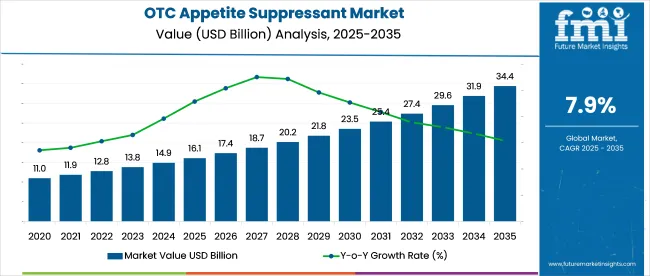

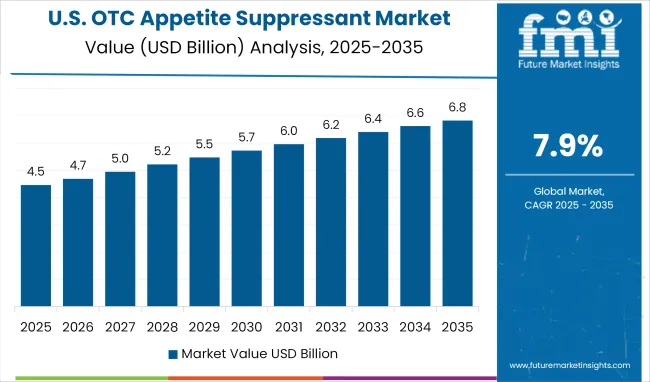

Global OTC appetite suppressant market is expected to grow from USD 16.1billion in 2025 to USD 34.4 billion by 2035, advancing at a 7.9% CAGR. This expansion is being shaped by demand among overweight adults seeking non-prescription alternatives to GLP-1 medications.

Nearly 63% of volume is concentrated in capsule and gummy formats containing stimulant-free botanicals, fiber bulking agents, or carb-blocker blends. Retailers are expanding shelf space for mood-balancing and satiety-enhancing SKUs, particularly in North America and Southeast Asia.

Private-label adoption is gaining traction as pharmacies shift toward in-house brands to improve margin control. Success now depends on clinical claim substantiation, clean-label ingredient sourcing, and long-term appetite modulation efficacy.

On December 31, 2024, UK-based startup Elcella unveiled a twice-daily capsule described as a “natural Ozempic,” designed to stimulate appetite-reducing hormones PYY and GLP-1 in the colon. Unlike synthetic GLP-1 drugs, Elcella works by triggering the body’s own hormone response, aiming to suppress hunger and reduce calorie intake without common side effects like nausea or fatigue.

Clinical findings suggest a 13% reduction in caloric intake. “We differ from weight-loss drugs in that Elcella releases your own naturally occurring appetite-reducing hormones rather than replacing them with synthetic hormones,” said Madusha Peiris, founder and CEO of Elcella, to the Daily Mail.

The OTC appetite suppressant market represents a niche within its broader categories. It accounts for approximately 2-3% of the global over-the-counter drugs market, driven by consumer-led weight control. Within the weight management products segment, appetite suppressants hold a stronger position, contributing around 8-10% of sales.

In the dietary supplements market, their share stands at roughly 3-4%, focused on natural ingredients like fiber blends and thermogenic agents. They make up about 2–3% of the broader consumer health and wellness category. In the nutraceuticals market, appetite suppressants represent 4-5%, reflecting rising interest in functional food-derived weight control solutions.

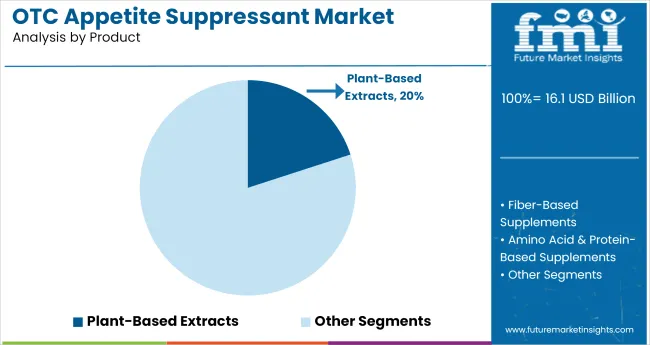

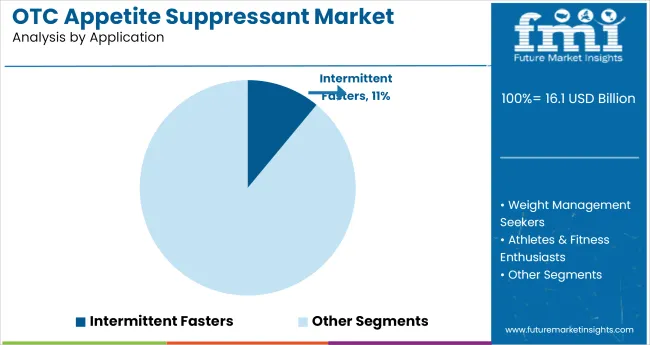

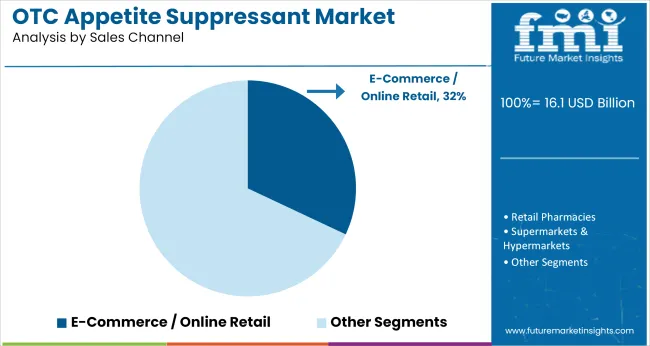

The OTC appetite suppressant industry is segmented by product type into plant-based extracts, synthetic compounds, and combination blends. Key applications include weight management, intermittent fasting, metabolic health support, and appetite control during diet cycles. Sales channels include e-commerce platforms, pharmacies, supermarkets, and wellness-focused specialty retailers.

Geographic analysis spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

Plant-based appetite suppressants are expected to account for 20.0% of industry share in 2025, driven by rising consumer preference for botanical compounds with minimal side effects and natural satiety support. These formulations are being adopted by individuals seeking stimulant-free appetite regulation with clean-label positioning.

Key actives such as glucomannan, garcinia cambogia, and green tea extract have been favored for their functional roles in pre-meal fullness and hunger control.

Unlike synthetic formulations, plant-based blends are being perceived as better tolerated during long-term use. Supplement brands have standardized dosages across capsules, powders, and gummies to maintain efficacy while supporting convenience and adherence.

Intermittent fasters are estimated to represent 11.0% of application demand in 2025, as appetite control becomes an integrated component of structured fasting and metabolic timing strategies. From 2020 to 2024, this user segment showed a marked increase in reliance on fasting-compatible suppressants that avoided insulin spikes or digestive triggers during fasting windows.

Delayed-release capsules and low-stimulant herbal formulations are being prioritized to assist with hunger during non-eating intervals. This demand has extended beyond conventional dieters and now includes time-restricted eaters and therapeutic fasters seeking product alignment with specific regimens like 16:8 or 20:4.

E-commerce and online retail channels are anticipated to generate 32.0% of OTC appetite suppressant sales in 2025, supported by algorithm-driven personalization, convenience, and rising DTC brand penetration. Between 2020 and 2024, digital storefronts emerged as the most effective point-of-sale for appetite management products, enabling rapid inventory turnover and customized promoting funnels.

Online platforms are allowing brands to deliver direct-to-consumer bundles, subscription refills, and influencer-driven campaigns—all of which have amplified consumer engagement. Ingredient transparency, third-party reviews, and shipping guarantees have further solidified this channel’s credibility.

The OTC appetite suppressant market is experiencing growth driven by increasing obesity rates and advancements in supplement formulations. While the industry benefits from rising consumer demand for accessible weight management solutions, challenges related to product efficacy, regulatory oversight, and industry credibility persist. Addressing these issues is crucial for sustaining long-term industry growth.

Expansion Driven by Rising Obesity Rates and Health Trends

The OTC appetite suppressant market is experiencing significant growth, fueled by the rising obesity rates and increasing consumer demand for weight management solutions. As of 2024, nearly 40% of the global population is affected by obesity, driving the demand for accessible weight management tools.

Advancements in supplement formulations have resulted in products that effectively suppress appetite, leading to a 15% increase in consumer adoption. Additionally, the growing health and wellness trend is influencing purchasing behaviors, with 60% of consumers opting for OTC products to support their health goals.

Challenges Related to Efficacy and Regulatory Concerns

The OTC appetite suppressant sector faces several challenges. The efficacy of these products varies widely, with clinical studies showing that 30% of users report inconsistent results, leading to potential dissatisfaction. Regulatory oversight for dietary supplements is less stringent than for prescription medications, raising concerns about product quality and safety.

A recent survey revealed that 22% of consumers are wary of OTC products due to safety concerns, further compounded by the proliferation of unverified products. This has led to a 12% increase in consumer complaints related to product quality and safety issues in the past year.

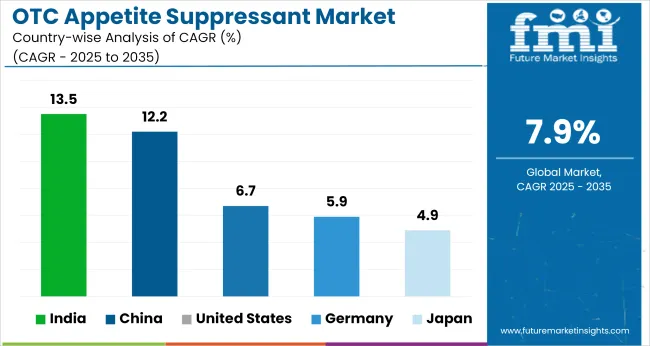

The global OTC appetite suppressant market is projected to expand at a 7.9% CAGR between 2025 and 2035. Among the 40+ countries analyzed, India leads with 13.5%, followed by China at 12.2%, both BRICS members benefiting from rising obesity concerns, expanded nutraceutical licensing, and growing online pharmacy adoption.

Indian firms are launching ayurvedic and herbal SKUs targeting younger urban consumers, while Chinese formulators are incorporating botanical actives like lotus leaf and puer tea into satiety formats.

The United States posts 6.7%, below the global average, reflecting FDA scrutiny and slower retail channel expansion. Germany follows at 5.9%, where EFSA claim limitations and pharmacy-only access is slowing product variety. Japan, at 4.9%, shows minimal appetite suppressant uptake due to cultural resistance and stronger preference for meal replacements.

Contrasts between BRICS and OECD countries highlight disparities in formulation freedom, claim permissibility, and platform penetration across regulated and semi-regulated OTC channels.

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 6.7% |

| Germany | 5.9% |

| China | 12.2% |

| Japan | 4.9% |

| India | 13.5% |

OTC appetite suppressant sales in the United States are projected to grow at a CAGR of 6.7% from 2025 to 2035. Rising demand for natural ingredients, combined with strong preference for self-managed weight control solutions, has supported this expansion. Plant-based and non-stimulant formulations have found growing favor across younger and middle-aged groups.

Product differentiation has been emphasized through branded capsules and gummies promoted for intermittent fasting and portion control. Regulatory clarity and a mature supplement ecosystem have allowed the segment to scale faster than in Asia-Pacific or Europe. OTC suppressants in the US are primarily positioned as part of lifestyle-driven nutrition regimens.

OTC appetite suppressant demand in Germany is expected to expand at a CAGR of 5.9% during the forecast period from 2025 to 2035. A shift in buyer behavior has occurred toward pharmacist-recommended or clinically backed products, supported by rising demand for controlled dietary support outside prescription frameworks.

German consumers prefer satiety-promoting blends with fiber and botanical actives, particularly in formats like sachets or slow-release tablets. Demand has grown in retail pharmacies and specialized health shops rather than mass e-commerce. European regulatory norms have shaped buyer trust around ingredients and dosage reliability.

OTC appetite suppressant consumption in China is anticipated to grow at a CAGR of 12.2% between 2025 and 2035. Rising consumer experimentation with satiety aids has gained momentum, particularly in major cities. Appetite control supplements are being promoted in connection with beauty, fitness, and metabolic wellness trends.

China's online platforms and cross-border e-commerce have accelerated access to global appetite suppressant brands. Domestic producers have been developing herbal blends, often paired with probiotics or teas, to enhance gut-related fullness. User interest has outpaced Western countries in digital education around intermittent fasting and calorie moderation.

OTC appetite suppressant sales in Japan are estimated to register a CAGR of 4.9% over the period from 2025 to 2035. Consumer choices have remained focused on minimal-intervention formulations, with appetite control perceived more as a lifestyle balance than a weight-loss strategy. Sales growth has been observed in formats such as konjac-derived satiety blends and green tea extract-based capsules.

Regulatory scrutiny remains high, with preference given to long-established Japanese brands over foreign entrants. The focus on natural functionality, low stimulant load, and simplicity in ingredients has influenced purchase patterns.

OTC appetite suppressant demand in India is forecast to record a CAGR of 13.5% from 2025 to 2035. Awareness of self-managed dietary interventions has increased in metro regions, aided by digital wellness platforms and fitness influencers. Young adults have embraced herbal satiety boosters, such as garcinia and glucomannan, often consumed before meals or alongside intermittent fasting routines.

Adoption remains nascent in Tier II and rural zones but has been rising steadily due to e-commerce access and low-price sachet models. The segment remains fragmented, with ongoing standardization challenges.

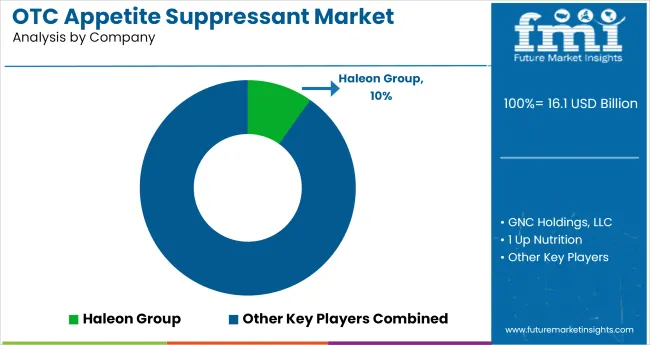

The OTC appetite suppressant market features a diverse mix of established nutraceutical firms, pharmaceutical players, and consumer health conglomerates. Haleon Group, Procter & Gamble, Nestlé USA, Unilever, and Bayer AG dominate retail visibility through branded fiber, stimulant-free, and metabolic regulation solutions distributed across pharmacies, mass retail, and e-commerce platforms.

Nature's Bounty, NOW Foods, and GNC Holdings, LLC operate at the intersection of supplementation and weight management, emphasizing fiber-based satiety and thermogenic actives.

Niche brands such as 1 Up Nutrition, NatureWise, Trim Healthy Mama, and Fiber Choice cater to specific demographics, including women, keto users, and natural-product consumers. The industry competitive intensity is shaped by digital-first wellness formats, strong influencer promoting, and demand for stimulant-free, GRAS-certified appetite regulation products.

Leading Company – Haleon Group

Industry Share – 9.8%

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 16.1 billion |

| Projected Industry Size (2035) | USD 34.4 billion |

| CAGR (2025 to 2035) | 7.9% |

| Base Year for Estimation | 2024 |

| Historical Period |

2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Plant-Based Extracts, Fiber-Based Supplements, Amino Acid and Protein-Based Supplements, Stimulant-Based Supplements, Hormonal/Neurotransmitter-Based Products, Combination Supplements, BHB Salts, L-Carnitine, Fat Absorption Inhibitors |

| Applications Analyzed (Segment 2) | Weight Management Seekers, Athletes and Fitness Enthusiasts, Diabetics and Individuals Focused on Blood Sugar Control, Obese and Overweight Individuals, Intermittent Fasters, Medical or Lifestyle-Driven Goals |

| Sales Channels Analyzed (Segment 3) | Retail Pharmacies, Supermarkets and Hypermarkets, Specialty Health and Wellness Stores, Hospital Pharmacies, Drug Stores, E-Commerce or Online Retail Platforms |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Haleon Group, GNC Holdings, LLC, 1 Up Nutrition, NatureWise, NOW Foods, Trim Healthy Mama, Procter & Gamble, Fiber Choice, Nestlé USA, Nature's Bounty, Unilever, Bayer AG |

| Additional Attributes | Dollar sales by product type and application, growth in intermittent fasting and diabetic-focused supplements, e-commerce channel acceleration, OTC availability trends, regional preference variations in stimulant vs. non-stimulant formulas |

The industry includes plant-based extracts, fiber-based supplements, amino acid and protein-based supplements, stimulant-based supplements, hormonal/neurotransmitter-based products, combination supplements, BHB salts, L-carnitine, and fat absorption inhibitors.

The industry is segmented into weight management seekers, athletes and fitness enthusiasts, diabetics and individuals focused on blood sugar control, obese and overweight individuals, intermittent fasters, and those with medical or lifestyle-driven goals.

These products are sold through retail pharmacies, supermarkets and hypermarkets, specialty health and wellness stores, hospital pharmacies, drug stores, and e-commerce or online retail platforms.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

The industry is projected to reach USD 34.4 billion by 2035.

The industry is expected to grow at a CAGR of 7.9% from 2025 to 2035.

Plant-based extracts are expected to lead with a 20.0% share in 2025.

The industry is estimated to reach USD 16.1 billion in 2025.

South Asia & Pacific, particularly India, is expected to show the highest growth with a projected CAGR of 13.5%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

OTC Glucose Monitors Market Size and Share Forecast Outlook 2025 to 2035

OTC Cat Medicines Market

Shotcrete/Sprayed Concrete Market Size and Share Forecast Outlook 2025 to 2035

Shotcrete Accelerators Market

Pet OTC Medication Market Analysis - Size, Share, and Forecast 2025 to 2035

Assessing OTC Medication Market Share in the Pet Industry

Dust Suppressant Market Size and Share Forecast Outlook 2025 to 2035

Rx-to-OTC Switches Market Analysis - Size, Share, and Forecast 2025 to 2035

Cough Suppressant Market Insight - Size, Trends and Forecast 2025 to 2035

Market Share Breakdown of Rx-to-OTC Switches Manufacturers

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Demand for OTC Glucose Monitors in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for OTC Glucose Monitors in USA Size and Share Forecast Outlook 2025 to 2035

The USA & Canada OTC Pet Nutritional Supplements Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Competitive Breakdown of Over-The-Counter (OTC) Veterinary Drug Providers

OTC Veterinary Drugs Market Report – Demand, Trends & Forecast 2025–2035

Repurposed Human Immunosuppressants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA