The global ophthalmic tonometers market is expected to observe a steady growth between 2025 to 2035 with the increasing instances of glaucoma and rising awareness about the health of the eye. The growing adoption of non-contact tonometers and handheld digital tonometers is expected to improve accuracy and patient comfort, thereby driving the market growth.

Furthermore, the increasing geriatric population, rising healthcare expenditure and the escalating adoption of early disease detection procedures are some of the factors creating high demand. AI-driven diagnostics and portable tonometers are also increasingly being used in telemedicine applications, which is further expected to enhance the aspect of market growth.

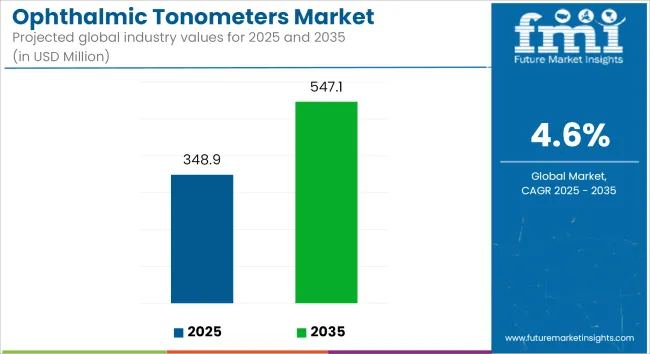

In 2025, the ophthalmic tonometers market was valued at approximately USD 348.93 million. By 2035, it is projected to reach USD 547.08 million, reflecting a compound annual growth rate (CAGR) of 4.6%.

This growth is driven by the increasing use of tonometry in routine eye examinations, particularly in hospitals, clinics, and ambulatory surgical centers.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 348.93 Million |

| Projected Market Size in 2035 | USD 547.08 Million |

| CAGR (2025 to 2035) | 4.6% |

The demand for advanced diagnostic tools with improved sensitivity and precision is also fueling market expansion. Additionally, manufacturers are investing in R&D to develop cost-effective, user-friendly, and automated tonometers, which will cater to the growing need for accurate intraocular pressure measurement. The expanding accessibility of ophthalmic care in developing regions is further accelerating market development.

The ophthalmic tonometers market in North America is presently dominant due to the aforementioned factors, including strong healthcare infrastructure, and high awareness regarding the diagnosis of glaucoma, along with significant investments in implementing various technologies (such as tonometers) in eye care.

The USA boasts the largest market share due to the high incidence of ocular disorders, along with positive reimbursement policies for eye disease management. Collaboration between research institutes and ophthalmic device manufacturers is also promoting innovation. In addition, the growing focus on early disease detection in the region and AI-based diagnostic solutions is also driving the growth of advanced tonometry devices in the market.

The Europe ophthalmic tonometers market benefits from a highly developed healthcare infrastructure, a rising need for non-invasive diagnostic instruments, and growing government initiatives aimed at vision-related health education. This trend also extends to ophthalmic technology, with countries like Germany, the UK, France, and Italy leading the way.

Rising prevalence of glaucoma and cataracts among the elderly population is a key factor driving market growth. In addition, handheld, portable tonometers are being developed so that patients can monitor their own eye pressures from home. Trends in sustainability are also driving manufacturers toward materials that are gentle on the environment and tonometry solutions that save energy.

In the Asia-Pacific region, rising healthcare expenditure, increasing number of eye disorders and growing medical tourism is making it a lucrative market for ophthalmic tonometers. Countries like China, Japan, South Korea, and India are experiencing prominent demand for ophthalmic diagnostics because of enhancing healthcare access and growing eye care infrastructure.

Increasing middle-class population and awareness of the importance of glaucoma screening is further driving the market growth. Furthermore, the growth of the region is being accelerated by the availability of low-cost, locally manufactured tonometers.

Increasing technological innovations, growing prevalence of glaucoma, and rising enterprising economies of the world driving the ophthalmic tonometers market to growth in a steady manner over the next decade. The evolving integration of AI, digital monitoring and telemedicine into eye diagnostics will be instrumental in designing the future market landscape for ocular health, and together they will guarantee better patient outcomes and increased effectiveness per ophthalmic care delivered.

Challenge

High Cost of Advanced Tonometers and Limited Accessibility

Available advanced tonometry devices are high in cost, and in developing regions, their low accessibility poses a challenge to the growth of the ophthalmic tonometers market. The high associated cost of advanced, especially non-contact and rebound tonometers, makes them prohibitive and limits their usability in small, suburban clinics and developing healthcare markets.

Adoption is further constrained by maintenance costs as well as the need for skilled professionals to operate these devices. Ljubljana) types of solutions are needed, such as cost-effective innovations, financing options, and expanded distribution.

Regulatory Compliance and Calibration Requirements

The industry is highly regulated, which mandates strict adherence to medical safety standards, calibration accuracy, and device reliability. Manufacturing and certification processes alongside a tonometer's need to comply with regulatory bodies such as the FDA, CE, and ISO complicate the process.

Moreover, the frequent calibration and quality assurance requirements may raise the operating costs for many healthcare facilities. For building Sensor solutions, it typically requires to: automate compliance, build self-calibrated or low-maintained devices, train people to monitor shipments and optimize detection etc.

Opportunity

Rising Prevalence of Glaucoma and Increasing Awareness

Increasing number of glaucoma and ocular hypertension cases around the world is propelling the growth of ophthalmic tonometers market. Advancements in diagnostic tools: Annual screening and monitoring of intraocular pressure (IOP) and other risk factors for glaucoma help detect the condition earlier on and prevent vision loss, driving healthcare providers to invest in advanced diagnostics.

This, in turn, is also paving way for the expansion of the market, supported by awareness campaigns by healthcare organizations and government initiatives promoting regular eye check lips. This growing demand has prompted manufacturers to develop tonometers that are easy-to-use, portable, and reasonably priced, which can potentially encourage better management of eye health.

Advancements in Non-Invasive and AI-Integrated Tonometers

These innovations are particularly relevant in the ears of investors considering integration due to the high market share potential associated with technological advancements in the ophthalmic tonometers sector, especially the adoption of devices like non-invasive tonometers utilizing leading-edge artificial intelligence-based solutions. Contact-free tonometers cause less discomfort to patients and are not prone to infections, which is why they are preferred in clinics and hospitals.

AI in tonometry devices improves accuracy of diagnoses, automates the data processing, and enhances patient monitoring. These new tonometers powered with AI, smart connectivity, and cloud-based patient data management allow organizations that invest in these technologies to take the lead in the future-forward because the healthcare market is being driven by the patient experience.

Between 2020 and 2024, the ophthalmic tonometers market will steadily grow due to growing awareness surrounding glaucoma, a strong healthcare infrastructure, and a rise in the adoption of digital diagnostic tools.

Portable and handheld tonometers became popular owing to their ease of use and cost-effective nature, while smart connectivity features integrated into the high-end models became common. Nonetheless, regulatory barriers and significant expense associated with precision calibration and requisite compliance have restricted market growth.

Looking forward to the years 2025 through 2035, market growth is anticipated to be driven by continued technological advancements in AI-powered tonometry, remote diagnostics, and desktop-use tonometers. Telemedicine solutions, automated IOP monitoring, and wearable tonometry sensors will revolutionize glaucoma management and preventive eye care.

Cost-effective production, AI-powered analytics, and patient-centric innovations are the factors likely to shape future growth in the ophthalmic tonometers market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict compliance with FDA, CE, and ISO guidelines |

| Technological Advancements | Growth in digital tonometry and smart connectivity features |

| Industry Adoption | Increased use of portable and handheld tonometers |

| Supply Chain and Sourcing | Dependence on specialized components and high manufacturing costs |

| Market Competition | Dominance of established ophthalmic device manufacturers |

| Market Growth Drivers | Rising glaucoma prevalence and awareness programs |

| Sustainability and Energy Efficiency | Focus on durable and reusable tonometry devices |

| Integration of Smart Monitoring | Limited adoption of AI-driven data analysis |

| Advancements in Product Innovation | Introduction of ergonomic, contact-free tonometers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance monitoring and automation of regulatory processes |

| Technological Advancements | AI-powered diagnostics, remote monitoring, and wearable tonometry devices |

| Industry Adoption | Expansion of home-use tonometry and telemedicine applications |

| Supply Chain and Sourcing | Cost-efficient production, local sourcing, and modular device manufacturing |

| Market Competition | Rise of AI-based startups and smart tonometry solutions |

| Market Growth Drivers | Personalized eye care solutions, automated IOP tracking, and AI-based diagnostics |

| Sustainability and Energy Efficiency | Development of energy-efficient, solar-powered, and eco-friendly diagnostic tools |

| Integration of Smart Monitoring | Widespread use of cloud-based patient data management and predictive analytics |

| Advancements in Product Innovation | Development of next-generation, AI-integrated, self-monitoring tonometry solutions |

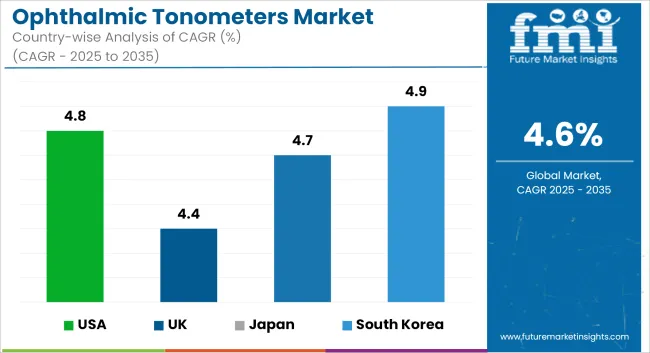

The ophthalmic tonometers market is dominated by the United States, which is attributed to the growing incidence of glaucoma and an advanced healthcare infrastructure. The increasing elderly population, which is more susceptible to eye diseases, also drives demand.

Also, technology like non-contact and rebound tonometers are incrementing diagnostic efficiency. The market is growing steadily due to the presence of key manufacturers and increasing awareness of early detection of glaucoma. Additionally, there is an influx of government initiatives and reimbursement policies that promote adoption rates throughout ophthalmology clinics and hospitals.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

Various factors, such as an increase in ocular hypertension cases and a growing geriatric population prone to glaucoma, are driving the United Kingdom ophthalmic tonometers market. Adoption of digital tonometers in hospitals and clinics is increasing to improve diagnostic accuracy.

Market growth is being driven by government healthcare initiatives for early detection of eye diseases. Expansion of private ophthalmic practices and investments in ophthalmic research are propelling sustained growth. The growing need of portable and easy-to-use tonometer for home monitoring is also driving the market dynamics.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

Key drivers of this market include the rising prevalence of glaucoma, as well as the continuing growth of various screening initiatives. This is led by countries with a strong medical device industry in Germany, France, and Italy, with a growing healthcare expenditure.

Emerging tech like AI-enabled tonometers and telemonitoring of eye pressure is coming into the mix. Ongoing increase of public health initiatives focusing on early detection along with treatment is also driving the development of the market. Because of online sales channels, advanced tonometry devices are now readily available.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

The market is driven by the rising incidence of age-related eye diseases and favorable government healthcare policies in Japan. Into the eye: The country is quick to adopt new technologies in ophthalmology devices such as AI-assisted tonometers.

The rising elder population is one of the major driving factors propelling the demand for tonometers, as routine eye screenings are becoming routine procedure. This increases diagnostic efficiency and is expected to propel the growth of the smart tonometry solutions market in hospitals and eye clinics. Additionally, the growth in the market is being boosted by the presence of domestic medical device manufacturers that are more inclined towards innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The South Korea ophthalmic tonometers market is experiencing growth with rising healthcare expenditure and advancements in diagnostic technologies. The growing use of smart and digital tonometry devices is helping to increase efficiency in eye care centers.

Increase in the number of ophthalmology clinics and medical tourism for eye treatment and surgical procedures are the major factors driving the market growth. Moreover, government initiatives supporting screenings of glaucoma and ocular diseases are accelerating the demand for advanced tonometry equipment. Moreover, the market growth is also boosted by the presence of key medical device companies prefer to emphasize innovative solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The global ophthalmic tonometers market is segmented based on product type, indication, method, end-user, and geography. Human application tonometers, human indentation tonometers, human rebound tonometers, veterinary application tonometers and veterinary rebound tonometers are product type segment for the market.

Application tonometers are among the commonly used tonometers in ophthalmic clinics and hospitals due to their capacity to accurately measure intraocular pressure (IOP), a process that is necessary for an accurate and early diagnosis of glaucoma. That is why indentation tonometers represent a more affordable option, particularly in developing healthcare markets.

The tonometers that are being increasingly preferred are rebound tonometers, which are easy to use, portable, and cause minimal discomfort to patients, therefore, appropriate for usage in both humans as well as veterinary applications. Rising awareness about early detection of glaucoma and the increasing geriatric population are some of the key factors driving the market growth. Moreover, contactless and user-friendly devices are in great demand, with patients and healthcare providers looking for more convenient and hygienic options.

Ophthalmic tonometers market segmentation, by portability handheld tonometers Desktop tonometers Iop (intra ocular pressure) is an indicator of office tonometry, but currently, an ophthalmic market survey has a booming need for portable and handheld tonometers, which are easier to use and operate at far-reaching locations. These portable devices can be useful, especially in the case of home-based eye care, mobile eye clinics, and veterinary use, where portability is a must.

Tonometers for desktop use, however, still are the gold standard for hospital-based ophthalmic diagnostic centers because they have very high precision, advanced digital interfaces, and can be integrated with electronic medical record (EMR) systems. This is fuelling the increasing adoption of tonometry devices in both human and veterinary ophthalmology, where technological advancements like non-contact tonometers and AI-assisted screening tools have fueled the rise in barometry devices.

Moreover, the incorporation of wireless connectivity and cloud-enabled data storage is enabling ophthalmologists and veterinary practitioners to remotely track and scrutinize intraocular pressure trends over time for better patient management.

On the basis of end use, the ophthalmic tonometers market is segmented into hospitals, ophthalmic diagnostic centers, veterinary hospitals and veterinary diagnostic centers. The hospital segment dominates the market with a major share owing to high patient volume, government funding for eye care programs, and rising adoption of advanced diagnostic devices.

Ophthalmic diagnostic centers are also growing significantly due to the increasing need for specialized eye treatment services coupled with next-gen tonometry solutions. The demand for specialized tonometers for diagnosing glaucoma and other ocular conditions among pets and livestock is growing in the veterinary sector, as veterinary hospitals and veterinary diagnostic centers continue making investments, which is likely to drive market growth.

The subsequent rise in the number of eye care awareness campaigns, the expanding veterinary healthcare industry, and the growth in AI-based diagnostic solutions are anticipated to further propel market demand. Moreover, the growing urbanization and rising geriatric population, coupled with an increasing emphasis on preventative eye care, will encourage more hospitals and clinics to offer tonometry services, thus supporting market progression.

The ophthalmic tonometers market is projected to grow in the coming years owing to increasing incidence of glaucoma, the growing awareness regarding eye health, and also due to technological advancements leading to better diagnostic technologies. Additionally, the increasing geriatric population, which is prone to ocular disorders, is acting as a major catalyst to the demand for tonometers around the globe.

Newer technologies like non-contact tonometry, digital tonometers, and AI-based diagnostic tools are enhancing the precision and convenience of measuring intraocular pressure (IOP). The market is also influenced by government programs conducted at various forums to raise awareness about glaucoma and the growing availability of portable and easy-to-use devices to detect and monitor glaucoma in clinical settings and at home.

Such innovations make tonometry easier, with a greater commitment to ergonomic designs, automated calibration systems, integration in cloud systems for remote monitoring etc. Moreover, the partnerships between health services and diagnostic equipment manufacturing companies for product advancement and market penetration is expected to lead the market for superior patient outcomes and optimized eye care services.

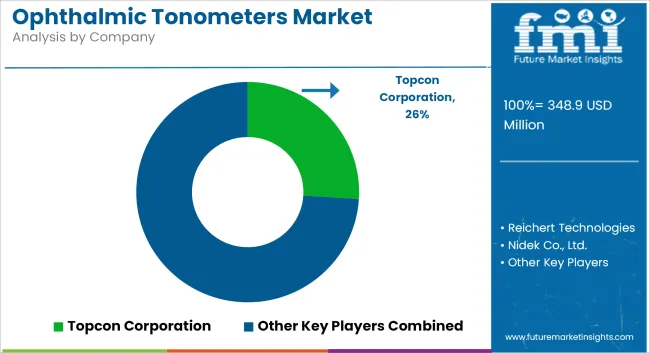

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Topcon Corporation | 22-26% |

| Reichert Technologies | 18-22% |

| Nidek Co., Ltd. | 14-18% |

| Carl Zeiss Meditec AG | 10-14% |

| Icare Finland Oy | 8-12% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Topcon Corporation | Develops advanced digital tonometers with high-precision IOP measurement, user-friendly interfaces, and integration with ophthalmic imaging systems for comprehensive glaucoma diagnosis. |

| Reichert Technologies | Specializes in non-contact tonometers featuring patented air-puff technology and automated data collection, reducing patient discomfort and improving workflow efficiency. |

| Nidek Co., Ltd. | Offers a range of handheld and tabletop tonometers, emphasizing ease of use, portability, and accurate IOP readings for clinical and at-home applications. |

| Carl Zeiss Meditec AG | Provides state-of-the-art tonometry solutions with AI-driven analytics, allowing for real-time patient monitoring and early glaucoma detection. |

| Icare Finland Oy | Focuses on rebound tonometry technology, delivering quick and painless IOP measurements without the need for anesthesia or air-puff techniques. |

Key Company Insights

Topcon Corporation (22-26%)

Topcon Corporation is the leader of ophthalmic tonometers market due to its high-precision diagnostic devices that integrate advanced optical and digital technologies. They have made advances in the field of an air puff tonometer and eye contact tonometer to take intraocular pressure readings quickly and accurately helping with better management of glaucoma.

By focusing on automation, connectivity, and integration with electronic health records (EHR) systems, Topcon enables efficiency in ophthalmology clinics and hospitals. It is also extending the company portfolio with AI-based diagnostic solutions, enhancing its competitive advantages in the global ophthalmic equipment industry.

Reichert Technologies (18-22%)

Reichert Technologies has a prominent position in the tonometry market, offering non-contact tonometers that do not require anesthesia, while also enabling rapid and accurate IOP readings. Roger kerr biotechnology company name is known for its proprietary air-puff technology that provides minimal patient discomfort and high accuracy making it a top choice for optometrists and ophthalmologists.

Reichert is also working on so-called cloud services connectivity capabilities for real-time data sharing and integration with remote patient monitoring services. Reichert's designs are ergonomically focused, allowing for high-speed measurement and enabling the company to expand its reach into eye care markets around the world.

Nidek Co., Ltd. (14-18%)

Nidek Co., Ltd. is an ophthalmic diagnostic equipment company and a leading global player that provides a wide variety of tonometry that are supplied for all areas such as clinics, hospitals, or even home care. Balanced assessment of the patient is ensured by a wide range of both contact and non-contact tonometers offered by the company.

Handheld tonometers by Nidek are gaining momentum by providing mobility and ease of use, particularly for mobile healthcare settings. Adding its recent sensors and digital display architecture, Nidek has enhanced both measurement accuracy and usability of these, helping it achieve strong competition.

Carl Zeiss Meditec AG (10-14%)

Carl Zeiss Meditec AG is well-known for its advanced ophthalmic imaging and diagnostic platforms, which also encompass tonometry solutions with AI and telemedicine functions. The company offers tonometers that not only offer highly accurate IOP readings, but also allow seamless integration with other ocular examination tools.

To improve diagnostic accuracy and patient care, Zeiss is concentrating its R & D efforts on automation and digital data management. Its strong brand image and technological proficiency establish it as one of the leading names in ophthalmic tonometry market.

Icare Finland Oy (8-12%)

Icare Finland Oy is a leader in paediatrics rebound tonometry, and is the manufacturer of tonometer devices designed to make IOP measurements rapid, painless and reliable without the use of anesthesia. Finally, its easy-to-use design and ability to measure intraocular pressure in multiple orientations have made it popular among clinicians and families alike.

In an ideal world, Icare Finland would also be present even more in the emerging markets, for the provision of eye care solutions in those area is of utmost urgency for the health care systems! This makes it ideal, as the company's focus on precision, portability, and patient comfort only works in its favor, ensuring that it is not going anywhere anytime soon.

Other Key Players (25-35% Combined)

Several other manufacturers contribute to the ophthalmic tonometers market, offering diverse solutions tailored to various clinical and patient needs. These key players include:

The overall market size for ophthalmic tonometers market was USD 348.93 million in 2025.

The ophthalmic tonometers market expected to reach USD 547.08 million in 2035.

Rising glaucoma prevalence, increasing aging population, growing eye care awareness, technological advancements in tonometry, and expanding ophthalmic diagnostic facilities will drive market demand.

The top 5 countries which drives the development of ophthalmic tonometers market are USA, UK, Europe Union, Japan and South Korea.

Portability and technological advancements driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End Use , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End Use , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End Use , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End Use , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End Use , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End Use , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End Use , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Portability, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End Use , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Portability, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Use , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use , 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Portability, 2023 to 2033

Figure 19: Global Market Attractiveness by End Use , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Portability, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End Use , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End Use , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End Use , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End Use , 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by Portability, 2023 to 2033

Figure 39: North America Market Attractiveness by End Use , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Portability, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End Use , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End Use , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End Use , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End Use , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Portability, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End Use , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Portability, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End Use , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End Use , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End Use , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End Use , 2023 to 2033

Figure 77: Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Europe Market Attractiveness by Portability, 2023 to 2033

Figure 79: Europe Market Attractiveness by End Use , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Portability, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End Use , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End Use , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End Use , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End Use , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Portability, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End Use , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Portability, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End Use , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End Use , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End Use , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End Use , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Portability, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End Use , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Portability, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End Use , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End Use , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End Use , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End Use , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Portability, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End Use , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Portability, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End Use , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Portability, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Portability, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Portability, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End Use , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End Use , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End Use , 2023 to 2033

Figure 157: MEA Market Attractiveness by Product, 2023 to 2033

Figure 158: MEA Market Attractiveness by Portability, 2023 to 2033

Figure 159: MEA Market Attractiveness by End Use , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ophthalmic Surgical Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Drug Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Injectable Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Sprays Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Diagnostic Equipment Market Analysis - Size, Share & Forecast 2025-2035

Ophthalmic Lasers Market Analysis - Innovations & Forecast 2024 to 2034

Global Ophthalmic Combination Product Market Analysis – Size, Share & Forecast 2024-2034

Ophthalmic Eye Drop Market – Trends & Forecast 2024-2034

Ophthalmic Knives Market

Ophthalmic Viscosurgical Devices Market

Herpes Zoster Ophthalmicus Market Size and Share Forecast Outlook 2025 to 2035

Excimer and Femtosecond Ophthalmic Lasers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA