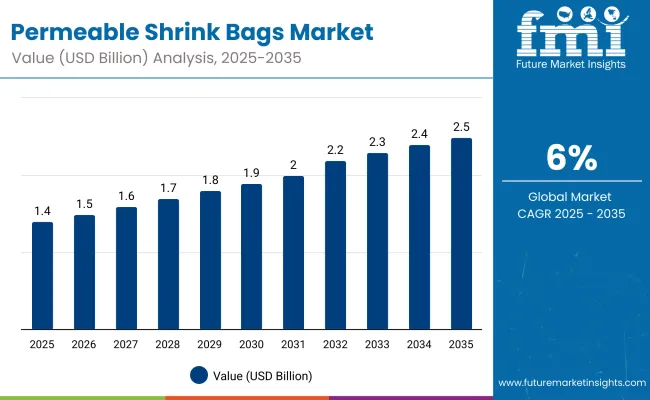

The permeable shrink bags market is expected to grow from USD 1.4 billion in 2025 to USD 2.5 billion by 2035, resulting in a total increase of USD 1.1 billion over the forecast decade. This represents a 78.6% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 6.0%. Over ten years, the market grows by a 1.8 multiple.

In the first five years (2025-2030), the market progresses from USD 1.4 billion to USD 1.9 billion, contributing USD 0.5 billion, or 45.5% of total decade growth. This phase is shaped by rising demand in fresh meat and cheese packaging, driven by permeability benefits that allow controlled oxygen transfer. Regulatory emphasis on food safety further strengthens adoption.

In the second half (2030-2035), the market grows from USD 1.9 billion to USD 2.5 billion, adding USD 0.6 billion, or 54.5% of the total growth. This acceleration is supported by advanced multilayer films, recyclable shrink materials, and enhanced puncture resistance. Expansion into emerging markets and consumer demand for extended shelf life in protein products ensure continued growth in this specialized packaging segment.

From 2020 to 2024, the permeable shrink bags market increased from USD 1.1 billion to USD 1.3 billion, supported by rising demand in fresh meat, cheese, and poultry packaging where controlled oxygen permeability is critical. Nearly 70% of revenue came from global packaging majors emphasizing food safety and extended shelf life. Leading companies such as Sealed Air, Amcor, and Winpak advanced multi-layer films with superior shrink performance and high puncture resistance. Competitive focus remained on barrier control, machinability, and food-grade compliance, while antimicrobial coatings and smart indicators stayed secondary. Service-led offerings, like pack performance audits, contributed less than 15% of total revenues during this period.

By 2035, the permeable shrink bags market will reach USD 2.5 billion, growing at a CAGR of 6.00%, with smart barrier technologies and recyclable shrink films representing over 40% of market value. Competitive intensity will rise as providers offer bio-based multilayer bags, embedded freshness indicators, and AI-driven packaging performance analytics. Established players are pivoting toward hybrid models combining advanced permeability control with digital traceability solutions. Emerging entrants such as Coveris, Schur Flexibles, and Krehalon are gaining market share with modular shrink systems, eco-friendly materials, and enhanced machinability, meeting global demand for sustainable and safe protein packaging.

Manufacturing sector implementation presents distinct challenges where packaging equipment suppliers must provide specialized machinery capable of handling advanced shrink film properties. Converting operations require precise temperature and tension controls that differ substantially from conventional shrink packaging processes. Equipment maintenance protocols must account for specialized cleaning procedures that prevent permeability channel contamination. Operator training programs need extensive modification to address material handling techniques specific to controlled oxygen transmission packaging.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Value (2035F) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.0% |

The growing demand for fresh, longer-lasting meat, poultry, and seafood products is driving growth in the permeable shrink bags market. These bags allow controlled oxygen transmission, extending shelf life while preserving color and texture. Increasing consumption of packaged protein and global expansion of cold chain logistics are boosting adoption.

Bags designed with advanced multilayer films, high puncture resistance, and tailored gas permeability are gaining traction for their ability to balance freshness and safety. Compatibility with automated packaging lines enhances efficiency, while reduced product drip loss appeals to retailers. Sustainability efforts with recyclable and lightweight materials further strengthen market growth opportunities worldwide.

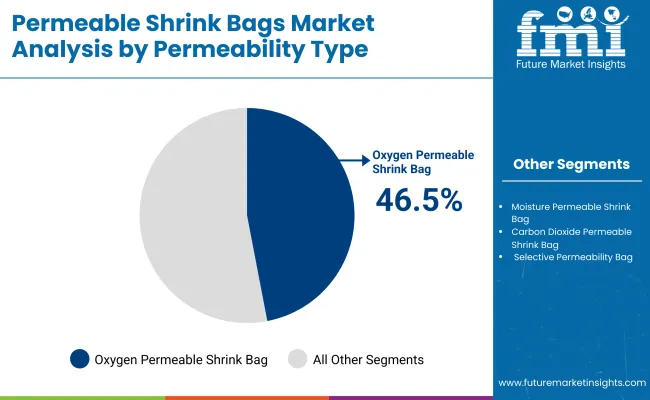

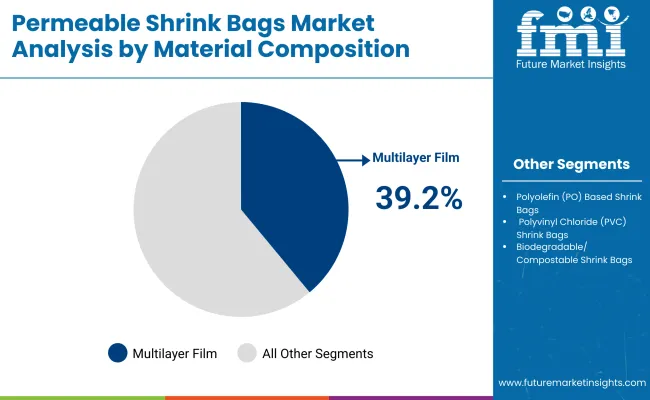

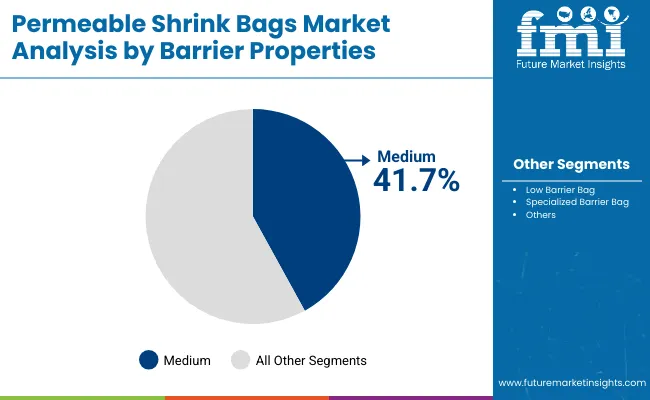

The market is segmented by permeability type, material composition, barrier properties, thickness, application, end-use industry, and region. Permeability type includes oxygen permeable, moisture permeable, carbon dioxide permeable, and selective permeability bags, designed to extend product shelf life. Material composition covers polyolefin-based shrink bags, PVC shrink bags, multilayer films such as EVOH, PA, and PE blends, along with biodegradable and compostable shrink bags. Barrier properties include low barrier, medium barrier, and specialized barrier bags, ensuring tailored protection for diverse food categories.

Thickness segmentation comprises up to 50 microns, 50-70 microns, and above 70 microns, offering durability and efficiency. Applications include fresh meat, processed meat, poultry, seafood, cheese and dairy, and others. End-use industries consist of retail meat & grocery chains, food processing companies, cheese manufacturers, seafood processors, and frozen & chilled food distributors. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Oxygen permeable shrink bags are projected to account for 46.5% of the market in 2025, driven by their ability to maintain meat color, freshness, and shelf appeal. These bags allow controlled oxygen transmission, which prevents premature spoilage while retaining the natural red appearance of fresh cuts. They are widely adopted in fresh meat and poultry packaging.

Their growing use is tied to retail demand for extended shelf-life products that maintain consumer appeal. Advances in polymer engineering enhance oxygen control, ensuring balance between freshness and microbial safety. These bags are integral to cold chain operations where display quality directly influences purchasing decisions.

Multilayer films are forecast to hold 39.2% of the market in 2025, offering excellent balance of permeability, strength, and sealing performance. Using blends of EVOH, PA, and PE, these films deliver adjustable barrier properties that suit diverse food categories. Their durability and puncture resistance ensure protection during storage and transport.

Adoption is driven by demand for high-performance packaging solutions across meat, cheese, and seafood applications. Multilayer construction also supports printing and labeling flexibility, enhancing brand presentation. As food safety regulations tighten, multilayer films are increasingly chosen for their compliance with global standards and ability to maintain product integrity.

Medium barrier bags are projected to represent 41.7% of the market in 2025, providing optimal protection against moisture and oxygen without the higher cost of specialized solutions. They suit a wide range of fresh and processed food items where moderate permeability ensures both safety and shelf-life extension.

These bags are popular among food processors seeking affordable yet reliable packaging. Advances in co-extrusion and resin technology further improve performance consistency. The segment’s balance of quality and cost makes it a preferred choice for mid-scale producers and retailers handling diverse product lines.

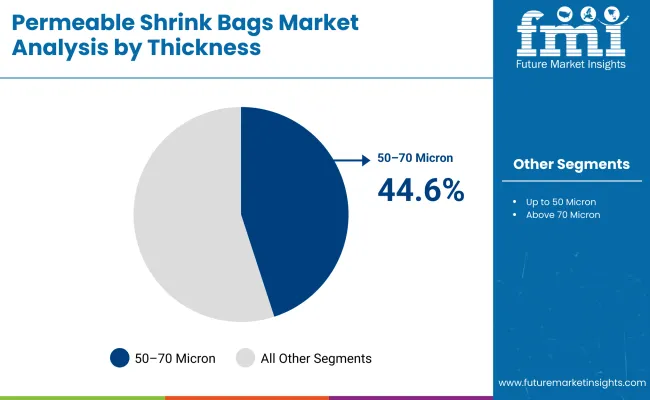

Bags with 50-70 microns thickness are forecast to account for 44.6% of the market in 2025, favoured for their strength and versatility across various food categories. This thickness provides adequate durability against punctures while remaining flexible enough for shrink wrapping operations.

Their ability to protect heavier cuts of meat and bulk products while maintaining shrink efficiency supports adoption. Food processors prefer this range for balancing material use, cost, and performance. Compatibility with automated shrink-wrapping equipment further reinforces its market share.

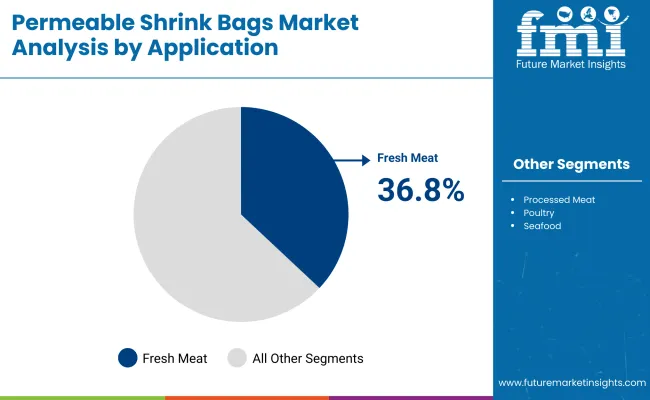

Fresh meat packaging is projected to hold a 36.8% share in 2025, driven by the need to ensure product safety, freshness, and shelf presentation. Permeable shrink bags in this category allow controlled gas exchange, preventing discoloration and extending shelf visibility.

Retailers prioritize these solutions to maintain quality through extended cold chain distribution. Packaging innovations such as easy-open seals and printable surfaces add further consumer convenience. Fresh meat continues to anchor demand due to consistent global consumption patterns and reliance on premium product presentation.

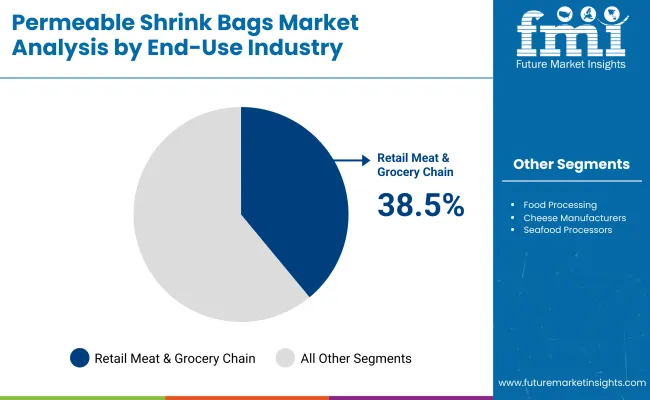

Retail meat and grocery chains are expected to represent 38.5% of demand in 2025, as these outlets require reliable packaging solutions to meet high-volume sales and customer expectations. Permeable shrink bags help preserve freshness and appearance, influencing consumer purchasing behaviour directly at the shelf.

These chains invest heavily in packaging innovation to enhance branding and reduce spoilage losses. Strategic partnerships with packaging suppliers allow customization for specific product lines. The segment’s dominance reflects the importance of packaging in shaping consumer trust and retail profitability.

The permeable shrink bags market is growing as demand rises for packaging that allows controlled gas exchange to extend the shelf life of fresh meat, poultry, and seafood. Adoption is driven by food safety regulations, global cold chain expansion, and consumer demand for fresher products. However, high material costs and recycling limitations restrict wider usage. Innovations in multilayer films, eco-friendly polymers, and automation-compatible formats are reshaping market opportunities.

Extended Shelf Life, Freshness Preservation, and Regulatory Compliance Driving Adoption

Permeable shrink bags are designed to maintain optimal oxygen transmission rates, keeping meat and seafood fresh while reducing spoilage. These bags support modified atmosphere packaging (MAP) and vacuum packaging methods, ensuring product quality during distribution. Rising global demand for protein-rich diets and stricter food safety standards are driving adoption in both developed and emerging markets. Retailers also favour these solutions for their transparency, product display quality, and ability to maintain appealing product colour. Together, these benefits position permeable shrink bags as a vital tool in modern food packaging.

High Costs, Recycling Challenges, and Processing Limitations Restraining Growth

Despite benefits, high costs of advanced multilayer films and manufacturing processes limit affordability for smaller meat processors. Recycling is challenging because permeable shrink bags often combine polyethylene, polyamide, and barrier coatings, complicating material separation. Limited compatibility with certain automated sealing equipment further hinders widespread use. In regions with strict plastic waste regulations, disposal adds compliance pressure. These issues slow market penetration, especially in cost-sensitive markets where price competition is high.

Multilayer Films, Sustainable Polymers, and Automation Integration Trends Emerging

Key trends include the development of advanced multilayer films with improved oxygen permeability and puncture resistance, ensuring longer shelf life for fresh proteins. Manufacturers are introducing sustainable, recyclable, and biodegradable polymer options to align with environmental regulations. Automation-compatible designs are gaining popularity, supporting faster, more consistent packaging operations. Enhanced printing and branding capabilities on shrink bags are also helping retailers differentiate products. As global meat consumption and export volumes increase, permeable shrink bags are positioned as critical to food safety, extended freshness, and sustainability-focused packaging solutions.

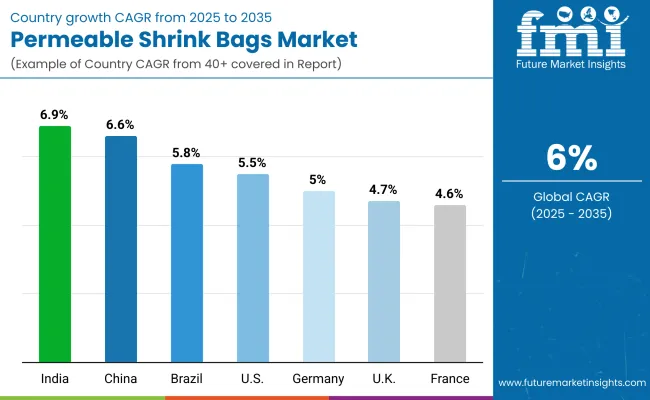

The global permeable shrink bags market is expanding steadily, fuelled by demand for high-barrier packaging that preserves freshness, extends shelf life, and supports sustainable practices. Asia-Pacific is emerging as the fastest-growing region, with India and China leading adoption due to growth in meat, seafood, and dairy packaging needs. Developed markets like the USA, Germany, and Japan remain critical in driving innovations such as recyclable multilayer films, automation-ready shrink processes, and regulatory-compliant packaging systems across food processing and retail.

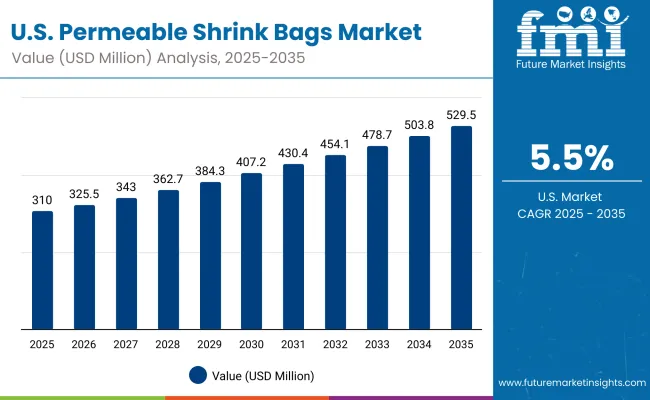

The USA market is projected to grow at a CAGR of 5.5% from 2025 to 2035, supported by strong demand from meat, poultry, and cheese packaging. Consumers are increasingly seeking vacuum-sealed products with extended shelf stability. Manufacturers are investing in recyclable shrink bags designed to maintain oxygen permeability for freshness. Advanced bagging lines with automation and labelling integration are also enhancing efficiency in food processing plants, making permeable shrink bags central to modern USA packaging strategies.

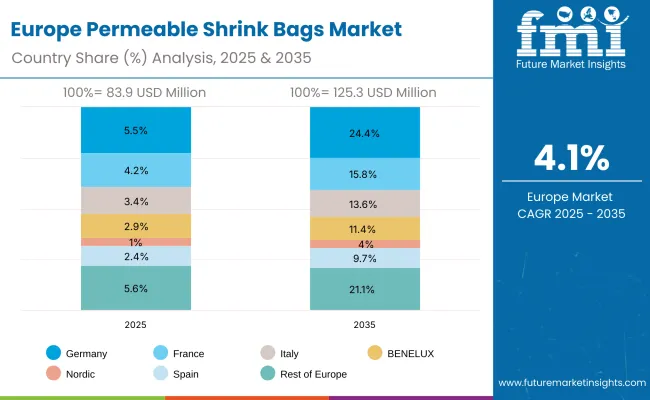

Germany’s market is expected to grow at a CAGR of 5.0%, driven by stringent EU food safety standards and strong meat and dairy exports. Demand for permeable shrink bags is increasing in premium food packaging due to their ability to balance shelf stability and freshness. Manufacturers are introducing eco-friendly, recyclable materials to align with sustainability regulations. Germany’s engineering strengths are also leading to advanced shrink systems integrated with smart sealing and quality monitoring technologies.

The UK market is forecast to expand at a CAGR of 4.7%, supported by demand in ready-to-cook, premium meat, and seafood products. Rising consumer preference for transparent, safe, and portion-controlled packaging is driving adoption. Local producers are adopting recyclable shrink bags to meet packaging waste reduction mandates. Startups and mid-sized processors are turning to automated shrink lines to scale operations and enhance consistency, aligning with FSMA and sustainability compliance standards in food supply chains.

China’s market is projected to grow at a CAGR of 6.6%, fuelled by rapid growth in protein consumption, seafood exports, and e-commerce-driven frozen food sales. Domestic manufacturers are scaling production of cost-effective permeable shrink bags with improved durability. Government food safety regulations are pushing wider adoption of advanced shrink-packaging technologies. Increasing demand from cold chain logistics and quick-service restaurants is also driving integration of shrink bags into diverse food categories across the country.

India is forecast to record the fastest growth at a CAGR of 6.9%, supported by rising demand for dairy, poultry, and seafood packaging. Export-focused meat processors are increasingly investing in high-barrier shrink bag formats that meet international standards. SMEs are adopting affordable shrink solutions to reduce spoilage and extend shelf life. Growing e-commerce grocery and ready-to-cook food markets are also accelerating demand for permeable shrink bags, particularly in urban regions with rising cold storage infrastructure.

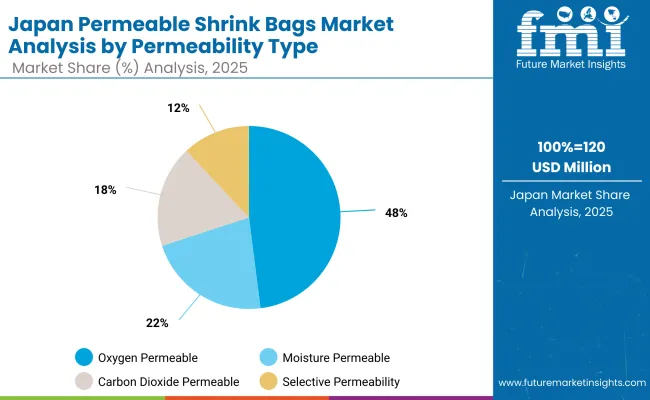

Japan’s market is projected to grow at a CAGR of 5.2%, driven by demand for seafood, premium meat, and ready-to-cook meal packaging. The country’s focus on hygiene and convenience is encouraging adoption of permeable shrink bags with precision sealing. Manufacturers are innovating with multilayer, moisture-resistant films tailored for seafood exports. Compact shrink systems are being widely adopted in small-scale facilities, while large-scale producers emphasize automated, high throughput shrink lines for operational efficiency and consistency.

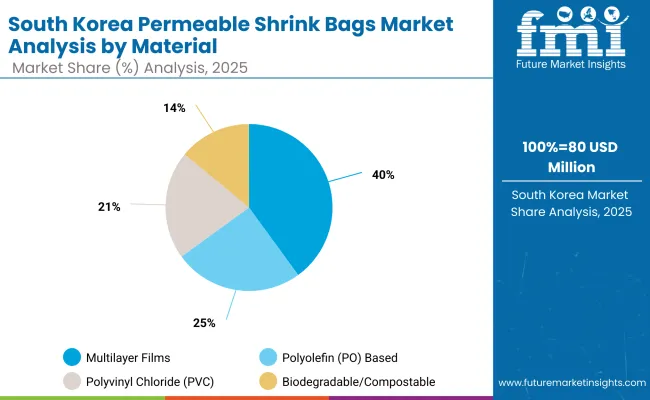

South Korea’s market is expected to grow at a CAGR of 4.8%, supported by its strong seafood, meat, and processed food industries. Shrink bags are being used to maintain product quality for both domestic and export markets. Manufacturers are emphasizing recyclable and lightweight shrink materials to align with global sustainability trends. Increasing exports of K-food and ready-to-cook meals are also driving innovation in permeable shrink bag applications, supported by advanced automated packaging lines.

Japan’s permeable shrink bags market is projected to reach USD 120 million in 2025, with oxygen permeable bags leading at 45.9% share. Moisture permeable bags follow at 23.2%, while carbon dioxide permeable bags account for 19.8%. Selective permeability bags contribute 11.2% of the market. Oxygen permeable bags dominate due to their effectiveness in extending product freshness and reducing spoilage, particularly for food and meat packaging. Moisture and carbon dioxide permeable bags serve specialized applications, while selective permeability solutions support niche needs, reflecting a growing diversification in Japan’s packaging industry driven by safety, quality, and storage performance requirements.

South Korea’s permeable shrink bags market, estimated at USD 80 million in 2025, is led by multilayer films (EVOH, PA, PE blends), which hold 37.9% of market share. Polyolefin-based shrink bags follow at 25.6%, PVC shrink bags account for 22.3%, and biodegradable/compostable options represent 14.1%. Multilayer films dominate due to superior barrier properties against oxygen and moisture, ensuring high food safety and extended shelf life. However, biodegradable shrink bags are steadily growing in adoption, reflecting increasing demand for sustainable packaging. Regulatory pressure and consumer preference for eco-friendly alternatives are expected to shift material trends in South Korea’s packaging sector.

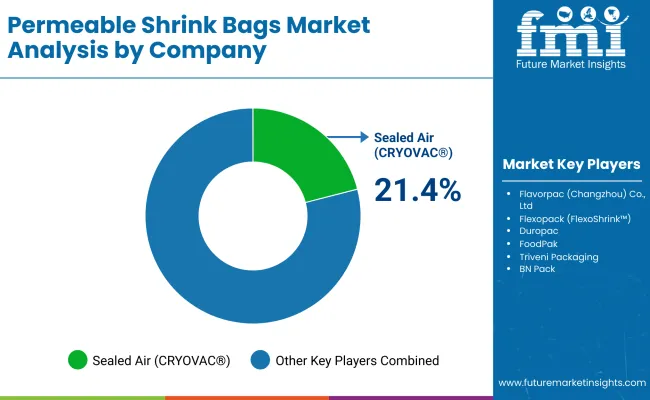

The permeable shrink bags market is moderately fragmented. Competition exists among global packaging leaders, regional converters, and specialized food packaging firms supplying solutions for meat, cheese, and fresh produce applications. Sealed Air (CRYOVAC®), Flavorpac (Changzhou) Co., Ltd., and Flexopack (FlexoShrink™) lead with high-barrier, breathable films designed for controlled permeability and extended shelf life. Their focus includes automation-ready formats and recyclable material development to meet food safety and sustainability standards. Duropac, FoodPak, and Triveni Packaging operate as mid-sized players providing shrink bag systems with strong sealing, consistent shrink ratios, and puncture resistance. These companies are active in protein and dairy packaging, offering customized solutions that improve leak prevention, product visibility, and line efficiency.

BN Pack, Pak&Vac, and Foresight Packaging Solutions serve niche regional markets, emphasizing flexible order volumes, fast turnaround times, and print customization. Their development of thin-gauge, high-strength films addresses sustainability and cost-efficiency goals for small and mid-size processors. KLAY EnerSol supports the market with specialized film engineering expertise, enhancing heat-seal performance and material durability. Market growth relies on advances in film permeability control, recyclability, and packaging automation compatibility, aligning with global shifts toward sustainable food protection solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| By Permeability Type | Oxygen Permeable Shrink Bags, Moisture Permeable Shrink Bags, Carbon Dioxide Permeable Shrink Bags, Selective Permeability Bags |

| By Material Composition | Polyolefin (PO) Based Shrink Bags, Polyvinyl Chloride (PVC) Shrink Bags, Multilayer Films (EVOH, PA, PE blends), Biodegradable/Compostable Shrink Bags |

| By Barrier Properties | Low Barrier Bags, Medium Barrier Bags, Specialized Barrier Bags |

| By Thickness | Up to 50 Microns, 50-70 Microns, Above 70 Microns |

| By Application | Fresh Meat, Processed Meat, Poultry, Seafood, Cheese and Dairy, Others |

| By End-Use Industry | Retail Meat & Grocery Chains, Food Processing Companies, Cheese Manufacturers, Seafood Processors, Frozen & Chilled Food Distributors |

| Key Companies Profiled |

Sealed Air (CRYOVAC®), Flavorpac (Changzhou) Co., Ltd., Flexopack (FlexoShrink™), Duropac, FoodPak, Triveni Packaging, BN Pack, Pak&Vac, Foresight Packaging Solutions, KLAY EnerSol |

| Additional Attributes | Growing preference for oxygen-permeable shrink bags to extend freshness of red meat, increasing adoption of multilayer films for enhanced barrier performance, rise in biodegradable shrink bag use to meet sustainability goals, demand from cheese and seafood processors for specialized permeability control, and rising retail adoption driven by convenience packaging trends and chilled supply chain expansion. |

The global permeable shrink bags market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the permeable shrink bags market is projected to reach USD 2.5 billion by 2035.

The permeable shrink bags market is expected to grow at a CAGR of 6.0% between 2025 and 2035.

The key permeability types in the permeable shrink bags market include oxygen permeable, moisture permeable, carbon dioxide permeable, and selective permeability shrink bags.

The oxygen permeable shrink bags segment is expected to account for the highest share of 46.5% in the permeable shrink bags market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shrink Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Shrink Wrapper Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Machine Size and Share Forecast Outlook 2025 to 2035

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Shrink Label Machine Market Size and Share Forecast Outlook 2025 to 2035

Shrink Tunnel Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Shrink Bundling Film

Analyzing Shrink Label Machine Market Share & Industry Leaders

Market Share Distribution Among Shrink Sleeve Labels Providers

Market Share Insights for Shrink Wrapping Machines Providers

Industry Share Analysis for Shrink Sleeve Label Applicator Manufacturers

Shrink Sleeve Labels Market Analysis by Flexographic and Digital Printing Through 2034

Shrink Bundling Film Market by Material Type from 2024 to 2034

Shrink Bundling Machine Market Trends & Forecast 2024-2034

Shrink Sleeve Labeling Equipment Market

Shrink Wrapping Machine Market

Shrink Tanks Market

Shrink Bands Market

Ops Shrink Label Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA