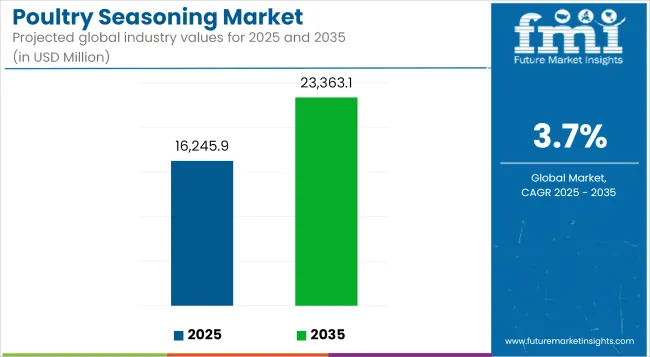

According to recent market analysis, poultry seasoning industry revenues stood at USD 16,245.9 million in 2025 and are forecast to reach USD 23,363.1 million by 2035, reflecting a CAGR of 3.7%. Consumer interest in bold and ethnic flavor profiles has strengthened the demand for seasoning solutions specifically tailored to poultry dishes.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 16,245.9 million |

| Projected Value (2035F) | USD 23,363.1 million |

| CAGR (2025 to 2035) | 3.7% |

The market has remained resilient amid growing scrutiny on synthetic additives, shifting toward natural herbs and spice-based formulations that align with clean-label and health-forward narratives.

A substantial transformation has been underway across the poultry seasoning landscape. Rising global poultry meat consumption, coupled with the surging appeal of global cuisines, has resulted in wider adoption of complex seasoning profiles across processed and packaged poultry products.

However, fluctuating spice raw material prices and quality inconsistencies in herb supply chains have hindered cost efficiency for manufacturers. Meanwhile, dry rubs and marinades have witnessed heightened innovation, as brands formulate multifunctional seasoning formats incorporating taste, color, and preservative attributes.

E-commerce platforms are increasingly being tapped for seasoning distribution, driven by the growing consumer interest in home-cooked flavored poultry dishes. While mature markets remain stable, dynamic growth has been observed in Asian and Middle Eastern cuisines gaining traction across global poultry seasoning applications.

By 2035, the poultry seasoning market is expected to evolve into a value-added component within poultry value chains, supported by technological infusion in flavor encapsulation and targeted release systems. Demand for sodium-reduced, preservative-free, and allergen-conscious seasoning products is poised to grow, aligned with stringent food safety compliance frameworks.

Herbaceous blends, particularly those including rosemary, thyme, oregano, and sage, are forecast to dominate commercial formulations. Functional poultry seasoning solutions incorporating antioxidant, antimicrobial, or moisture retention properties are anticipated to gain traction across B2B channels, particularly among poultry processors and institutional foodservice operators.

The table below provides a comparative chart over the six months, showing the changes of CAGR for the base year (2024) and the current year (2025) globally in the poultry seasoning sector. This in-depth analysis has shown us the significant changes in market performance as well as the revenue patterns, thus giving us invaluable insights into the industry's growth trajectory. The time frame of H1 spans January to June, while H2 consists of July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2025 to 2034) | 3.4% |

| H2 (2025 to 2034) | 3.7% |

| H1 (2025 to 2035) | 3.5% |

| H2 (2025 to 2035) | 3.9% |

The first half (H1) of the decade, starting from 2024 till 2034, will be characterized by a 3.4% growth rate of the market with a compound annual growth rate (CAGR). This will be followed by a much higher figure of 3.7% in the second half (H2) of the same decade.

In the next phase, which lasts from H1 2025 to H2 2035, the CAGR is set to increase to 3.5% in the first half slope mostly, and consequently, it will escalate to 3.9% in the second half. The first half of the year saw an increase of 10 BPS, while the second half of the year recorded an increase of 20 BPS.

Retail private label poultry seasonings are anticipated to contribute 18.7% of total revenues in 2025, rising to 26.9% by 2035 due to increasing penetration in both economy and premium supermarket chains.

The proliferation of retailer-owned seasoning blends across North America and Western Europe is reshaping consumer price expectations, expanding access to diverse poultry flavor profiles. Chains like Aldi, Lidl, Tesco, and Kroger have introduced store-brand poultry seasoning blends that offer comparable quality to branded SKUs at lower price points.

These formulations are typically produced by third-party seasoning manufacturers with BRCGS or IFS certification and leverage regionally familiar spice blends such as lemon pepper, garlic herb, and Cajun.

Retail private label penetration is further accelerated by the strategic focus on sustainable packaging and simplified ingredient disclosures. Retailers are increasingly collaborating with contract blenders to reduce sodium content, eliminate synthetic colorants, and incorporate country-of-origin labeling, all of which influence consumer trust and regulatory alignment.

Moreover, private label poultry seasonings are gaining traction in emerging markets, supported by strong in-store promotions and online recipe integrations.Private label growth is set to outpace branded counterparts over the next decade, particularly in mid-income consumer segments and ethnic seasoning categories.

Organic poultry seasonings are projected to account for 11.2% of the total market share in 2025, with expectations to surpass 15.6% by 2035, driven by clean-label preferences and rising regulatory scrutiny on synthetic additives.

Increased alignment with USDA Organic, EU Organic, and other country-specific certification frameworks has helped validate product claims for organic poultry seasonings, especially within the foodservice and premium retail segments. Regulatory guidance such as the EU Regulation (EU) 2018/848 has reinforced the requirement for organically sourced herbs and spices, including basil, thyme, and paprika, which are dominant in poultry marinades and dry rubs.

Leading manufacturers such as Frontier Co-op and Simply Organic (subsidiary of Frontier Co-op) continue to expand certified organic poultry seasoning blends tailored for home chefs and commercial kitchens.

The adoption of organic seasoning has also grown in meal kit platforms and pre-marinated poultry SKUs offered by premium grocers in Western Europe and North America. However, the price volatility of certified organic spices and limited mechanization in organic spice farming continue to influence supply-side margins.

Despite these challenges, organic poultry seasoning is expected to capture higher value growth compared to conventional blends, aided by improved traceability, e-commerce visibility, and demand for health-positioned poultry products.

The global poultry seasoning market is a combination of international companies, local players, and Chinese manufacturers, each taking part in the overall growth and competition of the market. Regional players create a significant impact on the market by delivering specific local taste preferences, sourcing indigenous ingredients, and providing seasoning blends that are tailored to be in accordance with traditional and cultural cooking styles.

These firms capitalize on their in-depth knowledge of regional customer behaviour and flavor characteristics, allowing them to build a solid customer base.

Regional manufacturers significantly dominate the North American and European markets, where clean-label and organic seasonings are in high demand. They emphasize premium, special series, and handmade blends that meet the needs of very specific groups such as gourmet cooking, health-conscious people, and restaurant-grade spice mixes.

For instance, Middle Eastern and Latin American regional brands have gained a reputation by offering poultry seasoning infused with unique spice combinations such as sumac, and chili-lime blends, thus drawing local and international buyers.

Chinese manufacturers are stepping forth as the poultry seasoning supply chain's new significant players. They primarily contribute through cost-efficient spice production and massive-scale exports. The focus of these companies is on bulk seasoning provides, private-label production, and wholesale distribution. Their competitive pricing and ability to meet high-volume demand have made them the major suppliers to food service providers and retailers in every corner of the globe.

The market's concentration stays dynamic, with regional players leading the product innovation, multinational companies utilizing branding power, and Chinese manufacturers providing cost-efficient production and scalability in the global poultry seasoning market.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | United States |

|---|---|

| Market Volume (USD Million) | 4,873.8 |

| CAGR (2025 to 2035) | 3.5% |

| Country | China |

|---|---|

| Market Volume (USD Million) | 3,249.2 |

| CAGR (2025 to 2035) | 4.8% |

| Country | India |

|---|---|

| Market Volume (USD Million) | 1,624.6 |

| CAGR (2025 to 2035) | 5.5% |

| Country | Brazil |

|---|---|

| Market Volume (USD Million) | 812.3 |

| CAGR (2025 to 2035) | 4.3% |

| Country | Germany |

|---|---|

| Market Volume (USD Million) | 649.8 |

| CAGR (2025 to 2035) | 3.2% |

According to forecasts, by 2025, the Unites States will still be in the leading position in the global poultry seasoning market, with an estimated market volume of USD 4,873.8 million. The major driver of this enormous market share is the strong USA poultry industry and consumers' preference for seasoned poultry products.

The USA market takes advantage of a multicultural culinary landscape that involves a wide range of flavors, which, in turn, creates signals for the development of various innovative and region-specific seasoning blends.

Moreover, the ongoing exercise of health-conscious eating has led to consumers' requests for less sodium and no artificial additives in their seasonings, thus having the effect of manufacturers' correcting their proposals, respectively. The market is expected to grow at a CAGR of 3.5% from 2025 to 2035, which is an indication of stable demand and continuous innovation in products.

The poultry seasoning market in China is registering growth with the urban population that is ever on the rise and the shift toward convenience foods. Chinese consumers have a rising interest in ready-to-use seasoning blends that are the key to efficient food preparations with more poultry being added to their diets.

There is a rise of both traditional Chinese flavors and Western-style seasonings, giving consumers a rich choice of options. The market is expected to grow at a CAGR of 4.8% between 2025 and 2035, thus providing positive perspectives for the seasoning manufacturers, both domestic and international, that wish to operate in the Chinese market.

The poultry seasoning market in India is on the verge of experiencing a major boom, with a projected CAGR of 5.5% from 2025 to 2035. This expansion is propelled by the growing consumption of poultry products that is, in turn, driven by the increase in disposable income and a stronger preference for protein-rich diets.

The Indian population has started to use a variety of seasoning brands and mix them with other new mounted tastes to alter their regular flavors. The market also reaps the benefits of good service businesses that encompass budgets for where restaurants and fast-food chains use diverse seasoning blends to accommodate consumer tastes that are ever-evolving. Joint ventures are being introduced with new products that reflect local flavors and dietary preferences.

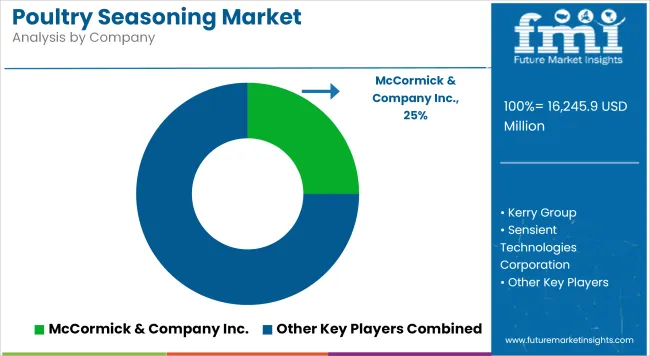

The global poultry seasoning market continues to thrive considerably due to the increasing consumer demand for a variety of fast and easy-to-use seasoning products. Key players are using a mixture of acquisition tactics, product innovation, and expansion into emerging markets to bolster market positions.

The global poultry seasoning market is expected to grow at a CAGR of 3.7% from 2025 to 2035.

The market is projected to reach approximately USD 23,363.1 million by 2035.

The organic poultry seasoning segment is anticipated to witness significant growth due to increasing consumer demand for natural and health-conscious products.

Key drivers include rising consumer interest in diverse culinary flavors, increased home cooking trends, and a growing preference for natural and organic seasoning products.

Leading companies include McCormick & Company, Bell's Foods, B&G Foods Inc., Frontier Co-op, Badia Spices Inc., and Aum Fresh.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Poultry Diagnostic Testing Market Size and Share Forecast Outlook 2025 to 2035

Poultry Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Poultry Feeder Market Size and Share Forecast Outlook 2025 to 2035

Poultry Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Poultry Vitamins Market Analysis - Size, Share & Forecast 2025 to 2035

Poultry Brooder Market Trend Analysis Based on Type, Operation, Poultry, Distribution Channel, and Region 2025 to 2035

Poultry Feed Market Analysis by Livestock, Nature, Feed Type, Form, and Region from 2025 to 2035

Poultry Keeping Machinery Market Growth - Trends & Forecast 2025 to 2035

Poultry Meal Market – Growth, Demand & Nutritional Benefits

Poultry Concentrate Market

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Rendered Poultry Products Market Analysis by Type and Grade Through 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Seasoning Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

The Europe Seasoning Market is segmented by product, end-use, brand and country through 2025 to 2035.

Savoury Seasoning Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA