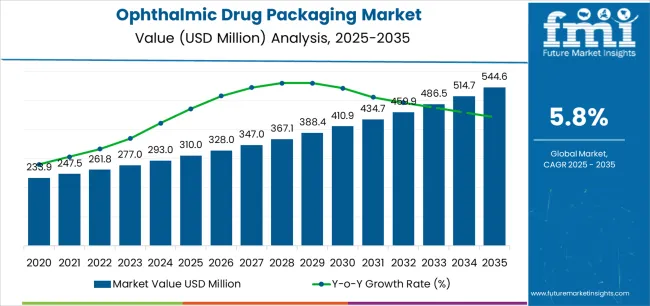

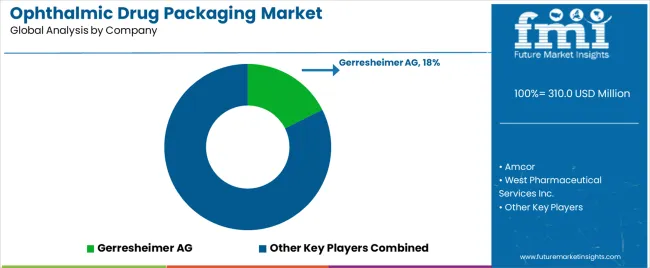

The Ophthalmic Drug Packaging Market is estimated to be valued at USD 310.0 million in 2025 and is projected to reach USD 544.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The ophthalmic drug packaging market is experiencing strong growth driven by rising prevalence of eye disorders, increasing demand for sterile and precise drug delivery systems, and technological advancements in material design and dispensing formats. The current market scenario reflects a growing preference for packaging solutions that ensure product stability, accurate dosing, and patient safety. Regulatory requirements emphasizing contamination control and compliance with pharmaceutical packaging standards are encouraging manufacturers to adopt advanced packaging materials and designs.

The future outlook is shaped by expanding ophthalmic drug development pipelines, growth in the geriatric population, and heightened awareness of ocular health. Investment in sustainable materials and smart packaging innovations is expected to enhance market competitiveness.

Growth rationale is underpinned by the dual focus on patient-centric design and regulatory adherence, coupled with the increasing commercialization of combination therapies that demand tailored packaging solutions As a result, the market is anticipated to maintain a steady growth trajectory across global pharmaceutical and healthcare sectors.

| Metric | Value |

|---|---|

| Ophthalmic Drug Packaging Market Estimated Value in (2025 E) | USD 310.0 million |

| Ophthalmic Drug Packaging Market Forecast Value in (2035 F) | USD 544.6 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

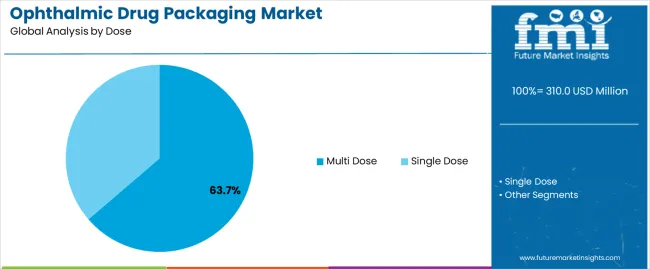

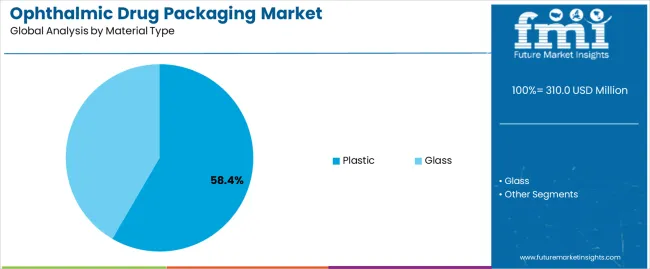

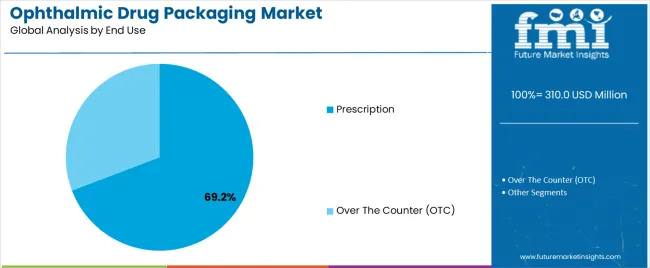

The market is segmented by Dose, Material Type, and End Use and region. By Dose, the market is divided into Multi Dose and Single Dose. In terms of Material Type, the market is classified into Plastic and Glass. Based on End Use, the market is segmented into Prescription and Over The Counter (OTC). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The multi dose segment, accounting for 63.70% of the dose category, has been leading the market due to its cost efficiency, convenience, and suitability for long-term ophthalmic treatments. Widespread adoption has been supported by patient preference for reusable containers and manufacturers’ focus on improving sterility assurance through advanced closure systems.

The segment’s performance has been further strengthened by innovations in preservative-free formulations and multi-dose droppers equipped with anti-contamination valves. Regulatory acceptance of multi-dose systems for both prescription and over-the-counter products has reinforced market growth.

Continuous improvement in precision dosing mechanisms and compatibility with viscous ophthalmic solutions is expected to sustain the segment’s leadership, ensuring ongoing preference among healthcare providers and end users.

The plastic segment, representing 58.40% of the material type category, has emerged as the dominant choice owing to its flexibility, lightweight nature, and adaptability to complex packaging designs. Its dominance is reinforced by ease of sterilization, cost-effectiveness, and compatibility with most ophthalmic formulations.

The material’s ability to maintain drug stability while offering transparency for dosage visibility has enhanced consumer trust. Continuous advancements in medical-grade polymers and barrier properties have improved safety and extended product shelf life.

Sustainability trends are encouraging the adoption of recyclable plastics and bio-based resins, which are supporting long-term environmental compliance These factors collectively ensure that plastic remains the preferred material for ophthalmic drug packaging across diverse market segments.

The prescription segment, holding 69.20% of the end use category, has maintained dominance due to the growing incidence of chronic ocular conditions that require continuous medical supervision and controlled drug administration. Increased patient reliance on physician-prescribed treatments has strengthened demand for standardized packaging solutions that ensure dosage accuracy and product integrity.

Regulatory frameworks favoring prescription-based drug distribution have reinforced the segment’s share. Hospitals, clinics, and ophthalmology centers continue to be major users of prescription-packaged ophthalmic drugs due to their emphasis on compliance and safety.

The segment’s growth is being further supported by the rising introduction of prescription-only biologics and combination therapies, which require advanced packaging technologies for stability and contamination prevention This strong clinical orientation is expected to sustain the segment’s leading position throughout the forecast period.

The global demand for the ophthalmic drug packaging market was estimated to reach a valuation of USD 233.9 million in 2020, according to a report from Future Market Insights (FMI). From 2020 to 2025, the ophthalmic drug packaging market witnesses significant growth, registering a CAGR of 5.6%.

| Historical CAGR 2020 to 2025 | 5.6% |

|---|---|

| Forecast CAGR 2025 to 2035 | 6.1% |

The development of intelligent packaging solutions with digital technology integrated is one advancement in the ophthalmic drug packaging market. Electronic sensors, RFID (Radio Frequency Identification) tags, or NFC (Near Field Communication) chips are a few examples of features that these smart packages may include.

These capabilities allow for real time monitoring of drug consumption, temperature, and expiration dates. By giving patients dose reminders and tracking, this invention improves drug adherence. It also gives healthcare practitioners useful data to assess treatment progress and improve patient outcomes. Such innovations are anticipated to push the market growth forward.

Personalized Therapies and Precision Medicine to Enhance Growth

One distinct factor propelling the ophthalmic drug packaging market is the increasing prevalence of precision medicines and customized medicine. The need for personalized ophthalmic drugs that are matched to each patient's unique profile is rising due to developments in genetic testing and targeted therapies. This trend necessitates creative packaging options that maintain accuracy and safety while enabling a range of doses, formulations, and administration schedules.

Personalized medicine also encourages pharmaceutical firms and package manufacturers to work together to create customized packaging forms that improve patient outcomes and drug efficacy. This driver is a reflection of the way that healthcare is changing to provide more individualized treatment, which is encouraging innovation in the packaging of ophthalmic drugs.

Quality Control and Supply Chain Disruptions to Impede the Market Growth

Few restraints of the market are:

This section focuses on providing detailed analysis of two particular market segments for ophthalmic drug packaging, the dominant dose type and the significant end use. The two main segments discussed below are the IVD equipment and immunoassay.

| Dose Type | Multi Dose |

|---|---|

| Market Share in 2025 | 81.7% |

The multi dose drug segment is anticipated to reach an 81.7% market share in 2025. Many eye disorders need frequent and long term therapy, making multidose packaging affordable and easy for patients. Since these drugs are usually taken in small amounts, dispensing several doses from a single container is feasible.

The use of multidose packaging improves patient outcomes and treatment efficacy by making it simpler for patients and healthcare professionals to keep track of medicine consumption and adherence.

Preservatives and antibacterial agents are frequently included in multi dose packaging for ocular medications in order to preserve sterility and avoid contamination over the course of therapy.

| End Use | Prescription |

|---|---|

| Market Share in 2025 | 64.2% |

In 2025, the prescription segment by end use is likely to gain a 64.2% market share. Ophthalmic drug packaging is mostly utilized for prescription medication since eye treatments are specialized. Prescription drugs frequently need exact dosage and administration guidelines catered to the specific requirements of each patient, therefore packaging designs that guarantee right delivery and save waste are required.

Specialist packaging is necessary to ensure therapeutic efficacy and safety for patients under professional medical care. This is because prescription ophthalmic drugs may include strong or delicate chemicals that need extra protection against contamination and degradation.

This section will go into detail on the ophthalmic drug packaging markets in a few key countries, including the United States, the United Kingdom, China, Japan and South Korea. This segment will focus on the key factors that are driving up demand in these countries for ophthalmic drug packaging.

| Countries | Forecast CAGR from 2025 to 2035 |

|---|---|

| The United States | 11.9% |

| The United Kingdom | 12.9% |

| China | 12.7% |

| Japan | 13% |

| South Korea | 14.1% |

The United States ophthalmic drug packaging ecosystem is anticipated to gain a CAGR of 4.3% through 2035. Factors that are bolstering the growth are:

The ophthalmic drug packaging market in the United Kingdom is expected to expand with a 5.5% CAGR through 2035. The factors pushing the growth are:

The ophthalmic drug packaging ecosystem in China is anticipated to develop with a 7.1% CAGR from 2025 to 2035. The drivers behind this growth are:

The ophthalmic drug packaging industry in Japan is anticipated to reach a 4.4% CAGR from 2025 to 2035. The drivers propelling growth forward are:

The ophthalmic drug packaging ecosystem in South Korea is likely to evolve with a 5.6% CAGR during the forecast period. The factors bolstering the growth are:

Companies are realizing how crucial it is to develop specialized packaging solutions to satisfy the various demands of healthcare professionals and patients. This might entail specially designed package formats, including pre filled syringes, multi dose bottles, or single dose vials, in addition to packaging designs that promote patient adherence and convenience of use. In the pharmaceutical sector, compliance with strict regulations is essential, especially when it comes to the packaging of ophthalmic drugs.

To guarantee product safety and market approval, leading companies place a high priority on adhering to rules established by regulatory authorities like the European Medicines Agency (EMA) in Europe and the Food and Drug Administration (FDA) in the United States. Continual research and development is necessary to propel innovation in the packaging of ophthalmic drugs. The key players in this market include:

Significant advancements in the ophthalmic drug packaging market are being made by key market participants, and these include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.8% from 2025 to 2035 |

| Market value in 2025 | USD 310.0 million |

| Market value in 2035 | USD 544.6 million |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Dose, Material Type, End Use, End User |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Amcor; West Pharmaceutical Services Inc.; Gerresheimer AG; Merck Sharp & Dohme Corp.; AptarGroup Inc.; Akorn Inc.; Mitotech SA; Bausch & Lomb Incorporated; Bayer AG; Novartis AG |

| Customization Scope | Available on Request |

The global ophthalmic drug packaging market is estimated to be valued at USD 310.0 million in 2025.

The market size for the ophthalmic drug packaging market is projected to reach USD 544.6 million by 2035.

The ophthalmic drug packaging market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in ophthalmic drug packaging market are multi dose and single dose.

In terms of material type, plastic segment to command 58.4% share in the ophthalmic drug packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ophthalmic Stereoscopic 3D Display Market Size and Share Forecast and Outlook 2025 to 2035

Ophthalmic Prefilled Injectables Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Surgical Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Injectable Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Sprays Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Diagnostic Equipment Market Analysis - Size, Share & Forecast 2025-2035

Ophthalmic Tonometers Market – Demand, Growth & Forecast 2025 to 2035

Ophthalmic Lasers Market Analysis - Innovations & Forecast 2024 to 2034

Global Ophthalmic Combination Product Market Analysis – Size, Share & Forecast 2024-2034

Ophthalmic Eye Drop Market – Trends & Forecast 2024-2034

Ophthalmic Knives Market

Ophthalmic Viscosurgical Devices Market

Herpes Zoster Ophthalmicus Market Size and Share Forecast Outlook 2025 to 2035

Excimer and Femtosecond Ophthalmic Lasers Market Size and Share Forecast Outlook 2025 to 2035

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA