven by increased consumption and regulatory support promoting fortified foods.

From 2025 to 2035, the market grows by USD 97.2 billion, reaching USD 190.4 billion. This period witnesses widespread adoption of premixes in emerging markets, advancements in formulation technologies, and expanding applications in animal nutrition. Overall, the complete premixes market offers vast opportunities for manufacturers and suppliers to innovate and capitalize on evolving consumer and industry needs.

| Metric | Value |

|---|---|

| Complete Premixes Market Estimated Value in (2025 E) | USD 93.2 billion |

| Complete Premixes Market Forecast Value in (2035 F) | USD 190.4 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The Complete Premixes market is experiencing consistent growth due to increasing demand for high-quality, nutritionally fortified animal feed products. Rising concerns around animal health and productivity have led to a growing preference for premixes that ensure uniform distribution of micronutrients in feed. This market is being further shaped by expanding commercial livestock operations and intensifying regulatory standards surrounding animal nutrition.

As global meat consumption continues to rise, particularly in emerging economies, livestock producers are prioritizing feed efficiency and performance outcomes. Technological advancements in feed formulation and the integration of precision nutrition practices have also contributed to the adoption of complete premixes.

Additionally, the need for convenient, ready-to-use formulations that reduce mixing errors and production time has supported their broader use. As sustainability and biosecurity become central concerns, complete premixes are expected to play a vital role in maintaining animal health while optimizing feed conversion ratios across poultry, swine, ruminants, and aquaculture..

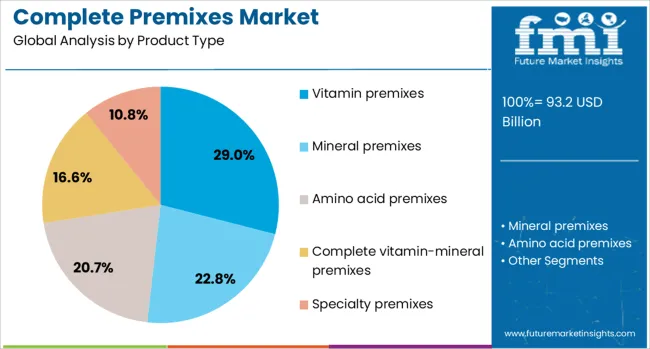

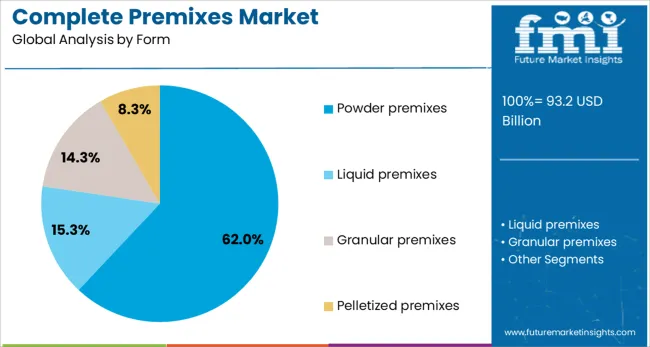

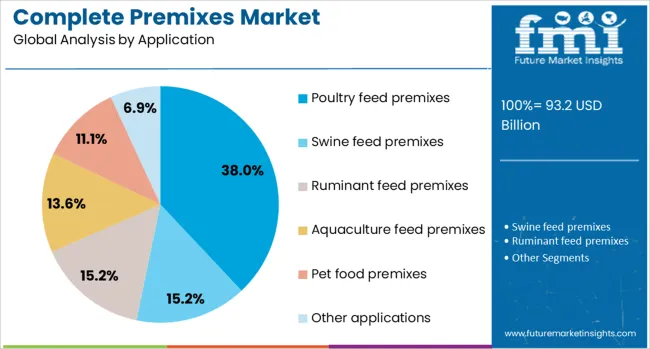

The complete premixes market is segmented by product type, form, application, end use, and geographic regions. By product type, the complete premixes market is divided into Vitamin premixes, Mineral premixes, Amino acid premixes, Complete vitamin-mineral premixes, and Specialty premixes. In terms of form, the complete premixes market is classified into Powder premixes, Liquid premixes, Granular premixes, and Pelletized premixes.

Based on the application, the complete premixes market is segmented into Poultry feed premixes, Swine feed premixes, Ruminant feed premixes, Aquaculture feed premixes, Pet food premixes, and Other applications. The end use of the complete premixes market is segmented into Commercial feed manufacturers, Livestock integrators, On-farm mixers, Pet food manufacturers, Specialty feed producers. Regionally, the complete premixes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vitamin premixes subsegment is projected to hold 29% of the Complete Premixes market revenue share in 2025, establishing it as the leading product type. Growth in this segment has been supported by the essential role vitamins play in maintaining immunity, reproduction, and metabolic function in livestock. Increasing prevalence of micronutrient deficiencies among animals due to intensive farming practices has driven the demand for targeted supplementation.

It has been observed that feed manufacturers prefer vitamin premixes because they offer a consistent and balanced micronutrient profile that can be integrated into various feed types with minimal risk of degradation. Their inclusion in feed has contributed to improved animal performance, reduced morbidity, and enhanced growth rates, particularly in poultry and swine production.

Regulatory emphasis on nutritional labeling and feed quality standards has further encouraged the use of fortified vitamin premixes. Their widespread applicability across multiple species and adaptability to custom formulations have positioned them at the forefront of the product type category..

The powder premixes subsegment is expected to capture 62% of the Complete Premixes market revenue share in 2025, making it the most dominant form. This leadership has been driven by the powder format’s ease of blending, long shelf life, and compatibility with diverse feed manufacturing processes. The cost-effectiveness and stability of powdered premixes have made them a preferred choice for both commercial and small-scale feed producers.

This form has also enabled uniform dispersion of nutrients in the feed, ensuring animals receive balanced rations with each intake. Increased automation in feed mills and improved mixing technologies have further enhanced the efficiency and reliability of powder premix integration.

Moreover, the lower transportation and storage costs associated with powdered forms have strengthened their acceptance across developing markets. The growing demand for flexible and scalable feed solutions that can be easily adjusted based on lifecycle and species-specific needs continues to favor the powder premixes segment across global markets..

The poultry feed premixes subsegment is forecasted to account for 38% of the Complete Premixes market revenue share in 2025, reflecting its position as the leading application. This growth has been driven by the increasing global consumption of poultry meat and eggs, which has led to intensified poultry farming practices. High feed efficiency requirements and rapid growth cycles in broilers have necessitated the use of nutrient-dense premixes to maintain health and productivity.

Poultry producers have turned to complete premixes to ensure uniformity and precision in nutrient delivery, which is essential for minimizing feed-related disorders and enhancing weight gain. Additionally, the rising focus on antibiotic-free production systems has promoted the use of fortified premixes as alternatives to traditional growth promoters.

Enhanced bioavailability of nutrients in poultry feed premixes has supported better digestion, immune function, and overall performance. The commercial poultry sector’s continuous expansion, along with its reliance on feed optimization, has been instrumental in driving the dominance of this application segment..

The complete premixes market is growing steadily as the animal feed industry focuses on providing nutritionally balanced diets for livestock and poultry to improve productivity and health. Complete premixes are fortified blends of vitamins, minerals, amino acids, and other essential nutrients designed to be mixed into feed formulations. Increasing demand for meat, dairy, and egg products worldwide supports market expansion. Growth is driven by intensifying livestock farming, especially in Asia-Pacific and Latin America, along with rising awareness about animal nutrition and feed quality. Regulatory emphasis on feed safety and traceability further fuels adoption of standardized premix products.

Complete premixes are formulated to meet specific nutritional needs based on animal species, age, and production goals. They typically contain a balanced mix of macro and micro minerals, vitamins, antioxidants, and feed additives such as enzymes and probiotics. Variations in composition cater to poultry, swine, ruminants, and aquaculture sectors. Advances in nutrient bioavailability and stability improve feed efficiency and animal health. Manufacturers customize premixes based on regional feed ingredient availability and livestock production practices, enhancing effectiveness and cost-efficiency.

By ensuring balanced nutrient supply, complete premixes contribute to improved growth rates, reproduction, immune response, and feed conversion ratios. This leads to higher yields of meat, milk, and eggs, meeting growing consumer demand. Premixes help mitigate nutritional deficiencies and reduce disease incidence, lowering reliance on antibiotics and growth promoters. Integration of functional additives supports stress resistance and gut health, addressing challenges posed by intensive farming systems. Increasing focus on sustainable animal husbandry practices promotes broader premix adoption.

Stringent regulations govern the composition, labeling, and safety of feed premixes to ensure animal and human health. Manufacturers must adhere to guidelines set by authorities such as the FDA, EFSA, and local agencies, requiring detailed documentation and traceability. Quality control involves rigorous testing for nutrient levels, contaminants, and microbial safety. Compliance with international standards and certifications builds customer trust and facilitates global trade. Variability in regulations across regions necessitates adaptable production and marketing strategies.

The market comprises global and regional players competing through product innovation, pricing, and technical support services. Raw material sourcing, particularly of vitamins and minerals, is influenced by availability and price volatility, affecting production costs. Companies invest in supply chain integration and strategic partnerships to ensure consistent quality and timely delivery. Expanding distribution networks and digital marketing enable wider reach, especially in emerging economies. Product differentiation through formulation customization and value-added services strengthens market position in a competitive landscape.

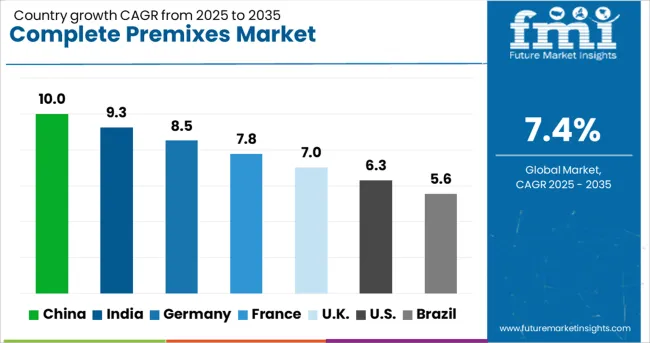

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

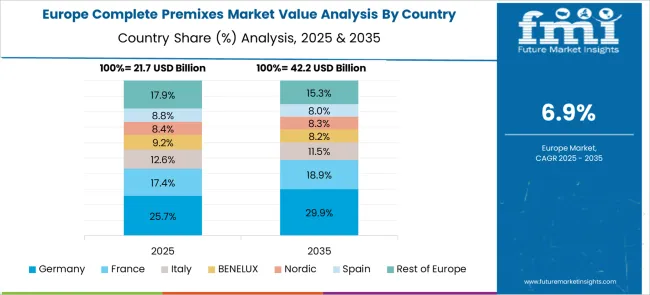

The global complete premixes market is growing at a 7.4% CAGR, driven by increasing demand in animal nutrition and feed industries. Among BRICS nations, China leads with 10.0% growth, supported by large-scale livestock farming and feed production capabilities. India follows at 9.3%, fueled by expanding animal husbandry and poultry sectors. In the OECD region, Germany records 8.5% growth, reflecting advanced feed formulation practices and regulatory standards. The United Kingdom grows at 7.0%, driven by quality control and product innovation. The United States, a mature market, shows 6.3% growth, shaped by stringent regulations and established distribution networks. These countries collectively influence market trends through production capacity, regulatory frameworks, and industry demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the complete premixes market with a 10.0% growth rate, fueled by the expanding livestock industry and rising demand for animal nutrition products. Compared to India, China benefits from advanced feed manufacturing technologies and larger-scale production facilities, allowing manufacturers to develop customized premix formulations to enhance animal health and productivity. The government’s focus on improving food safety and quality standards supports market growth. Increasing awareness about balanced nutrition among farmers and integrators is driving adoption. Furthermore, export demand from Southeast Asia further accelerates market expansion. Companies emphasize research in vitamin and mineral premixes tailored for poultry, swine, and aquaculture sectors.

India’s complete premixes market grows at 9.3%, driven by the rising animal husbandry sector and increasing protein consumption. Compared to Germany, India faces challenges in feed quality regulation but benefits from growing investment in feed infrastructure and farm modernization. Farmers and feed producers show greater interest in premixes that improve livestock immunity and growth rates. Rising awareness about the benefits of mineral and vitamin supplementation contributes to market uptake. Expanding dairy and poultry sectors act as key growth engines. Additionally, increasing availability of cost-effective local premixes enhances accessibility for small- and medium-scale farmers.

Germany’s complete premixes market grows at 8.5%, supported by a strong livestock industry and rigorous quality standards. Compared to the United Kingdom, Germany emphasizes traceability and high nutritional value in premix formulations. Feed manufacturers prioritize research on enhancing animal welfare through balanced mineral and vitamin blends. Demand remains steady in dairy, swine, and poultry sectors, with an increasing focus on organic and non-GMO premixes. The market benefits from strict regulations ensuring product safety and efficacy. Export opportunities within the European Union add to growth prospects.

The United Kingdom complete premixes market grows at 7.0%, with steady demand from dairy and poultry industries. Compared to the United States, the United Kingdom market places greater emphasis on sustainable sourcing and product traceability. Feed manufacturers focus on enhancing premix formulations to boost animal immunity and performance. Consumer awareness about food quality and animal welfare supports market growth. Additionally, regulatory compliance drives innovation in additive blends, including natural antioxidants and probiotics. Partnerships between feed producers and farmers promote better nutrition management practices.

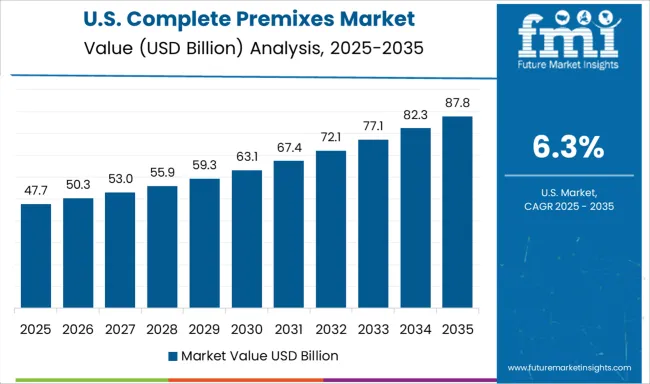

The United States complete premixes market grows at 6.3%, supported by the large-scale livestock and poultry industries. Compared to China, the United States market shows slower growth due to mature feed manufacturing sectors and diversified protein sources. However, demand remains strong for premixes that improve feed efficiency and animal health, particularly in swine and poultry. Research into enzyme and probiotic premixes gains traction to reduce antibiotic use. Additionally, growing consumer demand for antibiotic-free meat encourages premix innovation. The market benefits from integrated supply chains that improve product distribution and accessibility.

The complete premixes market is driven by global agribusiness and specialty ingredient companies that provide tailored nutritional solutions for animal feed. DSM-Firmenich leads through its strong focus on innovation in vitamins, enzymes, and feed additives that enhance animal health and productivity. Cargill Incorporated and ADM leverage their vast supply chains and technical expertise to deliver customized premix blends that meet diverse livestock nutritional requirements worldwide.

BASF SE and Nutreco N.V. contribute advanced formulations and sustainable ingredients aimed at improving feed efficiency and reducing environmental impact. Glanbia Plc and Kemin Industries specialize in precision premix solutions enriched with natural antioxidants, probiotics, and specialty nutrients that support animal well-being and performance. Invivo Group and Royal Agrifirm Group strengthen the market with regional expertise, offering localized product formulations and integrated supply services.

The market’s competitive landscape is shaped by ongoing R&D investments, regulatory compliance, and a growing emphasis on sustainable and health-oriented premix products that address the evolving needs of the global animal nutrition industry.

Market players focus on product innovation, sustainability, and customization to meet diverse animal nutrition needs. Expansion into emerging regions, strategic partnerships, and technological integration enhance competitiveness. Ensuring regulatory compliance and quality builds trust, driving growth amid rising demand for efficient, eco-friendly premix solutions worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 93.2 Billion |

| Product Type | Vitamin premixes, Mineral premixes, Amino acid premixes, Complete vitamin-mineral premixes, and Specialty premixes |

| Form | Powder premixes, Liquid premixes, Granular premixes, and Pelletized premixes |

| Application | Poultry feed premixes, Swine feed premixes, Ruminant feed premixes, Aquaculture feed premixes, Pet food premixes, and Other applications |

| End Use | Commercial feed manufacturers, Livestock integrators, On-farm mixers, Pet food manufacturers, and Specialty feed producers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM-Firmenich, Cargill Incorporated, ADM, BASF SE, Nutreco N.V., Glanbia Plc, Kemin Industries, Invivo Group, Royal Agrifirm Group, and Others |

| Additional Attributes | Dollar sales in the Complete Premixes Market vary by product type including vitamin premixes, mineral premixes, and vitamin-mineral premixes, application across poultry, swine, ruminants, and aquaculture, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising animal nutrition awareness, demand for enhanced feed efficiency, and expanding livestock production. |

The global complete premixes market is estimated to be valued at USD 93.2 billion in 2025.

The market size for the complete premixes market is projected to reach USD 190.4 billion by 2035.

The complete premixes market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in complete premixes market are vitamin premixes, _fat-soluble vs water-soluble, mineral premixes, _macro vs micro mineral segmentation, _chelated vs inorganic forms, amino acid premixes, _essential vs non-essential amino acids, complete vitamin-mineral premixes, _customized vs standard formulations, specialty premixes, _organic premixes, _non-gmo premixes, _medicated premixes and _performance enhancement premixes.

In terms of form, powder premixes segment to command 62.0% share in the complete premixes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Complete Nutrition Products Market Analysis by Product, Distribution Channel, and Region Through 2035

Nucleotide Premixes Market Analysis by form, application and region Flavors Through 2035

Dough Based Premixes Market Size and Share Forecast Outlook 2025 to 2035

Multi-Grain Premixes Market

Amino Acids Premixes Market

Batter Based Premixes Market Size and Share Forecast Outlook 2025 to 2035

USA Nucleotide Premixes Market Report – Size, Trends & Industry Forecast 2025-2035

Batter and Breader Premixes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA