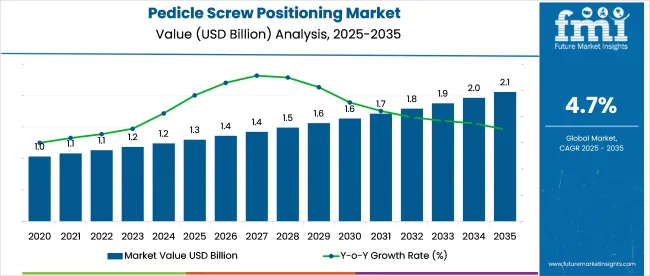

The pedicle screw positioning market is to be valued at USD 1.3 billion in 2025 and is anticipated to reach USD 2.1 billion by 2035, with a CAGR of 4.7%. Industry growth is being driven by the rising incidence of spinal deformities, degenerative disc diseases, and trauma, all of which require precise spinal-fixation solutions.

Accuracy in screw placement is being enhanced through minimally invasive surgical methods, intraoperative navigation systems, and robotic assistance, which are increasingly seeing adoption in leading spine centers. Competitive edge is now being claimed by firms investing in smart instrumentation and real-time imaging.

It is argued that failure to scale surgeon education on navigation-assisted techniques could hamper adoption, even as early-standardizing regions are predicted to capture longer-term clinical and cost-efficiency gains.

During Medtronic's Q3 FY24 earnings call on February 20, 2024, Geoff Martha, CEO of Medtronic, addressed the company’s core technology in the spine surgery space, stating, “Our Mazor robotic guidance system continues to drive adoption in spine surgery... Surgeons rely on its precision for accurate screw placement, reducing variability and improving patient outcomes.

This technology is critical to our leadership in procedural solutions.” This statement highlights the increasing reliance on precision tools, particularly in pedicle screw insertion, reflecting the industry’s demand for accurate, efficient, and effective surgical technologies within the spine robotics sector.

The industry holds a specialized share within its parent markets. In the orthopedic devices market, it accounts for approximately 3-5%, as pedicle screws are just one of many devices used for treating musculoskeletal and spinal conditions. Within the spinal surgery market, its share is around 15-20%, driven by the critical role of pedicle screws in spinal fusion and other corrective procedures.

In the medical devices market, the share is about 2-3%, as pedicle screw positioning systems are part of a broad range of surgical tools. In the minimally invasive surgery market, the share is around 5-7%, reflecting the increasing use of pedicle screw systems in less invasive spine surgeries. In the surgical instruments market, its share is approximately 4-6%, as it is an essential component for spinal procedures requiring precise screw placement.

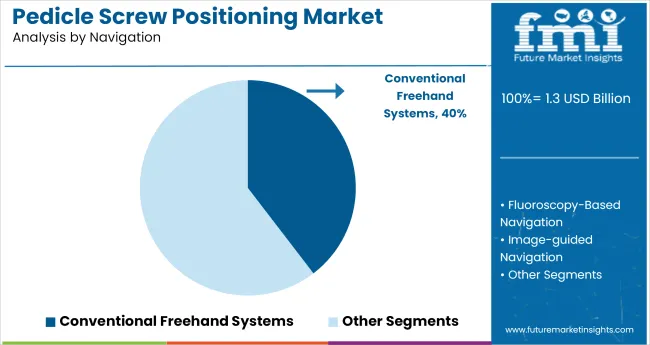

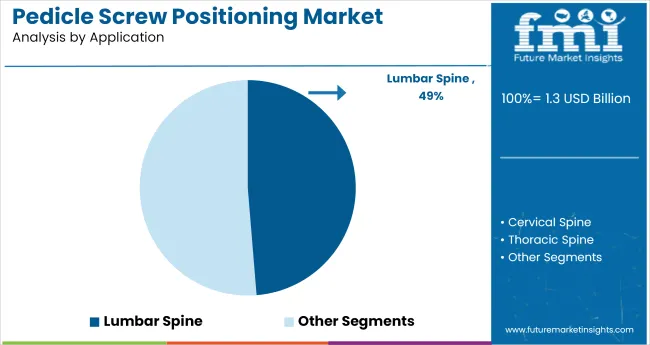

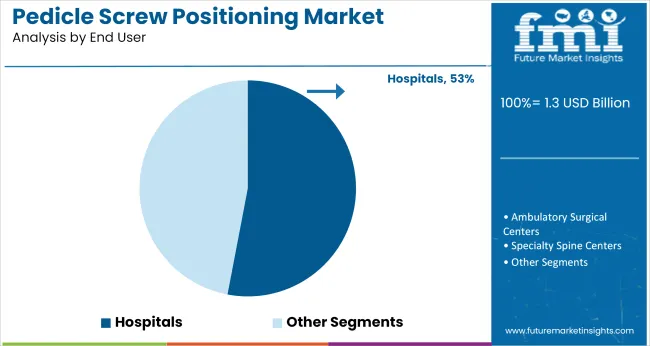

The industry is expected to grow, with conventional freehand systems leading the navigation segment at 39.6% industry share. Lumbar spine applications will dominate the application segment with 48.7%, while hospitals will remain the primary end-user, capturing 53% of the industry share.

Conventional freehand systems are projected to capture 39.6% of the industry in 2025. These systems are widely used in spinal surgeries due to their ease of use and cost-effectiveness. Conventional freehand techniques rely on the surgeon’s skill and experience to accurately position the screws without the need for advanced navigation technologies.

Despite the increasing adoption of robotic and computer-assisted systems, conventional freehand systems continue to hold a significant industry share, especially in regions where advanced systems are less accessible or cost-prohibitive.

Lumbar spine applications are expected to account for 48.7% of the industry in 2025. The lumbar spine is a critical area in spinal surgeries, and accurate screw placement is essential for stabilizing the spine, reducing pain, and restoring mobility.

Pedicle screw fixation is commonly used for treating lumbar spinal conditions, including fractures, degenerative diseases, and deformities. The demand for pedicle screw positioning in lumbar spine applications is driven by the growing prevalence of back disorders, especially in aging populations, and the increasing number of spinal surgeries performed globally.

Hospitals are projected to capture 53% of the industry share in 2025 as the primary end-user of pedicle screw positioning systems. Hospitals are the primary setting for complex spinal surgeries due to their advanced diagnostic and surgical infrastructure.

The ability to perform precise and accurate surgeries using pedicle screw positioning systems is critical in hospitals, where patient outcomes and safety are paramount. Hospitals benefit from the availability of skilled surgical teams and post-operative care facilities, making them the leading end-user segment for these technologies.

The industry is expanding due to increasing demand for precision in spine surgeries driven by aging populations and spinal deformities. High costs and procedural complexity are limiting adoption, particularly in regions with constrained healthcare resources.

Growing Demand for Spine Surgery Precision

The industry is driven by the increasing demand for precision in spine surgeries. With a rise in spinal deformities and aging populations, the need for accurate and reliable spine surgery tools is growing.

Pedicle screw systems, widely used in spinal fusion surgeries, offer better control and precision, reducing the risk of complications. As spine surgery becomes more advanced, the demand for specialized positioning tools like pedicle screw systems continues to grow, ensuring greater surgical accuracy and patient outcomes.

Challenges from High Costs and Complex Procedures

Despite industry growth, the industry faces challenges from high procedural costs and complexity. The specialized equipment required for these surgeries often results in significant expenses, which can be prohibitive, especially for smaller healthcare providers.

The intricate nature of pedicle screw placement demands highly skilled professionals, further adding to operational costs. These barriers are limiting the adoption of pedicle screw positioning systems in regions with constrained healthcare budgets, slowing overall industry growth.

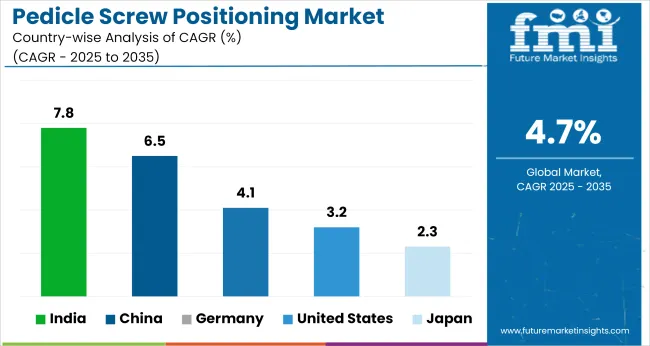

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

| Germany | 4.1% |

| China | 6.5% |

| Japan | 2.3% |

| India | 7.8% |

Global industry demand is projected to rise at a 4.7% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 7.8%, followed by China at 6.5%, and Germany at 4.1%, while the United States posts 3.2% and Japan records 2.3%. These rates translate to a growth premium of +66% for India, +39% for China, and -12% for the United States versus the baseline, while Japan lags with the slowest growth.

Divergence reflects local catalysts: expanding healthcare infrastructure and rising orthopedic procedures in India and China, while more mature industries like the United States and Japan experience slower growth due to industry saturation and established adoption in healthcare systems. Germany sees moderate growth, supported by technological advancements and ongoing demand in spine surgeries.

Sales of pedicle screw systems in the United States are projected to grow at a CAGR of 3.2% between 2025 and 2035. Hospitals and ambulatory surgery centers have integrated these systems into spine trauma and deformity corrections, especially under bundled payment schemes.

Reimbursement clarity for spinal instrumentation procedures has improved device penetration across mid-tier healthcare providers. Surgeons favor modular platforms compatible with imaging-guided workflows to reduce intraoperative variability. Procedural volume remains high in lumbar fusion, with device precision increasingly scrutinized in quality audits.

The industry in Germany is expected to record a CAGR of 4.1% from 2025 to 2035. Device adoption has been prioritized in trauma-focused neurosurgical centers and orthopedic clinics. German spinal surgeons prefer low-profile implants with multi-axial capabilities, especially in deformity corrections.

Technical standardization under the national DRG system encourages use of high-accuracy systems. Procurement decisions increasingly favor vendors offering intraoperative support and training modules in addition to implants.

Demand for pedicle screw systems in China is projected to grow at a CAGR of 6.5% through 2035. Provincial hospitals have expanded spine surgical capacity, particularly for aging patients with degenerative disc disease. Large-volume procurement of titanium-based implants supports affordability.

Local producers are supplying systems tailored for short-segment fusion and thoracic spine stabilization. Academic centers now include pedicle screw placement in their orthopedic residency modules, creating familiarity among younger surgeons.

Japan’s industry is forecasted to expand at a 2.3% CAGR between 2025 and 2035. Low procedural volume in rural regions has limited adoption, though tertiary centers in Tokyo and Osaka continue to perform high-complexity spinal procedures.

Domestic manufacturers focus on hybrid polyaxial systems designed for osteoporotic spines. Age-related spinal deformities have sustained demand, particularly among orthopedic departments focused on mobility preservation in geriatric patients.

India is projected to register the fastest growth, with a CAGR of 7.8% through 2035 in the pedicle screw positioning segment. Government-run insurance schemes and expansion of spine care facilities in tier-2 cities are enabling procedural volume growth.

Surgeons are increasingly trained in short-course workshops on spine stabilization techniques. Domestic companies are competing with imported systems by offering pre-sterilized screw kits for trauma and deformity cases.

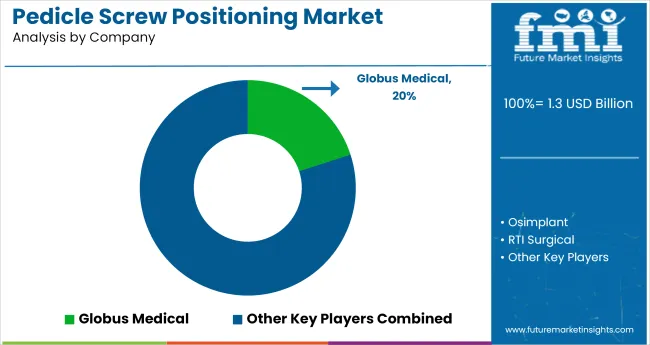

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Globus Medical, Zimmer Biomet, and DePuySynthes (Johnson & Johnson) lead the industry with advanced product portfolios, strong R&D capabilities, and extensive distribution networks across spinal surgery and trauma care sectors.

Key players including Spineway, Medtronic, and RTI Surgical offer specialized solutions that cater to specific spinal treatments and regional industry needs. Emerging players, such as ChoiceSpine LLC, ATEC Spine, Inc., and Z-Medical GmbH & Co. KG, focus on innovative technologies and cost-effective solutions, expanding their footprint in both developed and emerging industries. These players are driving the evolution of minimally invasive surgeries and enhancing patient outcomes with precision tools.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 1.3 billion |

| Industry Value (2035) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Navigation Segmentation | Conventional Freehand Systems, Fluoroscopy-Based Navigation, Image-guided Navigation, Robotic-Assisted Navigation |

| Application Segmentation | Cervical Spine, Thoracic Spine, Lumbar Spine, Multi-Level Spine Fixation |

| End User Segmentation | Hospitals, Ambulatory Surgical Centers, Specialty Spine Centers |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Globus Medical, Osimplant, RTI Surgical, MEDYSSEY USA, INC., Spineway, ATEC Spine, Inc., Z-Medical GmbH & Co. KG, SANYOU, ChoiceSpine LLC, Medicon eG |

| Additional Attributes | Dollar sales by navigation type, application, and end-user, increasing adoption of robotic-assisted systems in spine surgeries, growing demand for minimally invasive procedures, technological advancements in imaging and navigation systems, regional trends in spine surgery and medical device innovation. |

The segmentation by navigation includes conventional freehand systems, fluoroscopy-based navigation, image-guided navigation, and robotic-assisted navigation.

Application-based categories consist of cervical spine, thoracic spine, lumbar spine, and multi-level spine fixation.

End users include hospitals, ambulatory surgical centers, and specialty spine centers.

Geographically, the industry is divided into regions like North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

The industry size of the industry in 2025 is USD 1.3 billion.

The industry is projected to reach USD 2.1 billion by 2035, with a 4.7% CAGR.

Hospitals dominate the industry’s end-user segment with a 53% industry share in 2025.

India will lead the industry with a 7.8% CAGR from 2025 to 2035.

Globus Medical is the leading company in the industry with a 20% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pedicle Screw Systems Market - Growth & Forecast 2025 to 2035

Screw Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Screw Compressor Market Size and Share Forecast Outlook 2025 to 2035

Screw Capping Machine Market Size and Share Forecast Outlook 2025 to 2035

Screwdriver Market Size and Share Forecast Outlook 2025 to 2035

Screw Top Jar Market Insight - Growth & Trends to 2025 to 2025

Key Players & Market Share in Screw Conveyor Industry

Screw Air End Market Growth – Trends & Forecast 2024-2034

Screw Jacks Market

Screw Top Lids Market

Screw Top Pails Market

Leadscrew Market

Twin Screw Extruders Market Size and Share Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bone Screw System Market Growth – Demand, Trends & Industry Forecast 2024-2034

Ball screw Market

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Electric Corkscrew Market

Polypropylene Screw Caps Market

Structural Wood Screws Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA