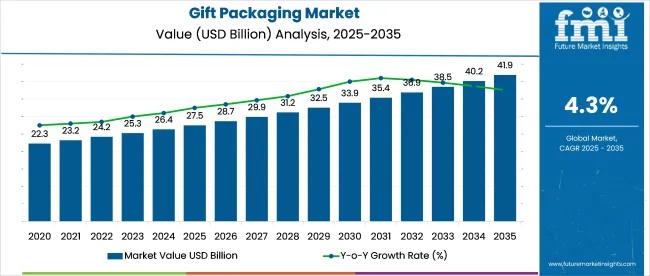

The gift packaging market expands from USD 27.5 billion in 2025 to USD 41.9 billion in 2035, with consistent YoY growth between 4.1% and 5%. In the early phase, growth is moderate, rising to USD 28.7 billion in 2026 and USD 29.9 billion in 2027-as seasonal celebrations and e-commerce gifting trends continue to scale.

| Attribute | Detail |

|---|---|

| Industry Size (2025) | USD 27.5 billion |

| Indsutry Size (2035) | USD 41.9 billion |

| CAGR (2025 to 2035) | 4.3% |

The 4.4% increase in 2026 signals renewed consumer activity post-pandemic normalization, while 2027's 4.2% points to maturing online gifting behaviors. Between 2028 and 2032, annual growth remains within a narrow band of 4.1% to 4.3%, and the market reaches USD 36.8 billion by 2032. Product innovations such as biodegradable wrap materials and modular gift boxes contribute to volume-driven expansion, especially in China, where a 5.8% CAGR sustains momentum.

From 2033, growth transitions toward higher-margin segments. The market climbs from USD 38.3 billion in 2033 to USD 39.9 billion in 2034 and then to USD 41.9 billion in 2035, with a stronger 5% YoY increase. This uptick is tied to personalization technologies, high-end rigid box formats, and expanding corporate gifting budgets in North America and Europe. Future gift packaging trends signal a value-driven shift in market structure, which favors customized and premium gifting formats over traditional volume-based packaging.

The gift packaging market plays a distinct role across several key industries. In the USD 1.2 trillion global packaging space, gift-focused formats make up 3-5%, driven by decorative and premium finishes. Retailers and e-commerce brands spend 8-12% of their secondary packaging budgets on gifting, aiming to elevate unboxing experiences.

Around 15-20% of the USD 500 billion gifting industry’s value goes toward presentation, which shows visual appeal matters to consumers. Luxury brands allocate 10-15% of their product costs to high-end gift packaging. Even in the eco-friendly packaging segment, worth USD 300 billion, 5-8% is tied to greener gifting formats.

The global gift packaging market is evolving with increasing personalization, seasonal demand, and premium branding needs. Among segments, paper & paperboard leads by material with 43% market share, driven by eco-conscious gift-wrapping solutions. Gift boxes, popular for luxury and ready-to-present items, account for 21% of product sales.

Gift boxes held a 16-17% share in 2020, valued at approximately USD 3.5-3.6 billion out of a USD 21.4 billion gift packaging market. By 2025, their share has grown to 21%, reaching USD 5.78 billion, driven by e-commerce, cosmetics, and premium gifting demand.

Custom rigid and collapsible formats are widely adopted by brands for presentation and reusability. Looking ahead, gift boxes are projected to command 23-24% of the market by 2035, translating to USD 9.6-10 billion of the projected USD 41.9 billion industry.

Secondary packaging is expected to dominate by volume and value in 2025, capturing over 47% share of the total packaging type segment. This segment dominates due to its dual role in protection and branding, particularly in retail and premium gifting. Products like decorative sleeves, windowed boxes, and wrapped-around covers are widely used across fashion, cosmetics, and electronics.

Paper and paperboard are projected to lead material usage in the gift packaging market in 2025, holding a 43% share, which translates to approximately USD 11.8 billion of the USD 27.5 billion market. Their dominance is linked to versatility in wraps, bags, and boxes, along with growing demand for recyclable and visually appealing formats. Their printability supports brand customization, while their lightweight nature aids logistics.

Procurement behavior in the industry is shifting toward modular pack formats, short-run print agility, and material traceability. Volatile paperboard prices, seasonal inventory compression, and SKU personalization are prompting converters to refine dieline engineering, digital finishing workflows, and secondary pack integration across confectionery, cosmetics, and e-commerce gifting verticals.

Short-Run Workflow Efficiency and Seasonal Fulfillment Speed

Folding carton suppliers in Turkey and Vietnam adapted their operations for short-run flexibility, responding to tighter lead times ahead of Q4 gift campaigns. By integrating automation and barcode-fed registration, production lines became more agile, supporting quicker turnarounds for fragrance and confectionery brands.

In Poland, packaging converters enhanced efficiency by refining job changeovers, making it easier to handle diverse formats like sleeve wraps and nested boxes. UK fulfillment centers aligned packaging production directly with marketing timelines, streamlining inventory flow.

These operational shifts enabled brand managers to launch region-specific, limited-edition gift packaging with precision-avoiding excess inventory and improving campaign responsiveness across premium and seasonal SKUs.

Personalization Demands Reshaping Print and Finishing Mix

Demand for personalized and themed gift packaging is reshaping production in markets like India, South Korea, and Germany. Brands use name-based designs, custom foiling, and textured finishes-especially for corporate gifts and influencer kits.

This shift has pushed converters to adopt faster, high-resolution digital printing that works on coated and metallic surfaces without delays. In the Middle East, online retailers are using fold-flat magnetic boxes with QR-linked messages to deliver a personalized feel while saving storage space.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| United States | 3.7% |

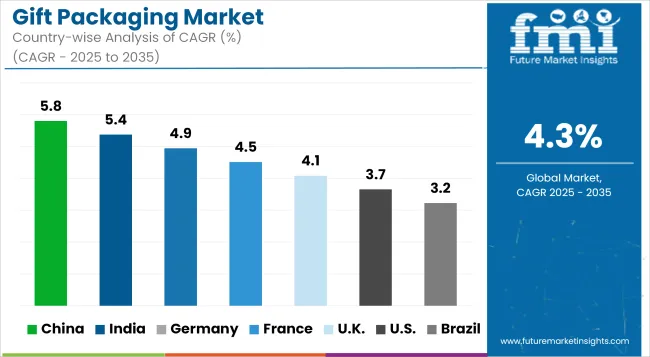

The industry is projected to grow at a CAGR of 4.3% between 2025 and 2035. China (BRICS) leads among the profiled markets with 5.8%, surpassing the global benchmark by 1.5% points. India (BRICS) follows at 5.4% (+1.1%), while Germany (OECD) posts 4.9% (+0.6%) and France (OECD) records 4.5% (+0.2%).

In contrast, the United States (OECD) trails at 3.7%, falling 0.6% below the global average. The differences across these markets reflect regional preferences in presentation aesthetics, retail gifting trends, and supply chain sophistication. BRICS nations are exhibiting faster expansion due to rising demand for personalized and decorative packaging, while OECD economies reflect a steady pace aligned with established retail and seasonal consumption cycles.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

In 2025, China holds an estimated 5.8% share of the global gift packaging market. Between 2020 and 2024, demand was rooted in traditional gifting tied to weddings and festivals, using low-cost plastic bags, foil wraps, and simple paper packs. Customization was rare, and production was mostly manual and regional. In 2025, packaging has shifted toward premium, design-led formats driven by e-commerce and social commerce.

India’s gift packaging market expanded from approximately USD 1.73 billion in 2020 to USD 2.15 billion by 2024, posting a CAGR of around 5.5%. This growth was driven by a sharp rebound in wedding celebrations, increased Diwali and Raksha Bandhan gifting volumes, and a rise in decorative packaging used by local brands and digital platforms. In 2025, the market is expected to reach USD 2.26 billion and grow to USD 3.83 billion by 2035 at a 5.4% CAGR, translating to annual value additions of USD 150-170 million.

During 2025 to 2035, a shift is visible in packaging as function and not just as protective wrapping for storytelling, personalization, and brand differentiation. Rigid boxes, printed sleeves, and fold-flat formats have replaced generic wraps in urban centers.

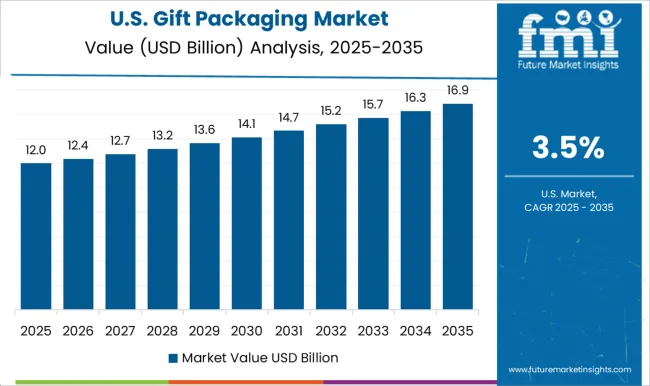

The USA gift packaging market is projected to grow from an estimated USD 10.2 billion in 2025 to approximately USD 14.6 billion by 2035, advancing at a 3.7% CAGR. From 2020 to 2024, the market increased from around USD 8.8 billion, driven by digital gifting adoption, seasonal gifting campaigns, and growing demand for personalized experiences. Annual market value additions of roughly USD 140 million indicate a transition from functional packaging toward branded, emotionally resonant formats.

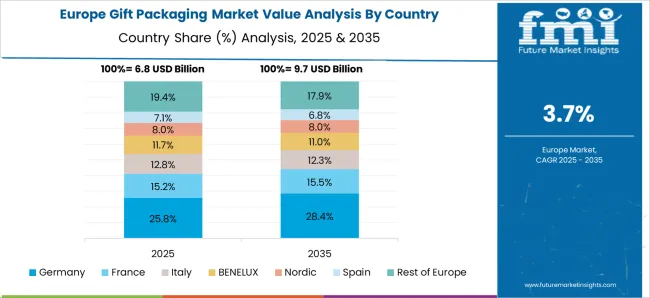

Germany gift packaging market is expected to grow at a 4.9% CAGR between 2025 and 2035, with average annual value additions of USD 130-140 million. During the historical period (2022 to 2024), year-on-year growth ranged between 5.2% and 5.5%. The growth shows renewed demand for gifting formats in cosmetics, gourmet food, and premium retail. Growth during this time was supported by expanded use of decorative rigid boxes and printed paper wraps for seasonal and branded gifting.

From 2025 onward, year-on-year gains are expected to remain consistent as retailers increase demand for customizable, design-focused packaging options.

France’s gift packaging market grew steadily between 2020 and 2024, driven by rising demand for premium formats in luxury retail and cosmetics. YoY growth ranged from 5.0% to 5.5%, with brands adopting metallic finishes, textured wraps, and eco-friendly materials to meet both consumer and regulatory expectations. From 2025 to 2035, the market is projected to grow at a 4.5% CAGR, with annual value additions of USD 100-150 million.

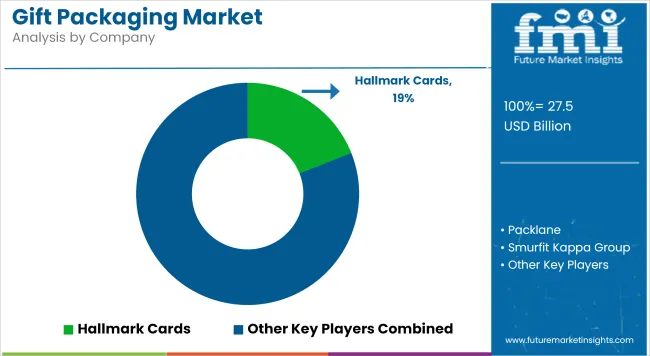

The industry is led by established players like Hallmark Cards and Smurfit Kappa Group, who dominate through brand strength and large-scale production. Hallmark refreshes its product line with seasonal collections and designer collaborations, while Smurfit Kappa prioritizes efficiency in high-volume manufacturing. Newer entrants such as Packlane and Qwikcilver Solutions compete by offering digitally customizable packaging solutions.

DS Smith plc and Mondi plc invest in material science to create lightweight yet sturdy packaging options. IG Design Group plc expands through acquisitions, increasing market penetration. Barriers to entry include substantial capital requirements for manufacturing facilities, compliance with quality standards, and the difficulty of securing retail distribution.

Smaller firms like Karl Knauer KG focus on premium segments with distinctive designs, while Interpack serves luxury brands with high-end printing techniques. Competition remains intense, requiring continuous innovation to gain market share.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 27.5 billion |

| Projected Market Size (2035) | USD 41.9 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Packaging Types Analyzed (Segment 1) | Primary, Secondary, Tertiary |

| Product Types Analyzed (Segment 2) | Gift Boxes, Containers, Ribbon & Bows, Gift Sacks, Gift Bags, Wrapping Paper, Tissue Paper & Shreds, Cellophane Over Wrap & Bags, Gift Cards & Money Holders, Others |

| Materials Analyzed (Segment 3) | Plastic, Paper & Paperboard, Metals, Glass, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East and Africa |

| Countries Tracked | United States, Canada, Germany, United Kingdom, France, India, China, Japan, Brazil, South Africa |

| Key Players | Hallmark Cards, Packlane, Smurfit Kappa Group, Ebro Colour GmbH, Interpack, Card Factory, DS Smith plc, IG Design Group plc, Karl Knauer KG, Mondi plc, Manjushree Technopack Limited, Qwikcilver Solutions, Diageo |

| Additional Attributes | Dollar sales, share by material and product type, rising demand from e-commerce gifting channels, expansion in custom and seasonal packaging, paperboard formats gaining share over plastics, branding-oriented packaging differentiation across Europe and Asia Pacific |

The global gift packaging market is estimated to be valued at USD 27.5 billion in 2025.

The market size for the gift packaging market is projected to reach USD 41.0 billion by 2035.

The gift packaging market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in gift packaging market are primary, secondary and tertiary.

In terms of product type, gift boxes segment to command 28.7% share in the gift packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Gift Packaging Companies

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA