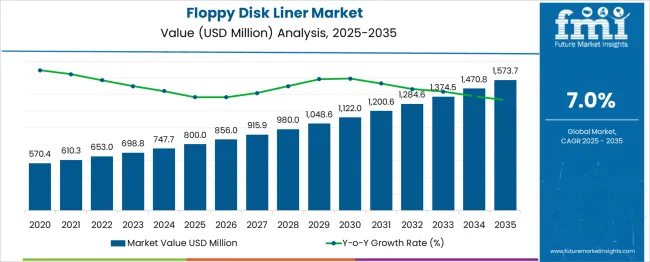

The Floppy Disk Liner Market is estimated to be valued at USD 800.0 million in 2025 and is projected to reach USD 1573.7 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

Ratio-based analysis highlights a moderately back-weighted growth pattern. The first half (2025–2030) sees the market grow from USD 800.0 million to 1,122.0 million, contributing USD 322.0 million, or 41.6% of total growth, with annual figures reaching 856.0 million in 2026, 915.9 million in 2027, 980.0 million in 2028, and 1,048.6 million in 2029, averaging yearly gains of USD 64.4 million.

The second half (2030-2035) delivers USD 451.7 million, or 58.4% of cumulative growth, as the market advances through 1,200.6 million in 2031, 1,284.6 million in 2032, 1,374.5 million in 2033, 1,470.8 million in 2034, and reaches 1,573.7 million by 2035. This creates a phase contribution ratio of 1.4:1, favoring the latter years, supported by niche demand in archival storage and legacy data systems. Market multipliers stand at 1.40x for both phases, indicating stable momentum with stronger absolute gains in later years. Manufacturers should prioritize raw material security, expand specialty product lines, and adopt lean production strategies to capture value in this steadily growing segment.

| Metric | Value |

|---|---|

| Floppy Disk Liner Market Estimated Value in (2025 E) | USD 800.0 million |

| Floppy Disk Liner Market Forecast Value in (2035 F) | USD 1573.7 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The floppy disk liner market retains a niche yet purposeful share across legacy and archival parent categories. In the storage media accessories market, floppy disk liners account for 2–3 %, since modern accessories for USB drives, SD cards, and optical media dominate spending. Within the magnetic and legacy media market, the share increases to 5–6 %, as floppy disks remain in limited use for niche applications and legacy hardware. In the computer archival and preservation materials market, floppy liners represent 8–10 %, reflecting their importance in museum, library, and IT decommissioning environments where disk preservation matters.

In the data handling and legacy IT infrastructure support market, they capture 4–5 %, given that most support budgets now focus on virtualization, cloud migration, or tape systems. Within the educational and hobbyist vintage computing supplies market, floppy disk liners hold 12–15 %, driven by retro computing enthusiasts and institutions maintaining early microcomputing platforms. Though small in most broader markets, demand remains steady due to large-scale digital archaeology, hardware conservation, and educational preservation initiatives. As interest in retro gaming and vintage system maintenance continues, floppy disk liners remain a specialized yet essential accessory in the broader landscape of media longevity and legacy system care.

The floppy disk liner market is maintaining relevance in niche applications despite the widespread obsolescence of floppy disks, driven by legacy systems, archival needs, and specialized use in certain industrial and governmental contexts. The persistence of demand has been supported by industries relying on stable, air‑gapped data storage and environments requiring electromagnetic shielding.

The market is being shaped by a focus on enhancing material durability, reducing static charge, and ensuring cleanroom compatibility to protect sensitive data media. Future outlook indicates continued albeit limited growth opportunities in refurbishment, specialty electronics, and archival supply chains.

Manufacturers are expected to capitalize on material innovations, operational efficiencies, and collaborations with legacy equipment suppliers to sustain profitability while addressing a declining but steady demand base.

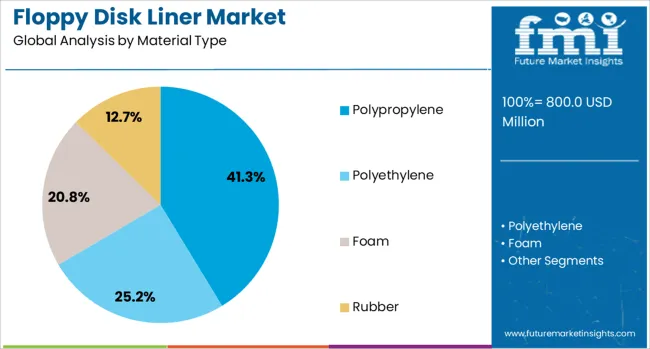

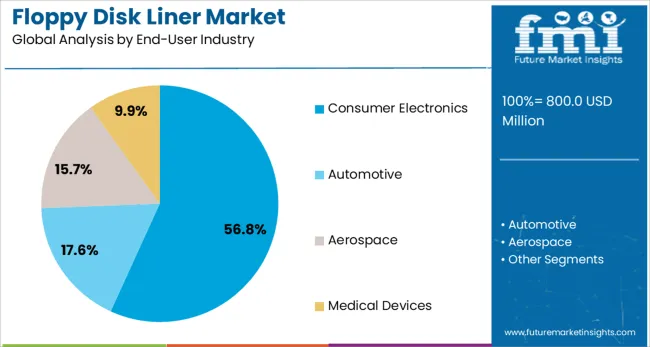

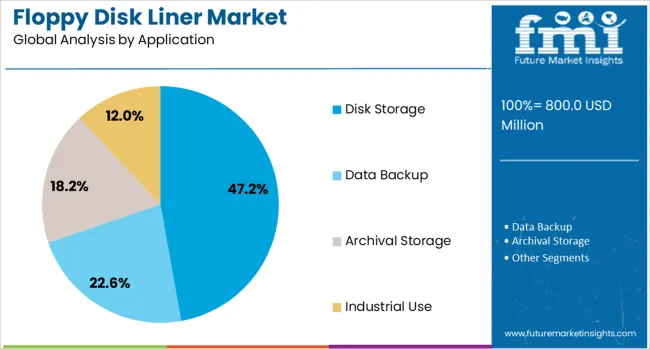

The floppy disk liner market is segmented by material type, end‑user industry, application, and geographic regions. The floppy disk liner market is divided by material type into Polypropylene, Polyethylene, Foam, and Rubber. The end-user industry of the floppy disk liner market is classified into Consumer Electronics, Automotive, Aerospace, and Medical Devices. Based on the application of the floppy disk liner market, it is segmented into Disk Storage, Data Backup, Archival Storage, and Industrial Use. Regionally, the floppy disk liner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material type, polypropylene is projected to account for 41.30% of the total market revenue in 2025, making it the leading material segment. This dominance has been attributed to its favorable mechanical properties, cost effectiveness, and superior resistance to static discharge compared to alternative materials.

Polypropylene liners have been preferred for their ability to provide consistent surface smoothness, minimizing abrasion and particulate contamination inside disk storage. Its chemical stability and ease of manufacturing have further enhanced its suitability for precision applications.

Advances in polymer processing and surface treatment have also improved its performance, enabling manufacturers to meet the stringent quality demands of legacy media users. The combination of functional reliability, affordability, and adaptability to existing production systems has secured polypropylene’s leading position in the market.

Segmented by end user industry, consumer electronics is expected to hold 56.8% of the market revenue in 2025, retaining its leadership among industries utilizing floppy disk liners. This leadership has been reinforced by the continued presence of legacy hardware in consumer and institutional settings where data stored on floppy disks remains relevant.

Manufacturers within the consumer electronics space have sustained production and refurbishment of floppy disk drives and related accessories to support archival access and niche hobbyist communities. The ability of this industry to efficiently integrate liner production into broader supply chains while maintaining consistent quality has further contributed to its prominence.

Growing interest among collectors and retro‑computing enthusiasts, coupled with institutional commitments to maintaining access to historical data, has enabled the consumer electronics segment to dominate demand.

When segmented by application, disk storage is forecast to account for 47.2% of the market revenue in 2025, establishing itself as the leading application segment. This position has been supported by the critical role of liners in ensuring the safe handling and longevity of magnetic media within storage systems.

Disk storage applications have prioritized liners that minimize contamination and prevent physical damage, thereby safeguarding the integrity of sensitive data. The necessity of maintaining clean and low‑friction environments inside disks has underscored the importance of high‑quality liners in archival and operational contexts.

Continued reliance on disk storage in select archival and controlled environments has sustained the demand for liners optimized for this purpose. The segment’s prominence has been maintained by its alignment with stringent quality requirements and its essential contribution to preserving functionality in legacy storage systems.

Floppy disk liners are thin protective sheets placed inside floppy disk sleeves to minimize dust deposition, static charge buildup, and abrasion-related wear during storage or use. These liners are made from non‑abrasive, antistatic films or coated papers and are broadly used in archival preservation, data recovery services, and retro computing communities. Adoption is influenced by the need for safeguarding aging magnetic media and preserving historical data integrity. Suppliers offering liners that are acid‑free, static‑dissipative, and dimensionally stable are positioned to serve collectors, museums, and service providers. Products enabling safe handling and long‑term preservation of magnetic disks continue to shape procurement priorities among archival specialists and retro computing enthusiasts.

Demand for floppy disk liners has been supported by increasing interest in maintaining legacy data repositories, especially within archival institutions and digital preservation projects. Preventive measures against dust accumulation and static discharge have remained vital for safeguarding magnetic media integrity during handling and storage. Collector and retro computing communities have consistently sought specialized liners to protect disks from surface abrasion and static‑related degradation. The limited lifespan of floppy disks has generated recurring need for replacement liners when stored media is inspected or utilized. Suppliers providing liners with verified antistatic properties and archival grade components have met requirements for long‑term data retention environments and restoration workflows.

Market expansion has been hindered by limited global demand for floppy disk liners due to the obsolescence of floppy media in mainstream storage solutions. Production volumes have remained low, resulting in high per‑unit manufacturing costs. Sourcing of archival grade, antistatic film or acid‑free substrates has introduced variability in pricing and supply consistency. Niche demand has meant that economies of scale have not been achieved, keeping product costs elevated for end users. Awareness of proper liner installation and handling protocols has been inadequate in some user segments, leading to improper use or inconsistent protection. Furthermore, variations in disk sleeve dimensions and liner specifications have occasionally resulted in fit‑compatibility issues, reducing perceived reliability among archival professionals.

Opportunities exist in serving niche markets such as heritage archives, museums, libraries, and retro computing groups seeking preservation materials. Custom liner formats sized for less common disk variants such as 8‑inch and microfloppy media, represent an area for product differentiation. Partnerships with archival suppliers and data recovery firms may enable bundled service packages that include preservation materials. Supply relationships with retro computing hobbyist networks and collector marketplaces could support recurring small‑batch orders. Educational institutions preserving historical computing media may seek archival‑grade liners in bulk for long‑term media maintenance. Manufacturers producing small runs of highly durable liners with documented antistatic and acid‑free features may capture this specialized demand.

The market has gravitated toward archival‑grade liner products that offer documented antistatic performance, acid‑free substrates, and dimensional precision for vintage disk formats. Printed packaging kits targeting collectors and retro computing enthusiasts including labeled sets for disk sleeves and storage boxes are gaining attention. Offerings of pre‑cut liners packaged per disk type have simplified use for preservation workflows. Supply of liners bundled with dust‑free handling gloves or antistatic cleaning kits has emerged among niche preservation providers. Demand for liner products verified by independent lab testing for static control and material neutrality continues to increase. Marketing initiatives directed at archival professionals and collector communities have supported product awareness, reinforcing procurement based on preservation reliability and quality assurance.

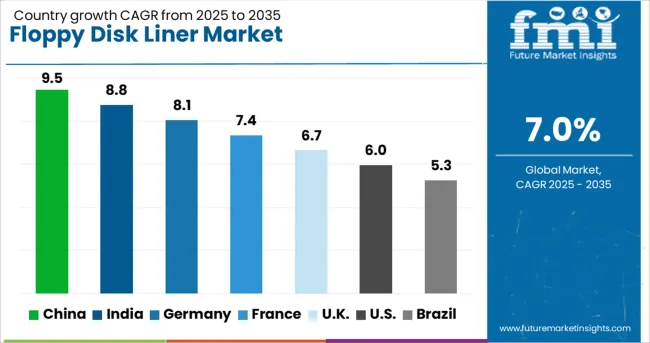

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

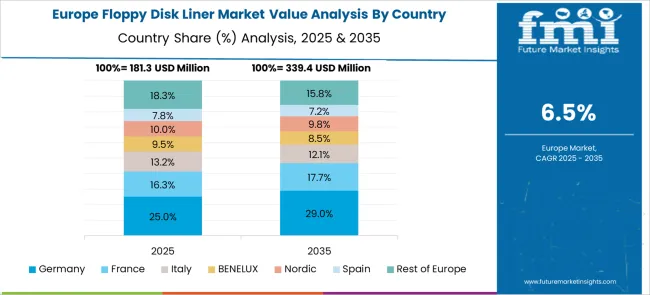

The floppy disk liner market is projected to expand at a CAGR of 7.0% between 2025 and 2035, driven by rising demand for precision storage components in archival data systems, legacy hardware maintenance, and specialty industrial applications. China, part of BRICS, leads growth with 9.5% CAGR, supported by large-scale production capabilities and export-oriented manufacturing. India, also within BRICS, follows at 8.8% CAGR, benefiting from niche adoption in secure data archival and domestic media refurbishment programs. Germany, a key OECD economy, posts 8.1%, driven by high-quality liner manufacturing for aerospace and defense archival systems. France records 7.4%, supported by demand from specialty electronics and retro-computing sectors. The United Kingdom grows at 6.7%, slightly below the global average, driven by collector markets and industrial archiving needs. The analysis includes over 40 countries, with the top five detailed below.

China is forecast to grow at a 9.5% CAGR, well above the global average of 7.0%, driven by a strong manufacturing base and export-oriented strategies. High demand for floppy disk liners in archival storage, retro-computing, and industrial data systems supports large-scale production. Domestic suppliers lead the market by delivering cost-effective liners that meet durability and precision standards. Partnerships with archival hardware manufacturers are strengthening China’s presence in long-term storage solutions. The adoption of automated manufacturing processes further improves production efficiency and quality control, making China a dominant global supplier.

India is projected to post 8.8% CAGR, supported by government archival programs and the restoration of legacy computing systems. Increased demand for secure data preservation in financial institutions and public sector organizations is driving adoption of floppy disk liners to maintain magnetic media integrity. Domestic suppliers are expanding capacity and adopting precision manufacturing techniques to serve both domestic and niche export markets. Investments in durable liner materials and cost advantages enhance India’s global competitive position in retro-computing supply chains.

Germany is expected to register 8.1% CAGR, driven by advanced manufacturing practices and demand from aerospace, automotive, and defense archival systems. Floppy disk liners remain critical for organizations maintaining specialized magnetic data storage. German manufacturers focus on high-precision liners using eco-compliant materials to ensure longevity and meet EU environmental standards. Export opportunities across Europe and North America remain strong. Ongoing research in precision engineering supports product innovation, reinforcing Germany’s reputation for high-quality liners in a specialized yet growing market.

France is projected to achieve 7.4% CAGR, driven by retro-computing demand, specialty electronics applications, and institutional data preservation programs. Floppy disk liners are essential for refurbishing vintage systems and securing archival records, especially in aerospace and defense projects. Manufacturers are investing in modular production lines for format-specific customization. Growth in collector markets, technology museums, and restoration firms is adding incremental demand, making France a key supplier within Europe for premium liners designed for longevity and precision.

The United Kingdom is forecast to expand at 6.7% CAGR, slightly below the global average, supported by industrial archiving requirements and collector-driven markets. Adoption of floppy disk liners continues in aerospace and media preservation sectors, ensuring secure magnetic storage. UK-based manufacturers focus on small-batch, high-precision production for specialized needs. Export demand from North American and European restoration companies further supports market growth. Digital marketplaces and e-commerce channels are emerging as vital distribution platforms for premium liners aimed at hobbyists and institutional buyers.

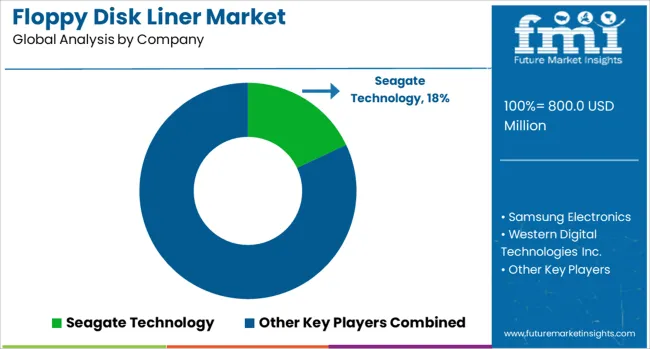

The floppy disk liner market exists as a niche segment within legacy data storage solutions, primarily supported by companies with historical expertise in magnetic media technologies. Key participants include Seagate Technology, Samsung Electronics, Western Digital Technologies Inc., Toshiba Corporation, Intel Corporation, Sony Corporation, Lenovo, and Kingston Technology Corporation.

While these companies are globally recognized leaders in modern storage devices such as SSDs and cloud-integrated systems, their engagement in floppy disk liners is largely tied to specialized archival applications, defense systems, and industrial automation where legacy hardware remains operational. Market structure reflects very high entry barriers due to declining demand, proprietary technology for magnetic media protection, and limited but critical use cases in government and aerospace sectors.

Competitive dynamics are minimal, as production is concentrated among a few players maintaining legacy product lines alongside modern storage solutions. Differentiation hinges on durability, dust protection, and static resistance of liners to extend the lifecycle of floppy disks in critical systems. Cost efficiency, customization for specific disk sizes, and long-term supply commitments remain essential for retaining niche clients. Strategic focus is on leveraging existing manufacturing facilities while minimizing operational costs through batch production for small-volume orders.

Future opportunities lie in supplying archival-quality liners for digital preservation projects and niche industries maintaining vintage computing environments, though substitution risk from emulation software and modern storage conversion remains high. Performance benchmarking is based on material integrity, contamination prevention, and adherence to archival storage standards, ensuring reliability in specialized long-term data retention scenarios.

The growing need for reliable performance in legacy systems and retro computing devices drives recent developments in the floppy disk liner market. Manufacturers such as Sony and Western Digital are introducing liners with improved durability, anti-static properties, and low-friction materials to reduce wear and enhance compatibility with aging hardware.

There is also a move toward advanced synthetic fibers that minimize dust accumulation and improve archival reliability. Some companies are experimenting with biodegradable alternatives and optimizing production processes to ensure consistent availability for industrial and archival applications where floppy disk usage remains critical.

| Item | Value |

|---|---|

| Quantitative Units | USD 800.0 Million |

| Material Type | Polypropylene, Polyethylene, Foam, and Rubber |

| End‑User Industry | Consumer Electronics, Automotive, Aerospace, and Medical Devices |

| Application | Disk Storage, Data Backup, Archival Storage, and Industrial Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Seagate Technology, Samsung Electronics, Western Digital Technologies Inc., Toshiba Corporation, Intel Corporation, Sony Corporation, Lenovo, and Kingston Technology Corporation |

| Additional Attributes | Dollar sales segmented by application (archival storage, aerospace, industrial automation, and defense) and liner material type (anti-static fabric and synthetic composites), with demand sustained by critical systems requiring magnetic media reliability. Regional demand remains strongest in North America and select defense-driven markets, while Asia-Pacific accounts for small-scale industrial usage. Innovation focuses on static-resistant fabrics, enhanced dust-blocking properties, and moisture control to ensure data integrity in long-term storage environments. |

The global floppy disk liner market is estimated to be valued at USD 800.0 million in 2025.

The market size for the floppy disk liner market is projected to reach USD 1,573.7 million by 2035.

The floppy disk liner market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in floppy disk liner market are polypropylene, polyethylene, foam and rubber.

In terms of end‑user industry, consumer electronics segment to command 56.8% share in the floppy disk liner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hard Disk Drive Market - Size, Share, and Forecast 2025-2035

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

Linerless Closures Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Linerless Label Industry

Liner Bag Market Report – Key Trends & Forecast 2024-2034

Liner Hanger Market

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Evaluating Eyeliner and Kajal Sculpting Pencil Packaging Market Share & Provider Insights

Eyeliner Pen Market

Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

IBC Liner Market Size and Share Forecast Outlook 2025 to 2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

EPE Liner Market Analysis – Size, Growth & Demand 2025 to 2035

Examining Market Share Trends in the Cap Liner Industry

IBC Liner Market Share Insights & Industry Leaders

Industry Share Analysis for Box Liners Companies

Cap Liner Films Market

Testliner Market

Pan Liners Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA