The Riboflavin Pigment Market will experience stable growth during the years from 2025 to 2035 because of rising needs for food and beverage natural colorants, enhanced awareness of health, and broader usage in dietary supplements and pharmaceuticals.

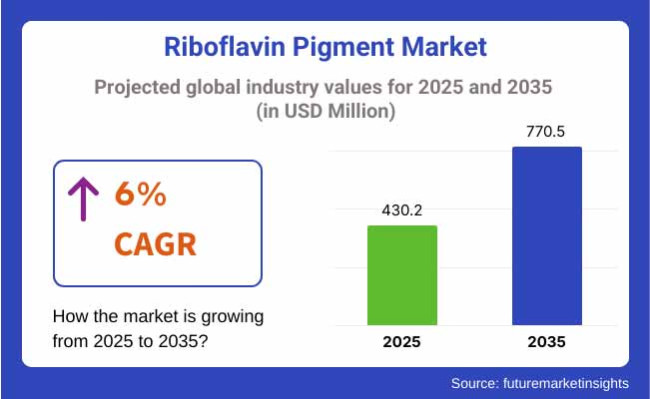

The natural yellow-orange pigment alongside colouring attributes makes riboflavin (vital B2) a valuable substance both for nutritional applications and colour alteration uses. From 2025 to 2035, the riboflavin pigment market is expected to grow from USD 430.2 million to USD 770.5 million while maintaining a compound annual growth rate (CAGR) of 6%.

The market expands because customers want clean-label items, and regulators support natural additives, while riboflavin delivers flexibility as a vitamin and colouring ingredient. Cost efficiency and increased purity result from the development of microbial fermentation alongside bio-based production techniques.

The wider market adoption of riboflavin faces limitations due to its instability under light and heat exposure in addition to formulation restrictions. The manufacturing sector tackles these issues using protective encapsulation systems and new ways to deliver the products.

The riboflavin pigment market exists in two areas: source and application types, and shows growing interest from food, pharmaceutical, and nutraceutical businesses. The riboflavin market features synthetic and fermentation-derived (natural) varieties, whose fermentation-derived segments develop because of their clean-label appeal. Food and beverage industries control the application sector because riboflavin enables both natural colouring and nutritional content delivery in breakfast cereals, dairy beverages, and drinks.

The pharmaceutical sector, together with dietary supplements, experiences high demand because riboflavin drives energy metabolic processes and supports vision health benefits. The demand for wholesome ingredients by manufacturers and consumers has elevated riboflavin-based pigments as their selection for product beauty and functionality improvements.

High demand for natural food additives, high supplement intake, and food fortification activities keep the North American riboflavin pigment market strong. Ingredient innovation and clean label expansion in the United States and Canada

Strict regulations on additives, organic food culture, and demand for sustainable colorants perceive the European market to be more advantageous. In terms of natural pigment implementation, Germany, France, and the UK are the leaders in the market for vitamin-based formulations.

The riboflavin pigment market in the Asia-Pacific region is driven by large-scale vitamin production, increasing health consciousness, and growing demand for fortified foods. China, India, Japan, and South Korea further boost growth through nutritional integration and industry expansion across new global parameters.

Challenge

Stability Issues and Limited Colour Intensity in Formulations

The market for riboflavin pigments is characterized by the current photo stability & colour limitations pertaining to its use within commercial formulations as a formidable challenge. Riboflavin (vitamin B2), on the other hand, is sensitive to light, pH changes, and oxidative environment, contributing to its degradation during processing or storage. However, it provides a natural yellow to orange pigment.

This instability limits their employability in cosmetics, beverages, and food products needing extended shelf life or exposure to light. Riboflavin also has limitations in colour vibrancy and colour range compared to synthetic colorants, which reduces its application in multicolour or vibrant branding.

Opportunity

Demand for Clean-Label, Nutrient-Infused Natural Colorants

The riboflavin pigment market is driven by high consumer demand for food colourings for natural, additive-free, and nutritious foods. Need Proof Riboflavin contributes to a subtle, natural yellow colour. Still, it also serves a functional purpose as a cofactor for enzymes involved in energy metabolism, cellular function, and antioxidant activity.

This combination of functionality and colour makes it great for use in functional beverages, energy drinks, infant formulas, supplements, and fortified foods. This evolution, as food manufacturers move away from synthetic dyes, as tartrazine and sunset yellow, has generated industry interest in vitamin-based pigments, such as riboflavin.

Recent research into fermentation-derived riboflavin, protective microencapsulation technology, and acid-stable formulations has all led to its use in increasingly diverse plant foods, organic and health-focused food products, unlocking mass-market potential and niche application opportunities alike.

From 2020 to 2024, the riboflavin pigment market grew at a steady rate due to clean-label trends, heightened fortification of vitamins, and increased recognition of nutritious colorants. Food and beverage companies swapped in riboflavin-based alternatives for synthetic yellow dyes in juice blends, cereals, powdered drink mixes and children’s snacks.

But issues with light degradation and limited formulation stability limited their use in categories like cosmetics, ambient-stable beverages and frozen desserts. Market penetration in some geographies also lagged, given regulatory compliance as well as sourcing concerns.

By 2025 to 2035, the market will gradually transmogrify to high-performance, fortified pigment systems, consisting of more soluble, more pH-stable, and more oxidatively stable riboflavin derived from its biotechnological progenitor. These innovations create applications in functional beauty, clinical nutrition, and hybrid health-food segments.

Advanced packaging materials, such as UV-blocking and moisture-resistant films, will enable an extended shelf life. In contrast, fermentation-derived production approaches and strain engineering will contribute both to lowering costs and ensuring sustainable supply chains. As plant-based sources increasingly combine nutrition, visual allure, and ingredient transparency, riboflavin will position itself as a staple in bioactive colour systems and wellness-focused formulations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance centered on natural colour labelling and vitamin content validation. |

| Technological Advancements | Focus on fermentation-sourced riboflavin with basic light protection. |

| Sustainability Trends | Interest in non-synthetic, vitamin-derived colorants. |

| Market Competition | Led by vitamin suppliers and natural colorant manufacturers. |

| Industry Adoption | Used in fortified drinks, cereals, dietary supplements, and infant formulas. |

| Consumer Preferences | Demand for natural colorants with added nutritional value. |

| Market Growth Drivers | Growth is driven by synthetic dye replacement and vitamin fortification trends. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion into fortified pigment labelling, bioactivity claims, and EU/US harmonized clean-label frameworks. |

| Technological Advancements | Growth in microencapsulated, pH-stable, and heat-resistant riboflavin formulations. |

| Sustainability Trends | Emphasis on low-emission fermentation, renewable substrates, and biodegradable packaging integration. |

| Market Competition | Entry of functional ingredient firms, biotech pigment startups, and wellness food innovators. |

| Industry Adoption | Broader use in cosmeceuticals, clean-label dairy alternatives, and fortified snack innovations. |

| Consumer Preferences | Preference for multi-functional pigments with visual appeal, shelf stability, and traceable sourcing. |

| Market Growth Drivers | Expansion fueled by bioactive wellness products, sustainable sourcing, and clean-label innovation. |

The United States riboflavin pigment industry is expanding due to rising demand for natural food colorants, clean-label supplements, and vitamin-balanced drinks. Riboflavin (vitamin B2), which is bright yellow in colour, is widely used in dairy, bakery, and energy drinks, particularly where synthetic dyes are being removed from use.

There is also an increasing use of riboflavin as a pigment and functional additive because of the increase in the nutraceutical industry focused on natural vitamins and bioactive compounds. The regulatory approval of GRAS-certified natural pigments is also encouraging innovation in fortified product formulations, added the FDA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

The UK riboflavin pigment market is growing owing to the increasing consumer penchant for plant-derived, additive-free food and rising application in vitamin-enriched products. “With its role as both a colorant and a dietary supplement, riboflavin is being used increasingly to provide colour and supplementation in functional drinks, cereals, and infant nutrition products.

The UK’s stringent food labelling laws mean that manufacturers use riboflavin in place of artificial dyes in many health-conscious food and drink categories. The expanding vegan market also drives demand for fermentation-derived riboflavin pigments.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The market is also achieving constant growth in Europe due to the stringent EU food safety regulations, increasing global demand for natural ingredients, and the growing acceptance of bio-based pigments. Riboflavin is being integrated into functional dairy, plant-based drinks, and vitamin supplements in Germany, France, and the Netherlands.

EU manufacturers are increasingly sourcing riboflavin from fermentation no animal origins to align with sustainability goals and vegan certifications. The clean-label product lines, however, are where it is establishing its claim as a dual-function ingredient in colour enhancement and nutrient fortification.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.0% |

The Japanese market for riboflavin pigments is growing slowly as a result of the traditional importance that has given Japanese people a way of thinking about nutritional balance, enrichment of vitamins in small portions, and precision formulation of food. It is also used as an additive in nutritional noodles, health beverages, and confectioneries, imparting colour as well as vitamin value.

The needs of such Japanese manufacturers to produce high-purity, odourless and water-soluble pigments, which will integrate well into movies that are transparent and know their construction will be delicate. The pharmaceutical industry’s choices for riboflavin-coated tablets and capsules on account of their visible appearance/transparency and stability also contributes to growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The demand for riboflavin pigment in South Korea is increasing steadily due to the development of nutraceuticals, increased demand for fortified food, and the rise of the clean label trend among health-conscious consumer segments. Riboflavin is gaining popularity as an ingredient for functional beverages, dietary powders, and kids’ nutrition products, where natural colour appeal is key.

Because of this, it drives many manufacturers to develop microbial fermentation technologies for riboflavin that can meet the industrial demand. With the convenient use of bioactive functional ingredients supported by the government, the local market is broadening, both in food and pharmaceutical processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

The demand for riboflavin pigment is growing as food manufacturers and nutritional brand focus on the usage of natural colouring agents along with the added health benefits. As mentioned before, riboflavin is vitamin B2 and is both: a bright yellow-orange pigment and an essential nutrient. As clean-label trends increasingly shape product innovation, riboflavin emerges as a natural replacement for synthetic pigments while delivering antioxidant and metabolic benefits.

Of these forms, powder is the dominant due to its long shelf life, ease of handling, and wide versatility in blending. Segment-wise, bakery and confectionery products account for the majority of the usage, owing in part to their visual appeal, and they are capable of fortification and product innovation. Collectively, these segments illustrate the move toward functional, nature-based ingredients in processed foods and drinks.

Riboflavin pigments are emerging as ingredients that increase product value, as they meet the regulatory, aesthetic, and nutritional needs of the food industry. Powdered forms facilitate high-volume manufacturing and accurate degeneration, while bakery products enable manufacturers to showcase both colour and health properties. The trend persists that permeates into different parts of the world in terms of the making of a healthy economy and alternative food processing markets.

| Form Type | Market Share (2025) |

|---|---|

| Powder | 66.4% |

The form segment is led by powdered riboflavin as the most practical and widely used format for food, pharmaceutical, and cosmetic purposes. Its long shelf stability, transport efficiency, and ease of storage make it perfect for large-scale production.

Food manufacturers favour riboflavin in powder form, which can be easily blended into dry mixes, doughs, batters and fillings without disrupting texture and moisture balance. Because of its concentrated purity that provides strong pigmentation even at low levels and uniformity in all types of formulations, it is very useful as far as colour consistency and nutritional declaration are concerned.

This form is also beneficial for dietary supplement manufacturers that incorporate powdered riboflavin in capsules, tablets and functional blends targeting energy metabolism, as well as skin and vision health. Riboflavin in powdered form has good stability in thermal processing, which allows its application in bakery products, cereals and beverages.

It also satisfies international regulatory criteria for food colouring and vitamin as an enrichment agent. With growing clean-label preferences and food processors searching for non-synthetic options, powdered riboflavin remains the go-to source for its demonstrated functionality, cost-effectiveness, and accessibility in the marketplace.

| Application Type | Market Share (2025) |

|---|---|

| Bakery & Confectionery Products | 39.2% |

Bakery and confectionery products are the largest segment in the application of riboflavin pigment market, owing to their health-taped branding that marries visual appeal to the consumer preference. From yellow sponge cakes and muffins, to bright-coloured candies and icings, manufacturers depend on riboflavin to provide a natural yellow-orange colour without the need for artificial dyes.

It pulls double duty, as both a colorant and a vitamin, to add to the product label and help businesses stand out in health-conscious markets. Riboflavin is used by functional foods segment brands to fortify bakery products with B-complex vitamins, increasing the appeal the product has across consumers of all ages.

In the category of confectionery, riboflavin acts as a colorant in gummies, jellies & sugar-coated products while providing nutritional properties. It provides a very pure and intense colour and retains its brightness during high-temperature processing and extended shelf life, making it ideal for packaged and ready-to-eat treats. Riboflavin’s natural origin and vitamin status lend themselves to clean label claims and consumer trust as consumers seek indulgent yet health-enhancing products.

Riboflavin pigment will register a leading revenue share in this segment, as demand for premium, fortified & visual bakery goods continues to witness an upward trend; demand for functional ingredients and, food aesthetics are maintaining their standards in developed markets.

The riboflavin pigment market features a specific and biogenic segment within the umbrella of food colorants and pharmaceutical ingredients, with the growing demand for non-synthetically derived yellowing colorants being the chief factor propelling the growth of this market. Riboflavin (Vitamin B2) serves dual roles as both a nutritional supplement and colouring additive, globally used in bakery, dairy products, drinks, dietary supplements, and ophthalmic solutions.

The players are focusing on fermentation-based production, high-purity formulations, stability in acid environments, and regulatory compliance (FDA, EFSA). The markets involved are vitamin manufacturers, nutraceutical producers, and natural pigment formulators working in both food-grade and pharma-grade applications worldwide.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DSM-Firmenich | 22-26% |

| BASF SE | 15-19% |

| Xinfa Pharmaceutical Co., Ltd. | 12-16% |

| Hegno Pharmaceuticals Co., Ltd. | 8-12% |

| Shanghai Acebright Pharmaceuticals Group | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| DSM-Firmenich | Expanded Quali®-B riboflavin pigment line in 2024, offering fermentation-derived yellow colouring for functional beverages and tablets. |

| BASF SE | Introduced pharma-grade riboflavin suitable for injectable and ophthalmic uses in 2025, with extended stability and fine particle dispersion. |

| Xinfa Pharmaceutical Co., Ltd. | Launched food-grade riboflavin pigment variants for the baking and confectionery industries in 2024, with high heat tolerance . |

| Hegno Pharmaceuticals Co., Ltd. | Released riboflavin API blends for dual-use in supplements and food color applications in 2025, ensuring regulatory traceability. |

| Shanghai Acebright Pharmaceuticals Group | Developed low-dust, high-brightness riboflavin pigments in 2024, suitable for capsule and premix applications. |

Key Company Insights

DSM-Firmenich

DSM-Firmenich leads in fermentation-derived vitamin colorants, offering clean-label riboflavin pigments with consistent brightness and nutritional co-benefits.

BASF SE

BASF supplies high-grade riboflavin for clinical and pharmaceutical use, with fine-milled, sterile-grade versions for injectable and sensitive formulations.

Xinfa Pharmaceutical Co., Ltd.

Xinfa dominates the Asian food additive space, delivering stable riboflavin pigments for high-temperature processing environments like baking and extrusion.

Hegno Pharmaceuticals Co., Ltd.

Hegno provides versatile riboflavin formulations, allowing use across nutraceutical and food sectors, with supply chain transparency and GMP adherence.

Shanghai Acebright Pharmaceuticals Group

Acebright specializes in granulated and micronized riboflavin pigment, supporting blend uniformity in powdered and encapsulated food or drug products.

Other Key Players (30-40% Combined)

Several other companies contribute to the riboflavin pigment market, focusing on natural colour intensification, B-complex blending, and high-shelf-stability variants:

The overall market size for the riboflavin pigment market was USD 430.2 million in 2025.

The riboflavin pigment market is expected to reach USD 770.5 million in 2035.

The increasing use of natural colorants in food products, rising demand for vitamin B2-enriched ingredients, and growing adoption of powder form pigments in bakery & confectionery applications fuel the riboflavin pigment market during the forecast period.

The top 5 countries driving the development of the riboflavin pigment market are the USA, UK., European Union, Japan, and South Korea.

Powder form and bakery & confectionery applications lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Western Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Western Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Eastern Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Eastern Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 52: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 60: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 62: Middle East and Africa Market Volume (MT) Forecast by Source, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Form, 2023 to 2033

Figure 22: Global Market Attractiveness by Source, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Form, 2023 to 2033

Figure 46: North America Market Attractiveness by Source, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 82: Western Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 86: Western Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 106: Eastern Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 110: Eastern Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 154: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 158: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pigment Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Pigmented Lesion Treatment Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Pigment Hot Stamping Foil Manufacturers

Feed Pigment Market Forecast and Outlook 2025 to 2035

Hyperpigmentation Lighteners Market Size and Share Forecast Outlook 2025 to 2035

Hyperpigmentation Skin Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hyperpigmentation Treatment Market - Trends & Future Outlook 2025 to 2035

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Algal Pigments Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Paper Pigments Manufacturers

Organic Pigments Market - Growth & Demand 2025 to 2035

Plastic Pigments Market

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Metallic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Dyes and Pigments Market

Arylamide Pigments Market Growth - Trends & Forecast 2025 to 2035

Fluorescent Pigment Market Size and Share Forecast Outlook 2025 to 2035

Pearlescent Pigment Market Growth - Trends & Forecast 2025 to 2035

Carotenoids Pigment Market Trends - Natural Colorants & Industry Growth 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA