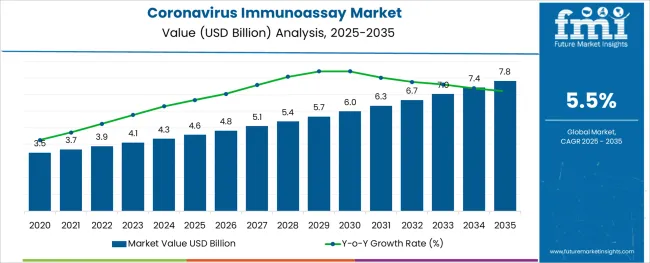

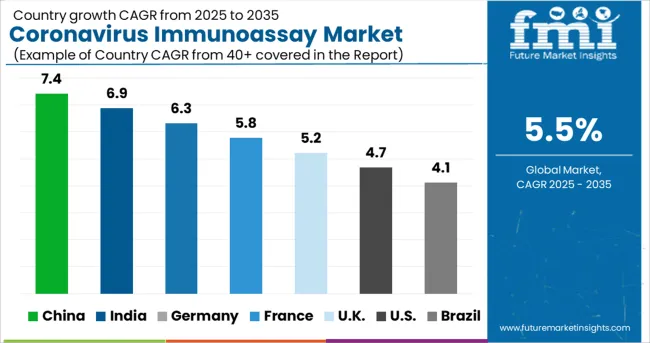

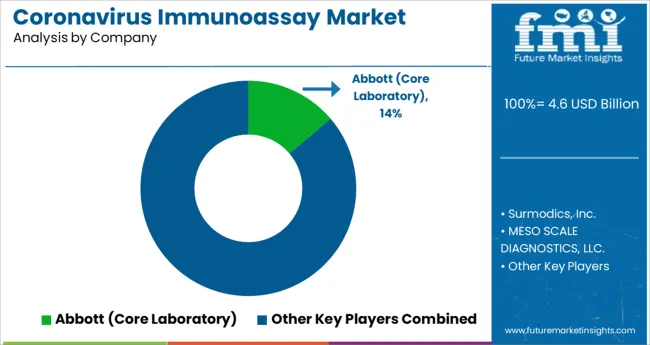

The Coronavirus Immunoassay Market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 7.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The coronavirus immunoassay market has expanded rapidly due to the ongoing global need for accurate and timely diagnosis of COVID-19 infections. The increasing prevalence of the virus and emphasis on monitoring immune response and infection rates have driven demand for sensitive and specific testing solutions. Healthcare providers and diagnostic laboratories have prioritized immunoassay-based testing to complement molecular methods, providing quicker and scalable testing options.

Technological improvements in assay sensitivity and throughput have enabled broader screening capabilities in clinical settings. Additionally, public health initiatives and government programs promoting widespread testing have contributed to the market’s expansion.

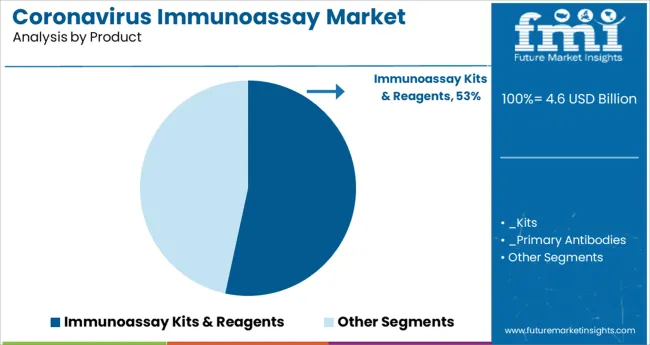

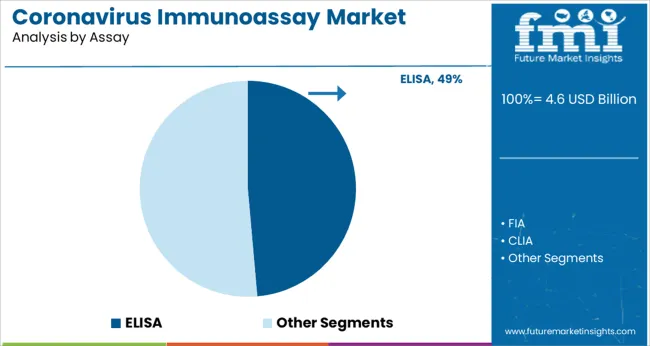

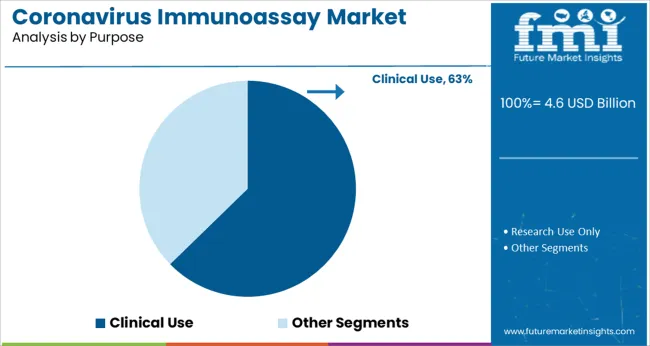

The market outlook is expected to be positive as immunoassays remain critical for clinical decision-making, vaccine efficacy studies, and epidemiological surveillance. Segmental growth is anticipated to be led by Immunoassay Kits & Reagents, ELISA assays, and Clinical Use applications, reflecting their dominance in diagnostic workflows.

The market is segmented by Product, Assay, Purpose, Specimen, Application, and End User and region. By Product, the market is divided into Immunoassay Kits & Reagents, Analysers & Instrument, Consumables, and Software. In terms of Assay, the market is classified into ELISA, FIA, CLIA, LFA, and Others. Based on Purpose, the market is segmented into Clinical Use and Research Use Only. By Specimen, the market is divided into Blood, Saliva, Nasopharynx, and Cell Culture Samples. By Application, the market is segmented into Clinical Diagnostics, Drug Discovery, and Screening of diseases & disorders. By End User, the market is segmented into Healthcare Industry. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Immunoassay Kits & Reagents segment is projected to account for 53.4% of the coronavirus immunoassay market revenue in 2025, maintaining its position as the leading product category. This segment has grown due to the essential role kits and reagents play in enabling high-quality, standardized testing across various laboratory environments. The availability of ready-to-use kits has facilitated rapid deployment and ease of use in clinical and research labs.

Continuous innovation in reagent formulations has improved assay sensitivity and specificity, addressing the challenges posed by viral mutations. Additionally, growing investments in laboratory infrastructure and increased testing demand have supported the expansion of this segment.

The widespread adoption of immunoassay kits in hospital and public health laboratories underscores their importance in the ongoing management of the pandemic.

The ELISA assay segment is projected to hold 48.6% of the coronavirus immunoassay market revenue in 2025, leading assay methodologies. ELISA’s popularity is driven by its high sensitivity, quantitative capabilities, and suitability for large-scale screening. Laboratories prefer ELISA for detecting antibodies and antigens related to COVID-19, supporting diagnosis and seroprevalence studies.

The assay’s compatibility with automation and multiplexing further enhances its utility in clinical workflows. Furthermore, ELISA’s established presence in immunodiagnostics has enabled swift adaptation to coronavirus testing needs.

With ongoing demand for monitoring immune responses post-infection and vaccination, the ELISA segment is expected to remain central in coronavirus immunoassay testing.

The Clinical Use segment is expected to represent 62.7% of the coronavirus immunoassay market revenue in 2025, affirming its critical role in patient diagnosis and management. Immunoassays are widely used in clinical settings to confirm infection, monitor antibody levels, and guide treatment decisions.

The need for rapid and reliable testing in hospitals and clinics has prioritized immunoassay adoption as a complement to molecular testing techniques. Clinical laboratories have expanded testing capacity and integrated immunoassay platforms to manage patient flow effectively.

Moreover, immunoassays contribute to epidemiological surveillance by providing data on infection spread and immunity levels. As clinical demand for accurate diagnostics continues, the Clinical Use segment is projected to maintain its dominant market share.

The market value for coronavirus immunoassays was approximately 13.2% of the USD 4.3 Billion worth global immunoassay market in 2024.

Along with developments in diagnostic testing, researchers are aiming to manufacture different therapies that could be used to treat COVID-19 patients. The diagnosis procedures may be effective in the suppression of COVID-19, allowing for the quick implementation of preventative measures such as identifying and isolating infected individuals and identifying those who have been directly contacted by affected patients.

Biosensors can detect pathogens in a variety of contexts with excellent sensitivity and selectivity without the need for sample preparation. Furthermore, biosensor-based technologies are rapidly emerging as complementary platforms to PCR and ELISA for SARS-CoV-2 identification and quantitative detection.

Moreover, electrochemical biosensors are effective diagnostic instruments that have enabled pathogen detection in a variety of biological specimens without the need for sample preparation, as well as pathogen detection on surfaces and detection via wireless actuation.

The ability to make life-saving decisions on therapeutic measures and the isolation of COVID-19 infected individuals at the earliest possible stage is enhanced by rapid testing, which eventually inhibits the spread of infection.

Owing to the aforementioned factors, the global coronavirus immunoassay market is expected to grow at a CAGR of 5.5% during the forecast period.

IoT is a promising technology that consists of interconnected computing devices communicating information over a network without the need for human intervention. IoMT has recently attracted a lot of interest from the healthcare community. It is a collection of medical devices and software applications that are linked to healthcare information technology systems.

Antibody tests are a critical response to virus transmission and provide timely treatment for patients, but global supply constraints and high demand for PCR primers and positive controls have diagnostic companies scurrying to create them.

The inability of many countries and businesses to respond to the COVID-19 pandemic is due to their supply chain-the transport of goods such as masks, ventilators, consumables, and even services (e.g., visiting clinics).

Many countries are also concerned about the lack of personal protective equipment (PPE), which is necessary for frontline healthcare workers to tackle the disease.

In Italy, a lack of personal protective equipment is implicated in increasing rates of infection and death. Many researchers believe the USA. requires far more respirators and surgical masks than are currently available. The supply chain's susceptibility can be associated with the negative effects of the shortages. These factors act as some of the key limitations in the global coronavirus immunoassay market.

Increasing Demand for Vital Test Kits in the USA Will Boost Sales of Coronavirus Immunoassays

The USA dominated the North America coronavirus immunoassay market, holding around 95.7% of the total market share in 2024.

Ongoing efforts within the country to communicate and facilitate the development of novel diagnostic assays and the worldwide delivery of test kits is expected to fuel sales in the market.

Several organisations are supporting these efforts by requesting assay developers to submit their test products for independent evaluation or by investing in collaborations to promote more accurate and faster diagnostic solutions.

As similar initiatives and knowledge sharing are attainable, including collaborative technological developments, demand for coronavirus immunoassays in the USA will increase at a considerable pace over the forecast period.

Rising Adoption of Molecular Assays in Germany Will Fuel Growth

Sales in the Germany market are forecast to increase at a 5.5% CAGR over the forecast period. The Health Security Committee (HSC) agreed on Recommendations for a common EU testing methodology for COVID-19 on September 17, 2024, laying out several activities that nations should consider when upgrading or adjusting their testing procedures.

Member States' first experiences with rapid antigen tests, as well as their discussions about the settings and conditions in which these tests should be performed, were incorporated in the Recommendations.

Since then, the HSC has been debating the use and application of rapid antigen testing in-depth, compiling a plethora of (technical) knowledge on the many types of tests used in Europe and the conditions under which they are employed. As a result of the increased prevalence of infection within the country, Germany will exhibit high demand for coronavirus immunoassays.

Sales of Kits and Reagents Will Continue Gaining Traction

Based on product type, sales of immunoassay kits & reagents are expected to increase at a CAGR of 5.4% by the end of the forecast period, holding about 68.3% of the global market in 2035.

Owing to rapid detection of infectious pathogens, as well as the accuracy associated with the prompt detection, sales are expected to increase in this segment. Moreover, greater accessibility of these products across developed, as well as emerging economies have provided more opportunities for the expansion of the coronavirus immunoassay market.

Demand for LFA Immunoassays Will Increase Over the Forecast Period

In terms of assay type, the LFA segment held 39.0% of the total market share in 2024, and is expected to account for 45.0% in 2035.LFA is a one-step, cost-effective and rapid assay. They are critical in instances of point-of-care, and have a long shelf life, with no need for refrigeration. These factors allow a higher adoption of these assays, thus propelling the sales.

Nasopharynx Segment to Remain the Most Lucrative

By specimen type, specimen collection through the nasopharynx held a dominant share value of around 38.9% in 2024. For the diagnosis of COVID-19 in adults and children, nasopharyngeal swabs are used to collect samples from the surface of the respiratory mucosa. Patients with suspected respiratory infections caused by other viruses or bacteria are frequently evaluated using this method.

Applications of Coronavirus Immunoassays for Clinical Diagnosis Will Gain Momentum

Total demand in the clinical diagnosis segment held around 66.4% of the total market share in 2024. With evolving dynamics in disease epidemiology, rising number of infectious cases, growing global burden of disease, and increasing efforts to enhance healthcare infrastructure, clinical diagnosis of disease will be necessary in assessing the impact of disease and its causative factors.

Adoption of Coronavirus Immunoassays in the Healthcare Sector Will Bolster

The healthcare sector held around 94.4% of the total market share in 2024 and the trend is expected to continue over the assessment period. Collaborative efforts by manufacturers as well as policy makers in the design and development of rapid diagnostic tests, along with the available facilities to promote accessibility of these products globally, the healthcare industry owns a dominant stance in the coronavirus immunoassay market.

To meet unmet patient demand, key companies are pursuing strategic initiatives in the field of immunoassays, spanning acquisitions and mergers, development of new products, and geographic coverage. Instances of key developmental strategies by the industry players in the coronavirus immunoassay market are given below:

| Attributes | Details |

|---|---|

| Base Yeas Market Size (2025) | USD 4.6 Billion |

| Projected Market Valuation (2035) | USD 7.8 Billion |

| Value-based CAGR (2035) | 5.5% |

| Forecast Period | 2012 to 2024 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Argentina, The UK, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC, and South Africa |

| Key Market Segments Covered | Product, Assay, Purpose, Specimen, Application, End User, and Region |

| Key Companies Profiled | Surmodics, Inc.; MESO SCALE DIAGNOSTICS, LLC.; Abbott (Core Laboratory); Siemens-healthineers (Siemens Medical ; Solutions USA, Inc); PerkinElmer Inc.; BD Biosciences; ThermoFisher Scientific Inc.; Zoetis Inc.; Promega Corporation; F. Hoffmann- La Roche Ltd.; bioMérieux SA; Elabscience Biotechnology Inc.; Innovative Research, Inc.; QIAGEN N.V.; Merck KgaA; Bio-Rad Laboratories, Inc.; Creative Diagnostics; Cell Signaling Technology, Inc.; NEW HORIZONS DIAGNOSTIC ; CORPORATION; DiaSorin S.p.A.; H.U. Group Holdings Inc (Fujirebio ; Holdings, Inc.); IDEXX Laboratories Inc.; Randox Laboratories Ltd.; Biopanda Reagents Ltd.; Shenzhen Bioeasy Biotechnology Co.,Ltd.; Quidel Corporation; Advnt Biotechnologies |

The global coronavirus immunoassay market is estimated to be valued at USD 4.6 billion in 2025.

It is projected to reach USD 7.8 billion by 2035.

The market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types are immunoassay kits & reagents, _kits, _primary antibodies, _secondary antibodies, _immunoassay substrates, _immunoassay buffers, analysers & instrument, consumables and software.

elisa segment is expected to dominate with a 48.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immunoassay Market Size and Share Forecast Outlook 2025 to 2035

Immunoassay CDMO Market Analysis – Size, Trends & Industry Outlook 2025-2035

Radioimmunoassay Market Growth - Trends & Forecast 2025 to 2035

The Neuro Immunoassay Market is segmented by product, and end user from 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mycology Immunoassays Testing Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence Immunoassay Analyzers Market

Autoimmunity Immunoassay Market

Biomarker-based Immunoassays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA