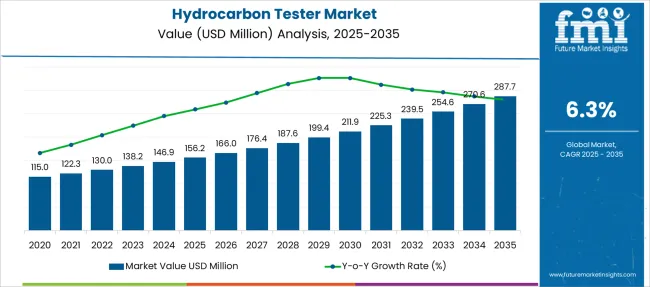

The Hydrocarbon Tester Market is estimated to be valued at USD 156.2 million in 2025 and is projected to reach USD 287.7 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Hydrocarbon Tester Market Estimated Value in (2025 E) | USD 156.2 million |

| Hydrocarbon Tester Market Forecast Value in (2035 F) | USD 287.7 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The hydrocarbon tester market is advancing steadily due to rising demand for efficient, accurate, and field-deployable testing systems in the oil and gas sector. Increasing exploration activities, stricter emission compliance, and the need for real-time quality control in refining and petrochemical industries are collectively shaping the market's future trajectory. Software-driven diagnostic capabilities and miniaturized sensor technologies have significantly improved the accuracy and responsiveness of hydrocarbon testing systems, especially in volatile environments.

Additionally, environmental monitoring regulations and safety standards are prompting operators to shift toward more sophisticated testers that ensure operational integrity and minimize downtime. The integration of cloud connectivity and wireless data transfer is further enhancing decision-making at both site and enterprise levels.

As industries pivot toward cleaner and more efficient hydrocarbon handling, the adoption of advanced testers equipped with data logging, automatic calibration, and multi-gas detection functionalities is expected to rise The future outlook remains positive as digital transformation and field automation become central to the energy ecosystem.

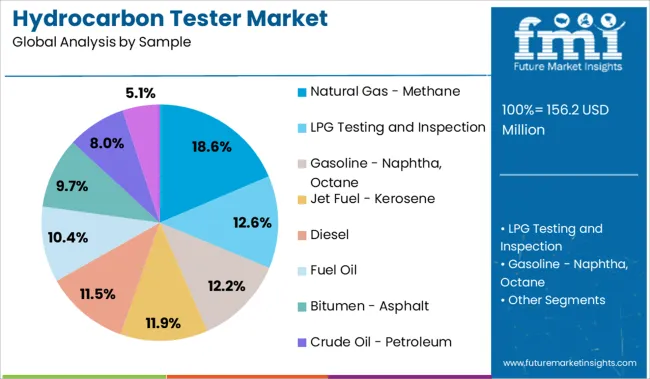

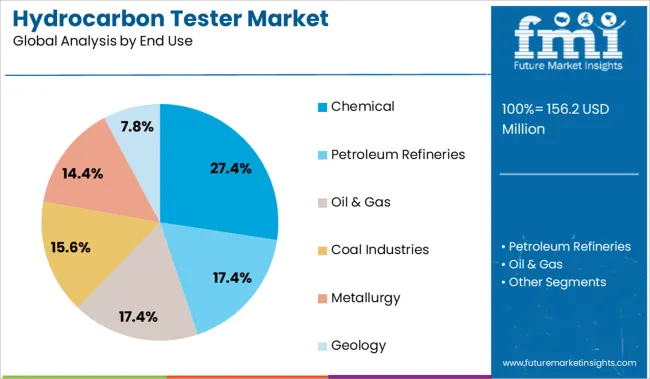

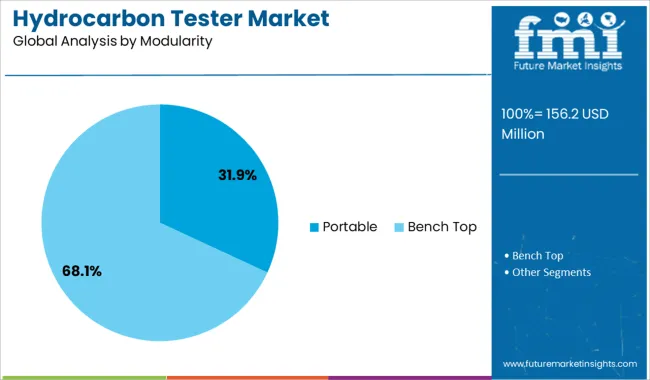

The market is segmented by Sample, End Use, and Modularity and region. By Sample, the market is divided into Natural Gas - Methane, LPG Testing and Inspection, Gasoline - Naphtha, Octane, Jet Fuel - Kerosene, Diesel, Fuel Oil, Bitumen - Asphalt, Crude Oil - Petroleum, and Other Samples. In terms of End Use, the market is classified into Chemical, Petroleum Refineries, Oil & Gas, Coal Industries, Metallurgy, and Geology. Based on Modularity, the market is segmented into Portable and Bench Top. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural gas methane segment is projected to hold 18.6% of the hydrocarbon tester market revenue share in 2025, reflecting its importance in energy supply chains and environmental compliance. This segment’s growth has been influenced by the critical need to monitor methane concentrations accurately across upstream and midstream infrastructure.

The increasing focus on methane leak detection, driven by international climate targets and regulatory mandates, has led to the adoption of high-precision testers tailored for natural gas streams. Software-configurable sensors within hydrocarbon testers allow real-time quantification and dynamic range adjustment, which is essential for ensuring compliance with emission thresholds.

Methane’s role as a primary energy carrier and its environmental sensitivity have resulted in growing demand for testers that can be deployed in remote or hazardous conditions with minimal calibration drift The reliability and repeatability of readings, combined with support for field-level diagnostics, have established this subsegment as a key focus area in natural gas management and distribution.

The chemical end use segment is expected to account for 27.4% of the hydrocarbon tester market’s revenue share in 2025, underscoring its critical application across complex process environments. The adoption of hydrocarbon testers in chemical facilities has been driven by the necessity to ensure accurate feedstock composition, detect volatile compounds, and maintain process safety.

Real-time monitoring solutions are being integrated into control loops to enhance process efficiency and reduce unplanned shutdowns. The evolving need to align with stringent occupational safety and emissions regulations has further accelerated the use of intelligent testers equipped with multi-sample capabilities and digital interfaces.

Enhanced material compatibility and robustness of testing instruments allow seamless integration into chemical production lines, especially where hydrocarbons are intermediates or end products Moreover, the demand for trace-level detection and automated calibration features has positioned hydrocarbon testers as essential components in the quality assurance frameworks of leading chemical manufacturers.

The portable modularity segment is forecast to hold 31.9% of the total revenue share in the hydrocarbon tester market by 2025, making it the leading configuration preference. This segment’s growth is being driven by increasing demand for flexible, on-the-go testing solutions capable of delivering high accuracy in field conditions. Portability allows technicians and operators to conduct tests across multiple sites without the logistical burden of large-scale installations.

Advancements in battery life, ergonomic design, and wireless data transfer have further expanded the use cases for portable testers in both routine inspections and emergency response scenarios. The integration of software-defined testing protocols and touchscreen interfaces has enhanced the user experience, allowing real-time visualization and configuration of tests.

Additionally, portable testers are being preferred in applications where operational continuity, safety, and traceability are essential, such as in oil terminals, gas processing facilities, and pipeline inspections Their cost-effectiveness and versatility continue to drive widespread adoption in field-intensive operations.

Hydrocarbon processing, one of the world's most important industries, must adhere to a plethora of regulations, standards, and norms in order to run smoothly. Because the sector is required to maintain the highest safety standards, effective hydrocarbon analysis is critical for hydrocarbon processing in order to achieve a high level of productivity. The hydrocarbon testing market is extremely regulated, and certain standards must be followed when analyzing the sample.

The American Society of Testing and Materials (ASTM) is an international standard-setting organization that creates standards for a wide variety of materials and products. These standards are critical for various end-user companies such as petroleum refineries, aviation companies, and automotive, geological, and chemical processing plants that examine and process fuel oils to ensure quality.

For instance, ASTM D7675 specifies a standard test method for determining total hydrocarbons in hydrogen using a hydrocarbon tester. These rigorous requirements in various geographies are ultimately propelling the hydrocarbon tester market forward. There is a high demand for simple hydrocarbon testers, which is causing manufacturers to release portable and simple hydrocarbon testers. The manufacturers' main strategy is to introduce advanced hydrocarbon testers with enhanced features.

Their primary focus is on introducing hydrocarbon testers with high sensitivity. For example, PetroSense Inc., one of the leading manufacturers of hydrocarbon testers, has introduced a portable hydrocarbon tester that has high sensitivity and analyses accurate and fast quantitative data for petroleum hydrocarbons in vapor and water. This type of advancement by manufacturers contributes to the global expansion of the hydrocarbon tester market.

The growing popularity of electric vehicles is causing a decline in sales of diesel and gasoline-powered vehicles. This has a significant negative impact on the hydrocarbon tester market, as the use of petrol and diesel engines is being replaced by electric batteries. During the forecast period, the growing prevalence of electric vehicles is expected to be a potential challenge for hydrocarbon testers.

Asia Pacific was the largest market for Hydrocarbon Tester. Geographically, countries with substantial inventions in the field of fossil fuels and geo analysis, such as Kuwait, China, and other Gulf countries, hold the major market share in the hydrocarbon tester market. The expansion of the hydrocarbon tester market is being driven by the increased production of energy sources and the demand for refined products. As these countries' fossil fuel production increases, so do the sales for refinement of these products.

To ensure safe and optimized processing, a wide range of hydrocarbon analysis measurements and analyzing devices such as flame ionization detectors, catalytic sensors, photo-ionization, gas chromatographs, infrared sensors, and others are required. As a result, rapid growth in the hydrocarbon processing industry in prominent economies such as China and India is expected to create lucrative growth opportunities for the hydrocarbon tester market. As a result, potential growth opportunities in the adoption of hydrocarbon testers in various industries are expected. The hydrocarbon tester market is expected to grow at a rapid pace as a result of several government initiatives in the Asia Pacific.

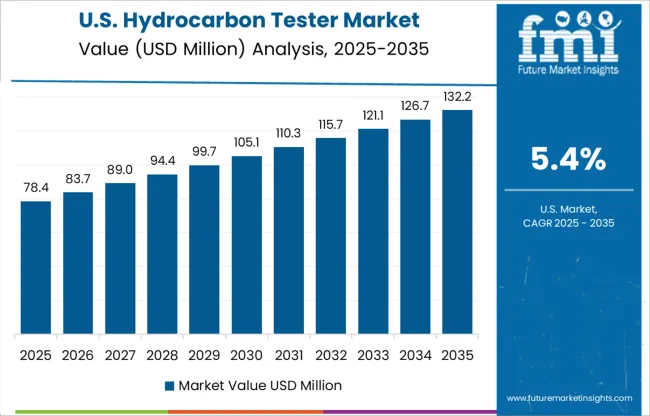

According to Future Market Insights, North America is expected to grow at a rapid CAGR in the global hydrocarbon tester market between 2025 and 2035.

Owing to the attributes such as integrated systems, flexible temperature ranges, and precision analysis, hydrocarbon testers are finding a wide range of applications in environmental monitoring, ethylene production, petroleum refining, and other sectors.

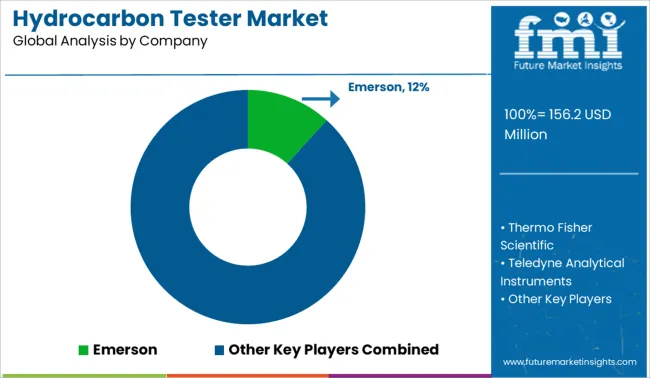

Some of the key participants present in the global Hydrocarbon Tester market include Emerson, Thermo Fisher Scientific, Teledyne Analytical Instruments, SICK AG, Agilent Technologies, Inc., MKS Instruments, PerkinElmer, J.U.M. Engineering GmbH, Galvanic, VIG Industries, Inc., Gow-Mac Instrument Co., Shimadzu Corporation, MOCON Inc., Buck Scientific., among others.

The market is highly concentrated owing to the existence of such a large number of participants and the escalating product launches with advanced connectivity and multi-functional features.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.3% from 2025 to 2035 |

| Market Value in 2025 | USD 156.2 million |

| Market Value in 2035 | USD 287.7 million |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Sample, End Use, Modularity, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, Australia & New Zealand, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | Emerson; Thermo Fisher Scientific; Teledyne Analytical Instruments; SICK AG; Agilent Technologies, Inc.; MKS Instruments; PerkinElmer; J.U.M. Engineering GmbH; Galvanic; VIG Industries, Inc.; Gow-Mac Instrument Co.; Shimadzu Corporation; MOCON Inc.; Buck Scientific |

| Customization | Available Upon Request |

The global hydrocarbon tester market is estimated to be valued at USD 156.2 million in 2025.

The market size for the hydrocarbon tester market is projected to reach USD 287.7 million by 2035.

The hydrocarbon tester market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in hydrocarbon tester market are natural gas - methane, lpg testing and inspection, gasoline - naphtha, octane, jet fuel - kerosene, diesel, fuel oil, bitumen - asphalt, crude oil - petroleum and other samples.

In terms of end use, chemical segment to command 27.4% share in the hydrocarbon tester market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrocarbon Accounting Solution Market Size and Share Forecast Outlook 2025 to 2035

Hydrocarbon and Silicone Coolant Market Size and Share Forecast Outlook 2025 to 2035

Hydrocarbon Cleaning Agents Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Hydrocarbon Accounting Solution Market Share & Industry Leaders

Total Hydrocarbon Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Europe Hydrocarbons Accounting Solution Market Insights – Demand & Growth 2025 to 2035

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

LAN tester Market Size and Share Forecast Outlook 2025 to 2035

SCC Tester Market Size and Share Forecast Outlook 2025 to 2035

LED Tester Market

DSL Tester Market Growth – Trends & Forecast 2019-2027

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Gold Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Food Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA