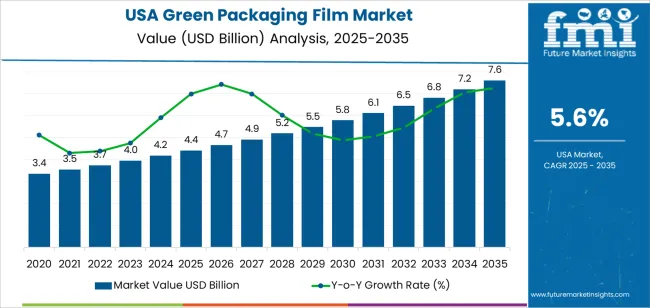

The USA green packaging film demand is valued at USD 4.4 billion in 2025 and is forecast to reach USD 7.6 billion by 2035, reflecting a CAGR of 5.6%. Demand is influenced by broader sustainability compliance within consumer-goods, food packaging, and industrial distribution channels. Adoption is shaped by a shift toward materials that reduce landfill pressure, support recyclability, and offer lower greenhouse-gas emissions through bio-based and compostable formulations. Brand-owner commitments to environmentally responsible packaging and state-level extended producer-responsibility policies reinforce procurement priorities.

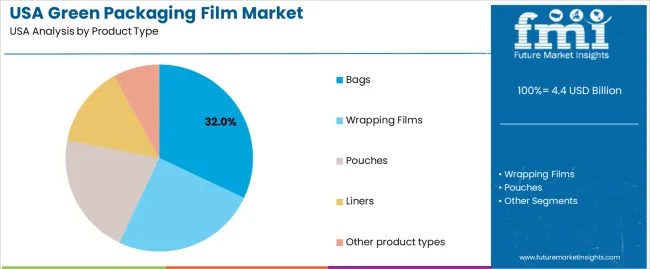

Bags lead product utilization due to high consumption in food handling, retail packaging, and waste-collection applications. Requirements for moisture resistance, mechanical durability, and cost-efficient film production contribute to their continued dominance. Product evolution focuses on improving mechanical properties of bio-based resins, enhancing shelf-life compatibility, and ensuring alignment with existing film-processing equipment.

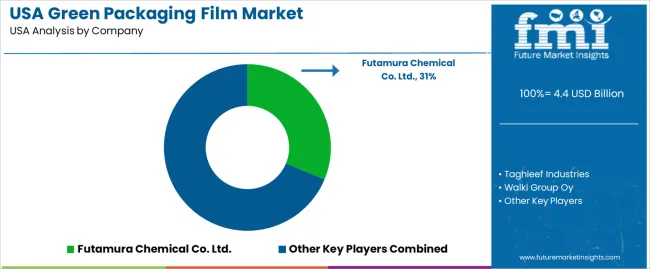

West USA, South USA, and Northeast USA exhibit the highest demand concentration because of expanded consumer packaged goods activity, supportive regulatory programs for sustainable packaging adoption, and recycling-network development. Institutional purchasers in grocery, e-commerce fulfilment, and food service operations remain key contributors. Prominent suppliers include Futamura Chemical Co. Ltd., Taghleef Industries, Walki Group Oy, BioBag Americas, Inc., and Avery Dennison Corporation. These companies supply compostable, recyclable, and renewable-material film products used across consumer and industrial packaging environments.

The early growth curve for green packaging film demand in the United States is shaped by rapid adoption across consumer-facing sectors responding to eco-friendly expectations and plastic-reduction policies. Initial acceleration comes from food and beverage brands, e-commerce fulfillment, and personal care manufacturers substituting traditional plastics with bio-based or recycled-content films to strengthen environmental credentials. Procurement decisions in the early phase rely on visible eco-friendly differentiation, retailer compliance requirements, and extended-producer responsibility initiatives.

The late-growth curve shows more moderated expansion as adoption becomes standardized across high-volume packaging categories. Growth shifts from brand-driven initiatives toward compliance with state-level regulations and circular-economy mandates. Cost sensitivity increases as green packaging transitions from niche to expected baseline, narrowing premium pricing advantages. Technological improvements in mechanical and chemical recycling support continued volume gains, while capacity expansion and material standardization lower barriers to transition.

Early growth displays faster movement driven by industry differentiation and regulatory anticipation, while late growth reflects structured adoption across mature packaging operations. The curve transitions from innovation-led acceleration to compliance-driven consistency, positioning green packaging films as an integrated component of long-term eco-friendly commitments in the United States.

| Metric | Value |

|---|---|

| USA Green Packaging Film Sales Value (2025) | USD 4.4 billion |

| USA Green Packaging Film Forecast Value (2035) | USD 7.6 billion |

| USA Green Packaging Film Forecast CAGR (2025-2035) | 5.6% |

Demand for green packaging film in the USA is rising because consumer goods companies and retailers are shifting toward materials with reduced environmental impact. Eco-friendly films used in food packaging, household products and e commerce fulfilment support corporate initiatives focused on lower carbon footprints and reduced plastic waste. USA consumers are becoming more aware of recyclability and responsible packaging choices, which encourages brands to use films based on recycled plastics, bio based feedstocks or improved barrier technology that supports material reduction. Food manufacturers seek packaging film that protects freshness while aligning with eco-friendly goals, and this strengthens demand for recyclable and compostable formats.

Growth in state and corporate green commitments also drives adoption of films that meet regulatory expectations for waste reduction. Packaging converters and film producers improve processing capabilities so that green films can run on existing packaging lines, which reduces transition barriers. Constraints include higher cost for bio based or advanced recyclable films compared with standard polyethylene and PET films. Performance limitations in some moisture sensitive or high barrier applications may slow adoption until technical improvements expand suitable use cases.

Demand for green packaging films in the United States reflects increased adoption of compostable, bio-based, and recyclable films across regulated packaging applications. USA manufacturers and food brands continue to introduce packaging formats that align with waste-reduction requirements and retailer eco-friendly guidelines. Selection depends on tear strength, sealing compatibility, and barrier performance for perishable packaged goods. USA operations integrate these films into automated wrapping, pouch forming, and bag-making equipment used in retail supply chains.

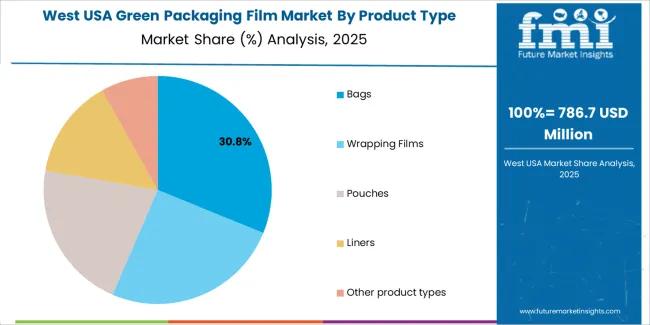

Bags account for 32.0%, used for fresh produce, bakery items, and weekly consumer packaged goods requiring recyclable or compostable packaging formats. Wrapping films represent 25.0%, supporting pallet, tray, and retail multipack applications needing load stability and clarity. Pouches account for 21.0%, reflecting adoption in snacks and ready-to-eat goods with barrier films suited to sealed packaging. Liners hold 14.0%, used in industrial and waste collection activities requiring durability with reduced environmental impact. Other product types represent 8.0%, covering niche industrial film formats. Adoption within the United States aligns with retail packaging workflows, pack-line compatibility, and demands for lower-impact flexible packaging systems.

Key points:

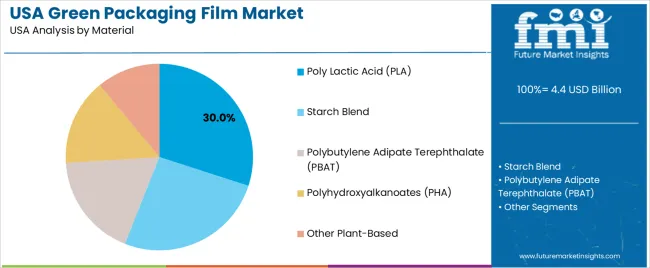

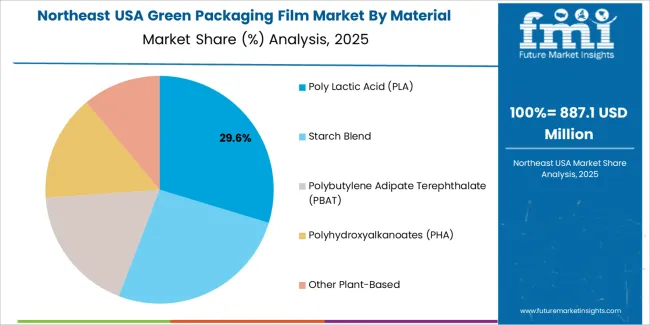

Poly lactic acid (PLA) represents 30.0%, supported by established supply chains and its use in transparent retail packaging. Starch blends account for 26.0%, used in compostable formats suited to short-shelf-life goods. Polybutylene adipate terephthalate (PBAT) holds 18.0%, often blended with other resins to improve flexibility and seal performance. Polyhydroxyalkanoates (PHA) represent 15.0%, used in higher-value packaging with full compostability attributes. Other plant-based materials hold 11.0%, covering cellulose and emerging bio-polymer formats. Material selection across the United States reflects balancing compostability, mechanical strength, and cost control while ensuring compatibility with retail package designs and industrial packaging equipment.

Key points:

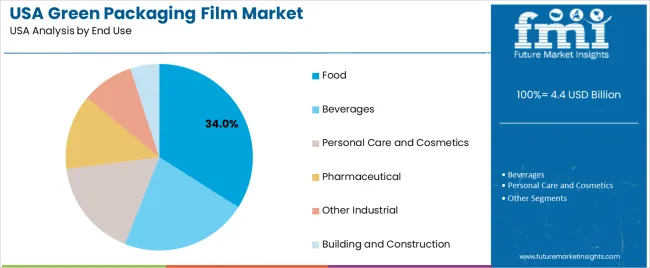

Food applications represent 34.0%, reflecting retail packaging for fresh and processed goods requiring regulated material contact. Beverages account for 22.0%, used in secondary wrapping for bottled and canned products. Personal care and cosmetics represent 17.0%, where renewable packaging formats support brand differentiation. Pharmaceutical use holds 13.0%, supporting regulated distribution of wellness products under controlled packaging requirements. Other industrial applications represent 9.0%, while building and construction accounts for 5.0%, mainly in protective sheets for interior handling. End-use distribution across the United States reflects consumer goods packaging requirements that prioritize structural stability, environmental compliance, and compatibility with distribution conditions.

Key points:

Corporate eco-friendly commitments, retailer packaging scorecards and increased consumer demand for recyclable and bio-based materials are driving demand.

In the United States, large food and beverage manufacturers are transitioning to greener packaging films to meet eco-friendly goals tied to reduced plastic waste and lower carbon emissions. National retailers encourage supplier adoption of recyclable films to align with packaging scorecard requirements that influence shelf placement and purchasing decisions. Consumers who shop through natural-food stores and mass-market chains increasingly look for films compatible with curbside recycling or composting programs. E-commerce growth also drives packaging optimization, as brands seek lower-weight, protective films for mailers and secondary wrapping to reduce packaging volume and shipping footprint. These conditions create sustained procurement of green packaging film across multiple product categories.

Limited recycling and composting infrastructure, higher material cost and performance trade-offs restrain adoption.

Many USA municipalities lack widespread access to film-recycling programs, making it difficult for brands to guarantee end-of-life recovery for green films. Bio-based and advanced recyclable films typically cost more than standard polyethylene packaging, reducing adoption among cost-sensitive brands and smaller converters. Performance factors such as heat-seal integrity, moisture barrier and durability in long-distance logistics may require multilayer structures that complicate recyclability, slowing transition to single-material solutions. These limitations result in gradual rather than rapid industry penetration.

Shift toward monomaterial polyethylene films, increased use in chilled food and produce packaging and rising demand for PCR-content film define key trends.

The USA packaging teams are prioritizing monomaterial designs that simplify recycling in mechanical recovery systems. Fresh produce brands and refrigerated food suppliers are adopting breathable green films that maintain shelf life while supporting eco-friendly claims in grocery channels. Post-consumer recycled (PCR) content films are gaining traction as companies respond to internal recycled-content targets and potential future regulation of virgin plastic USAge. Online marketplaces that promote green packaging solutions are improving access for mid-sized and regional brands. These trends support continued expansion of green packaging film adoption across the USA consumer goods landscape.

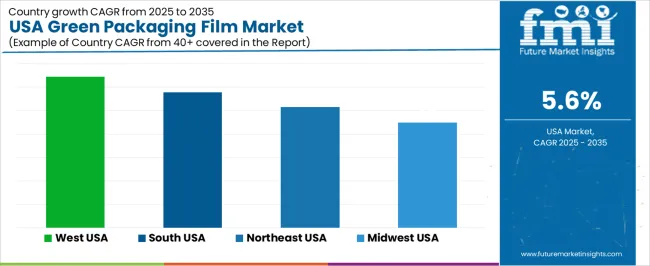

Demand for green packaging film in the United States reflects eco-friendly targets, retailer packaging standards, food-service waste reduction, and increasing use of bio-based, recyclable, and compostable films in consumer goods packaging. Regional growth differences align with policy incentives, supply-chain modernization, and adoption of green materials by brands and processors. West USA leads at 6.4%, followed by South USA (5.8%), Northeast USA (5.2%), and Midwest USA (4.5%).

| Region | CAGR (2025 to 2035) |

|---|---|

| West USA | 6.4% |

| South USA | 5.8% |

| Northeast USA | 5.2% |

| Midwest USA | 4.5% |

West USA expands at 6.4% CAGR, supported by stronger eco-friendly regulations and extensive consumer packaged goods distribution across California, Washington, Oregon, and Colorado. Food-service operators increase USAge of recyclable and plant-based films as part of local waste-reduction requirements. Major retailers promote high-recovery packaging formats to align with state recycling frameworks. Fresh produce logistics benefit from breathable bio-films that maintain product shelf stability in regional supply networks. Film suppliers serving beverage multipacks, bakery goods, and meal-prep kits improve adoption through compatibility with automated packing lines. Recycling-infrastructure access in metropolitan areas increases supplier confidence for long-term USAge planning.

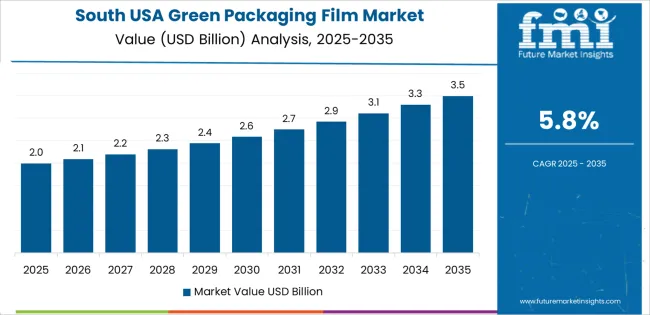

South USA grows at 5.8% CAGR, driven by food processing and distribution centers in Texas, Florida, Georgia, and North Carolina. Large supermarket networks support gradual film conversion where material changes maintain pack integrity in humid climates. Consumer goods manufacturers adopt eco-friendly films to support brand-led emissions-reduction commitments. Flexible-packaging converters in the region producer test recyclable polyethylene blends for snack items and shelf-stable staples. Regional ports facilitate inbound bio-material supply, supporting procurement stability.

Northeast USA grows at 5.2% CAGR, shaped by regulatory compliance and urban packaging demands in New York, New Jersey, and Massachusetts. Local statutes promote reduced single-use plastic in food-service chains and grocery distribution. E-commerce fulfillment facilities adopt recyclable mailer films and low-waste secondary packaging for frequent shipment cycles. Cold-chain networks apply compostable or bio-based films for dairy and fresh-meal packs that require durability under temperature variance. Recycling-service availability strengthens user confidence in upgraded film formats.

Midwest USA grows at 4.5% CAGR, influenced by packaged food manufacturing and centralized distribution across Illinois, Ohio, Michigan, and Wisconsin. Companies assess bio-based films where mechanical performance meets cost targets for high-volume products such as bakery goods and frozen items. Institutional food suppliers adopt recyclable formats for standardized pack sizes. Procurement decisions emphasize compatibility with legacy sealing and forming equipment. Equipment distributors provide testing support to ensure sealing strength and line stability before full rollout.

Demand for green packaging film in the USA is shaped by packaging-material manufacturers supplying compostable, bio-based, and recyclable films for food packaging, personal-care goods, and controlled industrial applications. Futamura Chemical Co. Ltd. holds an estimated 31.3% share, supported by controlled production of cellulose-based films distributed through its USA commercial network. These materials provide stable sealing performance, predictable barrier properties, and certified compostability used by ecofriendly-focused brands. Taghleef Industries maintains strong participation through bio-based and downgauged polypropylene films designed to reduce plastic USAge while maintaining packaging durability. Its materials offer consistent machinability on USA converting lines and reliable clarity for consumer-packaged goods. Walki Group Oy contributes selective presence with fibre-reinforced and recyclable barrier films integrated into USA food and industrial applications where controlled protection and resource-efficiency are priorities.

BioBag Americas, Inc. supports domestic compostable-packaging demand through PLA and starch-blend films suited to food-service packaging and organic-waste containment. Its materials provide stable tear strength and verifiable performance in municipal compost systems. Avery Dennison Corporation adds capability in pressure-sensitive and film-based labels designed for recyclability and reduced material use in USA supply chains. Competition in the USA centers on barrier consistency, compostability certification, recyclability compatibility, mechanical stability, and availability through national converting networks. Demand continues to increase as brands adopt bio-based and reduced-plastic films that support waste-reduction goals and align with evolving sustainability-compliance requirements in USA retail and food-packaging environments.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Bags, Wrapping Films, Pouches, Liners, Other product types |

| Material | Poly Lactic Acid (PLA), Starch Blend, Polybutylene Adipate Terephthalate (PBAT), Polyhydroxyalkanoates (PHA), Other Plant-Based |

| End Use | Food, Beverages, Personal Care and Cosmetics, Pharmaceutical, Other Industrial, Building and Construction |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Futamura Chemical Co. Ltd., Taghleef Industries, Walki Group Oy, BioBag Americas, Inc., Avery Dennison Corporation |

| Additional Attributes | Revenue segmentation by product format, biopolymer type, and end-use industries; growth linked to eco-friendly mandates, compostable packaging demand, and single-use plastic restrictions; adoption trends in food safety-compliant and high-barrier films; innovation in PLA/PBAT blends and recyclability improvements across the United States. |

The demand for green packaging film in USA is estimated to be valued at USD 4.4 billion in 2025.

The market size for the green packaging film in USA is projected to reach USD 7.6 billion by 2035.

The demand for green packaging film in USA is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in green packaging film in USA are bags, wrapping films, pouches, liners and other product types.

In terms of material, poly lactic acid (pla) segment is expected to command 30.0% share in the green packaging film in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green Packaging Film Market by Product Type, End Use, Material, and Region 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Packaging Films Suppliers

USA Stick Packaging Market Analysis – Growth, Trends & Forecast 2025-2035

USA Cling Film Market Trends – Size, Demand & Growth 2025-2035

USA Sachet Packaging Market Report – Trends, Demand & Industry Outlook 2025-2035

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

USA Barrier Packaging Market Analysis – Trends & Forecast 2024-2034

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

MOPP Packaging Films Market Insights - Growth & Forecast 2025 to 2035

Market Share Breakdown of Food Packaging Film Providers

Meat Packaging Films Market

Reusable Consumer Packaging Market

USA Flexible Plastic Packaging Market Insights – Trends, Demand & Growth 2025-2035

BOPET Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA