The ophthalmic surgical market is experiencing strong growth, driven by the increasing prevalence of eye disorders, rising geriatric population, and technological advancements in microsurgical procedures. Enhanced accessibility to ophthalmic care, along with improved healthcare infrastructure in emerging regions, has expanded procedural volumes.

Innovations in surgical devices, including femtosecond lasers, phacoemulsification systems, and disposable instruments, have improved safety and precision. The growing incidence of cataract, glaucoma, and refractive errors has heightened demand for efficient surgical interventions.

Furthermore, the market benefits from favorable reimbursement frameworks and the rising adoption of minimally invasive techniques that reduce recovery time. With continuous innovation and expanding ophthalmic service networks, the market is projected to remain on an upward trajectory, supported by robust investment in research and clinical development.

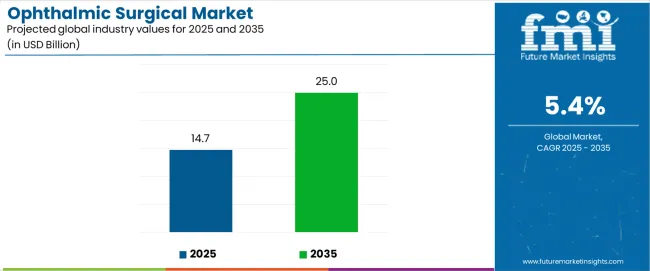

| Metric | Value |

|---|---|

| Ophthalmic Surgical Market Estimated Value in (2025 E) | USD 14.7 billion |

| Ophthalmic Surgical Market Forecast Value in (2035 F) | USD 25.0 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

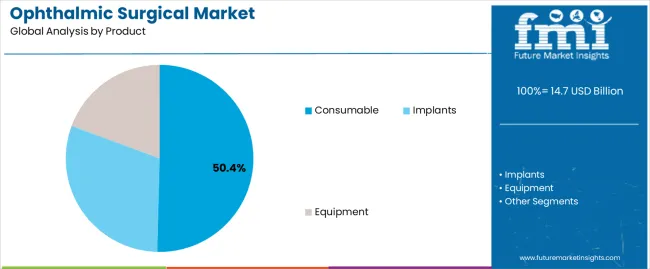

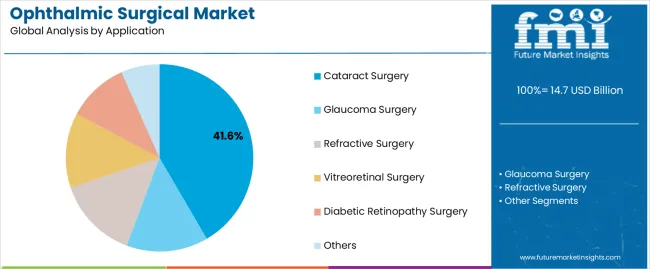

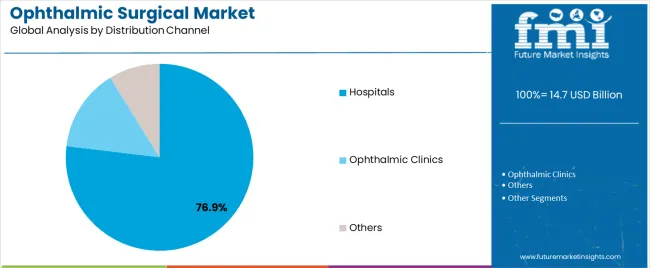

The market is segmented by Product, Application, and Distribution Channel and region. By Product, the market is divided into Consumable, Implants, and Equipment. In terms of Application, the market is classified into Cataract Surgery, Glaucoma Surgery, Refractive Surgery, Vitreoretinal Surgery, Diabetic Retinopathy Surgery, and Others. Based on Distribution Channel, the market is segmented into Hospitals, Ophthalmic Clinics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The consumable segment leads the product category with approximately 50.4% share, driven by the consistent demand for single-use items such as surgical instruments, drapes, and viscoelastic solutions. The segment benefits from high procedural turnover in ophthalmic surgeries, which require sterile, disposable components to prevent cross-contamination.

Technological advancements have introduced high-performance materials that enhance precision and ease of handling. Hospitals and clinics prefer consumables for their cost-efficiency and compliance with stringent infection control protocols.

As surgical volumes continue to rise globally, the recurring nature of consumable demand is expected to sustain this segment’s dominance in the ophthalmic surgical market.

The cataract surgery segment holds approximately 41.6% share in the application category, attributed to the high global prevalence of cataract cases and advancements in intraocular lens technologies. Increasing awareness, aging demographics, and the availability of rapid, outpatient-based procedures have contributed to growing procedural rates.

Modern techniques, such as laser-assisted cataract surgery and micro-incision methods, have improved precision and reduced recovery time. The segment’s leadership is reinforced by government initiatives promoting accessible eye care and public health campaigns addressing preventable blindness.

With ongoing technological progress and greater patient affordability, cataract surgery is expected to remain the dominant application area within ophthalmic procedures.

The hospitals segment dominates the distribution channel category with approximately 76.9% share, reflecting their comprehensive infrastructure, skilled surgical workforce, and advanced diagnostic capabilities. Hospitals serve as primary centers for complex ophthalmic surgeries, particularly those requiring specialized equipment and postoperative care.

Their ability to manage high patient volumes and maintain sterile environments enhances procedural efficiency and outcomes. The segment benefits from government and private investments in modern ophthalmology departments, integrating advanced imaging and surgical platforms.

As hospitals continue to expand ophthalmic service offerings and strengthen referral networks, this segment is expected to uphold its market leadership in the foreseeable future.

The global ophthalmic surgical market recorded a historic CAGR of 5.3% from 2020 to 2025.

The table below shows the estimated growth rates of the top five countries. The United States, Japan, and Germany are set to record high CAGRs of 8.3%, 8.1%, and 7.7%, respectively, through 2035.

| Country | Value CAGR |

|---|---|

| United States | 8.3% |

| Japan | 8.1% |

| China | 7.1% |

| Germany | 7.7% |

| United Kingdom | 7.3% |

The United States is expected to exhibit a CAGR of 8.3% throughout the forecast period. Top factors supporting the market expansion in the country include:

Japan is expected to expand with a CAGR of 8.1% through 2035. This is attributable to a combination of factors, including:

China is expected to grow at a CAGR of 7.1% during the forecast period. The key factors supporting the ophthalmic surgical market growth are:

Sales of ophthalmic surgery in Germany are estimated to record a CAGR of 7.7% through 2035. The primary factors bolstering the ophthalmic surgical market size are:

The United Kingdom is predicted to register a compound annual growth rate of 7.3% during the forecast period.

The section below shows the consumable segment dominating by product type. It is predicted to surge at a CAGR of 5.3% by 2035. Based on the distribution channel, the ophthalmic clinics segment is anticipated to generate a dominant share through 2025. It is set to rise at a 5.3% CAGR by 2035.

| Segment | Value CAGR |

|---|---|

| Consumable (Product Type) | 5.3% |

| Ophthalmic Clinics (Distribution Channel) | 5.3% |

The market value of consumables in ophthalmic surgery is USD 6,225.6 million, representing a 50.0% market share in 2025.

Ophthalmic clinics accounted for 54.2% of the share in terms of distribution channels in 2025 and are expected to surge at a CAGR of 5.3% over the forecast period.

Collaborations and acquisitions are common strategies companies employ in the ophthalmic surgical market to enhance their capabilities, expand their offerings, and stay competitive in the market's dynamic landscape.

Leading players in the ophthalmic surgical market collaborate and form partnerships more often to take advantage of complementary skills, encourage innovation, and expand their product lines.

For instance:

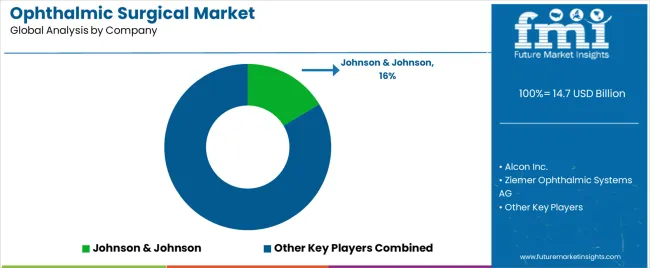

The global ophthalmic surgical market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the ophthalmic surgical market is projected to reach USD 25.0 billion by 2035.

The ophthalmic surgical market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in ophthalmic surgical market are consumable, implants and equipment.

In terms of application, cataract surgery segment to command 41.6% share in the ophthalmic surgical market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ophthalmic Viscosurgical Devices Market

Ophthalmic Stereoscopic 3D Display Market Size and Share Forecast and Outlook 2025 to 2035

Ophthalmic Prefilled Injectables Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Drug Packaging Market Forecast and Outlook 2025 to 2035

Ophthalmic Injectable Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Sprays Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Diagnostic Equipment Market Analysis - Size, Share & Forecast 2025-2035

Ophthalmic Tonometers Market – Demand, Growth & Forecast 2025 to 2035

Ophthalmic Lasers Market Analysis - Innovations & Forecast 2024 to 2034

Global Ophthalmic Combination Product Market Analysis – Size, Share & Forecast 2024-2034

Ophthalmic Eye Drop Market – Trends & Forecast 2024-2034

Ophthalmic Knives Market

Herpes Zoster Ophthalmicus Market Size and Share Forecast Outlook 2025 to 2035

Excimer and Femtosecond Ophthalmic Lasers Market Size and Share Forecast Outlook 2025 to 2035

Surgical Tourniquet Market Size and Share Forecast Outlook 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Surgical Aspirators Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA