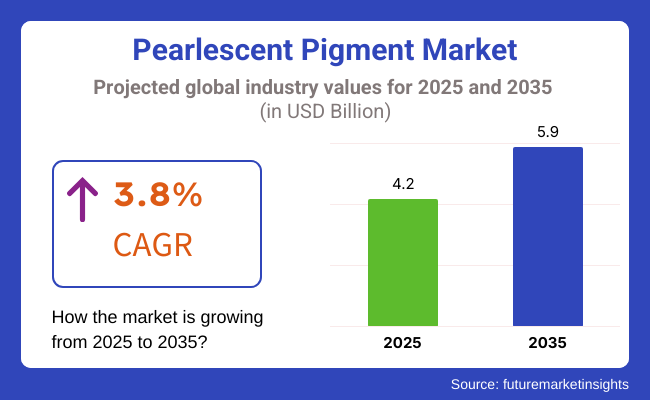

The global pearlescent pigment market is projected to reach USD 4.2 billion in 2025. A steady CAGR of 3.8% is expected from 2025 to 2035, pushing the market valuation to USD 5.9 billion by the end of the forecast period. Adoption has been growing in automotive coatings, plastics, cosmetics, and printing inks, where high-performance and aesthetic enhancements are essential.

In the automotive sector, pearlescent pigments have been widely applied in exterior coatings to achieve a metallic effect without metal particles. These pigments offer compatibility with waterborne systems and support environmentally compliant finishes. BASF, in its February 2025 technical bulletin, reported that pearlescent pigments enhanced resin dispersion and chemical stability in their new automotive coating lines. Changan Automobile disclosed in its 2024 ESG report that pearlescent finishes accounted for over 15% of premium vehicle exports, citing increased demand in international markets.

In cosmetics, pearlescent pigments have seen higher usage in products such as lip gloss, highlighters, and nail enamels. Merck KGaA noted in a January 2025 press release that sales of pearlescent pigments grew by 6% year-over-year due to their functional performance and visual appeal. CEO Belen Garijo stated that consumer preference for ethically sourced and sustainable mica aligns with the company’s long-term product strategy. An expansion of the pigment production line at the Darmstadt facility was confirmed in late 2024 to meet growing demand from clean beauty brands.

Toyo Ink SC Holdings reported in a 2024 investor presentation that demand increased for high-luster, non-metallic pigments in luxury packaging applications across Southeast Asia and Europe. Compliance with REACH regulations from the European Chemicals Agency was cited as a factor enhancing customer confidence. Adjustments in formulation processes were implemented at the company's Thailand plant to increase pigment uniformity in printing inks.

In plastics, pearlescent pigments have been integrated into PVC profiles, cosmetic containers, and household accessories. A white paper issued by Sudarshan Chemical Industries in March 2025 confirmed that their pigments provided improved UV stability and surface uniformity. These outcomes were achieved through the use of finer particle sizes and high-purity synthetic mica substrates, which replaced natural mica in several product lines.

Industry challenges related to raw material cost volatility, especially for mica and titanium dioxide, remain present. Increased environmental scrutiny over mica mining has pushed several producers to scale synthetic mica capacity. Kolortek disclosed in its 2024 operational update that a 25% production increase was executed to meet traceability and regulatory requirements in North American and European markets. Continued focus on sustainable formulations, synthetic alternatives, and application-specific performance is expected to sustain market demand over the coming decade.

The market is segmented based on purity type, structure type, end-use industry, and region. By purity type, the market is divided into natural pearl pigment, synthetic pearl pigment, and glass flake pearl pigment. In terms of structure type, it is segmented into substrate-free, monolayer, and multilayer.

Based on end-use industry, the market is categorized into automotive paints, personal care, plastic industry, printing, and others (textiles and fabrics, ceramics and glassware, toys and stationery, cosmetic packaging). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

The glass flake pearl pigment segment is projected to grow at the fastest CAGR of 6.4% between 2025 and 2035. These pigments are favored for their high reflectivity, weather resistance, and multi-angle brilliance, making them ideal for premium automotive paints, luxury goods, and high-end cosmetics.

Their enhanced sparkle and durability under UV exposure give them an edge in exterior applications requiring both aesthetics and performance. Demand is also rising in decorative coatings and specialty packaging, where visual impact is a key differentiator.

Synthetic pearl pigments, typically derived from mica substrates with titanium dioxide or iron oxide coatings, dominate the mainstream market due to their broad utility, color variety, and cost-effectiveness. They are widely adopted in personal care products, plastic masterbatches, and industrial inks.

Natural pearl pigments maintain limited but steady demand, particularly in artisanal and natural cosmetic formulations. These are derived from fish scales or natural mica and valued for their organic origin and soft luster, although challenges with consistency and supply scale limit broader application.

| Purity Type Segment | CAGR (2025 to 2035) |

|---|---|

| Glass Flake Pearl Pigment | 6.4% |

The multilayer structure segment is expected to grow at the highest CAGR of 6.7% from 2025 to 2035, driven by its ability to deliver superior color saturation, angle-dependent chromatic effects, and high durability. These pigments are constructed with alternating layers of refractive materials, which intensify light interference, making them ideal for automotive coatings, iridescent cosmetics, and luxury product decoration. Their complex structure enables advanced color effects like color travel and intense sparkle that are unattainable with simpler designs.

Monolayer pigments, typically consisting of a single mica or silica layer coated with metal oxides, continue to serve as a core option in mid-range applications, offering consistent pearlescent appearance at lower cost. They are widely used in packaging, plastics, and decorative paints. Substrate-free pigments are used primarily in highly specialized or experimental formulations. Although they offer unique light diffusion effects, their adoption remains niche due to cost, application complexity, and compatibility limitations.

| Structure Type Segment | CAGR (2025 to 2035) |

|---|---|

| Multilayer | 6.7% |

The automotive paints segment is projected to be the fastest-growing end-use category in the pearlescent pigment market, expanding at a CAGR of 6.9% from 2025 to 2035. Growth is fueled by rising global demand for premium finishes, color customization, and environmentally durable coatings in high-end vehicles.

Pearlescent pigments are used extensively in OEM finishes and aftermarket refinish coatings to achieve shimmering, multi-dimensional effects. The shift toward water-based coatings and low-VOC formulations further supports adoption of pearl pigments with eco-friendly binders.

The personal care sector remains a strong contributor, especially in decorative cosmetics and skincare, where pearlescent pigments provide glow, radiance, and texture-enhancing properties. Innovation in color cosmetics and vegan/natural ingredient trends are maintaining robust demand.

Plastic industry applications include masterbatches, molded consumer goods, and packaging films, where pigment dispersion and light stability are key performance factors. Printing continues to use pearlescent pigments in gravure and screen inks for premium labels and packaging, while others, including textiles and architectural coatings, form a niche but evolving market supported by specialty demand.

| End-use Industry Segment | CAGR (2025 to 2035) |

|---|---|

| Automotive Paints | 6.9% |

Challenges

The high production costs are a key consideration for the pearlescent pigment market - Producing pearlescent pigments, particularly high-purity synthetic variants, is expensive. Natural mica and other raw material prices directly impact market competition. The ethics aspect has emerged due to environmental concerns associated with mica mining, prompting regulatory intervention and awareness campaigns from consumers to reject child labour in the mica procurement process.

Opportunities

However, such challenges offer a route to an extension, particularly with bio-based pearlescent pigments that offer green and sustainably harvested options to their mineral counterparts. In high-performance applications, next-generation pigments with improved colour durability and better UV resistance are expected to drive wider adoption.

The rise of smart packaging and anti-counterfeiting solutions has also opened new avenues for pearlescent pigment demand, especially in the luxury goods and pharmaceutical sectors. Pigments Manufacturers Join Forces with Technology Firms to Expand Market Reach and Diversify Product Applications

The upsurge in demand for pearlescent pigments in the automotive, cosmetics, packaging, and coatings industries is propelling in the United States for this particular product. The high demand for premium products with luxury aesthetics and finishing, such as those used in luxury products, automotive coatings, and personal care products, is one of the primary factors spurring growth in this market. Furthermore, developments in pigment production, including eco-friendly and synthetic pearlescent pigments, are fostering adoption in end usage industries.

The automotive sector is the key market grower in the pearlescent pigments market owing to the high-quality vehicle coatings employed by the automotive manufacturers to enhance iridescent and metallic effects. Moreover, an increase in the demand for pearlescent pigments from the cosmetic segment on the back of the high use of these pigments in lipsticks, eyeshadow, nail polishes, skincare products, etc., is anticipated to increase consumer demand for natural, luminous, and shimmering appearances.

Just like market trends, civil regulations are also up at play. Tightening environmental regulations on heavy metal-based pigments has led to the development of non-toxic, biodegradable, and sustainable alternatives. The growing demand for these products is likely to drive the growth of the bio-based pearlescent pigments market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The growth of the United Kingdom's pearlescent pigment market is driven by the demand for high-end cosmetics, automotive coatings, and specialty printing applications. One major factor fueling growth in the market is the country’s robust luxury goods industry, which encompasses fashion, jewellery, and premium packaging.

A large shift towards bio-based and natural-derived pearlescent pigments is now being observed in cosmetics, personal care and food packaging categories as a result of the UK commitment to sustainability and green chemistry. Many companies have been investing in alternative formulations for pigments that can be playful and high-performance while minimizing damage to the environment.

There is also an increasing trend towards the use of specialty pigments in automotive coatings in the UK, particularly for luxury cars and custom paint jobs. The rise of electric vehicles (EVs) is also driving the popularity for cutting-edge, shiny and sparkling coatings that boost vehicle styling, as well as surface protection.

Moreover, the rise in demand for pearlescent pigments in specialty inks, decorative prints, and holographic security applications due to the growth of digital printing packaging further contributes to the market growth. Fruits and vegetables with coveted premium appearances dominate the UK luxury goods market as brands push the boundaries on how to incorporate pearlescent pigments for striking aesthetics.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

One of the largest market for pearlescent pigments are in Europe, especially the European pearlescent pigment market, which is forecasted to remain constant while being mainly driven by demand in luxury cosmetics, high-end automobile coatings, and premium packaging applications. Intense amount of usage for pearlescent pigments in automotive and fashion industries hold Germany, France, and Italy at the top leading countries on their overall market.

EU policies such as the Green Deal initiative are directed towards sustainable production of non-toxic and eco-efficient pigments. These factors are fuelling the demand for synthetic mica and plant-based pearlescent pigments. Likewise, strict reach dictates force pigment producers out of toxic materials, driving up the demand for safer substitutes.

France and Italy are the only remaining major contributors to the overall investment flow for aesthetic-enhancing pigments for the luxury and high-end consumer goods industry, which is primarily used for perfumes, fashion accessories and premium brand packaging. Furthermore, digital and 3D printing is leading to a growing demand for specialty inks with pearlescent effects.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

Japanese pearlescent pigment is witnessing a surge in demand owing to the growing automotive, electronics, and cosmetics industries. Japan’s emphasis on precision and high-tech manufacturing has made pearlescent pigments common in automotive coatings, consumer electronics and high-end cosmetics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

South Korea is witnessing a flourishing demand for pearlescent pigment with rapidly growing automotive, cosmetic, packaging, and electronics industries. South Korea is the leading international country in beauty and skin care products, where names like Amor Pacific, LG Household & Health Care, and Innisfree all make heavy use of pearlescent pigments in foundations, lipsticks, and eyeshadows to achieve glistening and gleaming effects.

With an increasing popularity of K-beauty among all age groups, it is further boosting the demand for Nano-sized, bio-compatible pearlescent pigments in cosmetic formulations, as K-beauty mainly focuses on glowing /dewy skin.

Another industry driving demand for pearlescent pigments is the automotive industry, which uses the pigments to make exterior paints more eye-catching. According to the latest market research, Korean car manufacturers such as Hyundai, Kia, and Genesis are also investing money in premium finishes with growing market demand for metallic, new iridescent, or UV-resistant coats.

Furthermore, the growing popularity of electric vehicles (EVs) and smart cars has resulted in the adoption of advanced filtering pearlescent pigments in interior trims, dashboards, and electronic display coatings to improve aesthetics.

Pearlescent pigments are also employed in the packaging and printing industries to brand luxury products, especially in electronics and skincare. Pearlescent pigments are also used extensively in high-end electronic devices, smartphone casings, and OLED displays to give them sleek and futuristic finishes (South Korea is home to electronics juggernauts like Samsung and LG).

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The market for pearlescent pigments is competitive as the applications for high quality aesthetic coatings, automotive, cosmetics, packaging, etc. proliferate. It focuses on innovative, green products and expanding your offering to meet the changing needs of the consumer. The market is projected to gain from the increasing demand for sustainable and high-performance pigments and technological advancements in the manufacturing process.

Some market players can be categorized as regional and niche which nurtures innovation, cost, and product diversification in driving growth over a wide sector of the market. Key players include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Purity Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Structure Type, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Structure Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Purity Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Structure Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Structure Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Purity Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Structure Type, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Structure Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Purity Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Structure Type, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Structure Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Purity Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Structure Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Structure Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Purity Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Structure Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Structure Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Purity Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Structure Type, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Structure Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Purity Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Purity Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Structure Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Structure Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End-use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Purity Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Structure Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Purity Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Purity Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Purity Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Purity Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Structure Type, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Structure Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Structure Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Structure Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Purity Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Structure Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End-use Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Purity Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Structure Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Purity Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Purity Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Purity Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Purity Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Structure Type, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Structure Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Structure Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Structure Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Purity Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Structure Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Purity Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Structure Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Purity Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Purity Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Purity Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Purity Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Structure Type, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Structure Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Structure Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Structure Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Purity Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Structure Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Purity Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Structure Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Purity Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Purity Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Purity Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Purity Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Structure Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Structure Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Structure Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Structure Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Purity Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Structure Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Purity Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Structure Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Purity Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Purity Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Purity Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Purity Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Structure Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Structure Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Structure Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Structure Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Purity Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Structure Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Purity Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Structure Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Purity Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Purity Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Purity Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Purity Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Structure Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Structure Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Structure Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Structure Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Purity Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Structure Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-use Industry, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Purity Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Structure Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Purity Type, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Purity Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Purity Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Purity Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Structure Type, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Structure Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Structure Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Structure Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Purity Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Structure Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-use Industry, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Purity Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Structure Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Purity Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Purity Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Purity Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Purity Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Structure Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Structure Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Structure Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Structure Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End-use Industry, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Purity Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Structure Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-use Industry, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The gross market value for Pearlescent Pigment Market was USD 4.2 Billion.

Pearlescent Pigment Market to USD 5.9 Billion by 2035.

Demand for aesthetic and high- performance coatings, coatings in automotive, cosmetics industries and packaging is expected to act as a key growth factor for pearlescent pigment market. Greater demand in areas like printing inks, plastics, and consumer goods makes projected expansion stronger. The increase in investment in new colour solutions and pigment technology will also accelerate the pigments & dyes market growth.

Top 5 countries as producers and consumers in Pearlescent Pigment Market are the USA, UK, European Union, Japan and South Korea.

Synthetic Pearl Pigments and Glass Flake Pearl Pigments: Among these two types of Pearl Pigments, synthetic pearl pigment and glass flake pearl pigment is expected to form a significant share, having a maximum share during the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.