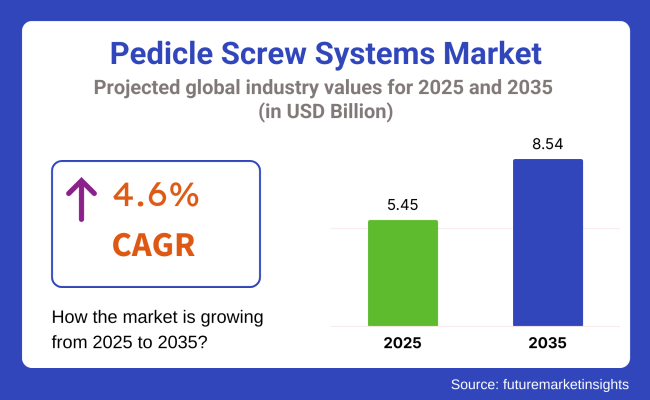

The global pedicle screw systems market is estimated to be valued at USD 5.45 billion in 2025 and is projected to reach USD 8.54 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. The market is experiencing steady growth which is supported by rising procedural volumes in spinal fusion surgeries, increasing incidences of spinal deformities, trauma, and degenerative disc diseases.

Advancements in minimally invasive surgical techniques, improved implant designs, and intraoperative navigation systems are elevating the precision and safety of pedicle screw placements. Reimbursement reforms and broader payer coverage for advanced spinal fixation procedures in both North America and Europe are enhancing patient access to these technologies.

Key manufacturers such as Medtronic Plc., Zimmer Biomet, B. Braun SE, Globus Medical, Stryker, NuVasive and others are aggressively advancing pedicle screw technologies through innovative product pipelines, robotic integration, and surgeon education programs. Demand is being driven by the growing adoption of complex deformity correction systems and hybrid screw designs that allow for intraoperative flexibility. In 2025, the USA FDA announced Eminent Spine’s 3D Printed Titanium Pedicle Screw System.

“Our mission has always been to innovate with purpose, and this clearance validates years of research, development, and surgeon collaboration,” said Dr. Stephen Courtney, Founder & CEO of Eminent Spine. “This is more than just a technological achievement - it’s a new era in spine surgery.” In 2024, MCRA partnered with Orthobond and achieved USA FDA De Novo for the Mariner Pedicle Screw System with Ostaguard™ coating. “This De Novo grant is a testament to Orthobond’s relentless innovation and marks a significant leap forward in patient care and safety.

MCRA takes immense pride in supporting Orthobond’s important regulatory milestone, which resonates with our fundamental mission to facilitate the introduction of safe and effective medical innovations into our healthcare system.”- Justin Eggleton, VP Head of Musculoskeletal Regulatory Affairs, MCRA

North America leads the global pedicle screw systems market, driven by high procedural volumes, early adoption of minimally invasive techniques, and favourable reimbursement structures for advanced spinal fixation procedures. Leading manufacturers have partnered with robotic navigation platforms to offer integrated solutions, enhancing surgical precision. Furthermore, increasing obesity rates and rising boomers are contributing to higher rates of degenerative spinal conditions requiring surgical intervention.

Europe is witnessing accelerated adoption of advanced pedicle screw systems driven by aging demographics, expanded coverage for spinal deformity correction, and harmonized CE MDR regulatory approvals. Public-private collaborations under the EU’s Horizon Europe program are supporting clinical trials evaluating real-world outcomes of robotic-assisted and AR-guided pedicle screw placements.

Growing surgeon education programs and investments in robotic surgical platforms across university hospitals are creating significant market expansion opportunities in in spinal oncology, trauma, and deformity correction procedures.

The below table presents the expected CAGR for the global market for pedicle screw systems over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2035, the business is predicted to surge at a CAGR of 5.3%, followed by a slightly lower growth rate of 5.0% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.3% (2024 to 2034) |

| H2 | 5.0% (2024 to 2034) |

| H1 | 4.6% (2025 to 2035) |

| H2 | 4.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.6% in the first half and decrease moderately at 4.1% in the second half. In the first half (H1) the market witnessed a decrease of 70.00 BPS while in the second half (H2), the market witnessed an increase of 90.00 BPS.

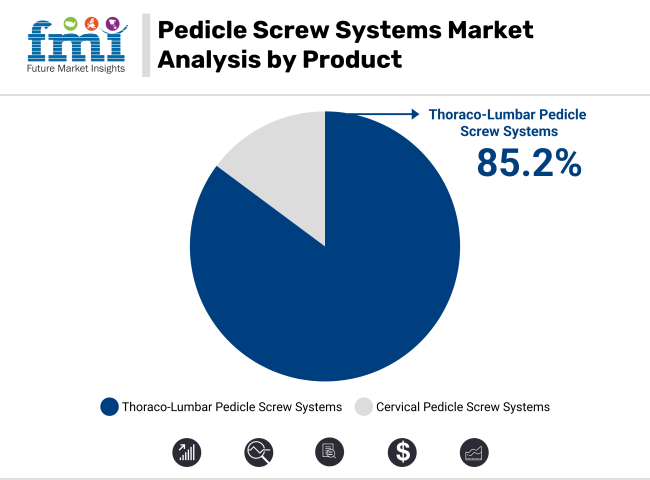

In 2025, thoraco-lumbar pedicle screw systems are expected to hold 85.2% of the revenue share in the pedicel screw system market. This dominance is largely driven by the high prevalence of thoraco-lumbar spine disorders, including scoliosis, degenerative disc disease, and spinal fractures. Thoraco-lumbar pedicle screw systems are favored due to their stability and ability to provide secure fixation for complex spinal procedures in the thoracic and lumbar regions.

The growing incidence of spinal disorders, coupled with an aging population and rising demand for minimally invasive spine surgery, has significantly contributed to the growth of this segment. Additionally, advancements in screw design, including screw size, thread configuration, and instrumentation, have enhanced their effectiveness and reliability in achieving spinal fusion. These factors, combined with improved surgical techniques and better patient outcomes, have reinforced the preference for thoraco-lumbar pedicle screw systems in spinal surgeries.

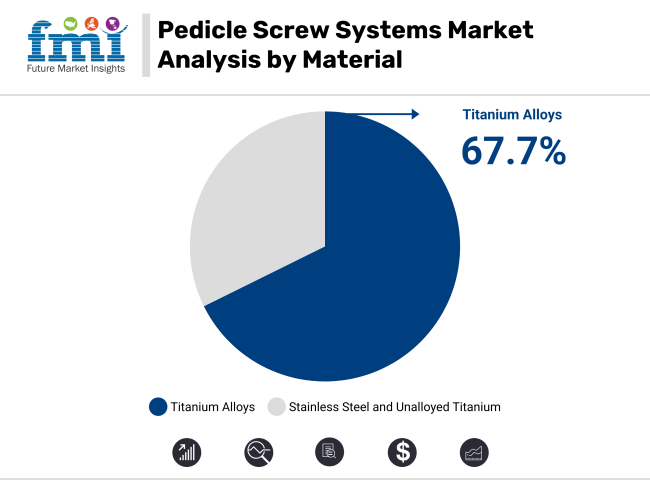

In 2025, titanium alloys are projected to account for 67.7% of the revenue share in the pedicel screw system market. This leadership position is driven by the superior strength, biocompatibility, and corrosion resistance of titanium alloys, making them ideal materials for spinal implants. Titanium alloys offer excellent mechanical properties, ensuring reliable fixation in the spine while minimizing the risk of implant failure.

Their lightweight nature reduces the overall burden on the patient’s body, and their biocompatibility ensures minimal rejection or adverse reactions, making them highly suitable for long-term implantation. Furthermore, the growing demand for durable, safe, and effective spinal implants in both traditional and minimally invasive spinal surgeries has increased the adoption of titanium alloys. As more hospitals and spine centers prioritize high-quality implants that support better clinical outcomes, titanium alloys are expected to maintain their leading position in the market.

The Increasing Shift Towards Outpatient Spinal Surgeries Is Increasing Adoption of Pedicle Screw Systems.

The growth in the market for pedicle screw systems is significantly propelled by the rise in outpatient spinal surgeries, encouraged by the proliferation of ambulatory surgery centers. With the specialized care at lower costs than in traditional hospital settings, ASCs are an attractive option for both the patient and insurers.

This transition is enabled due to the improvement in techniques for anesthesia, as this reduces intraoperative risks and postoperative recovery more rapidly, allowing procedures as complex as spinal surgeries that involve pedicle screw systems to be performed on an outpatient basis.

This has been an area of interest for healthcare providers in terms of resource optimization while ensuring the highest quality of care. For patients, this means reduced hospital stays and quicker recovery, both of which enhance overall satisfaction and decrease costs. This is why there has been a rise in demand for minimally invasive pedicle screw systems that are specifically designed for outpatient surgical workflows.

Further, with the incorporation of advanced surgical equipment, like intraoperative navigation systems and robotic-assisted technologies, precision has improved in outpatient facilities. Such technologies ensure proper pedicle screw placement, which helps to minimize complications and enhance the success rate of surgeries carried out outside the hospitals.

Manufacturers are taking advantage of this trend by investing in more compact, user-friendly systems designed for the outpatient environment, which further fuels market growth and expands spinal procedures accessibility across the globe.

Growing Adoption of Minimally Invasive Spine Surgery is favoring the Growth for Pedicle Screw Systems Market

The growing demand for minimally invasive spine surgery will also be a major catalyst for growth for pedicle screw systems, primarily because MISS boasts a number of benefits over standard open surgeries.

MISS uses incisions that are smaller and coupled with advanced technology to minimize damage to tissues thus greatly reducing blood loss, the trauma of operating, and also postoperative pain. This means faster recovery times, shorter hospital stays, and the risk of complications is much lower. Patients and surgeons alike prefer it.

Advances in technology have played a paramount role in MISS. There is a significant advancement with real-time imaging systems, intraoperative navigation systems, and robotic-assisted surgeries designed for the spinal platforms.

They enhance the accuracy of placing pedicle screws in the spine, reduce intraoperative errors, and thus improve surgical success. For instance, robotic systems can assist in achieving optimal screw trajectory with millimeter-level accuracy, while navigation-guided systems provide surgeons with detailed, real-time visualization of the spine.

The introduction of low-profile, modular, and expandable pedicle screw systems further promoted the adoption of MISS. These systems were designed to respond to varying anatomical challenges, providing greater flexibility and ease in minimally invasive approaches.

In addition, increased training programs for surgeons and patient awareness campaigns have driven the demand for MISS. Consequently, the pedicle screw system market for these advanced surgical techniques is growing, driving the overall market growth.

Development of Expandable and Cannulated Pedicle Screws Is Increasing the Product Adoption Within Healthcare Setting

The development of expandable and cannulated pedicle screws is emerging as a significant driver of growth in the market, especially for addressing complex spinal conditions and challenging patient anatomies.

Expandable pedicle screws, such as the Expedium Vertebral Body Derotation System by DePuy Synthes and X-PAC Expandable Pedicle Screw by Xtant Medical, offer enhanced bone purchase and stability by expanding within the vertebral body after insertion.

These screws are especially valuable in cases involving osteoporotic bone, where the traditional screws fail to provide adequate anchorage. It offers better surgical outcomes and the chance of fewer revision surgeries due to the adaptation of screws to various densities of bones.

Among cannulated pedicle screws, is that of the type being offered in ES2 by Stryker to be considered when performing a MISS. Because screws are cannulated, allowing an entry hole within the head into which one would insert the guidewire after they can be visualized under appropriate guidance, more delicate placement occurs - even where more anatomical obstacles exist; reducing the occurrence rate and soft tissue compromise. These innovations cater to the growing demand for advanced solutions that address unique patient needs.

By enhancing surgical precision, stability, and patient safety, expandable and cannulated screws are driving market adoption. Furthermore, ongoing research and development efforts by manufacturers are expected to introduce next-generation systems, further boosting market growth.

Competition from Non-Surgical Alternatives Is Emerging as Significant Growth Barrier for Market.

Increased efficacy of non-surgical treatments is now a serious constraint to the market growth. Non-invasive therapies such as physiotherapy, chiropractic care, pain management, and advanced biologics, such as stem cell therapies and platelet-rich plasma (PRP), are gaining popularity.

Such approaches do have some offering patients relief from pain, functional restoration, and healing without much reliance on surgical procedures. Hence most patients are now opting for these alternatives instead of surgeries necessitating the use of pedicle screw systems.

Physiotherapy and chiropractic therapies include combinations of muscle strengthening and spinal alignment to improve mobility and are offered for various conditions like lower back pain, herniated disc, and muscle strain. They lessen any need for more invasive procedures and allow patients to resume activity with minimal recovery time.

Similarly, alternatives like biologic counterparts like stem cell therapy and PRP injections have given a glimpse of insight on how to treat spinal degeneration and disc diseases. These varied therapies encourage the body's own regenerative processes to help their patients avoid surgery while directly addressing the sources of their spinal problems.

This increasing preference for non-surgical options, combined with an increasing economical option of these treatments, has further lessened the demand for invasive spinal surgeries like pedicle screw system surgeries.

Tier 1 companies comprise market leaders with a significant market share of 24.3% in global market. These companies engage in strategic partnerships and acquisitions to expand their product portfolios and access cutting-edge technologies. Additionally, they emphasize extensive clinical trials to validate the efficacy and safety of their products. Prominent companies in tier 1 include Medtronic, Aesculap Implant Systems LLC and Alphatec Holdings Inc.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 38.5% market share. They typically pursue partnerships with academic institutions and research organizations to leverage emerging technologies and expedite product development.

These companies often emphasize agility and adaptability, allowing them to quickly bring new treatments to market, additionally targeting specific types medical conditions. Additionally, they focus on cost-effective production methods to offer competitive pricing. Prominent companies in tier 2 include DePuy Synthes Inc, Evolution Spine LLC, Exactech Inc and Globus Medical Inc.

Finally, Tier 3 companies, such as Implanet SA, Life Spine Inc and NuVasive Inc. They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the pedicle screw systems sales remains dynamic and competitive.

The section below covers the industry analysis for the market for pedicle screw systems for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle Ease & Africa, is provided.

The United States is anticipated to remain at the forefront in North America, with higher market share through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 4.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| Germany | 3.3% |

| France | 3.5% |

| Spain | 3.6% |

| China | 4.1% |

| India | 4.5% |

| Australia & New Zealand | 3.0% |

| Japan | 3.9% |

United States. pedicle screw systems market is poised to exhibit a CAGR of 2.9% between 2025 and 2035. Currently, it holds the highest share in the North American market.

Companies such as DePuy Synthes, Stryker, Medtronic, and Zimmer Biomet drive market innovations because they offer state-of-the-art advancements.

As major companies continue investing in the areas of research and development (R&D) focused on developing designs with pedicle screws and innovating functions with which surgeons interact in surgeries, growth is imminent for these conditions in terms of enhancing precision while being a comprehensive solution to conditions within the spinal cavity.

More importantly, the huge market presence of these USA-based companies would ensure broad penetration of their products in the hospital, surgical center, and other healthcare institutions.

Their innovative developments in MISS, robotic-assisted techniques, and navigation systems have transformed spinal procedure practices. These companies can continue to fill the growing need for advanced pedicle screw systems because of the significant distribution networks and resources available to them.

Germany market for pedicle screw systems is poised to exhibit a CAGR of 3.3% between 2025 and 2035. Currently, it holds the highest share in the Western Europe market, and the trend is expected to continue during the forecast period.

Germany is one of the most developed countries in Europe in terms of healthcare.. Such a robust infrastructure ensures that health care institutions can provide the best possible treatments available, including the most advanced spinal surgeries requiring pedicle screw systems.

German hospitals stand out for their excellence in quality, allowing for safe and effective usage of these cutting-edge spinal technologies.

Another factor that ensures the acceptance of pedicle screws and other innovative medical equipment is that the country puts significant emphasis on the provision of world-class healthcare services. Well-trained and qualified surgeons in Germany enable them to employ cutting-edge technology for performing spinal surgery.

The medical standards and latest equipment used during operations boost confidence about the efficacy of pedicle screw systems, thereby spreading its usage all over.

Japan market is poised to exhibit a CAGR of 3.9% between 2025 and 2035. Currently, it holds the highest share in the South Asia & Pacific market, and the trend is expected to continue during the forecast period.

This increased awareness by both patients and doctors of the benefits of surgical treatment for degenerative disc diseases, scoliosis, and other spinal fractures contributes to an ever-growing inclination toward advanced spinal surgeries. There has been an overall increase in preference for surgical treatments, and thus, use of pedicle screw systems is generally associated with the rise in awareness about such benefits, like better results, stability, and short recovery times.

Educational programs, patient advocacy, and widespread media coverage have diminished the stigma surrounding spine surgery. Patients are thus more likely to seek surgical intervention when conservative treatments fail. Combined with Japan's highly skilled medical workforce and world-class healthcare infrastructure, this increasing acceptance leads to the adoption of pedicle screw systems, making the market expand in the country.

The market players are using strategies to stay competitive, such as product differentiation through innovative formulations, strategic partnerships with healthcare providers for distribution. Another key strategic focus of these companies is to actively look for strategic partners to bolster their product portfolios and expand their global market presence.

Recent Industry Developments in Pedicle Screw Systems Market

In terms of product, the industry is divided into- cervical pedicle screw systems and thoraco-lumbar pedicle screw systems.

In terms of material, the industry is segregated into- stainless steel, titanium alloys and unalloyed titanium.

In terms of application, the industry is segregated into- spondylolisthesis, fracture, scoliosis, spinal tumor, failed fusion and others.

In terms of level of surgery, the industry is segregated into- one-level pedicle screw systems, two-level pedicle screw systems, three-level pedicle screw systems and four-level and higher pedicle screw systems.

In terms of end user, the industry is segregated into- hospitals, ambulatory surgery centers and specialized clinics.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global market for pedicle screw systems is projected to witness CAGR of 4.6% between 2025 and 2035.

The global pedicle screw systems industry stood at USD 5.15 billion in 2024.

The global market for pedicle screw systems is anticipated to reach USD 8.54 billion by 2035 end.

India is set to record the highest CAGR of 4.5% in the assessment period.

The key players operating in the global market for pedicle screw systems include Medtronic, Aesculap Implant Systems LLC, Alphatec Holdings Inc., DePuy Synthes Inc, Evolution Spine LLC, Exactech Inc, Globus Medical Inc, Implanet SA, Life Spine Inc and NuVasive Inc.

Table 1: Global Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, by Product Type

Table 2: Global Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 3: Global Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 4: Global Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 5: Global Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 6: Global Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 7: Global Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Region

Table 8: North America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 9: North America Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 10: North America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 11: North America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 12: North America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 13: North America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 14: Europe Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 15: Europe Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 16: Europe Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 17: Europe Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 18: Europe Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 19: Europe Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 20: Latin America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 21: Latin America Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 22: Latin America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 23: Latin America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 24: Latin America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 25: Latin America Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 26: East Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 27: East Asia Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 28: East Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 29: East Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 30: East Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 31: East Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 32: South Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 33: South Asia Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 34: South Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 35: South Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 36: South Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 37: South Asia Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 38: Oceania Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 39: Oceania Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 40: Oceania Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 41: Oceania Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 42: Oceania Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 43: Oceania Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 44: Middle East and Africa Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 45: Middle East and Africa Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 46: Middle East and Africa Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 47: Middle East and Africa Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 48: Middle East and Africa Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 49: Middle East and Africa Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 50: Emerging Market Value (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029

Table 51: China Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 52: China Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 53: China Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 54: China Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 55: China Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 56: China Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 57: India Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 58: China Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 59: India Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 60: India Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 61: India Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 62: India Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Table 63: Brazil Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 64: Brazil Market Volume (Units) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Product Type

Table 65: Brazil Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Material Type

Table 66: Brazil Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Application

Table 67: Brazil Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By Level of Surgery

Table 68: Brazil Market Size (US$ Million) Analysis 2014 to 2021 and Forecast 2022 to 2029, By End User

Figure 1: Regional Average Pricing Analysis (US$) of Cervical, (2021A)

Figure 2: Regional Average Pricing Analysis (US$) of Cervical, (2029F)

Figure 3: Regional Average Pricing Analysis (US$) of Thoraco-Lumbar, (2021A)

Figure 4: Regional Average Pricing Analysis (US$) of Thoraco-Lumbar, (2029F)

Figure 5: Global Market Historical Market Value (US$ Million) Analysis, 2014 to 2021

Figure 6: Global Current and Future Market Value (US$ Million), 2022 to 2029 & Y-o-Y Growth Trend Analysis

Figure 7: Market Absolute $ Opportunity, 2021 to 2029

Figure 8: Global Market Share Analysis (%) By Product Type, 2022 & 2029

Figure 9: Global Market Y-o-Y Growth (%) By Product Type, 2022 to 2029

Figure 10: Global Market Attractiveness Analysis, By Product Type

Figure 11: Global Market Share Analysis (%) By Material Type, 2022 & 2029

Figure 12: Global Market Y-o-Y Growth (%) By Material Type, 2022 to 2029

Figure 13: Global Market Attractiveness Analysis, By Material Type

Figure 14: Global Market Share Analysis (%) By Application, 2022 & 2029

Figure 15: Global Market Y-o-Y Growth (%) By Application, 2022 to 2029

Figure 16: Global Market Attractiveness Analysis, By Application

Figure 17: Global Market Share Analysis (%) By Level of Surgery, 2022 & 2029

Figure 18: Global Market Y-o-Y Growth (%) By Level of Surgery, 2022 to 2029

Figure 19: Global Market Attractiveness Analysis, By Level of Surgery

Figure 20: Global Market Share Analysis (%) By End User, 2022 & 2029

Figure 21: Global Market Y-o-Y Growth (%) By End User, 2022 to 2029

Figure 22: Global Market Attractiveness Analysis, By End User

Figure 23: Global Market Share Analysis (%) By Region, 2022 & 2029

Figure 24: Global Market Y-o-Y Growth (%) By Region, 2022 to 2029

Figure 25: Global Market Attractiveness Analysis, By Region

Figure 26: North America Market Value (US$ Million) Analysis, 2014 to 2021

Figure 27: North America Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 28: North America Market Attractiveness Analysis, By Product Type

Figure 29: North America Market Attractiveness Analysis, By Material Type

Figure 30: North America Market Attractiveness Analysis, By Application

Figure 31: North America Market Attractiveness Analysis, By Level of Surgery

Figure 32: North America Market Attractiveness Analysis, By End User

Figure 33: North America Market Attractiveness Analysis, By Country

Figure 34: Europe Market Value (US$ Million) Analysis, 2014 to 2021

Figure 35: Europe Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 36: Europe Market Attractiveness Analysis, By Product Type

Figure 37: Europe Market Attractiveness Analysis, By Material Type

Figure 38: Europe Market Attractiveness Analysis, By Application

Figure 39: Europe Market Attractiveness Analysis, By Level of Surgery

Figure 40: Europe Market Attractiveness Analysis, By End User

Figure 41: Europe Market Attractiveness Analysis, By Country

Figure 42: Latin America Market Value (US$ Million) Analysis, 2014 to 2021

Figure 43: Latin America Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 44: Latin America Market Attractiveness Analysis, By Product Type

Figure 45: Latin America Market Attractiveness Analysis, By Material Type

Figure 46: Latin America Market Attractiveness Analysis, By Application

Figure 47: Latin America Market Attractiveness Analysis, By Level of Surgery

Figure 48: Latin America Market Attractiveness Analysis, By End User

Figure 49: Latin America Market Attractiveness Analysis, By Country

Figure 50: East Asia Market Value (US$ Million) Analysis, 2014 to 2021

Figure 51: East Asia Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 52: East Asia Market Attractiveness Analysis, By Product Type

Figure 53: East Asia Market Attractiveness Analysis, By Material Type

Figure 54: East Asia Market Attractiveness Analysis, By Application

Figure 55: East Asia Market Attractiveness Analysis, By Level of Surgery

Figure 56: East Asia Market Attractiveness Analysis, By End User

Figure 57: East Asia Market Attractiveness Analysis, By Country

Figure 58: South Asia Market Value (US$ Million) Analysis, 2014 to 2021

Figure 59: South Asia Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 60: South Asia Market Attractiveness Analysis, By Product Type

Figure 61: South Asia Market Attractiveness Analysis, By Material Type

Figure 62: South Asia Market Attractiveness Analysis, By Application

Figure 63: South Asia Market Attractiveness Analysis, By Level of Surgery

Figure 64: South Asia Market Attractiveness Analysis, By End User

Figure 65: South Asia Market Attractiveness Analysis, By Country

Figure 66: Oceania Market Value (US$ Million) Analysis, 2014 to 2021

Figure 67: Oceania Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 68: Oceania Market Attractiveness Analysis, By Product Type

Figure 69: Oceania Market Attractiveness Analysis, By Material Type

Figure 70: Oceania Market Attractiveness Analysis, By Application

Figure 71: Oceania Market Attractiveness Analysis, By Level of Surgery

Figure 72: Oceania Market Attractiveness Analysis, By End User

Figure 73: Oceania Market Attractiveness Analysis, By Country

Figure 74: Middle East and Africa Market Value (US$ Million) Analysis, 2014 to 2021

Figure 75: Middle East and Africa Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 76: Middle East and Africa Market Attractiveness Analysis, By Product Type

Figure 77: Middle East and Africa Market Attractiveness Analysis, By Material Type

Figure 78: Middle East and Africa Market Attractiveness Analysis, By Application

Figure 79: Middle East and Africa Market Attractiveness Analysis, By Level of Surgery

Figure 80: Middle East and Africa Market Attractiveness Analysis, By End User

Figure 81: Middle East and Africa Market Attractiveness Analysis, By Country

Figure 82: Global Vs. Emerging Market Value (%) Analysis 2014 to 2021 and Forecast 2022 to 2029

Figure 83: China Market Value (US$ Million) Analysis, 2014 to 2021

Figure 84: China Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 85: China Market Attractiveness Analysis, By Product Type

Figure 86: China Market Attractiveness Analysis, By Material Type

Figure 87: China Market Attractiveness Analysis, By Application

Figure 88: China Market Attractiveness Analysis, By Level of Surgery

Figure 89: China Market Attractiveness Analysis, By End User

Figure 90: India Market Value (US$ Million) Analysis, 2014 to 2021

Figure 91: India Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 92: India Market Attractiveness Analysis, By Product Type

Figure 93: India Market Attractiveness Analysis, By Material Type

Figure 94: India Market Attractiveness Analysis, By Application

Figure 95: India Market Attractiveness Analysis, By Level of Surgery

Figure 96: India Market Attractiveness Analysis, By End User

Figure 97: Brazil Market Value (US$ Million) Analysis, 2014 to 2021

Figure 98: Brazil Market Value (US$ Million) & Y-o-Y Growth (%), 2022 to 2029

Figure 99: Brazil Market Attractiveness Analysis, By Product Type

Figure 100: Brazil Market Attractiveness Analysis, By Material Type

Figure 101: Brazil Market Attractiveness Analysis, By Application

Figure 102: Brazil Market Attractiveness Analysis, By Level of Surgery

Figure 103: Brazil Market Attractiveness Analysis, By End User

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pedicle Screw Positioning Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Screw Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Screw Compressor Market Size and Share Forecast Outlook 2025 to 2035

Screw Capping Machine Market Size and Share Forecast Outlook 2025 to 2035

Screwdriver Market Size and Share Forecast Outlook 2025 to 2035

Screw Top Jar Market Insight - Growth & Trends to 2025 to 2025

Key Players & Market Share in Screw Conveyor Industry

Screw Air End Market Growth – Trends & Forecast 2024-2034

Screw Jacks Market

Screw Top Lids Market

Screw Top Pails Market

Leadscrew Market

Twin Screw Extruders Market Size and Share Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bone Screw System Market Growth – Demand, Trends & Industry Forecast 2024-2034

Ball screw Market

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Electric Corkscrew Market

Polypropylene Screw Caps Market

Structural Wood Screws Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA