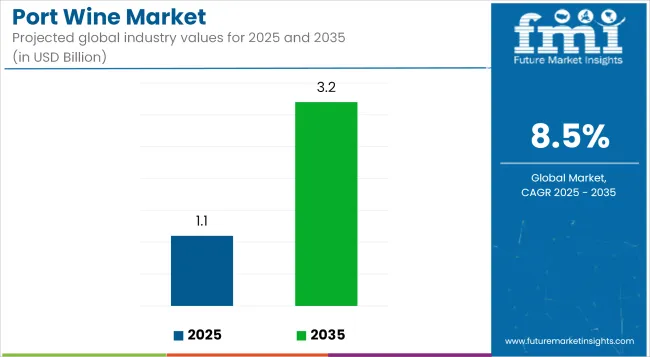

Rising adoption in mainstream and emerging markets is likely to drive the Port Wine market from a 2025 base of USD 1.10 Billion to a projected USD 3.20 Billion by 2035, advancing at a CAGR of 8.5%. A surge in premiumization across alcoholic beverages, combined with increasing consumer interest in fortified wines, is expected to maintain the market’s momentum.

With a base rooted in traditional Portuguese wine-making, the Port Wine category is benefiting from renewed interest among younger consumers and collectors in both mature and emerging wine-drinking regions.

Growth is being underpinned by several industry shifts. Ruby Port continues to outperform due to its price-accessibility, longer shelf life, and increasing appeal among new wine consumers seeking sweeter red profiles. Meanwhile, the vintage and tawny sub-segments are gaining traction within connoisseur circles, contributing to higher value sales.

However, logistical complexities and taxation on fortified alcohol imports in key countries have restrained volume growth to some extent. The off-trade channel-including supermarkets, hypermarkets, and wine boutiques-has outpaced on-trade due to changing buying patterns and wider availability.

Digital marketing and experiential storytelling have been strategically deployed by wineries and distributors to expand appeal beyond heritage drinkers. Sustainability certifications and traceability in vineyard-to-bottle operations have also become key differentiators.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 1.10 Billion |

| Projected Global Industry Value (2035F) | USD 3.20 Billion |

| Value-based CAGR (2025 to 2035) | 8.5% |

By 2035, the market is expected to see increased diversification of Port Wine portfolios beyond traditional red varieties. White and rosé Port, as well as ready-to-serve and cocktail-based formats, are anticipated to widen the consumer base. Globalization of boutique wine tourism and interest in protected designation-of-origin (PDO) wines are expected to further elevate Port’s positioning.

While Europe will retain dominance, faster uptake is projected across North America and parts of Asia Pacific, particularly in metro cities where wine culture is evolving. Higher-margin product tiers and D2C innovations will likely define competitive strategy over the coming decade.

Estimated to represent under 3% of the global Port wine market volume in 2025, long-aged Ports stored in cask (20, 30, and 40-year-old Tawny and Colheita styles) command disproportionately high value due to their aging complexity and rarity. These ultra-premium segments are strategically leveraged by producers like Taylor Fladgate, Graham’s, and Quinta do Noval to enhance brand prestige and capitalize on connoisseur demand.

In markets like the USA and Japan, these products are often sold through auction houses, high-end retailers, or as limited-edition collections, yielding margins that are up to 5x higher than standard Ruby Ports. The Instituto dos Vinhos do Douro e Porto (IVDP) mandates stringent certification, which ensures consumer trust in aging claims.

Aging infrastructure investment and cellar technology modernization are being prioritized to scale this niche sustainably, particularly with climate variability affecting maturation profiles. This segment plays a vital role in reinforcing provenance narratives and acts as a gateway to heritage-based luxury positioning, increasingly attractive to wine collectors and experiential travelers.

Growth is further supported by content partnerships with sommeliers and heritage storytelling on winery platforms. Strategic focus remains on scarcity-driven pricing, authenticity verification, and heritage branding.

Private label Port wines, including exclusive SKUs developed for large-format retailers such as Aldi (UK), Lidl (EU), and Costco (US), account for nearly 6.7% of global off-trade Port wine volume as of 2025. These offerings are targeted toward budget-conscious consumers and occasional wine buyers seeking value, especially during holiday seasons.

Retailers collaborate with Portuguese cooperatives and second-tier exporters to deliver consistent quality at lower price points, often using less-aged Tawny or Ruby blends with simplified labeling. This segment provides a critical access point to younger or first-time Port wine buyers. While margin structures are lower, volume velocity compensates, especially in markets with limited consumer knowledge of fortified wines.

Unlike branded Port wines that rely on legacy and appellation storytelling, private labels often downplay origin and focus on taste descriptors and food pairing utility. Regulatory compliance with EU PDO requirements ensures that even value-segment wines maintain regional authenticity.

Growth in this segment is aided by modern packaging formats (e.g., screw caps, smaller bottle sizes) and integration into seasonal endcap promotions. Future opportunities lie in flavored or infused Ports under private labels targeting casual drinkers.

Awareness in Benefits is Driving the Market Growth

The port wine markets compound annual growth rate is being driven by growing awareness of the wines advantages. Market expansion is largely being driven by growing awareness of port wines health benefits particularly those related to the antioxidant resveratrol. The nutritional benefits have drawn more and more consumers which has helped the port wine industry grow steadily.

Individuals are aware of its positive impact on health and wellbeing. This pattern suggests that consumers are choosing healthier options. In response to this demand the port wine industry is highlighting its nutritional advantages which helps to maintain its growth.

Rise in Tourism Drives the Market Growth

Recent years have seen a sharp increase in wine tourism with tourists from all over the world choosing to visit and drink wine in wine-producing regions. It is anticipated that these elements will propel the Port Wine Markets expansion. Wine lovers and tourists from all over the world are drawn to the Douro Valley and other wine-producing regions which are home to historic vineyards wineries and stunning landscapes.

The demand for port wine is directly impacted by the rise in wine tourism which in turn propels the port wine market. Additionally, customers become devoted customers and grow to appreciate the product.

Tier 1 companies comprises industry leaders acquiring a 50% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

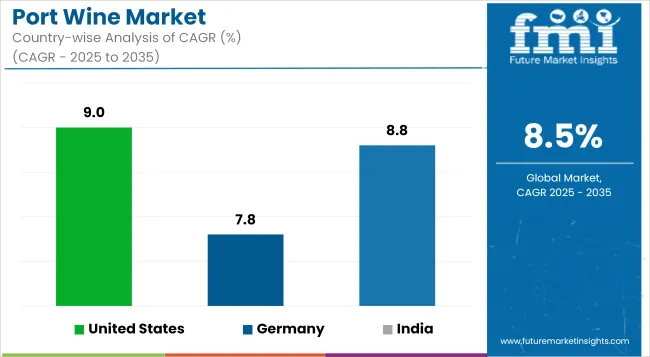

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 9.0%, 7.8% and 8.8%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 9.0% |

| Germany | 7.8% |

| India | 8.8% |

Many international wine producers focus on the USA because it continues to be the world’s largest wine consumer. In fact, 30% of the volume of port wine sold in the United States last year came from imports. In the United States the most significant channel for port wine sales in terms of volume and sales is still grocery stores wine shops and other off-premises businesses.

Over the forecast period the Indian market is expected to grow by over 8.8%. Based on FMI data the country consumes more than 30 million liters of wine annually. In India the majority of alcohol consumption has historically been in canned alcoholic beverages like beer whisky and rum.

Wine consumption has increased though due to a number of factors including rising purchasing power fast urbanization the availability of reasonably priced domestic wines the perceived health benefits of consuming low-alcohol beverages and shifting consumer attitudes. In the past ten years the Indian port wine industry has grown to be the largest category of alcoholic and non alcoholic beverages mostly due to the increase in upper-middle-class urban consumers.

Germany has a long wine culture but its industrial goods are more well-known than its agricultural or emotional products like wine. Germany has the fourth-largest market share for port wine worldwide despite its reputation for drinking beer. Fashion trends have led to the current popularity of aromatic wines in the German wine market.

In the past young people who drink wine did not think that light wines like sweet white wine rose and aromatic wine were cool. They prefer lighter wines and are now more confident consumers. Comparatively speaking German consumers are open to sampling wines from other countries. Customers increasing wine choices particularly occasionally improve New World wines standing in the port wine market.

The market for port wines will continue to grow as a result of major players in the industry making significant investments in R&D to broaden their product lines. Important market developments include new product launches contractual agreements mergers and acquisitions increased investments and cooperation with other organizations. Market participants are also engaging in a variety of strategic activities to broaden their footprint. In a more competitive and growing market environment the port wine industry needs to provide affordable products in order to grow and thrive.

By nature, methods industry has been categorized into Red and White

By type channel industry has been categorized into Tawny, Ruby and Vintage

Industry analysis has been carried out in key countries of North America, Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 8.5% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 3.20 Billion.

Rise in tourism is increasing demand for Port Wine.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Symington Family Estates, Quevedo, Sula Vineyard and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Audiometer Calibration System Market Size and Share Forecast Outlook 2025 to 2035

Wine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Portable Crushers Market Size and Share Forecast Outlook 2025 to 2035

Port Fuel Injection Units Market Size and Share Forecast Outlook 2025 to 2035

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Portable Toilet Rental Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Portable Appliance Tester (PAT) Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Portable Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Portable Electronic Analgesic Pump Market Size and Share Forecast Outlook 2025 to 2035

Portable Ramps Market Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Portable Buffet and Drop-In Ranges Market Size and Share Forecast Outlook 2025 to 2035

Portable Cancer Screen Devices Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA