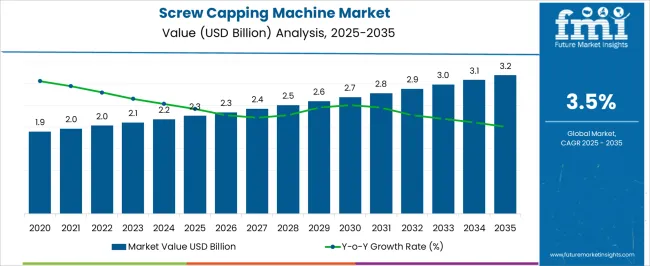

The Screw Capping Machine Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Screw Capping Machine Market Estimated Value in (2025 E) | USD 2.3 billion |

| Screw Capping Machine Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The screw capping machine market is expanding steadily due to the rising demand for efficient and reliable packaging solutions across industries. Increasing consumer preference for secure, tamper evident packaging and the emphasis on high speed production lines are encouraging manufacturers to invest in advanced capping technologies.

Automation and digital integration are improving precision, minimizing operational downtime, and reducing wastage, which has strengthened the role of screw capping machines in modern production environments. Regulatory requirements for packaging integrity in pharmaceuticals and food and beverage sectors are further fueling adoption.

The outlook remains promising as producers continue to prioritize cost efficiency, scalability, and compliance with safety standards, ensuring the sustained growth of this market in both developed and emerging economies.

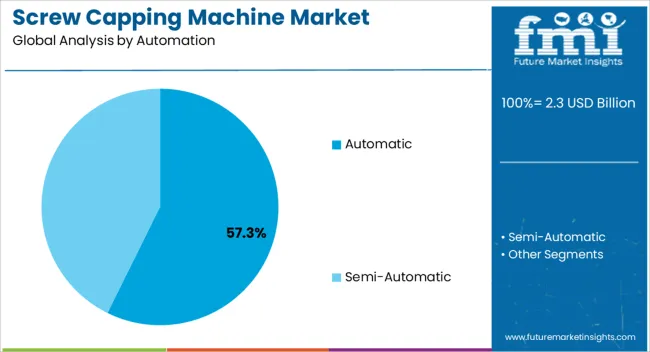

The automatic automation segment is projected to contribute 57.30% of the total market revenue by 2025, making it the leading category. This dominance is driven by the ability of automatic machines to deliver high throughput, maintain consistent quality, and reduce dependence on manual labor.

Enhanced operational efficiency, coupled with integration of smart controls, has made automatic machines highly preferred in industries requiring uninterrupted production.

Their scalability and long term cost benefits continue to strengthen their position as the preferred automation type.

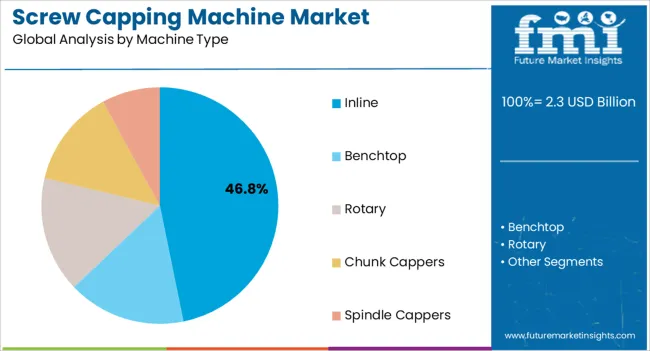

The inline machine type segment is expected to account for 46.80% of the total market revenue by 2025, establishing itself as the dominant machine configuration. Its widespread use is supported by its compact design, compatibility with continuous production lines, and ease of integration into existing systems.

Inline machines enable efficient space utilization and consistent capping performance, making them suitable for medium to high volume production facilities.

Their adaptability to various bottle shapes and sizes has further reinforced their adoption in packaging operations.

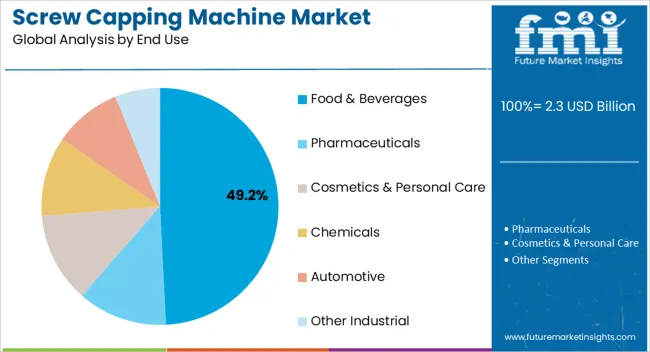

The food and beverages segment is anticipated to hold 49.20% of the total market revenue by 2025, positioning it as the largest end use category. This growth is fueled by the increasing consumption of packaged products, strict hygiene standards, and the demand for extended shelf life through secure packaging.

Screw capping machines provide reliability in sealing bottles and containers, ensuring product safety and compliance with food quality regulations.

Rising investments in automated bottling and packaging facilities by global food and beverage producers are further supporting the strong share of this segment.

The global screw capping machine industry has seen steady growth in terms of demand over the past decade. The primary factor driving growth is increased adoption of automation in various sectors, including pharmaceuticals, food & beverage, and cosmetics.

Screw capping machine is a critical component in the packaging process as it allows for fast and accurate capping of products, resulting in improved productivity and reduced labor costs. Asia Pacific has emerged as the dominant market for screw capping machines.

It is set to be driven by growth of the food & beverage and pharmaceutical sectors in countries such as China, India, and Japan. North America and Europe are also significant markets for screw capping machines. It is attributed to high demand for automation and advanced packaging technologies in these regions.

Increasing demand for convenience foods and growing preference for bottled beverages have further propelled growth in the market. The global market is estimated to witness a CAGR of 3.7% between 2025 and 2035.

Changing lifestyle of the masses, combined with a growing middle-class population would help the market to expand. Increased expenditure on food & beverage goods and soaring household consumption are further expected to fuel screw capping machine industry expansion.

Automation is increasingly becoming popular in the packaging sector, and screw capping machines play an essential role in this sector. These machines offer high-speed and efficient capping operations, reducing the need for manual labor and improving production efficiency.

Screw capping machines offer flexibility in the manufacturing process, allowing manufacturers to change capping configurations quickly. Growing trend toward sustainable packaging has led to rising demand for screw capping machines. These machines can cap various materials, including glass, plastic, and aluminum, which are commonly used in sustainable packaging.

With high demand for beverages, including soft drinks, water, and alcoholic beverages, there has been a corresponding increase in demand for screw capping machines. It is further anticipated to drive the global market.

PET bottles are becoming increasingly popular due to their lightweight, shatterproof, and recyclable nature. Screw capping machines are essential for capping PET bottles. With rising popularity of these bottles, screw capping machine demand is set to surge.

Screw capping machines are constantly evolving with new technologies being introduced to improve their efficiency and performance. There have been several technological advancements in screw capping machines in recent years, including improvements in speed, accuracy, and reliability.

Consumers are increasingly looking for unique and personalized packaging solutions. It has resulted in an increasing demand for customized screw capping machines.

Screw capping machines are becoming more advanced, with manufacturers incorporating new technologies such as vision systems, robotics, and artificial intelligence. Need for sustainable packaging solutions are driving demand for eco-friendly screw capping machines. They can help reduce both waste and energy consumption.

Magnetic capping technology is a new advancement in the screw capping machine market. It uses magnetic fields to attach caps to bottles, eliminating the need for mechanical pressure. It also offers higher precision, faster capping speeds, and improved sealing performance.

Artificial intelligence (AI) is being used in screw capping machines to improve performance and efficiency. AI algorithms can optimize capping speeds, reduce downtime, and detect and correct errors in real-time. It is set to push screw capping machine sales by 2035.

Need for Renewable Materials to Spur Demand for Bottle Capping Machines in the United States

| Country | The United States |

|---|---|

| Estimated Market Size (2035) | USD 612.4 million |

| Value-based CAGR (2025 to 2035) | 2.8% |

The United States screw capping machine market is set to witness steady growth in the assessment period. It is due to growing emphasis on sustainability and environmental responsibility. As consumers become more aware of the impact of their purchasing decisions on the environment, there is a rising need for eco-friendly and sustainable packaging solutions.

Screw capping machines play a crucial role in the packaging process and can significantly impact the sustainability of the final product. By diversifying the market, the country can encourage development and adoption of more sustainable and eco-friendly items. This could include machines that use renewable energy sources, minimize waste, or are made from recycled materials.

Constant Innovation in the United Kingdom to Fuel Demand for Customized Screw Capping Machines

| Country | The United Kingdom |

|---|---|

| Estimated Market Size (2035) | USD 138.5 million |

| Value-based CAGR (2025 to 2035) | 4.2% |

The United Kingdom owns a strong market base for screw capping machines. This is due to its highly developed manufacturing sector.

The United Kingdom has a long history of engineering excellence and innovation, and this expertise has translated into a strong market for screw capping machines. The country’s manufacturing sector is highly diversified, with a range of sectors such as food & beverage, pharmaceuticals, and cosmetics. These sectors are anticipated to propel demand for new packaging machinery.

Another factor that contributes to the United Kingdom’s strong market base is the country's proximity to leading Europe-based firms. The country’s commitment to innovation and technological advancement would help manufacturers to constantly develop new & improved screw capping machines.

High Demand for Packaged Items in China to Support Sales of Semi-automatic Capping Machines

| Country | China |

|---|---|

| Estimated Market Size (2035) | USD 278.3 million |

| Value-based CAGR (2025 to 2035) | 5.2% |

China has become a leading player in global manufacturing, with a large and diverse range of sectors that require packaging machinery. This has created a significant demand for screw capping machines in China, both for domestic use and for export to other countries.

China's growing middle-class population has led to an increasing demand for packaged goods, particularly in the food & beverage sector. The country’s government has invested heavily in research and development in recent years. This has led to the development of new and improved screw capping machines that are more efficient, cost-effective, and sustainable.

Demand for Automatic Screw Capping Machines to Expand Globally by 2035

Based on automation, the automatic segment is anticipated to exhibit a CAGR of around 4.1% in the estimated period. It is likely to generate a robust share of about 67% by 2035.

In the manufacturing sector, rising demand can be attributed to growing need for higher production efficiency and output. Automatic screw capping machines enable faster and more streamlined packaging processes, reducing labor costs and enhancing productivity.

They ensure consistent and precise capping, minimizing the risk of product leakage or contamination. Additionally, these machines offer improved quality control and compliance with market regulations, making them essential for maintaining high product standards.

In the pharmaceutical and healthcare sector, demand for automatic screw capping machines is driven by growing emphasis on product safety, reliability, and tamper-evident packaging. These machines provide secure sealing, ensuring the integrity and authenticity of pharmaceutical products. They also help to protect the end consumer by preventing unauthorized access to medications and minimizing the risk of tampering.

In the food & beverage sector, automatic screw capping machines are increasingly sought after due to the need for efficient and hygienic packaging processes. These machines enable quick and reliable sealing of various containers, ensuring freshness and integrity of food & beverages. Automation capabilities help to reduce human error, enhance productivity, and maintain consistent packaging quality, meeting the stringent standards.

Benchtop Screw Capping Machines to Find High Usage among Cosmetics Manufacturers

Benchtop screw capping machines by machine type are projected to witness a CAGR of 3.5% in the assessment period. It is anticipated to hold a significant share of 34% in 2035.

In the pharmaceutical and healthcare sector, benchtop screw capping machines are increasingly preferred for their compact size and versatility. These machines are ideal for small-scale production or laboratory settings, where space is limited.

They offer a cost-effective solution for sealing vials, bottles, or containers with precision and consistency. With their user-friendly design and adjustable settings, benchtop screw capping machines provide efficiency and convenience for pharmaceutical manufacturers, research facilities, and compounding pharmacies.

In the cosmetics and personal care sector, demand for benchtop screw capping machines is growing. These machines are well-suited for sealing various cosmetic products such as creams, lotions, and serums, with accuracy and speed.

Compact nature of benchtop screw capping machines allows them to be easily integrated into existing production lines or utilized in smaller manufacturing facilities. Their efficient operation and ability to handle different container sizes would make them a valuable asset for cosmetic product manufacturers.

Food & Beverage Manufactures to Adopt Automatic Capping Machines Worldwide

The food & beverages segment by end-use is projected to dominate the global screw capping machine market by 2035. These machines offer efficient and reliable sealing capabilities, ensuring the integrity and freshness of packaged food & beverage products. The sector’s focus on maintaining product quality and preventing contamination has fueled adoption of screw capping machines as a preferred sealing solution.

Screw capping machines provide high-speed automation, enabling manufacturers to achieve greater production efficiency and output. This is particularly beneficial for large-scale food & beverage operations where high volumes of products need to be sealed quickly and consistently.

Screw capping machines offer versatility in handling various container sizes and shapes, accommodating diverse packaging requirements of the food & beverage sector. This flexibility allows manufacturers to streamline their production processes and adapt to changing market needs more effectively.

Key market players can stay competitive through product innovation. This involves developing new capping machines that are faster, more accurate, or versatile than existing machines.

They are also focusing on incorporating new technologies such as automation or artificial intelligence. Also, providing prompt and reliable technical support, offering training & installation services, and responding quickly to customer inquiries & issues are a few other strategies.

Key Strategies Adopted by Screw Capping Machine Manufacturers:

Developing Innovative Products:

Screw capping machines are an essential piece of equipment in the packaging sector, providing a reliable and efficient method for sealing containers with screw caps. Manufacturers must focus on improving the efficiency and speed of the capping process. They should also ensure a consistent and secure seal for a wide range of container sizes and types.

One potential area of innovation could be the use of advanced robotics and machine learning algorithms to automate the capping process and minimize risk of errors or inconsistencies. This could include use of sensors and cameras to detect the position & orientation of caps and containers. They should also initiate machine learning algorithms to optimize the torque and sealing force required for each specific container type.

Customization:

Customization would help to offer capping machines that are tailored to specific container types, sizes, and materials. This can involve designing and manufacturing custom capping heads, chucks, and gripping mechanisms.

Such products can accommodate containers with unique shapes, thread patterns, and closure types. By providing a precise and secure fit for each container, these customized solutions can help improve capping efficiency and reduce the risk of product leakage or contamination.

Sustainability:

Sustainability would help in the use of recycled materials for the production of capping machines. By using recycled plastics or metals, manufacturers can reduce the amount of virgin materials needed to produce their machines, as well as divert waste from landfills.

A few manufacturers are exploring the use of bioplastics and other bio-based materials that are biodegradable and compostable, further reducing their environmental impact. Also, development of capping machines that are energy-efficient and use renewable energy sources is set to surge.

Strategic Expansion:

Expanding product lines is set to develop new capping machines that can meet a broader range of customer needs. This involves development of designing machines that can handle different container sizes and types. It can also include developing machines that can perform multiple capping operations in a single pass.

Acquisition:

Acquisitions involve purchasing companies that specialize in related areas such as filling, labeling, or packaging equipment. These can also include companies that have expertise in software or automation technologies that can enhance the performance of capping machines.

Here are a couple of examples of start-ups in the screw capping machine industry:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.3 billion |

| Projected Market Valuation (2035) | USD 3.2 billion |

| Value-based CAGR (2025 to 2035) | 3.5% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD billion) |

| Segments Covered | Automation, Machine Type, End-use, Region |

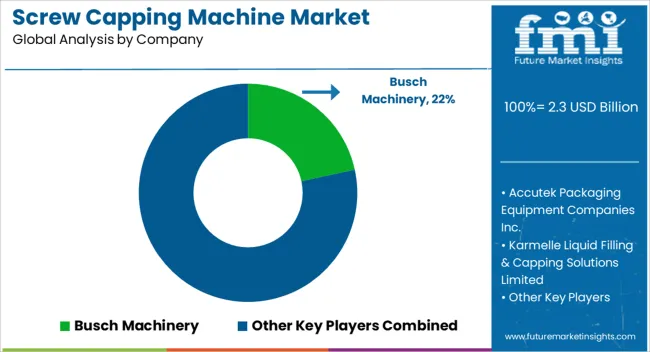

| Key Companies Profiled | Busch Machinery; Accutek Packaging Equipment Companies Inc.; Karmelle Liquid Filling & Capping Solutions Limited; Closure Systems International, Inc.; E-PAK Machinery, Inc.; Tecnocap S.p.A; APACKS; Seiko Corporation; New England Machinery Inc.; Jintan Sunshine Packing Machinery Co. Ltd. |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global screw capping machine market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the screw capping machine market is projected to reach USD 3.2 billion by 2035.

The screw capping machine market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in screw capping machine market are automatic and semi-automatic.

In terms of machine type, inline segment to command 46.8% share in the screw capping machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Screw Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Screw Compressor Market Size and Share Forecast Outlook 2025 to 2035

Screwdriver Market Size and Share Forecast Outlook 2025 to 2035

Screw Top Jar Market Insight - Growth & Trends to 2025 to 2025

Key Players & Market Share in Screw Conveyor Industry

Screw Air End Market Growth – Trends & Forecast 2024-2034

Screw Jacks Market

Screw Top Lids Market

Screw Top Pails Market

Leadscrew Market

Twin Screw Extruders Market Size and Share Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bone Screw System Market Growth – Demand, Trends & Industry Forecast 2024-2034

Ball screw Market

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Pedicle Screw Positioning Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pedicle Screw Systems Market - Growth & Forecast 2025 to 2035

Electric Corkscrew Market

Polypropylene Screw Caps Market

Structural Wood Screws Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA