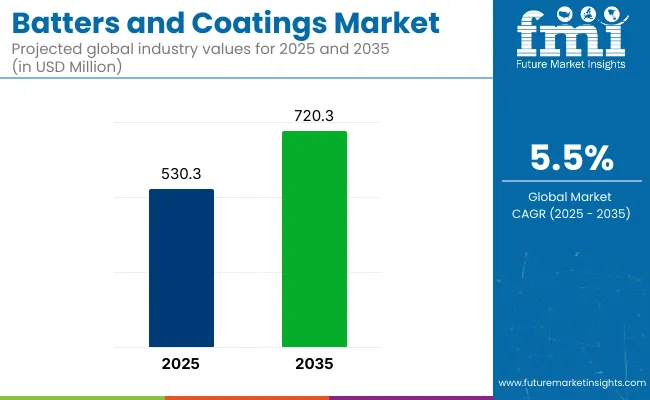

The global batters and coatings market is valued at an estimated USD 530.3 million in 2025, with revenue expected to advance to roughly USD 720.3 million by 2035, implying a compound annual growth rate of about 5.5% across the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 530.3 million |

| Industry Value (2035F) | USD 720.3 million |

| CAGR (2025 to 2035) | 5.5% |

Demand is driven across food-service chains, frozen entrée lines, and contract manufacturers supplying private-label products to retail. Batters and coatings has been encouraged by reformulation mandates that seek reduced oil uptake and cleaner labels while retaining the sensory cues consumers associate with indulgent fried foods.

The industry registers a niche yet functional role within broader food processing categories, accounting for varied shares across parent markets. In the frozen food market, it contributes approximately 3.5%, driven by its integration into coated meats, seafood, and vegetables. In the snack food segment, its share is close to 2.8%, primarily from breaded snacks and coated finger foods.

Within processed foods, the share stands at 1.9%, reflecting its role in prepared entrées and ready-to-cook items. In the food ingredients market, its share remains limited at around 1.2%, given its specific use compared to broader ingredient categories. It captures the highest relevance in the convenience food space, where its share reaches 4.1%, enabled by widespread use in QSR and frozen reheat meals.

A notable development within the batters and coatings segment is the shift toward phase-structured microfilm batters, which enable differentiated textural zones within a single crust layer. This approach uses immiscible emulsions and controlled hydration windows to engineer dual-phase coatings that produce a crisp outer shell with a moist intermediate barrier.

The technique, initially applied in high-end tempura items, has now migrated to industrial-scale manufacturing, supported by inline hydration tunnels and vacuum flash-fryers. The result is an upgraded mouthfeel that mimics chef-prepared quality in reheat-and-serve formats.

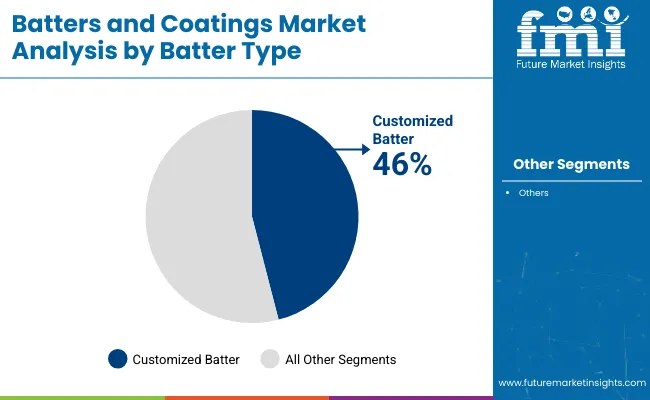

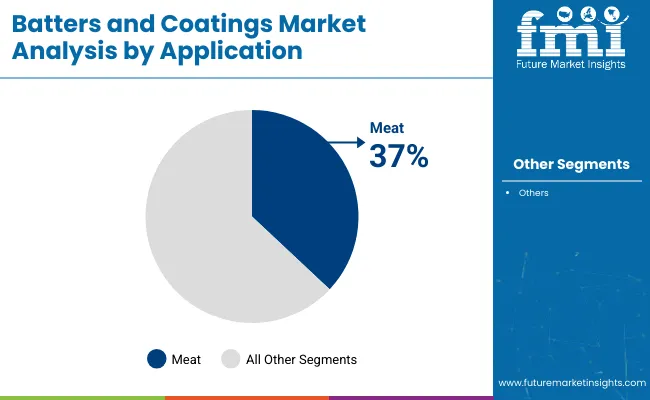

Customized batter and meat-based applications are driving concentrated investments across processing, formulation, and packaging systems. The adaptability of customized batters across equipment, dietary formats, and flavor systems makes them essential for differentiated product development in foodservice and packaged goods. Meat applications account for the largest downstream consumption, with processors optimizing coating systems to match texture, shelf stability, and consumer expectations in both frozen and chilled formats.

Customized batter is projected to hold 46% of the industry share by 2025.

Meat applications are expected to contribute 37% to industry value in 2025.

Customization is driving demand for high-performance batters tailored to regional preferences, dietary needs, and modern cooking platforms. Meat applications continue to lead volume growth, with processors investing in advanced coating systems to enhance texture, shelf life, and export viability.

Customization-Driven Product Formulation as a Competitive Lever

Rising complexity in consumer taste profiles has driven formulators toward customized batters tailored for texture, cooking method, and allergen-free positioning. Suppliers are embedding regional spices, gluten-free flours, and heat-stable coatings into modular systems to meet QSR and retail demands.

These adaptations have shifted R&D budgets toward high-performance mixes that cater to air fryers, steam ovens, and flash-freeze processes. Branded food manufacturers are moving away from generic blends, favoring differentiation via custom formulations that reflect local preferences and health claims.

Protein-Based Application Growth Reinforces Coating System Investments

The meat segment has strengthened its role as a volume anchor in batters and coatings through increased demand in frozen, processed, and portion-controlled formats. Meat processors are retrofitting lines to integrate improved pre-dust and batter adhesion systems, allowing higher yields and reduced oil absorption. Shelf-life extension and flavor retention remain strategic priorities, especially for export-ready meat products in ASEAN and BRICS markets. Coated meats also offer operational advantages in institutional catering and QSR rollouts.

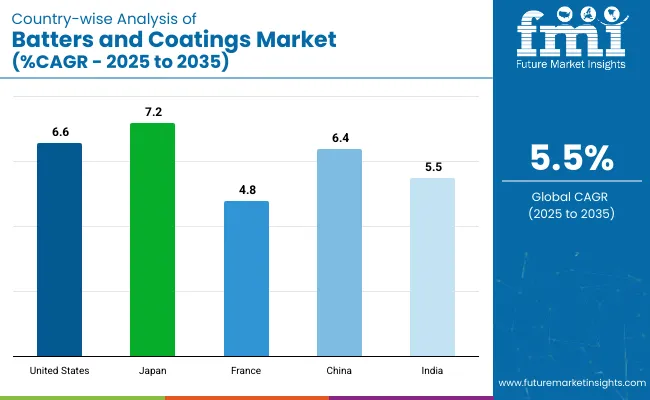

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.6% |

| Japan | 7.2% |

| France | 4.8% |

| China | 6.4% |

| India | 5.5% |

With global expansion estimated at 5.5% CAGR between 2025 and 2035, divergence across economic blocs is becoming more pronounced. India, part of BRICS, leads with 6.8%, driven by growth in frozen coated poultry and snacks.

Stronger output from contract processors and demand from quick-service restaurants are contributing to capacity additions in Rajasthan and Tamil Nadu. China, also in BRICS, is tracking at 6.3%, supported by expanding chilled meat exports and regional demand for shelf-stable coated foods. ASEAN countries collectively exceed 6%, as Malaysia, Vietnam, and Thailand scale exports of coated seafood and fried snack bases.

The United States, an OECD member, posts 4.6% CAGR, below the global rate, due to flattening demand in frozen retail categories and labor-cost-driven reformulation shifts. Germany and the United Kingdom, both OECD economies, stand at 3.9% and 3.4%, respectively, impacted by saturated product portfolios and slower cycles linked to clean-label reformulation pressures and packaging constraints.

The USA batters and coatings market is estimated to grow at 6.6% CAGR during the study period. Growth is being fueled by a nationwide shift toward convenience-oriented cooking formats, with household penetration of air-fryer appliances approaching 40% by 2025. Restaurant chains are adopting high-adhesion batters that withstand extended delivery windows, while frozen food brands are reformulating coatings to cut post-fry oil uptake by nearly one-third.

Regulatory pressure around acrylamide has led to rapid uptake of enzyme-treated starches and pulse-based flours, encouraging suppliers to build domestic capacity for specialty blends. Private-label expansion at club stores has also been observed, creating long-term supply contracts that lock in demand visibility for processors.

Japan’s batters and coatings segment is projected to register a 7.2% CAGR over the same horizon. Demand is being underpinned by the nation’s deep-fried culinary traditions, tempura, karaage, and katsu, now translated into frozen bento items for busy urban consumers.

Convenience-store chains are deploying flash-freeze tunnels that require ultra-thin, shear-stable batters to preserve crispness after microwave reheating. Import reliance on wheat is encouraging formulators to diversify into domestic rice and sweet-potato starches, aligning with food-security objectives. Robotics adoption in central kitchens is accelerating, as automated dipping and breading units boost through-put without compromising portion uniformity.

India’s batters and coatings category is expected to expand at 5.5% CAGR through 2035. Rising demand for ready-to-cook snacks such as paneer pops, coated chicken strips, and breaded seafood is being recorded across tier-2 and tier-3 cities. Organized quick-service chains are standardizing spice profiles in batters to achieve consistent heat and color across multi-state outlets.

Domestic milling groups are supplying sorghum- and chickpea-based flours that improve crunch while supporting gluten-free menu claims. Cold-chain investment under the Production-Linked Incentive (PLI) program is improving frozen distribution, giving coated items longer shelf reach without texture loss. E-commerce grocery platforms have introduced private labels priced 8-10% below national brands, widening access to value-conscious households.

France’s batters and coatings market is forecast to advance at about 4.8% CAGR over the forecast window. Heritage dishes like cordon bleu and breaded camembert continue to anchor demand, yet modern dietary shifts are steering R&D toward lighter, oil-reduced coatings that still deliver the classic “pané” crunch. Retailers are mandating clean-label ingredient decks, prompting formulators to replace synthetic emulsifiers with sunflower-lecithin systems sourced locally from Occitanie.

Domestic poultry processors are installing inline battering systems capable of handling gluten-free rice blends, supporting certifications required by school-meal programs. The rise of flexitarian eating has catalyzed investment in plant-protein-coated vegetable nuggets, a segment now accounting for double-digit growth in frozen aisles.

China’s batters and coatings industry is set to grow at roughly 6.4% CAGR during the projection period. Urban consumers are embracing single-serve frozen meals that rely on high-adhesion coatings to maintain crunch after rapid induction-heating in smart ovens. Domestic poultry giants have commissioned continuous batter-bread lines in Henan and Shandong, each capable of 12,000 kg per hour, ensuring scalable supply for nationwide delivery apps.

Government food-safety audits have intensified focus on coating uniformity, leading processors to integrate vision-based inspection systems that cut rejection rates by 15%. E-commerce festivals such as “618” have accelerated product launches featuring regional flavors, Sichuan pepper, XO sauce, embedded directly into batter matrices, reducing the need for external seasoning sachets. Rising health awareness has prompted R&D into pea-protein and konjac-enriched batters, lowering caloric density while preserving mouthfeel.

The supplier landscape spans legacy OEMs and emerging vendors specializing in slicing, mixing, and portioning equipment tailored for batter and coating operations. Grote Company, Hobart, and Bizerba lead with high-throughput automated slicers and IoT-enabled maintenance platforms, enabling uptime optimization for industrial processors and commissaries.

Berkel, Vollrath, and KWS serve mid-tier segments through ergonomic countertop solutions designed for bakeries, delis, and QSR chains. Nemco Food Equipment Ltd., Estella, and Beswood offer stainless-steel assemblies positioned for cloud kitchens and regional foodservice operators seeking reliability with minimal footprint.

Doyon Equipment Inc. and Vevor are expanding into multi-function mixers and dough handling equipment, enhancing prep-stage flexibility. Edlund, Garde, and LEM Products anchor the artisanal and small-batch segment with manual slicers and cutters. Omcan and other import-oriented firms boost SKU churn via global e-commerce platforms, supplying hardware into emerging markets and remote operations with limited procurement infrastructure.

Recent Batters and Coatings Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 530.3 million |

| Projected Market Size (2035) | USD 720.3 million |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in metric tons |

| Batter Type Analyzed (Segment 1) | Adhesion Batter, Tempura Batter, Beer Batter, Thick Batter, and Customized Batter. |

| Application Analyzed (Segment 2) | Meat, Pork, Chicken, Seafood, Vegetables, and Onion Rings. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Grote Company, Berkel, Hobart, Vollrath, KWS, Bizerba, Nemco Food Equipment Ltd., Estella, Beswood, Doyon Equipment Inc, Vevor, Edlund, Garde, LEM Products, and Omcan. |

| Additional Attributes | Dollar sales, category share, segment growth rates, regional demand shifts, application-level consumption, end-user trends, pricing benchmarks, pipelines, regulatory updates, private label penetration, and procurement priorities. |

By batter type, methods industry has been categorized into Adhesion batter, Tempura batter, Beer batter, Thick batter and Customized batter

By application, industry has been categorized into Meat, Pork, Chicken, Seafood, Vegetables and Onion rings

Industry analysis has been carried out in key countries of North America, Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is valued at USD 530.3 million in 2025.

It is forecasted to reach USD 720.3 million by 2035.

The market is anticipated to grow at a CAGR of 5.5% during this period.

Customized batter is projected to lead the market with a 46% share in 2025.

Asia Pacific, particularly Japan, is expected to be the key growth region with a projected growth rate of 7.2%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Marine Coatings Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Stealth Coatings Market Size and Share Forecast Outlook 2025 to 2035

Medical Coatings Market Growth & Demand 2025 to 2035

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Sputter Coating Market Growth – Trends & Forecast 2022 to 2032

Compound Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Ablative Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA