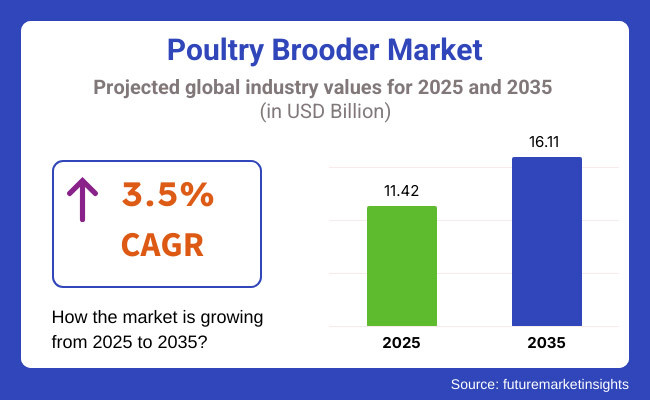

The worldwide poultry brooder industry is expected to be worth around USD 11.42 billion in 2025. With a forecasted compound annual growth rate (CAGR) of 3.5%, the industry is expected to be worth USD 16.11 billion by 2035. The growing mechanization of livestock farming operations is contributing significantly to industry growth. Poultry farm operators are increasingly adopting automation to optimize farm operations, improve efficiency, and minimize operational expenses.

The sector underwent a sudden transformation in 2024, with the heightened push of technological refinements, evolving consumer purchasing nature, and sustainability practices. The year further experienced an increased uptake of precision livestock farming practices, including smart-screening systems, robotic feeding solutions, and AI-backed health monitoring.

These advancements allowed cattle farmers to keep track of cattle health, improve feed efficiency, and limit operational costs. Additionally, the rising focus on sustainable and responsible livestock production attracted more investments in environmentally friendly feed alternatives, eventually improving waste management practices and climate-resilient breeding schemes.

Looking forward to 2025 and beyond, the industry refinements and expansion of the cattle supplies is projected to capitalize on these developments. The sector is likely to observe high-adoption of IoT-powered monitoring equipment, which will improve real-time data on cattle productivity and health. In addition, the surging demand for organic and grass-fed beef will encourage the adoption of pasture-based farming practices, creating sustainable growth in the industry.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Industry growth was consistent, fostered by the rising demand of dairy and meat globally, although impacted by COVID-19 supply chain challenges. | The industry will be reshaped by the automation and sustainability requirements, and AI-backed cattle management for seamless agriculture processes. |

| Rise of digital technologies including RFID tagging and automated feeding made production more efficient but was only used by large-scale operations. | Smart farming became the mainstream even for small-scale to mid-scale farms because of the IoT-backed disease tracking and automated nutrition systems. |

| Sustainability efforts concentrated on lowering methane emissions via optimized feed additives. | Carbon-neutral beef production, regenerative grazing, and lab-grown feed options will pick up speed. |

| Climate change resulted in unstable cattle health complications and feed shortages, elevating costs of production. | AI-based climate resilience planning and other protein sources will strengthen cattle immunity and industry stability. |

| There was increased demand for grass-fed, organic, and antibiotic-free beef, especially in Europe and North America. | Ethical beef production and blockchain-enabled meat traceability will become the choice of consumers. |

| Expansion of direct-to-consumer (DTC) platforms and online marketplaces broke up conventional supply chains. | Online marketplaces will be the major channel for sales, with data-driven logistics and inventory management streamlining world trade. |

The cattle supplies business comes under the category of the livestock and agriculture equipment sector, which is a part of the whole agriculture industry. It incorporated feed, veterinary services, breeding technology, farm automation, and cattle management systems.

The global cattle supplies industry is influenced by several macroeconomic determinants like rising population, evolving diet plans, trade policy, and progress in technologies. The heightened global demand for dairy and meat, particularly in developing nations, continues to boost investment in cost-effective cattle rearing solutions.

Furthermore, factors including inflation and fluctuating prices of feed have impacted industry consistency over the recent years. Government incentives and subsidies for sustainable livestock production, especially in North America and Europe, are driving the utilization of environmental-friendly feed as well as methane reduction solutions.

Climate change is another key driver transforming the industry. Unpredictable climatic conditions impact pasture fodder supply, prompting higher dependence on precision agriculture and substitute feed supply. Simultaneously, trade policies and geopolitics impact global beef supply chains, affecting exports and imports.

Between 2025 and 2035, industry growth will be shaped by digital transformation and sustainability efforts. AI-assisted herd management, blockchain-based supply chains, and alternative protein sources will be among the forces to shape efficiency and profitability in the cattle supplies sector.

The brooder industry for poultry is divided into electric brooders, gas brooders, and charcoal stove brooders, each serving distinct agricultural purposes. Charcoal stove brooders remain popular in areas with scarce electricity, especially in developing countries. They are used by farmers due to their affordability and simplicity, although fears of carbon emission and temperature variability fuel the demand for improved alternatives.

Gas brooders are expected to experience consistent growth as poultry farmers require energy-efficient equipment. Gas brooders will continue to be an option for large-scale poultry farms with improvements in thermostatic controls and fuel efficiency. Electric brooders will lead the industry as there is an increasing trend towards automation and a need for controlled temperature regulation.

Their potential to deliver uniform heat output and energy-efficient models makes them the first choice in commercial poultry operations. Clean energy initiatives in the agricultural sector launched by governments will further accelerate the growth of electric brooder usage. New technologies, like smart sensors and IoT-compatible temperature control, will improve their efficiency, and therefore, electric brooders will become the most wanted type among brooders by poultry farmers for future-proofing their business.

The industry for poultry brooders is classified into semi-automatic, manual, and automatic operations, with automation being the driver for industry growth. Automatic brooders will see the highest growth as poultry farmers increasingly seek efficiency and labor minimization. These brooders are endowed with sophisticated temperature control, humidity control, and automated feeding systems, thus presenting an optimal environment for poultry without human attention throughout.

With the advancement of technology, artificial intelligence will make these systems better, with real-time monitoring and adjustments for peak productivity. Manual brooders will remain in place for small-scale poultry farms and rural communities where automation is still not possible. Though they need constant monitoring, their low cost guarantees continued demand in price-sensitive areas.

Semi-automatic brooders will fill the gap between manual and automatic systems, providing limited automation at a low investment. Poultry farms intending to expand operations step by step will opt for these systems, taking advantage of features such as automatic heating but still having some level of manual operation. Greater adoption of IoT and remote monitoring systems in semi-automatic brooders will further make them user-friendly, making them a viable option for medium-sized poultry farms.

Poultry brooders are used across segments such as chickens, ducks, turkeys, and other poultry, with each having specific brooding requirements. The chicken segment will remain the industry leader owing to the large global demand for poultry meat and eggs. The growth in commercial poultry farming and increasing consumption patterns will propel investments in innovative brooding technologies that are customized for chicken production.

Ducks will also experience higher use of specialized brooders, especially in areas where duck farming is on the rise. Farmers are searching for energy-saving brooding systems that can accommodate the specific temperature and humidity requirements of ducklings. Turkeys, which need higher heat settings during their early growth phase, will gain from the increased availability of precision-controlled brooding machines.

Other bird species, such as geese and quails, will see their industry grow as niche farming becomes more popular. As consumers seek out other poultry species, farm owners will invest in multi-species brooding solutions that can support multiple bird species. The growing interest in maximizing the brooding conditions for various breeds of poultry will fuel demand for specialized and tailored brooder systems.

The industry for poultry brooders is distributed mainly through direct sales and agro sales channels, each contributing significantly to industry growth. Direct sales will become more dominant as manufacturers have direct relations with poultry farmers, offering tailor-made solutions and after-sales services. Large poultry farms, looking for long-term supply chain relationships, will opt for direct procurement in order to have reliable products and lower costs.

The transition to e-commerce will also boost direct sales, as poultry farm operators become more dependent on the internet to compare and buy brooders. Agro sales will remain a robust channel of distribution, especially in rural and developing sectors. Agricultural suppliers and cooperatives help make brooding equipment available to small and medium-sized farmers.

With governments and agriculture agencies promoting advanced poultry farming, agro distribution networks will find more support in place, thereby facilitating effective supply of advanced brooding solutions. Training schemes and funding facilities available through agro suppliers will further promote poultry farmers to adopt enhanced brooding facilities, resulting in greater use of automated and power-saving brooders in the industry.

The United States poultry brooder sector is likely to hold a leadership position, contributing to almost 30% of the total share in 2025. The robust poultry industry in the country, coupled with strong consumer demand for chicken products and speedy uptake of automated brooding technologies, continues to fuel industry growth.

Large-scale poultry farms are making significant investments in intelligent brooding systems that integrate IoT-enabled monitoring, ensuring efficient temperature management and feed efficiency. Sustainability continues to be a key focus, with higher regulatory interventions favoring energy-saving brooders and green heating options. Growth in the demand for organic and free-range poultry rearing is also affecting demand for advanced brooding technologies.

E-commerce platforms are also remodeling distribution channels, with direct manufacturer-to-farmer sales improving in a steady manner. Government encouragement toward modern poultry farming methods, such as grant incentives toward adopting low-emission heating systems, will further improve industry penetration.

With high investments in research and development, the United States continues to be a major innovator in poultry brooding technology, maintaining consistent industry growth through state-of-the-art automation, precision agriculture, and renewable energy systems.

Germany is expected to maintain a strong position in the poultry brooder industry, maintaining a share of close to 20% in 2025. The country's highly regulated poultry sector, strict animal welfare acts, and rising consumer demand for high-quality poultry products compel technology development in brooding solutions.

Germany's poultry farms are quickly transitioning to completely automated brooding systems, including AI-based temperature control and humidity control for maximizing chick survival rates. Industry growth comes dependent on sustainability, with the government mandating strong carbon emissions standards, prompting poultry growers to invest in energy-efficient and environmentally friendly brooders.

Growing demand for antibiotic-free and organic poultry is also driving demand for high-quality brooding equipment that promotes healthier growth environments. Germany's strong manufacturing industry underpins ongoing innovation in poultry brooder systems, enhancing heat efficiency and lowering operating costs for growers. With a well-developed poultry industry and technological innovation, Germany's poultry brooder sector will continue to grow steadily up to 2035.

United Kingdom's poultry brooder industry shall command close to 10% of the overall industry share by 2025 with a likely CAGR between 2025 and 2035 at 3.8%. Growth for the industry stems from increased consumer demand for organic and free-range poultry rearing as part of demand for more sustainable and ethically produced meat.

Government initiatives promoting low-carbon brooding methods are prompting poultry farm owners to make investments in electric and energy-efficient brooding equipment. Automation is emerging as a major trend, with AI-powered climate control and real-time monitoring solutions being rapidly implemented on poultry farms.

Increasing online retailing and direct-to-farmer sales channels are transforming the distribution landscape, facilitating poultry farmers' access to cutting-edge brooding solutions more efficiently. The UK's efforts towards the incorporation of renewable energy into farming activities have seen solar-powered brooders gain more uptake. Biosecurity regulations and poultry disease prevention efforts are also driving investments in improved brooding technologies.

China's poultry brooder industry is poised to hold nearly 10% value share in 2025, and it is projected to grow with a CAGR of 2.8% from 2025 to 2035. The nation's huge poultry industry, fueled by increasing demand for chicken and duck meat, is a key contributor to brooder sales. Large commercial poultry farms are investing in automation to optimize farm operations, specifically in electric and gas brooders with energy-efficient capabilities.

Urbanization and the expanding middle class are driving demand for better-quality poultry, leading farmers to embrace more sophisticated brooding systems that enhance chick survival. The Chinese government's emphasis on biosecurity measures against poultry disease is also spurring the uptake of smart brooding technologies.

Growing use of e-commerce to sell agricultural equipment is making brooder solutions available to small and mid-sized farms. With sustained government backing of mechanized poultry rearing and increasing investment in automation, China's poultry brooder industry will witness consistent improvements during the forecast period.

India's brooder poultry industry is expected to capture estimated 5% of global value share by 2025 with a high CAGR of 4.1% for the period from 2025 to 2035. Fast growth in India's poultry industry, spurred by rising meat demand and expanding commercial poultry farms, is propelling the demand for contemporary brooding systems.

Small and medium-scale poultry farmers are switching from conventional heating to automated and electric brooders in order to enhance chick survival and production yields. Government programs for farm mechanization and incentives for sophisticated livestock equipment are further fueling industry expansion.

Growing fear of poultry diseases and the demand for biosecure farming environments are causing widespread adoption of controlled heating systems. The trend of online marketing channels and agro-dealer networks is increasing the availability of high-quality brooding equipment to rural farmers. There is rising interest in energy-saving and solar-powered brooders that are making sustainable farming practices a trend.

Japan's poultry brooder industry will represent close to 3.8% of the world industry in 2025. The poultry industry in Japan is highly automated and efficient, and demand for high-end brooding solutions is on the rise. Technology-oriented farming being the focus in Japan, the country's poultry farmers are opting for AI-based climate control systems and precision brooding machinery to ensure maximum chick health and production rates.

Space limitations in poultry production have resulted in the creation of small, high-performance brooding systems that optimize production in small spaces. Sustainability continues to be a focus, with more emphasis on low-energy and intelligent brooding solutions that minimize electricity usage.

The need for antibiotic-free and organic poultry products is also influencing the industry, promoting investments in biosecure and clean brooder systems. Japan's dependency on imports for chicken equipment is slowly declining as local manufacturers emphasize innovation and autonomy.

South Korea's brooder industry for poultry is transforming at a fast pace, spurred by the growth of commercial poultry farms and the demand for efficient brooding solutions. The nation is experiencing a sharp transition toward automated brooding systems, with the integration of smart technology emerging as a top trend. Farmers are investing more in AI-driven climate control systems, real-time monitoring equipment, and energy-efficient heaters to promote poultry health and minimize mortality rates.

The emphasis of the government on encouraging sustainable livestock rearing practices is compelling the use of green and solar-powered brooders. South Korea's poultry sector is also experiencing increased consumer demand for organic and antibiotic-free chicken, compelling poultry farms to adopt sophisticated brooding systems that ensure healthier chick development. Following the prevalence of e-commerce channels, poultry farmers find it easier to access a great variety of brooding equipment, enhancing industry expansion.

France's poultry brooder industry will expand steadily, driven by the nation's rich culinary heritage and strong demand for high-quality poultry products. In contrast to most other sectors, France's poultry sector is dominated by heritage breeds and organic production, and this has created a surging demand for specialty brooding systems that are suited to traditional as well as free-range poultry rearing.

The government's aggressive initiative towards carbon reduction in agricultural activities is speeding up the uptake of solar-powered and energy-efficient brooders. Furthermore, France's focus on farm-to-table supply chains is propelling small- and medium-sized poultry farms to invest in advanced brooding technology to enhance chick survival rates and ensure high-quality production.

The other emerging trend in France's poultry brooder industry is the increased application of artificial intelligence to regulate temperatures and reduce the risk of disease. High-end sensors and computerized controls are increasingly being used in brooding systems, enabling poultry farmers to make very fine adjustments to environmental conditions. With these innovations and government backing, France's poultry brooder industry is likely to experience steady and technology-driven growth up to 2035.

Canada's poultry brooder sector stands out because of its dual focus on industrial large-scale poultry rearing and the increasingly popular small-scale and backyard poultry movement. Canada's erratic climatic extremes have necessitated higher investments in extremely adaptive brooding systems with the ability to control optimal temperature in both very cold winters and very hot summers.

In contrast with the rest of the world, the brooder sector in Canada has witnessed a boom in demand for hybrid brooding systems that integrate electric and gas heating to promote efficiency in different weather conditions. Sustainability also forms a key driver, with Canadian poultry farmers embracing low-emission, environmentally friendly brooder technologies in line with the government's overall agricultural carbon reduction efforts.

The emergence of Indigenous-owned poultry farming projects is also a separate driver influencing the Canadian sector since rural and First Nations communities have invested in improved brooding systems to enhance local meat production and food security. Moreover, blockchain technology application in poultry farming is becoming popular to enable producers to trace and validate ethical farming procedures, such as chick welfare within brooding systems.

Future Market Insights carried out an extensive survey with the major stakeholders in the poultry brooder sector, such as poultry farmers, equipment manufacturers, and industry experts.

Stakeholders brought to the fore the increasing need for IoT-enabled brooders that provide real-time monitoring of temperature, humidity, and chick well-being. Another important area of focus was sustainability, as most farmers were looking for sustainable alternatives in the form of solar-powered brooders to minimize their carbon footprint and operational expenses.

One other important takeaway from the survey was the rise of precision poultry farming practices being followed in big commercial farms and independent small-sized operations. Players in developed countries, including the United States and Germany, cited higher investments made in completely automated brooding systems for maximizing the efficiency of workers and improving the rate of survival for chicks.

At the same time, emerging economy stakeholders such as India and China cited government subsidies and rural electrification schemes as key drivers for the transition towards modern brooding technologies. E-commerce was also cited by the survey as an emerging sales channel, with farmers opting for online platforms to buy equipment because of cost savings and greater product variety.

In spite of the expanding growth trend, issues like the volatility of raw material costs and biosecurity were pointed out by the stakeholders as bottlenecks in sector growth. Most of the poultry farmers raised fears about avian flu as a possible cause of disease outbreaks that would create supply chain interruptions and affect investment levels in brooder technology. Industry experts are still optimistic, predicting a gradual boost in industry demand as technological innovation continues to define accessibility.

| Countries | Government Regulations & Certifications Impact |

|---|---|

|

United States |

The USDA control poultry farm standards for biosecurity and humane treatment of the poultry. DOE energy efficiency standards promote the application of sustainable brooding technology. Certifications mandated are NSF/ANSI for equipment safety and EPA guidelines for emissions management. |

| Canada | Animal welfare and disease control are overseen by the Canadian Food Inspection Agency (CFIA). Equipment producers for poultry must meet Canada's Energy Efficiency Regulations, which encourage environmentally friendly brooder systems. Certification according to the Safe Food for Canadians Act is required for poultry businesses. |

| United Kingdom | The UK has strict animal welfare legislation under the Animal Welfare Act and the Red Tractor Assurance Scheme, which mandates poultry farms to provide ideal brooding conditions. Firms are obligated to meet British Standards Institution (BSI) certifications for safety and efficiency in brooders. There are energy efficiency regulations to minimize emissions. |

| France | The European Union’s stringent poultry farming regulations impact the French industry, requiring adherence to EU animal welfare laws and environmental sustainability goals. Poultry farms must comply with the Label Rouge certification for premium poultry production, ensuring ethical brooding practices. |

| Germany | Germany also adheres to EU policies for poultry welfare, focusing on decreased carbon footprints and ethical brooding processes. Firms need to be compliant with EU requirements for poultry farm equipment and adhere to Federal Emission Control Act standards in order to minimize environmental footprint. Harsh enforcement of CE marking compliance is also required for brooder systems. |

| South Korea | The policies of the government regarding livestock welfare are becoming more stringent, compelling farms to implement automated, biosecure brooder systems. The Korean Agency for Technology and Standards (KATS) regulates safety certifications for poultry equipment to comply with national quality standards. |

| Japan | Japan's Ministry of Agriculture, Forestry, and Fisheries (MAFF) maintains high standards for poultry farming in terms of disease prevention and environmental sustainability. Brooder manufacturers are required to meet JIS (Japanese Industrial Standards) in terms of quality and efficiency. Incentives for smart farming promote IoT-based brooding solutions. |

| China | China's laws aim at disease control and safety of food, with strict poultry farm checks overseen by the Ministry of Agriculture. Firms need to achieve China Compulsory Certification (CCC) for poultry equipment. The government encourages automated brooding solutions in order to enhance efficiency and respond to increasing demand for poultry products. |

| India | Poultry farming is regulated by the Food Safety and Standards Authority of India (FSSAI), with a growing focus on hygiene and biosecurity. Poultry equipment must be certified by the Bureau of Indian Standards (BIS). Government subsidies are provided for upgrading poultry farms, promoting the use of energy-efficient brooders. |

The poultry brooder industry offers huge growth prospects, particularly in the convergence of IoT and AI-based brooder systems. Investors should invest in intelligent brooders with real-time monitoring capabilities that can automatically regulate temperature and humidity. As disease outbreaks become a growing concern, sophisticated sensor-enabled brooders that identify early warning signs of chick health problems will become popular, especially in high-risk areas like China and India, where biosecurity is a big issue.

Sustainability is increasingly becoming a purchasing decision driver, and companies need to diversify into solar-powered and biomass-fueled brooders to keep up with changing environmental laws. Germany and the UK have strict carbon emission standards, making demand for green alternatives high.

By providing government-approved, energy-efficient brooders, companies can access incentive programs that offset costs for farmers. Also, creating modular brooder systems with adjustable heat solutions will appeal to small and medium-sized poultry farms seeking scalable yet affordable solutions.

Stakeholders must expand direct-to-farmer sales channels, making use of online platforms and digital marketplaces to connect with rural and independent bird producers. For sectors such as the United States and Canada, where precision animal farming is gaining traction, provision of subscription- or rental-style access to more sophisticated brooding equipment can become new sources of revenue.

The poultry brooders industry remains moderately dispersed coupled with international behemoths and localized players competing via inventions, value, and partnerships. Nevertheless, consolidation is steadily channeling into the sector as last year, leading companies are heightening industry share by incorporating strategic acquisitions and alliances.

Being the top industry players, Big Dutchman International GmbH, focused on prompting advanced technologies into their brooding systems to improve energy efficiency and animal welfare. This strategy helped in improving operational expenses and also meets global sustainability trends, consolidating their share. Valco Companies Inc. emphasized on competitive pricing strategies in 2024 with core motive of creating next-generation brooding technologies affordable for cost-conscious sectors.

Furthermore, Big Dutchman International GmbH also closed a strategic alliance with a top IoT firm to integrate smart technologies into their brooding systems, which would elevate data analytics for farmers. Officine Facco & C. Spa launched a new solar-backed brooder line, to cater the surging demand for ec0-friendly farming solutions. Moreover, Valco Companies Inc. owned a regional distributor to fortify its supply chain and enrich industry landscape in Asia. These developments reflect the sector’s focus towards innovation, sustainability, and strategic expansion.

Market Share Analysis

The global poultry brooding industry is highly fragmented, with several key players contributing to the sector. Based on available industry data and trends, here are the approximate sector shares for the top six companies in the global poultry brooding industry in 2025:

Charcoal Stove Brooder, Gas Brooder, Electric Brooder

Automatic, Manual, Semi-automatic

Chicken, Duck, Turkey, Others

Direct Sales, Agro Sales

North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa

Rising poultry demand, farm automation, and energy-efficient brooders are key drivers, along with government subsidies and sustainability trends.

Electric brooders lead due to efficiency, while solar and biomass options are gaining traction for sustainability.

Regulations focus on energy efficiency, animal welfare, and environmental compliance, requiring certifications like USDA, CE, and BIS.

The industry is moderately fragmented but is shifting toward consolidation with mergers and acquisitions.

IoT-enabled smart brooders, automation, and eco-friendly solutions like AI-driven temperature control and modular designs are shaping the future.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Poultry, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Poultry, 2018 to 2033

Table 9: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 17: North America Market Value (US$ million) Forecast by Poultry, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Poultry, 2018 to 2033

Table 19: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 25: Latin America Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 27: Latin America Market Value (US$ million) Forecast by Poultry, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Poultry, 2018 to 2033

Table 29: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: Europe Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 37: Europe Market Value (US$ million) Forecast by Poultry, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Poultry, 2018 to 2033

Table 39: Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ million) Forecast by Poultry, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Poultry, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 51: MEA Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 55: MEA Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 57: MEA Market Value (US$ million) Forecast by Poultry, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Poultry, 2018 to 2033

Table 59: MEA Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Operation, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Poultry, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 14: Global Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 18: Global Market Value (US$ million) Analysis by Poultry, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Poultry, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Poultry, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Poultry, 2023 to 2033

Figure 22: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Operation, 2023 to 2033

Figure 28: Global Market Attractiveness by Poultry, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ million) by Operation, 2023 to 2033

Figure 33: North America Market Value (US$ million) by Poultry, 2023 to 2033

Figure 34: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 44: North America Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 48: North America Market Value (US$ million) Analysis by Poultry, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Poultry, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Poultry, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Poultry, 2023 to 2033

Figure 52: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Operation, 2023 to 2033

Figure 58: North America Market Attractiveness by Poultry, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) by Operation, 2023 to 2033

Figure 63: Latin America Market Value (US$ million) by Poultry, 2023 to 2033

Figure 64: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 78: Latin America Market Value (US$ million) Analysis by Poultry, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Poultry, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Poultry, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Poultry, 2023 to 2033

Figure 82: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Operation, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Poultry, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ million) by Type, 2023 to 2033

Figure 92: Europe Market Value (US$ million) by Operation, 2023 to 2033

Figure 93: Europe Market Value (US$ million) by Poultry, 2023 to 2033

Figure 94: Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 104: Europe Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 108: Europe Market Value (US$ million) Analysis by Poultry, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Poultry, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Poultry, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Poultry, 2023 to 2033

Figure 112: Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Operation, 2023 to 2033

Figure 118: Europe Market Attractiveness by Poultry, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ million) by Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ million) by Operation, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ million) by Poultry, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ million) Analysis by Poultry, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Poultry, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Poultry, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Poultry, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Operation, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Poultry, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ million) by Type, 2023 to 2033

Figure 152: MEA Market Value (US$ million) by Operation, 2023 to 2033

Figure 153: MEA Market Value (US$ million) by Poultry, 2023 to 2033

Figure 154: MEA Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 164: MEA Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 168: MEA Market Value (US$ million) Analysis by Poultry, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Poultry, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Poultry, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Poultry, 2023 to 2033

Figure 172: MEA Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Operation, 2023 to 2033

Figure 178: MEA Market Attractiveness by Poultry, 2023 to 2033

Figure 179: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Poultry Diagnostic Testing Market Size and Share Forecast Outlook 2025 to 2035

Poultry Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Poultry Feeder Market Size and Share Forecast Outlook 2025 to 2035

Poultry Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Poultry Seasoning Market Size, Growth, and Forecast for 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Poultry Vitamins Market Analysis - Size, Share & Forecast 2025 to 2035

Poultry Feed Market Analysis by Livestock, Nature, Feed Type, Form, and Region from 2025 to 2035

Poultry Keeping Machinery Market Growth - Trends & Forecast 2025 to 2035

Poultry Meal Market – Growth, Demand & Nutritional Benefits

Poultry Concentrate Market

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Rendered Poultry Products Market Analysis by Type and Grade Through 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA