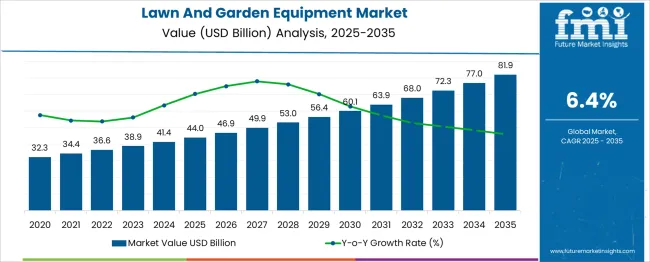

The Lawn and Garden Equipment Market is estimated to be valued at USD 44.0 billion in 2025 and is projected to reach USD 81.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. For investors and senior management, the dataset reveals a strong, steady trajectory with meaningful acceleration in the second half of the forecast period. From 2025 to 2030, the market grows from USD 44.0 billion to USD 60.1 billion, delivering USD 16.1 billion in incremental value.

This represents roughly 42% of the decade’s total growth. The first half of the cycle is driven by replacement demand, steady product innovation in battery-powered and autonomous equipment, and stable growth in established regions. For strategic planning, this phase favors companies with strong brand recognition and established retail distribution.

From 2030 to 2035, it will contribute USD 21.8 billion, or 58% of total growth, pushing the market to USD 81.9 billion. This acceleration reflects deeper market penetration of high-margin smart and connected lawn equipment, adoption in emerging economies, and higher replacement rates as technology cycles shorten.

The strongest single-year gain is observed between 2034 and 2035, at USD 4.9 billion, signaling continued momentum. Positioning for this late-stage growth will require aggressive expansion into untapped markets and leadership in product innovation to secure premium pricing.

| Metric | Value |

|---|---|

| Lawn And Garden Equipment Market Estimated Value in (2025 E) | USD 44.0 billion |

| Lawn And Garden Equipment Market Forecast Value in (2035 F) | USD 81.9 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The lawn and garden equipment market is viewed as a specialized yet steadily expanding category across broader parent industries. It is estimated to account for about 3.0% of the global outdoor power equipment market given its role in home and commercial grounds maintenance. Within the consumer gardening and landscaping tools sector a share of approximately 4.2% is assessed driven by demand for residential lawn mowers, trimmers, and leaf blowers.

In the commercial groundskeeping and turf equipment industry around 3.5% is observed supported by use in professional landscaping and sports facilities. Within the battery-powered cordless outdoor tools segment about 2.8% is evaluated as electrification gains momentum. In the sustainable and low emission garden solutions industry a contribution of roughly 2.1% is calculated reflecting interest in eco friendly equipment and campaigns to reduce gas-powered tools.

Trends in this market have been shaped by strong growth in battery-operated mower and trimmer models which offer quieter, emission free operation. Innovations have been focused on robotic lawn mowers featuring scheduling automation, collision avoidance and smartphone pairing for control and monitoring. Interest has increased in ergonomic designs, lighter frame materials and interchangeable battery platforms that integrate across tool ecosystems.

The Europe region has been observed to lead early adoption of zero emission garden tools while North America has shown sustained demand for high performance cordless systems. Strategic initiatives have included partnerships between battery producers and equipment manufacturers to deliver extended range power modules, modular attachments and integrated service platforms that support maintenance scheduling and usage analytics.

The lawn and garden equipment market is expanding steadily, driven by increased consumer interest in home improvement, rising adoption of landscaping in residential and commercial projects, and the growing popularity of hobby gardening. Environmental concerns and urban planning initiatives have encouraged green spaces, further reinforcing the demand for efficient, durable, and low-maintenance equipment.

Manufacturers are aligning with smart technology and ergonomic designs to cater to convenience-driven users, while e-commerce growth is enhancing accessibility and product variety. Regulatory policies promoting noise and emission reduction are also reshaping product innovation toward electric-powered tools.

Future market dynamics are expected to be influenced by sustainability benchmarks, digitized performance features, and the integration of battery-operated platforms across segments.

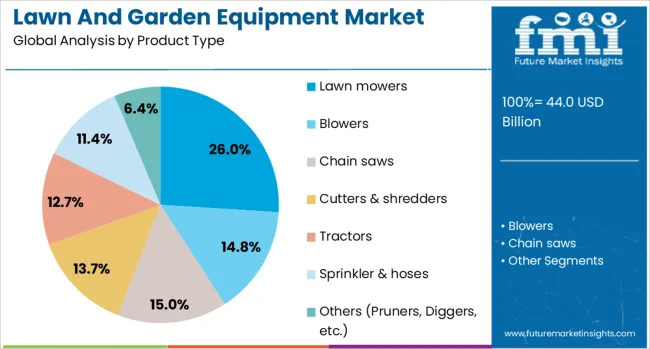

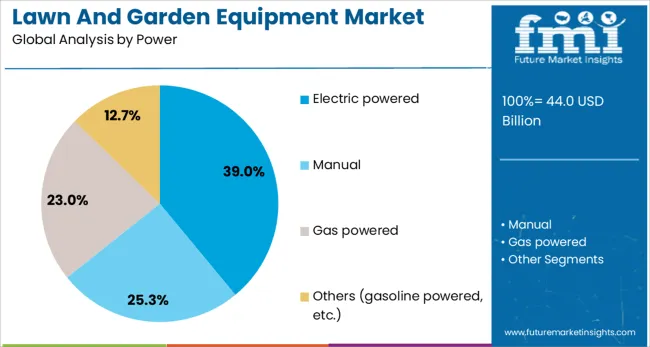

The lawn and garden equipment market is segmented by product type, power, price, end use, distribution channel, and geographic regions. The lawn and garden equipment market is divided by product type into Lawn mowers, Blowers, chainsaws, Cutters & shredders, Tractors, sprinklers & hoses, and Others (Pruners, Diggers, etc.). The lawn and garden equipment market is classified into electric-powered, Manual, gas-powered, and Others (gasoline-powered, etc.).

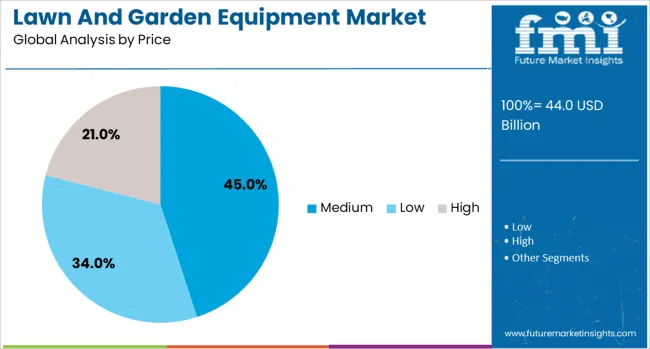

Based on the price of the lawn and garden equipment market, it is segmented into Medium, Low, and High. The lawn and garden equipment market is segmented by end use into Residential, Commercial, and Others (public parks, institutions, and community spaces). The distribution channel of the lawn and garden equipment market is segmented into Offline and Online.

Regionally, the lawn and garden equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Lawn mowers are projected to lead the market with a 26.00% revenue share in 2025, supported by their necessity in both residential lawn care and commercial landscaping.

Growth in single-family housing units, coupled with emphasis on outdoor aesthetics, has reinforced consistent demand for lawn mowers.

Their evolving compatibility with electric and robotic technologies is also expanding their application across suburban and urban environments.

Electric-powered equipment is estimated to capture 39.00% of the total market share in 2025, reflecting a transition toward eco-friendly and quieter alternatives.

Increased consumer awareness of carbon emissions, combined with stricter emission standards, is accelerating the adoption of electric lawn and garden tools.

Technological advances in battery life, charging efficiency, and power delivery are further making these models more competitive against traditional fuel-based equipment.

The medium price range is anticipated to hold 45.00% of the market in 2025, driven by a balance of cost-effectiveness and quality features sought by mainstream consumers.

This segment is witnessing demand from homeowners and professional landscapers who prioritize value and durability without incurring premium costs.

Strategic pricing by manufacturers and bundled offerings through retail channels are reinforcing this category’s dominance.

Lawn and garden equipment has been widely used in residential, commercial, and public landscaping projects for mowing, trimming, planting, and maintenance activities. The expansion of home gardening, landscaping services, and sports field maintenance has supported demand. Equipment categories such as lawn mowers, trimmers, blowers, tillers, and irrigation systems have been in consistent use across markets. Manufacturers have been focusing on cordless battery-powered models, ergonomic designs, and low-emission engines to meet user preferences while adhering to evolving performance and environmental standards.

The growth of home gardening and outdoor landscaping projects has been a significant driver for lawn and garden equipment demand. Homeowners have invested in mowers, hedge trimmers, and leaf blowers to maintain lawns, flower beds, and decorative landscapes. In regions with strong suburban housing development, equipment purchases have been linked to property enhancement and aesthetic appeal. Retailers and e-commerce platforms have expanded the availability of compact, lightweight, and easy-to-use tools suitable for small gardens and yards. The rising popularity of vegetable gardens and backyard recreational spaces has further encouraged equipment purchases. Seasonal demand spikes during spring and summer have been common in North America and Europe, with product promotions and bundled sales driving purchase decisions.

Lawn and garden equipment has been extensively used in commercial landscaping services, golf courses, parks, and sports facilities to maintain turf quality and visual appeal. Professional-grade mowers, aerators, and irrigation systems have been in high demand for large-scale maintenance projects. Sports stadiums and golf clubs have invested in advanced turf management equipment to meet performance and aesthetic requirements. Landscaping contractors have preferred durable, high-output machines that can withstand frequent use while delivering consistent results. Manufacturers in the United States, Germany, and Japan have developed heavy-duty models with wider cutting decks, automated controls, and GPS-assisted navigation for efficiency. The consistent demand from commercial sectors has helped offset seasonal fluctuations seen in residential markets.

Advances in battery technology, automation, and connectivity have transformed the performance of lawn and garden equipment. Cordless electric tools have offered reduced noise, lower emissions, and minimal maintenance compared to gasoline-powered models. Robotic lawn mowers with programmable schedules and obstacle detection have gained popularity among time-conscious users. Integration with mobile apps has allowed real-time monitoring of battery status, usage patterns, and maintenance reminders. Manufacturers have incorporated ergonomic handles, vibration reduction systems, and adjustable height settings to improve comfort during operation. In irrigation systems, smart controllers and moisture sensors have enabled precise water usage, reducing waste while maintaining healthy landscapes. These innovations have expanded product appeal across both professional and home user segments.

The lawn and garden equipment market has faced growth limitations due to high upfront costs for advanced models and seasonal demand patterns. Premium battery-powered tools, robotic mowers, and heavy-duty commercial machines have been priced beyond the reach of budget-conscious consumers. Seasonal sales peaks in spring and summer have resulted in underutilized manufacturing capacity during off-peak months. In regions with limited green spaces or prolonged winters, demand for lawn and garden equipment has remained low. Maintenance costs, battery replacement expenses, and fuel price fluctuations have also influenced purchasing decisions. Without strategies to reduce equipment costs, expand rental services, and increase off-season utility, market penetration may remain dependent on seasonal landscaping trends.

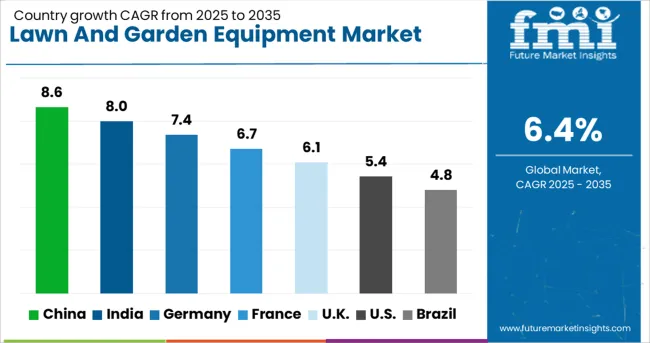

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The lawn and garden equipment market is expected to grow at a global CAGR of 6.4% between 2025 and 2035, driven by rising interest in landscaping, growth of urban green spaces, and technological advancements in gardening tools. China leads with an 8.6% CAGR, supported by large-scale manufacturing capabilities and expanding domestic landscaping projects. India follows at 8.0%, fueled by urban development, residential gardening trends, and hospitality sector landscaping. Germany, at 7.4%, benefits from high-quality engineering and demand for eco-friendly, battery-powered equipment. The UK, projected at 6.1%, sees steady growth from home gardening culture and public park maintenance. The USA, at 5.4%, reflects consistent demand from landscaping services and DIY gardening enthusiasts. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 8.6% from 2025 to 2035 in the lawn and garden equipment market, supported by rapid growth in landscaping services and residential property developments with private gardens. Domestic brands such as Greenworks, Supow, and Zhejiang Changjiang are expanding their range of battery-powered lawn mowers, hedge trimmers, and leaf blowers. Urban beautification projects and public park expansions are also contributing to steady equipment demand. Technological advancements, including robotic mowers with AI-assisted navigation, are gaining attention among high-income households and commercial landscaping firms.

India is forecasted to achieve a CAGR of 8.0% from 2025 to 2035, driven by increasing investment in horticulture, golf course development, and urban landscaping. Key suppliers such as Honda Power Products India, Husqvarna India, and STIHL India are introducing compact and fuel-efficient lawn equipment tailored to local conditions. Rising popularity of gated communities with shared green spaces is boosting demand for professional landscaping tools. Government-funded green city initiatives are also contributing to market growth.

Germany is projected to post a CAGR of 7.4% from 2025 to 2035, supported by strong demand for precision-engineered tools and environmentally friendly garden care solutions. Leading brands such as Gardena, Bosch Power Tools, and Einhell Germany are focusing on cordless electric equipment powered by advanced lithium-ion batteries. Robotic mowing technology is highly popular, with growing adoption among residential users seeking low-maintenance lawn care solutions. Integration with smartphone apps for remote monitoring and scheduling is further enhancing appeal.

The United Kingdom is expected to record a CAGR of 6.1% from 2025 to 2035, driven by home gardening trends and the professional landscaping sector. Companies such as Mountfield, Hayter, and Husqvarna UK are offering lightweight, easy-to-store electric tools suitable for small gardens typical in urban housing. The expansion of garden centers and DIY retail outlets is boosting consumer accessibility. Weather-adapted equipment, such as wet-grass compatible mowers, is increasingly in demand.

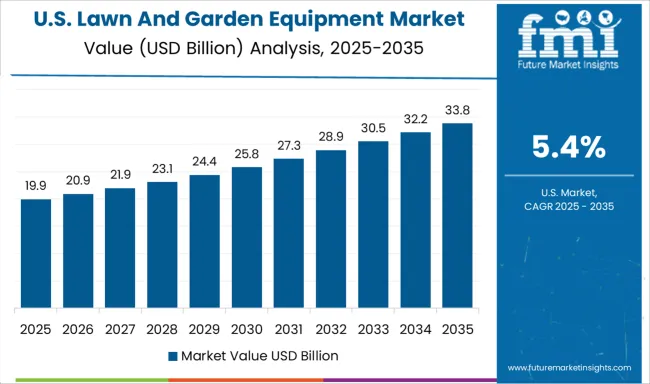

The United States is forecasted to grow at a CAGR of 5.4% from 2025 to 2035, supported by a large base of residential lawn owners and a strong commercial landscaping industry. Manufacturers such as John Deere, Toro, and MTD Products are introducing zero-turn mowers, battery-powered leaf blowers, and robotic mowing systems for diverse property sizes. Growth in professional landscaping services and golf course maintenance is contributing to steady demand. Consumer interest in smart, app-connected lawn care systems is also increasing.

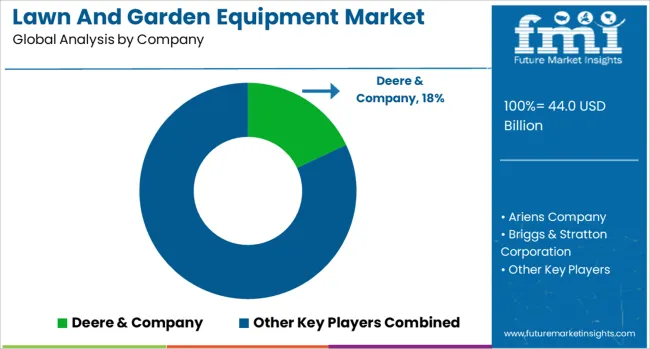

The lawn and garden equipment market is led by global power equipment brands and specialized tool manufacturers serving residential, commercial landscaping, and municipal maintenance sectors. Deere & Company and Husqvarna Group dominate with extensive portfolios of lawn tractors, robotic mowers, and handheld power tools, supported by global dealer networks.

Honda Motor Co., Ltd. and Kubota Corporation supply premium gas-powered and electric mowers, tillers, and utility vehicles, focusing on durability and performance. MTD Holdings Inc, now under Stanley Black & Decker, offers a wide range of consumer and professional-grade lawn equipment through brands such as Cub Cadet and Troy-Bilt. Ariens Company specializes in snow blowers and zero-turn mowers, catering to both residential and commercial users.

Briggs & Stratton Corporation provides engines and complete outdoor power equipment solutions, often partnering with OEMs for integration into branded machines. Robert Bosch GmbH and Makita Corporation lead in cordless and battery-powered garden tools, leveraging advancements in lithium-ion technology for quieter, low-maintenance operation. Fiskars Group and Falcon Garden Tools focus on manual tools such as pruners, shears, and spades, appealing to home gardening enthusiasts.

Koki Holdings Co., Ltd. (HiKOKI) targets the professional landscaping segment with heavy-duty power tools and garden machinery. Key strategies include expanding battery-powered equipment lines, developing smart and robotic mowing solutions, and strengthening retail and dealer channels. Entry barriers include brand loyalty in established markets, high R&D costs for robotics and battery technology, and the need for widespread service and parts support.

| Item | Value |

|---|---|

| Quantitative Units | USD 44.0 Billion |

| Product Type | Lawn mowers, Blowers, Chain saws, Cutters & shredders, Tractors, Sprinkler & hoses, and Others (Pruners, Diggers, etc.) |

| Power | Electric powered, Manual, Gas powered, and Others (gasoline powered, etc.) |

| Price | Medium, Low, and High |

| End Use | Residential, Commercial, and Others (public parks, institutions, and community spaces) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Deere & Company, Ariens Company, Briggs & Stratton Corporation, Falcon Garden Tools, Fiskars Group, Honda Motor Co., Ltd, Husqvarna Group, Koki Holdings Co., Ltd, Kubota Corporation, Makita Corporation, MTD Holdings Inc, Robert Bosch GmbH, and Stanley Black & Decker |

| Additional Attributes | Dollar sales by equipment type and end‑user segment, demand dynamics across residential homeowners, landscaping professionals, and institutional/commercial users, regional trends in gasoline-powered vs electric/battery-powered and manual (push/reel) vs robotic/automated tools adoption, innovation in robotic mowers, smart irrigation systems, high-capacity lithium-ion battery tools, and multi-function hybrid devices, environmental impact of emissions, noise pollution, battery/e‑waste disposal and lifecycle energy intensity, and emerging use cases in urban micro‑gardening, community landscaping services, smart connected gardens, and rental-based tool-sharing models. |

The global lawn and garden equipment market is estimated to be valued at USD 44.0 billion in 2025.

The market size for the lawn and garden equipment market is projected to reach USD 81.9 billion by 2035.

The lawn and garden equipment market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in lawn and garden equipment market are lawn mowers, blowers, chain saws, cutters & shredders, tractors, sprinkler & hoses and others (pruners, diggers, etc.).

In terms of power, electric powered segment to command 39.0% share in the lawn and garden equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lawn And Garden Equipment Afterparts Market Size and Share Forecast Outlook 2025 to 2035

Lawn and Garden Consumables Market Size and Share Forecast Outlook 2025 to 2035

Cordless Garden Equipment Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Lawn and Leaf Bags Market Size and Share Forecast Outlook 2025 to 2035

Lawn Aerators Market

Garden Digging Tools Market

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA