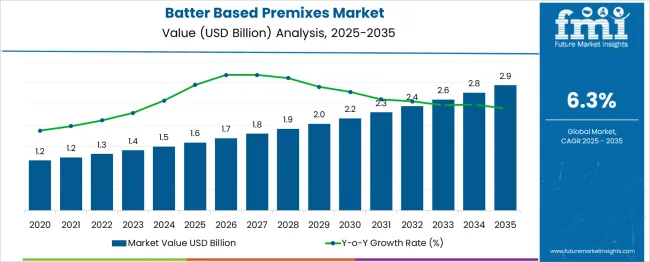

The batter based premixes market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. Demand generates an absolute increase of USD 1.3 billion and achieves a growth multiplier of 1.81x over the decade. This steady growth, supported by a CAGR of 6.3%, is driven by rising demand for convenience food, expansion of quick-service restaurants, and growing home-baking trends globally. During the first five years (2025–2030), the market will increase from USD 1.6 billion to USD 2.2 billion, adding USD 0.6 billion, which accounts for 46% of the total growth, with a 5-year multiplier of 1.38x.

The second phase (2030–2035) contributes USD 0.7 billion, representing 54% of incremental gains, reflecting stable demand from foodservice chains and innovation in gluten-free and fortified batter premixes. Year-on-year increments grow from USD 0.1 billion in the early years to USD 0.2 billion toward 2035, highlighting moderate acceleration as convenience-driven products continue to penetrate emerging markets. Manufacturers focusing on clean-label formulations, regional flavor customization, and digital retail expansion will capture significant value in this USD 1.3 billion opportunity, particularly as batter premixes become integral to bakery, fried food, and ready-to-cook product segments.

| Metric | Value |

|---|---|

| Batter Based Premixes Market Estimated Value in (2025 E) | USD 1.6 billion |

| Batter Based Premixes Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The batter-based premixes market holds a strong and growing position within several food and convenience-oriented sectors. In the food premixes market, its share is approximately 15–18%, as it represents a major application segment alongside beverage and nutritional premixes. Within the bakery ingredients market, the share is around 8–10%, as bread, cakes, and pastry mixes dominate this category. In the processed and convenience foods market, batter premixes contribute nearly 5–6%, given the wide range of packaged and ready-to-eat foods. For the frozen and ready-to-cook foods market, its share stands at about 10–12%, as batters are essential for coatings in products like fried snacks, seafood, and poultry items.

In the foodservice and QSR supply market, batter-based premixes account for roughly 6–8%, driven by increasing demand for consistent quality and operational efficiency in quick-service restaurants and catering services. Market growth is supported by rising consumption of convenience foods, the popularity of fried and coated products, and time-saving solutions for both households and commercial kitchens. Innovations such as gluten-free, clean-label, and fortified batter mixes are further enhancing market appeal. As global foodservice chains expand and at-home cooking trends grow, the batter-based premixes market is expected to strengthen its footprint across these parent markets.

Demand for batter based premixes has been supported by the expansion of global food service industries, rapid urbanization, and evolving dietary preferences that favor time-saving yet nutritious meal solutions.

The growing influence of Western breakfast culture in emerging markets and an increased focus on clean-label and preservative-free formulations have further accelerated market penetration. Companies are investing in product innovation to meet evolving consumer expectations, such as organic and allergen-free options, which are gaining popularity across various demographics.

Improvements in supply chain efficiency and the adoption of digital ordering platforms have streamlined product accessibility. The market is expected to maintain a positive trajectory as both manufacturers and retailers continue to invest in functional food products that combine health, taste, and convenience to cater to the changing lifestyle needs of consumers globally.

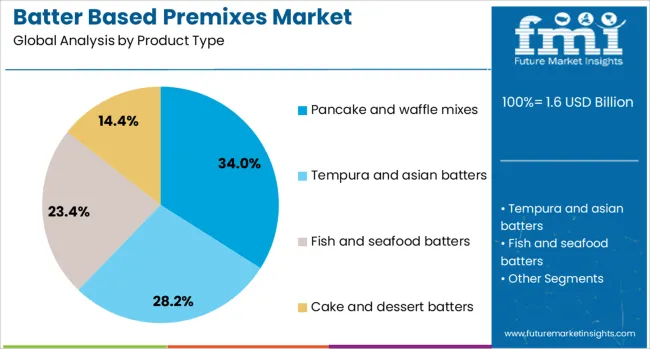

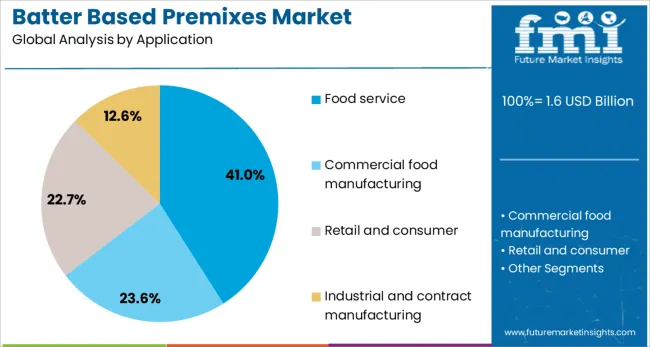

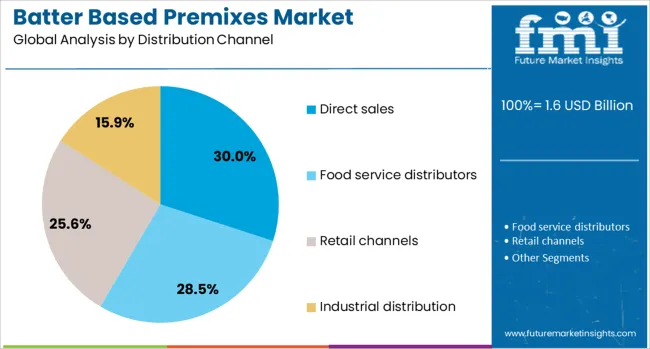

The batter based premixes market is segmented by product type, application, distribution channel, and geographic regions. By product type, the batter-based premixes market is divided into Pancake and waffle mixes, Tempura and asian batters, Fish and seafood batters, Cake and dessert batters, and Specialty and functional batters. In terms of application, the batter-based premixes market is classified into Food service, Commercial food manufacturing, Retail and consumer, and Industrial and contract manufacturing. Based on the distribution channel, the batter-based premixes market is segmented into Direct sales, Food service distributors, Retail channels, and Industrial distribution. Regionally, the batter based premixes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pancake and waffle mixes segment is anticipated to hold 34% of the batter-based premixes market revenue share in 2025, making it the leading product type. The strong consumer demand for convenient and versatile breakfast solutions has supported growth in this segment. These mixes have been widely preferred due to their simplicity in preparation, consistent quality, and suitability for both home kitchens and food service establishments.

The increasing popularity of quick-service breakfast menus and brunch offerings in restaurants has contributed to higher institutional demand for pancake and waffle premixes. Additionally, the appeal of these products in various regional cuisines has expanded their reach beyond traditional Western markets.

Product improvements such as gluten-free, organic, and flavored variations have further broadened the consumer base. As consumers seek out indulgent yet time-efficient food options, pancake and waffle mixes have continued to dominate retail shelves and commercial procurement channels, reinforcing their strong position within the overall product portfolio..

The food service segment is projected to contribute 41% of the batter based premixes market revenue share in 2025, emerging as the dominant application category. This growth has been driven by the rising use of premixes in hotels, restaurants, cafes, and institutional catering services. Food service providers have increasingly adopted batter based premixes to streamline operations, reduce preparation time, and maintain consistency in large-scale production environments.

The need for standardized taste and texture in mass food preparation has made these products indispensable in commercial kitchens. Furthermore, the ability to minimize food waste and improve inventory control has enhanced the operational efficiency of food service operators.

With the ongoing expansion of the hospitality industry and quick-service restaurant formats across both developed and emerging regions, the reliance on ready-to-use batter mixes has intensified. The continuous evolution of consumer dining preferences and demand for varied menus has encouraged greater utilization of premixes, thereby reinforcing the segment’s leadership in the application landscape..

The direct sales segment is forecasted to account for 30% of the batter based premixes market revenue share in 2025, establishing its position as the leading distribution channel. This growth has been attributed to the rising demand from food service businesses and bulk purchasers who prefer sourcing products directly from manufacturers or authorized suppliers.

Direct sales channels have allowed for greater customization of orders, pricing flexibility, and streamlined logistics, which are especially beneficial for institutional buyers. Manufacturers have also focused on strengthening relationships with end-users by offering tailored solutions, technical support, and supply assurance through direct engagement.

Growth of online B2B platforms and digital procurement tools has enhanced the reach and efficiency of direct sales models. As companies continue to prioritize transparency, traceability, and cost-effectiveness in their sourcing strategies, direct sales have emerged as a trusted channel that supports consistent quality, reduced intermediaries, and stronger brand loyalty across the supply chain..

The batter based premixes market is being fueled by rising demand from quick-service restaurants, retail consumers, and home baking enthusiasts. Growth is supported by the need for consistent texture and convenience in frying, pancake, and crepe solutions. Opportunities are emerging in clean-label, gluten-free, and regional flavor variants. Trends include adoption of fortified mixes, on‑the-go formats, and large‑scale automation compatibility for foodservice operations. Restraints include high cost of specialty ingredients, supply fluctuations, and shelf-life limitations. The market outlook suggests strong potential in value-added segments, supported by evolving consumer preferences and operational efficiency demands.

Major growth is being driven by rising usage of premixes in foodservice and retail segments. In 2024 and 2025, quick-service outlets and cafeterias preferred batter premixes to standardize product output and reduce kitchen preparation time. Retail interest surged with consumer adoption of ready-to-use mixes for pancakes, waffles, and batter coatings. Seasonal promotions and recipe innovation supported retail expansion. Demand from institutional buyers such as schools and corporate kitchens further contributed to volume growth. These factors indicate that operational efficiency and reliable product performance are national drivers for batter premix adoption.

Opportunities are emerging in specialty product niches and region-specific batter formulations. In 2025, gluten-free mixes and protein-enriched blends gained traction among health-aware consumers and allergen-sensitive markets. Regional flavor premixes—such as chickpea-based batters or spiced pancake mixes—were introduced in Asia-Pacific and European supermarkets. Foodservice operators also adopted premium premixes with regional appeals for frying and breakfast menus. These developments highlight potential for suppliers who deliver culturally tailored product lines, extended nutrition attributes, or label‑friendly formulations to seize differentiation and market share.

Emerging trends include fortified premixes and portable packaging formats. In 2024, fortified pancake and waffle mixes enriched with micronutrients such as iron and calcium were launched in food retail markets. Single-serve packet formats intended for on‑the‑go breakfast and impulse use gained popularity among urban consumers. Bulk premixes with consistent hydration performance and compatibility with automated batter dispensers were adopted in institutional foodservice. These shifts reflect a broader move toward convenience-driven innovation, with product design addressing speed, portability, nutrition, and operational ease in both home and commercial applications.

Market restraints are primarily caused by the high cost of specialty ingredients and limited product shelf life. In 2024 and 2025, importer premiums on gluten-free and fortified components led to higher retail pricing, reducing adoption among value-driven consumers. Additionally, the shorter shelf life of enriched batters created logistical challenges, particularly for smaller distributors and bakeries. Supply variability in grains and protein isolates added to pricing unpredictability. These constraints indicate that manufacturers must focus on cost-effective sourcing, preservative-free packaging innovations, and improved shelf stability to broaden appeal and support scalable market growth.

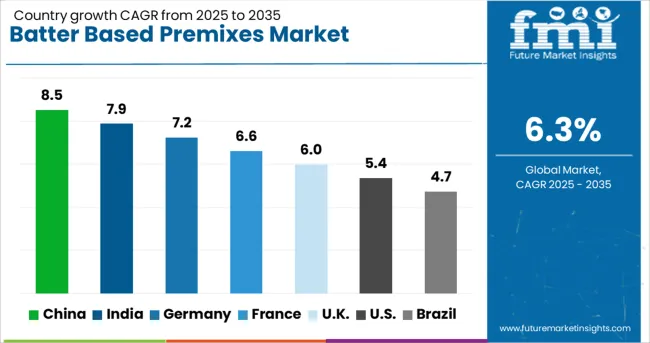

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

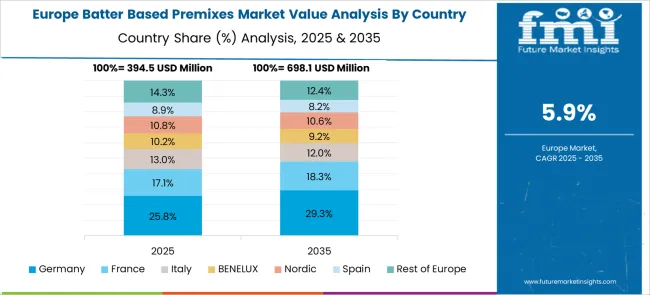

The global batter-based premixes market is projected to grow at 6.3% CAGR between 2025 and 2035. China leads with 8.5% CAGR, driven by rising quick-service restaurant (QSR) penetration and growing demand for fried snack foods. India follows at 7.9%, supported by strong growth in bakery cafés, frozen snack production, and convenience food categories. Germany records 7.2% CAGR, emphasizing clean-label and fortified batter solutions for premium processed food. The UK posts 6.0%, while the United States grows at 5.4%, reflecting steady demand for ready-to-use batters in an established convenience food market. Asia-Pacific dominates due to evolving consumer eating habits and rapid foodservice expansion, whereas developed markets prioritize low-oil, gluten-free, and functional batter variants.

China is expected to maintain leadership with 8.5% CAGR, driven by the popularity of ready-to-fry frozen snacks and expanding quick-service chains. Domestic brands and international players are introducing versatile batter premixes compatible with both traditional and Western-style fried products. Rising demand for crispy coatings in poultry and seafood segments accelerates adoption in large-scale food processing units. E-commerce platforms boost sales for home-use batter mixes, particularly in urban households seeking convenient cooking options. Innovation in formulations offering reduced oil absorption and improved texture supports growth in health-conscious consumer segments.

The batter premix market in India is forecasted to grow at 7.9% CAGR, propelled by rising snack culture, modern retail penetration, and growing home-baking trends. Traditional fried foods like pakoras and bhajiyas continue to sustain demand, while Western-style coated products expand usage in QSR and catering services. Manufacturers are focusing on fortified batter mixes enriched with proteins and natural flavors to meet urban consumer health demands. Premiumization trends in frozen snacks, such as breaded chicken and seafood, further boost premix consumption. The growth of online grocery platforms and food delivery chains provides additional distribution opportunities.

Germany is projected to grow at 7.2% CAGR, supported by rising demand for clean-label and allergen-free food solutions. Growth in frozen and convenience food categories increases the use of batter premixes in coated vegetables, seafood, and plant-based protein products. Manufacturers focus on developing gluten-free and organic batter solutions to meet EU regulatory compliance and consumer preferences for natural ingredients. Innovation in low-oil absorption coatings and functional batters enriched with fiber supports premiumization trends. Automated food processing facilities in Germany emphasize standardized, consistent coating solutions for large-scale production.

The United Kingdom market is forecasted to grow at 6.0% CAGR, fueled by the increasing popularity of convenience snacks and expanding fast-food chains. Frozen food manufacturers are adopting batter premixes to enhance coating stability and improve cooking consistency. Premium product innovation focuses on allergen-free and vegan-friendly formulations to meet dietary preferences. QSR chains demand customized batter systems that ensure uniform texture and crispiness across high-volume operations. Sustainability trends drive packaging innovations for retail batter products, enhancing shelf appeal and reducing environmental impact.

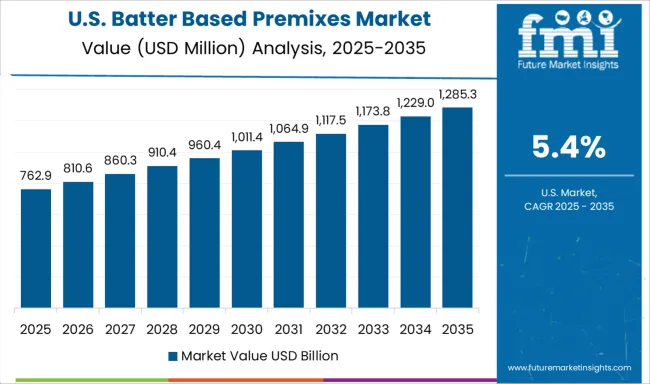

The United States market is projected to grow at 5.4% CAGR, reflecting steady adoption in an established processed and convenience food landscape. Demand is concentrated in QSR chains, catering services, and industrial frozen food production. Innovation in low-oil, gluten-free, and protein-enriched batters aligns with consumer interest in healthier indulgence. Manufacturers integrate functional ingredients to improve batter adhesion, crispiness, and moisture retention for poultry, seafood, and plant-based alternatives. Strategic partnerships between premix suppliers and major food processors support consistent product innovation and distribution scale.

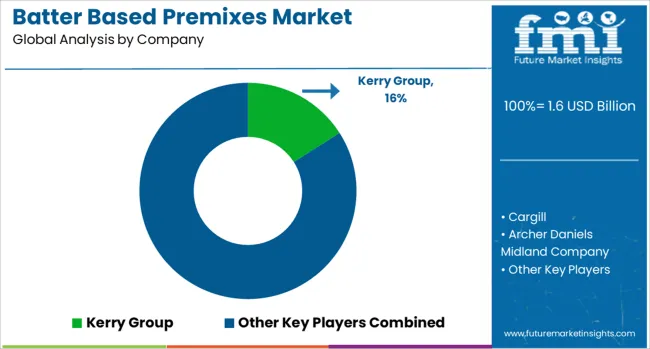

The batter based premixes market is moderately consolidated, with Kerry Group recognized as a leading player due to its wide range of specialty premixes designed for consistent quality in bakery and foodservice applications. The company’s expertise in flavor innovation, functional ingredient integration, and global supply capabilities positions it strongly in both retail and industrial segments. Key players include Cargill, Archer Daniels Midland Company (ADM), Continental Mills, Inc., Blendex Company, AB Mauri, and Ingredion Incorporated. These companies provide batter premixes formulated for applications such as cakes, pancakes, muffins, waffles, and specialty desserts. Their solutions focus on convenience, uniform texture, and extended shelf life, catering to commercial bakeries, quick-service restaurants, and home baking markets.

Market growth is driven by rising demand for ready-to-use baking solutions, growing popularity of premium and customized bakery products, and increased consumer preference for convenience in food preparation. Leading manufacturers are investing in clean-label and gluten-free premix variants, fortified options for nutritional benefits, and digital platforms for recipe personalization. Emerging trends include the adoption of plant-based ingredients and the development of multi-functional premixes compatible with diverse cooking techniques. Asia-Pacific is witnessing rapid market expansion due to urban lifestyle changes and growing interest in Western-style baked goods, while North America and Europe maintain strong demand for premium and specialty batter products.

In January 2025, Newly Weds Foods launched ‘DV’, an all-natural, clean-label antimicrobial premix at AMI’s show to enhance food safety in meats and coatings.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product Type | Pancake and waffle mixes, Tempura and asian batters, Fish and seafood batters, Cake and dessert batters, and Specialty and functional batters |

| Application | Food service, Commercial food manufacturing, Retail and consumer, and Industrial and contract manufacturing |

| Distribution Channel | Direct sales, Food service distributors, Retail channels, and Industrial distribution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kerry Group, Cargill, Archer Daniels Midland Company, Continental Mills, Inc., Blendex Company, AB Mauri, and Ingredion Incorporated |

| Additional Attributes | Dollar sales by premix type (batter ≈55–56% share, breader fastest growth) and product form (adhesion, tempura, beer, thick, custom). North America leads (\~35–46% share), Asia-Pacific grows fastest (\~6–8% CAGR). Buyers seek clean-label, gluten-free, and automated solutions. Innovations include enzymatic systems, ethnic-flavor coatings, and high-adhesion functional blends for industrial and QSR applications. |

The global batter based premixes market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the batter based premixes market is projected to reach USD 2.9 billion by 2035.

The batter based premixes market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in batter based premixes market are pancake and waffle mixes, _traditional pancake mixes, _belgian waffle mixes, _specialty and flavoured variants, tempura and asian batters, _traditional tempura batters, _crispy coating batters, _specialty asian applications, fish and seafood batters, _fish and chips batters, _seafood coating mixes, _pre-dip batter systems, cake and dessert batters, _funnel cake mixes, _donut batters, _specialty dessert applications, specialty and functional batters, _gluten-free formulations, _organic and clean label products and _plant-based and alternative protein batters.

In terms of application, food service segment to command 41.0% share in the batter based premixes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Batters and Coatings Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA