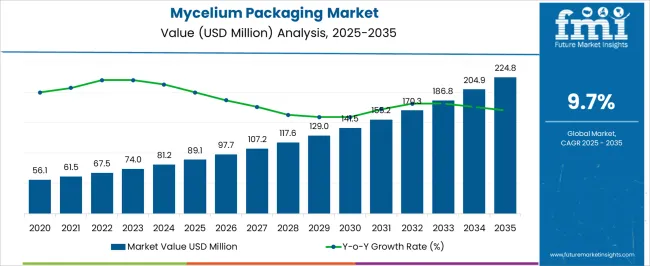

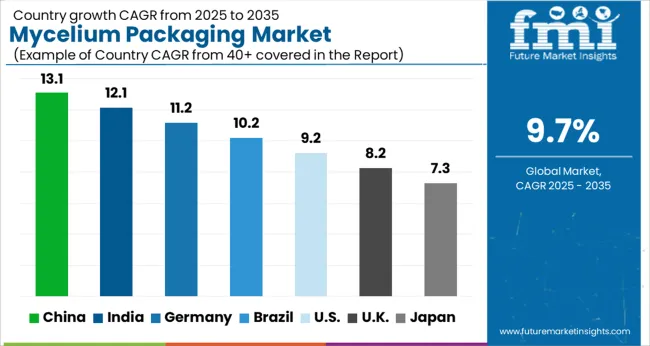

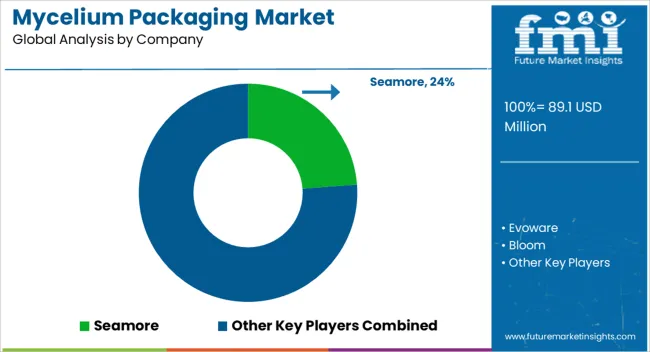

The Mycelium Packaging Market is estimated to be valued at USD 89.1 million in 2025 and is projected to reach USD 224.8 million by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Mycelium Packaging Market Estimated Value in (2025 E) | USD 89.1 million |

| Mycelium Packaging Market Forecast Value in (2035 F) | USD 224.8 million |

| Forecast CAGR (2025 to 2035) | 9.7% |

The mycelium packaging market is expanding as industries transition toward sustainable alternatives to plastic and synthetic foams. Increasing consumer awareness of environmental issues and stricter regulations on single use plastics have accelerated adoption of biodegradable packaging solutions.

Mycelium based materials provide strength, lightweight properties, and natural biodegradability, positioning them as a viable choice for protective and cushioning applications. Continuous investments in scaling production processes and advancements in material engineering are supporting broader commercial adoption across diverse industries.

The outlook remains strong as brands focus on reducing carbon footprints and aligning with circular economy principles, creating a favorable environment for growth in the global mycelium packaging market.

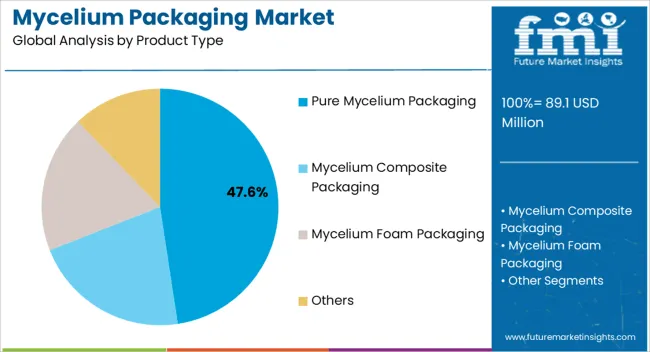

The pure mycelium packaging segment is expected to contribute 47.60% of the total market revenue by 2025 within the product type category, making it the leading segment. Its dominance is driven by its superior biodegradability, renewable sourcing, and ability to serve as a direct replacement for traditional petroleum based packaging materials.

The material offers natural insulation, strength, and lightweight characteristics that make it suitable for protective packaging solutions. Growing investments in eco friendly technologies and increasing corporate commitments to sustainable practices are reinforcing demand.

As industries emphasize waste reduction and environmental stewardship, pure mycelium packaging continues to gain market share and recognition.

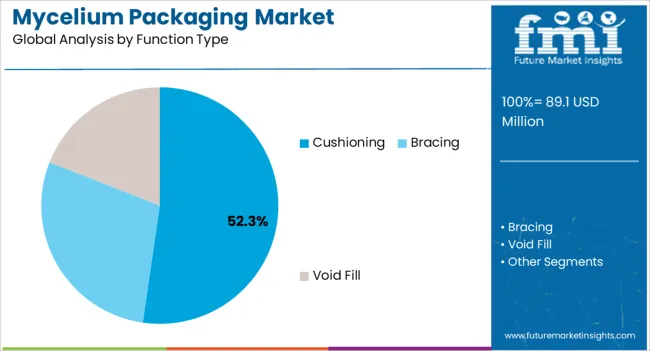

The cushioning segment is projected to account for 52.30% of the overall market revenue by 2025 under the function type category, positioning it as the most significant function. The growth of this segment is being supported by rising demand for protective packaging across e commerce, electronics, and fragile goods industries.

Cushioning made from mycelium offers superior shock absorption and biodegradability compared to synthetic foams, aligning with environmental goals and customer expectations. Companies are increasingly adopting cushioning solutions to enhance product safety during shipping while demonstrating sustainable practices.

The versatility of mycelium in creating customizable cushioning forms has further accelerated its dominance in this segment.

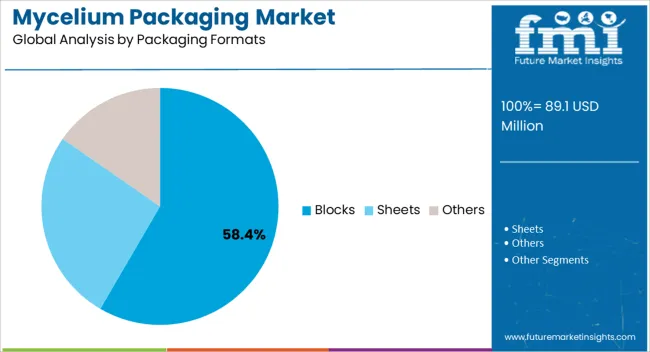

The blocks segment is anticipated to hold 58.40% of total revenue by 2025 within the packaging formats category, establishing it as the largest format. Blocks have gained preference due to their structural strength, ease of use, and adaptability across multiple packaging applications.

They are particularly valued in industries where safe transportation of heavy or delicate products is required. The natural biodegradability of mycelium blocks offers a sustainable alternative to polystyrene blocks, which are facing regulatory restrictions.

Continuous innovation in design flexibility and scalability has enhanced the adoption of blocks, ensuring their continued leadership in the packaging formats segment.

The future outlook of the mycelium packaging market looks promising as more and more companies are realizing the importance of sustainable packaging solutions.

Consumers are becoming more environmentally conscious. Moreover, they are opting for and promoting eco-friendly products which is cushioning the market growth.

One of the key factors driving the growth of the market is the increasing adoption of circular economy principles by businesses. With the circular economy model, materials are reused and recycled, reducing waste and conserving natural resources.

Mycelium-based packaging is a perfect fit for this model, as it is biodegradable, compostable, and can be recycled into new products.

Another trend that is expected to shape the future of the market is the development of innovative technologies.

Researchers and companies are continuously exploring new methods to enhance the properties of mycelium-based packaging. Such as making it more durable, moisture-resistant, and fire-retardant. Additionally, there is potential for new applications of mycelium in the packaging industry beyond just packaging, such as in insulation and construction materials.

The growth of the market also depends on the availability and cost of mycelium-based materials. As more companies enter the market, there may be increased competition for raw materials, which could drive up prices.

However, advancements in production methods and increased scalability could help reduce costs and make mycelium-based packaging more accessible.

The market is estimated to expand at 9.7% CAGR between 2025 and 2035, in comparison to 4.4% CAGR registered during 2020 to 2025.

The rising demand for mycelium packaging solutions has led to the emergence of new businesses and startups in the packaging industry. This is focused on developing innovative and sustainable solutions.

This has created new opportunities for entrepreneurs and investors to invest in this sector and contribute to the growth of the industry. Furthermore, the adoption of mycelium packaging by sizable corporations and retail chains is also driving the growth of the industry.

These companies are increasingly recognizing the importance of sustainability and are incorporating mycelium packaging into their packaging solutions.

Governments and regulating authorities are spreading a notion of sustainability in their respective region. They are highly favoring sustainability, especially in the consumer goods section through policies and campaigns.

FMI anticipates the segment to acquire more than 77.2% of the market share in 2025. The usage of mycelium packing in a solid, block-like structure is referred to as block formats.

This approach has become increasingly popular in the mycelium packaging market due to its versatility and user-friendliness.

One key advantage of block formats is their ability to be easily molded into a variety of shapes and sizes. As a result, they are perfect for a wide range of packaging applications, from preserving fragile objects during transportation to creating eye-catching retail packaging.

Mycelium blocks also have great insulating characteristics, making them perfect for shipping sensitive products such as electronics or perishable commodities. They can also be laced with natural antibacterial agents to help keep foods fresh and enhance their shelf-life.

Consumer Goods to Acquire 45.3% Market Share of Mycelium Packaging Market

Mycelium provides a viable alternative to traditional materials such as plastic. Mycelium packaging is biodegradable and compostable. This means that microorganisms can readily break it down into natural components such as water, carbon dioxide, and organic matter.

Furthermore, mycelium packaging can be customized to meet the needs of various consumer goods, such as food, cosmetics, and electronics. Its shape and size variability make it an appealing solution for businesses trying to lower their carbon footprint.

Mycelium packaging is also visually appealing, with its natural and organic appearance making it stick out on store shelves. This can assist brands in distinguishing themselves from their competitors.

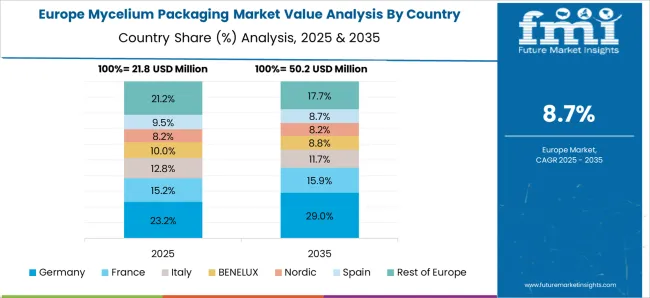

There has been a substantial surge in companies in Europe developing mycelium-based packaging solutions in recent years. These companies are collaborating with diverse industries, including food and beverage, cosmetics, and healthcare.

To create customized mycelium packaging products that match their requirements. In addition, several European research institutes and universities are conducting considerable research on mycelium-based materials and their applications in a variety of industries, including packaging.

This has resulted in the development of novel mycelium packaging options. Such as mycelium foam and mycelium leather, which have piqued the interest of both businesses and consumers.

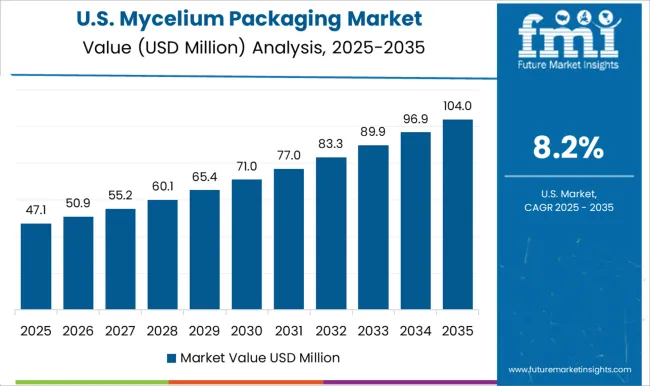

United States to Surpass the Market Share of 15.1% in 2025

In recent years, there has been an increase in interest in mycelium packaging because of a growing desire for sustainable and eco-friendly packaging options.

Ecovative Design, a significant player in the United States, has been at the forefront of mycelium-based packaging development. Mushroom packaging is another prominent competitor in the country, producing biodegradable packaging materials manufactured from agricultural waste and mycelium.

Other companies, including IKEA and Patagonia, have expressed interest in mycelium packaging as a more environmentally friendly alternative.

Region to witness a CAGR of 8.9% during the analysis period. Several Indian startups and businesses have entered the market and are developing novel solutions.

For example, BIO-LUTIONS, a Bangalore-based firm, has created mycelium-based packaging products that may be used for food packaging as well as cushioning and insulation in electronic items. Furthermore, collaborations between Indian and international companies are underway to bring advanced mycelium packaging technologies to India.

Ecovative, a leading mycelium packaging firm based in the United States, for example, has collaborated with Indian companies to bring their goods to the Indian market.

Some key players in this market include Ecovative Design, Evocative, MycoWorks, and Biohm. These companies are constantly investing in research and development to improve the quality of their products and to increase their production capacity.

Ecovative Design is one of the leading players in the market. The company has a strong presence in North America and Europe and is expanding its operations in other regions as well. It has developed a unique technology that uses mycelium to create a wide range of products, including packaging, insulation, and furniture.

MycoWorks is another leading player in the market. The company has developed a proprietary technology that allows it to produce mycelium-based materials that are stronger and more durable than traditional materials. It has collaborated with several leading brands in the fashion and automotive industries to create innovative products.

Biohm is a company that specializes in sustainable construction materials. It has recently entered the market and is exploring ways to use mycelium to create eco-friendly packaging solutions.

The company has a strong focus on sustainability and is committed to creating products that have a minimal impact on the environment.

Other players in the market include Mushroom Packaging, New Ecological Business Solutions, and Mogu. These companies are also investing in R&D to develop new products and expand their market share.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.7% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Packaging Format, By Function Type, By Product Type, By End User Industry, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Seamore; Evoware; Bloom; CuanTec; Mycelium Energy Solutions; AlgaePac; Algopack; Sea6 Energy; Oceanium; Cascadia Mycelium |

| Customization & Pricing | Available upon Request |

The global mycelium packaging market is estimated to be valued at USD 89.1 million in 2025.

The market size for the mycelium packaging market is projected to reach USD 224.8 million by 2035.

The mycelium packaging market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in mycelium packaging market are pure mycelium packaging, mycelium composite packaging, mycelium foam packaging and others.

In terms of function type, cushioning segment to command 52.3% share in the mycelium packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mycelium Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Mycelium Foam Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA