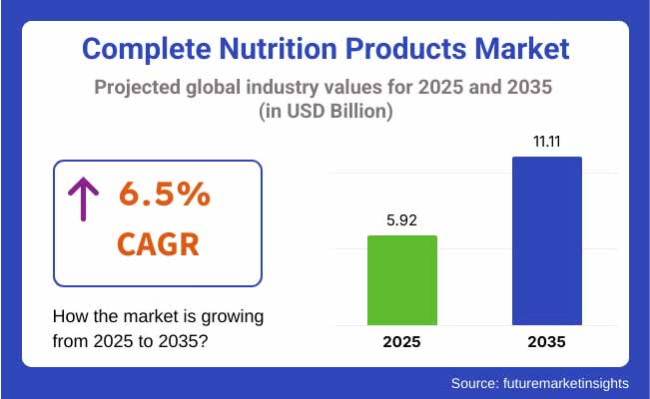

The global Complete Nutrition Products market is estimated to be worth USD 5.92 billion in 2025. It is projected to reach a value of USD 11.11 billion by 2035, expanding at a CAGR of 6.5% over the assessment period of 2025 to 2035. The complete nutrition products industry is currently riding a wave of growth propelled by consumers' increased need for diet solutions that are not only convenient and balanced but also health-focused.

This efficient nutrition product line most notably includes meal replacement powders, bars, and shakes packed with the required macronutrients, vitamins, and minerals necessary for proper health. The advent of preventive healthcare and the growing acceptance of functional foods are the other factors responsible for the sales growth.

The growth is greatly supported by the rising adoption of complete nutrition products by busy professionals, sportspeople, and those on a weight watch. These products are a quick and effective solution for filling silverware without cooking. Plant-based, organic, and allergen-free meal replacements are in greater demand as consumers are more focused on clean-label and sustainable nutrition options.

Additionally, the growth of the sports nutrition and wellness sectors is positively influencing the industry. Fitness enthusiasts and sportspersons are marketing complete nutrition products in their regimens to boost muscle recovery, energy levels, and performance. Also, the deepening trend of personalized diets is propelling the innovation of specific products planned for health purposes and eating preferences.

New technologies involve the introduction of new recipes and equipment that improve the taste, feel, and absorption of complete nutrition products. The utilization of protein, probiotics, fiber, and sugar-free innovation is not only improving but also satisfying customers' double expectations of nutrition and taste. The introduction of online sales and direct-to-consumer sales channels has also contributed to improved global access to complete nutrition products.

Challenges include high product pricing, regulatory scrutiny of health claims, and the competition posed by traditional whole foods. Customers' doubts about the effects of long-term health on meal replacements might diminish their popularity; thus, brands are to pay more attention to transparency and scientific validation of product benefits.

In spite of these challenges, there are many paths open for expansion. The high demand for medical nutrition, elderly nutrition, and fortified foods is creating new growth avenues.

Furthermore, the promotion of eco-friendly packaging and the use of sustainably sourced ingredients will, in turn, set up new paths for innovation and drive technological advancements. As long as the public stays in search of a well-balanced and easy-to-follow diet, not forgetting about the continuous growth of the products, the industry will be on an upward run for several years to come.

From 2020 to 2024, the growth was fueled by growing health awareness, urban lifestyle, and convenience-driven, nutritionally balanced food needs. Demand for meal replacement through shakes, bars, and ready-to-drink formats highlighted protein-based, plant-based, and functional categories. Clean-label and organic products picked up momentum as brands cut down on artificial additives and preservatives.

Direct-to-consumer (DTC) sales and e-commerce also went through the roof, enabling brands to reach broader markets while riding the digital marketing and subscription-based trends. From 2025 to 2035, the industry will experience a revolution driven by AI-based personalized nutrition, green ingredient innovation, and smart food technologies.

Genetic, metabolic, and microbiome profile-based personalized meal solutions will become mainstream. Sustainable proteins, such as algae-based and cultured proteins, will replace conventional sources to meet nutritional and environmental goals. Smart packaging with real-time freshness monitoring and interactive nutritional advice will increase consumer interaction. Blockchain and IoT-based transparency in manufacturing and ingredient sourcing will build more consumer trust.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Clean-label and plant-based nutrition with minimal processing in demand. | Personalized nutrition based on genetic, metabolic, and microbiome data powered by AI. |

| Functional ingredients such as probiotics, adaptogens, and immunity-boosting blends are popular. | Sustainab le proteins (algae-based, lab-cultured, and insect-based) disrupt formulations. |

| Subscription-based and direct-to-consumer (DTC) models drive e-commerce sales. | Smart packaging with freshness indication and interactive tracking of nutritional content. |

| Natural ingredients-led high-protein, low-sugar meal replacements are made a priority. | Blockchain-based ingredient sourcing for authenticity and transparency. |

| RTD (ready-to-drink) and on-the-go nutrition product development. | IoT-based food solutions for r eal-time monitoring of health and dietary optimization. |

SalesSales expansion is rapid as consumers demand balanced, convenient, and functional nutrition solutions. Sports and fitness consumers lead the demand for protein-rich, performance-enhancing products. At the same time, medical nutrition is highly adopted in hospitals, elderly care, and recovery treatments owing to its specific nutritional benefits.

General well-being consumers favor plant-based, organic, and enriched meal replacements with a push for sustainability and natural ingredients. Elderly nutrition, on the other hand, is on the rise, with emphasis placed on easy-to-digest formulas supplemented with vitamins and minerals for bone structure, muscle preservation, and brain protection.

With the increasing sophistication of personalization in nutrition, clean labels, and environmental sustainability in packaging, brands are meeting changing customer needs. The growth in online commerce has also added accessibility to e-commerce platforms through which complete nutrition solutions are distributed globally.

Certain risks, such as strict food safety regulations, nutrient composition standards, labeling requirements, and the inclusion of functional ingredients, are causing compliance difficulties for manufacturers at a global level. International food regulations are a must for meeting demand and consumer trust.

Supply chain disruptions, including the up-fluctuations of the prices of raw materials, ingredient shortages, and quality control concerns, are affecting production stability. Being heavily reliant on high-quality proteins, vitamins, and other specialty ingredients makes companies much more vulnerable. Companies must redistribute their sourcing strategies, be more collaborative with suppliers, and target an eco-friendly sourcing of ingredients to contain risks.

The industry is competing with whole-food diets, plant-based alternatives, and individualized nutrition plans, which are on the rise. People are interested in nutrition products that are clean-label, organic, and with stronger scientific support. To compete successfully, manufacturers have to concentrate on the development of new products, natural compositions, and health claims based on scientific evidence so that they can win the trust of health-conscious consumers.

This is why consumers are paying attention to issues like artificial additives, allergens, and digestibility that are related to their decisions to purchase a product. In the modern era of an increasingly strict industry, transparency of ingredient sourcing, clear labeling, and third-party certifications play a big role in maintaining consumer trust and brand loyalty.

On the other hand, economic uncertainties, changing dietary preferences, and increasing demand for specialized nutrition products are the main factors that influence growth. To ensure their long-term growth, companies should prioritize scientific research, regulatory compliance, and marketing campaigns that highlight health benefits, ease of use, and sustainability.

| Segment | Value Share (2025) |

|---|---|

| RTD Shakes (By Product) | 42% |

Thesegmentation is primarily based on product type and is divided into two segments: Ready-to-Drink (RTD) Shakes and Powdered Nutrition Products. RTD shakes are expected to hold the largest share at 42%, followed closely by powders at 38%.

Deployed due to convenience, portability, and time-saving benefits, RTD Shakes are perfect options for on-the-go consumers, including busy professionals and athletes. Many of these products are fortified with protein, vitamins, and minerals and/ or provide a single serving of balanced nutrition.

Market-leading brands Ensure, Soylent, and Huel have focused on meeting the demand by diversifying flavors and fine-tuning formulations to appeal to a wider consumer base. A spike in meal replacement trends and health-driven lifestyles is driving the RTD segment's growth.

Powdered nutrition products maintain a 38% market share due to cost-effectiveness and tailor-made nutrition. Users can change serving sizes or mix the powders in different drinks or recipes. Widely ranging from sports nutrition, weight management, and medical nutrition, leading brands from Optimum Nutrition, Garden of Life, and Orgain occupy the shelf.

The segment gets an advantage from the longer shelf life and tailored storage needs, which attracts bulk buyers as well as fitness enthusiasts. Globally, the demand for RTD shakes and powders remains strong, partly due to increasing awareness of complete nutritional solutions for active lifestyles, aging populations, and dietary management.

| Segment | Value Share (2025) |

|---|---|

| Online Stores (By Distribution Channel) | 38% |

It is predicted that in 2025, online stores will sling 38% of the share and 32% of supermarkets. The leap of e-commerce adoption is one of the key propellers contributing to the online segment growth. Consumers want the convenience, disparity , and competitive pricing that online platforms deliver.

Retailers such as Amazon, Walmart, and iHerb, as well as brand-specific sites from Huel, Soylent, and Orgain, offer subscription models, personalized recommendations, and bundled deals to empower consumers.

Moreover, online platforms provide an opportunity to cater to niche products, including plant-based, allergen-free, and keto-friendly nutrition solutions, coming to a broader demographic. The uptick in DTC (direct-to-consumer) strategies, in turn, is giving brands more ways to influence customer experience and capture real-time consumer feedback for product development.

The most significant channel is still supermarkets, with a 32% share, especially for impulse buying and for consumers who want to assess products in person. They come in every flavor and every shape, and supermarket chains like Kroger, Tesco, and Carrefour have massive stockpiles of RTDs and powders on their shelves, making them easily accessible to average shoppers.

End caps and placement near the point of sale, along with sample trials and cross-merchandising with other health and wellness products, can also help improve product visibility and provide a way for consumers to engage with products.

The supermarkets remain solidly behind them, but the growth of online sales will continue to take hold as consumer purchasing moves away from traditional bricks-and-mortar shopping, particularly among younger, tech-savvy, wellness-minded shoppers looking for both convenience and personalized shopping experiences.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 5.8% |

| France | 5.6% |

| Germany | 5.9% |

| Italy | 5.5% |

| South Korea | 6.2% |

| Japan | 5.7% |

| China | 7.3% |

| Australia | 6.0% |

| New Zealand | 5.9% |

The USA complete nutrition products market will register a CAGR of 6.5% in the forecast period 2025 to 2035 due to increasing consumer awareness about health and an increasing incidence of lifestyle disorders such as obesity and diabetes. Working professionals and older people are witnessing the growing demand for easy-to-consume, nutrient-dense meal substitutes and supplements.

Technology developments have created a surge in individualized nutritional plans, with additional drivers for industrial development. The availability of market-leading companies and an established distribution base are also growth drivers.

The UK is projected to register a CAGR of 5.8% during the forecast period. Health consciousness and health preventive consciousness are the major drivers of demand for finished nutrition products.

There is a surge in organic and plant-based nutrition products, with consumers shifting increasingly towards sustainable and ethical choices. Government efforts to promote healthy consumption and regulate nutritional supplements guarantee product quality and safety, thereby boosting consumer confidence.

France will increase at 5.6% CAGR from 2025 to 2035. The rising trend of health consciousness in the French and the increasing aging population have resulted in increasing demand for healthy nutrition solutions at convenience.

There is a demand for high-quality, natural ingredients and products that meet specific diet requirements. Growth in e-commerce websites has also made these products highly accessible to citizens in each region of the country.

Germany is predicted to grow with a 5.9% CAGR during the forecast period. The country's strong economy, along with its lifestyle, has resulted in a growing demand for health and wellness products.

Consumers are exhibiting a strong trend towards individual nutrition, with consumers looking for products fulfilling their respective health needs and requirements. The presence of cutting-edge production facilities ensures the quality production of nutrition products, and this, in turn, contributes to the growth.

Italy is poised to grow at a 5.5% CAGR over the forecast period from 2025 to 2035. Complete nutrition products are in high demand due to increased awareness about the importance of good health and a healthy diet.

There is a trend towards the inclusion of traditional Mediterranean diet foods within products that reflect local taste preferences with consideration for nutritional wholeness. Increased health-conscious retail outlets and online shopping have made them more readily available to a broader market.

South Korea is projected to grow at 6.2% CAGR throughout the forecast period. The expansion has been driven by greater demand for convenient nutrition solutions due to urbanization and busy lifestyles across the country.

There is great interest in functional foods that introduce additional health benefits over mere nutrition. The innovation of high-technology technology within product development and a keen attention to research and development have generated innovative products engineered to address several consumer demands.

Japan is predicted to grow at a rate of 5.7% between 2025 and 2035. Japan's aging population and health-and longevity-focused culture have opened up demand for nutrition products that benefit overall well-being.

Easy-to-swallow products specifically addressing prevalent elderly ailments, such as bone and cognitive function, are sought after. Alliances between healthcare organizations and manufacturers boost the legitimacy of the product.

China will lead the growth at a CAGR of 7.3% over the forecast period. Urbanization, an increasing middle-class population, and increasing health awareness are key drivers of the development. The younger generation's demand for convenient and healthier food has generated demand for ready-to-drink shakes and meal replacements.

Players are introducing Traditional Chinese products into their brands to localize in appeal. The dense concentration of e-commerce websites allows for extensive product coverage and consumer access.

Australia is growing at a CAGR of 6.0% from 2025 to 2035. An increasing health-conscious consumer base and active fitness culture fuel demand for complete nutrition products. Plant-based and organic versions are gaining popularity, indicating consumers' focus on sustainable and natural options. There is a high internet penetration and well-established retail infrastructure that supports sales.

New Zealand's sales are expected to grow at a CAGR of 5.9% during the forecast period. The country's emphasis on outdoor recreation and sports has driven a growing demand for active lifestyle nutrition products.

Consumers increasingly seek clean-label products and local ingredients. Government incentives for health and wellness programs and growing numbers of specialty health stores have also driven industry growth.

The complete nutrition products market worldwide is anticipated to register significant growth, considering the rise in consumer awareness toward health and wellness and the growing demand for easy and balanced meals.

With increasing busyness, consumers now look for something that contains total nutrition in one format, such as ready-to-drink shakes, meal replacement bars, and powdered supplements. Major players include Abbott Laboratories, Nestlé, and Herbalife. These players have, therefore, focused on innovations and product diversification to serve the ever-innovative health-conscious consumer.

The trend of personalized nutrition has been increasingly embraced, making companies create specific products that meet special dietary needs and preferences. In addition, more and more consumers are leaning toward plant-based and organic nutrition offerings that are influencing product development, especially when hearing about the clean-label options of their natural ingredients.

E-commerce platforms can increase access to the complete nutrition product industry by making them available to consumers at various times. Quality, transparency, and sustainability will be key considerations in the changing landscape, serving as the most critical features for brands to maintain competitive ability.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 18-22% |

| Nestlé Health Science | 14-18% |

| Herbalife Nutrition Ltd. | 12-16% |

| Amway | 10-14% |

| Glanbia PLC | 8-12% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Abbott Laboratories | Offers clinically formulated nutritional products like Ensure and Glucerna, focusing on scientifically validated and tailored meal replacements for various age groups. |

| Nestlé Health Science | Provides a broad portfolio, including Boost and Garden of Life pr oducts, emphasizing premium, medical-grade nutrition and advanced research in personalized nutrition. |

| Herbalife Nutrition Ltd. | It specializes in protein shakes, meal replacement bars, and targeted supplements for weight management and overall wellness, le veraging a global direct-selling network. |

| Amway | Markets the Nutrilite brand, focusing on organic, plant-based ingredients and personalized nutrition programs with strong global distribution. |

| Glanbia PLC | Develops high-quality sports nutrition and meal rep lacement products under brands such as Optimum Nutrition and SlimFast, focusing on functional ingredients and performance benefits. |

Key Company Insights

Abbott Laboratories (18-22%)

Abbott is a key leader in clinical nutrition, with products like Ensure and Glucerna widely recommended by healthcare professionals. Their focus on rigorous clinical validation and tailored nutrition solutions has solidified their position.

Nestlé Health Science (14-18%)

Nestlé Health Science leverages its extensive R&D capabilities to deliver premium nutritional products. By integrating advanced research into personalized nutrition and health science, it meets the demands of both hospitals and consumers.

Herbalife Nutrition Ltd. (12-16%)

Herbalife is renowned for its comprehensive range of protein shakes and supplements. Its robust global direct-selling model and continuous innovation in flavor and formulation drive strong consumer loyalty and market penetration.

Amway (10-14%)

Amway’s Nutrilite brand emphasizes organic and plant-based nutrition with a focus on personalized health solutions. The company’s strong multi-level marketing network enables rapid sales expansion and customer engagement.

Glanbia PLC (8-12%)

Glanbia excels in sports and performance nutrition with brands like Optimum Nutrition and SlimFast. Its emphasis on high-quality protein and functional ingredients, coupled with strategic partnerships in the fitness industry, supports its competitive position.

Other Key Players

The complete nutrition products market is categorized into Powder, RTD Shakes, and Bars based on product type.

The segmentation is into Supermarkets, Convenience Stores, and Online Stores, and the growth in digital trade acquisition and expansion of retail leads to an increase in sales.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and the Middle East and Africa.

The industry is slated to reach USD 5.92 billion in 2025.

The industry is predicted to reach a size of USD 11.11 billion by 2035.

Key companies include Abbott Laboratories, Nestlé Health Science, Amway, Glanbia PLC, Herbalife Nutrition Ltd., The Simply Good Foods Company, Huel Ltd., Soylent, Orgain, and Premier Nutrition Corporation.

China, slated to grow at 7.3% CAGR during the forecast period, is poised for the fastest growth.

RTD Shakes are among the most widely used product types.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Product, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Product, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Product, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product, 2023 to 2033

Figure 107: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Complete Premixes Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Yeast Market Size, Growth, and Forecast for 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

Nutritional Ingredients in Animal Feed Market Trends - Growth & Industry Forecast 2025 to 2035

Nutritional Lipids Market

Nutrition Therapy Market

Fish Nutrition Market Size, Growth, and Forecast for 2025 to 2035

GLP-1 Nutritional Support Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multi Nutritional Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Nutrition Hydrolysate Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Nutritional Premix Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Enteral Nutrition Market Analysis by Product Type, Feeding Route, By Consumer’s Age and End Users Through 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA