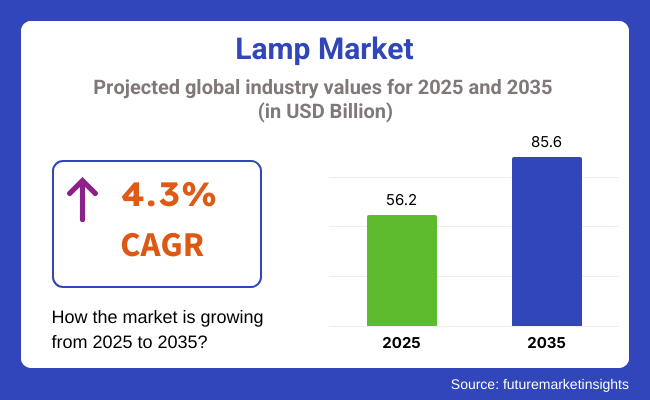

The global lamp market was USD 56.2 billion in 2025 and is projected to grow at a 4.3% CAGR between 2025 and 2035. The worldwide industry is anticipated to grow to USD 85.6 billion by 2035. One of the main drivers propelling this expansion is the widespread use of energy-saving lighting technologies, especially LED lamps, based on regulatory requirements and worldwide efforts toward sustainability.

During the forecasting period, replacement from conventional incandescent and compact fluorescent lamps (CFLs) to LED and smart lamp types will gain momentum. This is driven by improved lifespan, reduced power consumption, and falling unit prices of LEDs. Government regulations and strict energy-efficiency mandates in North America, Europe, and Asia Pacific are inducing positive conditions for the widespread adoption of sophisticated technologies.

Technological incorporation is dramatically changing the size of the industry. Smart lighting solutions that allow remote control, automated dimming, and energy tracking are becoming mainstream, especially in commercial and urban infrastructure segments. Such developments are not only enhancing functionality but also increasing aesthetic value and user convenience, driving demand from both residential and professional lighting markets.

Design flexibility and personalization are becoming major industry differentiators. Customers are looking more for lamps that match interior styles, provide tunable white light, or synchronize with ambient settings. Companies are reacting with a wide range of smart, modular, and decorative offerings that meet contemporary design and lifestyle demands.

Despite competitive pricing pressure, ongoing innovation and urbanization trends in the global industry are likely to drive long-term growth. The growth of smart city initiatives, along with retrofitting of existing lighting infrastructure in emerging economies, will be a key driver in sustaining demand momentum and broadening the application base in the coming decade.

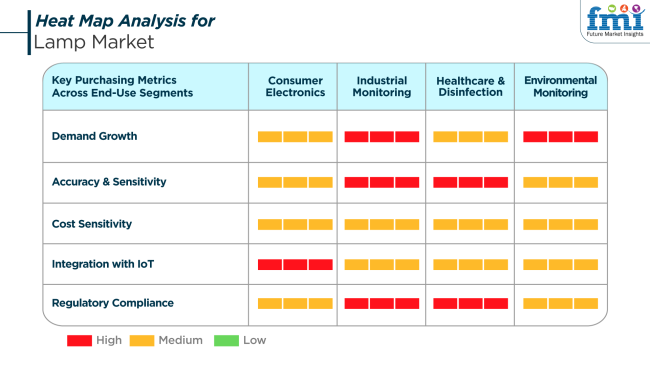

Key Purchasing Metrics Across End-Use Segments

The manufacturing is experiencing diverse dynamics in end-use markets, where performance, durability, and regulatory compliance are significant drivers of purchasing decisions. Consumer electronics emphasize beauty, dimming, and hassle-free connectivity to home automation. Thus, hassle-free connectivity with IoT is becoming the determining benchmark. Healthcare and disinfection markets also have similar priorities, such as the effectiveness of sterilization and precise lighting for the hospital setting.

Industrial monitoring applications need high-lumen, vibra at, environmental monitoring segments are served by long-life, low-power lighting suitable for extended field deployment. Regulation compliance across all industries is still of the highest importance. Newer regulations on electromagnetic compatibility, light flicker, and photobiological safety promote innovation and limit the entry of low-quality products into the industry. Hence, suppliers who comply with the eco-design standards and provide smart, flexible solutions are poised to thrive in meeting increased demand across various end-user verticals.

The lighting sector is confronted with severe challenges caused by rapid technological advancement and changing regulatory landscapes. One of the principal risks is obsolescence as developments in smart lighting and wireless control technologies keep pace ahead of manufacturers' capacity to modify product lines. Companies that do not invest in R&D risk obsolescence as consumers move toward integrated lighting ecosystems.

Price volatility in raw materials, particularly rare earth and semiconductors used in high-end material, is another area of concern. Supply chain disruptions, geo-political tension, and natural constraints can escalate input costs and delay production, restricting margins and delivery schedules. Regulatory risks also loom large, particularly for energy efficiency standards, environmental disposal regulations, and product labeling regulations.

In accordance with the region, the complexity of compliance varies, and non-compliance results in industry restriction or financial penalties. Strategic alignment with international compliance frameworks is, therefore, essential for sustaining growth and evading operational risks.

Between 2020 and 2024, the industry was shifting because energy-saving lighting products were being consumed extensively and there was rapid urbanization. Consumers and companies opted for green choices, which influenced the market for LED lamps over conventional incandescent and fluorescent lamps.

The growing trend towards smart homes and offices also favored connectivity with smart lighting systems. Design aesthetics emerged as the driving influence in buying decisions, and thus innovation in form, function, and personalization. Retailers and manufacturers answered the change by introducing connected lighting with dimming capabilities and voice control, bringing convenience and user control.

The business will grow on the strength of automation and sustainability technology breakthroughs through 2025 to 2035. Mood-sensing and adaptive brightness smart lighting solutions will become more widespread. Solar lights, modular designs, and recyclability will be in vogue with greater emphasis on green issues. AI and IoT integration will drive personalization and energy savings in homes and businesses. Integrated and decentralized lighting systems that are smart infrastructure-compatible, user-focused, energy-efficient, and low-impact material will take center stage.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Transition to LED from incandescent for energy efficiency | Introduction of adaptive smart lighting systems with AI-integrated |

| Growing demand for home automation through smart lamps | Higher use of IoT-enabled, highly customizable lighting environments |

| Growing demand for aesthetically designed and multi-functional lamps | Increased concern for sustainability, modularity, and green material usage |

| Growing e-commerce sales for lamp purchase | Virtual, immersive shopping experience and AR-driven product previewing |

| Focus on affordability and performance | Energy independence, recycling-friendly design, and personalized control taking precedence |

| LED dominance of urban and business buildings | Applications of solar energy and low-carbon materials for product offerings |

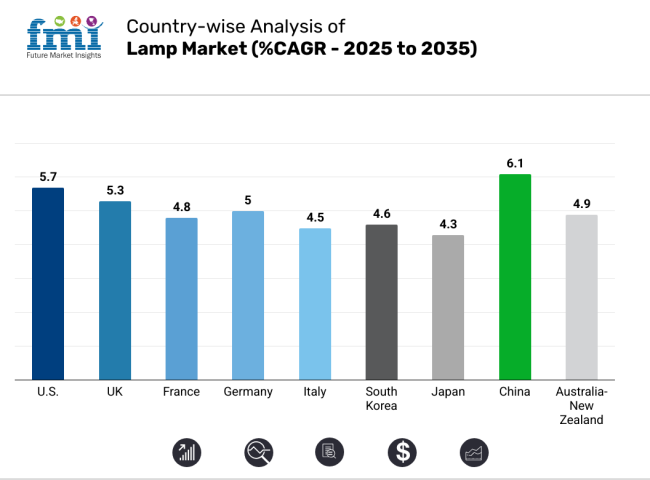

The USA industry will grow at 5.7% CAGR throughout the study. Growth is spurred by a combination of infrastructure upgrades, residential renovations, and changing consumer tastes toward energy-efficient lighting. The shift away from traditional incandescent and fluorescent lamps to LED-based products is gaining momentum, with support from government energy efficiency programs and utility rebate schemes.

The growth of intelligent home environments is also driving demand for connected lighting solutions, which is propelling the industry from its conventional utility to functional and aesthetic flexibility. Commercial real estate development, as well as retrofitting programs in offices, schools, and public facilities, continues to shape demand.

As there are more sustainability ambitions in institutional and corporate markets, environmental-friendly lighting products are being preferred. In addition, the surging popularity of custom and designer light fixtures among luxury residential segments is driving the diversification of the product. Strong distribution networks involving e-commerce and specialty retailers continue to support the USA market, giving it strong consumer and contractor access.

The British industry is anticipated to expand at 5.3% CAGR throughout the research period. The nation is undergoing a shift towards green lighting solutions owing to energy efficiency objectives and EU legacy regulations remaining part of UK energy policy. The adoption of LEDs is still on the rise in residential, commercial, and public infrastructure applications. Carbon neutrality and energy-saving efforts are leading to both government bodies and companies embracing low-energy lighting replacements.

The use of intelligent lighting technology is increasing, particularly in new buildings and refurbishing commercial premises under digital reinvention. With end-users and facility managers wanting longer-term savings on costs, systems that employ motion detection, dimming functionality, and intelligent controls are emerging as sought-after solutions.

Where heritage and renovation projects are undertaken, there, too, is an emerging demand for efficient yet tastefully designed options to drive differentiation in the marketplace. Overall, policy support, technological integration, and a maturing consumer base are driving the UK industry's steady growth.

The French industry will grow at 4.8% CAGR during the study period. Growing urban development and energy-efficiency reforms are driving the adoption of advanced technologies. Though the nation boasts a rich heritage in architectural and ornamental lighting, there has been a recent move towards functional, sustainable, and intelligent lighting solutions in both private and public spheres. LED conversion initiatives have taken precedence in city lighting overhauls, especially in Paris and other metropolitan cities.

Government incentives for green building activities, along with greater sensitivity toward the contribution of lighting to energy use, are directing demand to durable, low-maintenance light sources. French interior design and aesthetic requirements also shape lamp demand in hospitality, retail, and high-end residential markets. Regional and local makers persist in innovating designs and sustainability to address both functional and cultural needs. Increasing demand for home renovation and décor improvements further underpins retail sales.

The industry for Germany is projected to increase at 5% CAGR throughout the study. The country's emphasis on sustainability and energy efficiency continues to drive the industry, with large-scale LED retrofitting both in public infrastructure and commercial space. German standards for engineering and environmental regulation compel long-lasting, high-efficiency lighting technology, providing constant demand across residential and industrial spaces.

As Germany moves to low-emission infrastructure, lamps that fulfill the strict lumen output and lifespan requirements are in the spotlight. The commercial industry continues to be very active, fueled by lighting system upgrades in office buildings, healthcare buildings, and industrial buildings.

Smart lighting solutions, such as automated control systems and daylight integration, are becoming increasingly popular because of their energy-saving capabilities. Residential consumers are also opting for smart lamps and personalized fixtures. Germany's robust manufacturing base, comprising both global players and regional experts, makes the country a leading innovator in the European industry.

The Italian industry is anticipated to grow at 4.5% CAGR over the study period. A renewed focus on energy-efficient lighting in public and private building projects drives the growth of the market. Italian consumers are known to appreciate aesthetic design, and this trend continues to drive the uptake of designer fixtures in hospitality, residential, and commercial applications. LED conversion in public infrastructure, such as street lighting and heritage sites, is a growing area of investment.

Financial incentives for energy-efficient overhauls are driving household replacement, particularly in metropolitan locations. Italy's focus on the marriage of function and design is driving demand for aesthetic but performance-driven light products. Local SMEs and artisans have a specific position within the industry, particularly within high-quality, hand-fabricated products intended for luxury markets. Although fragmentation is a difficulty presented by the market, local design excellence and innovation drive a steady growth trend.

The South Korean industry is anticipated to grow at 4.6% CAGR over the study period. The nation's sophisticated technology infrastructure and focus on smart cities are driving demand for smart lighting solutions. IoT-enabled lamps are gaining traction in new buildings and retrofitting applications, especially in urban areas. Government programs encouraging energy efficiency in residential and commercial buildings facilitate wider industry growth.

Consumer demand for power savings, paired with speedy digitalization at workplaces and residences, is prompting demand for app-connected and voice-driven lighting solutions. Domestic producers are creating high-value products with provisions like tunable white light output and scheduling operations, promoting greater convenience and user customization.

Growing numbers of residents adopting smart living ecosystems will progressively direct usage toward matching emerging smart technology streams, resulting in a favorable long-term growth cycle for the predicted period.

The Japan industry is anticipated to register a 4.3% CAGR over the forecast period. The demographic trend in the country, such as a high aging population and urbanization, affects lighting requirements in residential and healthcare settings. The shift towards LED technology is established but continuing, with product demand increasingly centered on smart features and human-centric applications that modify color temperature and intensity for enhanced comfort and productivity.

Public investment in sustainable urban infrastructure is fueling upgrades to outdoor and institutional lighting. Hospitality and retail are also important sectors, requiring lamps with aesthetic qualities complemented by energy efficiency. Technical innovation in compact, modular, and high-lumen output forms supports Japan's space-efficient architecture. Japan's industry also features a strong bias toward quality and reliability, favoring locally produced brands consistent with national product standards.

The China industry will grow at 6.1% CAGR over the study period. China is still the biggest producer and consumer, with the help of huge urbanization, increasing disposable incomes, and continuous infrastructure development. Government initiatives for energy conservation are fueling the mass replacement of traditional lighting systems with LED and smart solutions.

Tier 1 and Tier 2 cities are investing in smart building infrastructure and intelligent street lighting that incorporates connected systems. China's internal consumer industry is changing quickly, with a growing demand for high-end lighting products with intelligent controls and personalized design aspects.

Concurrently, commercial and industrial applications are incorporating comprehensive lighting systems for operational effectiveness. Comprehensive domestic production abilities, combined with favoring policy environments and technical progress, are preparing China for ongoing dominance in production and innovation in the forecast period.

The Australia-New Zealand industry is projected to grow at 4.9% CAGR over the study period. Both nations are experiencing major energy transitions and replacing traditional lighting systems with energy-efficient lamps in domestic, commercial, and public infrastructure. Government policies, such as rebate schemes and minimum energy performance standards, have spurred LED adoption in different applications. Smart lighting technologies are increasingly prevalent in new developments and redevelopment efforts, particularly for urban residential projects and corporate space.

The push for sustainable building and green building certifications is further driving demand for eco-friendly and durable lamps. Consumer tastes in modern and minimalist design are further shaping the purchases in interior design. With high environmental awareness and availability of international products, the Australia-New Zealand industry is likely to grow steadily.

In 2025, the industry is expected to be significantly influenced by electrical discharge lamps, projected to hold 22% of the total industry share, while filament lamps are expected to capture 18%.

With a projected 22% share, electrical discharge lamps come in different varieties, such as fluorescent, halogen, and high-intensity discharge (HID) lamps. Such lamps are preferable owing to their energy efficiency and long life, as well as their capacity to deliver high-quality lighting. They have a very significant portion of commercial, industrial, and outdoor lighting due to their high-efficiency lighting of large spaces.

The world community is championing sustainability by instituting stricter regimes on energy efficiency and carbon emissions, all of which enhance the popularity. Some of the leading players in this segment include Philips Lighting, OSRAM, and General Electric, among others, which have very advanced solutions in electrical discharge lamps, including LED and smart lighting systems.

Filament lamps account for an estimated 18% of the industry but continue to cover much of the ground in residential and decorative lighting concepts. These are not as energy efficient, but the warm, pleasant light they emit makes them ideal for homes, vintage-style lighting fixtures, and decorative applications such as chandeliers and pendant lights.

Presently, incandescent filament lamps are being replaced with light-emitting diodes as far as energy efficiency goes, but they find their glory in a few other industry segments that appreciate their special aesthetics. General Electric, Sylvania, and Philips still produce filament lamps for some segments of consumers who want their nostalgia expressed in decorative or retro-style lighting.

In 2025, LED technology is expected to occupy 40% of the total industry, while fluorescent technology will account for 30%.

LED lamps, capturing 40% of the forecast industry share, are preferred over long-life, eco-friendly, and energy-efficient features. As governments tighten their energy rules and consumers seek sustainable goods, the world is getting more into LED lighting. Applications for LED lamps include the residential lighting sector, office spaces, street lighting, and the automobile industry for headlights and interior lights.

Leading light companies, such as Philips Lighting, Osram, and Cree, have advanced LED lighting solutions offering higher brightness, color accuracy, and adaptability. The addition of smart features, such as dimming and remote control capabilities, has further solidified the position of LED in the market.

On the other hand, fluorescent lamps are expected to share the industry with a 30% contribution. The majority of them are cheap and readily available in forms such as compact fluorescent lamps (CFLs) and tube lights. Although less energy-efficient than LEDs, fluorescent lamps continue to stand as one of the cost-effective lighting solutions for home and commercial requirements.

They are widely used in offices, warehouses, and schools, offering adequate illumination for comparatively lower investment costs. General Electric, Sylvania, and a few other companies still supply these lamps, but are generally losing their industry share due to a more affordable, broader diffusion of LED technology.

The global industry has undergone strategic transformation by legacy and new manufacturers as the global shift moves toward energy-efficient lighting. The sector is under the predominant influence of Philips Electronics and Osram Licht primarily due to their broad R&D capabilities coupled with their smart lighting integrations in the commercial and public infrastructure. With adaptive LED solutions and IoT-connected platforms, Philips still maintains its lead, while Osram puts its energies on high-performance specialty lighting for the automotive and industrial sectors.

General Electric, through its GE Lighting division (now merged into Savant Systems), concentrates on developing consumer-focused products that would enable intelligent lighting of the home and use history while innovating into the future. Maxlite recently bolstered its stronghold in the North American industry with its low-cost, compliant LED lamps intended for commercial retrofits.

But EiKO Global, LLC, is aggressively scaling up in value-added distribution with a full catalog of replacement with utility rebate alignment and very short lead times. The battleground today is digital compatibility with regulatory compliance and, in developing economies, the migration from fluorescent to LED technology.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Philips Electronics | 20-24% |

| Osram Licht | 18-21% |

| General Electric | 15-18% |

| Maxlite | 10-13% |

| EiKO Global, LLC | 7-10% |

| Other Players | 18-25% |

| Company Name | Offerings & Activities |

|---|---|

| Philips Electronics | Smart LED s, tunable white solutions, IoT lighting systems for smart buildings. |

| Osram Licht | Specialty industrial lamps, automotive lighting systems, horticultural and UV lamps. |

| General Electric | Smart home-compatible and LED retrofits for residential and commercial applications. |

| Maxlite | Value-optimized LED replacement lamps; strong utility rebate program support. |

| EiKO Global, LLC | Broad Catalog specializes in quick-ship, compliant solutions for contractors. |

Key Company Insights

Philips Electronics leads the industry with a 20-24% share, fueled by its dominance in connected lighting solutions and adaptive LED platforms. The company continues to set industry benchmarks for smart lighting ecosystems, especially in large-scale infrastructure and residential upgrades. Osram Licht, holding 18-21% of the market, sustains its stronghold through industrial-grade innovation and automotive integration. Its high-margin segments in UV, horticulture, and high-bay applications support its premium positioning.

General Electric, with a 15-18% share, remains influential through its GE Lighting subsidiary, which now operates under Savant’s smart home ecosystem. The brand capitalizes on its historical credibility while advancing in LED and connected residential segments.

Maxlite, with a 10-13% industry presence, focuses on affordability and utility incentive compatibility, securing contracts in commercial retrofit projects across North America. EiKO Global, LLC, with a 7-10% share, emphasizes availability, compliance, and service-driven distribution, catering to contractors and industrial users with time-sensitive needs.

Other Key Players

The industry is segmented into electrical discharge and filament types.

The industry is classified into indoor and outdoor categories.

The industry includes LED, fluorescent, halogen, and others.

The industry includes reading, decorative, and other types of lamps.

The industry is analyzed through offline and online channels.

The industry is divided into regions, including North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is expected to reach USD 56.2 billion in 2025.

The industry is projected to grow to USD 85.6 billion by 2035.

China, with a projected CAGR of 6.1%, is expected to see significant growth in this market.

Key players include Philips Electronics, Osram Licht, General Electric, Maxlite, EiKO Global, LLC, Amglo Kemlite Corp, Eye Lighting International, Astec Industries Inc, Siemens AG, and Interlective Corp.

Electrical discharge lamps are currently the most widely targeted segment in the industry.

Table 1: Global Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Volume (Units) Forecast by Application, 2019 to 2034

Table 7: Global Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 8: Global Volume (Units) Forecast by Technology, 2019 to 2034

Table 9: Global Value (US$ Million) Forecast by Products, 2019 to 2034

Table 10: Global Volume (Units) Forecast by Products, 2019 to 2034

Table 11: Global Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: Global Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 13: North America Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: North America Volume (Units) Forecast by Country, 2019 to 2034

Table 15: North America Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: North America Volume (Units) Forecast by Type, 2019 to 2034

Table 17: North America Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: North America Volume (Units) Forecast by Application, 2019 to 2034

Table 19: North America Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 20: North America Volume (Units) Forecast by Technology, 2019 to 2034

Table 21: North America Value (US$ Million) Forecast by Products, 2019 to 2034

Table 22: North America Volume (Units) Forecast by Products, 2019 to 2034

Table 23: North America Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: North America Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Latin America Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Latin America Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Latin America Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Latin America Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Latin America Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Latin America Volume (Units) Forecast by Application, 2019 to 2034

Table 31: Latin America Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 32: Latin America Volume (Units) Forecast by Technology, 2019 to 2034

Table 33: Latin America Value (US$ Million) Forecast by Products, 2019 to 2034

Table 34: Latin America Volume (Units) Forecast by Products, 2019 to 2034

Table 35: Latin America Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: Latin America Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 37: Western Europe Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: Western Europe Volume (Units) Forecast by Country, 2019 to 2034

Table 39: Western Europe Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: Western Europe Volume (Units) Forecast by Type, 2019 to 2034

Table 41: Western Europe Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: Western Europe Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Western Europe Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 44: Western Europe Volume (Units) Forecast by Technology, 2019 to 2034

Table 45: Western Europe Value (US$ Million) Forecast by Products, 2019 to 2034

Table 46: Western Europe Volume (Units) Forecast by Products, 2019 to 2034

Table 47: Western Europe Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Western Europe Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: Eastern Europe Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: Eastern Europe Volume (Units) Forecast by Country, 2019 to 2034

Table 51: Eastern Europe Value (US$ Million) Forecast by Type, 2019 to 2034

Table 52: Eastern Europe Volume (Units) Forecast by Type, 2019 to 2034

Table 53: Eastern Europe Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: Eastern Europe Volume (Units) Forecast by Application, 2019 to 2034

Table 55: Eastern Europe Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 56: Eastern Europe Volume (Units) Forecast by Technology, 2019 to 2034

Table 57: Eastern Europe Value (US$ Million) Forecast by Products, 2019 to 2034

Table 58: Eastern Europe Volume (Units) Forecast by Products, 2019 to 2034

Table 59: Eastern Europe Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 60: Eastern Europe Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 61: South Asia and Pacific Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: South Asia and Pacific Volume (Units) Forecast by Country, 2019 to 2034

Table 63: South Asia and Pacific Value (US$ Million) Forecast by Type, 2019 to 2034

Table 64: South Asia and Pacific Volume (Units) Forecast by Type, 2019 to 2034

Table 65: South Asia and Pacific Value (US$ Million) Forecast by Application, 2019 to 2034

Table 66: South Asia and Pacific Volume (Units) Forecast by Application, 2019 to 2034

Table 67: South Asia and Pacific Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 68: South Asia and Pacific Volume (Units) Forecast by Technology, 2019 to 2034

Table 69: South Asia and Pacific Value (US$ Million) Forecast by Products, 2019 to 2034

Table 70: South Asia and Pacific Volume (Units) Forecast by Products, 2019 to 2034

Table 71: South Asia and Pacific Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 72: South Asia and Pacific Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 73: East Asia Value (US$ Million) Forecast by Country, 2019 to 2034

Table 74: East Asia Volume (Units) Forecast by Country, 2019 to 2034

Table 75: East Asia Value (US$ Million) Forecast by Type, 2019 to 2034

Table 76: East Asia Volume (Units) Forecast by Type, 2019 to 2034

Table 77: East Asia Value (US$ Million) Forecast by Application, 2019 to 2034

Table 78: East Asia Volume (Units) Forecast by Application, 2019 to 2034

Table 79: East Asia Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 80: East Asia Volume (Units) Forecast by Technology, 2019 to 2034

Table 81: East Asia Value (US$ Million) Forecast by Products, 2019 to 2034

Table 82: East Asia Volume (Units) Forecast by Products, 2019 to 2034

Table 83: East Asia Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 84: East Asia Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 85: Middle East and Africa Value (US$ Million) Forecast by Country, 2019 to 2034

Table 86: Middle East and Africa Volume (Units) Forecast by Country, 2019 to 2034

Table 87: Middle East and Africa Value (US$ Million) Forecast by Type, 2019 to 2034

Table 88: Middle East and Africa Volume (Units) Forecast by Type, 2019 to 2034

Table 89: Middle East and Africa Value (US$ Million) Forecast by Application, 2019 to 2034

Table 90: Middle East and Africa Volume (Units) Forecast by Application, 2019 to 2034

Table 91: Middle East and Africa Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 92: Middle East and Africa Volume (Units) Forecast by Technology, 2019 to 2034

Table 93: Middle East and Africa Value (US$ Million) Forecast by Products, 2019 to 2034

Table 94: Middle East and Africa Volume (Units) Forecast by Products, 2019 to 2034

Table 95: Middle East and Africa Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 96: Middle East and Africa Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Value (US$ Million) by Technology, 2024 to 2034

Figure 4: Global Value (US$ Million) by Products, 2024 to 2034

Figure 5: Global Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 6: Global Value (US$ Million) by Region, 2024 to 2034

Figure 7: Global Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 8: Global Volume (Units) Analysis by Region, 2019 to 2034

Figure 9: Global Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 10: Global Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 11: Global Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 12: Global Volume (Units) Analysis by Type, 2019 to 2034

Figure 13: Global Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 14: Global Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 15: Global Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 16: Global Volume (Units) Analysis by Application, 2019 to 2034

Figure 17: Global Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 18: Global Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 19: Global Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 20: Global Volume (Units) Analysis by Technology, 2019 to 2034

Figure 21: Global Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 22: Global Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 23: Global Value (US$ Million) Analysis by Products, 2019 to 2034

Figure 24: Global Volume (Units) Analysis by Products, 2019 to 2034

Figure 25: Global Value Share (%) and BPS Analysis by Products, 2024 to 2034

Figure 26: Global Y-o-Y Growth (%) Projections by Products, 2024 to 2034

Figure 27: Global Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 28: Global Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 29: Global Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 30: Global Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 31: Global Attractiveness by Type, 2024 to 2034

Figure 32: Global Attractiveness by Application, 2024 to 2034

Figure 33: Global Attractiveness by Technology, 2024 to 2034

Figure 34: Global Attractiveness by Products, 2024 to 2034

Figure 35: Global Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: Global Attractiveness by Region, 2024 to 2034

Figure 37: North America Value (US$ Million) by Type, 2024 to 2034

Figure 38: North America Value (US$ Million) by Application, 2024 to 2034

Figure 39: North America Value (US$ Million) by Technology, 2024 to 2034

Figure 40: North America Value (US$ Million) by Products, 2024 to 2034

Figure 41: North America Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 42: North America Value (US$ Million) by Country, 2024 to 2034

Figure 43: North America Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 44: North America Volume (Units) Analysis by Country, 2019 to 2034

Figure 45: North America Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 46: North America Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 47: North America Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 48: North America Volume (Units) Analysis by Type, 2019 to 2034

Figure 49: North America Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 50: North America Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 51: North America Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 52: North America Volume (Units) Analysis by Application, 2019 to 2034

Figure 53: North America Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 54: North America Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 55: North America Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 56: North America Volume (Units) Analysis by Technology, 2019 to 2034

Figure 57: North America Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 58: North America Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 59: North America Value (US$ Million) Analysis by Products, 2019 to 2034

Figure 60: North America Volume (Units) Analysis by Products, 2019 to 2034

Figure 61: North America Value Share (%) and BPS Analysis by Products, 2024 to 2034

Figure 62: North America Y-o-Y Growth (%) Projections by Products, 2024 to 2034

Figure 63: North America Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 64: North America Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 65: North America Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 66: North America Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 67: North America Attractiveness by Type, 2024 to 2034

Figure 68: North America Attractiveness by Application, 2024 to 2034

Figure 69: North America Attractiveness by Technology, 2024 to 2034

Figure 70: North America Attractiveness by Products, 2024 to 2034

Figure 71: North America Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: North America Attractiveness by Country, 2024 to 2034

Figure 73: Latin America Value (US$ Million) by Type, 2024 to 2034

Figure 74: Latin America Value (US$ Million) by Application, 2024 to 2034

Figure 75: Latin America Value (US$ Million) by Technology, 2024 to 2034

Figure 76: Latin America Value (US$ Million) by Products, 2024 to 2034

Figure 77: Latin America Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 78: Latin America Value (US$ Million) by Country, 2024 to 2034

Figure 79: Latin America Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: Latin America Volume (Units) Analysis by Country, 2019 to 2034

Figure 81: Latin America Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 82: Latin America Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 83: Latin America Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 84: Latin America Volume (Units) Analysis by Type, 2019 to 2034

Figure 85: Latin America Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 86: Latin America Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 87: Latin America Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 88: Latin America Volume (Units) Analysis by Application, 2019 to 2034

Figure 89: Latin America Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 90: Latin America Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 91: Latin America Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 92: Latin America Volume (Units) Analysis by Technology, 2019 to 2034

Figure 93: Latin America Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 94: Latin America Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 95: Latin America Value (US$ Million) Analysis by Products, 2019 to 2034

Figure 96: Latin America Volume (Units) Analysis by Products, 2019 to 2034

Figure 97: Latin America Value Share (%) and BPS Analysis by Products, 2024 to 2034

Figure 98: Latin America Y-o-Y Growth (%) Projections by Products, 2024 to 2034

Figure 99: Latin America Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 100: Latin America Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 101: Latin America Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 102: Latin America Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 103: Latin America Attractiveness by Type, 2024 to 2034

Figure 104: Latin America Attractiveness by Application, 2024 to 2034

Figure 105: Latin America Attractiveness by Technology, 2024 to 2034

Figure 106: Latin America Attractiveness by Products, 2024 to 2034

Figure 107: Latin America Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: Latin America Attractiveness by Country, 2024 to 2034

Figure 109: Western Europe Value (US$ Million) by Type, 2024 to 2034

Figure 110: Western Europe Value (US$ Million) by Application, 2024 to 2034

Figure 111: Western Europe Value (US$ Million) by Technology, 2024 to 2034

Figure 112: Western Europe Value (US$ Million) by Products, 2024 to 2034

Figure 113: Western Europe Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 114: Western Europe Value (US$ Million) by Country, 2024 to 2034

Figure 115: Western Europe Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 116: Western Europe Volume (Units) Analysis by Country, 2019 to 2034

Figure 117: Western Europe Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 118: Western Europe Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 119: Western Europe Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 120: Western Europe Volume (Units) Analysis by Type, 2019 to 2034

Figure 121: Western Europe Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 122: Western Europe Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 123: Western Europe Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 124: Western Europe Volume (Units) Analysis by Application, 2019 to 2034

Figure 125: Western Europe Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 126: Western Europe Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 127: Western Europe Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 128: Western Europe Volume (Units) Analysis by Technology, 2019 to 2034

Figure 129: Western Europe Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 130: Western Europe Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 131: Western Europe Value (US$ Million) Analysis by Products, 2019 to 2034

Figure 132: Western Europe Volume (Units) Analysis by Products, 2019 to 2034

Figure 133: Western Europe Value Share (%) and BPS Analysis by Products, 2024 to 2034

Figure 134: Western Europe Y-o-Y Growth (%) Projections by Products, 2024 to 2034

Figure 135: Western Europe Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 136: Western Europe Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 137: Western Europe Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 138: Western Europe Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 139: Western Europe Attractiveness by Type, 2024 to 2034

Figure 140: Western Europe Attractiveness by Application, 2024 to 2034

Figure 141: Western Europe Attractiveness by Technology, 2024 to 2034

Figure 142: Western Europe Attractiveness by Products, 2024 to 2034

Figure 143: Western Europe Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Western Europe Attractiveness by Country, 2024 to 2034

Figure 145: Eastern Europe Value (US$ Million) by Type, 2024 to 2034

Figure 146: Eastern Europe Value (US$ Million) by Application, 2024 to 2034

Figure 147: Eastern Europe Value (US$ Million) by Technology, 2024 to 2034

Figure 148: Eastern Europe Value (US$ Million) by Products, 2024 to 2034

Figure 149: Eastern Europe Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 150: Eastern Europe Value (US$ Million) by Country, 2024 to 2034

Figure 151: Eastern Europe Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 152: Eastern Europe Volume (Units) Analysis by Country, 2019 to 2034

Figure 153: Eastern Europe Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 154: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 155: Eastern Europe Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 156: Eastern Europe Volume (Units) Analysis by Type, 2019 to 2034

Figure 157: Eastern Europe Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 158: Eastern Europe Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 159: Eastern Europe Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 160: Eastern Europe Volume (Units) Analysis by Application, 2019 to 2034

Figure 161: Eastern Europe Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 162: Eastern Europe Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 163: Eastern Europe Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 164: Eastern Europe Volume (Units) Analysis by Technology, 2019 to 2034

Figure 165: Eastern Europe Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 166: Eastern Europe Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 167: Eastern Europe Value (US$ Million) Analysis by Products, 2019 to 2034

Figure 168: Eastern Europe Volume (Units) Analysis by Products, 2019 to 2034

Figure 169: Eastern Europe Value Share (%) and BPS Analysis by Products, 2024 to 2034

Figure 170: Eastern Europe Y-o-Y Growth (%) Projections by Products, 2024 to 2034

Figure 171: Eastern Europe Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 172: Eastern Europe Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 173: Eastern Europe Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 174: Eastern Europe Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 175: Eastern Europe Attractiveness by Type, 2024 to 2034

Figure 176: Eastern Europe Attractiveness by Application, 2024 to 2034

Figure 177: Eastern Europe Attractiveness by Technology, 2024 to 2034

Figure 178: Eastern Europe Attractiveness by Products, 2024 to 2034

Figure 179: Eastern Europe Attractiveness by Distribution Channel, 2024 to 2034

Figure 180: Eastern Europe Attractiveness by Country, 2024 to 2034

Figure 181: South Asia and Pacific Value (US$ Million) by Type, 2024 to 2034

Figure 182: South Asia and Pacific Value (US$ Million) by Application, 2024 to 2034

Figure 183: South Asia and Pacific Value (US$ Million) by Technology, 2024 to 2034

Figure 184: South Asia and Pacific Value (US$ Million) by Products, 2024 to 2034

Figure 185: South Asia and Pacific Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 186: South Asia and Pacific Value (US$ Million) by Country, 2024 to 2034

Figure 187: South Asia and Pacific Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 188: South Asia and Pacific Volume (Units) Analysis by Country, 2019 to 2034

Figure 189: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 190: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 191: South Asia and Pacific Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 192: South Asia and Pacific Volume (Units) Analysis by Type, 2019 to 2034

Figure 193: South Asia and Pacific Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 194: South Asia and Pacific Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 195: South Asia and Pacific Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 196: South Asia and Pacific Volume (Units) Analysis by Application, 2019 to 2034

Figure 197: South Asia and Pacific Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 198: South Asia and Pacific Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 199: South Asia and Pacific Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 200: South Asia and Pacific Volume (Units) Analysis by Technology, 2019 to 2034

Figure 201: South Asia and Pacific Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 202: South Asia and Pacific Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 203: South Asia and Pacific Value (US$ Million) Analysis by Products, 2019 to 2034

Figure 204: South Asia and Pacific Volume (Units) Analysis by Products, 2019 to 2034

Figure 205: South Asia and Pacific Value Share (%) and BPS Analysis by Products, 2024 to 2034

Figure 206: South Asia and Pacific Y-o-Y Growth (%) Projections by Products, 2024 to 2034

Figure 207: South Asia and Pacific Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 208: South Asia and Pacific Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 209: South Asia and Pacific Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 210: South Asia and Pacific Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 211: South Asia and Pacific Attractiveness by Type, 2024 to 2034

Figure 212: South Asia and Pacific Attractiveness by Application, 2024 to 2034

Figure 213: South Asia and Pacific Attractiveness by Technology, 2024 to 2034

Figure 214: South Asia and Pacific Attractiveness by Products, 2024 to 2034

Figure 215: South Asia and Pacific Attractiveness by Distribution Channel, 2024 to 2034

Figure 216: South Asia and Pacific Attractiveness by Country, 2024 to 2034

Figure 217: East Asia Value (US$ Million) by Type, 2024 to 2034

Figure 218: East Asia Value (US$ Million) by Application, 2024 to 2034

Figure 219: East Asia Value (US$ Million) by Technology, 2024 to 2034

Figure 220: East Asia Value (US$ Million) by Products, 2024 to 2034

Figure 221: East Asia Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 222: East Asia Value (US$ Million) by Country, 2024 to 2034

Figure 223: East Asia Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 224: East Asia Volume (Units) Analysis by Country, 2019 to 2034

Figure 225: East Asia Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 226: East Asia Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 227: East Asia Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 228: East Asia Volume (Units) Analysis by Type, 2019 to 2034

Figure 229: East Asia Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 230: East Asia Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 231: East Asia Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 232: East Asia Volume (Units) Analysis by Application, 2019 to 2034

Figure 233: East Asia Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 234: East Asia Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 235: East Asia Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 236: East Asia Volume (Units) Analysis by Technology, 2019 to 2034

Figure 237: East Asia Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 238: East Asia Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 239: East Asia Value (US$ Million) Analysis by Products, 2019 to 2034

Figure 240: East Asia Volume (Units) Analysis by Products, 2019 to 2034

Figure 241: East Asia Value Share (%) and BPS Analysis by Products, 2024 to 2034

Figure 242: East Asia Y-o-Y Growth (%) Projections by Products, 2024 to 2034

Figure 243: East Asia Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 244: East Asia Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 245: East Asia Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 246: East Asia Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 247: East Asia Attractiveness by Type, 2024 to 2034

Figure 248: East Asia Attractiveness by Application, 2024 to 2034

Figure 249: East Asia Attractiveness by Technology, 2024 to 2034

Figure 250: East Asia Attractiveness by Products, 2024 to 2034

Figure 251: East Asia Attractiveness by Distribution Channel, 2024 to 2034

Figure 252: East Asia Attractiveness by Country, 2024 to 2034

Figure 253: Middle East and Africa Value (US$ Million) by Type, 2024 to 2034

Figure 254: Middle East and Africa Value (US$ Million) by Application, 2024 to 2034

Figure 255: Middle East and Africa Value (US$ Million) by Technology, 2024 to 2034

Figure 256: Middle East and Africa Value (US$ Million) by Products, 2024 to 2034

Figure 257: Middle East and Africa Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 258: Middle East and Africa Value (US$ Million) by Country, 2024 to 2034

Figure 259: Middle East and Africa Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 260: Middle East and Africa Volume (Units) Analysis by Country, 2019 to 2034

Figure 261: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 262: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 263: Middle East and Africa Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 264: Middle East and Africa Volume (Units) Analysis by Type, 2019 to 2034

Figure 265: Middle East and Africa Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 266: Middle East and Africa Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 267: Middle East and Africa Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 268: Middle East and Africa Volume (Units) Analysis by Application, 2019 to 2034

Figure 269: Middle East and Africa Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 270: Middle East and Africa Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 271: Middle East and Africa Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 272: Middle East and Africa Volume (Units) Analysis by Technology, 2019 to 2034

Figure 273: Middle East and Africa Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 274: Middle East and Africa Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 275: Middle East and Africa Value (US$ Million) Analysis by Products, 2019 to 2034

Figure 276: Middle East and Africa Volume (Units) Analysis by Products, 2019 to 2034

Figure 277: Middle East and Africa Value Share (%) and BPS Analysis by Products, 2024 to 2034

Figure 278: Middle East and Africa Y-o-Y Growth (%) Projections by Products, 2024 to 2034

Figure 279: Middle East and Africa Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 280: Middle East and Africa Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 281: Middle East and Africa Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 282: Middle East and Africa Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 283: Middle East and Africa Attractiveness by Type, 2024 to 2034

Figure 284: Middle East and Africa Attractiveness by Application, 2024 to 2034

Figure 285: Middle East and Africa Attractiveness by Technology, 2024 to 2034

Figure 286: Middle East and Africa Attractiveness by Products, 2024 to 2034

Figure 287: Middle East and Africa Attractiveness by Distribution Channel, 2024 to 2034

Figure 288: Middle East and Africa Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lamp shades Market Size and Share Forecast Outlook 2025 to 2035

Clamps Market Size and Share Forecast Outlook 2025 to 2035

Clamp Meter Market Analysis for 2025 to 2035

Glamping Market Analysis – Growth & Forecast 2024-2034

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

Heat Lamps Market - Commercial Food Warming & Service Excellence 2025 to 2035

Bale Clamp Intensive Market Size and Share Forecast Outlook 2025 to 2035

Floor Lamp Market Size and Share Forecast Outlook 2025 to 2035

Skull Clamp Market Size and Share Forecast Outlook 2025 to 2035

Strain Clamp Market Size and Share Forecast Outlook 2025 to 2035

Mosquito Lamps Market Size and Share Forecast Outlook 2025 to 2035

Cranial Clamps Market

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Lamps And Units For Aesthetic Medicine Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Lamps Market Growth - Trends & Forecast 2025 to 2035

The Dental Whitening Lamps Market is segmented by Product, Light Source and End User from 2025 to 2035

Subsea Umbilical Clamps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ultra Violet (UV) Lamps Market Analysis - Size, Share, and Demand Outlook from 2025 to 2035

Medical Germicidal Lamps Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Dental Polymerization Lamps Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA