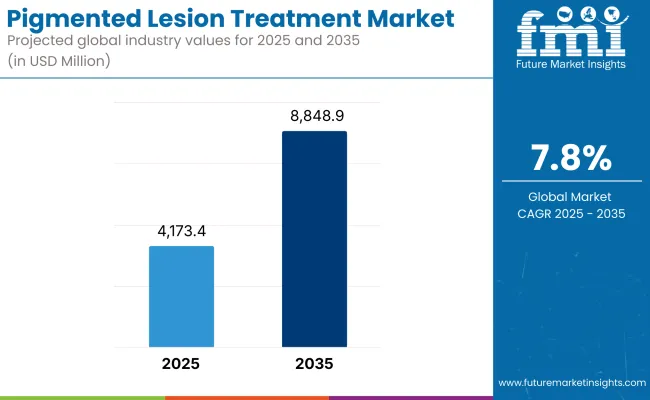

The market is expected to reach approximately USD 4,173.4 million in 2025 and expand to around USD 8,848.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 7.8% over the forecast period.

The molecular diagnostics industry is expected to witness significant change in the near term, driven by shifting consumer beauty and competitive device innovation, most notably in the pigmented lesion treatment space. As dermatological care based on appearance remains on the ascendancy, clinics and aesthetic facilities are focusing on treatments that provide speed, precision and minimal downtime.

The industry is increasingly driven by private investment, rapid device replacement cycles, and patient demand for non-invasive treatments. As premium skin care segments expand, providers are incorporating technologies for age spots, melasma and hyperpigmentation to their treatment portfolios. It is transforming the way clinics promote their offering, unlocking well-paying opportunities for the device companies and service based aesthetics firms.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4,173.4 million |

| Industry Value (2035F) | USD 8,848.9 million |

| CAGR (2025 to 2035) | 7.8% |

From 2020 to 2024, the market for pigmented lesion treatment saw steady expansion, with trends fueled primarily by cycles of innovation and changes in consumer attitudes. The initial years of the period witnessed a steady replacement of the older Q-switched lasers by the newer picosecond and nanosecond technologies, which provided better pigment targeting and fewer treatment sessions. Medical clinics started promoting pigmentation treatment under wider skin rejuvenation packages, widening its appeal to younger age groups.

The post-pandemic aesthetic boom further fueled procedure volumes, especially in private and boutique clinics. Notably, device vendors adopted aggressive channel strategies, offering leasing models and ROI-focused packages to attract small and mid-sized aesthetic centers.

Growth was also influenced by geographic diversification, with mid-tier cities and emerging markets showing increased adoption due to expanding networks of aesthetic franchise chains. As demand patterns matured, players with flexible, upgradable systems gained traction, setting the stage for a more modular, outcomes-driven market going forward.

North America continues to lead the pigmented lesion treatment market, driven by the rapid commercialization of AI-enabled diagnostic imaging integrated within aesthetic dermatology practices. Clinics are leveraging machine vision platforms to differentiate benign versus complex pigmented lesions, enabling precision-guided laser treatments with real-time feedback. This integration is influencing purchasing decisions toward platforms that sync with diagnostic software for lesion mapping and post-treatment tracking.

In the USA, multisite aesthetic chains are adopting unified device ecosystems compatible with centralized patient analytics, enabling cross-location treatment consistency. High procedural throughput in urban clinics is also prompting demand for ultra-fast devices with low cooldown time. Furthermore, tech-driven startups are offering performance-based leasing models, where device usage and treatment outcomes are tracked to determine monthly costs-disrupting traditional equipment procurement models.

In Europe, the pigmented lesion treatment market is being redefined by emerging reimbursement-linked outcome tracking and uniform treatment classification frameworks. Countries like Germany, Switzerland, and the Netherlands are piloting regional treatment coding systems that classify pigmentation types and correlate outcomes with device types used. This trend is creating a preference for systems capable of exporting structured treatment metadata for health audits and claims processing.

In Scandinavia and Western Europe, compact, energy-efficient laser platforms are favored due to stricter environmental regulations and clinic energy optimization goals. Moreover, the rise of cross-border aesthetic tourism within the EU is prompting clinics to adopt multilingual device interfaces and auto-calibration systems that support diverse operator skill sets. Device manufacturers offering multilingual support and simplified procedural presets are gaining preference across multilingual regions such as Belgium and Switzerland.

Asia-Pacific’s pigmented lesion treatment market is undergoing accelerated growth due to platform localization and tailored marketing strategies targeting urban millennials. In India, Vietnam, and Indonesia, aesthetic startups are driving demand for cost-optimized systems with mobile app-based consultation tools that help identify treatable pigment conditions. In Japan and South Korea, patient loyalty programs integrated with device treatment logs are reshaping how clinics promote repeat procedures, favoring systems with embedded CRM compatibility.

Chinese manufacturers are rapidly gaining domestic market share by offering modular treatment platforms with AI-guided protocols adapted to East Asian skin types. Meanwhile, in Australia and Singapore, aesthetic centers are bundling pigmented lesion removal with hyperpigmentation prevention treatments, pushing device makers to develop hybrid platforms capable of dual-functionality. Across emerging Asia, localized support networks and on-site training hubs are key factors in clinic purchasing decisions, giving regionally established vendors a strong competitive edge.

Lack of Treatment Protocol Harmonization and Device Usage Variability Limiting Market Predictability

A critical challenge facing the pigmented lesion treatment market is the absence of harmonized treatment protocols and highly inconsistent usage patterns of laser and light-based systems across care settings. Unlike standardized medical procedures, pigmentation treatments are often defined by practitioner preference, device brand familiarity, and subjective evaluation of lesion depth and type. This leads to inconsistent patient outcomes, affecting clinic reputation and treatment repeatability.

Additionally, the learning curve between device interfaces further complicates multi-brand adoption in aesthetic chains. With no clear clinical consensus on optimal pulse duration, fluence range, or wavelength combinations, vendors struggle to establish consistent value propositions.

Furthermore, variability in training programs across regions leads to suboptimal usage of advanced systems, undermining ROI for both the provider and manufacturer. These inconsistencies obstruct long-term planning and hinder widespread protocol licensing or white-label service development, especially in franchise-based business models.

Expansion of Subscription-Based Device Models and Integrated Treatment Analytics Unlocking New Revenue Channels

A major opportunity in the pigmented lesion treatment market is the growing adoption of subscription-based device usage models coupled with integrated treatment analytics platforms. Aesthetic clinics, particularly in urban growth hubs, are embracing pay-per-use and hybrid rental options that lower capital expenditure and enable access to high-end systems with minimal financial risk. Manufacturers offering bundled services-combining device access, maintenance, software updates, and usage analytics-are increasingly favored by mid-tier providers aiming to scale without operational overhead.

Simultaneously, the integration of cloud-based treatment tracking platforms is allowing clinics to benchmark pigmentation clearance rates, monitor session progress, and personalize treatment paths. These insights are not only improving patient satisfaction but also enabling outcome-based marketing and referral strategies. As subscription ecosystems evolve, they are opening new revenue opportunities for vendors who can deliver both hardware and digital performance insights-transforming the market from a device sale model into an ongoing service engagement.

From 2019 to 2023, the market for pigmented lesion treatment underwent steady development, mainly caused by the shift away from older laser systems towards newer picosecond and hybrid platforms. Clinics increasingly marketed pigmentation correction as a component of comprehensive skin improvement programs, expanding patient populations and growing session numbers. Device manufacturers reacted with quicker pulse delivery equipment and adaptive recognition of skin tone algorithms, allowing for more accurate treatments on diverse skin types.

Moving into 2024 and beyond, the market is expected to pivot toward platform convergence, where pigmentation, vascular, and rejuvenation treatments are performed on a single multi-functional system. AI-powered treatment customization, subscription-based device access, and real-time outcome dashboards will become industry standards.

Additionally, consumer-centric models-like at-home diagnostic tools linked to clinical treatments-are set to emerge, expanding patient acquisition channels. As aesthetic services become more data-driven, vendors capable of integrating hardware, software, and analytics will define the next phase of competitive advantage.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Device clearance primarily for dermatologic use; variable oversight of aesthetic clinics |

| Technological Advancements | Q-switched and IPL technologies with manual calibration |

| Consumer Demand | Aesthetic-focused patients targeting age spots and melasma ; clinic-based treatments |

| Market Growth Drivers | Rise in UV exposure, aging population, and aesthetic awareness |

| Sustainability | High energy consumption, non-recyclable tips and cartridges |

| Supply Chain Dynamics | OEM-to-clinic sales model; centralized distribution |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter standards for pigmentation-specific devices; home-use and AI tool regulations |

| Technological Advancements | AI-assisted pigment analysis, selective picosecond lasers, hybrid platforms with cooling |

| Consumer Demand | Growing DTC demand, younger consumers, and demand for fast, minimally invasive options |

| Market Growth Drivers | AI-powered skin mapping, multi-treatment platforms, and hybrid therapy protocols |

| Sustainability | Recyclable handpieces, energy-efficient lasers, modular maintenance systems |

| Supply Chain Dynamics | Subscription-based device models, clinic-level customization, emerging market expansion |

Market Outlook

The United States remains the most commercially advanced market for pigmented lesion treatment, driven by early consumer adoption of premium aesthetic services and the dominance of private dermatology groups. High patient expectations around minimal downtime and precision outcomes have fueled demand for ultra-targeted laser systems with proprietary pulse calibration.

Consolidated aesthetic networks are scaling rapidly, adopting treatment standardization protocols across regions. With high marketing intensity and a growing culture of elective cosmetic care, device manufacturers are bundling training, branding support, and CRM integrations as part of their go-to-market approach. In addition, integration with patient review platforms and satisfaction analytics is influencing procurement in competitive urban centers.

Market Growth Factors

Market Forecast

| Year | CAGR |

|---|---|

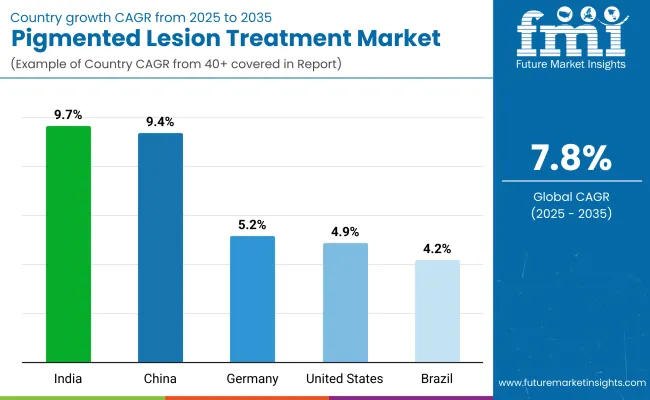

| 2025 to 2035 | 4.9% |

Market Outlook

India's market for pigmented lesion treatments is growing rapidly, driven by climbing urban demand for aesthetic dermatology and the spread of cosmetic clinics across Tier I and Tier II cities. Affordability and multi-functionality are major decision drivers, with clinics addressing a wide variety of pigmentation issues with minimal resources. Local players are making inroads with cost-effective, robust systems with excellent after-sales support.

At the same time, consumer demand is growing driven by social media, celebrity endorsements, and technology-enabled skin diagnostics. New business models like dermatology co-working facilities and mobile treatment vehicles are further stretching the reach of pigmentation treatments outside of traditional clinics.

Market Growth Factors

Market Forecast

| Year | CAGR |

|---|---|

| 2025 to 2035 | 9.7% |

Market Outlook

China’s pigmented lesion treatment market is undergoing aggressive expansion, led by private hospital groups, aesthetic mega-chains, and beauty tech startups. Consumer appetite for rapid, visible results is driving interest in high-frequency laser platforms and AI-assisted pigment mapping systems. Domestic brands are advancing quickly, leveraging local R&D capabilities and partnerships with app-based skin analysis platforms.

Clinics are also leveraging e-commerce platforms for service promotions, accelerating demand for devices that support visual treatment planning and real-time progress tracking. Additionally, China’s unique digital ecosystem is pushing manufacturers to integrate device data into popular mobile health and beauty apps, unlocking new engagement models.

Market Growth Factors

Market Forecast

| Year | CAGR |

|---|---|

| 2025 to 2035 | 9.4% |

Market Outlook

Germany’s pigmented lesion treatment market is driven by clinical efficacy, device reliability, and regulatory compliance. Aesthetic dermatology practices prioritize CE-certified systems that meet high documentation and procedural traceability standards. Preference is strong for multi-modality systems that can serve both cosmetic and dermatological indications within the same platform. Environmental impact considerations are also influencing procurement, with a shift toward energy-efficient and recyclable device components.

As clinical guidelines tighten around evidence-based care, treatment systems with built-in documentation tools and before/after image archiving are increasingly favored. Demand is also growing for systems that support pigmentation treatment under insurance coverage when categorized as medical necessity.

Market Growth Factors

Market Forecast

| Year | CAGR |

|---|---|

| 2025 to 2035 | 5.2% |

Market Outlook

Brazil represents a high-growth market for pigmented lesion treatment, with aesthetic procedures deeply integrated into the country’s beauty and wellness culture. A strong practitioner base and consumer demand for minimally invasive pigmentation correction have created a fertile ground for innovation.

Clinics emphasize ease of use, treatment safety on darker skin tones, and visible results with minimal sessions. The informal clinic segment is also substantial, with rising demand for entry-level professional devices that balance performance with affordability. Additionally, medical spas and beauty franchises are seeking compact, easy-to-train systems that support high client turnover. Local distributors play a critical role in market access and after-sales success.

Market Growth Factors

Market Forecast

| Year | CAGR |

|---|---|

| 2025 to 2035 | 4.2% |

Lasers and Energy-based Devices Dominating Market Share Through Precision and Versatility

Lasers and energy based devices are the most powerful segment in the pigmented lesion treatment market because of their very high efficacy, precision, and wide-ranging uses. Because lasers that cause injury to nearby tissue can be used to treat melanin-rich lesions, Q-switched, picosecond and fractional lasers are widely used by dermatology clinics around the world. These devices incorporate tunable wavelengths and pulse durations that allow physicians to improve lesions based on lesion depth, pigment density, and skin type.

Its consistent outcomes, minimal downtime, and rising availability for darker skin tones makes chemical peels the gold standard of pigmentation correction. Lastly, the new laser platforms are multi-modality, so clinics can expand the services they provide without the expense of additional systems.

Combined with skin imaging devices and treatment pre-sets, operator variability is minimized, speeding adoption. Laser systems offer improved clinical effectiveness, together with a cosmetic attractiveness that enables them to last as the standby mode in both city dermatology chains and boutique practices.

Micro-Focused Ultrasound Emerging as Niche Modality for Deep Dermal Lesion Targeting

Micro-focused ultrasound (MFU) is a new modality that is increasing in popularity in the treatment of pigmented lesions, particularly challenging-to-treat dermal pigmentations like deep melasma and recalcitrant lentigines. In contrast to lasers or RF, MFU delivers focused acoustic energy inside the skin without damaging the overlying epidermis, creating thermal coagulation to precise depths. This feature makes it an appealing choice for lesions placed at the dermal-epidermal junction or for those not responsive to traditional therapy.

Clinics that provide combination protocols have now started adding MFU as a pretreatment or follow-up to laser procedures to optimize long term pigment elimination and finally lower recurrence. Moreover, it is non-surgical and can even be endured by heat-sensitive skin types, thus offering a differentiator in competitive aesthetics markets.

Even if currently used in only a limited number of high-end offices, vendor-initiated education and cross-compatibility with facial tightening indications are leading to growth of interest. With greater awareness, MFU is in a strong position to wring market share from niche awareness, especially as it relates to a multi-modal, therapeutic-cosmetic platform for dermatologists.

Freckles Segment Leading the Market with High Treatment Demand and Cosmetic Relevance

Freckles are the most prevalent lesion type for cosmetic treatment of pigmented lesions due to their high prevalence and high demand in cosmetic treatment. These small, melanin-packed spots heal exceptionally well to non-invasive laser and light-based therapies, most notably Q-switched and IPL platforms. With increasing aesthetic awareness - particularly in both halves of East Asia and in Western markets - freckles are among the most frequently queried issues at dermatology clinics and medspas.

Treatment cycles on freckles are short, there is minimal time to recover, and quite frequently, visual effects are instantaneously apparent, rendering them favorable for both the providers and the patients. Such a chameleon-like responsiveness to a plethora of energy based modalities has led to unmatched clinical success and returning clients.

Cultural and cosmetic ideals in markets such as China, South Korea and Japan are oriented towards fair, even colored skin, which just reinforces demand. In addition, on the aesthetic dermatology front, advertising campaigns and smartphone-based skin-scanning applications are empowering consumers to self-diagnose and seek correction of freckles, driving first-time conversions.

Melasma Segment Emerging Due to Rising Incidence and Treatment Complexity

The increase in the base affected population (middle-aged adults) and demand of multimodal management of pigmented lesions makes melasma a high-growth segment of the overall pigmented lesion treatment market. As opposed to freckles or lentigines, melasma is characterized by a deeper deposition of pigmented material within the dermis and has a robust association with hormonal changes, UV exposure, and genetic susceptibility.

This complexity renders it more difficult to treat, commonly necessitating a combination of laser therapy along with topical depigmenting agents and also energy-based devices such as RF or ultrasound. Clinics are increasingly investing in platforms that enable customized pulse parameters and skin cooling to avoid post-inflammatory hyperpigmentation-especially in patients with darker skin types.

The advent of AI-driven diagnostic tools that categorize melasma type and depth is further allowing for precise treatment mapping. Not historically an aesthetic priority, growing awareness of its psychological and visual effects is bringing melasma into the mainstream of dermatology portfolios. As treatment protocols mature, further clinical and commercial development is anticipated for this segment.

The pigmented lesion treatment market is exploring a noteworthy opposition as the skin pigmentation disorder is along with increasing in revolt, developed dermatological technologies, and growing accessibility to aesthetic procedure. Pigmented lesions, which include melasma, age spots and freckles, are a common skin condition and they can be effectively treated through multiple modalities, including laser therapies, intense pulsed light (IPL) and topical treatments.

Presently, North America dominates the market by virtue of its mature healthcare infrastructure and elevation in awareness, whereas the Asia-Pacific region is expected to see the highest growth, powered by the growing healthcare system and the rising awareness regarding skin health.

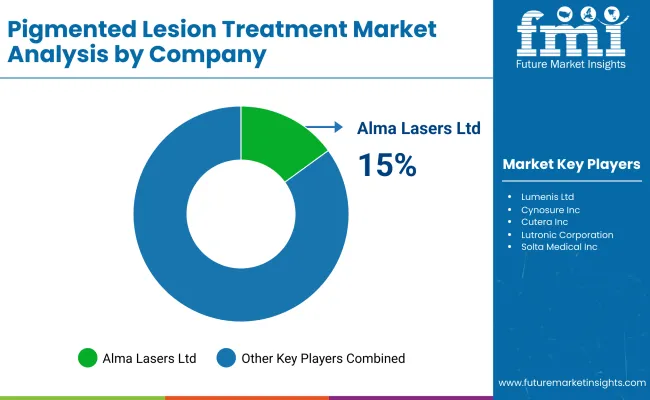

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Alma Lasers Ltd. | 15-20% |

| Lumenis Ltd. | 12-17% |

| Cynosure, Inc. | 10-15% |

| Cutera Inc. | 8-12% |

| Lutronic Corporation | 5-10% |

| Company Name | Key Offerings/Activities |

|---|---|

| Alma Lasers Ltd. | Offers a comprehensive range of laser and light-based systems, including the Harmony XL Pro platform, designed for treating various pigmented lesions with precision and minimal downtime. |

| Lumenis Ltd. | Provides advanced energy-based solutions, such as the M22™ multi-application platform, catering to a wide array of pigmented skin conditions. |

| Cynosure, Inc. | Develops innovative laser technologies, including the PicoSure ® system, which utilizes picosecond laser pulses for effective treatment of pigmented lesions and skin revitalization. |

| Cutera Inc. | Specializes in aesthetic and medical laser systems, with products like the enlighten® platform that combines picosecond and nanosecond laser pulses for treating pigmented lesions. |

| Lutronic Corporation | Offers a suite of devices, such as the Spectra™ laser system, known for its efficacy in treating melasma and other hyperpigmentation disorders. |

Key Company Insights

Alma Lasers Ltd.

A global leader in energy-based medical and aesthetic solutions, Alma Lasers is renowned for its versatile platforms that address a broad spectrum of pigmented skin conditions, emphasizing patient safety and treatment efficacy.

Lumenis Ltd.

With a strong focus on innovation, Lumenis offers multi-application platforms that combine various technologies, enabling practitioners to tailor treatments for individual patient needs effectively.

Cynosure, Inc.

Cynosure's commitment to research and development has led to the creation of cutting-edge laser systems that provide non-invasive solutions for pigmented lesions, enhancing patient satisfaction and clinical outcomes.

Cutera Inc.

Cutera's advanced laser platforms are designed to deliver precise energy levels, ensuring effective treatment of pigmented lesions while minimizing damage to surrounding tissues.

Lutronic Corporation

Lutronic's laser systems are recognized for their versatility and effectiveness in treating a variety of skin pigmentation issues, offering clinicians reliable tools for patient care.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:Fotonad.o.o., Sciton, Inc., Syneron Medical Ltd., Solta Medical Inc., Strata Skin Sciences, Inc. and Lynton Lasers Ltd.

The overall market size for pigmented lesion treatment market was USD 4,173.4 million in 2025.

The pigmented lesion treatment market is expected to reach USD 8,848.9 million in 2035.

High recurrence rates of dermal pigmentation are pushing clinics to adopt precision-guided platforms with real-time skin depth calibration.

The top key players that drives the development of pigmented lesion treatment market are Alma Lasers Ltd., Lumenis Ltd., Cynosure, Inc., Cutera Inc. and Lutronic Corporation.

Lasers and energy-based devices is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Lesion Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Lesion Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Lesion Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Lesion Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Lesion Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Lesion Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Lesion Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Lesion Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Lesion Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Lesion Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Lesion Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Lesion Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Lesion Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Lesion Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Lesion Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Lesion Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product,2023 to 2033

Figure 2: Global Market Value (US$ Million) by Lesion Type,2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User,2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region,2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region,2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region,2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product,2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product,2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Lesion Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Lesion Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Lesion Type,2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Lesion Type,2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User,2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User,2023 to 2033

Figure 21: Global Market Attractiveness by Product,2023 to 2033

Figure 22: Global Market Attractiveness by Lesion Type,2023 to 2033

Figure 23: Global Market Attractiveness by End User,2023 to 2033

Figure 24: Global Market Attractiveness by Region,2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product,2023 to 2033

Figure 26: North America Market Value (US$ Million) by Lesion Type,2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User,2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country,2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country,2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country,2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product,2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product,2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Lesion Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Lesion Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Lesion Type,2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Lesion Type,2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User,2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User,2023 to 2033

Figure 45: North America Market Attractiveness by Product,2023 to 2033

Figure 46: North America Market Attractiveness by Lesion Type,2023 to 2033

Figure 47: North America Market Attractiveness by End User,2023 to 2033

Figure 48: North America Market Attractiveness by Country,2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product,2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Lesion Type,2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User,2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country,2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country,2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country,2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product,2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product,2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Lesion Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Lesion Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Lesion Type,2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Lesion Type,2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User,2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User,2023 to 2033

Figure 69: Latin America Market Attractiveness by Product,2023 to 2033

Figure 70: Latin America Market Attractiveness by Lesion Type,2023 to 2033

Figure 71: Latin America Market Attractiveness by End User,2023 to 2033

Figure 72: Latin America Market Attractiveness by Country,2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product,2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Lesion Type,2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User,2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country,2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country,2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country,2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product,2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product,2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Lesion Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Lesion Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Lesion Type,2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Lesion Type,2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User,2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User,2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product,2023 to 2033

Figure 94: Western Europe Market Attractiveness by Lesion Type,2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User,2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country,2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product,2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Lesion Type,2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User,2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country,2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country,2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country,2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product,2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product,2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Lesion Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Lesion Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Lesion Type,2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Lesion Type,2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User,2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User,2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product,2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Lesion Type,2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User,2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country,2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product,2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Lesion Type,2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User,2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country,2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country,2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country,2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product,2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product,2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Lesion Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Lesion Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Lesion Type,2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Lesion Type,2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User,2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User,2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product,2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Lesion Type,2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User,2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country,2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product,2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Lesion Type,2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User,2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country,2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country,2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country,2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product,2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product,2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Lesion Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Lesion Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Lesion Type,2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Lesion Type,2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User,2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User,2023 to 2033

Figure 165: East Asia Market Attractiveness by Product,2023 to 2033

Figure 166: East Asia Market Attractiveness by Lesion Type,2023 to 2033

Figure 167: East Asia Market Attractiveness by End User,2023 to 2033

Figure 168: East Asia Market Attractiveness by Country,2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product,2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Lesion Type,2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User,2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country,2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country,2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country,2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product,2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product,2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Lesion Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Lesion Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Lesion Type,2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Lesion Type,2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User,2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User,2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product,2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Lesion Type,2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User,2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country,2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breast Lesion Localization Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast Lesion Localization Market Size and Share Forecast Outlook 2025 to 2035

Enamel Remineralization and White Spot Lesion Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA