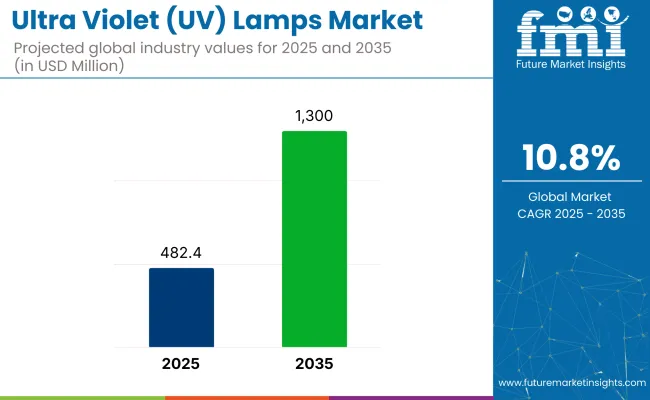

The global ultra violet (UV) lamps market is estimated at USD 482.4 million in 2025 at a CAGR of 10.8%, leading to a valuation of approximately USD 1300 million by the end of the forecast period. These estimates are based on quantitative trends observed across regional and application-level segments. This growth trajectory is being shaped by the increasing demand for safe, efficient, and chemical-free disinfection technologies in public, industrial, and residential sectors.

UV lamps have been widely adopted in water and wastewater treatment, medical sterilization, air purification, and industrial curing, driven by their proven ability to neutralize bacteria, viruses, and other pathogens. With a global pivot toward hygiene and contamination control post-COVID-19, the relevance of UV-based systems has significantly expanded, particularly in high-occupancy infrastructure and mission-critical environments.

Key regulatory bodies-including the USA Environmental Protection Agency (EPA) and the European Centre for Disease Prevention and Control (ECDC)-have endorsed UV disinfection as a supplementary solution for maintaining public health standards.

Furthermore, a research note by Columbia University’s Photonic Disinfection Lab affirms that “UV-C light has demonstrated rapid, high-efficacy inactivation of viruses and bacteria, making it a vital technology in the post-pandemic era” as per Columbia Engineering. Additionally, the World Health Organization has cited UV technologies as a practical, scalable sanitation method, especially in decentralized and low-resource environments.

R&D efforts have led to the introduction of eco-friendly, mercury-free UV lamps, including excimer-based systems and UV-C LEDs. These innovations have been aimed at improving energy efficiency, reducing environmental impact, and enabling integration with IoT-based monitoring systems. The adoption of automated UV disinfection solutions is gaining momentum in healthcare facilities, transit hubs, and smart buildings, reinforcing demand for durable and cost-effective lighting components.

The UV lamps market is thus being driven by a convergence of environmental regulation, public health initiatives, and technological advancement. With increased policy backing, sustained infrastructure spending, and growing awareness about microbial safety, long-term market growth is expected to remain robust through 2035.

The market is segmented based on lamp type, end use application, and region. By lamp type, the market is divided into UV mercury lamps and UV LEDs. Based on end use application, it is categorized into wastewater treatment, water treatment, air treatment, surface disinfection, and food & beverages disinfection. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

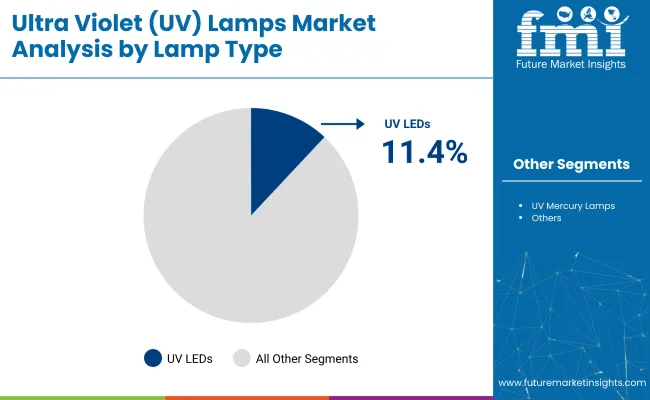

| Lamp Type | CAGR (2025 to 2035) |

|---|---|

| UV LEDs | 11.4% |

The UV LED segment is projected to be the fastest-growing lamp type in the ultra violet (UV) lamps market, registering a CAGR of 11.4% between 2025 and 2035. This rapid growth is fueled by their energy efficiency, mercury-free composition, compact size, and long operational life. UV LEDs are ideal for portable disinfection devices, smart water purification units, air purifiers, and embedded sterilization systems in consumer appliances.

Their instant on/off capability and lower power consumption give them a technological edge over traditional lamps. The rising demand for chemical-free and compact sanitation solutions in healthcare, hospitality, and residential sectors is further accelerating their adoption.

UV mercury lamps, while more established, continue to serve large-scale applications such as wastewater treatment and centralized air disinfection systems. Their high UV intensity, affordability, and compatibility with existing infrastructure make them suitable for municipal and industrial setups. Regulatory familiarity and proven performance sustain their demand in conventional installations.

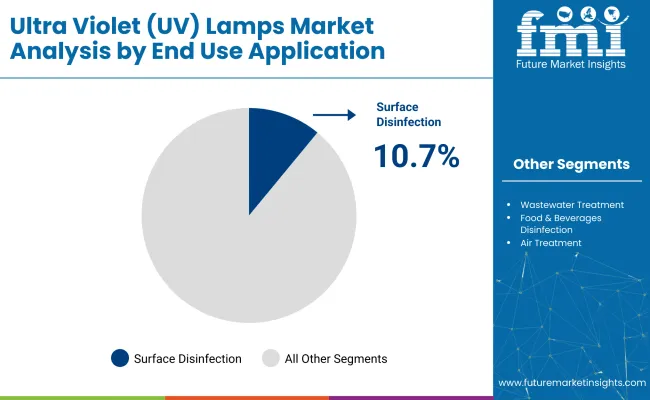

| End Use Application | CAGR (2025 to 2035) |

|---|---|

| Surface Disinfection | 10.7% |

The surface disinfection segment is projected to be the fastest-growing application in the ultra violet (UV) lamps market, expected to grow at a CAGR of 10.7% from 2025 to 2035. This growth is primarily driven by post-pandemic hygiene awareness and infection prevention protocols in hospitals, airports, hotels, and public transport hubs. UV-based surface treatment is gaining popularity as it effectively neutralizes viruses and bacteria without leaving chemical residues, making it a safe and environmentally friendly option. These systems are increasingly used for high-touch areas like door handles, elevator buttons, and checkout counters.

Water treatment and wastewater treatment remain vital segments, especially in municipal and industrial settings seeking chemical-free and low-maintenance disinfection methods. Air treatment is seeing increased adoption in HVAC systems for hospitals, office buildings, and cleanrooms, supporting indoor air quality initiatives. The food & beverages disinfection segment continues to expand steadily with tighter food safety compliance and quality assurance demands.

In North America, the Ultra Violet lamps market is fuelled by mature industrial base and stringent regulatory standards to ensure public health safety. North America is the biggest regional market, with the United States being the largest country, where UV technology is widely adopted in air and water treatment systems, especially in municipal water supply infrastructure and advanced HVAC systems for large commercial buildings. The same is true with Canada, which has seen a booming use of UV lamps as a result of growing demand for clean drinking water and indoor air in schools and homes.

Furthermore, the increasing establishment of smart building automation and energy-efficient building practices are pressuring the incorporation of UV lamps in advanced HVAC systems. Not only do these systems also reduce air pollution, they also increase energy efficiency both meeting sustainability aspirations and more stringent environmental standards. North America will serve as a leader in the future adoption of UV lamps in response to a trifecta of regulatory enforcement, technological improvements and heightened public awareness of the associated health benefits.

The European Ultra Violet lamps market is influenced by its stringent environmental and health regulations concerning water and air quality requirements. Regulations in the European Union on safe drinking water and clean air in the workplace have led to the widespread installation of UV disinfection systems across numerous sectors. Germany, the UK, France and Italy: The regional players where industrial-scale UV water treatment plants and residential air purification systems are staking out in forced.

Another impetus is the continent’s emphasis on renewable energy and sustainable building design. With green building certifications widely established, property developers and facility managers are investing in UV lamp technologies within their HVAC systems to meet even greater energy efficiency and indoor air quality thresholds. Ultraviolet (UV) lamps are also increasingly utilized in wastewater treatment plants, with European cities and industry being forced to use eco-friendly technologies to meet strict effluent limits.

Besides the treatment of water and air, initiatives from the medical and pharmaceutical sector are keeping demand for UV disinfection solutions, especially from Europe. Hospitals and research laboratories depend on UV lamps for key sterilization work, from decontaminating surgical equipment to keeping drug manufacturing environments sterile.

The most effective European resorts constantly fortify their eco-friendly guidelines and health and also health and wellness exercise holders, which is anticipated to add to the increasing demand for progress integrated UV lamp innovation throughout the forecast duration.

The Asia-Pacific region includes emerging economies witnessing significant industrialization, urbanization, and growing health and environmental concerns which contribute to being one of the fastest-growing UV lamp markets. Increased investment in water and waste water treatment facilities and in air quality improvement measures are seen across China, India, Japan, and South Korea. These countries face pressing issues linked to waterborne diseases and air pollution as their populations grow and their industrial bases expand. UV disinfection through the use of UV lamps is a highly effective chemical-free disinfection solution.

A robust manufacturing base allows UV lamps to be manufactured locally in China at competitive costs, which further enhances the market in this country. In contrast, India has on-going demand from urban and rural households, where the growing population and necessity to provide with the safe drinking water supply are backing the adoption of UV-based purification systems.

Challenge

Expensive and underutilised UV lamps

Challenges in the Ultra Violet (UV) Lamps Market include factors such as high initial investment costs, limited adoption in certain regions, and evolving regulatory standards. In the meantime, the advantages of UV lamps in disinfection, sterilization and industrial curing applications are countered with high costs of implementation as well as UV exposure safety issues.

And also the lack of awareness and only few standardized guidelines in developing economies restrict market growth. To avoid these problems manufacturers have to target on budget UV lamp solutions, enhance safety and cooperate with the regulators to reach the guidance for effective UV technology utilization with safety.

Opportunity

Growing Adoption of UV Disinfection and Smart UV Technologies

Increasing adoption of UV disinfection in applications such as healthcare, water treatment, and air purification is expected to create a substantial opportunity for the UV Lamps Market. UV-C technology is being used in various industries, including food processing, municipal water treatment plants, and medical facilities, to eliminate pathogens. We are also seeing the emergence of smart UV lamp systems, where the intensity of the system is monitored in real-time and can be automatically maintained.

Moreover, the trend towards sustainability has led to greater demand for energy-efficient alternatives such as UV LED, which consumes less power and are long-lasting. Smart UV solutions, AI-driven optimization of disinfection processes, and environment-friendly UV lamp technologies are key technologies to invest in.

The need for effective disinfection solutions and regulatory support for clean water and air initiatives drove strong growth from 2020 to 2024 in UV Lamps Market. Examples of these sectors include healthcare, hospitality, and public transportation where adoption was already ramping and accelerated this year with the pandemic.

In contrast, high operational costs, safety concerns, and rivalry from alternative disinfection technologies posed considerable hurdles. As a result, manufacturers have developed safer, more energy-efficient UV lamps and expanded their applications in the industrial and residential sectors.

2025 to 2035, the market will fast develop in ultraviolet (UV) light-emitting diodes (LED) technology, smart monitoring system integration, and other applications expanding by niche, such as ultraviolet light in semiconductor fabrication and in automotive coatings. AI-powered UV disinfection systems will be more efficient while consuming less energy.

The rising focus on environment-friendly solutions will lead to the manufacturing of mercury-free UV lamps and recyclable UV solvents. Businesses that prioritize research and innovation, energy efficiency, and compliance with evolving regulations will drive the next wave of UV technology.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strengthening UV safety regulations in healthcare and water treatment |

| Technological Advancements | Growth in traditional UV-C lamps and mercury-based solutions |

| Industry Adoption | Increased demand in healthcare, water purification, and air sterilization |

| Supply Chain and Sourcing | Dependence on mercury-based UV lamps and limited local manufacturing |

| Market Competition | Dominance of conventional UV lamp manufacturers |

| Market Growth Drivers | Pandemic-driven adoption and regulatory push for clean environments |

| Sustainability and Energy Efficiency | Early-stage development of UV-C LED alternatives |

| Integration of Smart Technologies | Limited use of IoT-based UV monitoring |

| Advancements in Industrial Applications | Primary use in sterilization and disinfection |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global emission-free UV lamp mandates and energy efficiency standards. |

| Technological Advancements | Widespread adoption of UV-C LEDs, AI-powered monitoring, and automated UV intensity adjustments. |

| Industry Adoption | Expansion into semiconductor fabrication, automotive coatings, and precision manufacturing. |

| Supply Chain and Sourcing | Shift toward mercury-free UV LEDs and regionalized production for supply chain stability. |

| Market Competition | Rise of new players specializing in smart UV solutions, AI-integrated disinfection, and UV robotics. |

| Market Growth Drivers | Continued demand for non-chemical disinfection, automation in sanitation, and eco-friendly UV solutions. |

| Sustainability and Energy Efficiency | Large-scale transition to mercury-free, recyclable UV lamps with lower energy consumption. |

| Integration of Smart Technologies | AI-driven UV intensity adjustments, remote diagnostics, and real-time performance analytics. |

| Advancements in Industrial Applications | Expansion into semiconductor lithography, automotive coatings, and advanced material curing. |

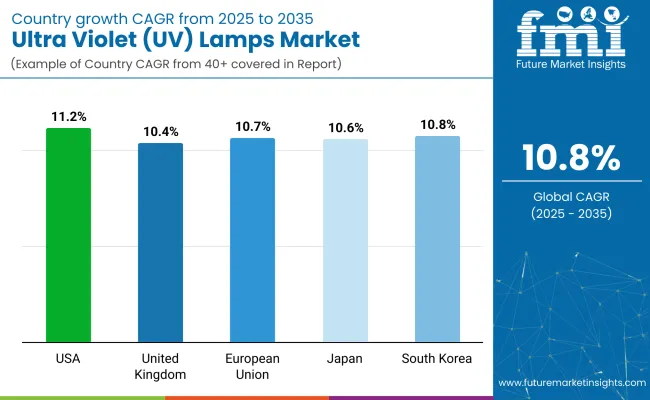

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.2% |

The United States UV lamps market is gaining momentum with increasing adoption of UV disinfection technologies by the healthcare, water treatment, and food processing industries. Strict water quality and sterilization conditions set by environmental protection agency (EPA) and food, and drug administration (FDA) are expected to drive the market of UV-C disinfection system.

UV lamps are widely used in the healthcare sector for sterilizing hospitals, Purifying air, and disinfecting medical devices. Furthermore, growing investments in semiconductor manufacturing are propelling the demand for UV curing and lithography applications.

The availability of commercial, healthcare, and residential segments provides ample opportunities due to the increasing demand for sustainable disinfection solutions.

Increasing demand for water purification, air disinfection, and industrial curing applications is driving the growth of the United Kingdom UV lamps market. To satisfy the highest health standards for drinking water and wastewater, the UK’s Environmental Agency and public health authorities are advocating UV-based water treatment solutions.

Key adopting industries are food & beverage and pharmaceuticals, where UV lamps are used for pathogen elimination and quality control. Furthermore, the increasing integration of UV-C disinfection systems in public transport systems, such as buses and trains, as well as in commercial buildings and offices, is fuelling the market expansion.

With growing attention towards sustainability and health safety standards in the UK, the UV Lamps market will overcome all challenges and thrive.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.4% |

The ultraviolet (UV) lamps market in Europe is broadening, attributed to stringent environmental regulations, rising investment in intelligent water treatment, and rising use in healthcare and industrial applications. Germany, France and Italy, among others, are leading markets for UV-C disinfection and industrial processing.

UV-based water and air purification technologies are driven by the EU’s Drinking Water Directive and Industrial Emissions Directive. Moreover, the increasing semiconductor and electronics industries in Germany and the Netherlands are fuelling the demand for UV curing and lithography applications.

Due to the rising demand for chemical-free and eco-friendly disinfection services, the EU UV lamps industry will continue to grow in the approaching year

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.7% |

Strong demand for ultraviolet disinfection in healthcare, semiconductor manufacturing, and industrial applications is driving growth in the Japanese market for UV lamps. Demand for these lamps in hospitals, laboratories and public transportation in Japan is provided by its aging population and focus on healthcare innovation.

The semiconductor and electronics industries, for instance, consume a great deal of UV lamps for photolithography and high-precision manufacturing and are largely dominated by Tokyo Electron and Canon. Further, rising implementation of smart UV sterilization systems in households and offices is driving the market demand.

Through continuous introduction of new releases in UV LED technology and increasing investment in disinfection solutions, the Japanese UV lamps market will grow at a strong and steady pace

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.6% |

The South Korean Market for UV Lamps is booming, with demand in semiconductor, healthcare, and smart buildings applications growing. Investment in smart cities and water purification projects in Mr Kim’s home country of South Korea is, meanwhile, accelerating adoption of UV-based air and water disinfection technologies.

Samsung and LG are among the key consumers of UV curing and lithography systems in the electronics and display manufacturing industries. Moreover, the growing adoption of ultraviolet germicidal irradiation in residential and commercial structures boosts the demand for Internet of Things (IoT)-enabled and artificial intelligence (AI) powered ultraviolet sterilizer.

The South Korean UV Lamp Market is anticipated to grow at a steady rate when ongoing efficiency advancements in UV LEDs and increasing regulations on air and water pollution are driven.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.8% |

The global ultra violet (UV) lamps market is gaining traction owing to the rising need for water and air disinfection, industrial curing, as well as medical sterilization applications. AI-powered UV sterilization systems, their energy-efficient UV-C LEDs, and advanced UV phototherapy solutions for efficacy, safety, and sustainability are all focused by the companies. End-users range from global suppliers of lighting products to specialized manufacturers of UV systems. There are significant technological developments in the areas of germicidal UV lamps, excimer lamps, and UV-based curing systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Signify N.V. (Philips Lighting) | 15-20% |

| Heraeus Holding GmbH | 12-16% |

| Xylem Inc. (Wedeco UV Systems) | 10-14% |

| Atlantic Ultraviolet Corporation | 8-12% |

| American Ultraviolet | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Signify N.V. (Philips Lighting) | Develops UV-C disinfection lamps, AI-driven smart UV systems, and industrial-grade UV air purifiers. |

| Heraeus Holding GmbH | Specializes in excimer UV lamps, high-intensity UV curing systems, and medical-grade UV sterilization solutions. |

| Xylem Inc. (Wedeco UV Systems) | Manufactures UV water purification systems, wastewater treatment UV lamps, and chemical-free sterilization technologies. |

| Atlantic Ultraviolet Corporation | Provides germicidal UV lamps, UV-C disinfection units, and high-efficiency UV sterilization chambers. |

| American Ultraviolet | Offers hospital-grade UV sterilization robots, industrial UV curing lamps, and phototherapy UV solutions. |

Key Company Insights

Signify N.V. (Philips Lighting) (15-20%)

Signify is among the market leaders in UV lamps, which power AI-optimized UV-C hospital, office and public space disinfection.

Heraeus Holding GmbH (12-16%)

Heraeus is adept with excimer UV and high-intensity UV lamps, providing superior sterilization for medical and industrial uses.

Xylem Inc. (Wedeco UV Systems) (10-14%)

Xylem UV water polishers offer advanced disinfection and chemical-free treatment for this effluent.

Atlantic Ultraviolet Corporation (8-12%)

Atlantic Ultraviolet creates germicidal UV lamps and air purification systems, encompassing intelligent disinfection technology.

American Ultraviolet (5-9%)

American Ultraviolet is a manufacturer of hospital-grade UV sterilizers, industrial UV curing lamps, and phototherapy devices.

Other Key Players (40-50% Combined)

Participating companies under this category include several industrial lighting and disinfection technology companies that are instrumental in next-generation UV lamp innovations, AI-powered sterilization systems, and sustainable UV generation disinfection solutions. These include:

The overall market size for Ultra Violet (UV) Lamps Market was USD 482.4 Million in 2025.

The Ultra Violet (UV) Lamps Market expected to reach USD 1.3 Billion in 2035.

The demand for UV lamps will be driven by factors such as growing concerns over water, air, and surface disinfection, increasing adoption in healthcare, food processing, and wastewater treatment industries. Additionally, the rise in environmental awareness and stringent regulations on sanitation will further propel market growth.

The top 5 countries which drives the development of Ultra Violet (UV) Lamps Market are USA, UK, Europe Union, Japan and South Korea.

UV Mercury Lamps and UV LEDs Drive Market Growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Lamp Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Lamp Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by z, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by z, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Lamp Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Lamp Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by z, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by z, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Lamp Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Lamp Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by z, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by z, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Lamp Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Lamp Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by z, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by z, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Lamp Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Lamp Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by z, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by z, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Lamp Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Lamp Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by z, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by z, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Lamp Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Lamp Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by z, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by z, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Lamp Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Lamp Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by End-Use Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by z, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by z, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Lamp Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by z, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Lamp Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Lamp Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Lamp Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Lamp Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by z, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by z, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by z, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by z, 2023 to 2033

Figure 21: Global Market Attractiveness by Lamp Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End-Use Application, 2023 to 2033

Figure 23: Global Market Attractiveness by z, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Lamp Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by z, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Lamp Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Lamp Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Lamp Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Lamp Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by z, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by z, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by z, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by z, 2023 to 2033

Figure 45: North America Market Attractiveness by Lamp Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 47: North America Market Attractiveness by z, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Lamp Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by z, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Lamp Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Lamp Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Lamp Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Lamp Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by z, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by z, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by z, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by z, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Lamp Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by z, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Lamp Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by z, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Lamp Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Lamp Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Lamp Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Lamp Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by z, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by z, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by z, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by z, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Lamp Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by End-Use Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by z, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Lamp Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by z, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Lamp Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Lamp Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Lamp Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Lamp Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by z, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by z, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by z, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by z, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Lamp Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by End-Use Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by z, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Lamp Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by z, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Lamp Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Lamp Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Lamp Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Lamp Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by z, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by z, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by z, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by z, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Lamp Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by End-Use Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by z, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Lamp Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by z, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Lamp Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Lamp Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Lamp Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Lamp Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by z, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by z, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by z, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by z, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Lamp Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by End-Use Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by z, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Lamp Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by z, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Lamp Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Lamp Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Lamp Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Lamp Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by End-Use Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by z, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by z, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by z, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by z, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Lamp Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by End-Use Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by z, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultra Short Base Line (USBL) Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Low Temperature Perfluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Market Size and Share Forecast Outlook 2025 to 2035

Ultra High Bond (UHB) Tape Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultralight Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Jewelry Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Ultra High Purity (UHP) Valve Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Fine Ath Market Size and Share Forecast Outlook 2025 to 2035

Ultra High Precision Power Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Ultra-thin Temperature Plate Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic NDT Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultra Wideband Anchor and Tags Market Size and Share Forecast Outlook 2025 to 2035

Ultra-High Definition (UHD) Panel (4K) Market Size and Share Forecast Outlook 2025 to 2035

Ultrapure Water Market Size and Share Forecast Outlook 2025 to 2035

Ultra High Performance Concrete Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Air Bubble Detectors Market Size and Share Forecast Outlook 2025 to 2035

Ultracapacitors Market Size and Share Forecast Outlook 2025 to 2035

Ultra-Low Temperature Freezers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA