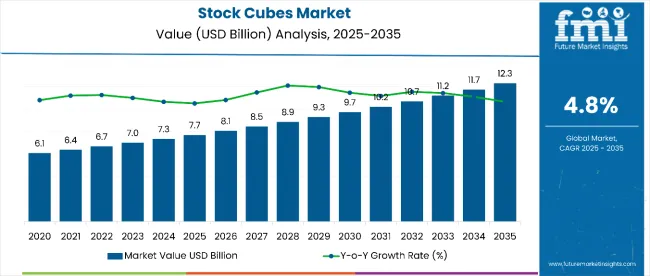

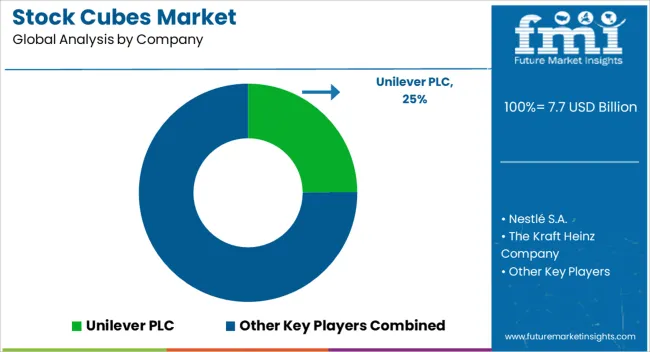

The global stock cubes market is projected to grow from USD 7.7 billion in 2025 to USD 12.3 billion by 2035, reflecting a CAGR of 4.8%. Factors driving this growth include rising demand for convenient food products, increasing preference for ethnic cuisines, and growing awareness of umami flavor enhancement. Additionally, innovation in low-sodium and organic stock cubes is contributing to the expansion of the stock cubes market across various regions.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 7.7 billion |

| Projected Value (2035F) | USD 12.3 billion |

| CAGR (2025 to 2035) | 4.8% |

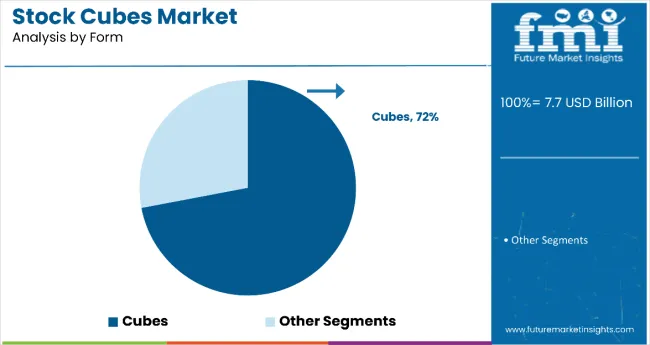

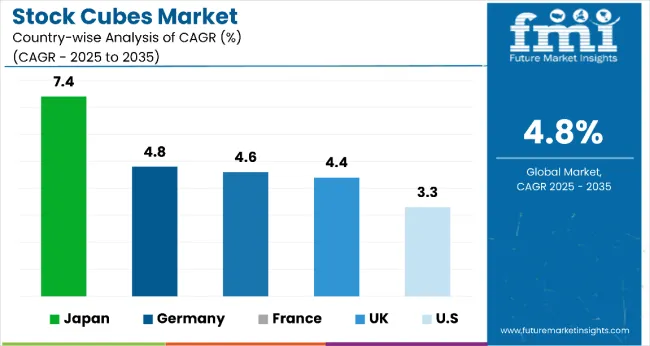

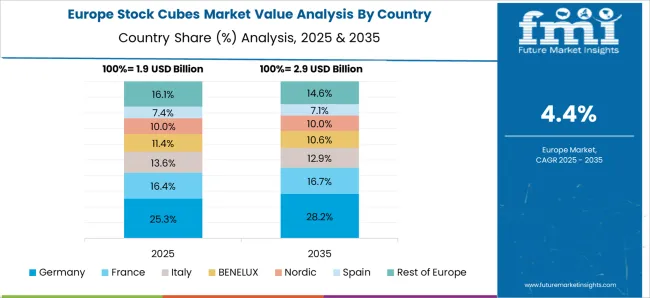

Japan is expected to remain the largest contributor in the stock cubes market, expanding at a significant CAGR of 7.4%, with growth driven by rapid urbanization and health-conscious consumers. Meanwhile, Germany and France follow this growth with prominent CAGRs of 4.8% and 4.6% respectively. By form, the cube segment is anticipated to dominate the market with 72% of the market share, while retail sales (B2B) account for 60% of the market share in 2025.

The stock cubes market holds a niche yet significant position across several parent markets. It accounts for approximately 25% of the global bouillon market, as stock cubes are the most common bouillon format. Within the processed food ingredients market, it represents about 3%, given its narrow application compared to broader categories like thickeners and preservatives.

In the culinary aids market, stock cubes hold a 15% share, driven by their widespread use in home and commercial cooking. They contribute nearly 5% to the seasoning and flavor enhancers market, and make up around 2% of the larger packaged food market globally.

The stock cubes market is expected to evolve further through innovations in organic formulations, zero-salt variants, and plant-based ingredients. Government guidelines encouraging sodium reduction and clean labeling are influencing product development. In addition, packaging innovations and e-commerce expansion are reshaping the consumer purchase experience, while sustainability initiatives in sourcing practices continue to shape the industry outlook.

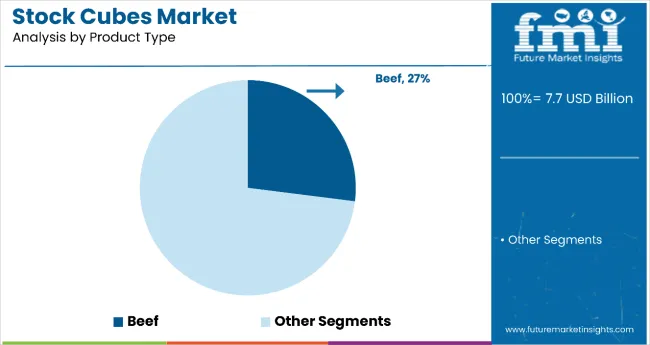

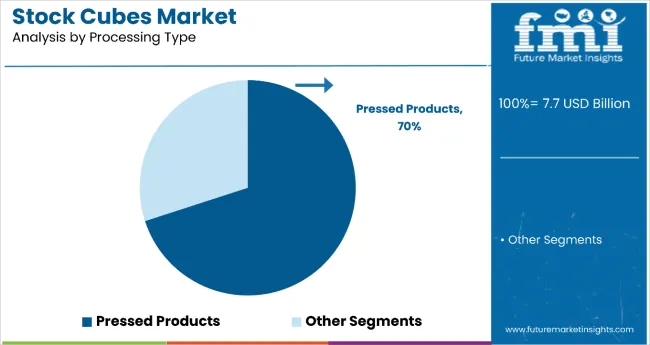

The market is segmented into product type, nature, form, sales channel and region. By product type, it is segmented into vegetable, fish, pork, chicken, beef, and others (lamb, ham). By nature, it is segmented into organic, vegan and conventional. By form, it includes cubes and tablets. By processing type, it is segmented into pressed products and extruded products.

By packaging format, it includes box, packet/sachet and jars (plastic & glass). By sales channel, it is segmented into food processing companies/brands, private label brands, food service (HoReCa), retail sales (B2C) including online and store-based retailing such as convenience stores, discount stores, hypermarkets/supermarkets, specialty stores, independent small grocers, other grocery retailers, non-grocery retailers, pop-up stores, and mixed retailers. By region, it covers North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East & Africa.

Beef stock cubes lead the product type segment with a 27% share in 2025. Their popularity is driven by their protein content, flavor depth, and versatility across cuisines. Chicken and vegetable cubes follow due to widespread application in home cooking and processed meals. Pork and fish cubes continue to serve niche culinary requirements, especially in regional dishes. The "others" segment, including lamb and ham, holds a modest share due to limited regional preference and premium pricing.

Conventional stock cubes dominate the nature segment with an 84% share in 2025. Their wide availability, affordability, and established consumer trust make them the go-to option for many households. Organic and vegan cubes are gaining traction, especially among health-conscious consumers. Vegan options are rising in popularity due to plant-based trends, while organic cubes appeal to clean-label seekers despite higher costs.

Cube form is the preferred format, accounting for over 72% of the market share in 2025. Their compact shape, easy measurement, and solubility make them ideal for home and foodservice use. Tablet forms are used less frequently due to slower dissolution rates and limited visibility in the retail sector. Cubes remain the default form factor due to their long-standing presence and ease of use in global cuisines.

Pressed products lead the processing type segment with nearly 70% of the market in 2025. They are preferred due to long shelf life, ease of packaging, and firm structure that holds shape during transport. Extruded products are typically used for budget lines or custom blends, though they are less stable in high-moisture conditions. Pressed products dominate shelves globally thanks to efficient branding and retail compatibility.

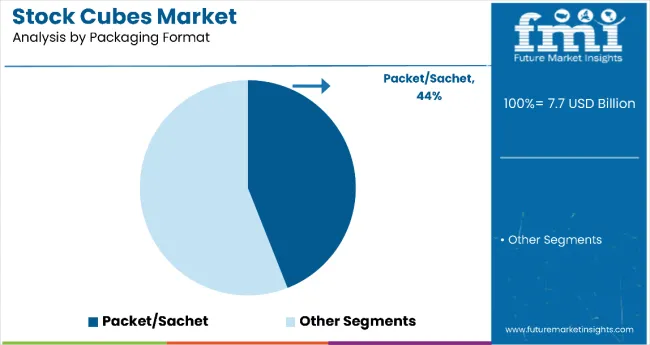

Packet/sachet format leads this segment with around 44% market share in 2025. Its single-serve convenience, affordability, and low packaging cost make it ideal for mass-market sales. Box packaging follows closely, especially in developed markets. Jar formats, both plastic and glass, serve premium brands and specialty stores, where visual appeal and resealability are key. Glass jars are gaining popularity in the organic product line.

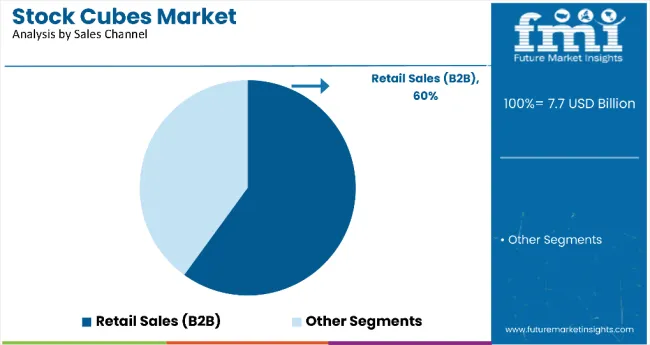

Retail sales (B2C) dominate the stock cubes market with over 60% share in 2025, driven by hypermarkets/supermarkets and online platforms. Among store-based retailing, supermarkets and discount stores account for a significant volume. Online retailing is the fastest-growing sub-channel, especially for organic and vegan cubes. Foodservice (HoReCa) and food processing companies provide bulk demand, particularly for chicken and beef variants.

Recent Trends in the Stock Cubes Market

Key Challenges in the Stock Cubes Market

In the stock cubes market, Japan is projected to register the fastest growth with a CAGR of 7.4% from 2025 to 2035, driven by rising urbanization and demand for umami-rich, health-focused products. Germany follows with a 4.8% CAGR, supported by the preference for organic and allergen-free offerings.

France and the UK are expected to grow at 4.6% and 4.4% respectively, owing to increasing demand for clean-label and plant-based options. The USA lags slightly behind with a 3.3% CAGR, where growth is sustained by ethnic cuisine trends and online retail expansion. Overall, Asia is outpacing Western markets in innovation and demand.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

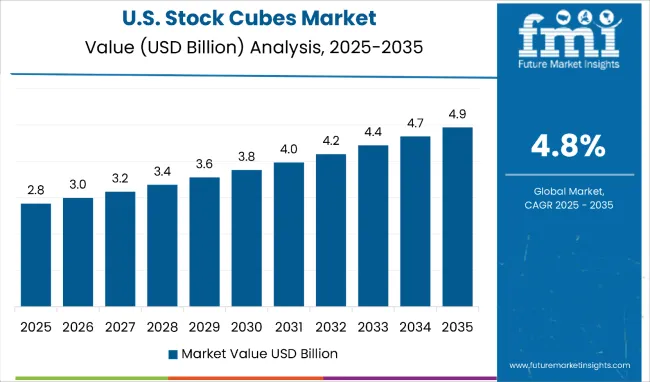

The stock cubes revenue in the USA is projected to expand at a CAGR of 3.3% from 2025 to 2035. Growth will be driven by the increasing popularity of ethnic cuisines, where flavor bases like stock cubes are essential. Rising health awareness is accelerating the demand for low-sodium and organic alternatives. E-commerce platforms and large retailers will continue to serve as the dominant distribution channels across urban and suburban markets.

The stock cubes market in the UK is anticipated to rise at a CAGR of 4.4% between 2025 and 2035. British consumers increasingly seek quick and healthy meal solutions, driving demand for convenient products like stock cubes. Growth in veganism and plant-based eating habits is leading to innovation in meat-free flavor enhancers. Heightened awareness regarding sodium intake is also shaping consumer preferences.

The sales of stock cubes in Germany are slated to flourish at a CAGR of 4.8% during the period 2025 to 2035. German consumers prioritize natural and bio-certified food products, creating a strong base for organic and allergen-free stock cubes. Supermarkets, discount chains, and online grocery platforms are key retail points. The growing interest in vegan culinary products is expected to further support segment expansion.

The revenue from stock cubes in France is forecasted to expand at a CAGR of 4.6% from 2025 to 2035. Demand remains stable due to the fundamental role of broths and sauces in traditional French cooking. Organic, clean-label, and low-sodium variants are witnessing greater shelf space in mainstream retail. French brands continue to enjoy strong loyalty, but private label and artisanal options are gaining visibility.

The stock cubes market in Japan is predicted to expand rapidly at a CAGR of 7.4% between 2025 and 2035. This growth will be supported by rising urbanization, dual-income families, and increasing demand for fast, nutritious meal ingredients. Japanese consumers prioritize low-sodium, umami-rich, and health-supportive stock cube variants. Domestic brands continue to innovate with functional, premium formulations tailored to local preferences.

The stock cubes market is moderately fragmented, with multinational corporations and regional players vying for shelf space and consumer loyalty. Key global leaders such as Unilever PLC, Nestlé S.A., The Kraft Heinz Company, and Ajinomoto Co., Inc. command strong brand recognition and wide distribution networks. These companies are leveraging innovation in clean-label ingredients, plant-based stock formulations, and sodium-reduction technologies to stay competitive.

Companies are competing aggressively through pricing, health-forward product innovation, strategic acquisitions, and expanding their presence across emerging markets via regional partnerships. Firms like Premier Foods and GBfoods Group are focusing on premiumization and ethnic flavor profiles, while others like Kallo Foods Ltd. and BOU Brand LLC emphasize organic, vegan, and gluten-free offerings.

Retail partnerships, regional manufacturing footprints, and flavor diversification remain central to market expansion efforts. Private label growth, especially by TESCO PLC, is creating added pressure on pricing, prompting major players to double down on product differentiation and loyalty marketing.

Recent Stock Cubes Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 7.7 billion |

| Projected Market Size (2035) | USD 12.3 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in kilotons |

| By Product Type | Vegetable Stock Cubes, Chicken Stock Cubes, Beef Stock Cubes, Fish Stock Cubes, Others |

| By Nature | Organic, Vegan, Conventional |

| By Form | Cubes, Tablets |

| By Processing Type | Pressed Products, Extruded Products |

| By Packaging Format | Box, Packet/Sachet, Jars (Plastic, Glass) |

| By Sales Channel | Food Processing Companies/Brands, Private Label Brands, Food Service (HoReCa), Retail Sales (B2C) (Online Retailing, Store-Based Retailing) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa, Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ Countries |

| Key Players | Unilever PLC, Nestlé S.A., The Kraft Heinz Company, Bell Food Group, Hormel Foods Corporation, Kallo Foods Ltd., PREMIER FOODS, Ajinomoto Co., Inc., BOU Brand LLC, CALDOS DEL NORTE SL, GBfoods Group, IMANA FOODS (SA) (PTY) LTD, Edwards & Sons Trading Company, Inc., Goya Foods, Inc., Promasidor, Patisen, Doyin Group, Daily-Need Group, TESCO PLC. |

| Additional Attributes | Dollar sales by value, market share analysis by segments, and country-wise analysis |

The global stock cubes market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the stock cubes market is projected to reach USD 12.3 billion by 2035.

The stock cubes market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in stock cubes market are vegetable, fish, pork, chicken, beef and others (lamb, ham).

In terms of nature, organic segment to command 42.7% share in the stock cubes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stock Trading App Market Size and Share Forecast Outlook 2025 to 2035

Stock Tank Market Size and Share Forecast Outlook 2025 to 2035

Stock Clamshell Packaging Market

Livestock Panel Gates Market Size and Share Forecast Outlook 2025 to 2035

Livestock Trailer Market Size and Share Forecast Outlook 2025 to 2035

Livestock Monitoring System Market

Global Live Stock Vaccine Market Analysis – Size, Share & Forecast 2024-2034

Rolling Stock Management Market Forecast Outlook 2025 to 2035

Rolling Stocks Market Size and Share Forecast Outlook 2025 to 2035

Wire Livestock Panels Market Size and Share Forecast Outlook 2025 to 2035

PAG Base Stock Market Size and Share Forecast Outlook 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Peelable Lid Stock Market Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market Size and Share Forecast Outlook 2025 to 2035

Polycoated Cup Stock Market Size and Share Forecast Outlook 2025 to 2035

Metallized Rollstock Film Market Size, Growth, and Forecast 2025 to 2035

Industry Share Analysis for Polycoated Cup Stock Companies

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA