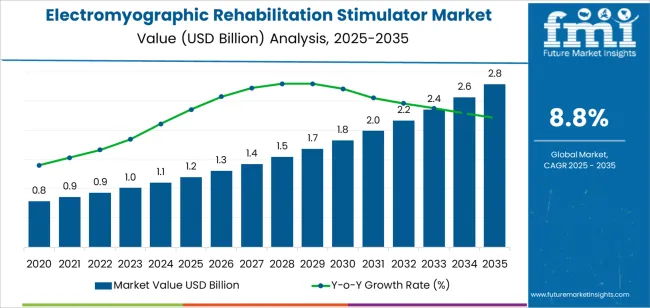

The global electromyographic rehabilitation stimulator market is valued at USD 1.2 billion in 2025. It is slated to reach USD 2.8 billion by 2035, recording an absolute increase of USD 1,608.5 million over the forecast period. This translates into a total growth of 132.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8.8% between 2025 and 2035. The overall market size is expected to grow by nearly 2.32X during the same period, supported by increasing incidence of neurological disorders and stroke cases, growing adoption of advanced rehabilitation technologies in clinical settings, and rising emphasis on functional recovery and patient mobility restoration across diverse healthcare facilities, rehabilitation centers, and home healthcare applications.

Between 2025 and 2030, the electromyographic rehabilitation stimulator market is projected to expand from USD 1.2 billion to USD 1,851.8 million, resulting in a value increase of USD 637.2 million, which represents 39.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing stroke prevalence and spinal cord injury cases requiring specialized rehabilitation interventions, rising adoption of neuromuscular electrical stimulation protocols, and growing demand for portable rehabilitation devices in outpatient and home healthcare settings. Healthcare providers and rehabilitation specialists are expanding their electromyographic stimulation capabilities to address the growing demand for evidence-based rehabilitation solutions that ensure functional recovery and neurological improvement.

From 2030 to 2035, the market is forecast to grow from USD 1,851.8 million to USD 2.8 billion, adding another USD 971.3 million, which constitutes 60.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of robotic rehabilitation systems integrating electromyographic feedback, the development of artificial intelligence-driven stimulation protocols for personalized therapy, and the growth of specialized applications for geriatric neurological care and sports injury rehabilitation. The growing adoption of telerehabilitation platforms and remote patient monitoring will drive demand for connected electromyographic stimulators with enhanced functionality and therapeutic precision features.

Between 2020 and 2025, the electromyographic rehabilitation stimulator market experienced steady growth, driven by increasing recognition of neuromuscular electrical stimulation benefits and growing adoption of these devices as essential tools for neurological rehabilitation and muscle function restoration in diverse clinical and therapeutic applications. The market developed as rehabilitation specialists and neurologists recognized the potential for electromyographic technology to facilitate motor relearning, prevent muscle atrophy, and support functional recovery while meeting patient safety requirements. Technological advancement in stimulation waveforms and electrode design began emphasizing the critical importance of maintaining precise muscle activation and patient comfort in challenging rehabilitation environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.2 billion |

| Forecast Value in (2035F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

Market expansion is being supported by the increasing global incidence of neurological conditions and traumatic injuries driven by aging populations and lifestyle factors, alongside the corresponding need for advanced rehabilitation technologies that can restore motor function, prevent muscle deterioration, and maintain functional independence across various stroke recovery, spinal cord injury rehabilitation, and postoperative care applications. Modern rehabilitation centers and neurological clinics are increasingly focused on implementing electromyographic stimulation solutions that can accelerate functional recovery, enhance neuroplasticity, and provide consistent therapeutic outcomes in demanding clinical conditions.

The growing emphasis on evidence-based rehabilitation and functional outcomes is driving demand for electromyographic stimulators that can support targeted muscle activation, enable objective progress monitoring, and ensure comprehensive neurological recovery. Healthcare providers' preference for therapeutic devices that combine clinical effectiveness with patient safety and treatment adherence is creating opportunities for innovative electromyographic stimulation implementations. The rising influence of value-based healthcare models and patient-centered rehabilitation programs is also contributing to increased adoption of electromyographic stimulators that can provide measurable functional improvements without compromising treatment accessibility or care quality.

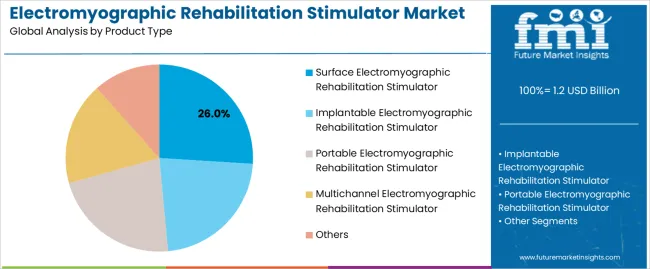

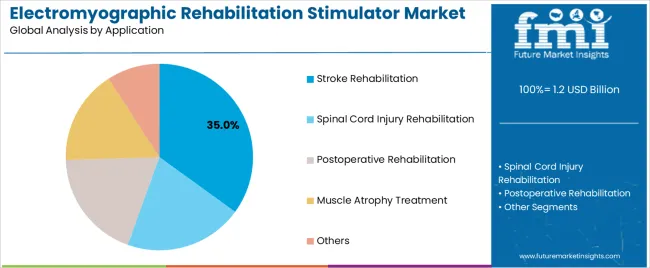

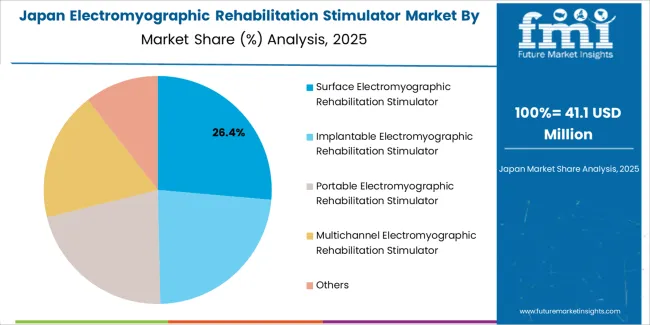

The market is segmented by product type, application, and region. By product type, the market is divided into surface electromyographic rehabilitation stimulator, implantable electromyographic rehabilitation stimulator, portable electromyographic rehabilitation stimulator, multichannel electromyographic rehabilitation stimulator, and others. Based on application, the market is categorized into stroke rehabilitation, spinal cord injury rehabilitation, postoperative rehabilitation, muscle atrophy treatment, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The surface electromyographic rehabilitation stimulator segment is projected to maintain its leading position with 28% market share in the electromyographic rehabilitation stimulator market in 2025, reaffirming its role as the preferred product category for non-invasive neuromuscular rehabilitation and functional electrical stimulation applications. Rehabilitation specialists and physiotherapists increasingly utilize surface electromyographic stimulators for their ease of application, proven therapeutic effectiveness, and ability to deliver targeted muscle activation while maintaining patient comfort and treatment safety. Surface stimulator technology's proven effectiveness and application versatility directly address the industry requirements for accessible rehabilitation interventions and clinically validated therapeutic solutions across diverse patient populations and neurological conditions.

This product segment forms the foundation of modern neuromuscular rehabilitation programs, as it represents the device category with the greatest contribution to non-invasive functional recovery and established clinical evidence record across multiple neurological disorders and rehabilitation protocols. Healthcare industry investments in outpatient rehabilitation services continue to strengthen adoption among physical therapy clinics and rehabilitation centers. With demographic trends requiring increased stroke rehabilitation capacity and improved functional outcomes, surface electromyographic rehabilitation stimulators align with both clinical effectiveness objectives and patient acceptance requirements, making them the central component of comprehensive neurological rehabilitation strategies.

The stroke rehabilitation application segment is projected to represent 35% share of electromyographic rehabilitation stimulator demand in 2025, underscoring its critical role as a primary driver for device adoption across stroke units, rehabilitation hospitals, and specialized neurological recovery centers. Healthcare professionals prefer electromyographic stimulation for stroke rehabilitation due to its proven ability to facilitate motor recovery, improve muscle strength, and enhance functional independence while supporting neuroplasticity and motor relearning processes. Positioned as essential technologies for modern stroke care, electromyographic rehabilitation stimulators offer both therapeutic advantages and clinical evidence support.

The segment is supported by continuous innovation in stroke rehabilitation protocols and the growing availability of advanced stimulation devices that enable personalized therapy programs with enhanced recovery outcomes and improved patient quality of life. Additionally, stroke centers are investing in comprehensive electromyographic stimulation integration programs to support increasingly complex rehabilitation pathways and patient demand for effective functional recovery interventions. As healthcare systems emphasize stroke survival rates and long-term disability reduction, the stroke rehabilitation application will continue to dominate the market while supporting advanced stimulation protocols and recovery optimization strategies.

The electromyographic rehabilitation stimulator market is advancing steadily due to increasing incidence of stroke and neurological disorders driven by aging populations and growing adoption of neuromuscular electrical stimulation protocols that provide effective functional recovery and muscle preservation benefits across diverse rehabilitation, postoperative care, and chronic condition management applications. However, the market faces challenges, including high device costs and reimbursement limitations, technical complexity requiring specialized training and clinical expertise, and patient compliance barriers related to treatment duration and electrode application requirements. Innovation in wireless connectivity and user-friendly designs continues to influence product development and market expansion patterns.

The growing incidence of stroke cases globally is driving demand for specialized rehabilitation technologies that address motor impairment recovery including muscle weakness restoration, gait pattern improvement, and upper extremity function enhancement. Stroke rehabilitation requires advanced electromyographic stimulation protocols that deliver targeted neuromuscular activation across multiple muscle groups while supporting neuroplasticity and motor learning processes. Healthcare providers are increasingly recognizing the clinical advantages of early electromyographic stimulation integration for stroke recovery programs and functional outcome improvement, creating opportunities for innovative stimulation devices specifically designed for acute and chronic stroke rehabilitation applications.

Modern electromyographic rehabilitation stimulator manufacturers are incorporating artificial intelligence algorithms and machine learning capabilities to enhance treatment personalization, optimize stimulation parameters, and support comprehensive patient progress tracking through automated therapy adjustment and predictive outcome modeling. Leading companies are developing devices with real-time muscle response monitoring, adaptive stimulation intensity control, and cloud-based therapy management platforms that allow rehabilitation specialists to customize treatment protocols and track functional improvements remotely. These technologies improve clinical outcomes while enabling new care delivery models, including telerehabilitation services, home-based therapy programs, and data-driven rehabilitation planning. Advanced technology integration also allows manufacturers to support clinical research initiatives and evidence generation beyond traditional device functionality.

The expansion of home healthcare services and increasing patient preference for community-based rehabilitation is driving demand for portable electromyographic stimulators with simplified operation and wireless connectivity enabling independent therapy sessions. These advanced applications require user-friendly device designs with intuitive controls and safety features that enable unsupervised home use, creating accessible market segments with differentiated value propositions. Manufacturers are investing in compact device engineering and mobile application development to serve home rehabilitation markets and outpatient therapy programs while supporting innovation in patient engagement and treatment adherence strategies.

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| Brazil | 9.2% |

| U.S. | 8.4% |

| U.K. | 7.5% |

| Japan | 6.6% |

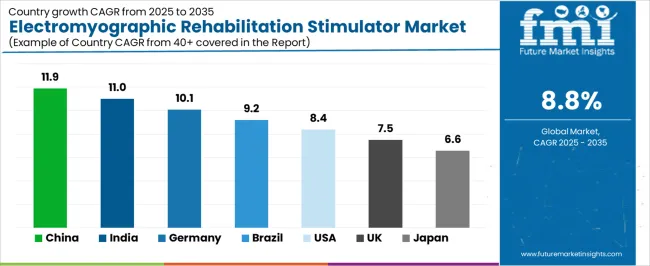

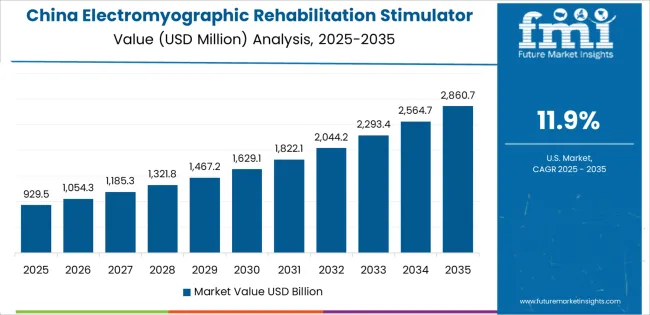

The electromyographic rehabilitation stimulator market is experiencing solid growth globally, with China leading at 11.9% CAGR through 2035, driven by expanding stroke treatment infrastructure, growing neurological rehabilitation center networks, and increasing government investment in advanced medical device adoption. India follows at 11.0%, supported by rising stroke incidence, expanding private healthcare facilities, and growing awareness of advanced rehabilitation technologies. Germany shows growth at 10.1%, emphasizing advanced rehabilitation medicine excellence, comprehensive therapy protocols, and strong medical device innovation capabilities. Brazil demonstrates 9.2% growth, supported by expanding healthcare coverage, increasing neurological disorder prevalence, and growing rehabilitation center development. The United States records 8.4%, focusing on stroke care advancement, Medicare coverage expansion, and clinical evidence generation for neuromuscular stimulation. The United Kingdom exhibits 7.5% growth, emphasizing National Health Service rehabilitation programs and stroke pathway optimization. Japan shows 6.6% growth, supported by aging population healthcare needs and established neurological care infrastructure.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

How Is Healthcare Infrastructure Expansion Accelerating Market Growth in China?

Revenue from electromyographic rehabilitation stimulators in China is projected to exhibit exceptional growth with a CAGR of 11.9% through 2035, driven by expanding stroke treatment capacity and rapidly growing neurological rehabilitation infrastructure supported by government Healthy China 2030 initiatives and healthcare modernization programs. The country's massive stroke patient population and increasing investment in rehabilitation medicine are creating substantial demand for advanced electromyographic stimulation solutions. Major medical device manufacturers and international companies are establishing comprehensive production and clinical support capabilities to serve both domestic markets and regional export opportunities.

Why Is Neurological Disease Prevalence Boosting Market Adoption in India?

Revenue from electromyographic rehabilitation stimulators in India is expanding at a CAGR of 11.0%, supported by the country's increasing stroke incidence, expanding private rehabilitation facilities, and rising healthcare awareness driving demand for advanced neurological recovery technologies. The country's growing healthcare infrastructure and medical tourism sector are driving sophisticated electromyographic rehabilitation capabilities throughout urban and metropolitan markets. Leading medical device companies and domestic manufacturers are establishing distribution networks and clinical training programs to address growing demand.

How Does Medical Excellence and Research Leadership Sustain Market Growth in Germany?

Revenue from electromyographic rehabilitation stimulators in Germany is expanding at a CAGR of 10.1%, supported by the country's world-class rehabilitation medicine infrastructure, comprehensive stroke care pathways, and strong emphasis on evidence-based therapeutic interventions. The nation's healthcare quality standards and advanced medical device expertise are driving sophisticated electromyographic stimulation capabilities throughout clinical and research sectors. Leading medical technology companies are investing extensively in clinical validation studies and product innovation for German healthcare requirements.

Why Is Rehabilitation Service Expansion Strengthening Market Potential in Brazil?

Revenue from electromyographic rehabilitation stimulators in Brazil is expanding at a CAGR of 9.2%, supported by the country's expanding healthcare coverage through Sistema Único de Saúde, increasing neurological disorder burden, and growing private rehabilitation sector investment. Brazil's developing rehabilitation infrastructure and rising healthcare standards are driving demand for advanced therapeutic devices. Medical device distributors and rehabilitation equipment suppliers are investing in market development to serve both public and private healthcare sectors.

How Are Advanced Stroke Care Programs Supporting Market Expansion in United States?

Revenue from electromyographic rehabilitation stimulators in the United States is expanding at a CAGR of 8.4%, supported by the country's comprehensive stroke care networks, extensive clinical research infrastructure, and growing emphasis on value-based rehabilitation outcomes. The nation's established medical device market and evidence-based medicine approach are driving demand for clinically proven electromyographic stimulation solutions. Manufacturers are investing in FDA approval processes and clinical trial programs to support Medicare reimbursement and healthcare provider adoption.

How Do Integrated NHS Pathways Drive Rehabilitation Technology Adoption in United Kingdom?

Revenue from electromyographic rehabilitation stimulators in the United Kingdom is expanding at a CAGR of 7.5%, supported by the country's National Health Service stroke care guidelines, integrated rehabilitation pathways, and increasing emphasis on early supported discharge programs. The UK's centralized healthcare system and focus on clinical effectiveness are driving structured adoption of electromyographic rehabilitation technologies. Medical device suppliers are establishing partnerships with NHS trusts to support stroke pathway implementation and rehabilitation service enhancement.

How Does Geriatric Healthcare Demand Support Market Growth in Japan?

Revenue from electromyographic rehabilitation stimulators in Japan is expanding at a CAGR of 6.6%, supported by the country's rapidly aging population, established neurological care infrastructure, and comprehensive rehabilitation medicine system. Japan's healthcare sophistication and quality standards are driving demand for advanced electromyographic therapy products. Leading medical device manufacturers are investing in product development for geriatric rehabilitation requirements and long-term care applications.

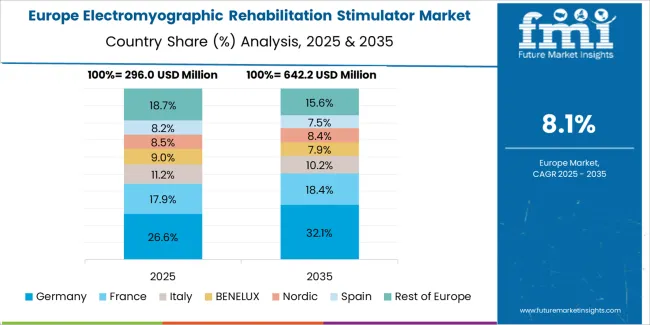

How Are Rehabilitation Modernization Initiatives Shaping Market Development Across Europe?

The electromyographic rehabilitation stimulator market in Europe is projected to grow from USD 362.7 million in 2025 to USD 812.4 million by 2035, registering a CAGR of 8.4% over the forecast period. Germany is expected to maintain leadership with a 29.6% market share in 2025, moderating to 29.3% by 2035, supported by advanced rehabilitation medicine infrastructure, comprehensive stroke care networks, and strong medical device manufacturing excellence.

France follows with 18.4% in 2025, projected at 18.7% by 2035, driven by national stroke plan implementation, rehabilitation hospital networks, and advanced neurology research programs. The United Kingdom holds 15.8% in 2025, reaching 15.5% by 2035 on the back of NHS stroke pathway development and early supported discharge initiatives. Italy commands 12.9% in 2025, rising slightly to 13.1% by 2035, while Spain accounts for 10.3% in 2025, reaching 10.6% by 2035 aided by healthcare modernization and rehabilitation center expansion. Switzerland maintains 5.1% in 2025, up to 5.2% by 2035 due to premium healthcare quality and advanced medical technology adoption. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 7.9% in 2025 and 7.6% by 2035, reflecting steady development in stroke care improvement and rehabilitation medicine advancement.

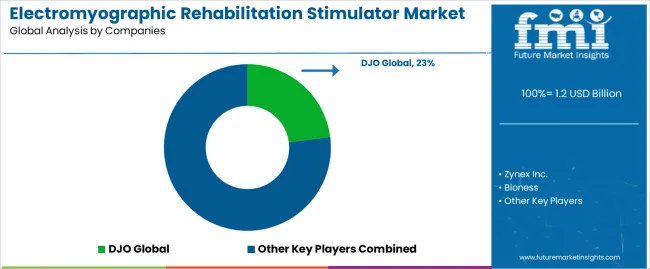

The electromyographic rehabilitation stimulator market is characterized by competition among established medical device manufacturers, specialized rehabilitation equipment companies, and neurotechnology developers. Companies are investing in clinical evidence generation, regulatory compliance, product usability enhancement, and healthcare provider education to deliver effective, safe, and clinically validated electromyographic stimulation solutions. Innovation in stimulation waveform optimization, wireless connectivity, and artificial intelligence integration is central to strengthening market position and competitive advantage.

DJO Global leads the market with comprehensive orthopedic and rehabilitation solutions, offering electromyographic stimulation devices with focus on clinical effectiveness, ease of use, and evidence-based therapeutic protocols across diverse neurological and musculoskeletal rehabilitation applications. Zynex Inc. provides innovative neurostimulation technologies with emphasis on portable designs and patient accessibility. Bioness delivers specialized neurorehabilitation systems with comprehensive clinical support and training programs.

Ottobock offers advanced prosthetics and rehabilitation technologies with focus on functional restoration and patient mobility. Medtronic specializes in implantable neuromodulation systems with emphasis on advanced spinal cord stimulation and deep brain stimulation technologies. STORZ MEDICAL AG focuses on extracorporeal shockwave therapy and rehabilitation equipment. LivaNova PLC provides neuromodulation solutions for epilepsy and depression treatment. NeuroMetrix, Inc. offers wearable neurostimulation devices with focus on chronic pain management.

RehaStim GmbH specializes in multichannel functional electrical stimulation systems for rehabilitation applications. Schwa-Medico GmbH focuses on electrotherapy and rehabilitation equipment for European markets. EMS Electro Medical Systems S.A. provides medical technology solutions across multiple therapeutic areas. Hocoma AG offers robotic rehabilitation systems with integrated electromyographic feedback. Tecnalia focuses on applied research and technology development for rehabilitation applications. Hasomed GmbH specializes in electromyographic biofeedback and stimulation systems. Aleva Neurotherapeutics SA develops implantable neuromodulation technologies for neurological disorders.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.2 billion |

| Product Type | Surface Electromyographic Rehabilitation Stimulator, Implantable Electromyographic Rehabilitation Stimulator, Portable Electromyographic Rehabilitation Stimulator, Multichannel Electromyographic Rehabilitation Stimulator, Others |

| Application | Stroke Rehabilitation, Spinal Cord Injury Rehabilitation, Postoperative Rehabilitation, Muscle Atrophy Treatment, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | DJO Global, Zynex Inc., Bioness, Ottobock, Medtronic, STORZ MEDICAL AG |

| Additional Attributes | Dollar sales by product type and application category, regional demand trends, competitive landscape, technological advancements in neuromuscular stimulation, clinical validation development, artificial intelligence integration, and rehabilitation outcome optimization |

The global electromyographic rehabilitation stimulator market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the electromyographic rehabilitation stimulator market is projected to reach USD 2.8 billion by 2035.

The electromyographic rehabilitation stimulator market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in electromyographic rehabilitation stimulator market are surface electromyographic rehabilitation stimulator, implantable electromyographic rehabilitation stimulator, portable electromyographic rehabilitation stimulator, multichannel electromyographic rehabilitation stimulator and others.

In terms of application, stroke rehabilitation segment to command 35.0% share in the electromyographic rehabilitation stimulator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telerehabilitation Market

Home Rehabilitation Service Market Trends – Growth & Industry Outlook 2024-2034

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Medical Rehabilitation Robotics Market Trends - Growth & Forecast 2025 to 2035

VR Stroke Rehabilitation Market Insights – Growth & Trends 2023-2033

Veterinary Rehabilitation Services Market Size and Share Forecast Outlook 2025 to 2035

Bowel Stimulators Market Growth – Trends, Demand & Forecast 2024-2034

Muscle Stimulator Market Size and Share Forecast Outlook 2025 to 2035

SPG Microstimulator System Market

Deep Brain Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Spinal Cord Stimulators Market Growth - Trends & Forecast 2025 to 2035

Bone Growth Stimulators Market is segmented by product type, application and end user from 2025 to 2035

Vagus Nerve Stimulator Market Analysis – Growth & Industry Insights 2018-2026

Pelvic Floor Stimulators Market – Trends & Forecast 2025 to 2035

Nerve Locator Stimulator Market

Gastric Electrical Stimulators Market Growth - Trends & Forecast 2025 to 2035

Percutaneous Electrical Nerve Stimulators Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA