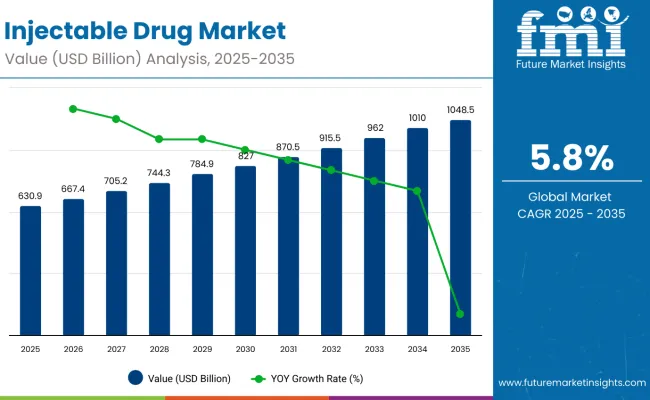

The global injectable drug market is projected to expand from USD 630.9 billion in 2025 to USD 1,048.5 billion by 2035, registering a steady compound annual growth rate (CAGR) of 5.8% over the forecast period. This robust growth is driven by increasing prevalence of chronic diseases, rising demand for biologics and biosimilars, advancements in drug delivery technologies, and expanding healthcare infrastructure worldwide.

| Attributes | Details |

|---|---|

| Injectable Drug Market Value for 2025 | USD 630.9 billion |

| Projected Market Value for 2035 | USD 1,048.5 billion |

| Value-based CAGR (2025 to 2035) | 5.8% |

Injectable drugs play a crucial role in the treatment of various conditions including oncology, diabetes, autoimmune disorders, and infectious diseases. Their ability to provide rapid therapeutic action, improved bioavailability, and precise dosing has made them indispensable in modern medical care. The growing preference for self-administration devices, such as prefilled syringes and auto-injectors, is also expanding market accessibility and patient compliance.

Biologics and biosimilars represent a significant and fast-growing segment within the injectable market. The increasing availability of biosimilar injectables is helping reduce treatment costs and expand patient access globally. Furthermore, ongoing innovations in formulation, such as sustained-release injectables and combination therapies, are enhancing treatment outcomes and convenience.

Regionally, North America and Europe dominate the market due to well-established healthcare systems, high healthcare expenditure, and greater adoption of advanced therapeutics. However, Asia Pacific is emerging as the fastest-growing region, propelled by improving healthcare access, increasing incidence of chronic diseases, and expanding pharmaceutical manufacturing capabilities.

In a verified statement from Beckers Hospital Review in April 2025, Mark Cuban, CEO of Mark Cuban Cost Plus Drug Co., emphasized the company's commitment to enhancing the injectable drug supply chain: “This partnership reshapes the supply chain for injectable medications. Together, we're not just filling gaps, we're creating a more transparent, efficient, and patient-centered system.” This quote reflects the company's efforts to address injectable drug shortages and improve distribution efficiency.

With rising global health challenges and continuous technological advancements, the injectable drug market is poised for sustained growth and evolution through 2035.

Injectable drugs are among the most strictly regulated pharmaceutical products due to their direct delivery into the bloodstream or tissue. Regulatory authorities enforce comprehensive controls over formulation, sterility, manufacturing processes, packaging, and labeling to ensure safety, efficacy, and quality. These regulations apply across the drug’s life cycle, from development to post-market surveillance.

Approval and Clinical Testing Requirements:

Injectable drugs must undergo rigorous clinical testing and regulatory review before market approval. In the United States, the Food and Drug Administration (FDA) requires submission of an Investigational New Drug (IND) application followed by a New Drug Application (NDA) or Biologics License Application (BLA) depending on the product type. In the European Union, the European Medicines Agency (EMA) handles centralized approvals for injectable drugs, requiring a full evaluation of quality, safety, and clinical efficacy under EU Regulation No 726/2004.

Sterility and Manufacturing Standards:

Sterility is critical for injectable formulations. Manufacturers must comply with current Good Manufacturing Practices (cGMP) to maintain sterile conditions and prevent microbial contamination. Regulatory guidelines include the FDA’s 21 CFR Part 210 and 211, as well as EU GMP Annex 1 for sterile medicinal products. These cover facility design, aseptic processing, cleanroom classification, environmental monitoring, and quality control testing.

Material and Container Safety:

The materials used in vials, ampoules, and syringes must be chemically compatible with the injectable drug and meet standards for leachables, extractables, and particulate matter. In the U.S., the FDA provides guidance on container-closure integrity and requires compliance with USP <661>, <788>, and <1207>. The EU follows similar rules under its pharmacopoeial and GMP standards.

Labeling and Packaging Requirements

Labeling must include dosage, route of administration, storage instructions, expiration date, and warnings. The FDA and EMA both require that labeling be accurate, clearly written, and include prescribing information. Injectable drugs must also include tamper-evident packaging and in many jurisdictions, serialization codes to prevent counterfeiting.

Post-Market Surveillance and Pharmacovigilance:

Manufacturers are required to continuously monitor and report adverse events associated with injectable drugs. In the U.S., this is done through the FDA Adverse Event Reporting System (FAERS), while the EU uses EudraVigilance. Authorities may also mandate Phase IV studies or additional risk mitigation strategies to ensure ongoing safety.

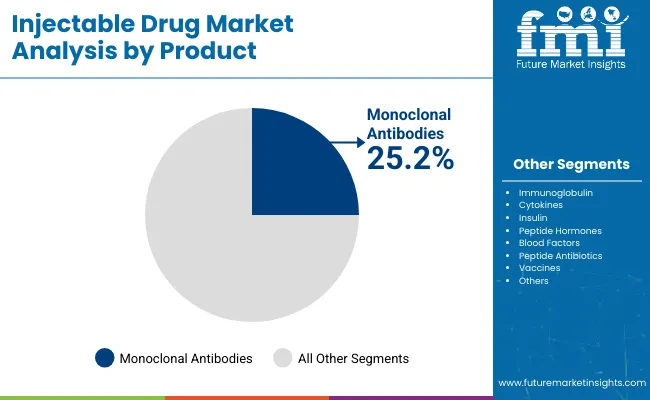

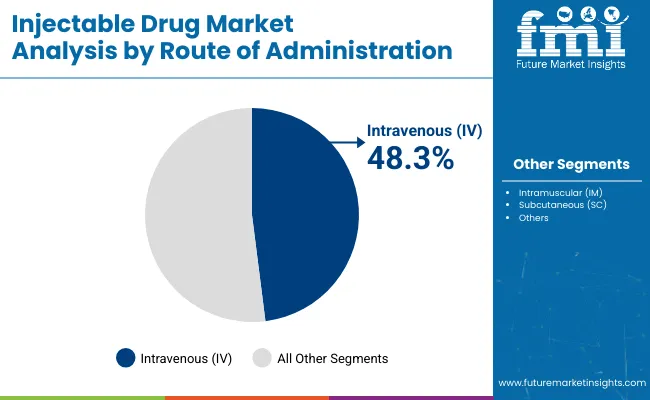

Monoclonal antibodies dominate the injectable drug market with a 25.2% share in 2024, driven by rising cancer cases and autoimmune disease prevalence. Intravenous (IV) injections lead the administration route segment with 48.3%, favored for their rapid and efficient drug delivery.

Monoclonal antibodies are expected to capture 25.2% of the injectable drug market share in 2024, reflecting their growing use in oncology and chronic inflammatory diseases. Drugs such as Alemtuzumab and Bevacizumab are increasingly adopted to target various cancer types due to their precision in attacking tumor-specific antigens, improving patient outcomes.

Beyond cancer, monoclonal antibodies like infliximab and adalimumab have transformed treatment landscapes for autoimmune disorders including Crohn’s disease and ankylosing spondylitis. The specificity and efficacy of these biologics foster expanding clinical indications and increasing physician preference.

Advancements in antibody engineering and biosimilar introductions lower costs and broaden accessibility. Manufacturers invest in novel delivery technologies and enhanced formulation stability to optimize patient compliance.

The rising global burden of cancer and autoimmune diseases, along with increased diagnostic capabilities, are key drivers underpinning the monoclonal antibody segment’s leadership in the injectable drug market through 2035.

Intravenous (IV) injections dominate the injectable drug market’s route of administration segment, holding 48.3% share in 2024. This preference is primarily due to the direct introduction of drugs into the bloodstream, ensuring rapid absorption and immediate therapeutic effect.

IV injections are widely used for delivering pain relief medications, monoclonal antibodies, chemotherapeutics, and fluids, especially in hospital and clinical settings where fast-acting treatments are critical. Their flexibility in dosing and compatibility with a broad range of injectable drugs further enhances their appeal.

Physicians and patients favor IV delivery for its reliability in achieving predictable plasma concentrations, making it ideal for acute conditions and complex therapies. The growth of outpatient infusion centers and home health care services also contributes to increasing IV administration.

Technological advancements in infusion pumps, safety devices, and needle-free systems improve patient comfort and reduce risks associated with IV injections. Ongoing demand for faster-acting injectable therapies ensures IV injections will remain the dominant administration route in the injectable drug market.

Problems like the aging population and the rise in mental health problems are seeing the healthcare sector develop in Europe. The rise in patients is invariably leading to greater demand for injectable drugs.

The Europe Medicines Agency (EMA) approving injectable drugs for marketing and distribution at a fair rate is propelling the market in Europe. Governments in Europe striving to make healthcare affordable in Europe is also helping the market’s development.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Spain | 4.0% |

| United Kingdom | 3.0% |

| Italy | 3.3% |

| France | 3.4% |

| Germany | 2.5% |

The CAGR of the market for the forecast period in Spain is anticipated to be 4.0%. Some of the factors influencing the growth of the market in the country are:

The market is expected to register a CAGR of 3.0% in the United Kingdom through 2035. Some of the factors responsible for the growth of the market are:

The market is expected to progress at a CAGR of 3.4% in France for the forecast period. Some factors influencing the progress are:

The market is expected to progress at a CAGR of 3.3% in Italy throughout the forecast period. Some factors influencing the progress are:

The market is expected to progress at a CAGR of 2.5% in Germany. Some factors influencing the progress are:

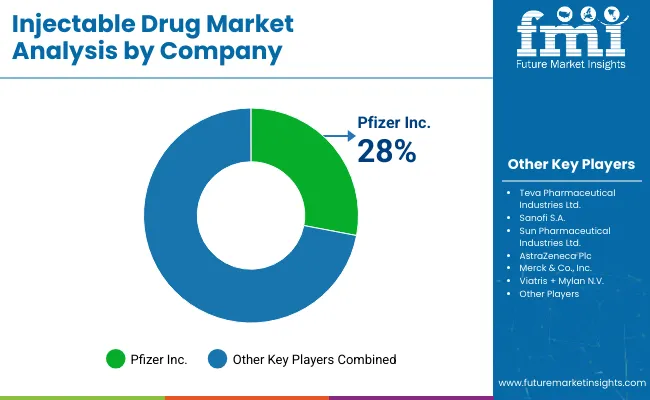

The injectable drug market is moderately fragmented. Multinational companies are focusing on expanding production, while small-scale companies are looking for investments to remain competitive.

Pfizer Inc.’s personalized approach towards patients is seeing the company develop targeted injectable drugs. Other companies in the market are establishing partnerships between themselves to develop and advertise new products.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 630.9 billion |

| Projected Market Size (2035) | USD 1,048.5 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Monoclonal Antibody, Immunoglobulin, Cytokines, Insulin, Peptide Hormones, Blood Factors, Peptide Antibiotics, Vaccines, Small Molecule Antibiotics, Chemotherapy Agents, Others |

| Applications Analyzed (Segment 2) | Oncology, Infectious Diseases, Diabetes, Blood Disorders, Hormonal Disorders, Musculoskeletal Disorders, CNS Diseases, Pain Management, Cardiovascular Diseases |

| Molecule Types Analyzed (Segment 3) | Small Molecule, Large Molecule |

| Routes of Administration Analyzed (Segment 4) | Intravenous (IV), Intramuscular (IM), Subcutaneous (SC) |

| Distribution Channels Analyzed (Segment 5) | Hospital Pharmacies, Retail Pharmacies, Drug Stores, Online Pharmacies |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, Saudi Arabia, South Africa |

| Key Players Influencing the Market | Pfizer Inc., Teva Pharmaceutical Industries Ltd., Sanofi S.A., Sun Pharmaceutical Industries Ltd., AstraZeneca Plc, Merck & Co., Inc., Viatris + Mylan N.V., Cipla Inc., Dr Reddy’s Laboratories Ltd., Samsung Biologics, Abbott Laboratories |

| Additional Attributes | Dollar sales and share by drug class; therapeutic area growth trends; regional demand and regulatory updates; competitive landscape and pricing dynamics; delivery technology innovations; patient preference insights; supply chain trends; emerging market opportunities |

The size of the injectable drug market is estimated to be USD 630.9 billion in 2025.

The injectable drug market is expected to increase at a CAGR of 5.8% over the forecast period.

The injectable drug market is expected to register a CAGR of 3.0% in the United Kingdom over the period from 2025 to 2035.

The injectable drug market is forecasted to reach a size of USD 1,048.5 billion by 2035.

Use of biotechnology for developing new drugs and the rising importance of vaccines are two of the trends in the injectable drug industry.

Pfizer Inc., Teva Pharmaceutical Industries Ltd., Sanofi S.A., and Sun Pharmaceutical Industries Ltd. are some of the prominent companies in the injectable drug market.

Monoclonal antibodies are the top product type in the injectable drug market, with an estimated market share of 10.8% in 2025.

The injectable drug market is expected to register a CAGR of 2.5% in Germany over the period from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Molecule Type, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Molecule Type, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 10: Global Market Volume (Units) Forecast by Route of Administration, 2019 to 2034

Table 11: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Molecule Type, 2019 to 2034

Table 20: North America Market Volume (Units) Forecast by Molecule Type, 2019 to 2034

Table 21: North America Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 22: North America Market Volume (Units) Forecast by Route of Administration, 2019 to 2034

Table 23: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: Latin America Market Value (US$ Million) Forecast by Molecule Type, 2019 to 2034

Table 32: Latin America Market Volume (Units) Forecast by Molecule Type, 2019 to 2034

Table 33: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 34: Latin America Market Volume (Units) Forecast by Route of Administration, 2019 to 2034

Table 35: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 40: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 41: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Western Europe Market Value (US$ Million) Forecast by Molecule Type, 2019 to 2034

Table 44: Western Europe Market Volume (Units) Forecast by Molecule Type, 2019 to 2034

Table 45: Western Europe Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 46: Western Europe Market Volume (Units) Forecast by Route of Administration, 2019 to 2034

Table 47: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Molecule Type, 2019 to 2034

Table 56: Eastern Europe Market Volume (Units) Forecast by Molecule Type, 2019 to 2034

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 58: Eastern Europe Market Volume (Units) Forecast by Route of Administration, 2019 to 2034

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 60: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 64: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 66: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Molecule Type, 2019 to 2034

Table 68: South Asia and Pacific Market Volume (Units) Forecast by Molecule Type, 2019 to 2034

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 70: South Asia and Pacific Market Volume (Units) Forecast by Route of Administration, 2019 to 2034

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 72: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 74: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 75: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 76: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 77: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 78: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 79: East Asia Market Value (US$ Million) Forecast by Molecule Type, 2019 to 2034

Table 80: East Asia Market Volume (Units) Forecast by Molecule Type, 2019 to 2034

Table 81: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 82: East Asia Market Volume (Units) Forecast by Route of Administration, 2019 to 2034

Table 83: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 84: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 86: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 88: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 90: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Molecule Type, 2019 to 2034

Table 92: Middle East and Africa Market Volume (Units) Forecast by Molecule Type, 2019 to 2034

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 94: Middle East and Africa Market Volume (Units) Forecast by Route of Administration, 2019 to 2034

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 96: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Molecule Type, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 6: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 8: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 12: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 16: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 17: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 18: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 19: Global Market Value (US$ Million) Analysis by Molecule Type, 2019 to 2034

Figure 20: Global Market Volume (Units) Analysis by Molecule Type, 2019 to 2034

Figure 21: Global Market Value Share (%) and BPS Analysis by Molecule Type, 2024 to 2034

Figure 22: Global Market Y-o-Y Growth (%) Projections by Molecule Type, 2024 to 2034

Figure 23: Global Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 24: Global Market Volume (Units) Analysis by Route of Administration, 2019 to 2034

Figure 25: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 26: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 27: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 28: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 29: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 30: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 31: Global Market Attractiveness by Product, 2024 to 2034

Figure 32: Global Market Attractiveness by Application, 2024 to 2034

Figure 33: Global Market Attractiveness by Molecule Type, 2024 to 2034

Figure 34: Global Market Attractiveness by Route of Administration, 2024 to 2034

Figure 35: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: Global Market Attractiveness by Region, 2024 to 2034

Figure 37: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 38: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: North America Market Value (US$ Million) by Molecule Type, 2024 to 2034

Figure 40: North America Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 41: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 42: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 44: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 47: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 48: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 49: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 51: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 52: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 53: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 54: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 55: North America Market Value (US$ Million) Analysis by Molecule Type, 2019 to 2034

Figure 56: North America Market Volume (Units) Analysis by Molecule Type, 2019 to 2034

Figure 57: North America Market Value Share (%) and BPS Analysis by Molecule Type, 2024 to 2034

Figure 58: North America Market Y-o-Y Growth (%) Projections by Molecule Type, 2024 to 2034

Figure 59: North America Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 60: North America Market Volume (Units) Analysis by Route of Administration, 2019 to 2034

Figure 61: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 62: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 63: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 64: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 65: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 66: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 67: North America Market Attractiveness by Product, 2024 to 2034

Figure 68: North America Market Attractiveness by Application, 2024 to 2034

Figure 69: North America Market Attractiveness by Molecule Type, 2024 to 2034

Figure 70: North America Market Attractiveness by Route of Administration, 2024 to 2034

Figure 71: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: North America Market Attractiveness by Country, 2024 to 2034

Figure 73: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Latin America Market Value (US$ Million) by Molecule Type, 2024 to 2034

Figure 76: Latin America Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 77: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 83: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 84: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 87: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 88: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 91: Latin America Market Value (US$ Million) Analysis by Molecule Type, 2019 to 2034

Figure 92: Latin America Market Volume (Units) Analysis by Molecule Type, 2019 to 2034

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Molecule Type, 2024 to 2034

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Molecule Type, 2024 to 2034

Figure 95: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 96: Latin America Market Volume (Units) Analysis by Route of Administration, 2019 to 2034

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 99: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 100: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 103: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 104: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 105: Latin America Market Attractiveness by Molecule Type, 2024 to 2034

Figure 106: Latin America Market Attractiveness by Route of Administration, 2024 to 2034

Figure 107: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 109: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 110: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: Western Europe Market Value (US$ Million) by Molecule Type, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 113: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 114: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 119: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 120: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 123: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 124: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 127: Western Europe Market Value (US$ Million) Analysis by Molecule Type, 2019 to 2034

Figure 128: Western Europe Market Volume (Units) Analysis by Molecule Type, 2019 to 2034

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Molecule Type, 2024 to 2034

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Molecule Type, 2024 to 2034

Figure 131: Western Europe Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 132: Western Europe Market Volume (Units) Analysis by Route of Administration, 2019 to 2034

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 135: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 136: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 139: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 140: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 141: Western Europe Market Attractiveness by Molecule Type, 2024 to 2034

Figure 142: Western Europe Market Attractiveness by Route of Administration, 2024 to 2034

Figure 143: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 145: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: Eastern Europe Market Value (US$ Million) by Molecule Type, 2024 to 2034

Figure 148: Eastern Europe Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 149: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 156: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 160: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Molecule Type, 2019 to 2034

Figure 164: Eastern Europe Market Volume (Units) Analysis by Molecule Type, 2019 to 2034

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Molecule Type, 2024 to 2034

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Molecule Type, 2024 to 2034

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 168: Eastern Europe Market Volume (Units) Analysis by Route of Administration, 2019 to 2034

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 172: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 175: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 176: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 177: Eastern Europe Market Attractiveness by Molecule Type, 2024 to 2034

Figure 178: Eastern Europe Market Attractiveness by Route of Administration, 2024 to 2034

Figure 179: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 180: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 181: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 182: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 183: South Asia and Pacific Market Value (US$ Million) by Molecule Type, 2024 to 2034

Figure 184: South Asia and Pacific Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 185: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 188: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 192: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 196: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Molecule Type, 2019 to 2034

Figure 200: South Asia and Pacific Market Volume (Units) Analysis by Molecule Type, 2019 to 2034

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Molecule Type, 2024 to 2034

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Molecule Type, 2024 to 2034

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 204: South Asia and Pacific Market Volume (Units) Analysis by Route of Administration, 2019 to 2034

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 208: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 211: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 212: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 213: South Asia and Pacific Market Attractiveness by Molecule Type, 2024 to 2034

Figure 214: South Asia and Pacific Market Attractiveness by Route of Administration, 2024 to 2034

Figure 215: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 217: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 218: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 219: East Asia Market Value (US$ Million) by Molecule Type, 2024 to 2034

Figure 220: East Asia Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 221: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 222: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 224: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 227: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 228: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 231: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 232: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 235: East Asia Market Value (US$ Million) Analysis by Molecule Type, 2019 to 2034

Figure 236: East Asia Market Volume (Units) Analysis by Molecule Type, 2019 to 2034

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Molecule Type, 2024 to 2034

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Molecule Type, 2024 to 2034

Figure 239: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 240: East Asia Market Volume (Units) Analysis by Route of Administration, 2019 to 2034

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 243: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 244: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 247: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 248: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 249: East Asia Market Attractiveness by Molecule Type, 2024 to 2034

Figure 250: East Asia Market Attractiveness by Route of Administration, 2024 to 2034

Figure 251: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 252: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 253: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 254: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 255: Middle East and Africa Market Value (US$ Million) by Molecule Type, 2024 to 2034

Figure 256: Middle East and Africa Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 257: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 260: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 264: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 268: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Molecule Type, 2019 to 2034

Figure 272: Middle East and Africa Market Volume (Units) Analysis by Molecule Type, 2019 to 2034

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Molecule Type, 2024 to 2034

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Molecule Type, 2024 to 2034

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 276: Middle East and Africa Market Volume (Units) Analysis by Route of Administration, 2019 to 2034

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 280: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 283: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 284: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 285: Middle East and Africa Market Attractiveness by Molecule Type, 2024 to 2034

Figure 286: Middle East and Africa Market Attractiveness by Route of Administration, 2024 to 2034

Figure 287: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 288: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Injectable Drug Delivery Market Analysis – Growth & Trends 2024-2034

North America Injectable Drug Market Analysis – Size, Share & Forecast 2024-2034

Injectable Drug Packaging Market

Injectable Thyroid Drug Market Size and Share Forecast Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Injectable Drug Market

Injectable Anti-Wrinkle Treatment Market Size and Share Forecast Outlook 2025 to 2035

Injectable Nanomedicines Market Size and Share Forecast Outlook 2025 to 2035

Injectable Liquid Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Injectable Potassium Phosphate Market – Growth & Forecast 2024 to 2034

Injectable Cocoa Fillings Market

Injectable Benzodiazepine Market – Trends, Growth & Forecast 2022-2032

Injectable Bulking Agents Market

Global Non-injectable Insulin Market Insights – Size, Trends & Forecast 2024-2034

Lipid Injectable Market

Spinal Injectable Market Size and Share Forecast Outlook 2025 to 2035

Generic Injectable Market Report - Growth, Demand & Forecast 2025 to 2035

Global Sterile Injectable CDMO Market Analysis – Size, Share & Forecast 2024-2034

Glucagon Injectable Market

Ophthalmic Injectable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA