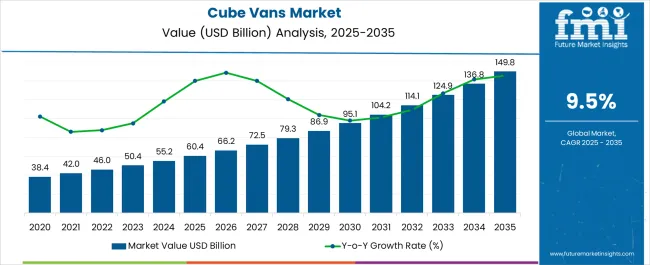

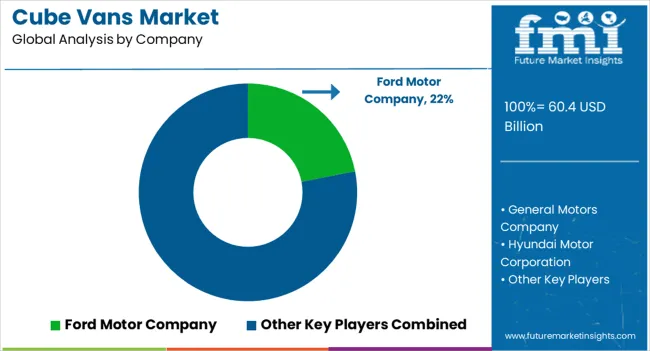

The Cube Vans Market is estimated to be valued at USD 60.4 billion in 2025 and is projected to reach USD 149.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period. Cost-structure analysis reveals that several interdependent components, including vehicle manufacturing, powertrain integration, body fabrication, electronics and telematics, logistics, and after-sales services shape the market’s value chain.

Manufacturing costs, including raw materials such as steel, aluminum, and composite panels, account for a significant portion of the overall expenditure. Powertrain and engine integration, particularly with the rising shift toward electric and hybrid configurations, introduces additional costs, while advanced telematics and cargo management systems further influence unit-level pricing. Within the value chain, suppliers of critical components such as chassis, drivetrains, and electronic control units hold substantial influence on production costs and technological differentiation. Assembly operations, whether localized or centralized, contribute to labor and operational expenditures, whereas distribution and logistics functions impact cost efficiency in delivering finished vans to commercial and industrial clients.

The maintenance and service networks, including warranty management and replacement parts, form an essential post-production cost element that supports total value capture across the chain. Strategic collaboration among component suppliers, OEMs, and service providers is increasingly employed to optimize cost efficiency and reduce lead times. By 2035, the market value chain is expected to continue evolving, with technology integration and logistics optimization being critical levers for cost management and value creation throughout the lifecycle.

| Metric | Value |

|---|---|

| Cube Vans Market Estimated Value in (2025 E) | USD 60.4 billion |

| Cube Vans Market Forecast Value in (2035 F) | USD 149.8 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The cube vans market is expanding steadily as demand grows for compact, efficient, and customizable freight solutions across urban and suburban logistics networks. Increased e-commerce activity, just-in-time inventory strategies, and last-mile delivery requirements are propelling the adoption of cube vans by both small businesses and fleet operators.

These vehicles offer optimized cargo space, maneuverability in tight cityscapes, and ease of upfitting for various commercial applications. Regulatory pressures to reduce vehicular emissions and the need for operational efficiency are influencing procurement decisions across delivery services, mobile workshops, and service fleets.

Advancements in chassis design, lightweight materials, and fleet tracking technologies are further supporting market evolution. The positive growth outlook is underpinned by the shift toward agile logistics infrastructure and demand for flexible load-carrying platforms across sectors, including retail, construction, and service delivery.

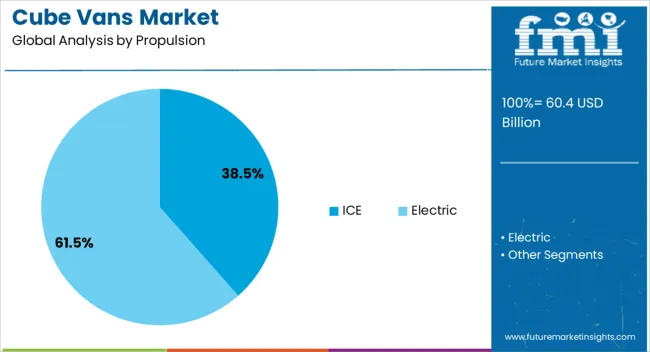

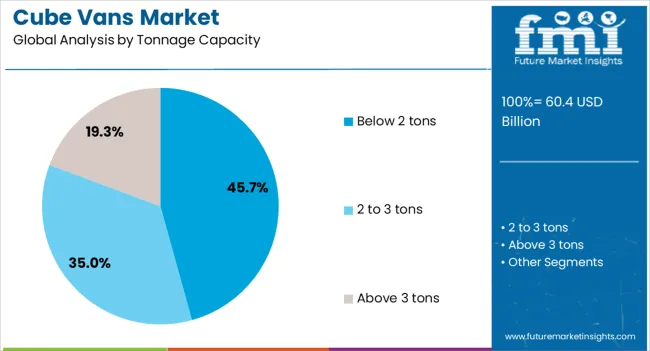

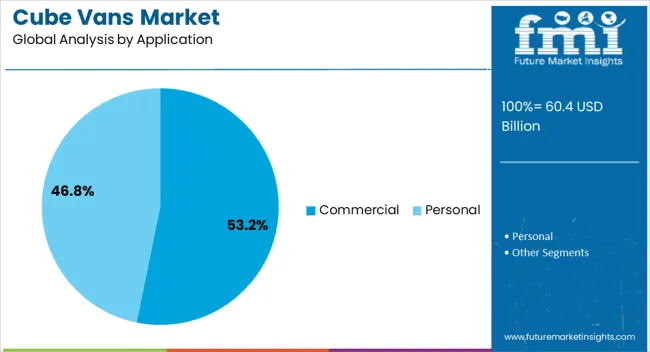

The cube vans market is segmented by propulsion, tonnage capacity, application, and geographic regions. By propulsion, the cube vans market is divided into ICE and Electric. In terms of tonnage capacity, the cube vans market is classified into below 2 tons, 2 to 3 tons, and above 3 tons. Based on application, the cube vans market is segmented into Commercial and Personal. Regionally, the cube vans industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The internal combustion engine segment is projected to account for 38.50% of the total revenue by 2025 within the propulsion category, maintaining its lead in the segment. This dominance is supported by the widespread availability of fueling infrastructure, lower upfront costs compared to electric alternatives, and the long-range capabilities required for regional logistics.

Many commercial operators continue to rely on ICE-powered cube vans due to their established maintenance practices and component availability. The resilience of this segment is further sustained by its versatility across urban and rural routes, especially in regions where electrification infrastructure is still developing.

Despite rising electrification trends, ICE propulsion remains the preferred option in fleets prioritizing immediate scalability and low capital expenditure, reinforcing its substantial market presence.

The below 2 tons segment is expected to hold 45.70% of the total market revenue by 2025 under the tonnage capacity category, making it the leading weight class. The increasing need for nimble and lightweight transportation solutions suitable for urban delivery environments drives this preference.

Vehicles within this category are favored for their fuel efficiency, regulatory compliance regarding gross vehicle weight, and suitability for congested urban traffic conditions. Small businesses and courier services find this tonnage range optimal for frequent stops, last-mile routes, and reduced operating costs.

The ability to access restricted zones and operate under simplified licensing norms in many jurisdictions has further enhanced their popularity. As urban logistics becomes more dynamic and customer delivery expectations rise, the below 2 tons category continues to dominate the cube vans market landscape.

The commercial application segment is projected to contribute 53.20% of the total market revenue by 2025, establishing it as the foremost use case for cube vans. This is largely attributed to the increasing role of cube vans in supporting delivery, service, and trade operations across urban and suburban regions.

Their modular cargo areas, customization potential, and efficient load-carrying capability make them ideal for industries such as parcel delivery, mobile services, and equipment transport. Businesses are adopting cube vans as part of fleet modernization efforts to enhance productivity and meet growing consumer demand for timely and flexible services.

The reliability, operational efficiency, and broad applicability of cube vans in commercial workflows have collectively ensured their leading position in the application segment.

The market has been expanding due to increasing demand for versatile, cargo-focused vehicles in logistics, retail, and last-mile delivery sectors. These vehicles, characterized by enclosed, box-shaped cargo compartments, have been widely used for transporting goods, equipment, and perishable items. Manufacturers have focused on improving load capacity, fuel efficiency, and durability while integrating connectivity and telematics solutions. Market growth has been influenced by the rise of e-commerce, urban distribution needs, and fleet modernization initiatives, making cube vans an essential component of efficient commercial transport networks globally.

The market has been strongly driven by the expansion of e-commerce and last-mile delivery services. These vehicles have been extensively deployed to transport packages, groceries, and temperature-sensitive goods from distribution centers to consumers. The enclosed cargo space has enabled secure, organized, and efficient delivery while reducing damage risks during transit. Fleet operators have increasingly relied on cube vans to maintain delivery schedules and meet customer expectations for speed and reliability. Urban congestion and smaller delivery windows have encouraged the use of compact yet spacious cube vans, capable of navigating city streets while carrying significant payloads. In addition, logistics companies have optimized route planning and load distribution using telematics, further enhancing operational efficiency. The rise of direct-to-consumer sales channels has reinforced the role of cube vans as critical vehicles in modern delivery and supply chain operations.

Technological advancements have significantly influenced the cube vans market by enhancing vehicle performance, safety, and operational efficiency. Engine efficiency improvements, hybrid and electric powertrains, and advanced suspension systems have optimized fuel consumption while maintaining load stability. Safety features, including electronic stability control, collision avoidance systems, and rear-view cameras, have reduced accidents and cargo damage. Telematics solutions and GPS tracking have allowed real-time fleet monitoring, predictive maintenance scheduling, and route optimization, reducing downtime and operating costs. Cargo management systems, including adjustable shelving, tie-downs, and temperature-controlled compartments, have improved load handling flexibility. These technological enhancements have made cube vans more versatile and reliable, supporting diverse applications across commercial fleets, logistics operators, and specialized transport services while meeting regulatory and environmental standards.

The market has been shaped by regulatory policies and environmental mandates aimed at reducing emissions and improving safety standards. Emission regulations have encouraged the adoption of hybrid and electric cube vans, particularly in urban delivery zones with air quality restrictions. Vehicle safety standards have mandated crashworthiness, cargo securement, and driver assistance features, ensuring the protection of personnel and goods. Incentive programs, including subsidies for electric or low-emission vans, have further supported adoption among fleet operators. Regulatory frameworks have also guided the standardization of vehicle dimensions, weight limits, and cargo configurations, promoting operational consistency. Compliance with these policies has driven manufacturers to innovate in powertrain technology, telematics integration, and structural design, reinforcing the role of cube vans as sustainable, efficient, and safe vehicles for modern commercial transport networks.

The market has benefited from fleet modernization programs and the increasing demand for customized vehicles. Commercial operators have upgraded older fleets to newer models with higher payload capacity, improved fuel efficiency, and advanced safety and connectivity features. Customization options, including insulated cargo compartments, refrigeration units, and modular shelving systems, have allowed operators to tailor vans for specific applications such as food delivery, retail distribution, or equipment transport. Leasing and subscription-based vehicle models have facilitated easier fleet expansion and replacement, especially for small and medium enterprises. Fleet management software has enabled real-time monitoring, predictive maintenance, and efficient scheduling, further enhancing operational performance. These strategies have encouraged widespread adoption of cube vans, ensuring they remain integral to commercial transport, logistics efficiency, and the evolving needs of urban and regional distribution networks.

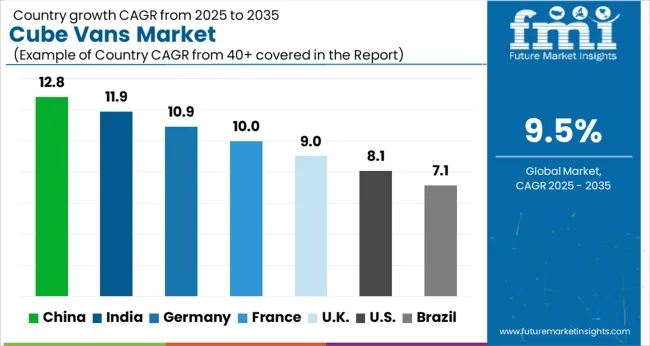

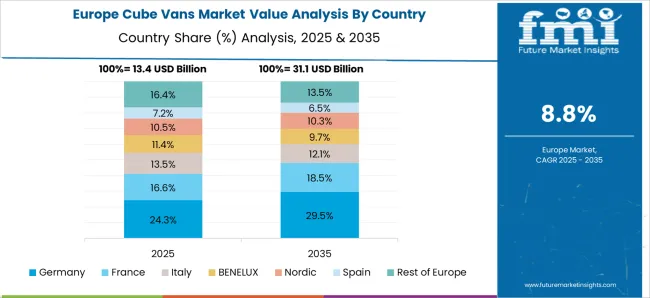

The market is set to grow at a CAGR of 9.5% from 2025 to 2035, fueled by increasing demand for last-mile delivery solutions, urban logistics expansion, and fleet electrification trends. China leads with a 12.8% CAGR, driven by rapid e-commerce growth and modernization of commercial vehicle fleets. India follows at 11.9%, supported by expanding logistics networks and rising small business delivery requirements. Germany, at 10.9%, benefits from advanced automotive manufacturing and focus on sustainable urban transport solutions. The UK, growing at 9.0%, advances through electrification initiatives and fleet optimization programs. The USA, at 8.1%, witnesses steady adoption due to e-commerce growth and commercial transportation upgrades. This report covers 40+ countries, with the top markets highlighted here for reference.

The market in China is expected to grow at a CAGR of 12.8%, fueled by increasing e-commerce operations and last-mile delivery services. Rising demand for efficient urban and intercity logistics solutions is promoting adoption. Manufacturers are focusing on compact, fuel-efficient vans equipped with electric and hybrid powertrains to cater to emission reduction targets. Strategic collaborations between vehicle producers and delivery service providers are accelerating market growth. Technological innovations in load management, telematics, and route optimization are enhancing operational efficiency. Expansion of warehousing and distribution networks across metropolitan and semi-urban regions is further stimulating sales.

India is forecasted to grow at a CAGR of 11.9%, driven by rapid growth in e-commerce, small business deliveries, and urban transportation demands. Manufacturers are introducing lightweight, fuel-efficient vans designed for congested city streets and cost-effective logistics. Government initiatives promoting electric mobility and emission control regulations are encouraging adoption of electric cube vans. Partnerships between fleet operators and manufacturers are expanding market presence. Increasing consumer demand for timely deliveries and operational efficiency is boosting sales. Strategic focus on after-sales service and vehicle reliability is enhancing market growth.

The market in Germany is anticipated to expand at a CAGR of 10.9%, supported by rising urban logistics, delivery services, and environmentally friendly transportation solutions. Manufacturers are emphasizing electric and hybrid vans, advanced telematics, and automated load management systems. Adoption is growing among last-mile delivery companies, retailers, and small businesses. Strategic alliances between technology providers and vehicle manufacturers are enabling the integration of smart mobility solutions. Government incentives for zero-emission vehicles and regulations on urban emissions are further promoting market expansion.

The United Kingdom market is projected to grow at a CAGR of 9.0%, driven by expansion of e-commerce logistics and small business delivery operations. Manufacturers are focusing on electric, hybrid, and fuel-efficient models equipped with telematics and route optimization technologies. Increasing urban congestion and environmental policies are promoting low-emission vans. Adoption is rising among retailers, courier services, and fleet operators. Strategic collaborations with logistics providers are expanding market reach. Continued innovation in vehicle design, load management, and energy efficiency is expected to support growth.

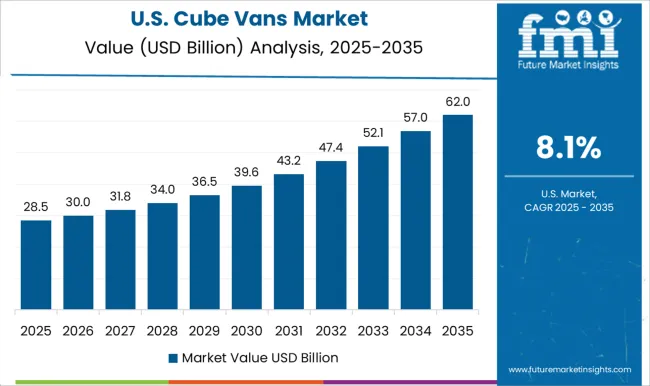

The United States market is forecasted to grow at a CAGR of 8.1%, driven by the increasing demand for last-mile delivery and urban logistics solutions. Manufacturers are introducing electric and hybrid vans, lightweight designs, and telematics-enabled vehicles to meet operational efficiency and emission targets. Expansion of e-commerce and courier services is boosting sales. Strategic partnerships between fleet operators and vehicle producers are facilitating broader adoption. Demand for reliable, fuel-efficient vans and integration of advanced load management systems is expected to support steady growth.

The market is led by prominent automotive manufacturers, including Ford Motor Company, and General Motors Company. Ford delivers a wide range of versatile cube vans designed for urban deliveries, featuring robust payload capacity and fuel-efficient engines. General Motors focuses on durable and reliable vans with advanced telematics and safety features suitable for commercial fleets. Other key players such as Isuzu, Mercedes-Benz Group AG, and Nissan Motor Co. Ltd. emphasize performance, driver comfort, and low total cost of ownership, catering to logistics, retail, and service sectors. Renault, Stellantis NV, and Volkswagen AG offer flexible configurations with electric and diesel options, targeting sustainable commercial operations and compliance with regional emission standards. Rising demand for last-mile delivery solutions, e-commerce growth, and increasing fleet modernization drive innovation and adoption in the Cube Vans market, highlighting the strategic role of technology, efficiency, and operational reliability among leading providers.

| Item | Value |

|---|---|

| Quantitative Units | USD 60.4 Billion |

| Propulsion | ICE and Electric |

| Tonnage Capacity | Below 2 tons, 2 to 3 tons, and Above 3 tons |

| Application | Commercial and Personal |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ford, General Motors (Chevrolet/GMC), Stellantis (Ram), Mercedes-Benz (Sprinter Cab Chassis), Isuzu, Hino, Mitsubishi Fuso, Iveco, Renault Group, Volkswagen Commercial Vehicles |

| Additional Attributes | Dollar sales by van size and payload capacity, demand dynamics across delivery and commercial segments, regional trends in urban logistics adoption, innovation in fuel efficiency and cargo management, environmental impact of emissions, and emerging use cases in e-commerce and last-mile distribution. |

The global cube vans market is estimated to be valued at USD 60.4 billion in 2025.

The market size for the cube vans market is projected to reach USD 149.8 billion by 2035.

The cube vans market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in cube vans market are ice, _petrol, _diesel, _cng, electric, _hev, _bev and _others.

In terms of tonnage capacity, below 2 tons segment to command 45.7% share in the cube vans market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ice Cube Tray Market Trends & Growth Forecast 2024-2034

Stock Cubes Market Size and Share Forecast Outlook 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Air-Cooled Cube Ice Machines Market – Efficient Cooling & Industry Trends 2025-2035

Water Cooled Cube Ice Machines Market - Growth Forecast & Industry Demand 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Remote Cooled Cube Ice Machines Market – Advanced Refrigeration & Industry Growth 2025 to 2035

Water Resistant Packing Cubes Market

Vans Market Size and Share Forecast Outlook 2025 to 2035

Caravans Market Size and Share Forecast Outlook 2025 to 2035

Mini Vans Market

Cargo Vans Market Size and Share Forecast Outlook 2025 to 2035

Electric Vans Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Vans Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA