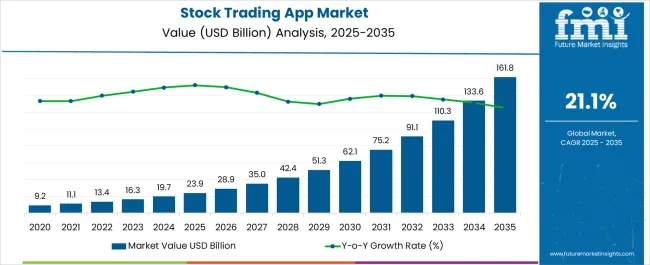

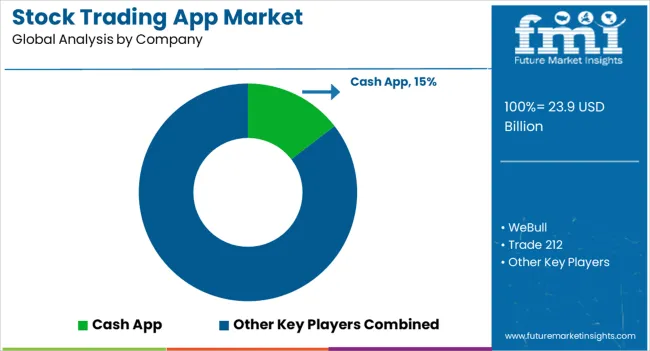

The Stock Trading App Market is estimated to be valued at USD 23.9 billion in 2025 and is projected to reach USD 161.8 billion by 2035, registering a compound annual growth rate (CAGR) of 21.1% over the forecast period.

| Metric | Value |

|---|---|

| Stock Trading App Market Estimated Value in (2025 E) | USD 23.9 billion |

| Stock Trading App Market Forecast Value in (2035 F) | USD 161.8 billion |

| Forecast CAGR (2025 to 2035) | 21.1% |

The stock trading app market is expanding rapidly, driven by growing retail participation in equity and derivative markets, supported by increasing smartphone penetration and improving internet connectivity. Financial news outlets and company disclosures have emphasized the rising preference for mobile-first platforms that allow real-time trading, portfolio tracking, and access to financial education resources.

The proliferation of low-commission or commission-free models has widened accessibility for new investors, particularly in emerging economies. Additionally, integration of advanced features such as AI-powered insights, algorithmic trading support, and seamless payment gateways has enhanced user adoption.

Press releases from fintech firms have highlighted strong capital inflows into trading app development, underscoring investor confidence in the sector’s long-term growth. Regulatory frameworks in multiple regions are also being refined to ensure user protection, further strengthening market credibility. Looking forward, growth is expected to be supported by Android-based platforms due to their accessibility and reach, while individuals continue to dominate end-user adoption as retail trading culture matures worldwide.

Demand for stock trading apps is driven by cloud-integrated stock trading apps. Cloud-based financial solutions offer numerous advantages. Additionally, stock trading apps provide performance, analytics, and analyses of the stock trading app market's financial status.

Numerous tasks can be accomplished with stock trading apps solution risk management. Monitoring and intelligence features are available on the platform. These elements might boost stock trading app market profit.

In enterprises, there is driving demand for stock trading apps. Further, there is a high demand for data-driven financial decision-making tasks. The stock trading apps' reports and features are useful to any business. These reports' precision and efficiency aid in making better decisions.

The market's end users include banks, financial institutions, and accounting firms. The market's demand for these end-users is increasing as the stock trading app's market fluctuations and risks are analyzed by the stock trading app. The stock trading apps can send alerts to assist with transaction processing. All of these advantageous features contribute to significant stock trading app growth.

Stock trading apps can protect users from financial risk and fraud. This exceptional solution aids in the regulation of stock trading apps-critical financial decisions. Compliance with regulatory requirements, on the other hand, is a stumbling block.

In the stock trading app, there are several rules and a standard. Stock trading apps necessitate proper and skilled use. Further, the stock trading apps market's changing compliance standards can stifle growth as well as future trends of stock trading apps. Also, decisions may differ depending on the compliances and standards.

Poor stock trading app management can result in financial losses. These difficulties in the stock trading app market negatively affect the adoption of stock trading apps.

Growing digitization in various industries creates market growth along with market opportunities. These factors are to blame for the stock trading app's increased penetration to influence the stock trading apps market adoption trends. Further, the rise of big data is increasing the demand for stock trading apps.

The growing digitization provides many app market opportunities. Furthermore, the key players are taking the initiative to improve the stock trading app to affect the market trends. Furthermore, stock trading app awareness might grow in the coming years. Various banks contribute to the creation of camp gains and programs to increase product awareness resulting in market opportunities.

BI and analytics are driving factors in the market. Stock trading apps' operations might be expanded by BI and analytics. Further, the stock trading app includes features such as knowledge measurement, KPI functions, analytics, and reporting. The stock trading apps market's services are likely to expand as a result of this BI.

Large-scale industries are likely to drive demand for stock trading apps. All of these market expansions and market opportunities might have a significant impact on market growth. Further, business intelligence has the potential to take the stock trading app market to the next level of financial services. Also, these market developments are going to result in high revenue rates.

The professional traders lead the stock trading app market share based on end users with a projected market share of 52% through 2035. The individuals category is estimated to hold a CAGR of 22.2% through 2035 by end users in the stock trading app market.

The Android segment leads the market share by platform, with a market share of 50.7% by 2035. The iOS segment holds the market by platform with a projected CAGR of 24.0% through 2035.

North America is estimated to have a great stock trading app market share. It is a significant player in the global stock trading apps market. This region has a high awareness of the market.

Using the stock trading app, the market increases customer satisfaction in financial institutions. Further, the region has more investment in North America. In the market, added features and upgrades are prevalent. Furthermore, North America has a few compliance issues. The presence of key players results in a significant rate of adoption of stock trading apps.

The stock trading apps market might see the addition of new features and services in the coming years. Also, the market is segmented into key regional players such as Asia Pacific, Europe, and North America.

There is a great deal of interest in the market. Market-empowering innovations and upgrades are also going to result in notable market growth.

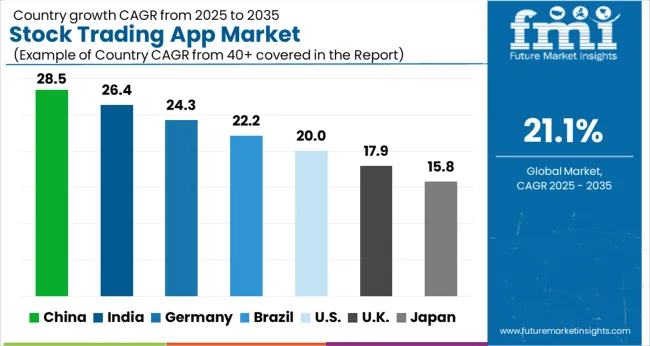

The stock trading apps market is likely to expand significantly in the Asia Pacific region. China, Japan, and India are the market’s three most important players. Furthermore, big analytics is a highly sought-after solution in China.

The stock trading app market’s primary driving force is the demand for stock trading apps and analytical technology. Moreover, banks and institutions are significantly expanding in India surging market opportunities. In addition, high-growth nations are merging in Europe and Latin America to affect the market's key trends and opportunities.

The stock trading app market is becoming increasingly competitive. In a competitive market, market expansion, acquisitions, mergers, and collaborations are more common.

The adoption of stock trading apps is being witnessed by central financial systems. In these regions of the market, the stock trading app is witnessing market future trends and becoming widely used.

Companies primarily focus on providing stock trading apps with a zero-based budget methodology. Further, the key market players are promoting the significant development of wealth management apps.

Several companies offer built-in intelligence-based financial solutions. Moreover, rising global demand for Android and Apple iOS-based devices in the stock trading app market might create key market opportunities for global key players. Also, the key market players are working on a transparent financial analysis app.

Recent Developments:

Cash App has revealed its intention to let customers deposit their salaries directly into the app. This change might make it simple for Cash App customers to manage their money and make stock investments by allowing them to have their wages directly transferred into their Cash App accounts.

Start-ups:

Established Vendors:

The global stock trading app market is estimated to be valued at USD 23.9 billion in 2025.

The market size for the stock trading app market is projected to reach USD 161.8 billion by 2035.

The stock trading app market is expected to grow at a 21.1% CAGR between 2025 and 2035.

The key product types in stock trading app market are android, ios and others.

In terms of end user, individuals segment to command 64.7% share in the stock trading app market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stock Cubes Market Size and Share Forecast Outlook 2025 to 2035

Stock Tank Market Size and Share Forecast Outlook 2025 to 2035

Stock Clamshell Packaging Market

Livestock Panel Gates Market Size and Share Forecast Outlook 2025 to 2035

Livestock Trailer Market Size and Share Forecast Outlook 2025 to 2035

Livestock Monitoring System Market

Global Live Stock Vaccine Market Analysis – Size, Share & Forecast 2024-2034

Rolling Stocks Market Size and Share Forecast Outlook 2025 to 2035

Rolling Stock Management Market Growth – Trends & Forecast 2024-2034

Wire Livestock Panels Market Size and Share Forecast Outlook 2025 to 2035

PAG Base Stock Market Size and Share Forecast Outlook 2025 to 2035

Peelable Lid Stock Market Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market - Trends & Forecast 2034

Polycoated Cup Stock Market Size and Share Forecast Outlook 2025 to 2035

Metallized Rollstock Film Market Size, Growth, and Forecast 2025 to 2035

Industry Share Analysis for Polycoated Cup Stock Companies

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments and Stockings Market Analysis - Size, Share, and Forecast 2025 to 2035

AI Trading Platform Market Trends – Growth & Industry Outlook 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA