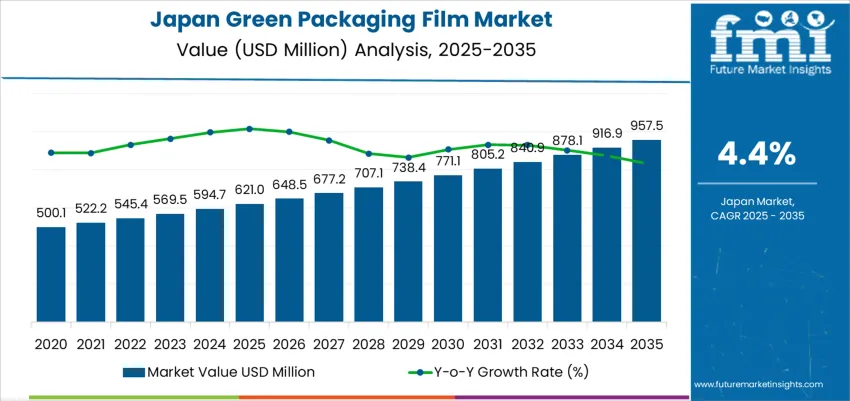

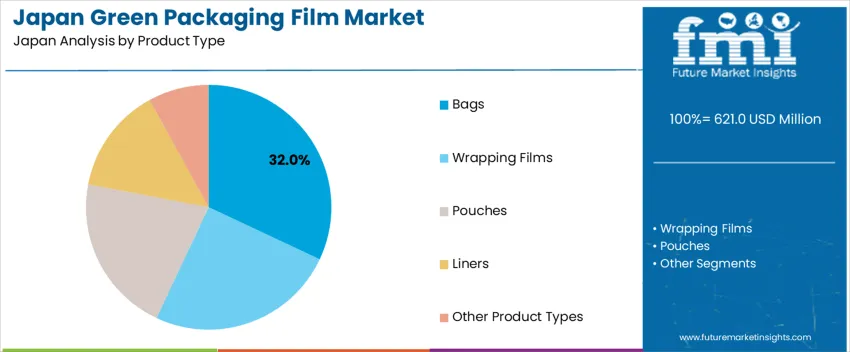

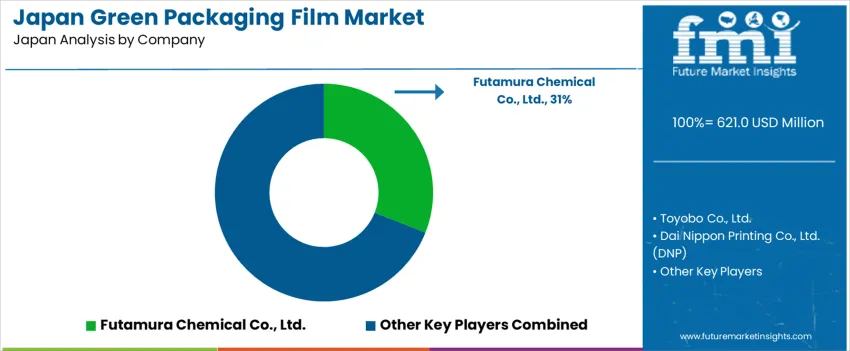

The Japan green packaging film demand is valued at USD 621.0 million in 2025 and is projected to reach USD 957.5 million by 2035, reflecting a CAGR of 4.4%. Demand is influenced by transitions toward recyclable and compostable film formats, with greater emphasis on reducing fossil-based plastics and improving waste-management outcomes. The shift follows retailer sustainability pledges, circular-economy policies, and expanded packaging requirements for food, personal-care items, and household products. Bags represent the leading product category due to their high usage in retail, consumer goods, and fresh-food distribution. Adoption is supported by bio-based polymer development, improved seal strength, and clarity standards required for branded packaging. Barrier enhancements for moisture and oxygen control continue to improve viability for perishable food applications.

Kyushu & Okinawa and Kanto show the highest deployment levels. These regions host major converting operations, advanced recycling networks, and large consumer product manufacturing zones that support ongoing substitution of conventional plastics. Key suppliers include Futamura Chemical Co., Ltd., Toyobo Co., Ltd., Dai Nippon Printing Co., Ltd. (DNP), Unitika Ltd., and Taghleef Industries. These companies produce biodegradable film, recyclable mono-material structures, and bio-based alternatives designed for commercial packaging and regulated environmental-compliance programmes.

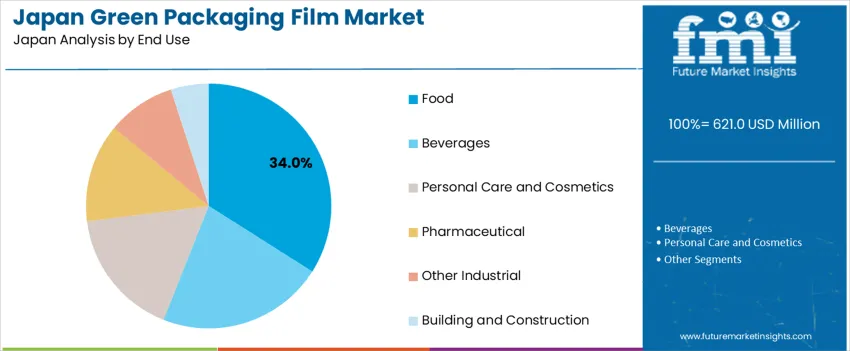

Demand for green packaging film in Japan reflects a broad set of contributing forces across food manufacturing, consumer retail, and regulated industrial distribution. The strongest contribution comes from packaged food and beverage applications because sustainability mandates align with long-term packaging reduction goals and circular-economy policies. Retailers encourage procurement of recyclable and compostable materials, increasing the weight of these sectors in total growth. Household-care and personal-care products contribute moderately as brands shift toward low-carbon packaging to strengthen eco-compliance and maintain consumer trust.

Industrial applications add incremental contribution but remain secondary due to cautious adoption and higher material-cost sensitivity. Japanese municipalities enforce waste-management standards supporting greener polymer usage, influencing steady growth from regulatory compliance. Imports of environmentally improved films supplement domestic output, supporting value growth despite stable consumption volumes. Growth contributors remain diversified, preventing reliance on any single segment. The overall index indicates sustained expansion driven by food-industry leadership, regulatory alignment, and advanced material development by domestic producers.

| Metric | Value |

|---|---|

| Japan Green Packaging Film Sales Value (2025) | USD 621.0 million |

| Japan Green Packaging Film Forecast Value (2035) | USD 957.5 million |

| Japan Green Packaging Film Forecast CAGR (2025-2035) | 4.4% |

Demand for green packaging film in Japan is increasing because consumer goods companies, food manufacturers and retailers are transitioning toward materials that reduce environmental impact while supporting product protection and shelf life. Japanese consumers show strong preference for packaging aligned with recycling and waste-reduction goals, which encourages adoption of films that use recycled content, bio-based feedstocks or downgauged structures to reduce total plastic volume. Convenience stores, supermarkets and online grocery platforms also drive this shift as they expand private-label products that highlight sustainability features. Green films that are compatible with existing PET or polyethylene recycling streams are favored because they allow companies to improve environmental performance without major equipment changes.

Government policies promoting circular economy principles support investments in packaging that can be collected, sorted and reprocessed within Japan’s infrastructure. Food manufacturers choose sustainable barrier films for fresh and frozen items to maintain quality while addressing environmental concerns. Constraints include higher material cost for advanced sustainable films, technical challenges in moisture-sensitive applications and limited commercial availability of certified bio-based resins. Smaller brands may postpone transitions until pricing stabilizes and recycling systems expand further.

Demand for green packaging film in Japan reflects sustainability policies, consumer waste-reduction expectations, and brand adoption of bio-based packaging formats. Domestic packaging users prioritize compostability, lightweight structure, and reduced fossil-based resin content. Procurement decisions consider compatibility with food-contact standards, print clarity, and mechanical strength across cold-chain and ambient distribution. Japanese manufacturers emphasize recycling alignment and material innovation that supports low-carbon product portfolios.

Bags represent 32.0%, driven by widespread usage in retail packaging, household storage, and flexible food containers. Japanese users prioritize lightweight performance and reliable sealing for portioned items. Wrapping films account for 25.0%, supporting pallet protection and direct-food wrapping in supermarkets. Pouches hold 21.0%, valued for extended shelf life and print customization, while liners represent 14.0%, serving industrial containment applications. Other product types total 8.0%, used in niche packaging needs. Product choice reflects mechanical strength expectations, labeling compatibility, and ecofriendly commitments across Japan’s packaged goods supply chains.

Key points:

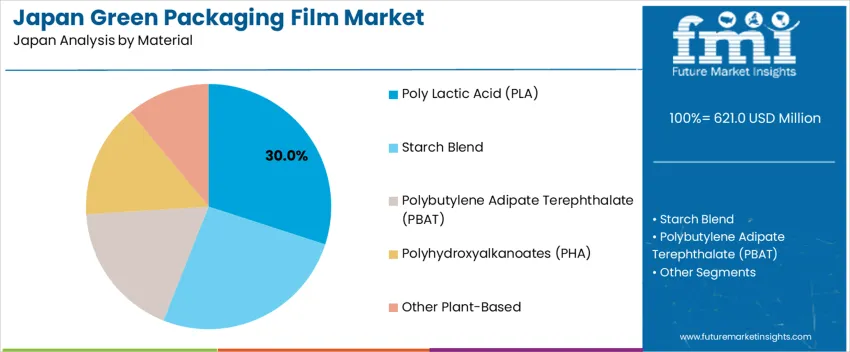

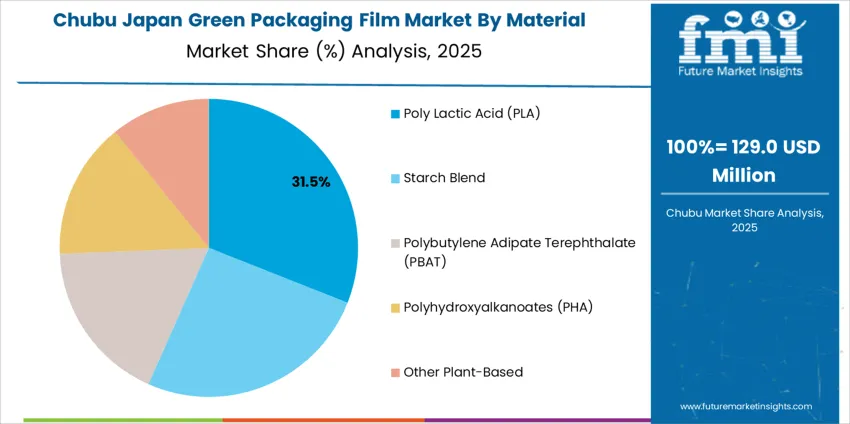

PLA represents 30.0%, driven by transparency, rigidity, and food-contact compliance. Starch-blend materials hold 26.0%, valued for rapid biodegradation in controlled waste systems. PBAT accounts for 18.0%, selected for flexibility in high-strain packaging. PHA represents 15.0%, applied where full marine and soil biodegradation is required. Other plant-based materials total 11.0%, serving specific barrier or process-compatibility needs. Material preference in Japan reflects production scalability, product clarity, and alignment with national recycling guidance for bio-based solutions used in mainstream consumer packaging.

Key points:

Food applications represent 34.0%, based on continuous packaged-food consumption and strict hygiene standards in Japanese retail. Beverages hold 22.0%, especially for secondary packaging or protective wrapping. Personal care and cosmetics represent 17.0%, where brand sustainability claims influence packaging decisions. Pharmaceuticals account for 13.0%, applying bio-based films for product integrity and regulatory compliance. Other industrial uses total 9.0%, followed by building and construction at 5.0% where durability is essential. End-use patterns in Japan reflect established packaging infrastructure and consumer preference for low-impact, high-quality material performance.

Key points:

Expansion of circular-economy policies, retailer expectations for reduced plastic waste and rising demand for recyclable packaging in grocery distribution are driving demand.

In Japan, green packaging film gains momentum as national programs such as resource recycling targets encourage manufacturers to shift toward materials with lower environmental impact. Major supermarket chains and convenience stores require suppliers to reduce single-use plastics in ready-to-eat meals, produce and household goods, creating demand for recyclable and bio-based films. Packaging converters located in Kanto, Kansai and Tokai regions increase production of lightweight films to meet transportation efficiency goals linked to long-distance distribution systems. Consumers in urban prefectures show growing interest in products that minimize plastic volume and offer clear end-of-life pathways through existing waste-collection networks, reinforcing sustained domestic usage of green film formats.

Cost sensitivity among food manufacturers, performance limitations in moisture-prone applications and uneven recycling infrastructure restrain adoption.

Bio-based and recyclable films often carry higher pricing than traditional polyolefins, limiting uptake among smaller food producers with narrow margins. Some green films provide weaker heat-seal or moisture-barrier properties, making adoption more difficult in categories such as chilled foods and sauces that dominate Japanese convenience-store sales. Film-recycling access varies by municipality, and differences in processing methods reduce clarity for both manufacturers and consumers about disposal requirements. These structural constraints contribute to cautious and gradual expansion across packaging categories.

Shift toward monomaterial polyethylene structures, increased integration of recycled content and rising adoption in export-oriented food lines define key trends.

Japanese film producers are prioritizing monomaterial designs that align with mechanical recycling capabilities used by regional waste-processing operators. Food manufacturers are testing post-consumer recycled content in film structures for non-contact layers, supporting circularity without compromising safety compliance. Export-oriented brands in confectionery, snacks and instant foods use green films to meet overseas sustainability expectations, strengthening competitiveness in foreign retail channels. Fulfillment centers supplying online grocery and meal-kit services introduce lighter and easier-to-separate films to reduce household disposal complexity. These trends indicate a steady transition toward environmentally aligned packaging films within Japan.

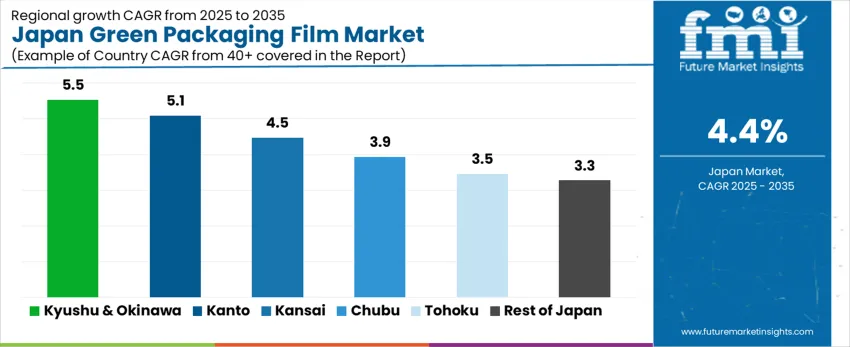

Demand for green packaging films in Japan reflects ecofriendly commitments, circular material adoption, and retail preferences for reduced-waste packaging. Food processors, consumer-goods manufacturers, and logistics providers influence procurement patterns across Japan. Kyushu & Okinawa leads at 5.5%, followed by Kanto (5.1%), Kinki (4.5%), Chubu (3.9%), Tohoku (3.5%), and Rest of Japan (3.3%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.5% |

| Kanto | 5.1% |

| Kinki | 4.5% |

| Chubu | 3.9% |

| Tohoku | 3.5% |

| Rest of Japan | 3.3% |

Kyushu & Okinawa records 5.5% CAGR, influenced by agricultural product packaging, seafood handling, and retail distribution upgrades prioritizing sustainability outcomes. Fresh produce and processed food suppliers introduce recyclable and bio-based films to maintain shelf life across humid storage environments. Tourism-linked consumption encourages compact film-wrapped goods that meet convenience needs while lowering environmental impact. Regional logistics centers favor lightweight films that reduce waste volumes in municipal recovery systems with capacity limitations. Retailers evaluate film clarity and sealing strength to maintain product hygiene during handling in busy store formats. Procurement teams align film adoption with cost efficiency and compliance with evolving packaging ecofriendly goals set by regional retail groups.

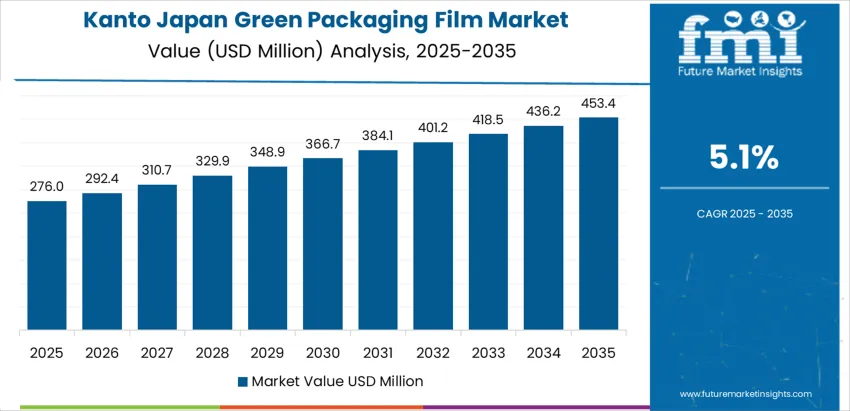

Kanto expands at 5.1% CAGR, led by Tokyo and Yokohama food manufacturers adopting recyclable mono-material films for high-turnover packaged goods. Large urban populations create continuous requirements for snack and ready-meal packaging aligned with retail ecofriendly commitments. Distribution networks favor lightweight and mechanically recyclable films that integrate into established sorting processes. Pharmaceutical and personal-care suppliers adopt films that maintain product security while lowering material intensity in secondary packaging. Local governance programs encouraging plastic reduction influence design practices and label spacing requirements. Procurement focuses on film performance during rapid filling cycles in automated production lines.

Kinki posts 4.5% CAGR, guided by Osaka and Kyoto consumer-goods distribution and retail merchandising formats prioritizing recyclable packaging displays. Packaged food suppliers shift from mixed-material laminates to simplified structures supporting mechanical recovery without performance loss. Retailers apply sustainability scoring systems to evaluate packaging suitability across high-traffic stores. E-commerce activity increases demand for protective films with reduced resin use. Standardization programs encourage substitution of high-barrier films only where shelf-life compliance requires it.

Chubu grows at 3.9% CAGR, shaped by manufacturing clusters in Aichi and Shizuoka supplying packaged foods for national distribution. Sustainability preferences influence film selection where packaging must maintain sealing reliability through multi-stop transport. Industrial buyers assess film compatibility with existing machinery to avoid retrofit delays. Automotive supply chains introduce recyclable films for component protection to streamline waste handling in assembly plants. Procurement teams monitor mechanical strength and film stiffness to safeguard product integrity during warehouse storage.

Tohoku advances at 3.5% CAGR, supported by agricultural and processed-food packers operating seasonal volumes requiring moisture-resistant films with reduced resin content. Distributed populations create wider shipping routes where film toughness influences product handling. Public programs encourage reduced-waste packaging in coastal areas with strict disposal rules. Retailers adopt transparent films designed for efficient shelf inspection and extended product visibility.

Rest of Japan records 3.3% CAGR, reflecting small-scale manufacturing and regional retail channels transitioning gradually toward recyclable film formats. Food specialty producers evaluate bio-based materials where supply volumes are secure. Film usage focuses on minimal waste, portability, and consistent handling in local distribution networks. Municipal recycling differences influence adoption speed, requiring alignment with local collection rules to ensure recovery rates.

Demand for green packaging film in Japan is shaped by suppliers developing bio-based, compostable, and recyclable films for food packaging and controlled retail applications. Futamura Chemical Co., Ltd. holds about 31.0% share, supported by cellulose-film technology used in Japanese food packaging where consistent barrier stability and print quality are required. Its films align with certified compostable standards and predictable machinability in domestic converting lines. Toyobo Co., Ltd. maintains strong participation through polyester and bio-oriented films used in flexible packaging where transparency, sealing reliability, and downgauged material usage are priorities. DNP supports major Japanese food brands with recyclable barrier-film systems that deliver controlled oxygen and moisture performance during distribution.

Unitika Ltd. contributes stable presence in PLA-based and specialty films applied in fresh-food packaging, balancing durability and reduced resource consumption. Taghleef Industries, through its Japan activity, provides specialty solutions for labels and flexible packaging that require mechanical stability and responsible resin selection. Competition in Japan focuses on barrier reliability, composability certification, recyclability compatibility, forming efficiency, and secure domestic supply chains. Demand continues in applications where green packaging materials support food-quality protection and compliance with Japan’s evolving environmental-packaging objectives.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Bags, Wrapping Films, Pouches, Liners, Other Product Types |

| Material | Poly Lactic Acid (PLA), Starch Blend, Polybutylene Adipate Terephthalate (PBAT), Polyhydroxyalkanoates (PHA), Other Plant-Based |

| End Use | Food, Beverages, Personal Care and Cosmetics, Pharmaceutical, Other Industrial, Building and Construction |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Futamura Chemical Co., Ltd., Toyobo Co., Ltd., Dai Nippon Printing Co., Ltd. (DNP), Unitika Ltd., Taghleef Industries |

| Additional Attributes | Evaluation of demand across bio-derived films including PLA and PBAT; adoption influenced by food-grade compliance, material recyclability, compostability, and carbon-reduction policies; demand breakdown by packaging formats and retail-driven sustainability requirements across Japanese regions. |

The demand for green packaging film in Japan is estimated to be valued at USD 621.0 million in 2025.

The market size for the green packaging film in Japan is projected to reach USD 957.5 million by 2035.

The demand for green packaging film in Japan is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in green packaging film in Japan are bags, wrapping films, pouches, liners and other product types.

In terms of material, poly lactic acid (pla) segment is expected to command 30.0% share in the green packaging film in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green Packaging Film Market by Product Type, End Use, Material, and Region 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Demand for Green Packaging Film in USA Size and Share Forecast Outlook 2025 to 2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Packaging Films Suppliers

Japan Stick Packaging Market Insights – Size, Demand & Trends 2025-2035

Japan Cling Film Market Analysis – Trends & Insights 2025-2035

Japan Sachet Packaging Market Outlook – Share, Growth & Forecast 2025-2035

Japan Blister Packaging Market Trends – Demand & Growth 2025-2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

MOPP Packaging Films Market Insights - Growth & Forecast 2025 to 2035

Japan Premade Pouch Packaging Industry Analysis by Material Type, Closure Type, End Use, and Region through 2025 to 2035

Market Share Breakdown of Food Packaging Film Providers

Meat Packaging Films Market

Japan Pharmaceutical Packaging Market Report – Demand, Growth & Innovations 2025-2035

BOPET Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA