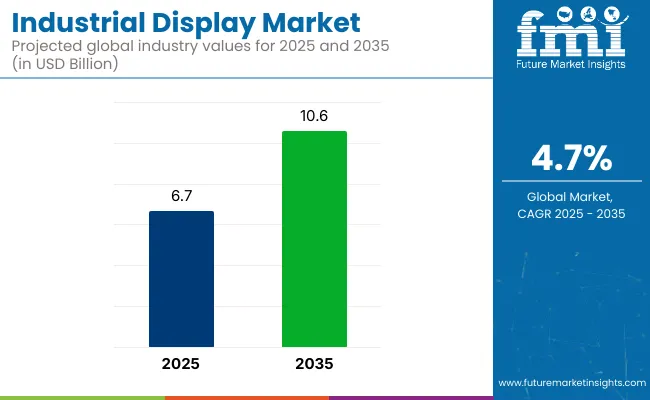

The global industrial display market is set to expand at a CAGR of 4.7 percent, rising from USD 6.7 billion in 2025 to USD 10.6 billion by 2035. This growth is expected to be driven by accelerating investments in smart factory initiatives and the wider adoption of human-machine interface panels across manufacturing, energy, and transportation operations. Demand for rugged, sunlight-readable screens has been boosted by stricter workplace-safety requirements and the need for real-time visualisation on crowded plant floors. Additionally, continual improvements in OLED, TFT-LCD, and e-paper technologies are being credited with greater durability and lower power draw, factors that are widening adoption in harsh industrial environments.

| Market Attribute | Value |

|---|---|

| Market Size in 2025 | USD 6.7 billion |

| Market Size in 2035 | USD 10.6 billion |

| CAGR (2025 to 2035) | 4.7% |

The United States is forecast to command the largest share of global revenue through 2035, propelled by widespread smart-factory upgrades in automotive and aerospace plants. South Korea is anticipated to be the fastest-growing national market at roughly 5 percent CAGR, underpinned by sustained investments in electronics and semiconductor production. Japan is expected to leverage its robotics leadership to accelerate the adoption of high-resolution OLED panels on assembly-line controls. Germany, France, and the wider European Union are projected to raise demand for rugged panel-mount screens as Industry 4.0 compliance projects are deployed. The United Kingdom is expected to experience steady replacement cycles for touchscreen monitors as logistics and warehousing automation continue to scale up.

Demand-side strengths in manufacturing, automotive, and medical sectors also help make North America a leading market for industrial displays. As the USA and Canada continue to invest in high-tech display technologies for use in automation, industrial and control systems, and diagnostic devices.

Key manufacturers are located in developing regions, a rise in government backing to promote smart factory projects, and stringent regulations on workplace safety measures are factors driving the market growth. Moreover, the increasing deployment of IoT-enabled devices and touch-based interfaces across various industrial applications is also expected to drive market growth.

With the growing industrial display market in Europe, they are progressively seen in various applications across the automotive and energy sectors and also upholding Germany's scientific rigor and innovativeness. Demand is being led from factory automation and process control applications, with nations like Germany, France, and the UK taking the lead in high-resolution industrial display innovation.

The market growth can be attributed to rising demand for Industry 4.0 initiatives, automated, digitalized manufacturing and human-machine interfaces palatability. Further, the industry growth trajectory is being influenced by both regulatory support for energy-efficient displays and sustainable manufacturing.

The industrial display market in Asia-Pacific region is expected to grow the fastest as there has been a rapid industrialization along with increased investments in automation and increased transportation infrastructure. With key areas of contribution namely China, Japan, and India, more efforts are being directed towards developing solid display solutions for smart factories, railways, and healthcare.

The regional requirements spurred by the development of cutting-edge manufacture lines and increase in the dip tech and semiconductor manufacture. Asia-Pacific is becoming the center of industrial displays manufacturing and innovation backed by affordable manufacturing facilities and trained workforce.

The industrial display market is likely to witness steady growth over the next ten years due to constant advancements in industrial display technology, resulting in growing adoption across several industries, and higher consumer demand for high-performance and durable displays.

Now, the companies are concentrating on features such as screen resolution, durability, and energy efficiency to meet different applications. Future of the industry the future of the industry is also being shaped by the growing global network for research collaborations, rising investments into smart manufacturing, and the increase in AI-based interfaces.

Challenge

High Initial Investment and Maintenance Costs

Due to the correspondingly high initial investment necessary to yield resilient, high-quality displays resistant to working conditions in the industry, the Industrial display market has always confronted challenges. Manufacturers are required to use ruggedized components, sunlight-readable screens and advanced touch interfaces, all of which increases cost.

Industrial displays need to be recalibrated, and their anti-glare coatings must be applied frequently, which can also be an expensive proposition, sandwiched between dustproof enclosures. Some possible solutions include developing new manufacturing technologies to make this more cost-effective, enabling modular upgrade paths, and improving longevity with better thermal management, impact resistance, and so on.

Rapid Technological Obsolescence

Industrial display technologies are changing and evolving at an ever-increasing pace, raising issues of obsolescence. It only accelerates as industries trend toward smart manufacturing, IoT data integration and AI-voice driven interfaces, making older display technologies obsolete quicker. This leads to challenges in keeping up with the latest technology and cloud innovation, while working with existing industrial systems.

This can also be mitigated by considering backward compatible design for the displays, investing in software-defined displays that can be updated over the air, and with flexible architectures of the display that allow technology upgrades to be added as required rather than needing to replace the entire system.

Opportunity

Growing Demand for Industrial Automation and Smart Manufacturing

High-performance industrial displays are in high demand right now owing to the growing adoption of Industry 4.0 and automation technologies. For production efficiency, smart factories depend on real-time data visualization, human-machine interfaces (HMI) and touchscreen control panels.

This leads to improved operational control, refined safety monitoring and effective workflow management due to advanced industrial displays. Investments in AI-driven industrial displays, edge computing integration, and visualization solutions connected to the cloud will give manufacturers a competitive edge in the changing landscape of automation.

Advancements in OLED and E-Paper Displays for Industrial Use

Advanced display technologies such as OLED and e-paper are creating new possibilities in the Industrial display market. OLED panels are low in contrast and power consumption, which makes them ideal for various low-power industrial use cases.

Could be certainly used in logistics, manufacturing dashboards, smart labeling systems as e-paper displays can be unreadable with low energy consumption. As a result, manufactures targeting the industrial space by developing flexible, robust, and adaptive display solutions will meet the increasing need for cutting-edge industrial visualization tools.

The demand for industrial displays is expected to grow due to automation and the need for user-friendly interfaces for monitoring and control. The move to digitization and remote monitoring increased the demand for industrial touchscreen panels and ruggedized display solutions.

Production and pricing were affected by supply chain disruptions and semiconductor shortages. In response, companies improved domestic supply chains, diversified their component supply sources, and adopted AI-driven predictive maintenance for their display systems.

2025 to 2035 is focused on micro-LED technology, foldable industrial screens, and AI-based predictive analysis of display diagnostics. Augmented reality (AR) will drive the future of industrial displays with improved worker training, as well as more effective tools for visualizing maintenance and providing remote support.

Eco-friendly innovative display materials, such as sustainable, recyclable products and energy-efficient displays, will be industry standards. The next generation of industrial digitalization will be led by companies that develop AI-driven interfaces, smart data visualization and environmentally sustainable display technologies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with industry safety standards and electromagnetic interference regulations |

| Technological Advancements | Widespread use of LCD and touchscreen HMIs |

| Industry Adoption | Increased use in factory automation, transportation, and energy sectors |

| Supply Chain and Sourcing | Disruptions due to semiconductor shortages and global logistics issues |

| Market Competition | Dominance of established industrial display manufacturers |

| Market Growth Drivers | Growth in Industry 4.0 and real-time monitoring needs |

| Sustainability and Energy Efficiency | Initial steps toward low-power, durable displays |

| Integration of Smart Monitoring | Limited AI-driven diagnostics and remote monitoring capabilities |

| Advancements in Product Innovation | Improved touchscreen sensitivity and ruggedization |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-enhanced compliance automation, stricter energy efficiency mandates, and expanded cybersecurity requirements |

| Technological Advancements | Growth in micro-LED, AR-integrated industrial screens, and flexible OLED displays |

| Industry Adoption | Expansion into robotics, AI-driven monitoring, and industrial AR visualization |

| Supply Chain and Sourcing | Localization of component production, increased use of sustainable and recyclable materials |

| Market Competition | Rise of specialized display startups, custom-built industrial visualization solutions |

| Market Growth Drivers | AI-powered predictive displays, remote collaboration interfaces, and cloud-connected industrial control panels |

| Sustainability and Energy Efficiency | Full-scale adoption of recyclable displays, e-paper technology, and energy-efficient visualization systems |

| Integration of Smart Monitoring | Predictive display maintenance using AI, real-time performance analytics, and proactive system alerts |

| Advancements in Product Innovation | Development of foldable, adaptive, and multi-functional industrial display solutions |

The industrial display market in the United States is substantially boosted by the quick acceptance of the automation, smart manufacturing, and digital transformation in multiple industries. Rugged displays, touchscreen interfaces, and high-resolution industrial monitors are becoming increasingly sought after, especially in manufacturing, aerospace, and defense and healthcare environments.

Growing investments in IoT and AI-driven monitoring solutions further propelling market expansion due to the rise of Industry 4.0. In addition, progress in display technologies including OLED, LCD and e-paper are enhancing efficiency and durability to withstand harsh industrial conditions. Government support for industrial digitalization and workplace safety initiatives is also visibly driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

Industrial display market in the United Kingdom growing at a steady pace due to increased adoption of automation in manufacturing and logistics sectors the industrial display market across the United Kingdom is projected to expand at a steady pace during the forecast period, owing to the increasing adoption of automation across these sectors. This is attributed to the increasing implementation of smart factories and industrial IoT solutions that require energy-saving and high-performance industrial displays.

This can be attributed to the presence of leading display manufacturers and the continuous investments in research and development that are accelerating technological innovations in this space. In addition, strict regulatory standards for workplace safety and enhanced machinery interface are driving the adoption of high-resolution and touch-enabled industrial screens. AR and remote monitoring solutions are also streamlining operations across industrial sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

The deployment of automation technologies and smart industrial solutions, particularly in Germany, France, and Italy, is driving robust growth in the European Union’s industrial display market.

The focus on sustainable and energy-efficient manufacturing in this region is supporting durable and high-contrast industrial displays. There is a growing interest and investments in new technologies such as predictive maintenance, Digital twins, and cloud-based monitoring systems, accelerating the adoption of next-generation display technologies.

In addition, strict EU regulations on workplace safety and operational transparency are driving industries to invest in sophisticated visualization and real-time monitoring solutions. Innovative flexible and transparent displays are expected to bring forth new avenues for growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

Japan has a strong technological base and is focusing on advanced manufacturing, fostering the growth of its industrial display market. South Korea's leadership in robotics, automation, and industrial IoT (the Internet of Things) is fueling demand for sophisticated display solutions.

Strong adoption of high-resolution OLED, e-paper and 4K-based industrial display is improving operational efficiency across all industrial sectors from automotive to semiconductor to electronics manufacturing.

AI and real-time monitoring capabilities are exploring aspects of user experience and productivity in industrial screens. Moreover, initiatives from the government promoting smart factories and Industry 4.0 are further augmenting investments in next-gen industrial display technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

Driven by its cutting-edge semiconductor and electronics manufacturing, South Korea's industrial display market is booming. The nation’s display technology prowess, from OLED to micro-LED breakthroughs, is also fueling innovations among industrial screens for automation and control applications.

The rising utilization of AI powered machine interface and cloud connected visualization system is exerting an additional beneficial impact on the market. Also, the investment in 5G infrastructure and smart factories as part of South Korea digital new deal is expected to boost the demand for high-performance industrial displays for remote monitoring and predictive maintenance. The process of product development and customization is also being aided by collaborations between industrial equipment manufacturers and display technology companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The Leverage behind the Desks Rugged displays are largely dominating the market because these displays are highly durable and resistant to extreme environmental conditions and have a long operational life. Such displays find widespread use in automotive, aerospace, and industrial automation applications that require shock resistance, waterproofing, and wide temperature tolerance.

The increasing adoption of smart factories, Industry 4.0, and the use of IoT-enabled monitoring systems have also boosted the demand for rugged displays in manufacturing, logistics, and transportation sectors. High-brightness screens, energy-saving panels, and anti-glare coating technology make them more usable in outdoor and harsh environments too.

And as edge computing capabilities and AI-driven monitoring solutions are being integrated in rugged displays, manufacturers are making their displays more intelligent and can adjust according to the changing needs of the industry. Sunlight-readable screens and advanced thermal management systems increase their versatility in extreme climate environments and more demanding operational situations.

In sectors where integrated, compact, and hassle-free display devices are preferred, panel-mount monitors are becoming increasingly common. They are commonly used in medical equipment, data loggers, and control system interface and even to replace obsolete CRT monitors in industrial control systems where precision and real-time data visualization is essential. With pie-chart representation of gradual market growths, ask us for Panel Mount Monitor country wise analysis of market, by type and applications.

Moreover, advancements in multi-touch technology, edge-to-edge glass displays, and integrated connectivity solutions are improving their functionality for use in more advanced operational environments.

They are also paving the way toward their broader applications in industrial automation and human-machine interface (HMI) systems by transforming into advanced haptic feedback touchscreens and enhanced gesture control capabilities, and interactive displays powered by AI. In response to this growing concern, manufacturers are prioritizing sustainable materials and energy-efficient backlighting technologies that minimize power consumption, all while delivering superior display quality.

Automotive and aerospace industries are the major end-users of industrial displays for vehicle diagnostics, navigation systems and cockpit displays. With the incorporation of heads-up displays (HUD), digital instrument clusters, and advanced infotainment systems the demand for high-resolution industrial displays with ruggedness and energy efficiency has witnessed a substantial upsurge.

The increasing popularity of electric vehicles (EVs), autonomous driving, and in-flight entertainment systems is also fueling demand for OLED and LED-based industrial displays. Augmented reality (AR) and holographic displays are transforming driver assistance systems and pilot navigation interfaces to further promote safety and operational effectiveness.

In addition, manufacturers are working on energy-efficient display technologies like flexible OLED screens and ultra-thin panels to make automotive and aerospace displays more ergonomic and efficient.

The healthcare industry has also been one of the largest growing end uses for industrial displays, because of their integration with medical imaging and diagnostic systems, as well as patient monitoring systems. This has shifted the focus for medical display panels to be high resolution, touch-enabled, and anti-microbial, as more healthcare organizations are migrating towards digital healthcare solutions from telemedicine to AI-driven medical diagnostics.

In addition, advances in e-paper displays, flexible OLED screens, and energy-efficient medical-grade monitors improve usability during surgical procedures, in intensive care units (ICUs), and in portable medical devices.

The growing demand for remote patient monitoring systems, interactive telehealth solutions, and AI-assisted diagnosis displays is driving the innovation for healthcare visualization technologies. And hygienic, easy-to-clean screen coatings and blue-light reduction technologies being adopted are further enhancing patient safety and healthcare provider efficiency.

Industrial displays are quickly becoming part of the retail sector for digital signage, self-checkout kiosks, and interactive customer engagement systems. The product offerings include OLED and LED displays, e-paper displays, with increasing demand for displays for smart retail, AI-powered analytics, and AR shopping experiences.

Moreover, rising adoption of automation solutions such as automated inventory tracker, electronic shelf labels, and real-time price adjustment systems, is augmenting the industry for industrial displays in retail application.

Retailers have even started leveraging AI-based personalized advertising in-store displays, smart fitting room mirrors, along with voice-activated virtual assistants that can improve customer engagement and the buying process. Adaptive brightness settings and ultra-wide display formats and 3D technologies are redefining the interactive retail experience and dynamic advertising solution.

The industrial display market in the north region is also expected to grow continuously in the north region as demand for ruggedized and high-performance display solutions increases across numerous industries, including manufacturing, transportation, energy, and healthcare.

Touch-enabled graphics, IoT integration, and high-resolution displays are some of the advanced technologies that companies are focusing on to improve operational efficiency and provide real-time monitoring. Adoption of industrial-grade LCDs, OLED panels and flexible displays for various applications are among the key trends.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Advantech Co., Ltd. | 18-22% |

| Winmate Inc. | 14-18% |

| Siemens AG | 11-15% |

| Hope Industrial Systems | 8-12% |

| AAEON Technology Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Advantech Co., Ltd. | Leading provider of rugged industrial displays with IoT-enabled smart features for various industries. |

| Winmate Inc. | Specializes in industrial-grade touchscreens, panel PCs, and high-durability displays for harsh environments. |

| Siemens AG | Develops high-resolution, durable industrial displays for automation, energy, and transportation sectors. |

| Hope Industrial Systems | Offers reliable industrial monitors and touchscreen displays with high resistance to extreme conditions. |

| AAEON Technology Inc. | Focuses on embedded industrial display solutions with edge computing capabilities. |

Key Company Insights

Advantech Co., Ltd. (18-22%)

The industrial display market leader Advantech provides a large selection of ruggedized screens with high durability, touchscreen capability, and IoT compatibility. Its domain focus plays well to its strength in industrial, manufacturing, healthcare and transportation industries, positioning the company to capitalize on the integration of intelligent automation and industrial IoT.

Winmate Inc. (14-18%)

Winmate Inc. is recognized as a provider of industrial display solutions such as panel PCs and rugged touchscreen monitors. The company focuses on high-performance screens that perform reliably in extreme conditions, serving customers in oil & gas, defense, and logistics.

Siemens AG (11-15%)

Siemens manufactures industrial display systems that incorporate progressive automation, high-definition visual display, energy-efficient operation, and coverage. As a result of a powerful background in both automation and smart factories, the company is the go-to for intelligent displays in industrial settings.

Hope Industrial Systems (8-12%)

Hope Industrial Systems provides industrial-grade displays, offering additional protection against dust, moisture, and vibration. With a focus on reliability and cost, the company has become a dominant force in the industrial display sector.

AAEON Technology Inc. (6-10%)

AAEON offers high-computing power embedded industrial display solutions for industries that require edge processing and real-time data display. Partnering with AI and IoT tech providers gives the company a leg-up in the market.

Other Key Players (30-40% Combined)

There are several regional and global manufacturers in the industrial display market, which primarily focus their efforts on high-performance and robust display solutions. Key players include:

The overall market size for the industrial display market was USD 6.7 billion in 2025.

The industrial display market is expected to reach USD 10.6 billion in 2035.

The demand for the industrial display market will be driven by increasing automation in manufacturing, rising adoption of IoT and smart factories, growing demand for rugged and durable displays, advancements in touchscreen and high-resolution technologies, and expanding applications in transportation, healthcare, and energy sectors.

The top 5 countries which drives the development of industrial display market are USA, UK, Europe Union, Japan and South Korea.

Rugged and panel-mount displays lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by End User, 2017 to 2032

Table 8: Global Market Volume (Units) Forecast by End User, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Type, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by End User, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast by End User, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 20: Latin America Market Volume (Units) Forecast by Type, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 22: Latin America Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2017 to 2032

Table 24: Latin America Market Volume (Units) Forecast by End User, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 28: Europe Market Volume (Units) Forecast by Type, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 30: Europe Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by End User, 2017 to 2032

Table 32: Europe Market Volume (Units) Forecast by End User, 2017 to 2032

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 36: Asia Pacific Market Volume (Units) Forecast by Type, 2017 to 2032

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 38: Asia Pacific Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End User, 2017 to 2032

Table 40: Asia Pacific Market Volume (Units) Forecast by End User, 2017 to 2032

Table 41: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: Middle East & Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 43: Middle East & Africa Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 44: Middle East & Africa Market Volume (Units) Forecast by Type, 2017 to 2032

Table 45: Middle East & Africa Market Value (US$ Million) Forecast by Technology, 2017 to 2032

Table 46: Middle East & Africa Market Volume (Units) Forecast by Technology, 2017 to 2032

Table 47: Middle East & Africa Market Value (US$ Million) Forecast by End User, 2017 to 2032

Table 48: Middle East & Africa Market Volume (Units) Forecast by End User, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Technology, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by End User, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 10: Global Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 14: Global Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2017 to 2032

Figure 18: Global Market Volume (Units) Analysis by End User, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2022 to 2032

Figure 21: Global Market Attractiveness by Type, 2022 to 2032

Figure 22: Global Market Attractiveness by Technology, 2022 to 2032

Figure 23: Global Market Attractiveness by End User, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Type, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Technology, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by End User, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 34: North America Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 38: North America Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2017 to 2032

Figure 42: North America Market Volume (Units) Analysis by End User, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2022 to 2032

Figure 45: North America Market Attractiveness by Type, 2022 to 2032

Figure 46: North America Market Attractiveness by Technology, 2022 to 2032

Figure 47: North America Market Attractiveness by End User, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Type, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Technology, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by End User, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 62: Latin America Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2017 to 2032

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Technology, 2022 to 2032

Figure 71: Latin America Market Attractiveness by End User, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Type, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Technology, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by End User, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 82: Europe Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 86: Europe Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by End User, 2017 to 2032

Figure 90: Europe Market Volume (Units) Analysis by End User, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by End User, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End User, 2022 to 2032

Figure 93: Europe Market Attractiveness by Type, 2022 to 2032

Figure 94: Europe Market Attractiveness by Technology, 2022 to 2032

Figure 95: Europe Market Attractiveness by End User, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ Million) by Technology, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ Million) by End User, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 106: Asia Pacific Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 110: Asia Pacific Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End User, 2017 to 2032

Figure 114: Asia Pacific Market Volume (Units) Analysis by End User, 2017 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Type, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Technology, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by End User, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: Middle East & Africa Market Value (US$ Million) by Type, 2022 to 2032

Figure 122: Middle East & Africa Market Value (US$ Million) by Technology, 2022 to 2032

Figure 123: Middle East & Africa Market Value (US$ Million) by End User, 2022 to 2032

Figure 124: Middle East & Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: Middle East & Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 127: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: Middle East & Africa Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 130: Middle East & Africa Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 131: Middle East & Africa Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 132: Middle East & Africa Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 133: Middle East & Africa Market Value (US$ Million) Analysis by Technology, 2017 to 2032

Figure 134: Middle East & Africa Market Volume (Units) Analysis by Technology, 2017 to 2032

Figure 135: Middle East & Africa Market Value Share (%) and BPS Analysis by Technology, 2022 to 2032

Figure 136: Middle East & Africa Market Y-o-Y Growth (%) Projections by Technology, 2022 to 2032

Figure 137: Middle East & Africa Market Value (US$ Million) Analysis by End User, 2017 to 2032

Figure 138: Middle East & Africa Market Volume (Units) Analysis by End User, 2017 to 2032

Figure 139: Middle East & Africa Market Value Share (%) and BPS Analysis by End User, 2022 to 2032

Figure 140: Middle East & Africa Market Y-o-Y Growth (%) Projections by End User, 2022 to 2032

Figure 141: Middle East & Africa Market Attractiveness by Type, 2022 to 2032

Figure 142: Middle East & Africa Market Attractiveness by Technology, 2022 to 2032

Figure 143: Middle East & Africa Market Attractiveness by End User, 2022 to 2032

Figure 144: Middle East & Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large Industrial Displays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Industrial Valve Market Size and Share Forecast Outlook 2025 to 2035

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Industrial Elevators Market Size and Share Forecast Outlook 2025 to 2035

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Battery Market Size and Share Forecast Outlook 2025 to 2035

Industrial Nailers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Relay Market Size and Share Forecast Outlook 2025 to 2035

Industrial Hose Assembly Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA