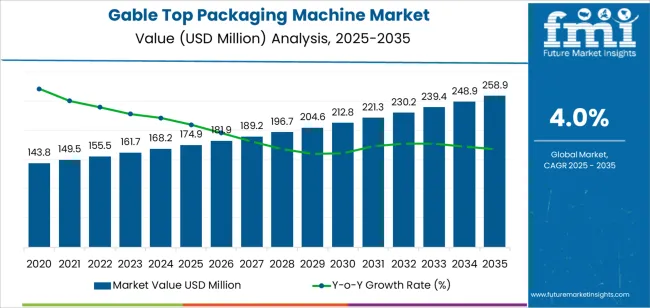

The global gable top packaging machine market is projected to expand from USD 174.9 million in 2025 to approximately USD 258.9 million by 2035, reflecting an absolute increase of USD 83.99 million and a CAGR of 4.0%. The market size is expected to grow by nearly 1.5X during the forecast period, largely supported by the rising global demand for liquid packaging solutions and the adoption of advanced automated packaging machinery in food and beverage production. Regional growth dynamics show clear distinctions in market drivers, with mature markets focusing on efficiency and sustainability while emerging economies emphasize capacity expansion and affordability.

North America is positioned as a key revenue generator, supported by the high consumption of packaged milk, juice, and other liquid food products. Manufacturers in the U.S. and Canada are increasingly investing in automated gable top packaging systems to improve production throughput and ensure compliance with food safety regulations. Europe follows closely, with strong adoption in Germany, France, and Nordic countries, where strict packaging sustainability laws and consumer preference for eco-friendly cartons are driving machine upgrades. The region is also benefiting from strong innovation in packaging machinery, with European suppliers at the forefront of high-performance automated systems that reduce waste and enhance product safety.

Asia-Pacific is expected to record the fastest growth, led by China, India, and Southeast Asia, where rapid urbanization, rising disposable incomes, and the expansion of modern retail are increasing demand for packaged dairy and beverages. Local and global machine suppliers are investing heavily in expanding production and service networks across these countries, capitalizing on the rising consumption of milk, juice, and plant-based beverages. Japan and South Korea add further growth momentum by adopting advanced robotic and automated features in packaging lines, ensuring consistent quality in highly competitive food and beverage markets.

The Middle East and Africa, though relatively smaller in market size, present significant growth opportunities due to ongoing dairy sector expansion in Saudi Arabia, the UAE, and South Africa. Investment in packaging infrastructure is being driven by both local producers and multinational food companies seeking to strengthen their regional presence. Latin America, particularly Brazil and Mexico, shows promising potential as dairy and juice consumption expands, with local producers upgrading to modern gable top packaging systems to meet higher hygiene standards and consumer demand for sustainable formats.

Gable Top Packaging Machine Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 174.9 million |

| Market Forecast Value (2035) | USD 258.9 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

| MANUFACTURING TRENDS | TECHNOLOGY ADVANCEMENT | QUALITY & PERFORMANCE |

|---|---|---|

| Dairy Industry Expansion - Continuous growth in dairy product packaging across global markets, including fresh milk, flavored beverages, and premium dairy products driving demand for efficient gable top packaging solutions. | Automation Integration - Advanced machine technologies enabling improved packaging efficiency and reduced labor costs through automated filling, sealing, and quality control systems. | Packaging Quality Standards - Industry requirements establishing performance benchmarks favoring high-precision packaging machinery with consistent sealing and contamination prevention. |

| Beverage Market Growth - Growing emphasis on aseptic liquid packaging and eco-friendly carton solutions creating demand for versatile gable top packaging machinery. | Speed Enhancement Technologies - Professional manufacturing demands requiring high-capacity machines offering superior throughput while maintaining packaging integrity and product safety. | Production Efficiency Optimization - Quality standards requiring optimal speed distribution and minimal downtime in commercial packaging operations. |

| Premium Packaging Demand - Superior performance characteristics and branding capabilities making gable top packaging essential for premium dairy and beverage applications. | Sterilization Technology Requirements - Certified machines with proven specifications required for aseptic packaging applications. | Manufacturing Technology Requirements - Advanced filling formulations and sealing specifications driving need for precision machinery capabilities. |

| Category | Segments / Values |

|---|---|

| By Speed Category | Below 5000CPH; 5000-10000CPH; Above 10000CPH |

| By Application | Dairy Products; Beer/Beverages; Juice & Soft Drinks; Plant-Based Beverages; Others |

| By Technology Type | Aseptic Filling; Non-Aseptic Filling; Cold Fill; Hot Fill |

| By Package Size | Below 500ml; 500ml-1L; Above 1L |

| By Distribution Channel | Direct Sales; Industrial Distributors; Regional Service Partners; Online Equipment Suppliers |

| By End User | Dairy Processors; Beverage Manufacturers; Food & Beverage Contractors; Others |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025-2035 Outlook |

|---|---|

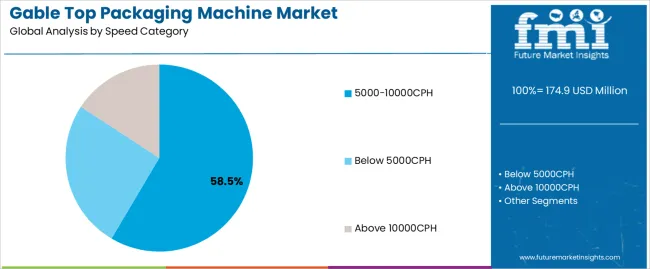

| 5000-10000CPH | Leader in 2025 with 58.5% market share; likely to maintain strong position through 2035. Optimal balance of production capacity, operational efficiency, and cost-effectiveness for medium to large dairy operations. Momentum: steady growth driven by dairy processing expansion and beverage manufacturing. Watchouts: competition from higher-speed alternatives and automation requirements. |

| Above 10000CPH | High-performance segment with 24.2% share, benefiting from large-scale dairy operations and major beverage manufacturers requiring maximum throughput and efficiency. Momentum: rising in industrial-scale operations. Watchouts: higher capital costs and specialized maintenance requirements. |

| Below 5000CPH | Specialized segment serving smaller operations and regional processors requiring cost-effective packaging solutions for local market distribution. Momentum: moderate growth in emerging markets and specialty applications requiring flexible production capabilities. |

| Segment | 2025-2035 Outlook |

|---|---|

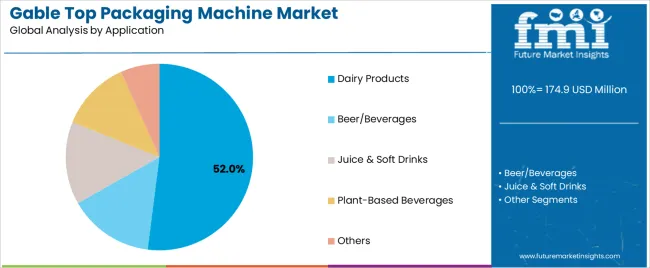

| Dairy Products | Largest application segment in 2025 at 52.0% share, supported by global dairy consumption growth and fresh milk packaging demand across developed and emerging markets. Driven by health consciousness and premium dairy product trends. Momentum: strong growth from emerging market dairy processing and organic product expansion. Watchouts: plant-based alternatives and regulatory changes affecting dairy industry. |

| Beer/Beverages | Key segment for alcoholic beverage packaging, particularly in markets adopting gable top formats for premium beer and specialty alcoholic beverages. Momentum: steady growth through craft brewery expansion and premium packaging adoption. Watchouts: glass and can competition and changing consumer preferences. |

| Juice & Soft Drinks | Professional beverage manufacturing segment relying on aseptic packaging solutions for fruit juices, energy drinks, and functional beverages requiring extended shelf life. Momentum: moderate growth in health-conscious beverage markets. Watchouts: plastic bottle competition and ingredient cost pressures. |

| Plant-Based Beverages | Specialized segment for non-dairy milk alternatives including almond, oat, soy, and other plant-based beverages with stringent quality and branding requirements. Momentum: strong growth from dietary trend shifts and environmental consciousness. Watchouts: market saturation and ingredient sourcing challenges. |

| Distribution Channel | Status & Outlook (2025-2035) |

|---|---|

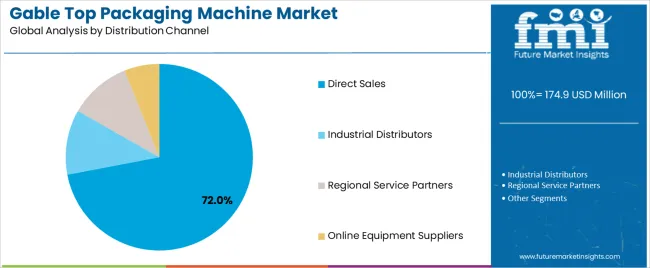

| Direct Sales | Dominant channel in 2025 with 72% share for industrial customers. Offers technical support, customization capabilities, and comprehensive service agreements. Momentum: steady growth driven by manufacturing industry consolidation and technical requirements. Watchouts: customer concentration risks and competitive pricing pressures. |

| Industrial Distributors | Important channel serving mid-sized processors with inventory management and regional technical support services. Provides value through local presence and application expertise. Momentum: moderate growth as manufacturers seek supply chain efficiency and regional service capabilities. |

| Regional Service Partners | Traditional channel for local processors requiring immediate support and relationship-based service. Regional expertise and customized maintenance solutions. Momentum: stable growth in established markets, evolving toward specialized service provision and technical consultation. |

| Online Equipment Suppliers | Emerging channel for smaller processors and replacement parts seeking competitive pricing and product information. Limited technical support but convenient ordering. Momentum: rising growth as digital transformation accelerates B2B purchasing and smaller manufacturers seek cost-effective sourcing. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Expanding dairy processing across emerging markets and developed regions is driving demand for efficient gable top packaging machinery supporting fresh milk, flavored dairy, and premium product manufacturing. | High capital investment requirements and maintenance costs continue to impact smaller processors and regional manufacturers considering machinery upgrades. | Development of advanced automation technologies, improved filling precision, and integrated quality control systems are enabling superior performance. |

| Beverage Industry Innovation - Increasing adoption of eco-friendly carton packaging in beverage industry and premium product positioning is creating demand for versatile gable top machinery. | Competition from Alternative Packaging - Growth of flexible packaging, plastic bottles, and can packaging technologies affect traditional gable top market demand. | Speed Enhancement Technologies - Advanced high-capacity machines, improved changeover capabilities, and optimized production efficiency are advancing machinery capabilities. |

| Aseptic Processing Growth - Rising demand for extended shelf-life products and ambient storage capabilities in dairy and beverage manufacturing fuels steady machinery adoption. | Regulatory Compliance Costs - Stricter food safety standards and packaging regulations increase equipment specifications and certification requirements. | Specialized Application Development - Emerging demand for machinery tailored to plant-based beverages, functional drinks, and premium dairy applications. |

| Manufacturing Automation - Advanced efficiency requirements and labor optimization in processing facilities impact machinery selection and integration needs. | Raw Material Price Volatility - Fluctuating costs of packaging materials and component supplies affect equipment operating economics. | Ongoing R&D Focus - Continuous improvement in filling technology, sterilization systems, and packaging integrity to meet evolving manufacturing standards. |

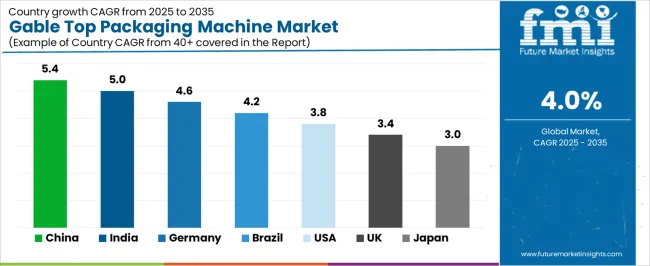

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| Brazil | 4.2% |

| United States | 3.8% |

| United Kingdom | 3.4% |

| Japan | 3.0% |

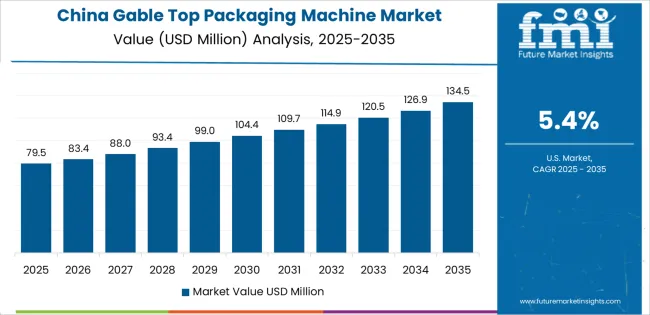

Revenue from gable top packaging machines in China is projected to exhibit strong growth with a CAGR of 5.4% from 2025 to 2035, driven by expanding dairy processing infrastructure and comprehensive beverage manufacturing capabilities creating substantial opportunities for machinery suppliers across liquid packaging operations, aseptic processing facilities, and specialty product manufacturing sectors. The country's established manufacturing tradition and growing domestic consumption are creating significant demand for both high-speed and medium-capacity packaging systems. Major dairy companies and beverage manufacturers including leading processors are establishing comprehensive local machinery supply facilities to support large-scale production operations and meet growing demand for efficient packaging solutions.

Revenue from gable top packaging machines in India is expanding to reach a CAGR of 5.0% from 2025 to 2035, supported by extensive dairy industry growth and comprehensive liquid packaging sector development creating demand for reliable machinery solutions across diverse processing categories and export-oriented production segments. The country's growing dairy sector and expanding beverage capabilities are driving demand for packaging solutions that provide consistent manufacturing performance while supporting cost-effective production requirements. Equipment suppliers and manufacturing service providers are investing in local market development to support growing industrial operations and professional processing demand.

Demand for gable top packaging machines in Germany is projected to reach a CAGR of 4.6% from 2025 to 2035, supported by the country's leadership in precision manufacturing and advanced packaging technologies requiring sophisticated automation systems for dairy and beverage applications. German manufacturing companies are implementing high-precision packaging systems that support advanced filling capabilities, operational reliability, and comprehensive quality protocols. The market is characterized by focus on engineering excellence, equipment precision, and compliance with stringent environmental and performance standards.

Revenue from gable top packaging machines in Brazil is growing to reach a CAGR of 4.2% from 2025 to 2035, driven by processing industry expansion programs and increasing liquid packaging production creating opportunities for machinery suppliers serving both domestic manufacturing operations and export-oriented processing contractors. The country's expanding industrial base and growing processing capabilities are creating demand for packaging equipment that support diverse production requirements while maintaining performance standards. Manufacturing service providers and industrial supply companies are developing distribution strategies to support operational efficiency and customer satisfaction.

Demand for gable top packaging machines in the United States is projected to reach a CAGR of 3.8% from 2025 to 2035, driven by advanced processing excellence and specialized dairy capabilities supporting premium liquid packaging development and comprehensive high-performance applications. The country's established processing tradition and mature beverage market segments are creating demand for high-quality packaging equipment that support operational performance and manufacturing standards. Equipment manufacturers and industrial suppliers are maintaining comprehensive development capabilities to support diverse processing requirements.

Revenue from gable top packaging machines in the United Kingdom is growing to reach a CAGR of 3.4% from 2025 to 2035, supported by processing innovation and established industrial capabilities driving demand for premium packaging solutions across traditional manufacturing systems and specialty production applications. The country's manufacturing heritage and established industrial capabilities create demand for machinery that support both traditional processing methods and modern high-efficiency applications.

Demand for gable top packaging machines in Japan is projected to reach a CAGR of 3.0% from 2025 to 2035, driven by precision manufacturing tradition and established packaging technology leadership supporting both domestic processing markets and export-oriented equipment production. Japanese companies maintain sophisticated machinery development capabilities, with established manufacturers continuing to lead in automation technology and precision manufacturing standards.

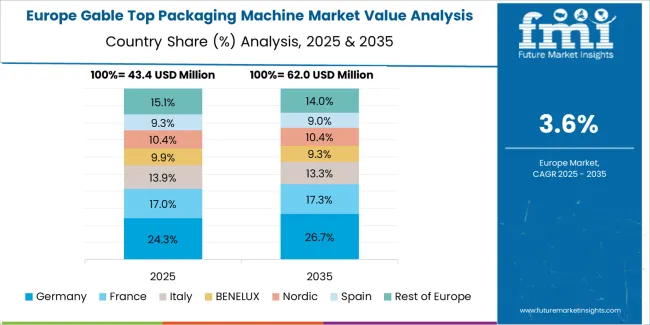

European Gable Top Packaging Machine operations are increasingly concentrated between German precision engineering and Italian specialty manufacturing. German facilities dominate high-speed packaging machinery production for dairy and premium beverage applications, leveraging advanced automation technologies and strict quality protocols that command price premiums in global markets. Italian manufacturers maintain leadership in flexible packaging solutions and specialty applications, with companies specializing in customized systems and design innovations driving technical specifications that smaller suppliers must meet to access premium processing contracts.

Eastern European operations in Poland and Czech Republic are capturing cost-competitive manufacturing contracts through skilled labor advantages and EU regulatory compliance, particularly in standard packaging machinery for regional dairy and beverage processors. These facilities increasingly serve as manufacturing capacity for Western European brands while developing their own automation expertise.

The regulatory environment presents both opportunities and constraints. EU food safety compliance requirements create quality standards that favor established European manufacturers over imports while ensuring consistent performance specifications. Brexit has created complexity for UK machinery sourcing from EU suppliers, driving opportunities for direct relationships between processors and international equipment providers.

Supply chain consolidation accelerates as manufacturers seek economies of scale to absorb rising component costs and environmental compliance expenses. Vertical integration increases, with major processing companies acquiring packaging machinery capabilities to secure equipment supplies and quality control. Smaller manufacturers face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream processing requirements.

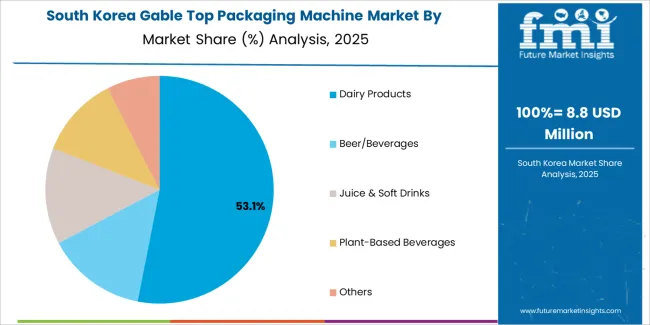

South Korean Gable Top Packaging Machine operations reflect the country's advanced manufacturing sector and technology-oriented business model. Major food and beverage companies drive equipment procurement strategies for their liquid packaging operations, establishing direct relationships with specialized machinery suppliers to secure consistent quality and pricing for their processing operations targeting both domestic and international markets.

The Korean market demonstrates particular strength in integrating packaging machinery into advanced processing lines, with companies developing systems that meet stringent quality standards for premium dairy and beverage applications. This integration approach creates demand for specific performance specifications that differ from traditional applications, requiring suppliers to adapt automation technologies and processing capabilities.

Regulatory frameworks emphasize processing safety and environmental protection, with Korean standards often exceeding international requirements. This creates barriers for smaller equipment suppliers but benefits established manufacturers who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with Korean certification and comprehensive quality documentation systems.

Supply chain efficiency remains critical given Korea's technological advancement focus and competitive processing dynamics. Companies increasingly pursue development contracts with suppliers in Japan, Germany, and specialized manufacturers to ensure access to advanced packaging technologies while managing cost pressures. Investment in research and development supports quality advancement during extended equipment development cycles.

Profit pools are consolidating upstream in precision automation technology manufacturing and downstream in application-specific machinery designs for dairy, beverage, and premium liquid packaging markets where certification, filling performance, and consistent quality command premiums. Value is migrating from basic machine production to specification-driven, application-ready equipment where automation expertise, speed technology, and reliable processing performance create competitive advantages.

Several archetypes define market leadership: established machinery manufacturers defending share through automation excellence and production scale; specialty technology companies leveraging advanced system integration expertise and customer relationships; integrated processing equipment producers with internal machinery capabilities and market access; and emerging manufacturers pursuing cost-competitive production while developing technical capabilities.

Switching costs - processing compatibility, quality certification, production integration - provide stability for established suppliers, while technological advancement and performance requirements create opportunities for innovative manufacturers. Consolidation continues as companies seek production scale; direct sales channels grow for premium equipment while traditional distribution remains relationship-driven. Focus areas: secure dairy and premium beverage market positions with application-specific performance specifications and technical support; develop automation technology and precision manufacturing capabilities; explore specialized applications including plant-based beverages and functional drinks.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Established Machinery Manufacturers | Production scale; automation expertise; established customer base | Quality consistency; technical service; cost optimization |

| Specialty Technology Companies | Advanced automation; technical innovation; application expertise | R&D leadership; customized solutions; premium positioning |

| Integrated Processing Equipment Producers | Vertical integration; market access; cost control | Internal supply; quality control; market responsiveness |

| Emerging Cost-Competitive Producers | Manufacturing efficiency; competitive pricing; market entry capabilities | Production scaling; technology adoption; regional market focus |

| Technical Distributors | Market knowledge; customer relationships; technical support services | Application expertise; inventory management; customer education |

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 174.9 m illion |

| Speed Categories | Below 5000CPH; 5000-10000CPH; Above 10000CPH |

| Applications | Dairy Products; Beer/Beverages; Juice & Soft Drinks; Plant-Based Beverages; Others |

| Technology Types | Aseptic Filling; Non-Aseptic Filling; Cold Fill; Hot Fill |

| Package Sizes | Below 500ml; 500ml-1L; Above 1L |

| Distribution Channels | Direct Sales; Industrial Distributors; Regional Service Partners; Online Equipment Suppliers |

| End Users | Dairy Processors; Beverage Manufacturers; Food & Beverage Contractors; Others |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

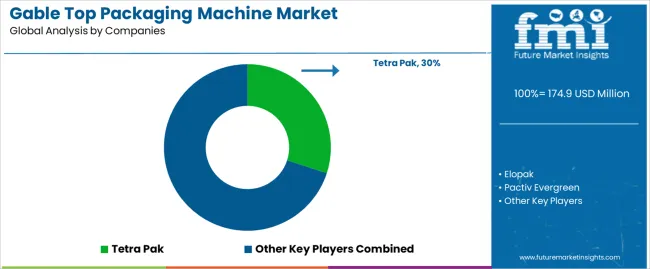

| Key Companies Profiled | Tetra Pak; Elopak; Pactiv Evergreen; NiMCO; Galdi; Schneider Packaging Equipment; SEPPA; Shenyang Beiya Beverage Machinery; Shandong Vodasco Intelligent Technology; Greatview Aseptic Packaging; TidePac Aseptic Packaging Material; Wuxi Kaimi Packaging Technology; Jiangsu Jinrui Machinery; Coesia Group; KHS Group; Sidel Group; Krones AG |

| Additional Attributes | Dollar sales by speed category and distribution channel; Regional demand trends (NA, EU, APAC); Competitive landscape; Direct vs. distributor adoption patterns; Processing and automation integration; Precision filling innovations driving manufacturing enhancement, performance reliability, and technical excellence |

The global gable top packaging machine market is estimated to be valued at USD 174.9 million in 2025.

The market size for the gable top packaging machine market is projected to reach USD 258.9 million by 2035.

The gable top packaging machine market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in gable top packaging machine market are 5000-10000cph, below 5000cph and above 10000cph.

In terms of application, dairy products segment to command 52.0% share in the gable top packaging machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gable Box Market Trends & Industry Growth Forecast 2024-2034

Gable-Top Liquid Cartons Market Size and Share Forecast Outlook 2025 to 2035

Gable Top Caps And Closures Market by Material, Product & Distribution Forecast 2025 to 2035

Competitive Overview of Gable Top Caps And Closures Companies

Gable Top Packaging for Liquid Food Market Size and Share Forecast Outlook 2025 to 2035

Gable Top Packaging Market Size and Share Forecast Outlook 2025 to 2035

Topical Anti-infective Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Antibiotic Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Top Coated Direct Thermal Printing Films Market Size and Share Forecast Outlook 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Topical Bioadhesives Market - Trends & Forecast 2025 to 2035

Competitive Breakdown of Top Coated Direct Thermal Printing Films Providers

Global Topical Pain Relief Market Insights – Size, Trends & Forecast 2024-2034

Topical Applicator Market Growth & Pharmaceutical Innovations 2024-2034

Top Loading Cartoning Machine Market Forecast and Outlook 2025 to 2035

Top Bottom Packaging Box Market from 2024 to 2034

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Atopic Dermatitis Treatment Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

NetOps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA