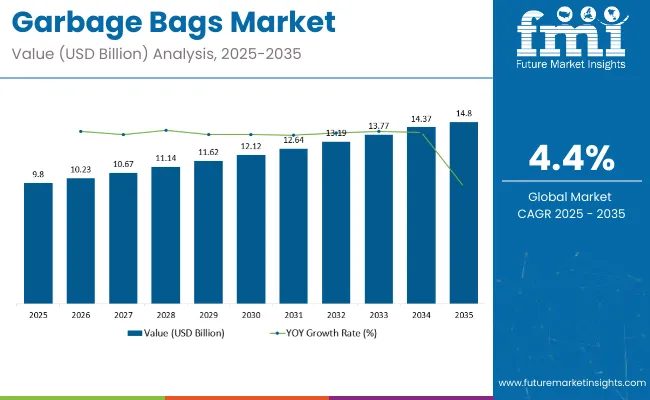

The global garbage bags market is projected to grow from USD 9.5 billion in 2024 to USD 9.8 billion in 2025 and reach USD 14.8 billion by 2035, expanding at a CAGR of 4.4%. This growth is fueled by increasing urbanization, higher waste generation, and the growing need for efficient waste management solutions in households and industries.

Garbage bags are crucial for waste collection and disposal. The rise in population, particularly in urban areas, is driving increased demand. Commercial and industrial sectors also contribute significantly to this demand due to waste management needs. Convenience, hygiene, and the growing awareness of the importance of proper waste disposal are further boosting market growth.

Sustainability has become a key focus in the market. Manufacturers are producing biodegradable and compostable bags made from plant-based materials or recycled plastics. In 2024, companies like TCC introduced compostable garbage bags made from cornstarch and other biodegradable materials. These bags provide the same performance as conventional plastic bags but have a much lower environmental impact.

Technological advances in recycling and waste separation are also influencing the market. Garbage bags designed for waste segregation, such as bags for recyclables and compos tables, are increasingly in demand. This trend supports sustainability initiatives worldwide and contributes to higher recycling rates. Many countries now require waste segregation at the source, boosting the demand for specialized bags.

North America and Europe lead the market, owing to strict regulations on waste management and a growing preference for eco-friendly products. However, the Asia Pacific region is expected to grow at the fastest rate, driven by increasing urban populations and industrialization, particularly in countries like China and India.

As the market continues to expand, innovations in materials and sustainable waste management practices will play a key role in shaping its future. The garbage bags market is expected to grow steadily through 2035, driven by increased environmental awareness and the need for more efficient waste disposal solutions.

| Attributes | Key Insights |

|---|---|

| Estimated Size (2025) | USD 9.8 billion |

| Projected Size (2035) | USD 14.8 billion |

| Value-based CAGR (2025 to 2035) | 4.4% |

The garbage bags market is subject to various government regulations aimed at environmental protection, waste management, and product safety. These regulations are primarily focused on materials used, biodegradability, and the reduction of plastic waste. Governments globally are imposing stricter standards to limit plastic pollution, and manufacturers must comply with environmental guidelines, which influence production and distribution.

Leading companies in the garbage bags market are increasingly adopting eco-friendly alternatives to traditional plastic bags in response to government regulations and growing consumer demand for sustainable solutions. These companies are innovating with materials that are biodegradable, compostable, and made from renewable resources.

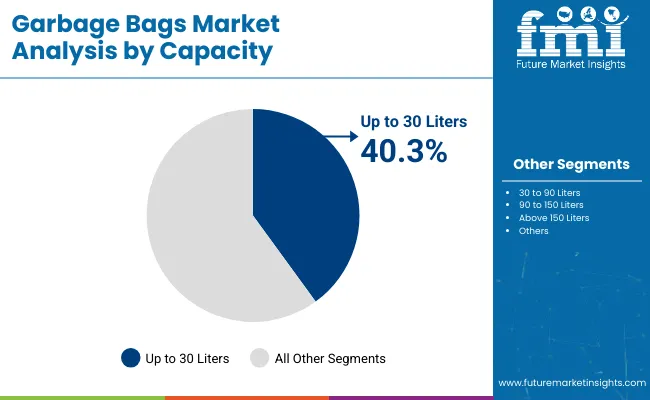

The garbage bags market is expected to grow significantly, driven by the increasing demand for cost-effective and efficient waste disposal solutions. Up to 30 liters garbage bags and polyethylene (PE) bags lead the market due to their affordability, versatility, and strength. These segments are projected to dominate through 2035, supported by innovation and sustainability trends in waste management.

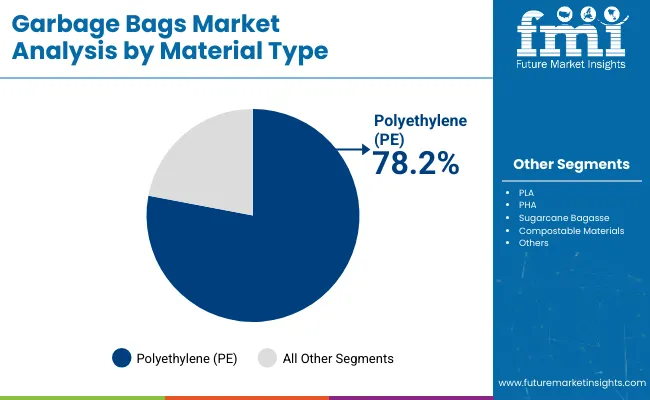

The polyethylene (PE) garbage bags segment is projected to dominate the market, capturing approximately 78.2% of the market share by 2035. PE is favored for its exceptional cost-effectiveness, flexibility, puncture resistance, and versatility. These properties make PE bags ideal for a wide variety of uses, from carrying liquids to handling sharp objects.

PE’s moisture-resistant nature prevents leaks and ensures that waste stays contained, making it a reliable choice for both residential and commercial use. Companies like Reynolds Consumer Products, Inc. manufacture high-quality PE garbage bags that cater to diverse needs, including household use and industrial applications.

The material’s ability to be easily mass-produced at a low cost contributes to its widespread use in the garbage bags industry. With its affordability, strength, and versatility, PE garbage bags will continue to lead the market as the preferred material for waste management solutions, ensuring its dominant market share through 2035.

The up to 30 liters garbage bags segment is expected to lead the market with a projected 40.3% share by 2035, driven by their suitability for daily household waste disposal. These bags are ideal for managing waste in small bins typically used in kitchens, bathrooms, and small offices. Their compact size ensures that they fit well into standard-sized bins, making them easy to store and handle.

For example, in a typical household kitchen, a 30-liter bag is sufficient to manage leftovers, food packaging, and other daily waste, preventing overflow. The practical design, affordability, and versatility of these bags make them a preferred choice for residential waste management.

Leading brands like Reynolds Consumer Products, Inc. offer 30-liter bags that are durable enough for both household and light commercial use. As waste management practices evolve and consumers continue seeking efficient disposal solutions, the demand for up to 30-liter garbage bags will continue to rise, positioning this segment as the market leader through 2035.

The global garbage bags market is expanding steadily due to urbanization, rising waste generation, and regulatory shifts toward sustainable disposal solutions. Polyethylene bags continue to dominate due to cost-efficiency, but demand for compostable alternatives is rising. While retail and commercial use cases drive demand, raw material volatility poses a major challenge.

The growing urban population has significantly increased household and commercial waste, fueling demand for efficient disposal methods such as garbage bags. In 2023, global municipal solid waste generation exceeded 2.3 billion tonnes, according to the World Bank, with projections reaching 3.4 billion tonnes by 2050. This surge in daily waste disposal has boosted the need for durable, leak-proof garbage bags in both residential and commercial settings.

Additionally, changing consumer lifestyles and greater hygiene awareness have encouraged consistent usage, particularly in households and healthcare environments. Lightweight polyethylene bags remain the preferred material due to their affordability and versatility. Furthermore, retail chains and public sanitation departments increasingly rely on garbage bags for systematic waste handling, contributing to consistent market expansion.

Volatility in crude oil prices continues to impact the production costs of garbage bags, especially those made from polyethylene and other petroleum-based resins. Polyethylene, which holds over 75% market share of garbage bags market, is directly affected by fluctuations in oil markets. Manufacturers have struggled to maintain profit margins amid rising raw material prices and supply chain disruptions, particularly during the post-pandemic recovery.

The challenge is further complicated by rising demand for biodegradable alternatives, which require investment in new processing technologies and higher production costs. Smaller manufacturers face hurdles in transitioning to sustainable materials while maintaining affordability, limiting scalability. Regulatory pressures to reduce single-use plastics also add complexity, forcing producers to balance compliance with cost-efficiency.

Stringent government mandates and corporate sustainability goals are opening new growth avenues for compostable and biodegradable garbage bags. Countries such as Germany, Canada, and India have introduced regulations to reduce plastic waste, encouraging public and private entities to invest in alternatives. Compostable bags made from starch blends, PLA, and PBAT are gaining popularity, especially in food service and retail sectors.

Multinationals like Bio Bag International and Novolex have expanded compostable product lines to meet demand. Public procurement tenders increasingly include environmental compliance clauses, creating a market advantage for sustainable suppliers. Technological advancements in bio-based resins and partnerships with waste management companies are expected to reduce cost barriers over time, making green alternatives more mainstream.

Despite increasing demand, the adoption of high-performance or eco-friendly garbage bags is limited in developing markets due to poor waste management infrastructure. Improper segregation at the source undermines the efficiency of garbage collection systems. In countries like Indonesia, Nigeria, and parts of Latin America, garbage bags are underutilized or misused, reducing their effectiveness and market potential.

A lack of consumer awareness and low enforcement of disposal regulations contribute to low-quality or unbranded bag usage. Additionally, biodegradable bags often end up in landfills or incineration plants instead of composting facilities, limiting their environmental impact. These issues collectively reduce the scalability of advanced bag variants and slow down investments in innovation and sustainable packaging solutions in emerging economies.

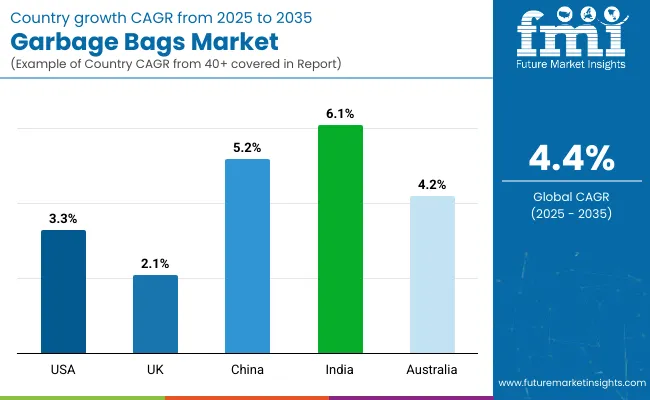

The garbage bags market is expanding globally, with varied growth rates driven by urbanization, eco-regulations, and improved waste segregation systems. Countries like the USA, China, India, and Australia are witnessing rapid innovation in bag materials and distribution networks, while the UK and Germany continue to lead sustainable packaging transitions across Europe.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.3% |

| UK | 2.1% |

| China | 5.2% |

| India | 6.1% |

| Australia | 4.2% |

The United States is expected to witness a CAGR of 3.3% through 2035 in the garbage bags market. The steady demand is attributed to consistent municipal solid waste generation and strong uptake across both residential and commercial sectors.

Government mandates on waste management and recycling compliance further stimulate the demand for segmented garbage bags types such as biodegradable and color-coded variants. Consumer preference for thicker, odor-resistant liners has encouraged premiumization in the retail segment, while institutional buyers favor bulk-pack low-density polyethylene (LDPE) bags for industrial waste.

Brands like The Clorox Company and Reynolds Consumer Products are investing in bio-based bag innovations to appeal to eco-conscious consumers. Additionally, widespread urban sprawl and the rising number of single-person households are increasing per capita waste generation, reinforcing long-term market stability. Retailers like Walmart and Amazon also support the market through high product visibility and accessible private label options.

In the UK, the garbage bags market is growing at a CAGR of 2.1% during the forecast period. The demand is strongly aligned with the country’s evolving sustainability standards and consumer push for plastic-free alternatives. Biodegradable and compostable garbage bags have gained notable traction, particularly in urban and suburban households. Government initiatives such as the UK Plastics Pact and single-use plastic bags are influencing both manufacturers and distributors to shift toward plant-based and recycled content bags.

Leading supermarkets like Tesco and Sainsbury’s have replaced traditional polyethylene variants with eco-certified alternatives. Industrial users in the healthcare and hospitality sectors continue to rely on performance-grade bags, especially for hazardous and bulk waste disposal. However, pricing sensitivity remains high, which could slow adoption in certain consumer demographics. Despite this, the market is poised for incremental growth as innovation in bio-resins and waste collection infrastructure continues to advance.

China is expected to grow at a robust CAGR of 5.2% from 2025 to 2035 in the garbage bags industry. Urbanization, stricter waste classification laws, and expanding e-commerce platforms are primary growth drivers. In cities like Shanghai and Beijing, household garbage classification mandates are pushing up demand for labeled, color-coded, and size-specific garbage bags.

The rise of organized retail, food delivery, and e-commerce logistics contributes to daily consumption of multi-capacity bags. Additionally, the construction boom and large-scale urban redevelopment projects increase demand from commercial and industrial segments.

Domestic manufacturers, especially in Zhejiang and Guangdong provinces, are scaling up biodegradable bag production, supported by subsidies and low-cost bio-polymer availability. However, the market still faces challenges with counterfeit and substandard bags, prompting stricter regulatory compliance for packaging standards. Multinational brands are increasingly eyeing joint ventures with local players to penetrate China’s fragmented yet high-volume market.

India is projected to witness the highest CAGR of 6.1% in the garbage bags market during the 2025 to 2035 period. The country’s rapid urbanization, increased sanitation awareness, and Swachh Bharat (Clean India) mission have significantly boosted the uptake of garbage bags across tier 1 and tier 2 cities. Municipal bodies are progressively distributing garbage bags for segregated collection at the source-green for wet waste and black for dry. The demand is high in residential societies, small businesses, and street food vendors.

Furthermore, the push for plastic bans in states like Maharashtra and Tamil Nadu is accelerating the use of biodegradable alternatives. Manufacturers are increasingly offering cost-effective, thin-gauge HDPE and compostable bags tailored to Indian price sensitivity. Domestic companies like Bio Green and Greentech Environ are scaling up production of starch-based bags, backed by both government incentives and NGO-led awareness campaigns. As digital retail penetration rises, e-commerce giants like Flipkart and BigBasket are also aiding market reach.

Australia is emerging as a significant contributor to the garbage bags market, driven by progressive waste reduction policies, stringent environmental regulations, and widespread adoption of compostable bags. Although exact CAGR data is unavailable, industry sources estimate market growth at around 4.2% annually from 2025 to 2035. Councils in cities like Melbourne and Sydney now mandate food and organic waste separation, fueling demand for color-coded liners-particularly green bags for compost bins.

Retailers including Woolworths and Coles have introduced private-label garbage bags made from plant starch and recycled content, helping boost affordability and compliance. Moreover, institutional demand from universities, healthcare, and office complexes is shifting toward heavy-duty, industrial-grade compostable liners. Startups and local manufacturers are also innovating in bag thickness and barrier technology to meet both environmental and performance expectations.

The garbage bags market is led by a mix of global giants, mid-sized innovators, and regional players. Tier 1 companies such as Berry Global Inc., The Clorox Company (Glad), and Reynolds Consumer Products (Hefty) dominate with advanced manufacturing capabilities, strong retail partnerships, and consistent product innovation. These players invest heavily in R&D and sustainable technologies. Berry Global, for example, introduced garbage bags containing 70% post-consumer recycled content in 2024, aligning with circular economy goals.

Tier 2 companies like Novolex and Inteplast Group are expanding their reach through private-label supply deals and compostable bag innovations. Regional manufacturers such as Novplasta CZ s.r.o. and Cosmoplast Industrial Co. cater to localized needs with cost-efficient production and distribution models.

The market remains moderately consolidated, with top-tier firms holding significant shares while still leaving space for niche entrants focused on biodegradable solutions. Barriers to entry are relatively low from a manufacturing standpoint, but scaling operations, securing retail shelf space, and meeting international compliance standards require capital and regulatory know-how.

As plastic bags and sustainability norms intensify, suppliers are shifting strategies to focus on plant-based polymers and odor-control innovations, setting the stage for long-term competition based on performance, material transparency, and environmental responsibility.

Innovation and sustainability remain key growth levers across the garbage bags industry. In 2023, Berry Global partnered with Microban International to introduce Color Scents® antimicrobial trash bags that offer both fragrance and hygiene benefits, a response to increased demand for multi-functional household goods.

The following year, Glad launched Force Flex Tall Kitchen Bags using 50% recovered plastic, tapping into environmentally conscious consumer preferences. Meanwhile, BioBag International expanded its certified compostable product line in Europe, gaining traction in retail chains amid tightening EU compostability norms.

In early 2025, Reynolds Consumer Products introduced a limited-edition birthday cake-scented trash bag to mark Hefty’s 60th anniversary, followed by the release of Fabuloso Watermelon-scented bags. Commenting on the brand’s innovation streak, Lisa Smith, Senior VP of Marketing at Reynolds Consumer Products, noted, “We’re committed to creating small joys in everyday routines - even in taking out the trash.” These developments reflect how market leaders are blending sensory experience with sustainability to drive customer engagement and long-term brand loyalty.

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 9.5 billion |

| Current Total Market Size (2025) | USD 9.8 billion |

| Projected Market Size (2035) | USD 14.8 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Materials Analyzed (Segment 1) | Polyethylene (PE), PLA, PHA, Sugarcane Bagasse, Compostable Materials |

| Polyethylene Subtypes (Segment 2) | Low Density Polyethylene (LDPE), Liner Low Density Polyethylene (LLDPE), High Density Polyethylene (HDPE) |

| Capacities Analyzed (Segment 3) | Up to 30 liters, 30 to 90 liters, 90 to 150 liters, Above 150 liters |

| Sales Channels Analyzed (Segment 4) | Direct Sales (Manufacturers), Distributors/Wholesalers, Online |

| End Uses Analyzed (Segment 5) | Service, Healthcare, Building & Construction, Retail, Hotel & Restaurants, Household, Civil Government, Defense |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Garbage Bags Market | Berry Global Inc., The Clorox Company, Reynolds Consumer Products, Novolex, Inteplast Group, Ltd., Poly-America, L.P., Aluf Plastics, BioBag International AS, Novplasta CZ s.r.o., Cosmoplast Industrial Company (L.L.C.) |

| Additional Attributes | Growth in demand for eco-friendly and biodegradable garbage bags, Shifts in material types with increasing demand for compostable products, Market penetration of recycled PE and virgin PE, Regional variations in packaging needs across end-users (commercial vs household) |

| Customization and Pricing | Customization and Pricing Available on Request |

The market is segmented into Polyethylene (PE), PLA, PHA, Sugarcane Bagasse, and Compostable Materials. Polyethylene is further categorized into Low Density Polyethylene (LDPE), Linear Low Density Polyethylene (LLDPE), and High Density Polyethylene (HDPE), each available in Virgin PE and Recycled PE variants.

The market is divided into Up to 30 Liters, 30 to 90 Liters, 90 to 150 Liters, and Above 150 Liters.

Sales channels include Direct Sales (Manufacturers), Distributors/Wholesalers, and Online.

The end users include Service, Healthcare, Building & Construction, Retail, Hotels & Restaurants, Household, Civil Government, and Defense.

The market covers key countries across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

The global garbage bags market is projected to reach USD 14.8 billion by 2035, up from USD 9.8 billion in 2025, growing at a CAGR of 4.4% during the forecast period.

Polyethylene (PE) is the dominant material in the garbage bags market, accounting for approximately 78.2% of the total share in 2035 due to its strength, cost-efficiency, and widespread usability.

Garbage bags with up to 30-liter capacity are preferred for household waste disposal, accounting for over 40.3% market share in 2035. They fit standard bins and are suitable for daily domestic use.

North America and Europe are leading in sustainable garbage bag adoption, driven by strict environmental regulations and consumer demand for compostable and biodegradable alternatives.

Volatile raw material prices, especially polyethylene, and limited waste segregation infrastructure in developing countries are major challenges that affect scalability and adoption of eco-friendly solutions.

Table 01: Global Market Volume Analysis (million Units) 2019 to 2023 and Forecast 2024 to 2034, By Capacity

Table 02: Global Market Value (US$ million) 2019 to 2023 and Forecast 2024 to 2034, By Capacity

Table 03: Global Market Volume Analysis (million Units) 2019 to 2023 and Forecast 2024 to 2034, By Material

Table 04: Global Market Value Analysis (US$ million) 2019 to 2023 and Forecast 2024 to 2034, By Material

Table 05: Global Market Volume (million Units) 2019 to 2023 and Forecast 2024 to 2034, By Sales Channel

Table 06: Global Market Value (US$ million) 2019 to 2023 and Forecast 2024 to 2034, By Sales Channel

Table 07: Global Market Volume Analysis (million Units) 2019 to 2023 and Forecast 2024 to 2034, By End-use

Table 08: Global Market Value Analysis (US$ million) 2019 to 2023 and Forecast 2024 to 2034, By End-use

Table 09: Global Market Volume Analysis (million Units) 2019 to 2023 and Forecast 2024 to 2034, By Region

Table 10: Global Market Value Analysis (US$ million) 2019 to 2023 and Forecast 2024 to 2034, By Region

Figure 01: Global Market Share Analysis by Capacity 2024E & 2034F

Figure 02: Global Market Share Analysis by Region 2024E

Figure 03: Global Market Share Analysis by End-use 2024E & 2034F

Figure 04: North America Market Share Analysis by Capacity 2024E & 2034F

Figure 05: North America Market Share Analysis by Country 2024E

Figure 06: North America Market Share Analysis by End-use 2024E & 2034F

Figure 07: Latin America Market Share Analysis by Capacity 2024E & 2034F

Figure 08: Latin America Market Share Analysis by Country 2024E

Figure 09: Latin America Market Share Analysis by End-use 2024E & 2034F

Figure 10: Europe Market Share Analysis by Capacity 2024E & 2034F

Figure 11: Europe Market Share Analysis by Country 2024E

Figure 12: Europe Market Share Analysis by End-use 2024E & 2034F

Figure 13: East Asia Market Share Analysis by Capacity 2024E & 2034F

Figure 14: East Asia Market Share Analysis by Country 2024E

Figure 15: East Asia Market Share Analysis by End-use 2024E & 2034F

Figure 16: South Asia Market Share Analysis by Capacity 2024E & 2034F

Figure 17: South Asia Market Share Analysis by Country 2024E

Figure 18: South Asia Market Share Analysis by End-use 2024E & 2034F

Figure 19: Middle East and Africa Market Share Analysis by Capacity 2024E & 2034F

Figure 20: Middle East and Africa Market Share Analysis by Country 2024E

Figure 21: Middle East and Africa Market Share Analysis by End-use 2024E & 2034F

Figure 22: Oceania Market Share Analysis by Capacity 2024E & 2034F

Figure 23: Oceania Market Share Analysis by Country 2024E

Figure 24: Oceania Market Share Analysis by End-use 2024E & 2034F

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

Garbage Truck Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Garbage Bag Companies

Electric Garbage Van Market Analysis by Product type, Loading Capacity, End User and Region from 2025 to 2035

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Net Bags Market

VCI Bags Market

Sandbags Market

Leno Bags Market Size and Share Forecast Outlook 2025 to 2035

Silo bags Market Size and Share Forecast Outlook 2025 to 2035

Food Bags Market Share, Size, and Trend Analysis for 2025 to 2035

Competitive Breakdown of Silo Bag Manufacturers

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Jumbo Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Market Share Breakdown of Craft Bags Manufacturers

Competitive Breakdown of Paper Bags Providers

Market Share Analysis of Jumbo Bags & Key Players

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA