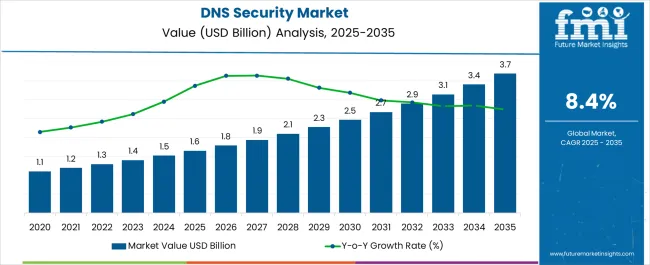

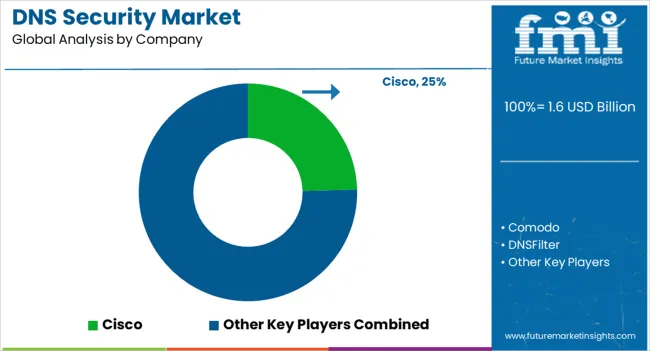

The DNS Security Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| DNS Security Market Estimated Value in (2025 E) | USD 1.6 billion |

| DNS Security Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The DNS security market is expanding rapidly as enterprises confront escalating cyber threats, phishing attacks, and malware infiltration through domain name system vulnerabilities. Cloud adoption, remote working, and digital transformation have intensified the reliance on DNS infrastructure, thereby increasing the demand for security solutions that safeguard business continuity.

Continuous advancements in threat intelligence integration, machine learning, and automated response mechanisms are enhancing the efficacy of DNS security platforms. Regulatory mandates for data protection and privacy compliance are further encouraging organizations to adopt robust DNS security measures.

With cybercriminals exploiting DNS as a frequent attack vector, enterprises are prioritizing DNS security as a foundational layer of their cybersecurity architecture. The outlook remains strong as investments in cloud-based platforms and scalable enterprise-grade solutions position DNS security as a critical enabler of digital trust and resilience.

The cloud based DNS security software segment is expected to account for 57.30% of the total market revenue by 2025 within the deployment category, making it the leading segment. Growth in this area is driven by the scalability, flexibility, and lower upfront infrastructure costs that cloud solutions provide.

Enterprises have increasingly preferred cloud platforms due to their ability to deliver real time threat detection and updates across distributed networks. The rapid shift to hybrid and remote work models has further reinforced the need for secure, cloud enabled DNS protection to support mobile workforces and global operations.

With faster deployment capabilities and seamless integration into existing IT ecosystems, cloud based solutions continue to dominate the deployment landscape.

The large enterprises segment is projected to hold 62.50% of total market revenue by 2025 within the enterprise size category, positioning it as the most dominant. This is attributed to the higher exposure of large organizations to cyber threats, coupled with their complex IT infrastructures and expansive global networks.

Large enterprises possess greater budgets for cybersecurity investment, enabling adoption of advanced DNS security tools with analytics, automation, and threat intelligence capabilities. Additionally, regulatory compliance requirements and reputational risk management are compelling large organizations to prioritize DNS security.

Their established IT teams and resources have also facilitated faster implementation and scaling of robust security solutions, reinforcing their leadership in this segment.

The IT and telecom industry segment is expected to represent 41.80% of total market revenue by 2025, establishing it as the leading industry. This dominance is driven by the high volume of sensitive data traffic managed by telecom operators and IT service providers, making them primary targets for DNS based attacks.

The demand for uninterrupted connectivity, secure service delivery, and customer trust has intensified investment in DNS security solutions. IT and telecom companies are also at the forefront of cloud adoption, 5G deployment, and digital infrastructure development, all of which require robust DNS protection.

The convergence of large user bases, high value data, and mission critical service delivery continues to position IT and telecom as the largest industry contributor to DNS security adoption.

According to Future Market Insights (FMI), the DNS security demand is estimated to grow at 8.4% CAGR between 2025 and 2035 as compared to 6.3% CAGR during the historic period of 2020 to 2025.

Growth in the market is underpinned by the adoption of the traditional firewall was prominent historically. DNS security or DNS Security Extension (DNSSEC) protects the organization against cyber-attacks by filtering out unwanted content and blacklisting malicious sites.

DNS security provides an additional layer of protection to the network. Also, it offers an authentication method for DNS data protection. It helps to protect the organization from denial of service (DOS), distributed denial of service (DDoS), DNS amplification, and DNS-related cyber-attacks.

By preventing DDoS attacks, cloud-based DNS security software offers benefits such as resiliency, scalability, and security. Cloud-based DNS security software also makes it easier for businesses to set up the DNSSEC which provides a cryptographic means of validating DNS records and providing protection against typical DNS security assaults.

Cloud-based DNS security software allows for better network monitoring and visibility, as well as simple and convenient network setup adjustments for businesses. As a result of this, a number of small and mid-sized enterprises are accepting that cloud deployment is an effective platform for DNS security software implementation.

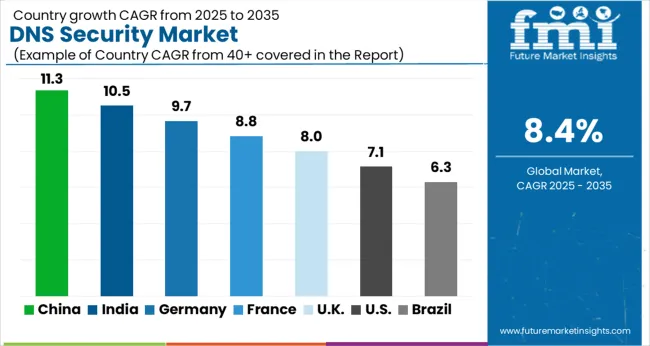

The DNS security market in South Asia and Pacific is expected to grow at the fastest rate. During the forecast period, the region is expected to grow by 10.8% CAGR, as countries such as India and China are being driven by improved security regulatory reforms.

However, North America is expected to account for the largest market share of 29.9% in 2025 in the DNS security market. Early adoption of the DNS security solutions and the presence of major network security vendor world drive market growth in the region. The organizations in the developed region are increasingly implementing DNS security solutions to recognize and prevent threats at the initial stages.

India DNS Security Market to Lead the Global Market through 2025 & beyond

The DNS security demand in India is expected to account for nearly 35% of the South Asia & Pacific market share through 2035. In 2024, India was the most impacted country in terms of DNS attacks. Major industries in India that are prone to cyber-attacks include telecom & IT, banking, healthcare, retail, e-commerce, among others.

For instance, as per FMI analysis, in May 2024, there was an increase in data theft through DNS-based attacks, with 26% of firms reporting that customer’s sensitive information was stolen by cyber-criminals in India. Hence, due to such factors, large enterprises and SMEs in India will continue to adopt DNS security solution to prevent network-based attacks.

Growing Cyber Security Awareness in the USA to Push DNS Security Market

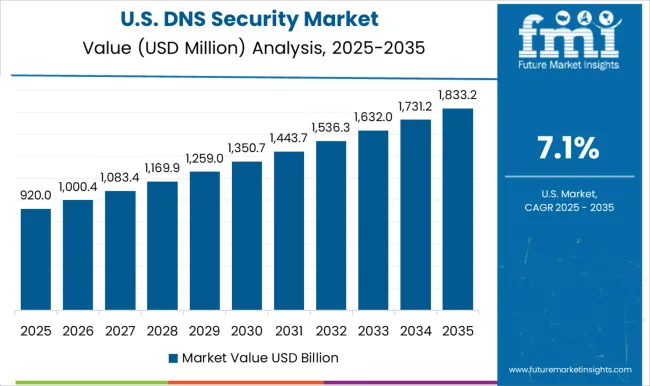

During the forecast period, the USA is expected to account for the largest market share of 72% in 2025 in North America DNS security market.

Increasing adoption of cloud-based DNS security solutions with DNS load balancing, multi DNS functionality, and DDoS protection capabilities are the major drivers of the DNS security market in the USA The untapped opportunities and growing awareness about cyber security among the country's users are estimated to drive growth in the USA market.

For an instance in March 2025, the USA government advised USA firms to enhance their cybersecurity policies as there is a chance of a cyber-attack from Russia for harming the economy of the country, due to Russia-Ukraine conflict. As a result, there will be an increase in adoption of DNS security solutions from North American organizations. Also, the growing small business industry is creating opportunities for growth that will enhance the DNS security market's growth throughout the forecast period.

Implementation of Comprehensive Cybersecurity Policies in South Korea to Boost DNS Security Market

Sales revenue in South Korea is estimated to grow at an impressive rate of around 9.8% CAGR between 2025 and 2035. South Korea is one of the most digitally connected and developing nations in the world.

Over the last three years, South Korea government has established better and more comprehensive cybersecurity policies focused on ensuring the capability to prepare, respond, and recover in both the private and public sectors.

South Korea has experienced large volume of cyber-attacks over the years. For instance, in June 2024, The Korean Atomic Energy Research Institute (KAERI), has claimed that it was hacked by the North Korean advanced persistent threat (APT) Group “Kimsuky”.

Due to such factors, South Korean private and public sector organizations will continue to implement DNS security solution, during the forecast period.

| Countries | BPS Change (H2'22 (O) - H2'22 (P)) |

|---|---|

| USA | (+)25 |

| Germany | (+)24 |

| South Korea | (+)22 |

| Indian | (+)26 |

| China | (+)23 |

The H2’22(O)-H2’22(P) BPS change in South Korea was of (+)22 units attributed to the rise in cyber-attacks and threats such as DDoS (Distributed Denial of Service), malware, phishing, and others is increasing the demand for DNS security solutions. Where as in India the widespread adoption of cloud computing and other Internet of Things (IoT) technologies has increased the need for secure and reliable DNS infrastructure leading to the deviation of (+)26 units.

The development of new and advanced DNS security solutions, such as DNSSEC (Domain Name System Security Extensions), is fuelling the growth of the market resulting in China a BPS change of (+)23 units.

Germany encountered a BPS change of (+)24 units for the IoT connectivity management platform market as the organizations becoming increasingly aware of the importance of DNS security, they are investing in solutions to secure their networks against cyber threats.

USA witnessed a BPS of (+)25 BPS units for the IoT connectivity management platform market owing to the implementation of strict government regulations such as the California Consumer Privacy Act (CCPA) is driving the demand for DNS security solutions to comply with data protection regulations.

Over 2 Out of 5 DNS Security Sales to be contributed by DNS Security Software

The cloud-based DNS security software segment accounted for around 43.7% market share in the global DNS security market in 2025. However, the segment is likely to grow by 2.5X between 2025 & 2035. The rising application of digital technologies such as AI/ML, IoT, and others are compelling industries to adopt such cloud-based network security solutions.

Enterprises are changing their applications and workload to cloud infrastructure, which offers features like cost-effectiveness, reliability, and scalability. Cloud-based DNS security solution allows businesses to scale up quickly with the help of real-time network configuration, monitoring with enhanced scalability and agility. Due to these reasons, the adoption of cloud-based DNS security solution is set to grow the highest.

Burgeoning Incidence of Cyber-Attacks in SMEs to Augment DNS Security Software Adoption

The SMEs segment is expected to grow by 2.3X during the forecast period, in the overall DNS security market. Furthermore, due to the increased digitalization across the globe, the segment is expected to showcase a strong growth over the upcoming years.

SMEs are highly investing in DNS security solutions to protect their networks against DDoS attacks and other threat vectors that might compromise the IT networks for the risk of being attacked. This rising awareness about DNS attacks, advanced cyber-attacks are directly impacting a company’s productivity and brand reputation. DNS security helps SMEs to improve data security and also helps to reduce financial losses.

Surging Cyber-Attacks Due to Large Volume of Data to Increase DNS Security Solution Sales

In telecom industry, large volume of customer data and information are generated and stored within telecom network infrastructures. This data includes customer’s identity, payment and account details and other sensitive information. Hence, to gain access to such critical customer data, telecom industry is one of the highly targeted industry for network breaches and DNS-based attacks.

As per FMI analysis, nearly 2/3rd of major communication service providers in India have noticed network-based cyber-attacks in 2024, where DNS attacks are prominent one. These attacks also affected telco’s service continuity due to network and service downtime. Service downtime and data breaches are harming the organization’s reputation and trust which results in high customer churn rates. To preventing from cyber and DNS attacks telecom companies are implementing the DNS security solutions, globally.

DNS security market players are focusing on various strategies for increasing their investments in research and development to upgrade their technologies as per the market requirement. Also, several organizations are acquiring and entering into a partnership with other companies to develop their own DNS security solution to serve the customer demand.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 3.7 billion |

| CAGR (2025 to 2035) | 8.4% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand deployments for volume |

| Deployment Models Analyzed (Segment 1) | Cloud-based DNS Security Software, On-premises DNS Security Software |

| Enterprise Sizes Analyzed (Segment 2) | Large Enterprises, Small and Medium-sized Enterprises (SMEs) |

| Industries Analyzed (Segment 3) | IT & Telecom, BFSI, Healthcare, Manufacturing, Retail, Government, Others |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, UAE, South Africa |

| Key Players influencing the DNS Security Market | Cisco, Comodo, DNSFilter, Webroot, Infoblox, TitanHQ, EfficientIP, Akamai, MXToolBox, F5 Networks, BlueCat, Neustar, CSIS Security Group |

| Additional Attributes | Dollar sales increase led by SME cybersecurity investments, cloud-based DNS security gaining traction for scalability, telecom sector driving mission-critical adoption, DDoS and DNS-layer protection advancing, digital transformation accelerating demand across BFSI and healthcare industries. |

| Customization and Pricing | Customization and Pricing Available on Request |

The global dns security market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the dns security market is projected to reach USD 3.7 billion by 2035.

The dns security market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in dns security market are cloud-based dns security software and on-premises dns security software.

In terms of enterprise size, large enterprises segment to command 62.5% share in the dns security market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DNS DHCP And IPAM Market

Domain Name System (DNS) Firewall Market

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA