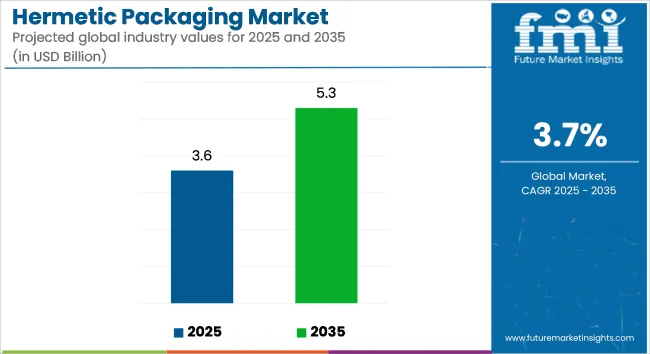

The hermetic packaging market is projected to grow from USD 3.6 billion in 2025 to USD 5.3 billion by 2035, registering a CAGR of 3.7% during the forecast period. Sales in 2024 reached USD 3.4 billion, indicating a steady demand trajectory. This growth has been attributed to the increasing demand for airtight and moisture-resistant packaging solutions across various sectors, including aerospace, defense, healthcare, and telecommunications.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 3.6 billion |

| Market Value (2035F) | USD 5.3 billion |

| CAGR (2025 to 2035) | 3.7% |

The rise in advanced electronics and the need for reliable protection against environmental factors have further propelled the adoption of hermetic packaging. Advancements in sealing technologies have enhanced the functionality and durability of these solutions, aligning with the evolving needs of manufacturers and consumers alike.

In December 2024, Teledyne Technologies Incorporated and Micropac Industries, Inc. jointly announced today the successful completion of the previously announced merger of Micropac with a wholly-owned subsidiary of Teledyne. "We are delighted to welcome Micropac and its employees to the Teledyne family," said Robert Mehrabian, Executive Chairman of Teledyne.

"Likewise, Micropac is proud to join Teledyne, and we look forward to leveraging Teledyne's additional market reach and technical capabilities, while maintaining the Micropac name and continuing to operate from our new state-of-the-art facility in Garland, Texas," said Mark King, Chairman, President and Chief Executive Officer of Micropac.

The hermetic packaging market has been significantly influenced by the increasing demand for sustainable and environmentally friendly packaging solutions. Manufacturers have been transitioning towards recyclable and biodegradable materials to align with environmental sustainability goals and meet regulatory requirements.

Innovations in material science have led to the development of packaging solutions that not only provide superior protection but also minimize environmental impact. Additionally, advancements in manufacturing technologies have enabled the production of lightweight and durable packaging, catering to a wide range of applications across different industries

The hermetic packaging market is witnessing continuous growth, driven by the ongoing expansion of various end-use industries and the increasing emphasis on reliable and durable packaging solutions. The market's trajectory suggests a steady rise in demand for innovative, high-quality packaging that caters to both consumer preferences and regulatory requirements.

Companies investing in research and development to create durable, cost-effective, and environmentally friendly packaging are expected to gain a competitive edge. The integration of advanced materials and ergonomic designs will likely play a crucial role in shaping the future of the hermetic packaging market. Furthermore, strategic partnerships and acquisitions highlight the industry's focus on expanding capabilities and meeting evolving market demands.

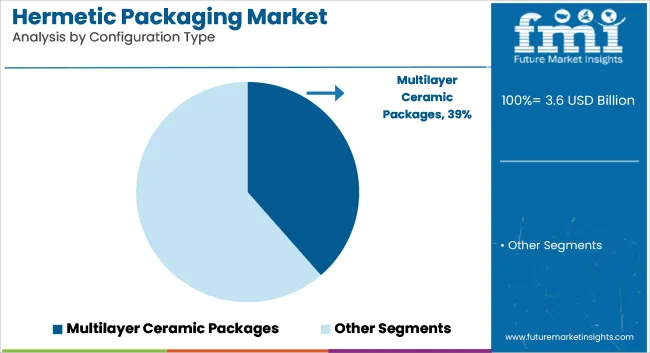

The market is segmented based on configuration type, sealing technique, end-use industry, and region. By configuration type, the market includes multilayer ceramic packages, metal can packages, glass-to-metal seals, ceramic-to-metal seals, and transponder packages. In terms of sealing technique, the market is categorized into epoxy sealing, laser welding, glass frit sealing, compression sealing, and solder sealing.

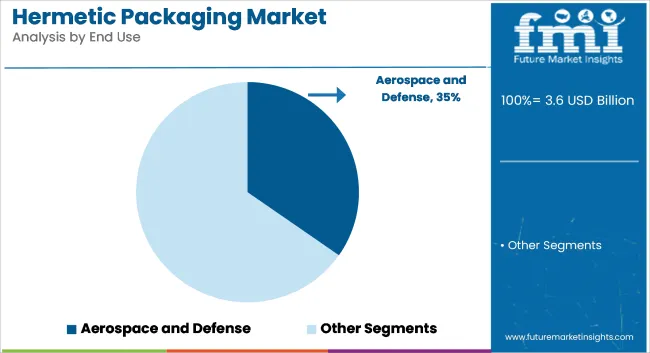

By end-use industry, the market comprises aerospace & defense, automotive electronics, healthcare & medical devices, consumer electronics, telecommunications, industrial equipment, and energy & power systems. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Multilayer ceramic packages have been projected to account for 38.6% of the hermetic packaging market in 2025, driven by their ability to offer superior mechanical strength, thermal stability, and moisture resistance. These packages have been widely used in high-reliability applications such as defense electronics, medical implants, and high-frequency communications.

Complex multilayer circuitry and miniaturized component embedding have been enabled through ceramic substrates, supporting increased integration density. Advanced metallization processes have been applied to enhance signal transmission and heat dissipation, improving long-term durability in harsh environments.

Compatibility with both surface-mount and through-hole devices has made multilayer ceramic packages essential in mission-critical aerospace and automotive applications. Their suitability for hermetic sealing with glass or metal components has contributed to their sustained adoption across ruggedized electronics. As demand for high-reliability microelectronics increases, particularly in defense and medical segments, multilayer ceramic packages are expected to maintain their position as the leading configuration due to their proven performance and flexible design capabilities.

The aerospace and defense segment has been estimated to hold a 34.7% market share in the hermetic packaging market in 2025, supported by stringent performance and reliability standards for military-grade electronics. Hermetic sealing has been critical in safeguarding sensors, radar systems, and control modules from moisture, pressure changes, and contaminants.

Metal and ceramic seals have been extensively deployed in navigation systems, avionics, communication devices, and satellite payloads, where uninterrupted operation is essential. Harsh environment resistance, along with electromagnetic shielding, has been prioritized in these applications.

Defense contracts and space exploration programs have accelerated innovation in microelectronic packaging, leading to high-specification hermetic designs. Compliance with military standards such as MIL-STD-883 and NASA-grade quality requirements has further reinforced adoption in national defense infrastructure. With continuous modernization of aircraft and space technologies, hermetic packaging demand in this sector is anticipated to grow steadily. Long-term government spending and system upgrades will continue to rely on robust, leak-proof packaging formats.

High Production Costs and Complex Manufacturing Processes

The biggest challenge in the hermetic packaging market is the high cost of sealing materials and complex manufacturing, which makes hermetic packaging pricey compared to regular packaging. Also, strict rules for aerospace, military, and medical use increase testing and compliance costs, which limit adoption in markets sensitive to price.

There are also other types of packaging tech, like plastic coatings and cases that compete with the more traditional hermetic sealing methods.

Growth in 5G Electronics, Medical Implants, and AI-Driven Sensor Packaging

Though there are issues, the hermetic packaging market has big growth chances. The rise of 5G use needs tightly sealed parts, driving increased need.

The use of hermetic seals in items such as pacemakers, nerve tools, and hearing aids opens up new money paths for makers who create safe, hermetic packaging. Also, the rise of AI-driven smart sensors in factory work, car safety, and space gear increases the need for strong hermetic cases.

The creation of mixed hermetic packaging methods that join glass-to-metal, ceramic-to-metal, and new tiny coatings, boosts function, makes devices smaller, and saves money in future tech items.

The hermetic packaging market in the USA is growing fast. This is because of more need for good packaging in planes, defense, and medical tools. It is also used more in making computer chips and small tech parts. The USA Department of Defense and the Federal Aviation Administration set rules for sealing military and plane electronics.

New small tech parts, more use of hermetic packaging in medical implants, and more money going into space-safe enclosures make the market grow. Plus, new ways to seal ceramic and metal and glass and metal packaging improve what the industry can do.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The hermetic packaging market is growing in the UK because more people need strong electronic packaging for defense, healthcare, and high-end industrial uses. The UK Ministry of Defence (MoD) and British Standards Institution (BSI) enforce strict rules for sealed parts used in military and space electronics.

More people are using glass-to-metal seals, there's more study in high-frequency packaging, and hermetic packaging is being used more in satellite tech. These all help the market grow. Besides, investments in low-outgassing materials for space electronics are guiding industry trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

The hermetic packaging market in the EU is growing well because of tough rules for electronics, more semiconductor making, and more money invested in new packaging tech. The EU Space Agency and the European Committee for Electrotechnical Standardization have strict rules for sealing in space and defense uses.

Germany, France, and Italy lead in hermetic cases for medical implants, vacuum-sealed chip packaging, and mixed packaging for car electronics. Growth in MEMS and optoelectronic packaging is also pushing new ideas.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

The hermetic packaging market in Japan is growing. There's more need for tiny semiconductor packages and better sensor packages. The government is helping a lot with electronic manufacturing. The Ministry of Economy, Trade, and Industry (METI) and the Japan Electronics and Information Technology Industries Association (JEITA) have rules for hermetic packaging in cars, medical devices, and other electronics.

Japanese companies are making precise ceramic and glass seals. They also have new AI MEMS packages and better semiconductor cover tech. On top of that, there are new ultra-low-leak packages for quantum computers. These new ideas are changing the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The hermetic packaging market in South Korea is growing fast. This is thanks to more semiconductor factories, higher use of sturdy packaging in 5G and AI products, and more need for sealed enclosures in defense gear. The South Korean Ministry of Trade, Industry, and Energy (MOTIE) and the Korea Electronics Association (KEA) enforce rules for reliable electronic packaging.

The growth in MEMS and photonics packaging, more use of sealed LED lights, and bigger spending on top-tier semiconductor solutions are pushing the market forward. Plus, South Korea's lead in consumer electronics and telecom is increasing the need for sealed microelectronic parts.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

The market for hermetic packaging is growing. This is because more people require reliable electronic packaging in planes, medical devices, cars, and defense equipment. The push comes from greater use of MEMS (Micro-Electro-Mechanical Systems), new ways to pack semiconductors, and the need for coverings that keep out air and water.

Firms are looking at better seals made of ceramic, glass-to-metal, and plastic to make parts last longer, stay cool, and resist rust. Key players in this market include top semiconductor manufacturers, aerospace part suppliers, and specialty materials providers. They all work on new, small, strong hermetic covers and vacuum-sealed packs.

The overall market size for the hermetic packaging market was USD 3.6 billion in 2025.

The hermetic packaging market is expected to reach USD 5.3 billion in 2035.

Increasing demand for moisture-resistant and airtight packaging in electronics, aerospace, and medical applications, along with advancements in semiconductor packaging, will drive market growth.

The USA, China, Germany, Japan, and South Korea are key contributors.

Ceramic-to-metal sealing is expected to dominate due to its high durability and superior protection for sensitive electronic components.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hermetic Food Grain Storage Market Size and Share Forecast Outlook 2025 to 2035

Hermetic Reciprocating Refrigerator Compressor Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Hermetic Jars Industry

Hermetic Jars Market Analysis – Trends & Growth Forecast through 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA