The Static VAR Compensator market is experiencing significant growth driven by the increasing demand for power quality management and grid stability across industrial, commercial, and utility sectors. The future outlook for this market is shaped by the rapid expansion of electrical infrastructure, modernization of transmission and distribution networks, and the growing adoption of renewable energy sources, which introduce variability in power systems.

Investments in smart grid technologies and regulatory mandates for voltage stabilization and reactive power compensation are further accelerating market growth. The implementation of advanced power system management solutions has highlighted the need for real-time voltage control and enhanced system reliability, which are critical for maintaining uninterrupted power supply.

Additionally, the increasing focus on reducing energy losses, preventing equipment damage, and ensuring efficient utilization of power resources is driving adoption As electrical grids become more complex and the demand for stable, high-quality power intensifies, Static VAR Compensators are expected to play a pivotal role in ensuring operational efficiency and reliability across diverse end-use sectors.

Market dynamics reveal sophisticated procurement requirements where operational specifications must satisfy competing performance criteria across multiple power system applications. Electric utilities evaluate static var compensators based on their ability to provide dynamic voltage regulation, reactive power compensation, and grid stability support during renewable energy fluctuations. Industrial facilities prioritize systems capable of power factor correction and voltage stabilization for large motor loads and variable frequency drives. Railway operators require equipment that maintains stable traction power supply during fluctuating load conditions.

Regulatory frameworks increasingly mandate grid stability technologies as essential infrastructure for supporting renewable energy integration and smart grid development. Grid codes in various jurisdictions require utilities to maintain specific power quality standards that can only be achieved through dynamic compensation systems like static var compensators. Environmental regulations promoting carbon reduction and renewable energy deployment create indirect requirements for voltage stability equipment that enables higher renewable penetration levels.

Government initiatives supporting grid modernization provide significant market drivers through infrastructure investment programs and regulatory requirements. The U.S. Department of Energy has allocated billions in funding for grid stability improvements that specifically include static var compensator installations. European Union directives on renewable energy integration mandate grid stability measures that favor dynamic compensation technologies. Asian markets demonstrate strong government support through state-owned utility investments in transmission system upgrades.

Supply chain considerations affect equipment availability and project timelines due to specialized manufacturing requirements for high-power thyristor devices and custom transformer configurations. Static var compensator manufacturing requires precision-engineered components including high-current thyristors, power-grade reactors, and specialized control systems that may face extended lead times during high demand periods. Quality control requirements for utility-grade equipment necessitate comprehensive testing and certification processes.

| Metric | Value |

|---|---|

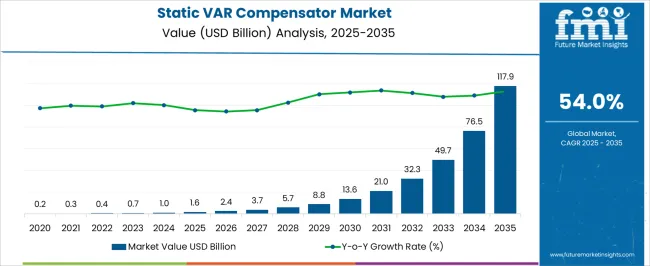

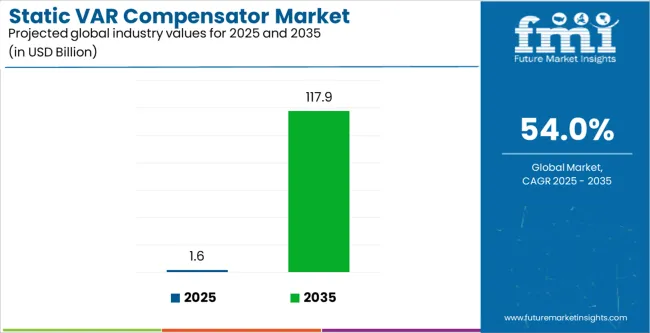

| Static VAR Compensator Market Estimated Value in (2025 E) | USD 1.6 billion |

| Static VAR Compensator Market Forecast Value in (2035 F) | USD 117.9 billion |

| Forecast CAGR (2025 to 2035) | 54.0% |

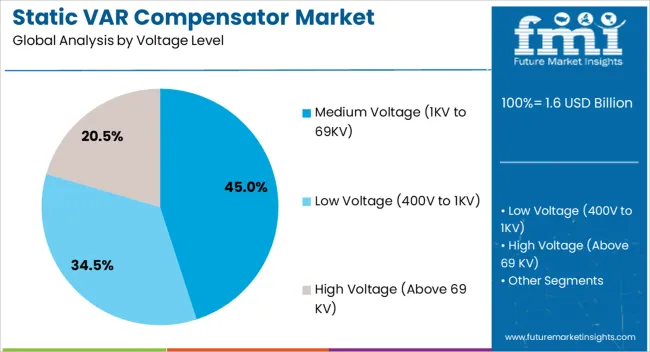

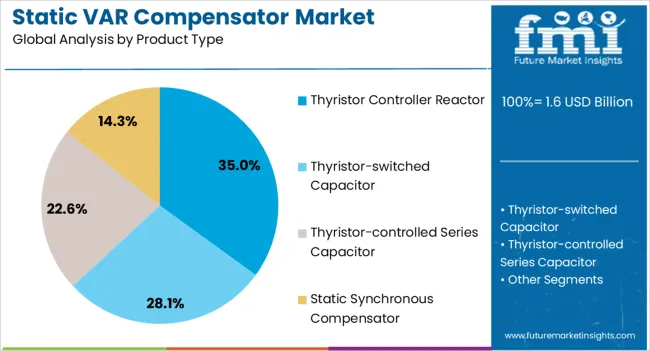

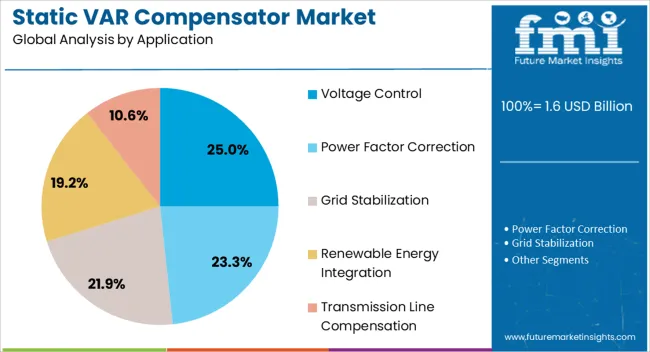

The market is segmented by Voltage Level, Product Type, Application, and End-use Industry and region. By Voltage Level, the market is divided into Medium Voltage (1KV to 69KV), Low Voltage (400V to 1KV), and High Voltage (Above 69 KV). In terms of Product Type, the market is classified into Thyristor Controller Reactor, Thyristor-switched Capacitor, Thyristor-controlled Series Capacitor, and Static Synchronous Compensator. Based on Application, the market is segmented into Voltage Control, Power Factor Correction, Grid Stabilization, Renewable Energy Integration, and Transmission Line Compensation. By End-use Industry, the market is divided into Power Generation, Renewable, Non-renewable, Energy Utilities, Electric Traction, Mining And Metal, Oil And Gas, Textile, Cement, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The medium voltage segment, covering 1KV to 69KV, is projected to hold 45.00% of the Static VAR Compensator market revenue share in 2025, making it the leading voltage level. This dominance has been driven by the wide applicability of medium voltage systems in industrial plants, commercial complexes, and regional distribution networks.

The segment has benefited from the increasing need for voltage stabilization and reactive power compensation in environments where power quality fluctuations can affect sensitive equipment and operational efficiency. The modular and scalable design of medium voltage Static VAR Compensators allows for easier integration with existing power infrastructure, supporting rapid deployment and operational flexibility.

Moreover, growing investments in smart grids and the modernization of legacy electrical networks have reinforced adoption The segment’s growth is further supported by regulatory compliance requirements, energy efficiency initiatives, and the need for reliable power delivery in regions experiencing expanding electricity demand.

The thyristor controller reactor segment is expected to capture 35.00% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment has been driven by the capability of thyristor-controlled systems to provide precise and rapid voltage regulation, improving overall power quality.

The technology enables continuous reactive power compensation, which is crucial for maintaining grid stability in industrial, commercial, and utility networks. Adoption has been further supported by advancements in control algorithms, improved system reliability, and ease of integration with existing power systems.

The segment’s prominence is also linked to increasing investments in renewable energy integration, where dynamic voltage compensation is required to offset variability from distributed energy sources Operational efficiency, flexibility, and the ability to reduce energy losses have reinforced the segment’s leading position in the Static VAR Compensator market.

The voltage control application segment is anticipated to account for 25.00% of the Static VAR Compensator market revenue in 2025, making it the leading application. This growth has been influenced by the rising need to maintain stable voltage levels across transmission and distribution networks, ensuring uninterrupted power supply and optimal performance of electrical equipment.

Voltage control solutions are critical for minimizing fluctuations that can lead to operational inefficiencies, equipment failure, and energy losses. The segment has benefited from advancements in control systems that enable precise, real-time regulation of reactive power.

Increasing deployment of renewable energy sources, electrification of industrial processes, and modernization of electrical grids have further accelerated adoption Additionally, regulatory requirements for grid stability and energy efficiency initiatives are driving utilities and industrial operators to implement advanced voltage control solutions, reinforcing the segment’s dominant market position.

Market to Grow Nearly 1.6X through 2035

The global static VAR compensator industry is forecast to grow around 1.6X through 2035. This can be attributed to the growing integration of renewable energy sources into power grids, increasing investments in upgrading aging infrastructure for enhanced efficiency, and escalating awareness of the importance of power quality and stability.

Government initiatives aimed at promoting clean energy and improving grid reliability will also positively impact static VAR compensator sales. By 2035, the total market revenue is set to reach USD 1,667.0 million.

East Asia to Remain Hotbed for Static VAR Compensator Manufacturers

As per the latest analysis, East Asia is anticipated to retain its dominance in the global market during the assessment period. It is set to hold around 28.5% of the global static VAR compensator market share in 2035. This is attributed to several factors.

China’s rapid industrialization and urbanization have increased its energy demand. SVCs play an important role in providing grid stability and energy efficiency in these increasing demands, leading to their adoption in various industries.

The government of China is actively investing to upgrade its electricity grid and promote clean energy initiatives. Policies aimed at improving energy efficiency and reducing carbon emissions are encouraging the use of standardized VAR compensators, thus furthering market growth.

China is one of the world’s leading investors in renewable energy. Integrating renewable energies such as wind and solar into the grid requires sophisticated energy efficiency solutions, where SVCs prove to be of great value.

SVCs are becoming essential solutions for maintaining grid stability and efficiency and ensuring reliable electricity supplies. These devices are widely used in electrical systems to rapidly control reactive power on high-voltage transmission networks.

SVCs are used for various purposes, such as voltage regulation, power factor correction, and grid stabilization, serving different industrial and utility needs. The need for SVCs to support the assimilation of renewable energy into the grid is set to rise due to the worldwide shift to renewable energy sources.

Concerns like grid instability due to load changes and renewable energy sources with fluctuating availability would propel the use of SVCs. Increasing investments by nations like India and Brazil in upgrading their power infrastructure to fulfill growing power needs will boost market growth.

Increasing government initiatives geared toward improving grid reliability and integrating renewable power sources will create lucrative opportunities for manufacturers. The growing adoption of electrical automobiles and the electrification of industries are other factors spurring sales growth.

Global sales of SVCs grew at a CAGR of 2.3% between 2020 and 2025, with total market revenue reaching about USD 1.6 million in 2025. In the forecast period, the worldwide SVC industry is set to progress at a CAGR of 5.0%, indicating a 2.7% spike from the historical growth rate.

| Historical CAGR (2020 to 2025) | 2.3% |

|---|---|

| Forecast CAGR (2025 to 2035) | 5.0% |

During the historical period, the global SVC market recorded slow growth. This was mostly due to economic uncertainties, slower adoption of renewable energy, limited infrastructure investments, and conservative spending patterns in the power sector.

Looking forward, the market is anticipated to advance at a steady CAGR, totaling a valuation of USD1,667.0 million by 2035. The future of the SVC market lies in its integration with smart grid technology.

By using advanced monitoring and control capabilities, SVCs can dynamically respond to grid conditions, optimize power flow, and enhance system reliability and efficiency. This integration will enable utilities to manage the complexities of modern power grids better, accommodate increasing renewable energy penetration, and mitigate grid congestion issues.

Emerging economies present significant growth opportunities for the SVC market. Countries like India, China, and Brazil are witnessing rapid urbanization, industrialization, and infrastructure development, leading to increased demand for electricity and greater strain on power grids.

As these emerging nations invest in upgrading their power infrastructure and integrating renewable energy sources, there will be a growing need for SVCs to ensure grid stability, optimize power quality, and support the efficient transmission of electricity. Hence, a steady CAGR has been predicted for the target industry from 2025 to 2035

Increasing Power Demand Set to Boost Market Growth

The global surge in electricity demand, particularly in developing regions, serves as a pivotal factor propelling the adoption of advanced technologies such as SVCs. This escalating demand stems from a multifaceted landscape of factors, including population growth, rapid urbanization, and increasing industrialization.

As societies embrace technological advances and elevate their standards of living, the reliance on electrical power becomes more pronounced. This, in turn, is intensifying the strain on existing power infrastructure, creating room for electronic devices like SVCs.

The imperative for enhanced power quality and grid stability emerges as a direct consequence of this escalating demand. SVCs play a crucial role in meeting these challenges by dynamically regulating reactive power, thereby maintaining grid stability and voltage levels.

The SVC technology proves instrumental in mitigating power fluctuations, reducing the risk of outages, and ensuring a reliable and consistent power supply. Consequently, as nations strive to meet the burgeoning energy needs of their populations, the adoption of SVCs stands out as an indispensable solution to fortify power systems.

Upgrading Aging Infrastructure Creating Growth Opportunities

Aging power infrastructure is another prominent factor creating opportunities for the global SVC industry. As power systems across various regions continue to age, the imperative for upgrades becomes increasingly apparent.

The conventional power infrastructure, marked by outdated technologies and equipment, often struggles to meet the growing demands of modern societies. In response to this challenge, utilities and governments globally are investing in comprehensive upgrades to enhance the efficiency, reliability, and performance of existing power grids.

SVCs emerge as a crucial solution within this context. These devices offer dynamic reactive power compensation, addressing voltage fluctuations and power quality issues prevalent in aging grids.

By installing SVCs, utilities can significantly improve the stability and reliability of their power distribution systems. The capability of SVCs to regulate voltage levels and mitigate grid instabilities positions them as indispensable components in the modernization initiatives aimed at rejuvenating aging power infrastructures.

The aging power infrastructure factor underscores the transformative role that SVCs play in revitalizing grids. These devices help companies in ensuring that they meet the evolving demands of a technologically advancing world while maintaining optimal efficiency and reliability.

Rise in Grid Modernization Initiatives Augmenting Growth

Grid modernization initiatives play a pivotal role in shaping the global SVC market. Governments and utilities are proactively investing in transformative grid modernization projects with the overarching goal of augmenting the efficiency, reliability, and stability of power systems. This strategic initiative reflects a response to the evolving needs of contemporary societies and the imperative to accommodate a burgeoning demand for electricity.

The compensators find themselves seamlessly integrated into these forward-looking modernization endeavors. As essential components of smart grid solutions, SVCs contribute to the optimization of power flow, voltage control, and grid stability. Their ability to dynamically regulate reactive power enhances the resilience of power systems in the face of changing demands and unforeseen fluctuations.

Under the banner of grid modernization, SVCs emerge as instrumental tools in fortifying power infrastructures against challenges such as voltage variations and instability. As governments and utilities globally embark on these initiatives, the adoption of SVCs underscores their commitment to ushering in a new era of technologically advanced, reliable, and efficient power distribution systems.

The synergy between grid modernization initiatives and SVC deployment exemplifies a strategic alliance focused on the future-proofing of power grids. Thus, increasing grid modernization initiatives will eventually propel demand through 2035.

High Initial Costs as a Barrier to Wide-scale Adoption of SVCs

The formidable challenge of high initial costs stands as a notable restraint in the widespread adoption of SVCs. The installation of these sophisticated systems involves a substantial upfront investment, encompassing equipment procurement, engineering, and installation expenses. This financial barrier proves particularly significant for utilities and industries operating within regions marked by stringent budget constraints.

For many entities, especially in developing economies, allocating substantial funds for SVC implementation might be a formidable hurdle. The capital-intensive nature of these projects can lead to hesitancy or delays in decision-making processes. Similarly, growing popularity of STATCOM may limit market growth.

The impact of high initial costs extends beyond mere affordability; it directly influences the pace and scale of SVC integration into power systems. As organizations carefully weigh the financial implications against the anticipated benefits, the market may witness slower adoption rates, inhibiting the realization of SVCs' potential in enhancing power quality and grid stability.

Overcoming cost restraint necessitates strategic financial planning, innovative financing models, and advocacy for the long-term benefits that SVCs bring to the reliability and efficiency of power infrastructures. Thus, companies need to focus on these remedies to counter market barriers.

The table below highlights key countries’ market revenues. China, the United States, and Japan are set to remain the top three consumers of VAR compensators, with projected valuations of USD 117.9 million, USD 169.8 million, and USD 150.4 million, respectively, in 2035.

| Countries | Static VAR Compensator Market Revenue (2035) |

|---|---|

| China | USD 117.9 million |

| United States | USD 169.8 million |

| Japan | USD 150.4 million |

| India | USD 140.9 million |

| Poland | USD 140.7 million |

The table below shows the estimated growth rates of the top five countries. Italy, Mexico, and KSA are set to record high CAGRs of 6.9%, 6.2%, and 6.1%, respectively, through 2035.

| Countries | SVC Market CAGR (2025 to 2035) |

|---|---|

| Italy | 6.9% |

| Mexico | 6.2% |

| KSA | 6.1% |

| Czech Republic | 6.1% |

| Canada | 5.9% |

| Hungary | 5.8% |

When it comes to SVC adoption, China leads from the forefront. This is attributable to factors like increasing grid modernization initiatives, booming renewable energy sector, and strong presence of leading SVC manufacturers.

As per the latest analysis, China is set to record steady growth, with total market size reaching USD 117.9 million by 2035. Over the next ten years, demand for static VAR compensators in China is predicted to rise at 3.8% CAGR.

China’s ambitious renewable energy targets and rapidly developing technology are increasing demand for SVCs. China’s renewables reached around 31.7% of total energy consumption, and the trend is set to escalate further, requiring robust grid stabilization plans. These insights highlight the potential of China as the largest market for SVCs.

The country’s massive investment in renewable energy and infrastructure, with escalating demand for electricity, is also increasing the need for SVC and other advanced energy management solutions. This will further boost market growth through 2035.

Recent government policies, such as the Renewable Energy Law, emphasize sustainable energy development and grid modernization. Prominent factors such as rapid urbanization, technological advances, and government policies will continue to contribute to making China a larger market.

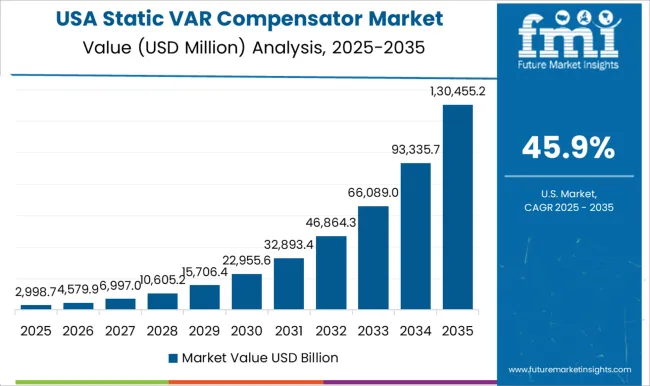

The growth of the market in the United States can be attributed to several key factors. First, the nation has a well-established and advanced electricity grid, which requires energy efficiency and produces very stable electricity. This demand is further compounded by renewable energy sources such as coupling solar and wind to electricity.

The United States market growth is also propelled by greater integration of renewable energy and grid modernization programs in states such as California and Texas. Similarly, high adoption of electric vehicles is prompting utilities to invest in SVC technology.

A supportive regulatory framework and government policies play an important role in promoting market development. Policies aimed at promoting clean energy and energy efficiency to incentivize companies will also encourage companies to invest in SVC technologies.

Sales of static VAR compensators in the United States are projected to soar at a CAGR of around 5.4% during the assessment period. Total valuation in the nation will reach around USD 169.8 million by 2035.

The section below shows the thyristor controller reactor segment dominating the industry, recording a CAGR of 4.7% through 2035. Based on end-use industry, the energy utilities segment is predicted to grow at 4.7% CAGR during the forecast period.

| Top Segment (Product Type) | Thyristor Controller Reactor |

|---|---|

| CAGR (2025 to 2035) | 4.7% |

The thyristor controller reactor segment stands out as a key segment in the global SVC market for several reasons. The reason for its widespread adoption is its ability to provide accurate and dynamic reactive power compensation, making it highly effective in voltage regulation and power factor correction applications in various industries.

Thyristor controller reactors provide excellent reliability and stable performance, allowing the grid to operate even more stable under varying load conditions. This reliability factor is essential for industries where uninterrupted power supply is essential, such as manufacturing and utilities.

Advances in thyristor technology have favored thyristor-controlled reactors over other types. The capability of thyristor-controlled reactors to operate in both capacitive and inductive modes gives them versatility and application potential in different grid conditions continues to increase.

Thyristor controller reactors are also more cost-effective than other product types. As a result, the target segment is anticipated to account for a significant volume share of 41.1% in 2025. On the other hand, demand for static synchronous compensators is forecast to rise at a CAGR of 5.1%.

| Top Segment (End-use Industry) | Energy Utilities |

|---|---|

| CAGR (2025 to 2035) | 4.7% |

Demand for static VAR compensators remains high among energy utilities due to several factors. SVCs play a crucial role in voltage control, power factor correction, and grid stabilization, ensuring reliable and stable electricity supply to consumers.

Energy utilities rely on SVCs to manage voltage fluctuations, optimize power factors, and enhance grid stability, especially in regions with high renewable energy penetration. As a result, their adoption is growing significantly in energy utilities.

The increasing integration of renewable energy sources into the grid poses challenges in maintaining grid stability, which necessitates the deployment of SVCs by energy utilities. SVCs help utilities manage the variability of renewable energy generation and ensure smooth integration into the grid.

Aging power infrastructure and increasing electricity demand create the need for SVCs to modernize grids and improve system efficiency. As energy utilities strive to enhance grid reliability and efficiency, the demand for SVCs is set to remain robust in the foreseeable future.

As per the latest analysis, the energy utilities segment is projected to progress at 4.7% CAGR during the forecast period. It is set to attain a valuation of USD 117.9 million by 2035.

The Static VAR Compensator (SVC) Market is expanding as utilities and heavy industries push to stabilize power quality, manage voltage fluctuations, and improve grid reliability amid rising renewable integration. With transmission networks experiencing higher load variability, SVCs are becoming essential in maintaining reactive power balance and enhancing system efficiency. Demand is also increasing in steel, mining, and manufacturing facilities where voltage regulation directly impacts production continuity.

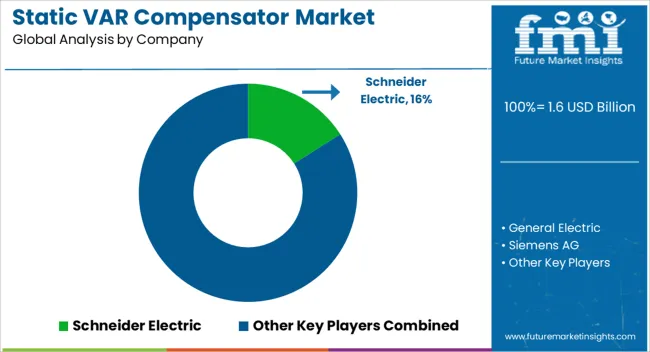

Schneider Electric, General Electric, and Siemens AG are at the forefront of delivering utility-scale SVC solutions that support grid modernization and renewable-heavy power systems. Their offerings combine advanced thyristor technology with digital control platforms for faster response and improved visibility of grid conditions. Mitsubishi Electric Corporation and ABB continue to strengthen global deployment with high-capacity SVC systems tailored for large transmission networks and industrial substations.

Companies such as Hyosung Corporation, Fuji Electric, NR Electric Co., Ltd., and Nissin Electric Co., Ltd. have built strong positions in Asia, providing cost-effective SVC technology suited for expanding power grids and industrial hubs. Meanwhile, S&C Electric Company, American Superconductor Corp., and Merus Power Dynamics Oy specialize in flexible, modular SVC solutions designed for rapid deployment, grid reinforcement projects, and industrial voltage stabilization.

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 1,020.2 million |

| Market Size (2035) | USD 1,667.0 million |

| Growth Rate (2025 to 2035) | 5.0% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (Units) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Market Segments Covered | Voltage Level, Product Type, Application, End-use Industry, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia Pacific; Middle East & Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, BENELUX, NORDICS, Poland, Hungary, Balkan and Baltics, Russia, India, Association of Southeast Asian Nations, Australia and New Zealand, China, Japan, South Korea, Kingdom of Saudi Arabia, Other GCC Countries, Türkiye, Other African Union, South Africa |

| Key Companies Profiled | Schneider Electric, General Electric, Siemens AG, Mitsubishi Electric Corporation, ABB, Emerson Electric Co., Hyosung Corporation, Fuji Electric, NR Electric Co., Ltd., Nissin Electric Co., Ltd., S&C Electric Company, American Superconductor Corp., Merus Power Dynamics Oy |

The global static var compensator market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the static var compensator market is projected to reach USD 117.9 billion by 2035.

The static var compensator market is expected to grow at a 54.0% CAGR between 2025 and 2035.

The key product types in static var compensator market are medium voltage (1kv to 69kv), low voltage (400v to 1kv) and high voltage (above 69 kv).

In terms of product type, thyristor controller reactor segment to command 35.0% share in the static var compensator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

MCR Based Static VAR Compensator Market Size and Share Forecast Outlook 2025 to 2035

Thyristor Based Static VAR Compensator Market Size and Share Forecast Outlook 2025 to 2035

Static Synchronous Compensator (STATCOM) Market Size and Share Forecast Outlook 2025 to 2035

Static UPS Market Size and Share Forecast Outlook 2025 to 2035

Variable Frequency Drive Market Size and Share Forecast Outlook 2025 to 2035

Variable Air Volume System Market Size and Share Forecast Outlook 2025 to 2035

Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Static Stability Control Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Static Random Access Memory (SRAM) Market Size and Share Forecast Outlook 2025 to 2035

Variable Valve Timing Market Size and Share Forecast Outlook 2025 to 2035

Variable Displacement Compressor Market Size and Share Forecast Outlook 2025 to 2035

Variable Reluctance Sensor Market Size and Share Forecast Outlook 2025 to 2035

Varicella Zoster Infection Treatment Market Size and Share Forecast Outlook 2025 to 2035

Static-Free Packaging Films Market Growth - Demand & Forecast 2025 to 2035

Varactor Diode Market Size and Share Forecast Outlook 2025 to 2035

Varicose Vein Treatment Market Growth - Trends & Forecast 2025 to 2035

Variable Speed Generators Market Analysis & Forecast by Technology, End Use and Region through 2035

Variable Data Printing Market Analysis – Growth & Forecast through 2034

Varicella Vaccines Market Insights - Growth, Trends & Forecast 2024 to 2034

Invar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA