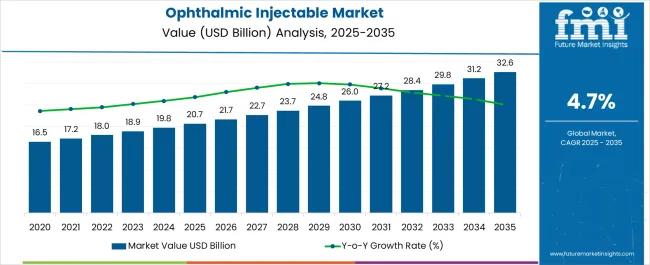

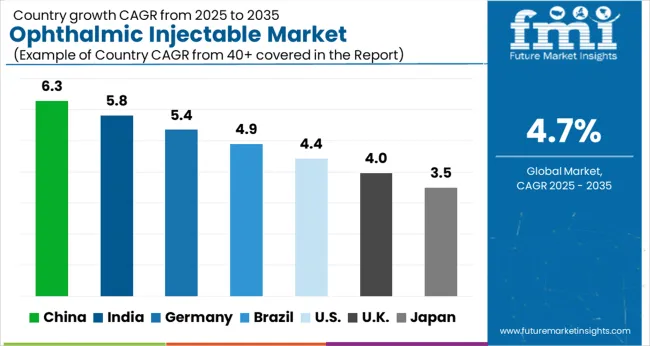

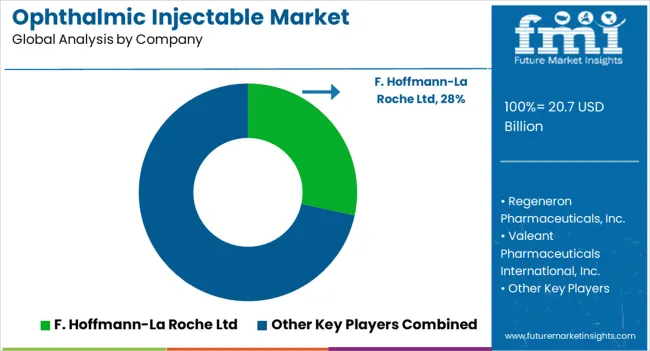

The Ophthalmic Injectable Market is estimated to be valued at USD 20.7 billion in 2025 and is projected to reach USD 32.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Ophthalmic Injectable Market Estimated Value in (2025 E) | USD 20.7 billion |

| Ophthalmic Injectable Market Forecast Value in (2035 F) | USD 32.6 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The ophthalmic injectable market is expanding steadily as the prevalence of chronic eye disorders such as age related macular degeneration, diabetic retinopathy, and retinal vein occlusion continues to rise globally. Increasing adoption of biologics and targeted therapies has accelerated the use of injectable formulations that deliver high efficacy and localized treatment outcomes.

Technological advancements in injection delivery systems and the development of long acting formulations are improving patient compliance and treatment adherence. Growing awareness about early diagnosis, coupled with supportive healthcare infrastructure and rising geriatric populations, is strengthening demand.

Furthermore, reimbursement support for advanced ophthalmic therapies in developed markets is encouraging wider use. The outlook remains positive as pharmaceutical companies continue to invest in pipeline innovation and strategic collaborations to address unmet needs in ophthalmology.

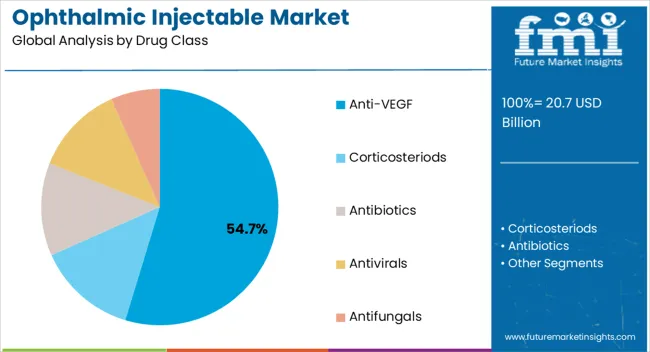

The anti VEGF drug class segment is projected to account for 54.70% of market revenue by 2025, making it the leading segment within this category. Its dominance is being driven by the proven efficacy of anti VEGF agents in slowing disease progression and preserving vision in patients with retinal disorders.

The ability to directly target vascular endothelial growth factor pathways has provided significant clinical benefits compared to earlier treatment options. Expanded approvals across multiple retinal indications and strong adoption by ophthalmologists have reinforced demand.

Continued innovation in sustained release formulations and biosimilars is further supporting the long term growth of this segment.

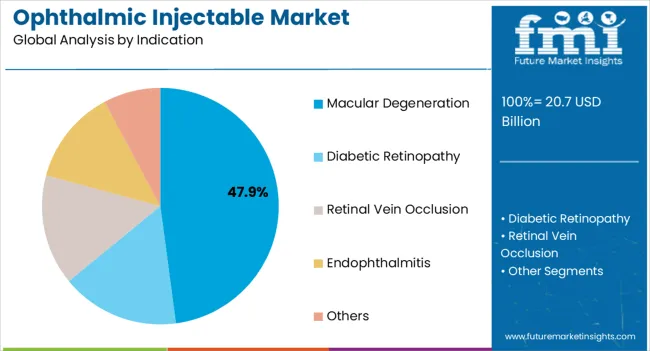

The macular degeneration indication segment is expected to hold 47.90% of total market revenue by 2025, positioning it as the leading indication segment. This growth is being fueled by the rising global prevalence of age related macular degeneration and the increasing availability of targeted therapies that address the underlying vascular causes.

Advancements in diagnostic technologies have enabled earlier detection, thereby expanding the eligible patient pool for injectable therapies. Supportive reimbursement policies and increased awareness campaigns on age related eye health are further driving adoption.

The segment continues to grow as pharmaceutical pipelines remain focused on improving treatment durability and outcomes for macular degeneration patients.

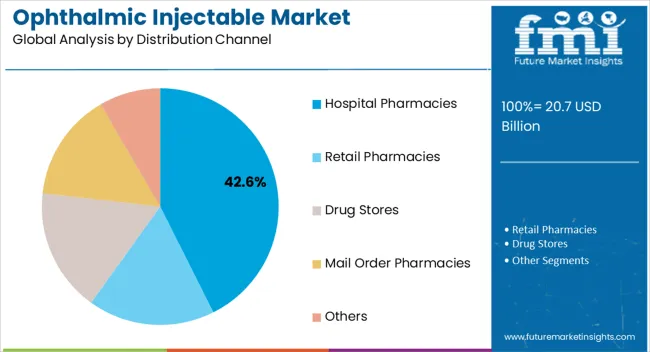

The hospital pharmacies distribution channel segment is set to contribute 42.60% of total revenue by 2025, securing its position as the leading distribution channel. This is largely attributed to the fact that ophthalmic injectables are administered in clinical settings under the supervision of specialists.

Hospitals provide the necessary infrastructure for sterile preparation, monitoring, and follow up, ensuring safe and effective use of injectable treatments. The growing number of hospital based ophthalmology clinics and expansion of specialty pharmacy services have strengthened this segment.

Additionally, hospital pharmacies benefit from direct procurement agreements with manufacturers, ensuring consistent supply and availability of critical therapies. This combination of safety, accessibility, and professional oversight has cemented hospital pharmacies as the primary distribution channel for ophthalmic injectables.

From 2020 to 2025, the global ophthalmic injectable market experienced a CAGR of 4.8%, reaching a market size of USD 20.7 billion in 2025.

From 2020 to 2025, the global ophthalmic injectable industry witnessed steady growth due to the shift towards minimally invasive treatments. The landscape of treatment for numerous eye disorders has been completely transformed by the development of novel ocular injectables such anti-vascular endothelial growth factor (anti-VEGF) medicines and corticosteroids. These innovations have improved treatment outcomes and patient satisfaction, leading to increasing usage and market development.

In ophthalmology, there has been a paradigm shift towards minimally invasive treatments. Ophthalmic injectables provide targeted and localized drug delivery to the eye, making them a less invasive alternative to surgical interventions. The inclination for minimally invasive procedures has contributed to the increased demand for ophthalmic injectables.

Future Forecast for Ophthalmic Injectable Industry:

Looking ahead, the global ophthalmic injectable industry is expected to rise at a CAGR of 4.9% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 32.6 billion in 2035.

Future developments in drug delivery methods offer hope for ophthalmic injectables. The duration and effectiveness of treatment can be increased with the development of sustained-release implants, micro/nano-particles, and intelligent delivery systems. These developments might result in the release of novel injectables with improved therapeutic profiles, spurring market expansion.

Personalised medicine is the way of the future of healthcare, and ophthalmology is no exception. The creation of personalised ophthalmic injectables catered to the needs of specific individuals may be facilitated by improvements in genetic screening and biomarker identification. This individualized strategy may improve treatment results and spur market expansion.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 32.6 billion |

| CAGR % 2025 to End of Forecast (2035) | 4.7% |

The ophthalmic injectable industry in the United States is expected to reach a market value of USD 32.6 billion by 2035, expanding at a CAGR of 4.7%. The ophthalmic injectable market in the United States is expected to grow as the country's mental health awareness grows. Age-related macular degeneration is becoming more and more prevalent across the nation.

Age-related macular degeneration (AMD) affected 16.5 million (12.6%) Americans aged 40 and over in 2020, according to the Centers for Disease Control and Prevention. It's probable that injectable therapies for macular degeneration will be even more successful and require less frequent administration. Thus, the market is growing as ophthalmic injectables are being used for therapeutic purposes.

| Country | The United Kingdom |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 800.0 million |

| CAGR % 2025 to End of Forecast (2035) | 4.4% |

The ophthalmic injectable industry in the United Kingdom is expected to reach a market value of USD 800.0 million by 2035, expanding at a CAGR of 4.4% during the forecast period. The market in the United Kingdom is expected to grow due to the increased preference for minimally invasive treatment options of eye diseases.

Compared to conventional surgical treatments, ophthalmic injectables are frequently thought of as being minimally invasive. Due to their convenience, shorter recovery times, and decreased risk of problems, these non-surgical therapy methods are preferred by many patients. The rising demand for ophthalmic injectables has been influenced by this tendency for least invasive procedures.

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 1.7 billion |

| CAGR % 2025 to End of Forecast (2035) | 5.4% |

The ophthalmic injectable industry in China is anticipated to reach a market value of USD 1.7 billion by 2035, moving at a CAGR of 5.4% during the forecast period. The ophthalmic injectable industry in China is expected to grow prominently due to the prevalence of diabetic retinopathy.

A main factor in diabetes vision loss and blindness is diabetic retinopathy (DR). Injectable treatments for diabetic retinopathy are likely to be considerably more effective and demand less frequent administration. As a result of the increased usage of ophthalmic injectables for therapeutic purposes, the market is expanding.

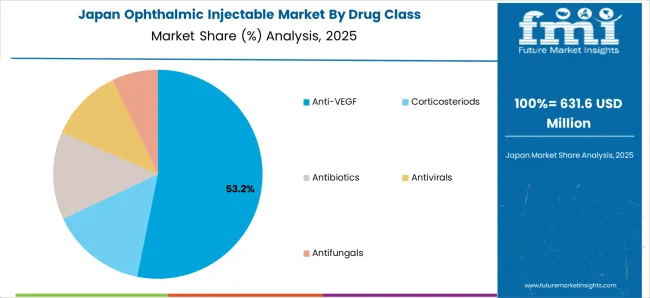

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 755.0 million |

| CAGR % 2025 to End of Forecast (2035) | 4.2% |

The ophthalmic injectable industry in Japan is estimated to reach a market value of USD 755.0 million by 2035, thriving at a CAGR of 10.9%. Due to the development in the ophthalmic healthcare, the Japanese market is expected to increase. In Japan, the regulatory landscape for digital therapies is changing.

Significant progress has been made in ophthalmic injectables and associated technologies. Newer medications with higher efficacy and safety characteristics have been released, appealing patients as well as healthcare professionals. The availability of new therapeutic alternatives has boosted demand for these injectables.

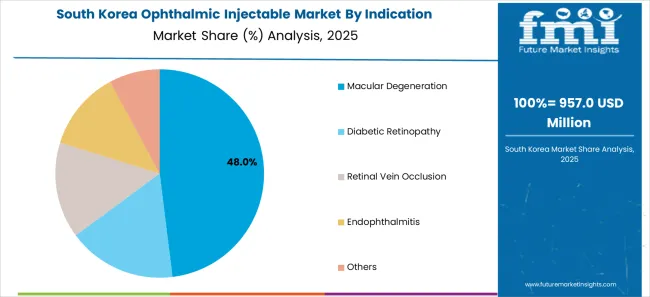

| Country | South Korea |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 395.0 million |

| CAGR % 2025 to End of Forecast (2035) | 4.1% |

The ophthalmic injectable industry in South Korea is expected to reach a market value of USD 395.0 million by 2035, expanding at a CAGR of 4.1% during the forecast period. The market in South Korea is expected to develop as people become more aware of the importance of mental health.

The general public is becoming more aware of eye health and the significance of frequent eye exams. Improved diagnostic equipment and procedures enable earlier diagnosis of eye problems, increasing demand for ophthalmic injectables as a therapy option.

The anti-VEGF dominated the ophthalmic injectable industry with a market of 37.6% in 2025. This segment captures a significant market share in 2025 due to its ease of use.

A patient may benefit from in-person psychotherapy sessions enhanced with digital tools or platforms in a combination therapy approach. This could involve using smartphone apps for self-monitoring and self-help tools, joining online support groups, or participating in virtual reality-based exposure therapy.

Macular degeneration dominated the ophthalmic injectable industry with a share of 31.20.7% in 2025. Due to the rising prevalence of macular degeneration. Macular degeneration is becoming more common over the world, which is causing the market to expand.

WHO estimates that there were about 20.7 million cases of age-related macular degeneration in 2025. For improved therapeutic results, injectable medications are used in the majority of macular degeneration therapies.

The hospital pharmacies dominated the ophthalmic injectable industry with a share of 31.20.7% in 2025. This segment captures a significant market share in 2025 due to the demand for accessible and convenience.

Hospital pharmacy may contribute significantly to the patient care team by reviewing medications and educating patients about various eye conditions in clinic settings. As a result, hospital pharmacists are essential to eye treatment.

The ophthalmic injectable industry is highly competitive. Numerous players are looking out to hold on to market share globally. Key players are thus, trying to adopt new and effective strategies to stay ahead of the competition.

Key Strategies Adopted by the Players

Companies make significant investments in research and development to bring new goods to market that offer improved efficiency, dependability, and cost-effectiveness. Companies may set themselves apart from rivals and adapt to clients' changing requirements thanks to product innovation.

Strategic partnerships and collaborations between leading organisations in the sector are frequently formed to take advantage of one another's advantages and broaden their market reach. These partnerships can provide businesses access to emerging markets and technology.

The market for ophthalmic injectables is expanding significantly in developing nations like China and India. Important firms are creating local production facilities and bolstering their distribution networks in an effort to increase their market share.

In order to strengthen their market positions, increase the scope of their product offerings, and gain access to new markets, major companies in the ophthalmic injectable market frequently participate in mergers and acquisitions.

Key Developments in the Ophthalmic Injectable Market:

The global ophthalmic injectable market is estimated to be valued at USD 20.7 billion in 2025.

The market size for the ophthalmic injectable market is projected to reach USD 32.6 billion by 2035.

The ophthalmic injectable market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in ophthalmic injectable market are anti-vegf, corticosteriods, antibiotics, antivirals and antifungals.

In terms of indication, macular degeneration segment to command 47.9% share in the ophthalmic injectable market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ophthalmic Prefilled Injectables Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Eye Drop Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Stereoscopic 3D Display Market Size and Share Forecast and Outlook 2025 to 2035

Injectable Osteoarthritis Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Injectable Drug Industry Analysis in North America Forecast Outlook 2025 to 2035

Ophthalmic Drug Packaging Market Forecast and Outlook 2025 to 2035

Ophthalmic Surgical Market Size and Share Forecast Outlook 2025 to 2035

Injectable Anti-Wrinkle Treatment Market Size and Share Forecast Outlook 2025 to 2035

Injectable Thyroid Drug Market Size and Share Forecast Outlook 2025 to 2035

Injectable Nanomedicines Market Size and Share Forecast Outlook 2025 to 2035

Injectable Liquid Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Sprays Market Size and Share Forecast Outlook 2025 to 2035

Injectable Drug Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ophthalmic Diagnostic Equipment Market Analysis - Size, Share & Forecast 2025-2035

Ophthalmic Tonometers Market – Demand, Growth & Forecast 2025 to 2035

Ophthalmic Lasers Market Analysis - Innovations & Forecast 2024 to 2034

Injectable Potassium Phosphate Market – Growth & Forecast 2024 to 2034

Global Ophthalmic Combination Product Market Analysis – Size, Share & Forecast 2024-2034

Injectable Drug Delivery Market Analysis – Growth & Trends 2024-2034

Injectable Cocoa Fillings Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA