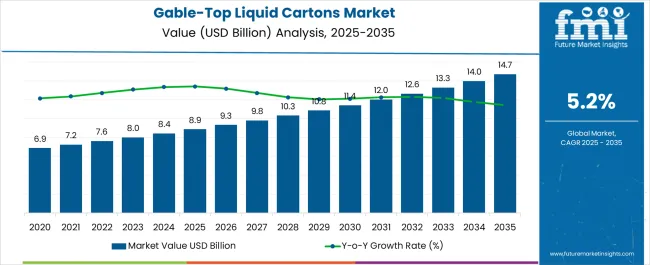

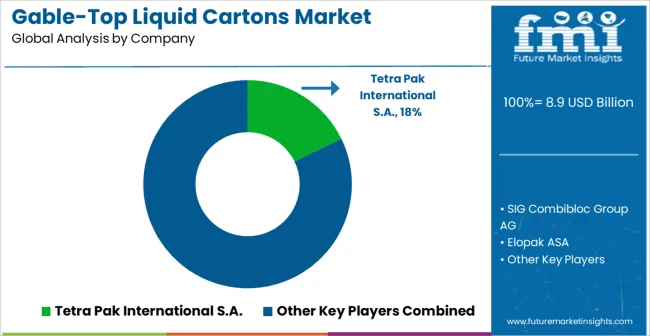

The Gable-Top Liquid Cartons Market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 14.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Gable-Top Liquid Cartons Market Estimated Value in (2025E) | USD 8.9 billion |

| Gable-Top Liquid Cartons Market Forecast Value in (2035 F) | USD 14.7 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Gable-Top Liquid Cartons market is experiencing steady growth, driven by the increasing demand for convenient, safe, and sustainable packaging solutions in the food and beverage industry. Rising consumer preference for ready-to-use and single-serve packaging formats has reinforced the adoption of gable-top cartons. Innovations in material technologies, including multilayer polyethylene and barrier coatings, have enhanced product shelf life and ensured protection against contamination and spoilage.

The market is further supported by growing regulatory focus on food safety and sustainable packaging, which encourages the use of recyclable and lightweight materials. Advancements in production processes and filling technologies have improved operational efficiency and reduced costs for manufacturers. Integration with automated packaging lines enables faster production cycles and consistent quality.

As environmental awareness rises and supply chains increasingly emphasize sustainability and waste reduction, gable-top liquid cartons are expected to remain a preferred packaging format The market outlook is further strengthened by growing investments in expanding production capacity and the adoption of innovative designs that balance convenience, functionality, and cost-efficiency.

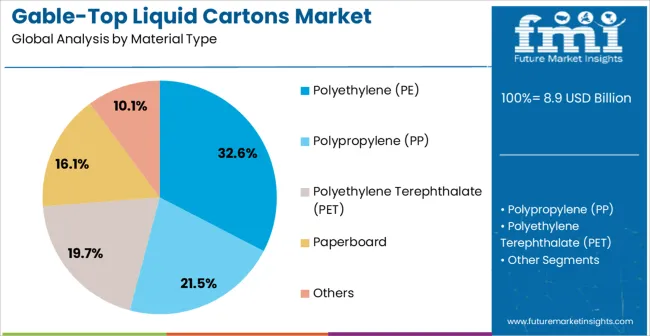

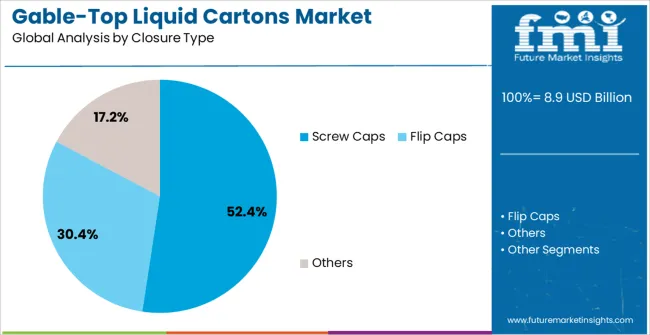

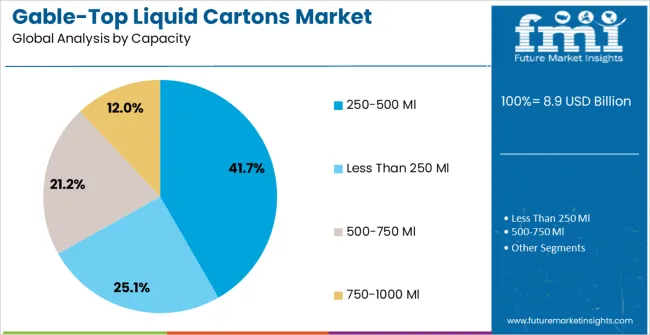

The gable-top liquid cartons market is segmented by material type, closure type, capacity, end user, and geographic regions. By material type, gable-top liquid cartons market is divided into Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Paperboard, and Others. In terms of closure type, gable-top liquid cartons market is classified into Screw Caps, Flip Caps, and Others. Based on capacity, gable-top liquid cartons market is segmented into 250-500 Ml, Less Than 250 Ml, 500-750 Ml, and 750-1000 Ml. By end user, gable-top liquid cartons market is segmented into Food & Beverages, Paints & Lubricants, Pet Food, and Other Industries. Regionally, the gable-top liquid cartons industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene (PE) segment is projected to hold 32.6% of the market revenue in 2025, establishing it as the leading material type. Growth is being driven by its excellent barrier properties, lightweight nature, and cost-effectiveness, which enhance product protection and reduce transportation costs. PE-based cartons provide durability and flexibility, enabling manufacturers to maintain the integrity of liquid contents during handling, storage, and distribution.

Compatibility with high-speed filling lines and sealing equipment supports operational efficiency and large-scale production. The material’s recyclability and compliance with environmental regulations further strengthen its appeal. As consumer demand for safe, hygienic, and environmentally responsible packaging increases, PE is expected to maintain its leadership position.

Ongoing innovations in polyethylene formulations, such as improved barrier layers and bio-based alternatives, are enhancing performance while supporting sustainability objectives The ability to combine functionality, cost efficiency, and environmental compliance ensures the continued dominance of the polyethylene material segment in the gable-top liquid cartons market.

The screw caps segment is anticipated to account for 52.4% of the market revenue in 2025, making it the leading closure type. Its growth is driven by the convenience and reusability it provides to consumers, allowing easy opening and resealing of liquid products. Screw caps enhance product safety by minimizing leakage and contamination risks, while supporting extended shelf life.

Manufacturers benefit from the ease of integration with automated filling lines, ensuring consistent closure quality and operational efficiency. The segment’s popularity is further reinforced by the growing demand for on-the-go packaging solutions in retail and foodservice channels. Compliance with food safety regulations and compatibility with a wide range of liquid formulations, including dairy, juices, and beverages, strengthens adoption.

As consumer preference for functional, safe, and convenient packaging increases, screw caps are expected to remain the preferred closure type Continuous improvements in design and sealing technology, along with sustainability initiatives, further solidify the leadership of screw caps in the gable-top liquid cartons market.

The 250-500 ml capacity segment is projected to hold 41.7% of the market revenue in 2025, establishing it as the leading size category. Its dominance is being driven by consumer demand for single-serve and portion-controlled packaging, which offers convenience and reduces waste. This capacity range is widely adopted in retail and foodservice channels, meeting the needs of on-the-go consumption and small household usage.

Cartons within this range provide optimal portability while maintaining sufficient volume for nutritional and beverage products. Manufacturers benefit from standardized production processes and packaging lines designed for this capacity, which enhance operational efficiency and reduce costs. Environmental considerations, such as recyclability and reduced material usage, further support adoption.

The ability to balance convenience, portability, and product protection ensures sustained preference for the 250-500 ml segment As trends in individual packaging and ready-to-consume products continue to rise, this capacity segment is expected to remain the primary revenue contributor within the gable-top liquid cartons market.

FMI predicts that one thing that sets gable top cartons apart from plastic packaging alternatives is source material

In recent years, companies and consumers alike have grown increasingly conscious of how their actions affect the environment. This rise in environmental awareness has led to a higher demand for sustainable packaging solutions. The carton manufacturers are prepared to meet this demand with high-quality eco-friendly gable top cartons.

Gable Top is a superior alternative to many traditional packaging solutions and have several advantages such as better branding, convenience of transportation, storage and use and also is environmentally friendly. Cartons are being utilized to pack edible liquids like dairy products, fruit juices, tomato sauce, soft drinks, water, and non-edible beverages like oils, fuels, and cleaners.

Also, a liquid packaging board is a multi-ply paperboard with robust wet sizing, high stiffness, and a high barrier coating. The most familiar is to utilize three plies with a basis weight of approximately 300 g/m2. These employ polyethylene-coated paperboard or additional liquid packaging board & sometimes a foil laminate. They are mainly known to use polyethylene, paperboard, polypropylene, and aluminum in the form of foil.

A report from Future Market Insights suggests that, despite the gable top carton’s strong association with milk products, it can be used for all kinds of packaging applications. The gable top carton is versatile enough to package everything from dry roasted peanuts to potato salad, and comes with the benefit of sustainability.

One thing that sets gable top cartons apart from plastic packaging alternatives is source material. While plastic is made from non-renewable resources, like crude oil, gable top cartons are primarily made of paperboard, which can be sustainably sourced from renewable resources.

Gable top cartons are also highly recyclable. A recent study found that gable top cartons can be recycled in 62.8% of USA communities. In 2025, they could only be recycled in 37% of the USA communities. The fact that this number has grown so much in the last decade indicates that it will likely continue to increase in the coming years, making the gable top carton an even more sustainable packaging solution.

Gable-top cartons are typically used in liquid packaging, but now this package type is gaining ground in new applications. Gable-top cartons provide high communication potential and stands out on the shelf with their unique shape and customized front panel window.

In addition to being renewable and recyclable, gable top cartons are great for sustainability because they require less fuel to be burned during transportation. Cartons are much more efficiently shaped than plastic jugs or carafes, so they can be shipped in greater volumes. As a result, shipping cartons requires fewer trips, and by extension, fewer fossil fuels, than shipping an equal amount of plastic containers.

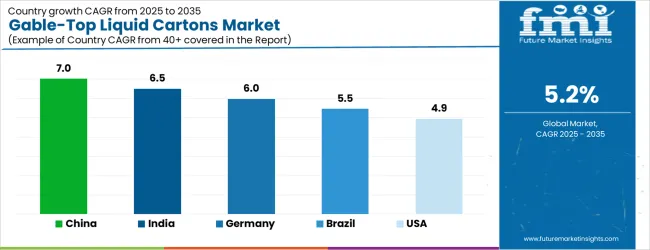

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| USA | 4.9% |

| UK | 4.4% |

| Japan | 3.9% |

The Gable-Top Liquid Cartons Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.9%, yet still underscores a broadly positive trajectory for the global Gable-Top Liquid Cartons Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The USA Gable-Top Liquid Cartons Market is estimated to be valued at USD 3.3 billion in 2025 and is anticipated to reach a valuation of USD 3.3 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 410.3 million and USD 265.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Material Type | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Paperboard, and Others |

| Closure Type | Screw Caps, Flip Caps, and Others |

| Capacity | 250-500 Ml, Less Than 250 Ml, 500-750 Ml, and 750-1000 Ml |

| End User | Food & Beverages, Paints & Lubricants, Pet Food, and Other Industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tetra Pak International S.A., SIG Combibloc Group AG, Elopak ASA, Evergreen Packaging LLC, Nippon Paper Industries Co., Ltd., Greatview Aseptic Packaging Co., Ltd., Adam Pack S.A., BillerudKorsnäs AB, Stora Enso Oyj, Mondi Group, Smurfit Kappa Group plc, WestRock Company, and International Paper Company |

The global gable-top liquid cartons market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the gable-top liquid cartons market is projected to reach USD 14.7 billion by 2035.

The gable-top liquid cartons market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in gable-top liquid cartons market are polyethylene (pe), polypropylene (pp), polyethylene terephthalate (pet), paperboard and others.

In terms of closure type, screw caps segment to command 52.4% share in the gable-top liquid cartons market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Embolic Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Armor Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA