The smartwatch chips market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period. During this early adoption phase, annual increments range from USD 0.1 billion to 0.2 billion, reflecting cautious expansion as manufacturers ramp up production and consumer acceptance grows. The year 2025, with a market value of USD 2.0 billion, marks a key inflection point where demand begins to accelerate.

Early gains are driven by the rising use of wearables across health monitoring, fitness tracking, and personal connectivity, providing a solid foundation for the market’s scaling phase. From 2025 to 2035, the market enters a scaling and consolidation phase, growing from USD 2.0 billion to USD 5.3 billion. Annual increases range between USD 0.2 billion and 0.4 billion, with growth becoming more consistent as the market matures.

By 2030, the market reaches around USD 3.2 billion, showing robust adoption across broader demographics. The final five years, 2030 to 2035, display steady growth, indicating consolidation within the sector. Market expansion is balanced, annual growth stabilizes, and leading chip manufacturers solidify their positions while new entrants focus on niche applications to capture specific segments of demand.

| Metric | Value |

|---|---|

| Smartwatch Chips Market Estimated Value in (2025 E) | USD 2.0 billion |

| Smartwatch Chips Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

Enhanced consumer interest in connected lifestyles, fitness tracking, and remote health diagnostics is contributing significantly to the expansion of this market. Technological advancements in chip design, including reduced power consumption and increased processing speed, are improving smartwatch functionality and user experience. Growing investments in R&D for low-latency, high-efficiency chipsets are further driving innovation in the segment.

The increasing penetration of smartwatches across both developed and emerging markets, along with integration with smartphones and IoT ecosystems, is shaping the future outlook. Manufacturers are increasingly focusing on creating chip architectures that can support AI-driven applications, offline functionalities, and seamless connectivity, ensuring continued evolution and competitive differentiation in the global market.

The smartwatch chips market is segmented by type, application, and geographic regions. By type of the smartwatch chips market is divided into 64-bit, 32-bit, and Others. In terms of application of the smartwatch chips market is classified into Android System Smartwatch, iOS System Smartwatch, Windows System Smartwatch, and Others. Regionally, the smartwatch chips industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 64-bit type is projected to account for 53.6% of the Smartwatch Chips market revenue in 2025, making it the leading architecture in the type segment. This dominant position is being driven by the increasing demand for high-speed data processing, advanced app compatibility, and multitasking capabilities in smartwatches.

Devices using 64-bit chipsets are able to support more complex functions such as health diagnostics, voice commands, offline navigation, and seamless connectivity with other smart devices. Enhanced memory access and power efficiency have made 64-bit architectures highly suitable for next-generation wearables that require real-time data handling and energy optimization.

The shift in consumer preferences toward premium smartwatches with advanced features has also contributed to the widespread adoption of this chip type As smartwatch use cases expand beyond fitness to include payments, messaging, and multimedia, the need for powerful and efficient processing units is reinforcing the growth of the 64-bit segment.

The Android System Smartwatch application is expected to hold 47.8% of the Smartwatch Chips market revenue in 2025, establishing it as the largest application segment. This leading share is being attributed to the widespread adoption of Android-based smartwatches across both mid-range and premium price categories.

Compatibility with a wide ecosystem of devices, support for diverse apps, and ease of customization have made Android the preferred platform for many smartwatch manufacturers. The flexibility of Android systems allows for tailored user experiences, regional language support, and integration with multiple third-party services, enhancing user engagement.

The rising demand has also influenced growth in this segment in price-sensitive markets where Android-powered devices dominate due to affordability and accessibility. Moreover, continuous software updates and integration with Google services have improved functionality and user trust, further solidifying the dominance of Android System Smartwatches in the market.

The smartwatch chips market is experiencing rapid growth driven by rising demand for wearable electronics, health monitoring, and IoT connectivity. These chips enable fitness tracking, heart rate monitoring, GPS, and seamless smartphone integration. Asia-Pacific dominates manufacturing due to established semiconductor production hubs, while North America and Europe drive adoption with high smartwatch penetration and advanced healthcare integration. Market expansion focuses on low-power consumption, high processing performance, miniaturization, and AI-enabled capabilities. Companies differentiate through advanced system-on-chip (SoC) designs, energy-efficient architectures, and secure connectivity features.

Developing smartwatch chips that combine high performance with ultra-low power consumption remains a key challenge. Balancing processing speed, battery efficiency, and thermal management in a compact form factor is difficult. Variations in fabrication processes and material quality can affect chip reliability and longevity. Manufacturers must meet stringent requirements for wearables, including continuous operation, accuracy in health metrics, and compatibility with various sensors. Until industry-wide standards for power-performance optimization and testing are widely adopted, product variability and design limitations may hinder adoption in premium smartwatch segments.

Technological advancements are enhancing smartwatch chip capabilities. Innovations include system-on-chip (SoC) integration, AI-powered health monitoring, multi-sensor support, and energy-efficient wireless communication protocols. Chipmakers are incorporating advanced processors, memory modules, and secure connectivity features to support real-time analytics, GPS, and biometric tracking. Companies leveraging cutting-edge semiconductor technologies, such as FinFET nodes and optimized architectures, improve performance while minimizing power draw. These innovations enable smarter, faster, and more reliable wearable devices, fueling growth in fitness, healthcare, and connected lifestyle applications.

Smartwatch chips must comply with global electronics, safety, and health regulations. This includes electromagnetic compatibility (EMC), radiation safety, and privacy standards for health data collection. Certain regions require medical device certifications for health-monitoring functionalities. Compliance ensures user safety, device reliability, and data security, while non-compliance can limit market access. Manufacturers aligning chip design with recognized regulatory frameworks gain credibility and facilitate global adoption. Until regulations for wearable health technologies and data privacy become harmonized internationally, companies must carefully navigate diverse compliance landscapes to avoid legal and operational challenges.

The smartwatch chips market is highly competitive, with major semiconductor companies and emerging specialized chipmakers vying for market share. Supply chain constraints, including silicon wafer availability, semiconductor fabrication capacity, and advanced packaging materials, can impact production timelines. Companies investing in vertical integration, strategic partnerships, and diversified sourcing gain reliability and cost advantages. Competitive differentiation focuses on processing speed, low-power consumption, multi-sensor support, and secure connectivity. Until supply chain stability improves, component availability and intense rivalry will continue to influence market growth, pricing, and adoption in wearable electronics.

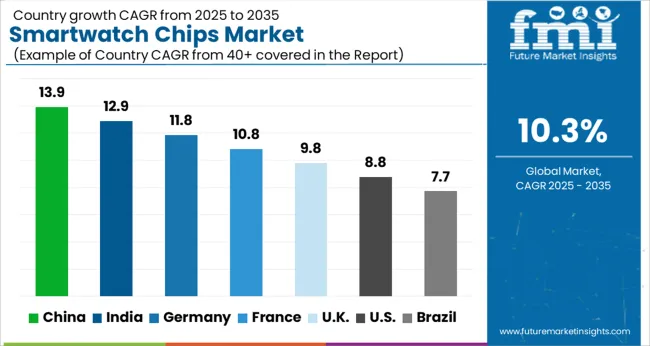

The global Smartwatch Chips Market is projected to grow at a CAGR of 10.3% through 2035, supported by increasing demand across wearable electronics, fitness monitoring, and consumer gadgets. Among BRICS nations, China has been recorded with 13.9% growth, driven by large-scale production and adoption in consumer electronics, while India has been observed at 12.9%, supported by growing utilization in wearable devices and electronics manufacturing. In the OECD region, Germany has been measured at 11.8%, where production and deployment for consumer electronics and fitness applications have been steadily maintained. The United Kingdom has been noted at 9.8%, reflecting consistent use in wearable technology and electronic gadgets, while the USA has been recorded at 8.8%, with production and adoption in consumer electronics and wearable devices being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The smartwatch chips market in China is expanding at a CAGR of 13.9%, driven by the country’s growing wearable technology adoption and consumer demand for smart health and fitness devices. Manufacturers are increasingly integrating advanced functionalities such as heart rate monitoring, GPS, NFC, and AI-powered health tracking into smartwatches, fueling the need for high-performance chips. China’s strong electronics manufacturing ecosystem and focus on research and development allow local companies to produce innovative, energy-efficient, and compact chips at competitive prices. The rising popularity of smartwatches among both urban and younger demographics contributes significantly to market growth. Additionally, collaborations between semiconductor firms and smartwatch brands are enhancing chip capabilities while reducing production costs. Government support for technology innovation and digital health solutions further drives demand. The smartwatch chips market in China is therefore expected to maintain robust growth throughout the forecast period.

The smartwatch chips market in India is growing at a CAGR of 12.9%, supported by increasing consumer awareness of wearable devices for health monitoring, fitness tracking, and smart connectivity. Rising smartphone penetration, expanding e-commerce platforms, and a tech-savvy population are boosting the adoption of smartwatches. Local and international smartwatch brands are focusing on India, enhancing demand for high-performance, energy-efficient chips capable of supporting advanced features such as biometric sensors, AI processing, and GPS navigation. Government initiatives promoting digital health and smart technology adoption further contribute to market growth. India’s growing electronics manufacturing sector and emerging semiconductor ecosystem also support the production of smartwatch chips locally. With the rising interest in connected health solutions and lifestyle gadgets, the smartwatch chips market in India is expected to maintain steady and significant growth over the forecast period.

The smartwatch chips market in Germany is expanding at a CAGR of 11.8%, driven by growing consumer interest in wearable technology for health monitoring, fitness, and lifestyle management. German consumers increasingly demand smartwatches with advanced features, including heart rate sensors, GPS, AI-based analytics, and long battery life, boosting the need for high-performance, reliable chips. Germany’s strong electronics and automotive sectors, combined with high disposable income, support rapid adoption of wearable devices. Local semiconductor manufacturers focus on producing energy-efficient, compact chips to meet consumer and industrial requirements. Government support for digital health initiatives, IoT integration, and innovation in smart electronics further enhances the market. With increasing collaboration between semiconductor companies and smartwatch brands, Germany is expected to witness steady growth in the smartwatch chips market throughout the forecast period.

The smartwatch chips market in the United Kingdom is growing at a CAGR of 9.8%, supported by rising adoption of wearable technology for fitness, health monitoring, and connectivity. Consumers increasingly prefer smartwatches with advanced features like biometric tracking, GPS, and AI-powered health insights, boosting demand for reliable and compact chips. UK manufacturers and international brands are investing in semiconductor solutions that ensure energy efficiency, faster processing, and enhanced device performance. Government initiatives promoting digital health solutions and smart technology adoption further encourage growth. The expanding e-commerce and retail sectors also make smartwatch devices more accessible to a broad consumer base. With ongoing innovation in wearable electronics and rising consumer interest in connected devices, the smartwatch chips market in the United Kingdom is poised for steady growth over the forecast period.

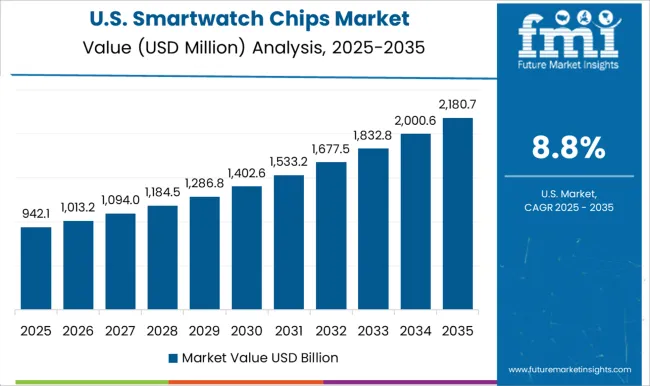

The smartwatch chips market in the United States is expanding at a CAGR of 8.8%, driven by growing adoption of wearable devices for fitness, health monitoring, and smart connectivity. Consumers increasingly seek smartwatches with features such as heart rate monitoring, GPS, AI health analytics, and long battery life, driving the need for advanced semiconductor solutions. Leading smartwatch manufacturers are partnering with chip developers to produce high-performance, energy-efficient, and compact chips. The USA semiconductor industry’s strong innovation ecosystem supports continuous development of next-generation smartwatch chips. Rising awareness of digital health, lifestyle monitoring, and IoT integration further boosts market demand. With increasing adoption of wearable technology and expansion of connected health solutions, the smartwatch chips market in the United States is expected to grow steadily over the forecast period.

The smartwatch chips market is expanding rapidly, driven by increasing demand for wearable technology, health monitoring, fitness tracking, and connected lifestyle devices. Smartwatch chips are critical components that integrate processing power, wireless connectivity, sensors, and low-power operation, enabling advanced functionalities in compact wearable devices. Qualcomm Incorporated is a key player, offering high-performance, energy-efficient system-on-chips (SoCs) that support advanced connectivity, AI processing, and health-tracking capabilities. Arm Limited, Inc. provides widely adopted processor architectures that power low-energy wearable devices with high computational efficiency. Nordic Semiconductor focuses on ultra-low-power wireless communication chips, essential for Bluetooth-enabled smartwatches. Huawei Technologies Co. develops integrated chip solutions that combine processing, connectivity, and sensor interfaces for its wearable devices. Ingenic Semiconductor Co., Ltd. specializes in low-power processors for wearable and IoT applications, optimizing performance and battery life.

Intel Corporation delivers versatile chipsets suitable for advanced smartwatch features, including AI acceleration and data processing. Silicon Laboratories, Inc. provides ultra-low-power microcontrollers and wireless solutions for compact wearable form factors. Analog Devices, Inc. and Microchip Technology offer high-precision sensor interfaces and power management solutions critical for health monitoring and battery efficiency. Broadcom, Inc. supplies integrated wireless and connectivity chips supporting Bluetooth, Wi-Fi, and GPS functions in wearable devices. These leading suppliers and manufacturers are driving innovation in smartwatch chip design, focusing on miniaturization, power efficiency, advanced connectivity, and enhanced processing capabilities. Their solutions enable smartwatches to deliver richer user experiences, extended battery life, and seamless integration with mobile and cloud ecosystems.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Type | 64-bit, 32-bit, and Others |

| Application | Android System Smartwatch, iOS System Smartwatch, Windows System Smartwatch, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Qualcomm Incorporated, Arm Limited, Inc., Nordic Semiconductor, Huawei Technologies Co., Ingenic Semiconductor Co., Ltd., Intel Corporation, Silicon Laboratories, Inc., Analog Devices, Inc., Microchip Technology, and Broadcom, Inc., Ltd. |

| Additional Attributes | Dollar sales by type including application processors, memory chips, sensors, and connectivity modules, application across fitness tracking, health monitoring, and communication features, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising smartwatch adoption, demand for wearable health monitoring, and advancements in low-power, high-performance chip technologies. |

The global smartwatch chips market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the smartwatch chips market is projected to reach USD 5.3 billion by 2035.

The smartwatch chips market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in smartwatch chips market are 64-bit, 32-bit and others.

In terms of application, android system smartwatch segment to command 47.8% share in the smartwatch chips market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biochips Market Size and Share Forecast Outlook 2025 to 2035

5G Chipset Market Analysis - Growth & Forecast through 2034

Wi-Fi Chipset Market Growth - Trends & Forecast 2025 to 2035

Lab-On-Chips Market Size and Share Forecast Outlook 2025 to 2035

Veggie Chips Market Growth - Consumer Trends & Flavor Innovations 2025 to 2035

Mobile Chipset Market Analysis by Clock Speed, Frequency Type, Processing Node Type, End-User & Region from 2025 to 2035

Cloud AI Chipsets Market

TSN Ethernet Chips Market Size and Share Forecast Outlook 2025 to 2035

Zero Calorie Chips Market Outlook - Growth, Demand & Forecast 2025 to 2035

Computer Microchips Market Size and Share Forecast Outlook 2025 to 2035

Automotive AI Chipset Market Trends – Growth & Forecast 2025 to 2035

Veterinary Microchips Market Size and Share Forecast Outlook 2025 to 2035

DNA Chromatography Chips Market Size and Share Forecast Outlook 2025 to 2035

Integrated Graphics Chipset Market Analysis by Device Type, Industry Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Wi-Fi Semiconductor Chipset Market Growth - Trends & Forecast through 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA